Content

What is the Current Water Treatment Systems Market Size and Share?

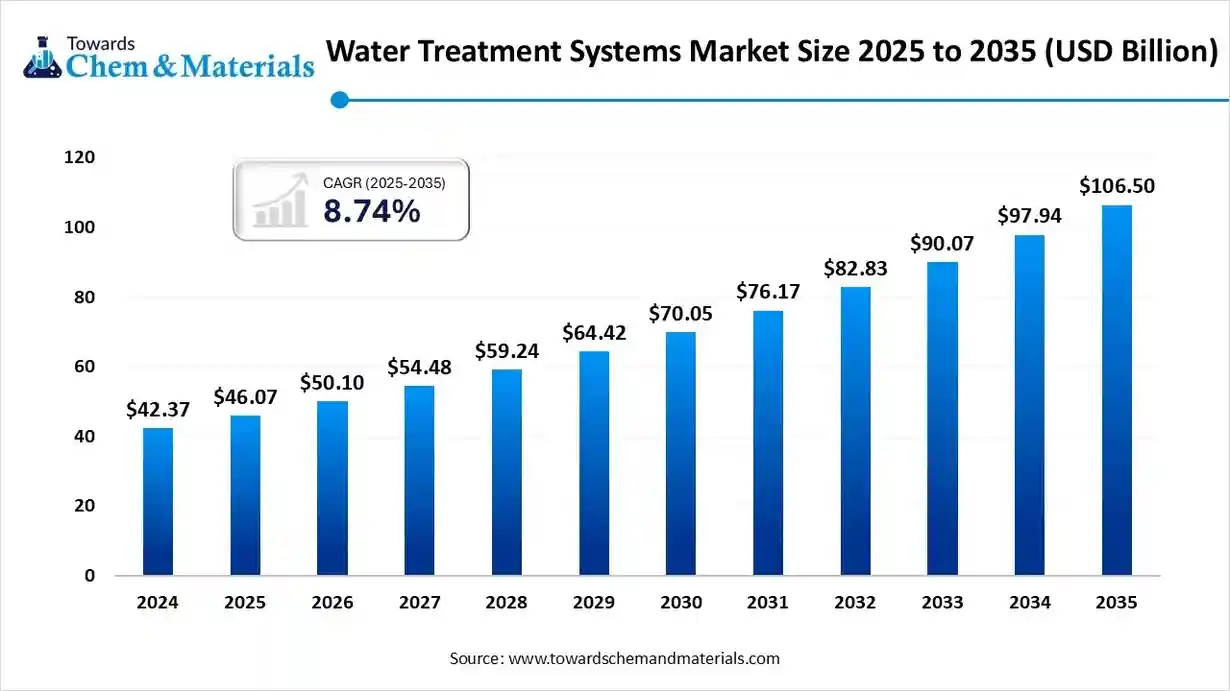

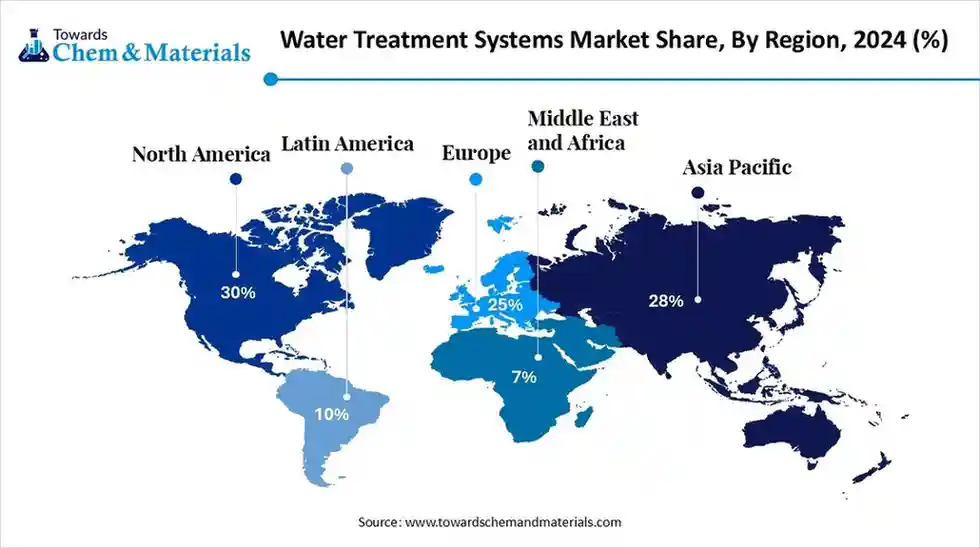

The global water treatment systems market size is calculated at USD 46.07 billion in 2025 and is predicted to increase from USD 50.10 billion in 2026 and is projected to reach around USD 106.50 billion by 2035, The market is expanding at a CAGR of 8.74% between 2025 and 2035. North America dominated the water treatment systems market with a market share of 30% the global market in 2024.The growing demand for clean water and the rapid expansion of industrial activities drive the market growth.

Key Takeaways

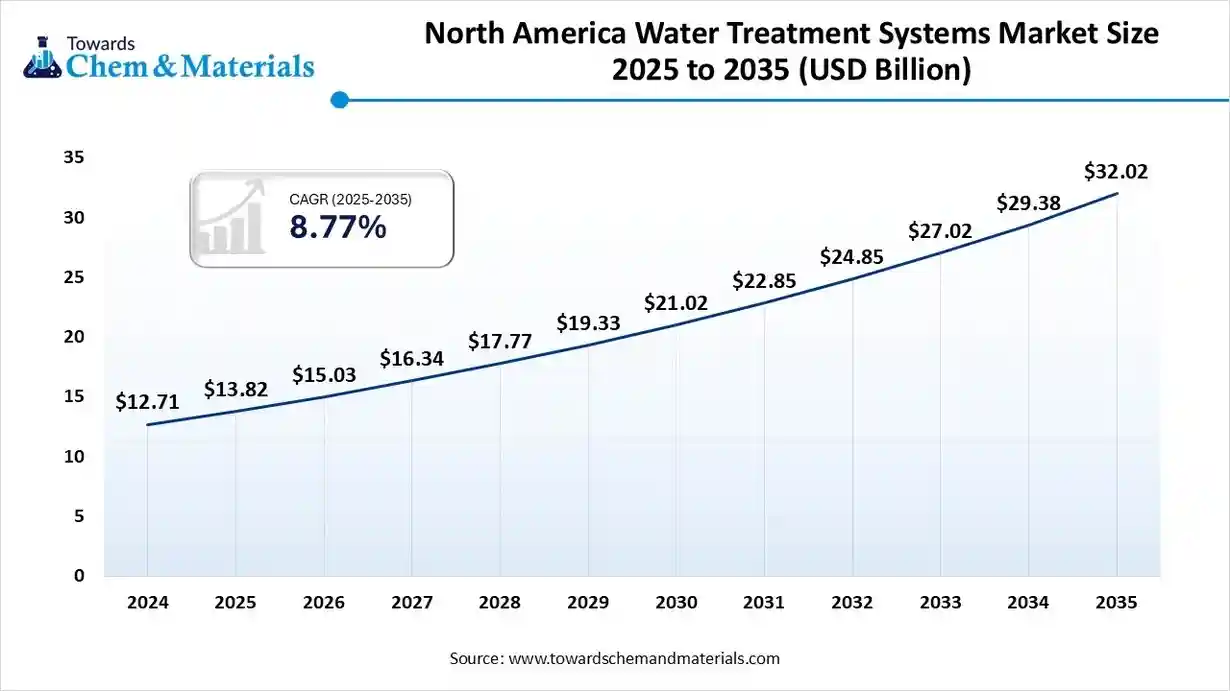

- North America dominated the water treatment systems market and accounted for the largest revenue share of 30% in 2024.

- By product type, the packaged/pre-engineered systems segment accounted for the largest revenue share of 30% in 2024.

- By technology, the membrane technologies segment held the largest revenue share of 35% in 2024.

- By system type, the on-site packaged systems segment accounted for the largest revenue share of around 40% in 2024.

- By end-use industry, the power generation segment dominated the market with a share of 20% in 2024

- By water source, the industrial wastewater segment held the largest market share of 30% in 2024.

The Engines of Expansion: What Drives Water Treatment Systems Growth?

The water treatment systems market growth is driven by growing industrialization, a strong focus on water reuse, higher consumption of water, aging municipal water infrastructure, and stricter water purity requirements in industries.

What are Water Treatment Systems?

Water treatment systems are technologies used to purify water for specific uses like safe discharge, drinking, and industrial processes. The system helps to remove contaminants like chemicals, bacteria, and minerals. A water treatment system uses different processes like coagulation, sedimentation, filtration, disinfection, and flocculation. A water treatment system offers safe drinking water, supports agriculture, and supplies water for industrial processes.

Water Treatment Systems Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the industry is expected to see accelerated growth due to growing water scarcity issues and depletion of freshwater resources. Growth is being reinforced by growing industrial activities and stringent government rules for water quality, particularly in the Asia-Pacific and North America.

- Sustainability Trends: Sustainability is reshaping the water treatment systems landscape, with rising adoption of energy-neutral systems and expansion of water recycling & reuse. For instance, SUSBIO, an India-based company, develops energy-efficient prefabricated packaged sewage treatment plants.

- Global Expansion: Key companies are expanding geographically to align with stricter regulations on water quality and growing industrial activities, particularly in MEA and the Asia Pacific. Companies like Veolia, Pentair, Suez, Xylem, Ecolab, and Evoqua Water Technologies are expanding globally.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 50.10 Billion |

| Expected Size by 2035 | USD 106.50 Billion |

| Growth Rate from 2025 to 2034 | CAGR 8.74% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Leading Region | North America |

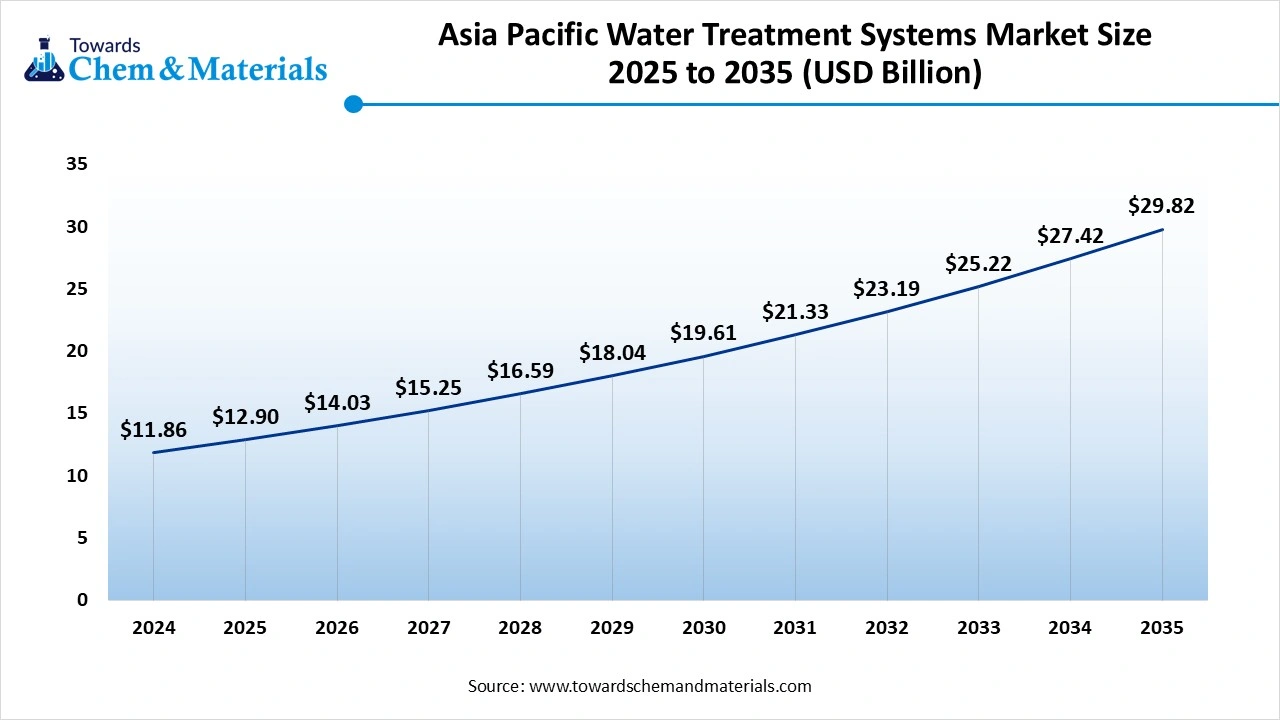

| Fastest Growing Region | Asia Pacific |

| Segment Covered | By Product Type, By Technology, By System Type / Deployment, By End-Use Industry, By Water Source / Feedwater, By Region |

| Key Companies Profiled | Veolia Environnement, SUEZ, Xylem Inc., Ecolab Inc., DuPont, Pentair plc, Kurita Water Industries Ltd., Kemira Oyj, Solenis,Evoqua Water Technologies, SNF Floerger, VA Tech WABAG (WABAG), Thermax Ltd., Doosan / Doosan Enerbility, Aquatech International, Fluence Corporation, BASF , Calgon Carbon / Cabot , Hitachi Ltd. / Mitsubishi Electric ,3M |

Key Technological Shifts in the Water Treatment Systems Market:

The water treatment systems market is undergoing key technological shifts driven by the demand for energy efficiency, regulatory compliance, and improved reliability. One of the most significant transformations is the integration of Artificial Intelligence, which prevents equipment failures and enables real-time quality monitoring. AI makes informed decisions about treatment methods and handles the complex treatment processes.

AI continuously monitors water quality and detects potential equipment failures. AI offers personalised details about the quality of tap water.

- For instance, Xylem company uses AI for Xylem Vue software & analytics software to minimize water losses, manage water networks, and detect leaks in water systems.

Trade Analysis of Water Treatment Systems Market: Import & Export Statistics

- Vietnam exported 1797 shipments of water treatment systems.(Source: www.volza.com)

- From May 2024 to April 2025, the United Kingdom exported 25 shipments of water treatment systems.(Source: www.volza.com)

- MattenPlant Pte Ltd is the leading supplier of water treatment systems in the world.(Source: www.volza.com)

Water Treatment Systems Market Value Chain Analysis

- Feedstock Procurement : The feedstock procurement sourcing of raw water and treatment chemicals like flocculants, pH adjustment chemicals, coagulants, filter media, & disinfectants.

- Key Players: SUEZ, Thermax Limited, Evoqua Water Technologies, Veolia, Ion Exchange India Ltd, Xylem

- Chemical Synthesis and Processing : The chemical synthesis and processing involve steps like coagulation, precipitation, disinfection, pH adjustment, flocculation, and oxidation.

- Key Players: Veolia, DuPont, Nouryon, Ecolab, Evoqua Water Technologies, Dow

- Quality Testing and Certifications : The quality testing involves testing of properties like odor, turbidity, pH, chemical contaminants, chloride, dissolved oxygen, & color, and certifications like WQA Gold Seal, NSF/ANSI Standards, & BIS.

Global Trends: Regional Drivers for Water Treatment Systems

| Regions | Drivers | Key Regulations | Key Companies |

| North America |

|

|

|

| Asia Pacific |

|

|

|

| Europe |

|

|

|

| Latin America |

|

|

|

| Middle East & Africa |

|

|

|

Segmental Insights

Product Type Insights

Why the Packaged or Pre-Engineered Systems Segment Dominates the Water Treatment Systems Market?

The packaged or pre-engineered systems segment dominated market with a 30% share in 2024. The cost-effectiveness and ease of installation of packaged systems help market growth. The growing residential complexes, industrial estates, and commercial properties increase demand for pre-engineered systems. The easy accessibility of systems in construction sites, remote areas, & rural communities, and the modular nature of packaged or pre-engineered systems, drives the market growth.

The monitoring, control & digital solutions segment is the fastest-growing in the market during the forecast period. The strong focus on reducing human error and real-time monitoring increases the adoption of digital solutions. The aging water infrastructure and stricter water quality standards require digital solutions. The presence of limited freshwater resources and increasing awareness about water contamination risks requires monitoring, control & digital solutions, supporting the overall market growth.

The engineered or custom treatment plants segment is significantly growing in the market. The stringent regulations on water quality and growing water scarcity problems increase demand for engineered or custom treatments. The rapid industrial activities and growing wastewater discharge help the market growth. The stricter water quality standards in the diverse industrial base drive the overall market growth.

Technology Insights

How did the Membrane Technologies Segment hold the Largest Share in the Water Treatment Systems Market?

The membrane technologies segment held the largest revenue share of 35% in the market in 2024. The strong focus on removing impurities like viruses, dissolved salts, and bacteria from water sources increases demand for membrane technologies. The growing wastewater reuse & recycling, and focus on a smaller physical footprint, increase the adoption of membrane technologies. The stricter regulations on water quality and focus on long-term operation savings require membrane technologies, driving the overall market growth.

The advanced oxidation/UV/electrochemical segment is experiencing the fastest growth in the market during the forecast period. The strong focus on the production of clean water and removing harmful chemicals from water requires advanced oxidation or electrochemical systems. The growing development of water treatment plants and the adoption of environmentally friendly methods increase demand for electrochemical systems. The focus on recovering valuable metals from wastewater and increasing water reuse requires advanced oxidation or electrochemical systems, supporting the overall market growth.

The biological treatment segment is growing at a significant rate in the market. The growing demand for clean water and high volume of wastewater production increases the demand for biological treatment. The stringent rules on wastewater discharge and growing water scarcity problems increase demand for biological treatment. The growing reuse of wastewater and the strong pressure on water resources require biological treatments, driving the overall market growth.

System Type Insights

Why the On-Site Packaged Systems Segment is Dominating the Water Treatment Systems Market?

The on-site packaged systems segment dominated the market with a 40% share in 2024. The space-efficient designs and focus on rapid installations increase the adoption of on-site packaged systems. The easy installation of systems on temporary sites, military bases, and remote locations helps market growth. The cost-effectiveness and adaptability of systems in large industrial facilities & small residential complexes drive the overall market growth.

The modular or containerized systems segment is the fastest-growing in the market during the forecast period. The modular designs and growing water scarcity issues increase demand for containerized systems. The modular systems provide strong support for decentralized treatment and are suitable for a limited space. The easy installations, cost-effectiveness, portability, and compact footprint of containerized systems support the overall market growth.

The centralized or engineered facilities segment is significantly growing in the market. The growing modernization of water infrastructure and decline of freshwater resources increase demand for centralized or engineered facilities. The presence of advanced technology and high pressure on existing water supplies requires centralized or engineered facilities. The increasing water scarcity issues and growing water recycling drive the overall market growth.

End-Use Industry Insights

Which End-Use Industry Held the Largest Share in the Water Treatment Systems Market?

The power generation system segment held the largest revenue share of 20% in the market in 2024. The well-established thermal & nuclear power facilities and stricter regulations on water quality in power generation increase demand for water treatment systems. The process, like steam generation & cooling, and focus on wastewater management requires water treatment systems. The growing industrialization and expansion of power generation drive the overall market growth.

The semiconductor & electronics manufacturing segment is experiencing the fastest growth in the market during the forecast period. The growing semiconductor fabrication and increasing use of devices like PCs, laptops, & smartphones increase demand for water treatment systems. The growing expansion of data centers and the development of advanced chips require a water treatment system for the production of pure water. The growing expansion of semiconductor manufacturing supports the overall market growth.

The oil & gas segment is growing at a significant rate in the market. The high production of oil & gas generates a massive amount of produced water that requires water treatment systems. The increasing use of enhanced oil recovery and the rise in exploration in the oil & gas sector require water treatment systems. The growing expansion of the oil & gas industry drives the overall market growth.

Water Source Insights

Why the Industrial Wastewater Segment Dominates the Water Treatment Systems Market?

The industrial wastewater segment dominated the market with a 30% share in 2024. The growing production of wastewater in industries like chemical, power, manufacturing, and Food & beverage requires water treatment systems. The stricter regulations on industrial wastewater discharge and the increasing need for clean water in industries require water treatment systems. The growing expansion of industries like chemicals, food processing, manufacturing, and pharmaceuticals generates industrial wastewater, driving the overall market growth.

The process water reuse or zero-liquid-discharge (ZLD) segment is the fastest-growing in the market during the forecast period. The stricter regulations on wastewater discharge and increasing water scarcity issues increase water reuse. The strong focus on removing wastewater discharge and lowering operational costs requires zero-liquid-discharge systems. The rapid growth in industrial activities and a strong focus on recovering valuable materials from wastewater increase the adoption of ZLD systems, supporting the overall market growth.

The municipal or surface water segment is significantly growing in the market. The growing consumption of water and the rise in water pollution increase demand for water treatment systems. The stricter regulations on water quality and focus on conserving water resources increase the adoption of water treatment systems. The growing demand for safe drinking water drives the overall market growth.

Regional Insights

The North America water treatment systems market size was valued at USD 13.82 billion in 2025 and is expected to reach USD 32.02 billion by 2035, growing at a CAGR of 8.77% from 2025 to 2035. North America dominated the market with a 30% share in 2024. The stricter regulations on water quality and the strong presence of water treatment infrastructure increase demand for water treatment systems. The growing awareness about the consumption of clean water and the booming oil & gas industry increases demand for water treatment systems. The growing industries like pharmaceuticals & semiconductors increase demand for water treatment systems. The increasing investment in the upgradation of water treatment facilities and a strong focus on water reuse require water treatment systems, driving the overall market growth.

Water Treatment Systems: Power Behind Flowing Clean Water in the U.S.

The United States is a major contributor to the water treatment systems market. The stricter rules on water quality and high investment in water infrastructure increase demand for water treatment systems. The growing need for clean water industries like food & beverage, power generation, and pharmaceuticals increases the adoption of water treatment systems. The rise in water contamination crises and the high demand for residential drinking water require water treatment systems, supporting the overall market growth.

- The United States exported 1208 shipments of water treatment systems. (Source: www.volza.com)

Asia Pacific Water Treatment Systems Market Trends

The Asia Pacific water treatment systems market size is estimated at USD 12.90 billion in 2025 and is projected to reach USD 29.82 billion by 2035.

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The increasing demand for clean water and the rise in industrial activities increase the demand for water treatment systems. The growing water pollution and increasing water scarcity problems require water treatment systems. The rising awareness about waterborne diseases and strong government support for the development of new water infrastructure require water treatment systems, driving the overall market growth.

From Infrastructure to Innovation: China’s Leadership in Water Treatment

China is a key contributor to the market. The well-established industrial base in sectors like electronics, petrochemicals, and power increases demand for water treatment systems. The strong government support for water safety and stricter regulations, like zero liquid discharge, increases demand for water treatment systems. The strong presence of the electronics & semiconductor industry and increasing awareness about water pollution require water treatment systems, supporting the overall market growth.

- China exported 3200 shipments of water treatment systems.(Source: www.volza.com)

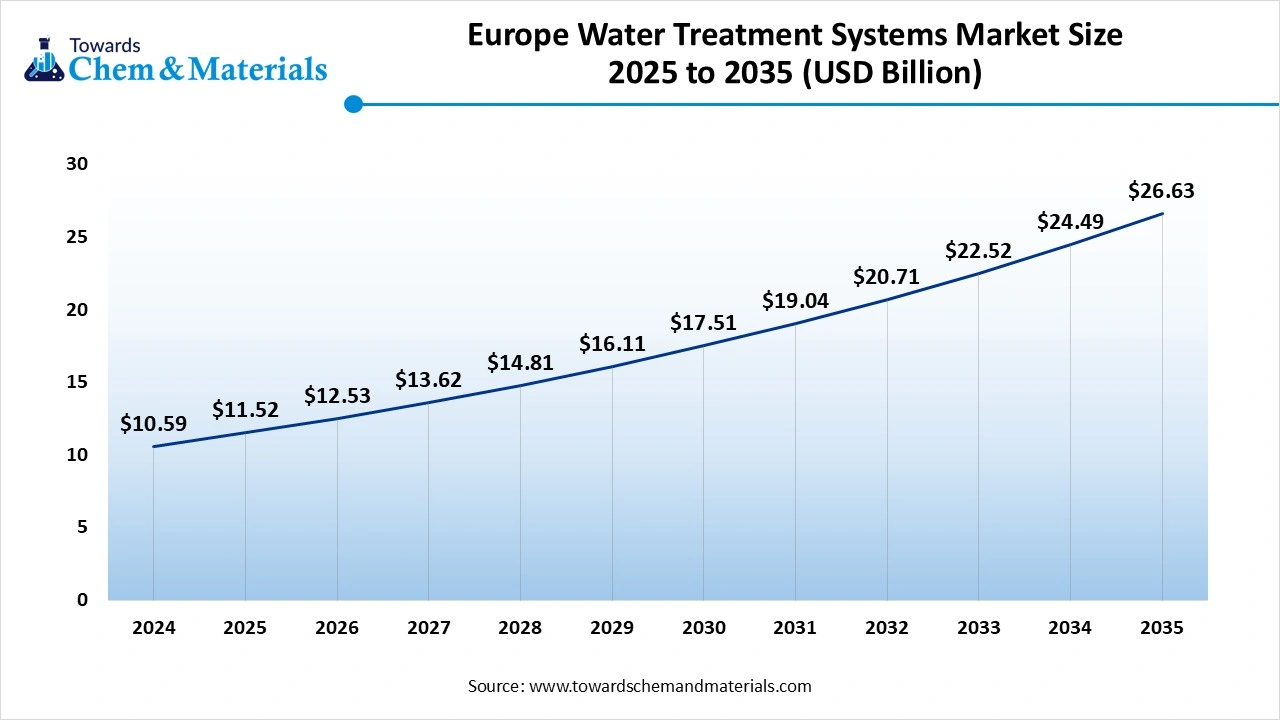

How Water Flowing Clean in the European Region?

The Europe water treatment systems market size is estimated at USD 11.52 billion in 2025 and is projected to reach USD 26.63 billion by 2035.

Europe is significantly growing in the water treatment systems market. The stricter regulations on drinking water & wastewater, and depletion of freshwater resources increase demand for water treatment systems. The strong government support for the modernization of wastewater facilities and the increasing development of water treatment solutions requires water treatment systems. The growing awareness about water pollutants and increasing water scarcity issues requires water treatment systems, driving the overall market growth.

Germany Water Treatment Systems Market Trends

Germany is growing in the market. The growing power generation and well-established residential construction increase demand for water treatment systems. The stringent rules on water quality and a strong focus on sustainable & advanced solutions require water treatment systems. The need for high-purity water in industries like advanced manufacturing, pharmaceuticals, and biotechnology requires water treatment systems, supporting the overall market growth.

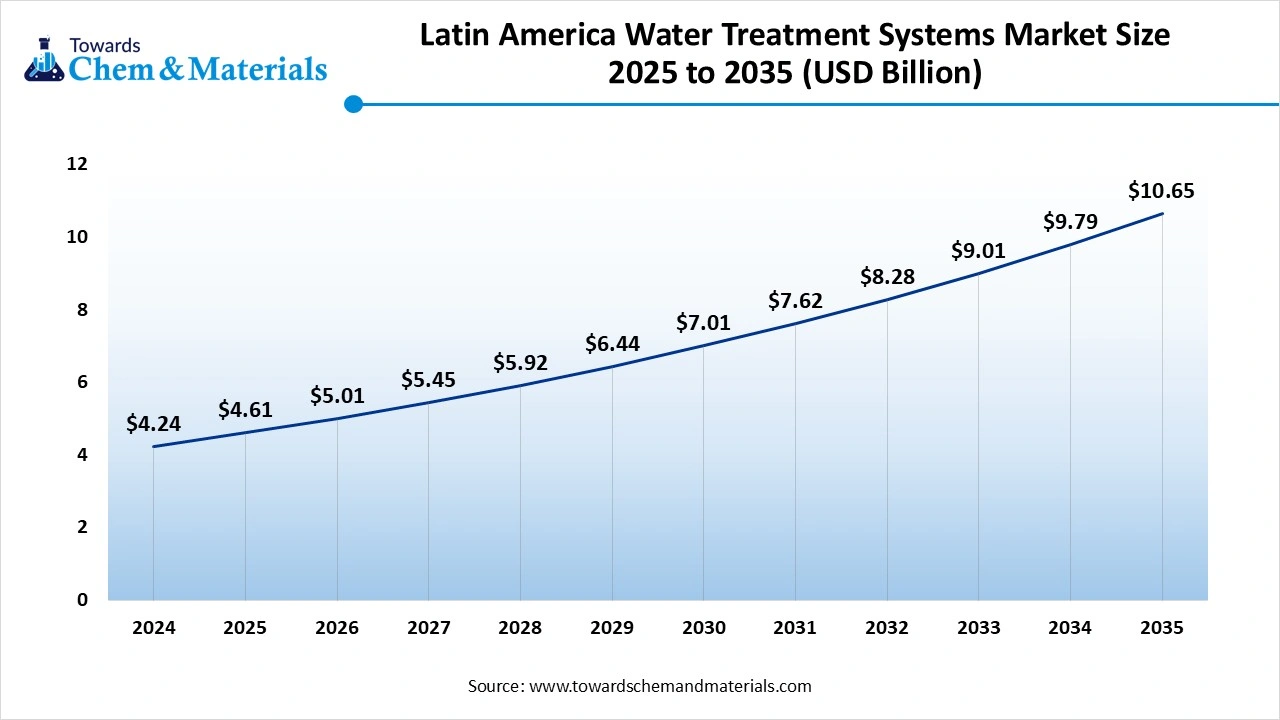

Water Treatment Systems Market Expansion In Latin America

The Latin America water treatment systems market size is estimated at USD 4.61 billion in 2025 and is projected to reach USD 10.65 billion by 2035.

The water treatment systems market in Latin America is experiencing strong growth. This growth is driven by rapid urbanization, industrialization, and rising awareness of water scarcity and quality issues. Governments and industries are investing in modern filtration, membrane, and reuse technologies to meet stricter environmental regulations. Brazil leads the region, holding the largest market share, while countries like Mexico and Argentina are also increasing infrastructure spending.

Brazil Water Treatment Systems Market Trends

In Brazil, the water treatment systems market is expanding rapidly, driven by increasing urbanization, industrial growth, and stricter environmental regulations. Rising concerns about water scarcity, pollution, and public health are encouraging the adoption of advanced filtration and membrane technologies. Government initiatives and public–private partnerships are supporting new treatment facilities and system upgrades. Despite challenges such as uneven regional development and funding gaps, Brazil remains the key growth engine for the sector in Latin America.

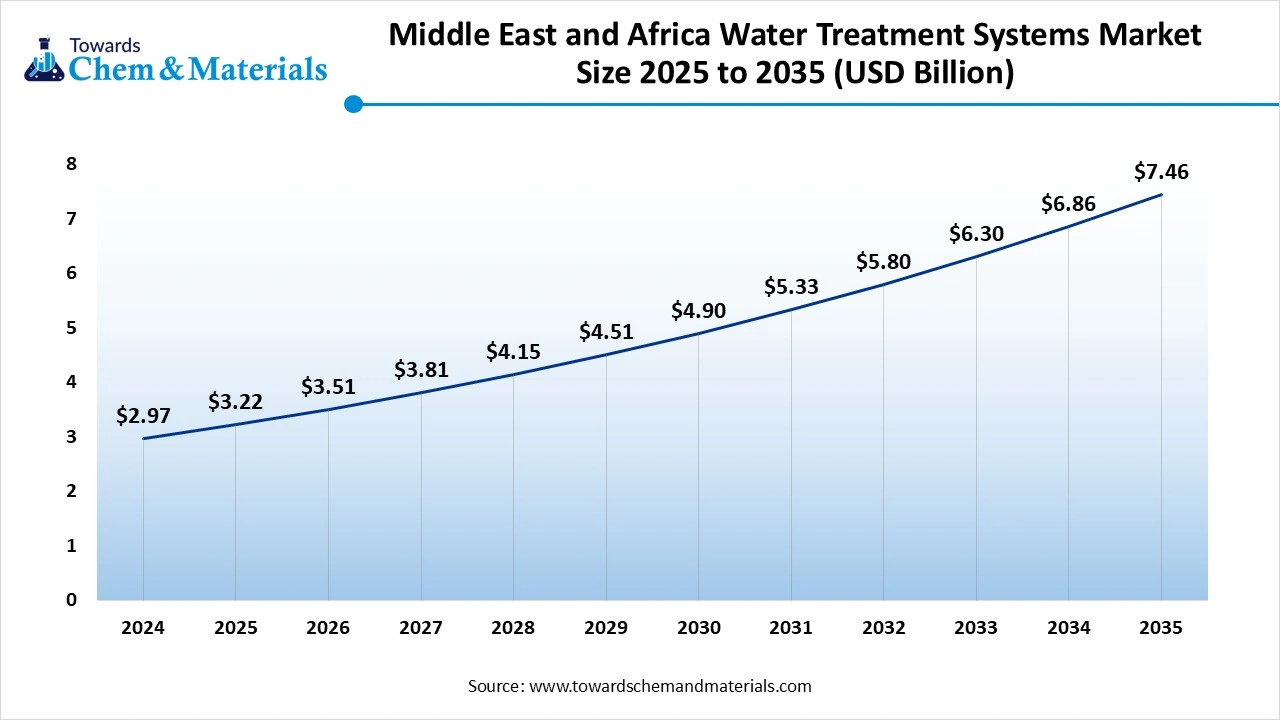

What Are The Growth Factors Of Water Treatment Systems Market In Middle East And Africa

The Middle East and Africa water treatment systems market size is estimated at USD 3.22 billion in 2025 and is projected to reach USD 7.46 billion by 2035.

The growth of the market in the Middle East and Africa is driven by rapid urbanization, population growth, and increasing water scarcity caused by arid climates and limited freshwater resources. Governments are investing heavily in desalination plants, wastewater recycling, and advanced filtration technologies to ensure sustainable water supply. Rising industrial activities, stricter environmental regulations, and growing awareness of waterborne diseases further boost demand.

- Countries such as Saudi Arabia, the UAE, and South Africa are leading infrastructure development, supported by public–private partnerships. Additionally, technological innovation and smart water management solutions are accelerating market expansion across the region.

South Africa Water Treatment Systems Market Trends

In South Africa, the water treatment systems market is growing steadily due to increasing water scarcity, aging infrastructure, and rising demand for safe, potable water. Frequent droughts and pollution in major water sources have pushed both the government and private sector to invest in advanced filtration, desalination, and wastewater recycling technologies. Urbanization and industrial expansion are further driving the need for efficient water treatment solutions.

Recent Developments

- In June 2025, Optimarin launched the Guardian Ballast water treatment system. The new system is useful for large vessels as well as compact vessels. The system offers predictable costs, flexibility, and reliability.(Source: maritime-executive.com)

- In May 2025, Echo launched the Echo Pure Whole Home Water Filter for families. The system consists of advanced filtration and provides cleaner & purified water to every tap. The system uses UV technology to remove viruses & bacteria, and it has a 5-stage filtration process.(Source: www.businesswire.com)

- In September 2025, De Nora launched a compact PFAS treatment system, Sorb FX Pak, for rural & small water systems. The system offers GAC media and ion exchange. The system is useful for vessels with a diameter ranging from 20’’ to 48’’ and affordable for any public water system.(Source: www.filtsep.com)

- In March 2025, Veolia launched the nutshell filtration system, ToroJet, to produce water for oil & gas. The system lowers 2 milligrams per liter of hydrocarbon concentrations and removes 98% solids. The system offers easy access to maintenance and is a cost-effective solution.(Source: worldoil.com)

Top Water Treatment Systems Market Companies

Xylem Inc.

Corporate Information

- Name: Xylem Inc. (Ticker: NYSE: XYL)

- Headquarters: Rye Brook, New York (U.S.)

- Business: Global water technology provider serving utility, industrial, commercial, residential markets: transport, treatment, test & efficient use of water.

- Global presence: Operates in 150+ countries.

History and Background

- Xylem was spun off from ITT Corporation in 2011: on January 12, 2011, ITT announced plans to separate its water business into a new publicly traded company named Xylem.

- The name “Xylem” comes from the plant tissue that transports water symbolizing water flow/technology.

- Early revenues: In 2011 they achieved ~$3.8 billion revenue and ~12,500 employees.

Key Developments and Strategic Initiatives

- Sustainability positioning: Xylem has been recognized for sustainability (e.g., inclusion in the Dow Jones Sustainability Index for North America/FTSE4Good indices.

- Digital water & analytics: In recent years the company has made a strategic push into digital & analytics for water networks (see Partnerships).

- Product & service expansion across full water cycle: transport, treatment, test, reuse.

- Efficiency & margin improvement efforts: They have emphasized operational productivity, price realization, margin expansion.

Mergers & Acquisitions

- In October 2024, Xylem acquired a majority stake in Idrica, a water analytics/data management firm.

In May 2023 they acquired Evoqua Water Technologies for ~$7.5 billion creating what was described as the “world’s largest pure play water technology company”.

Partnerships & Collaborations

- Xylem and Amazon (via some initiative) to deploy advanced leak detection and water management technology in Mexico City & Monterrey.

- Collaboration with nanobubble technology company (Moleaer) to scale municipal/industrial wastewater applications.

Product Launches / Innovations

- Their portfolio includes: pumps & controls, filtration/disinfection, instrumentation & analytics, smart metering & network communications (brands like Flygt, Goulds Water Technology, Sensus, YSI).

- Innovation focus: Digital water solutions (Xylem Vue platform), network analytics, leakage control, remote monitoring.

Key Technology Focus Areas

- Water infrastructure: Movement (pumps), treatment, testing.

- Applied water: Residential, commercial, building services, industrial & agricultural water systems.

- Measurement & control/analytics: Smart meters, sensors, data platforms, software.

- Water reuse and circular water: Technologies enabling reuse, non revenue water reduction, leak detection.

R&D Organisation & Investment

- While exact R&D spend isn’t detailed in our sources here, Xylem emphasises innovation and technological leadership (e.g., analytics, smart water solutions).

- Their Indian technology centre and manufacturing facility in Vadodara indicates investment in regional R&D/engineering/production.

SWOT Analysis

Strengths

- Strong brand and global footprint in water technology sector.

- Comprehensive portfolio across full water cycle: transport, treatment, analytics.

- Diversified end markets: municipal utilities, industrial, commercial, residential.

- Solid recent financial performance and margin expansion.

Weaknesses

- Integration risk from acquisitions (e.g., Evoqua, Idrica).

- Exposure to global markets means currency/geo political risk.

- Some legacy businesses may carry lower margins or be non core hence the divestiture drive.

Opportunities

- Growing global demand for water infrastructure, aging assets, water scarcity, reuse.

- Digital water/analytics uptake: leak detection, asset management, smart networks.

- Emerging markets (India, Asia, Latin America) with major water treatment needs.

- Sustainability/regulation push (water quality, wastewater treatment) favourable.

Threats

- Competitive pressures (many players in water & environment).

- Raw material/commodity cost inflation impacting margins.

- Regulatory changes, environmental compliance risks.

- Macroeconomic/demand slowdowns in municipal/industrial spending.

Recent News & Strategic Updates

- Q2 2025 results: Revenue of US$2.3 billion (up ~6% reported/organic), EPS up ~16%. Full year guidance raised.

- Q3 2025 results: Revenue ~US$2.268 billion (+7.8 % YoY), adjusted EPS ~$1.37 (+23 %). Adjusted EBITDA margin ~23.2%.

Other Top Companies

- Veolia Environnement: The company offers specialized water management services, including distribution & production of drinking water, recycling, collection, & treatment of wastewater, and management of industrial process water.

- SUEZ: The French-based company focuses on waste recovery & recycling and water cycle management.

- Xylem Inc.: The water technology company offers highly engineered solutions, including reuse, collection, & treatment to address the full water cycle.

- Ecolab Inc.: The leading water solution & services provider across various sectors like healthcare, food processing, high tech, food service, hospitality, life sciences, and other industries.

- DuPont: The American company offers solutions & services for clean water and sustainable use.

- Pentair plc

- Kurita Water Industries Ltd.

- Kemira Oyj

- Solenis

- Evoqua Water Technologies

- SNF Floerger

- VA Tech WABAG (WABAG)

- Thermax Ltd.

- Doosan / Doosan Enerbility

- Aquatech International

- Fluence Corporation

- BASF

- Calgon Carbon / Cabot

- Hitachi Ltd. / Mitsubishi Electric

- 3M

Segments Covered

By Product Type

- Packaged / Pre-engineered Systems

- Skid-mounted RO / UF / NF units

- Packaged MBR / biological units

- Standardized filtration & chemical dosing skids

- Engineered / Custom Treatment Plants

- Site-specific turnkey plants

- Large ZLD / desalination engineering projects

- Components & Equipment (pumps, membranes, valves, sensors)

- Spiral-wound & hollow-fiber membranes

- High-efficiency pumps & blowers

- Chemicals & Consumables

- Antiscalants, biocides, coagulants, pH adjusters

- Filter media, cartridges

- Operation & Maintenance / Aftermarket Services

- O&M contracts, spare parts supply

- Monitoring, Control & Digital Solutions (SCADA, IIoT, analytics)

By Technology

- Membrane Technologies (RO / UF / NF / MF)

- Biological Treatment (MBR, activated sludge, biofilm)

- Thermal Processes (evaporation, multi-effect evaporators, distillation)

- Filtration & Media (sand, multimedia, activated carbon)

- Ion Exchange & Softening

- Chemical Treatment & Coagulation

- Advanced Oxidation / UV / Electrochemical

By System Type / Deployment

- On-site Packaged Systems (plant-level installation)

- Centralized / Engineered Facilities (large municipal-style plants for industrial clusters)

- Modular / Containerized Systems

- Hybrid Systems (packaged + engineered integration)

- Mobile / Temporary Treatment Units

By End-Use Industry

- Power Generation (boiler feed, cooling tower, ash handling)

- Oil & Gas (produced water treatment, process water)

- Chemicals & Petrochemical

- Food & Beverage

- Metals & Mining

- Pharmaceuticals & Life Sciences

- Semiconductor & Electronics Manufacturing

- Pulp & Paper

- Textiles

- Other Industrial Users

By Water Source / Feedwater

- Industrial Wastewater (process effluent)

- Municipal / Surface Water (treatment for process use)

- Groundwater / Brackish Water

- Seawater (desalination for process or potable)

- Boiler, Cooling & Utility Water Make-up

- Process Water Reuse & Zero-Liquid-Discharge (ZLD)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa