Content

What is the Current Water-Based Solvent Paints Market Size and Share?

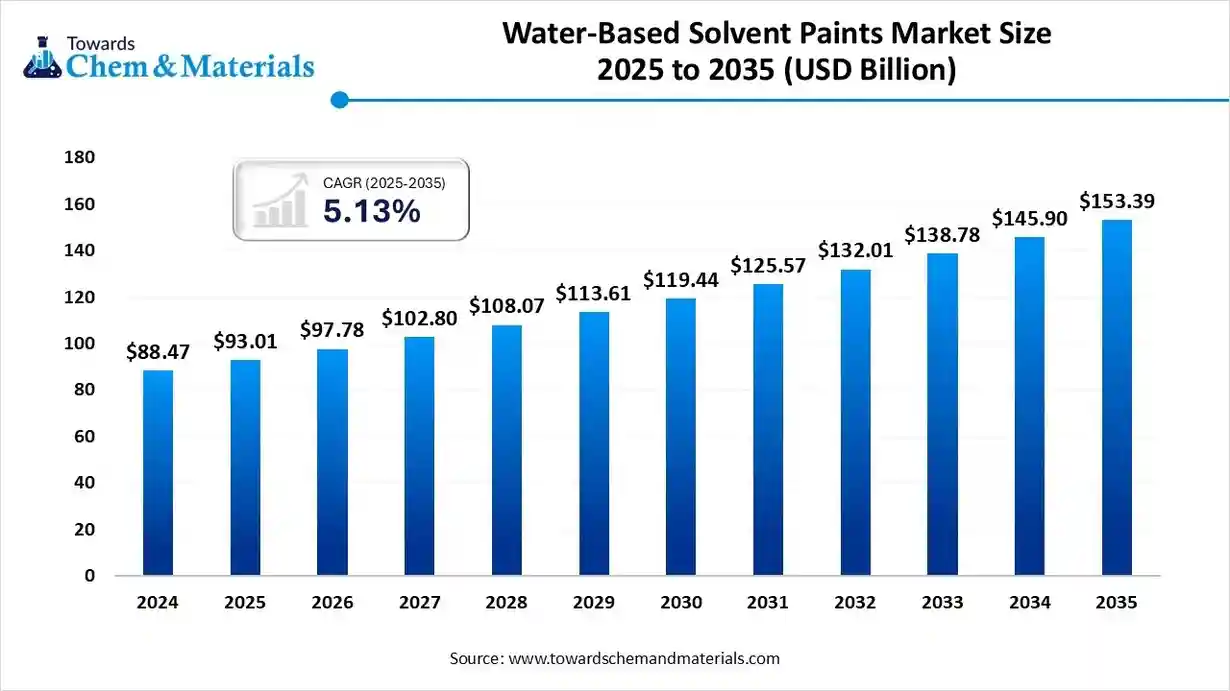

The global water-based solvent paints market size is calculated at USD 93.01 billion in 2025 and is predicted to increase from USD 97.78 billion in 2026 and is projected to reach around USD 153.39 billion by 2035, The market is expanding at a CAGR of 5.13% between 2025 and 2035. Asia Pacific dominated the water-based solvent paints market with a market share of 40.60% the global market in 2024. The increasing need for energy efficiency and eco-friendly manufacturing is likely to generate value-added opportunities for industry participants.

Key Takeaways

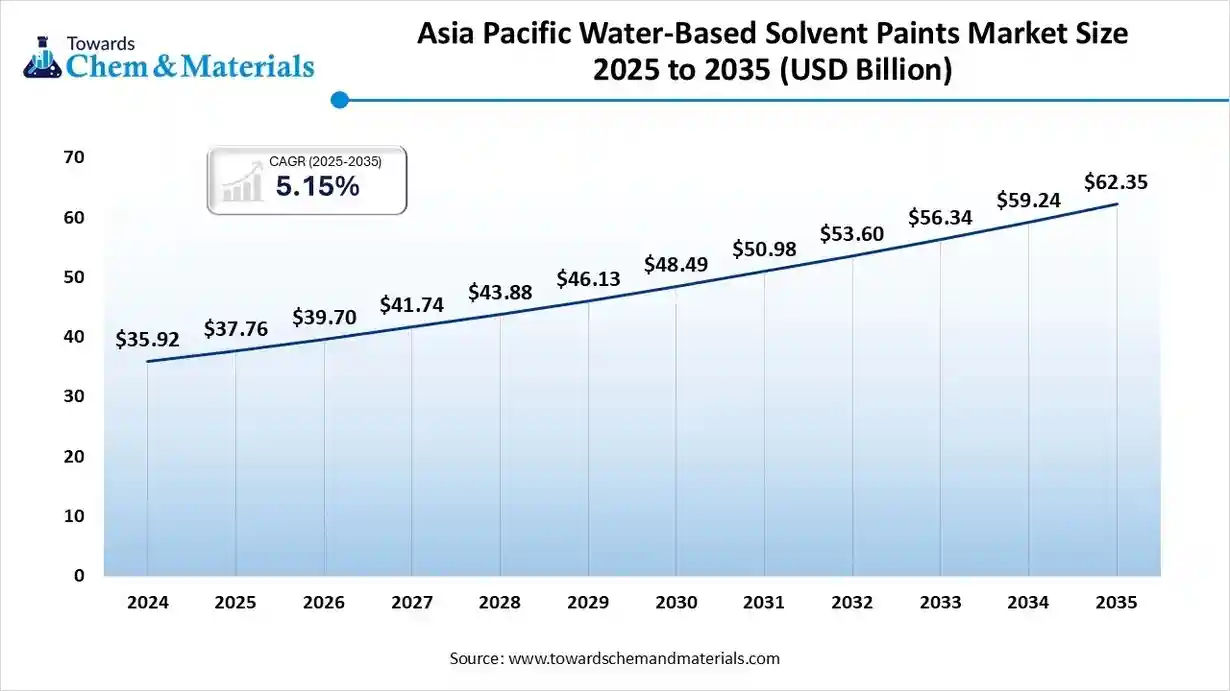

- By region, Asia Pacific region dominated the water-based solvent paints market with approximately 40.6% industry share in 2024 and is set to grow at a high 8.2% CAGR during the forecasted period.

- By region, Europe is likely to capture a greater portion of the market in the future.

- By type, the acrylic paints segment dominated the market with approximately 43.8% in 2024.

- By type, the epoxy paints segment is expected to grow at the fastest 6.8% CAGR in the market during the forecast period.

- By end-use industry, the construction segment dominated the market with approximately 43.5% industry share in 2024.

- By end-use industry, the automotive segment is expected to grow at a rate of 7.4% in the market during the forecast period.

- By distribution channel, the direct sales segment dominated the market with approximately 75.5% industry share in 2024.

- By distribution channel, the retail & online segment is expected to grow at the high 7.4% CAGR in the market during the forecast period.

Smart Chemistry for a Sustainable Tomorrow: Water-Based Paints on The Rise

Water-based solvent-paints are increasingly preferred because they use water as the main solvent instead of traditional organic volatile compounds. A recent review notes that water-borne coatings form the largest global class of coatings and offer markedly lower volatile organic compound (VOC) content compared with solvent-borne systems.

These paints deliver key performance benefits: lower VOC emissions improve indoor air quality and reduce environmental impact. For example, a 2023 study found that VOC content in water-based coatings averaged only about 50.8 percent of that in conventional solvent-based coatings.

Drying time and manufacturability are also improving thanks to advanced resin chemistry and nano-fillers. Research on TiO₂ nano-powder in water-based coatings shows enhanced opacity, durability, and significant VOC reduction, pointing to both environmental and functional gains. The environmental credentials of water-based paints make them well-suited for a wide array of applications, including architectural surfaces, automotive finishing, industrial equipment, and packaging substrates. Architectural coatings alone are rapidly shifting toward water-borne formulations due to regulatory pressures and sustainability commitments.

Current Trends in Water-Based Solvent Paints Market :

- Industry Growth Overview: Growth in the water-based solvent paints market is supported by rising demand for low-odor, low-toxicity and safer coating solutions across residential, industrial and commercial sectors. Between 2025 and 2034, stricter indoor-air-quality regulations and the shift away from solvent-heavy formulations have strengthened manufacturers' revenue potential. The emergence of tint-on-demand systems, where microfactories located in retail stores and contractor hubs produce small batches for nearby projects, is improving supply efficiency and supporting rapid customisation trends across the market.

- Sustainability Trends: Sustainability remains a major driver as producers aim to lower lifecycle environmental impacts across formulation, production, and application stages. Global manufacturers are increasing the use of lower-carbon binders, bio-based additives, and recycled pigments to reduce embodied emissions in finished coatings. Water-based systems also help reduce volatile organic compound levels, supporting cleaner work environments and contributing to compliance with environmental standards in key markets. Growing investment in advanced resins and low-energy curing technologies further aligns the industry with long-term sustainability goals.

- Global Expansion: Expansion is evident across both emerging and developed markets as manufacturers adapt production to regional climate and regulatory demands. In Asia Pacific, companies are establishing compact blending centres near urban areas to tailor formulations to local water quality, humidity conditions, and application practices. North America and Europe continue to invest heavily in new production technologies, including smart batching, digital colour-matching, and advanced dispersion systems that enhance product consistency and reduce waste. This global expansion is strengthening supply networks and accelerating the adoption of water-based coatings across diverse end-use industries.

- Major Investors: Leading producers, including multinational chemical companies and regional coating specialists, are expanding their portfolios of water-borne technologies in response to rising regulatory pressures and customer demand. Investments are focused on improved resin engineering, low-VOC formulations, and automated production systems that enhance both performance and sustainability. Collaboration between raw material suppliers, equipment manufacturers, and coating companies is also increasing as the industry aims to scale environmentally responsible solutions globally.

- Startup Ecosystem: The startup landscape is expanding with innovators developing new water-compatible polymers, ultra-low-VOC additives and digital tinting platforms. Many emerging companies are focusing on nanotechnology, bio-based ingredients and advanced dispersion methods to create high-performance coatings with lower environmental footprints. Partnerships with major paint producers and building-materials distributors are helping these startups accelerate commercial testing and bring new technologies to market more quickly.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 97.78 Billion |

| Expected Size by 2035 | USD 153.39 Billion |

| Growth Rate from 2025 to 2035 | CAGR 5.13% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2026 - 2035 |

| Leading Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Segment Covered | By Type, By End-Use Industry, By Distribution Channel, By Region |

| Key Companies Profiled | Akzo Nobel N.V. , PPG Industries, Inc. , The Sherwin-Williams Company , BASF SE , Nippon Paint Holdings Co., Ltd. , Axalta Coating Systems Ltd. , Jotun Group , Kansai Paint Co., Ltd, Asian Paints Limited , Hempel A/S , Berger Paints India Ltd. , RPM International Inc., Tikkurila Oyj , DuluxGroup Limited , Sika AG |

From Nano to IoT: The Digital Revolution in Coating Innovation

The coatings industry is rapidly shifting toward digital and material technologies that enable higher performance, lower emissions, and greater application precision. Waterborne epoxies and hybrid resin systems now provide durable finishes with reduced volatile organic compound levels, supporting cleaner indoor environments and improved worker safety. Nano-additives such as silica, alumina, and titanium dioxide enhance hardness, speed up curing, and increase scratch and abrasion resistance, which allows faster recoating cycles on construction and industrial sites.

Digital colour capture tools and mobile tinting applications are improving consistency by matching shades more accurately across batches. IoT-enabled spray guns and connected application equipment help monitor spray patterns, reduce overspray, and optimise film thickness in real time, improving material efficiency and lowering overall project waste. These advances together reflect a broader move toward smart chemistry and smart application systems that elevate both performance and sustainability in modern coatings.

Trade Analysis of the Water-Based Solvent Paints Market:

- Export leaders and export scale : For 2023, UN Comtrade / WITS data show the European Union as a major exporter of paints and varnishes in non-aqueous media, with total export value around USD 1.70 billion under the HS grouping for non-aqueous paints and varnishes. Germany is the single largest national exporter in that group with exports over USD 1.15 billion in 2023. These figures indicate strong European capacity for advanced coating formulations and intermediates.

- Aqueous paints trade (water-based proxy) :Aqueous paints (HS subset commonly used as a proxy for waterborne coatings) show Germany, the United States and Italy among the top exporters by value in 2023, with Germany exporting roughly USD 1.39 billion of aqueous paint products in 2023 according to product-level trade summaries. This highlights that traditional coatings exporters are already shipping significant volumes of water-compatible formulations.

- Major import markets and regional patterns : China and the European Union were among the largest importers of paints and varnishes across non-aqueous and related categories in 2023, with China importing about USD 878.6 million in the non-aqueous grouping. Many emerging markets in Southeast Asia, Latin America, and Africa import finished waterborne paints and intermediate concentrates due to limited local blending capacity.

- Regulation driving trade and product reformulation :Regulatory limits on volatile organic compounds, particularly the EU Paints Directive 2004/42/EC, shape formulation choices and, in turn, trade flows by increasing demand for compliant low-VOC imports or for local reformulation of imported concentrates. Exporters that certify compliance with EU and other regional VOC limits gain competitive access to those markets.

Input, logistics, and cost drivers : Trade in key inputs such as titanium dioxide, specialty resins and coalescents affects manufacturing economics and export competitiveness for waterborne systems. Disruptions in pigment or resin supply, or trade remedies on inputs, can raise costs and shift sourcing patterns; customs databases and national statistics help quantify these linkages at the partner level.

Value Chain Analysis of the Water-Based Solvent Paints Market:

- Distribution to Industrial Users :Distribution involves transporting water-based paints from production sites to industrial customers such as automotive plants, construction firms and packaging manufacturers through regional warehouses, dealer networks and direct supply agreements. Distributors must ensure product stability by managing temperature and humidity, as waterborne coatings can be sensitive to environmental conditions during storage and transport. Technical support teams also assist industrial users with on-site application guidance, ensuring proper film formation and compliance with performance standards.

- Key Players: PPG Industries Inc., The Sherwin-Williams Company, AkzoNobel N.V., BASF SE

- Chemical Synthesis and Processing :Water-based paints rely on a multi-step synthesis chain that involves emulsion polymerisation, pigment dispersion, rheology modification, and the integration of performance additives. This stage requires specialised raw materials such as acrylic emulsions, polyurethane dispersions, coalescing agents and defoamers supplied by major chemical manufacturers. Continuous improvement in binder chemistry and pigment-dispersion technologies helps producers achieve lower volatile organic compound levels and higher durability, supporting both performance and sustainability goals in industrial markets.

- Key Players: BASF SE, Axalta Coating Systems LLC, Nippon Paint Holdings Co. Ltd., Kansai Paint Co. Ltd.

- Regulatory Compliance and Safety Monitoring :Regulatory compliance covers adherence to standards that limit volatile organic compound emissions, govern chemical safety, and define workplace protection requirements for coating production and application. Agencies such as the U.S. Environmental Protection Agency, the Occupational Safety and Health Administration and the European Chemicals Agency oversee these frameworks, which include chemical registration, hazard communication and environmental performance criteria. Water-based coatings often support easier compliance because they contain lower levels of hazardous solvents, but producers must still document product safety, maintain updated technical data sheets and meet regional labelling requirements.

- Key Agencies: U.S. Environmental Protection Agency (EPA), Occupational Safety and Health Administration (OSHA), European Chemicals Agency (ECHA)

Water-Based Solvent Paints Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Additional Notes |

| United States | Environmental Protection Agency (EPA) | EPA Requirements (40 CFR Part 59) | Reducing photochemical smog caused by VOC emissions | This is the federal agency responsible for setting and enforcing environmental protection laws, including VOC emission limits in coatings. |

| European Union | European Commission (EC) | Deco paint Directive (2004/42/EC) | Minimizing chemical pollution to protect biodiversity and water quality | This is the executive body that initiates and enforces EU-wide legislation for chemical products. |

| China | State Administration for Market Regulation (SAMR) | Mandatory GB Standards (e.g., GB 30981.1-2025 and GB 30981.2-2025) | Implementing stricter control of VOCs to combat air pollution and improve environmental quality | This agency releases and enforces mandatory national standards (GB Standards) for various product categories, including paints. |

Segmental Insights:

Type Insights

How did the Acrylic Paints Segment Dominate the Water-Based Solvent Paints Market in 2024?

- The acrylic paints segment dominated the market with a 43.8% industry share in 2024, driven by factors such as versatility, eco-friendliness, and quick drying. Moreover, these acrylics are easily stick to various surfaces like metal, wood, or concrete, which is driving the segment growth in recent years.

- On the other hand, the epoxy paints segment is expected to grow at a significant 6.8% CAGR, driven by their features such as higher chemical resistance, stronger adhesion, and greater surface protection. With the growing need for long-lasting coatings that withstand corrosion, heat, and abrasion, epoxy paints are likely to gain significant market share in the coming years.

- The polyurethane paints segment is also notably growing, driven by their weather resistance and higher gloss levels. Moreover, automotive and indoor manufacturers have been heavily demanding these paints for premium finishes over the past few years. Also, this paint combines beauty with toughness, which is likely to create significant opportunities in the industry in the coming years.

End Use Insights,

Why does the Construction Segment Dominate the Water-Based Solvent Paints Market by End Use?

- The construction segment dominated the market, accounting for 43.5% of industry share in 2024, as most building projects require water-based paints for walls, roofs, and concrete surfaces. These paints are safe, easy to apply, and dry fast, making them perfect for homes, offices, and public buildings. They also release fewer harmful fumes, supporting green building standards.

- The automotive segment is expected to grow rapidly as car manufacturers shift toward water-based, low-VOC paints to meet increasingly stringent environmental regulations. These paints help reduce emissions during production while providing high-quality finishes.

- The industrial manufacturing segment is also growing rapidly as factories and equipment manufacturers adopt water-based paints to improve worker safety and meet environmental standards. These paints are used on machinery, storage tanks, and tools for protection against corrosion and wear.

Distribution Channel Insights

How did the Direct Sales Segment Dominate the Water-Based Solvent Paints Market in 2024?

- The direct sales segment dominated the market with 75.5% industry share in 2024, as many paint manufacturers sell directly to contractors, construction firms, and industrial clients. This enables better pricing, faster delivery, and direct user feedback.

- On the other hand, the retail & online segment is expected to grow rapidly as more customers buy paints for DIY projects and home improvements. E-commerce platforms make it easy to compare brands, colors, and prices. Paint companies are also offering online shade selection tools and doorstep delivery.

Regional Analysis:

The Asia Pacific water-based solvent paints market size was valued at USD 37.76 billion in 2025 and is expected to reach USD 62.35 billion by 2035, growing at a CAGR of 5.15% from 2025 to 2035. Asia Pacific dominated the water-based solvent paints market with a 40.6 percent share, supported by strong demand from industrial, construction and automotive sectors in recent years. Rapid urban development and infrastructure investments across major economies have increased the use of low-VOC waterborne coatings in both commercial and residential projects.

The presence of large-scale manufacturing bases in India, China and Japan has also encouraged wider adoption of advanced coating technologies, creating a more sophisticated and quality-driven consumer base. Continuous expansion in electronics, packaging and automotive refinishing industries further strengthens regional demand, positioning Asia Pacific as a long-term growth engine for water-based coatings.

Government Supports Powers China’s Water-Based Paint Revolution

China maintained its dominance in the water-based solvent paints market due to the presence of the heavy automotive and construction industries nowadays. Also, greater government support for eco-friendly building materials has significantly contributed to the water-based paint industry in China.

Europe Water-Based Solvent Paints Market Analysis

Europe is expected to capture a major share of the water-based solvent paints market, driven by a strong regional shift toward sustainability and the enforcement of stringent environmental regulations across industrial sectors. Policies that limit volatile organic compounds and promote cleaner production methods have accelerated the transition from solvent-based to waterborne coating technologies.

Heavy investment in automotive manufacturing, energy-efficient buildings and green construction materials is also increasing the use of advanced water-based formulations. In addition, regional research initiatives and industry partnerships are supporting innovation in low-VOC resins and eco-friendly additives, which is likely to strengthen market growth in the coming years.

Sustainable Coatings Take Centre Stage in Germany’s Paint Industry

Germany is expected to emerge as a prominent player in the water-based solvent paints market in the coming years, driven by ongoing production of low-emission, high-performance coatings. Moreover, the major brands are actively investing in the research and development of durable paints.

Water-Based Solvent Paints Market Share, By Region, 2024 (%)

| Regional | Revenue Share |

| North America | 25.11% |

| Europe | 19.55% |

| Asia Pacific | 40.60% |

| Latin America | 9.65% |

| Middle East and Africa | 5.09% |

North America Water-Based Solvent Paints Market Trends

North America is a notably growing region due to early access f the technology and environmental law enforcement by the regional government. Moreover, countries in the region, such as Canada and the USA, have been focusing on cleaner manufacturing methods, which has sustained the growth of the water-based paint industry.

Eco-Friendly Coatings Drive United States Paint Market Growth

The United States is expected to gain significant market share due to its strong construction and automotive industries. Increasing environmental regulations are pushing both sectors to switch to low-VOC, water-based coatings. American consumers also prefer safer, odor-free paints for home interiors.

Latin America Water-Based Solvent Paints Market Analysis

Latin America is expected to capture a notable share of the water-based solvent paints market. as urbanization and housing construction rise across countries like Brazil and Mexico. Governments are promoting eco-friendly products and improving infrastructure, driving demand for water-based paints.

Brazil Paints Greener Future with Water-Based Innovations

Brazil is expected to emerge as a prominent player in the water-based solvent paints market in the coming years, driven by expanding construction and automotive sectors. As housing projects and industrial parks grow, demand for safe, durable, and low-odor paints is rising. Brazilian manufacturers are introducing water-based coatings to replace traditional solvent-based products.

Recent Developments

- In March 2025, the PPG established the plant of waterborne automotive coatings in Thailand. Also, the main motive of these establishments is to enhance the local production capacity of waterborne basecoats and primers as per the published reports.(Source:news.ppg.com)

Top Vendors in the Water-Based Solvent Paints Market & Their Offerings:

- Akzo Nobel N.V. – Akzo Nobel offers water based solvent free and low-VOC coatings for architectural, automotive, and industrial applications. Its portfolio includes durable interior and exterior paints designed for reduced emissions and improved environmental performance.

- PPG Industries, Inc. – PPG manufactures a wide range of water-based coatings for residential, commercial, and industrial use. The company focuses on high-performance, low odor, and fast-drying formulations that meet strict environmental regulations.

- The Sherwin-Williams Company – Sherwin-Williams provides premium quality water-based paints used in architectural, protective, and marine applications. Its solutions emphasize low VOC content, strong adhesion, and long-term durability.

- BASF SE – BASF supplies innovative water-based coating technologies and resins that improve film formation, gloss, and chemical resistance. Its products support eco-efficient coatings across automotive, industrial, and decorative markets.

- Nippon Paint Holdings Co., Ltd. – Nippon Paint produces advanced water-based coatings for homes, commercial buildings, and industrial uses. Its offerings prioritize sustainability, low odor, and high-performance weather protection.

- Axalta Coating Systems Ltd. – Axalta develops water-based coatings for transportation, automotive refinishing, and industrial applications. The company focuses on corrosion protection, color consistency, and fast-curing technologies.

- Jotun Group – Jotun manufactures water-based decorative paints and protective coatings for marine, offshore, and infrastructure projects. Its products are formulated for durability, environmental safety, and ease of application.

- Kansai Paint Co., Ltd. – Kansai Paint offers water-based architectural and industrial coatings with improved air quality, reduced solvent emissions, and strong protective performance. The company invests in green coating innovations for global markets.

- Asian Paints Limited – Asian Paints provides a broad range of water-based interior and exterior paints emphasizing low VOCs, antibacterial finishes, and long-lasting color stability. It is a leading supplier across residential and commercial segments.

- Hempel A/S – Hempel supplies water-based protective and decorative coatings for marine, infrastructure, and industrial assets. Its formulations support corrosion resistance and sustainability standards.

- Berger Paints India Ltd. – Berger Paints manufactures water-based decorative and protective coatings that deliver strong coverage, low odor, and long-term reliability. Its portfolio serves residential, commercial, and industrial needs.

- RPM International Inc. – RPM produces specialty water-based coatings, sealants, and building materials through its network of brands. Its products serve construction, maintenance, and protective applications with a focus on environmentally friendly formulations.

- Tikkurila Oyj – Tikkurila develops high-quality water-based decorative paints with low emissions and excellent washability. Its products are widely used in Nordic and European markets for residential and professional applications.

- DuluxGroup Limited – DuluxGroup offers water-based architectural and industrial paints with low VOC content, fast drying properties, and enhanced environmental safety. Its coatings are widely used across Australia and New Zealand.

- Sika AG – Sika produces water-based coatings, sealants, and construction chemicals featuring strong adhesion and protective performance. Its solutions support sustainable building and infrastructure projects.

Segments Covered in the Report

By Type

- Acrylic Paints

- Epoxy Paints

- Polyurethane Paints

- Alkyd Paints

By End-Use Industry

- Construction

- Automotive

- Industrial Manufacturing

- Furniture & Wood

By Distribution Channel

- Direct Sales

- Retail & Online

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa