Content

What is the Current Metal Recycling and Recovery Market Size and Share?

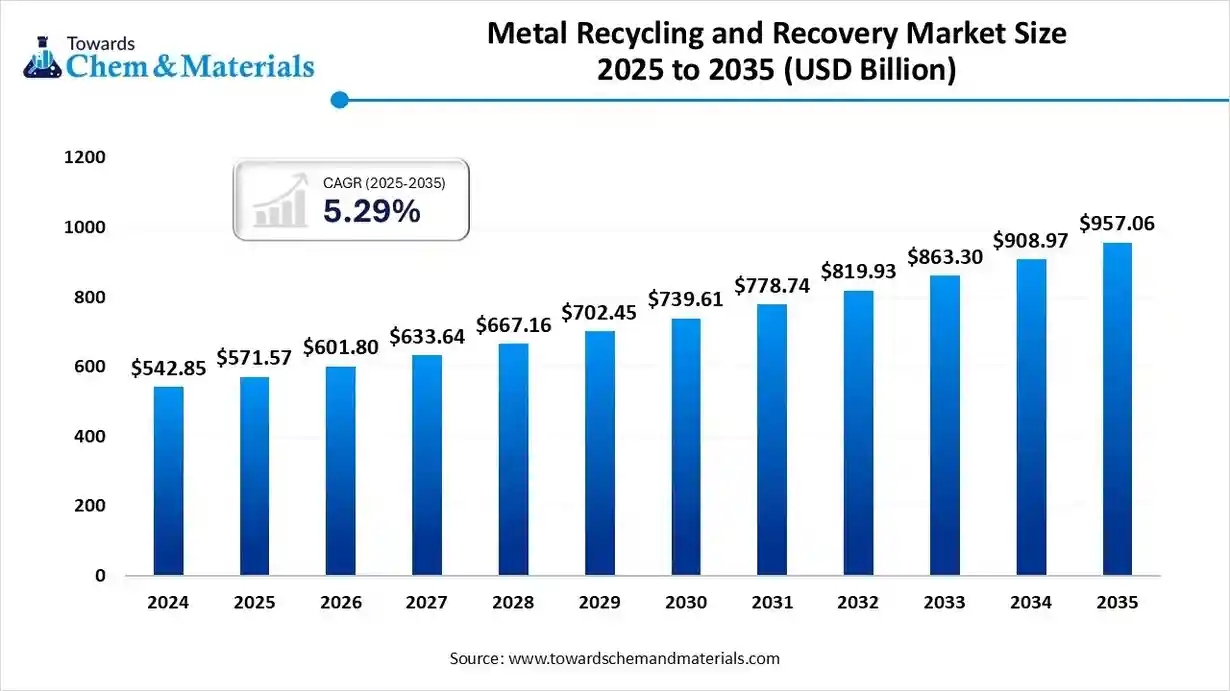

The global metal recycling and recovery market size is calculated at USD 571.57 billion in 2025 and is predicted to increase from USD 601.80 billion in 2026 and is projected to reach around USD 957.06 billion by 2035, The market is expanding at a CAGR of 5.29% between 2025 and 2035. Asia Pacific dominated the metal recycling and recovery market with a market share of 43% the global market in 2024.The growing demand for energy efficiency and eco-friendly manufacturing is likely to create value-added opportunities for industry participants.

Key Takeaways

- By region, Asia Pacific dominated the metal recycling and recovery market with approximately 43% industry share in 2024.

- By region, North America is likely to capture a greater portion of the market in the future.

- By metal type, the ferrous metal segment dominated the market with approximately 58% in 2024.

- By metal type, the battery and critical metals segment is expected to grow at a 9% CAGR in the market during the forecast period.

- By process, the mechanical processing & sorting segment dominated the metal recycling and recovery market with approximately 41% industry share in 2024.

- By process, the hydrometallurgical/chemical recovery segment is expected to grow at the fastest rate in the market during the forecast period.

- By end use, the automotive segment dominated the market with approximately 31% industry share in 2024.

- By end use, the aerospace and defence segment is expected to grow at a 7% CAGR in the market during the forecast period.

Sustainability in Motion: The Rise of the Global Metal Recycling Market

The metal recycling and recovery market covers the collection, sorting, processing, and re-refining of metal-containing materials (ferrous and non-ferrous) from end-of-life products, manufacturing scrap, and electronic waste, as well as the recovery of critical metals (e.g., lithium, cobalt, nickel, copper) from batteries and urban waste streams.

The market includes physical recovery (shredding, sorting, smelting), chemical/hydrometallurgical recovery (leaching, solvent extraction), and emerging biological/pyrometallurgical techniques. Demand is driven by resource scarcity, circular-economy policies, decarbonization / low-carbon metal production goals, rising scrap value, growth in electronics and EV batteries, and regulatory pressure to divert waste from landfills.

Metal Recycling and Recovery Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the increasing need for cost-effectiveness and the surge for urban mining from electronics, building, and end-of-life vehicles is paving the way for economic benefits in the manufacturing sector. Moreover, the price swings in the virgin metal market are another factor for the industry's growth in recent years.

- Sustainability Trends: Major companies have been actively quantifying the carbon saved per ton while increasingly preferring lower-carbon processes in recent years. Also, the buyers have seen the heavy requirement of verified recycled content. Moreover, the greater government support for eco-friendly manufacturers is driving the industry potential in the current period.

- Global Expansion: Several regions around the world have been building their own recycling centres in recent years. Moreover, the major regions have avoided scrap exports by processing them locally, thereby creating greater employment in their own regions. Also, the major companies have been establishing strategic collaborations in recent years.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 601.80 Billion |

| Expected Size by 2035 | USD 957.06 Billion |

| Growth Rate from 2025 to 2035 | CAGR 5.29% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2026 - 2035 |

| Leading Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segment Covered | By Metal Type, By Process / Technology, By End-Use Industry, By Region |

| Key Companies Profiled | Sims Limited (Sims Metal Management), Schnitzer Steel Industries, Nucor Corporation, Steel Dynamics, Inc., Novelis Inc., Alcoa Corporation, Umicore, Aurubis AG, Boliden, European Metal Recycling (EMR), Li-Cycle Corp., Redwood Materials, |

Recycling Reinvented: AI and Automation Drive Metal Recovery Growth

Smart machines with sensors and cameras now sort metals faster and more accurately. Robots are replacing risky manual work and improving safety. Chemical and water-based recovery methods are helping to extract valuable metals from batteries and electronic waste more efficiently. Small, mobile recycling units are being used near waste sources to save time and fuel.

Trade Analysis of the Metal Recycling and Recovery Market:

What’s Traded (Product Categories & HS Proxies)

- Ferrous scrap (HS 7204 / 7201 family): shredded scrap, remelt scrap, pig iron from scrap — used by EAF steelmakers.

- Stainless-steel scrap (HS 7204.21/7204.22 series): higher-value alloy scrap with Ni/Cr content.

Aluminium scrap (HS 7602): wrought & cast aluminium scrap, ingots from secondary smelters. - Copper scrap (HS 7404 / 7402): bare bright copper, mixed alloys, cable scrap, high value, and tight supply.

- Lead, zinc, precious metals scrap: battery scrap, plating residues, and electronic scrap feed smaller but high-margin trade lanes.

Because many up-front recyclers process and upgrade scrap (shearing, baling, demagnetizing, sorting), exported volumes are a mix of raw and processed grades, and buyers pay premiums for high-quality, contamination-free bales and prepared bundles.

Top Exporters (by Metal / Recent HS Data Highlights)

- United States — major exporter across scrap iron/steel, aluminium, and copper waste streams; large volumes of well-sorted, processed scrap leave North America for Asia and Europe.

- Germany / Netherlands / Belgium (EU hubs) — large exporters of stainless and high-quality steel scrap and major re-export/processing hubs for intra-EU & extra-EU flows. The Netherlands and Germany appear prominently in stainless and aluminium scrap exports.

- Japan & Korea — both significant exporters (specialist non-ferrous and stainless scrap) and important re-exporters in some product lines.

- India & Turkey — while often large importers, these countries also export certain processed secondary products and re-route flows regionally (India has had a marked increase in export shipments in recent years in some HS subcategories).

- China — historically a major importer of mixed and aluminium scrap (policy changes have varied imports), and a large domestic processor, its import rules strongly influence global scrap prices and routings.

Top Importers/Demand Centres

- Turkey — a critical global importer of ferrous scrap (feeds extensive electric-arc furnace capacity); Turkey often ranks as the world’s largest importer of scrap steel by value.

- India — large importer of ferrous and non-ferrous scrap for its steel and foundry sectors; surge in shipments in 2022–2024 shows India’s growing role as a central demand hub.

- South Korea & Japan — consistent importers of high-grade scrap for specialty steel and alloy production.

- EU & U.S. domestic mills — import some grades but also source domestically; intra-EU flows are very important for stainless and aluminium feedstock.

Typical Trade Flows & Logistics Patterns

- High-quality processed scrap (sorted, demagnetized, baled) tends to be exported from developed-market recyclers (U.S., EU, Japan) to industrial remelters in Turkey, Korea, India and Southeast Asia.

- Aluminium and copper scrap — because of higher unit value and stricter contamination tolerances, often travel on shorter, trusted trade lanes (e.g., EU Europe, North America to Mexico/Latin America, North America/EU to Asia).

- Electronic waste and battery scrap increasingly move via specialized brokers and must clear more stringent customs and environmental controls; they’re traded in smaller, higher-value consignments.

- Re-export hubs: The Netherlands, Belgium, and the UAE act as consolidation and re-export nodes, especially where value-added sorting/processing occurs before onward shipment.

Value Chain Analysis of the Metal Recycling and Recovery Market:

- Distribution to Industrial Users : The distribution of recycled metals to industrial users involves a robust supply chain with specialized processors, traders, and end-user manufacturers.

Key Players: Sims Limited (Australia/Global), Nucor Corporation (U.S.), and ArcelorMittal (Luxembourg/Global) - Chemical Synthesis and Processing :Chemical synthesis and processing methods are crucial in the metal recycling and recovery market for extracting and refining metals from complex waste streams

Key Players: Umicore (Belgium/Global), Aurubis AG (Germany), and Glencore International AG (Switzerland) - Regulatory Compliance and Safety Monitoring :Regulatory compliance and safety monitoring in the metal recycling market involve several governmental and non-governmental agencies

Key Players: Material Recycling Association of India (MRAI), International Atomic Energy Agency (IAEA), and Basel Convention

Metal Recycling and Recovery Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | Environmental Protection Agency (EPA) | Resource Conservation and Recovery Act (RCRA) | Reducing landfill waste | This is the federal agency responsible for implementing and enforcing environmental protection laws and waste management regulations. |

| European Union | European Commission (EC) | Waste Framework Directive (WFD) (Directive 2008/98/EC) | Moving towards a circular economy | This is the executive body that proposes and enforces EU-wide legislation on waste and raw materials. |

| China | Ministry of Ecology and Environment (MEE) | Law of the People's Republic of China on the Prevention and Control of Environmental Pollution by Solid Waste | Strengthening environmental protection through stricter enforcement | It is the main environmental protection agency responsible for setting and enforcing pollution control policies and standards for solid waste and environmental protection. |

Segmental Insights:

Metal Type Insights

How did the Ferrous Metals Segment Dominate the Metal Recycling and Recovery Market in 2024?

- The ferrous metals segment dominated the metal recycling recovery market, accounting for approximately 58% of the industry share in 2024, driven by higher recycling rates and the widespread use of iron and steel across major industries such as automotive, construction, and machinery. Moreover, with advantages such as easy separation and quality retention comparable to first-hand ferrous metals, ferrous metals have attracted significant industry attention.

- On the other hand, the battery & critical metals segment is expected to grow rapidly, driven by a surge in electric vehicle adoption and the need for renewable energy storage. Moreover, the battery waste increases, and the recovery of these metals is profitable and essential in the current period.

- The aluminum segment is also growing rapidly, driven by factors such as lightweighting, improved recyclability, and corrosion-resistant properties. Moreover, by requiring only 5% recycled aluminum to produce new aluminum, the segment has attracted greater industry attention from sustainable production players.

Process/Technology Insights

Why does the Mechanical Processing & Sorting Segment Dominate the Metal Recycling and Recovery Market by Process?

- The mechanical processing & sorting segment dominated the market, accounting for approximately 41% of industry share in 2024, as these methods are efficient, cost-effective, and widely adopted. The process involves shredding, magnetic separation, eddy current sorting, and density separation to recover ferrous and non-ferrous metals.

The hydrometallurgical/chemical recovery segment is expected to grow at the fastest rate due to its ability to recover high-purity metals from complex waste streams, such as e-waste and spent batteries. This process uses leaching agents and solvents to dissolve valuable metals, offering better selectivity and environmental performance than traditional smelting. - The pyrometallurgical segment in the metal recycling and recovery market is also expected to see notable growth due to its efficiency in processing mixed and high-volume metal waste. This process involves high-temperature smelting to extract metals from ores or scrap, making it suitable for recovering copper, aluminum, and steel.

End Use Insights

How did the Automotive Segment Dominate the Metal Recycling and Recovery Market in 2024?

- The automotive segment dominated the metal recycling and recovery industry with approximately 31% share in 2024, as vehicles contain large amounts of recyclable metals such as steel, aluminum, and copper. End-of-life vehicles provide a consistent source of scrap material, and automakers increasingly adopt recycled metals to reduce production costs and meet sustainability goals.

- The aerospace & defence segment is expected to grow rapidly due to rising demand for high-performance, lightweight metals such as titanium. nickel and aluminum alloys. These metals are expensive and strategically important, making their recovery highly valuable.

- The construction & infrastructure segment is also notably growing in the market for metal recycling, due to large-scale urbanization, renovation, and demolition activities that generate high volumes of metal waste. Steel, aluminum, and copper are widely used in buildings, bridges, and electrical systems, making them easily recoverable during reconstruction projects.

Regional Analysis:

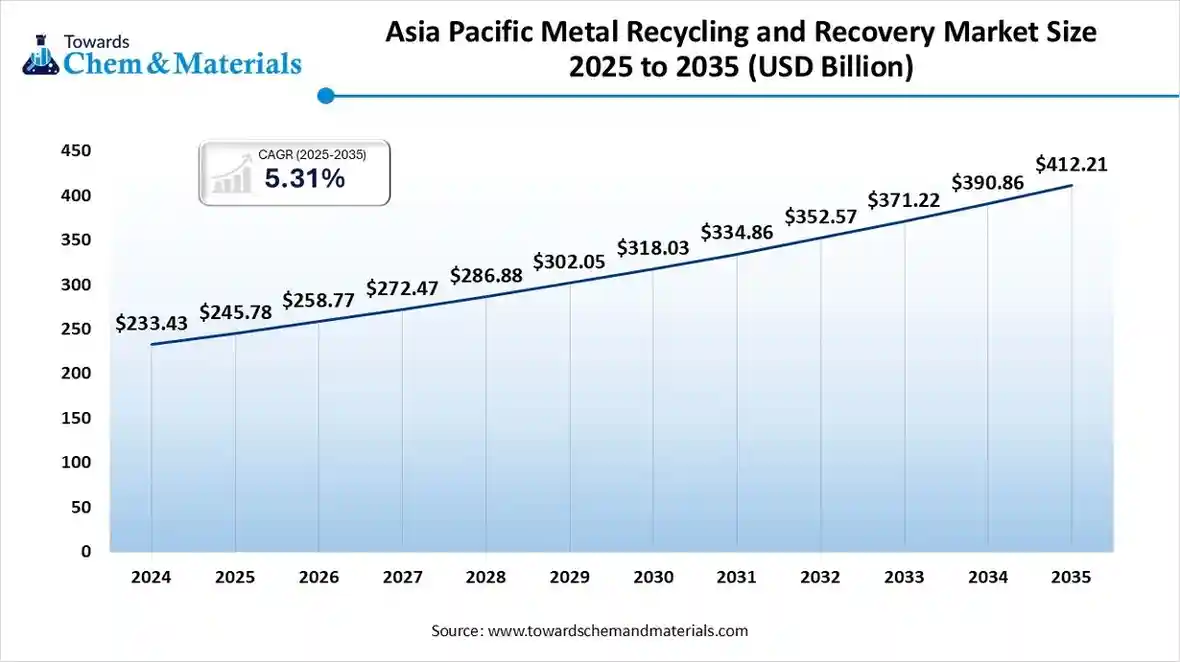

The Asia Pacific metal recycling and recovery market size was valued at USD 245.78 billion in 2025 and is expected to reach USD 412.21 billion by 2035, growing at a CAGR of 5.31% from 2025 to 2035. Asia Pacific dominated the metal recycling and recovery market, accounting for approximately 43% of the industry share, owing to its large manufacturing base and ongoing industrialization. Moreover, regional countries such as India, Japan, and China have seen significant growth in automotive production, electronic manufacturing, and construction, which is contributing to industry growth in the region.

Government Backing Fuels China’s Metal Recycling Revolution

China maintained its dominance in the metal recycling and recovery market due to stronger metal recycling infrastructure and early adoption of advanced technologies. Furthermore, the country is known for its heavy consumption and recycling of metals like copper, steel, and aluminum in the current period. Also, greater government support for recycled metal use has played a major role in the industry's expansion in China.

Why Is North America's Metal Recycling and Recovery Seeing Notable Growth in the Market?

North America is expected to capture a major share of the metal recycling and recovery market, driven by heavy investment in advanced recycling technologies and the implementation of sustainability standards. Moreover, several manufacturers in the region have focused on electric waste recovery, battery recycling, and eco-friendly manufacturing in recent years.

United States Leads the Way in Advanced Metal Recycling Systems

The United States is expected to emerge as a prominent country for the metal recycling and recovery market in the coming years, owing to early technology adoption and advanced metal recovery infrastructure. Moreover, the country manufacturers are increasingly offering to establish recycling systems for the ferrous and non-ferrous metals in the current period.

What Are the Trends in the European Metal Recycling and Recovery Market?

Europe is a notably growing region due to national circularity initiatives and advanced recovery infrastructure. Moreover, countries in the region, such as Germany, the United Kingdom, and France, have seen a significant recovery in metals such as steel, aluminum, and electronic waste.

Germany Sets Global Standards in Sustainable Metal Processing

Germany is expected to gain significant market share due to its advanced industrial base and strong environmental policies. The country has highly efficient collection and sorting systems for ferrous, non-ferrous, and electronic waste. German companies are pioneers in developing mechanical and hydrometallurgical recovery technologies, ensuring high metal purity.

Metal Recycling and Recovery Market Share, By Region, 2024 (%)

| Regional | Revenue Share |

| North America | 24% |

| Europe | 18% |

| Asia Pacific | 43% |

| Latin America | 9% |

| Middle East and Africa | 6% |

Latin America Metal Recycling and Recovery Market Analysis

Latin America is expected to capture a notable share of the metal recycling and recovery market. As recycling awareness and infrastructure development increase across the region. Expanding construction, automotive, and manufacturing sectors generate substantial metal waste suitable for recovery. Governments are beginning to introduce waste management and recycling regulations, encouraging organized collection systems.

Brazil Forging a Greener Future Through Metal Recycling

Brazil is expected to emerge as a prominent player in the metal recycling and recovery market in the coming years, driven by its strong manufacturing base and growing sustainability awareness. The country has a large supply of ferrous and aluminum scrap from construction, automotive, and packaging industries. Local recyclers are improving collection networks and adopting mechanical and thermal processing technologies.

Recent Developments

- In April 2025, The Nobian, Asahi Kasai, Furuya Metal, and Mastermelts established a strategic collaboration. The main motive behind the collaboration is to recycle metals from the electrolyzer compounds, as per the company's published report.(Source: www.asahi-kasei.com)

Top Vendors in the Metal Recycling and Recovery Market & Their Offerings:

- Sims Limited (Sims Metal Management) – Sims Limited is one of the world’s largest metal recycling and resource recovery companies, operating across ferrous and non-ferrous metal segments. The company collects, processes, and trades scrap steel, copper, aluminum, and precious metals, integrating advanced shredding and sorting technologies to maximize material recovery. Sims also focuses on urban mining and circular economy initiatives, contributing to decarbonization in the steel and manufacturing industries.

- Schnitzer Steel Industries – Schnitzer Steel operates integrated ferrous and non-ferrous recycling facilities and steel manufacturing plants. Through its Pick-n-Pull and Cascade Steel divisions, the company recycles millions of tons of scrap metal annually and converts it into new steel products, emphasizing low-emission electric arc furnace (EAF) steelmaking and sustainable resource management.

- Nucor Corporation – Nucor is one of the largest steel producers in North America and a major recycler of ferrous scrap metals. The company’s electric arc furnace operations rely heavily on recycled steel feedstock, aligning with its commitment to low-carbon steel production. Nucor also develops closed-loop recycling partnerships across construction and manufacturing sectors.

- Steel Dynamics, Inc. – Steel Dynamics operates metal recycling and steelmaking operations through its OmniSource division. The company collects and processes scrap for use in its steel production facilities, emphasizing efficiency, resource circularity, and traceable raw material sourcing across the steel value chain.

- Novelis Inc. – Novelis is a global leader in aluminum recycling and rolled product manufacturing, processing millions of tons of post-consumer and industrial aluminum scrap each year. The company’s closed-loop recycling systems supply automotive, beverage can, and aerospace sectors, supporting carbon reduction and material efficiency.

- Alcoa Corporation – Alcoa integrates primary and secondary aluminum production, operating large-scale aluminum recycling facilities worldwide. Its sustainable metal recovery programs focus on reducing waste, increasing scrap reuse, and minimizing carbon emissions in the aluminum value chain.

- Umicore – Umicore is a global materials technology company specializing in precious metal and battery material recycling. The company’s processes recover platinum group metals, cobalt, nickel, and lithium from end-of-life products, making it a key enabler in the circular economy for energy storage and electronics.

- Aurubis AG – Aurubis is one of the largest copper recyclers globally, processing copper concentrates, scrap, and electronic waste. The company’s refining and smelting facilities recover copper, nickel, tin, and precious metals, ensuring high-purity metal output through advanced pyro- and hydrometallurgical technologies.

- Boliden – Boliden operates mining and recycling facilities for base and precious metals across Europe. Its recycling division focuses on electronic waste, lead-acid batteries, and metal scrap, producing refined copper, zinc, and gold using low-carbon energy and efficient recovery systems.

- European Metal Recycling (EMR) – EMR is a leading UK-based recycler of ferrous and non-ferrous metals, handling millions of tons of scrap annually. The company offers collection, processing, and resale services for steel, aluminum, and copper, while investing in advanced separation technologies and sustainability initiatives to reduce waste and energy consumption.

- Li-Cycle Corp. – Li-Cycle is a North American company specializing in lithium-ion battery recycling, utilizing its Spoke & Hub Technologies to recover lithium, nickel, cobalt, and other critical materials. Its hydrometallurgical process enables high recovery rates while minimizing environmental impact, supporting the EV and energy storage value chain.o

- Redwood Materials – Redwood Materials, founded by former Tesla executives, focuses on battery recycling and materials recovery from lithium-ion batteries and e-waste. The company recovers lithium, copper, nickel, and cobalt, creating a domestic circular supply chain for battery materials used in electric vehicles and renewable energy storage.

Segments Covered in the Report

By Metal Type

- Ferrous Metals (Steel & Iron)

- Aluminum

- Copper

- Lead

- Precious Metals (Gold, Silver, Platinum group)

- Battery & Critical Metals (Lithium, Cobalt, Nickel, Rare Earths)

- Others (Zinc, Tin, Magnesium, etc.)

By Process / Technology

- Mechanical Processing & Sorting (Shredding, Magnetic/Eddy Current, Optical Sorting)

- Pyrometallurgical (Smelting, Refining)

- Hydrometallurgical / Chemical Recovery (Leaching, Solvent Extraction)

- Electrochemical Recovery / Electrowinning

- Biohydrometallurgy / Biorecovery & Emerging Processes

- Cryogenic & Advanced Separation Technologies

By End-Use Industry

- Automotive (Scrap & Secondary Metals for Casting, Body Parts)

- Construction & Infrastructure

- Electrical & Electronics (including PCBs, connectors)

- Packaging (Aluminum Cans, Foils)

- Aerospace & Defense (high-spec recycled alloys)

- Energy (Wind, Transmission, Battery supply chain)

- Industrial Machinery & Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa