Content

Metal Recycling Market Size and Growth 2025 to 2034

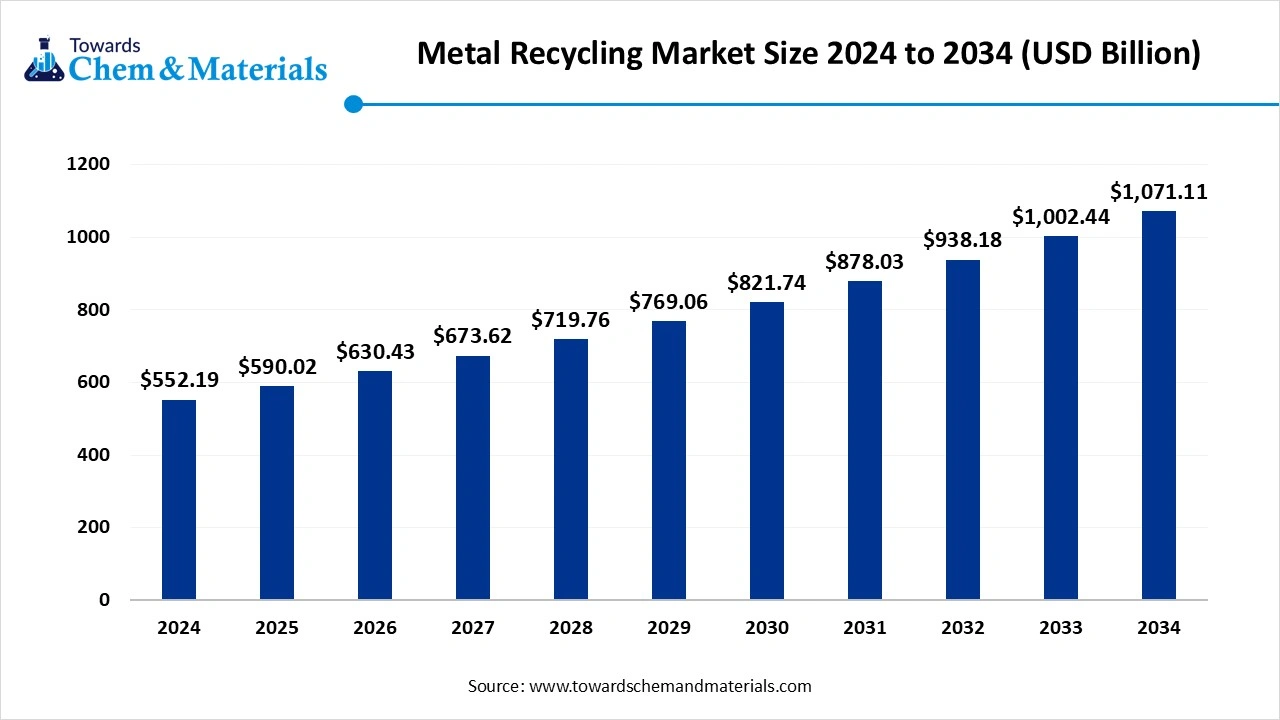

The global metal recycling market size was reached at USD 552.19 billion in 2024 and is expected to be worth around USD 1,071.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.85% over the forecast period 2025 to 2034. The focus on lowering carbon footprints, high demand for metal, and growing industrialization drive the overall growth of the market.

Key Takeaways

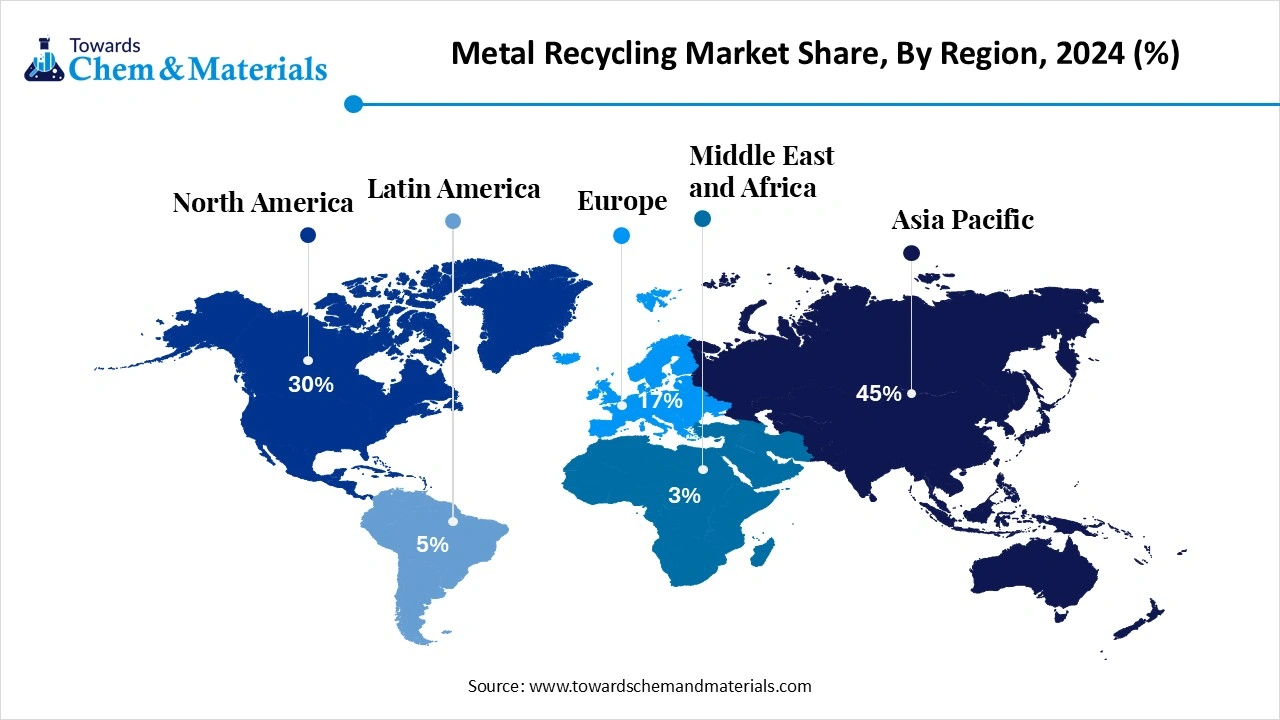

- By region, Asia Pacific held approximately a 45% share in the metal recycling market in 2024 due to the growing industrial activities.

- By region, North America is growing at the fastest CAGR in the market during the forecast period due to the increasing development of infrastructure.

- By metal type, the ferrous metals segment held approximately a 65% share in the market in 2024 due to the growing use of steel & iron in various industrial applications.

- By metal type, the non-ferrous metals segment is expected to grow at the fastest CAGR in the market during the forecast period due to the strong focus on clean energy transition.

- By scrap source, the industrial scrap segment held approximately a 50% share in the market in 2024 due to the growing manufacturing sector.

- By scrap source, the obsolete scrap segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing adoption of electronic devices.

- By processing method, the melting & refining segment held approximately a 40% share in the market in 2024 due to the growing demand for high-quality metals.

- By processing method, the sorting & shredding segment is expected to grow at the fastest CAGR in the market during the forecast period due to the rising complexity of scrap.

- By end-use industry, the construction & infrastructure segment held approximately a 45% share in the market in 2024 due to the growing construction activities.

- By end-use industry, the automotive segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing production of vehicles.

Power of Metal Recycling in a Greener Tomorrow and Sustainability

Metal recycling is the multi-step process of recycling metal by collecting metals like steel, aluminium, copper, and others from various sources. The process involves collection, sorting, processing, melting, purification, and repurposing scrap metals. Metal recycling offers benefits like environmental protection, waste reduction, resource conservation, climate change mitigation, and energy savings. It is widely used in industries like construction, automotive, electronics, packaging, and machinery.

Factors like rising metal demand, focus on sustainability, stringent regulations for reducing landfill waste, advanced sorting technologies, growing utilization of recycled metals in renewable energy infrastructure & electric vehicles, and expansion of recycling facilities contribute to the growth of the metal recycling market.

- Germany exported $2.06B of scrap aluminum in 2023.(Source: oec.world)

- Indonesia exported $3.45B of precious metal scraps in 2023.(Source: oec.world)

- Germany exported $4.54B of scrap iron in 2023.(Source: oec.world)

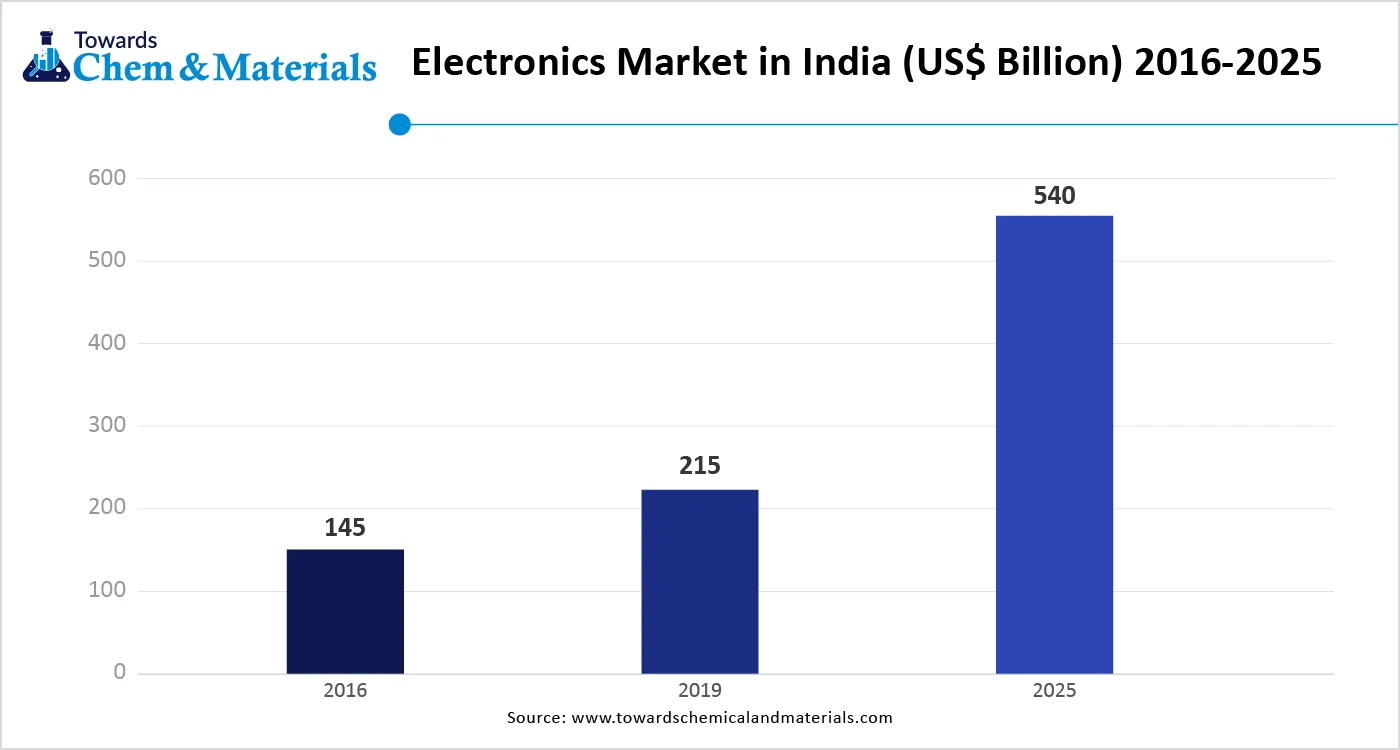

Growing Electronic Industry Drives the Metal Recycling Market

The growing electronic industry and increasing adoption of various electronic products increase demand for recycled metals. The increasing manufacturing of connectors, electronic components, and circuit boards requires recycled metals like silver, copper, gold, and palladium.

The increasing need for lithium-ion batteries in solar panels and electric vehicles increases demand for recycled metals. The growing adoption of electronic devices like smartphones, laptops, computers, and wearables increases demand for recycled metals like palladium, gold, copper, silver, and nickel. The increasing manufacturing of batteries and the high popularity of electronic gadgets increase demand for recycled metals. The high volume of discarded electronics and the generation of e-waste increase the production of recycled metals. The growing electronic industry is a key driver for the growth of the metal recycling market.

Market Trends

- Growing Environmental Awareness: The growing environmental concerns like pollution, greenhouse gas emission, climate change, and carbon dioxide emission increase demand for metal recycling to support sustainability.

- Increasing Demand for Metals: The growing demand for metals like aluminum & steel in various applications like infrastructure development, construction, automotive, packaging, and many more helps the market growth.

- Technological Advancements: The ongoing technological advancements, like improvement in metal recovery, advanced sorting, advanced shredders, and AI-driven processes, make metal recycling more effective.

Market Opportunity

Expansion of Packaging Surge Demand for Recycled Metals

The growing expansion of the packaging industry and focus on sustainable packaging increase demand for recycled metals. The rapid growth in e-commerce and increased consumption of packaged foods increases demand for recycled metals. The growing consumer demand for eco-friendly packaging and the need for durable packaging increase the adoption of recycled metals. The growing demand for metal packaging in products like vegetables, beer, canned fruits, soft drinks, and seafood increases demand for recycled metals.

The growing production of food & beverage cans, aerosol cans, paint cans, and beauty & cosmetic product tubes requires recycled metals. The strong focus on less energy consumption and reducing waste increases demand for recycled metal packaging. The expansion of packaging creates an opportunity for the growth of the metal recycling market.

Market Challenge

High Capital Cost Shuts Down Metal Recycling Market Growth

Despite several benefits of metal recycling in various industries, the high capital cost restricts the market growth. Factors like need for extensive labor, high-quality storage for scrap materials, high investment in specialized machinery, efficient transportation, and large-scale infrastructure are responsible for the high capital cost.

The need for specialized equipment like advanced machinery for separation & sorting, and the development of large-scale infrastructure like utility vehicles, land acquisition, recycling facilities, & plant upgrades increases the cost. The labor-intensive processes like processing, collection, & sorting, and the need for efficient logistical networks increase the cost. The need for large storage facilities and costly equipment requires a high cost. The high capital cost hampers the growth of the market.

Regional Insights

Asia Pacific Metal Recycling Market Trends

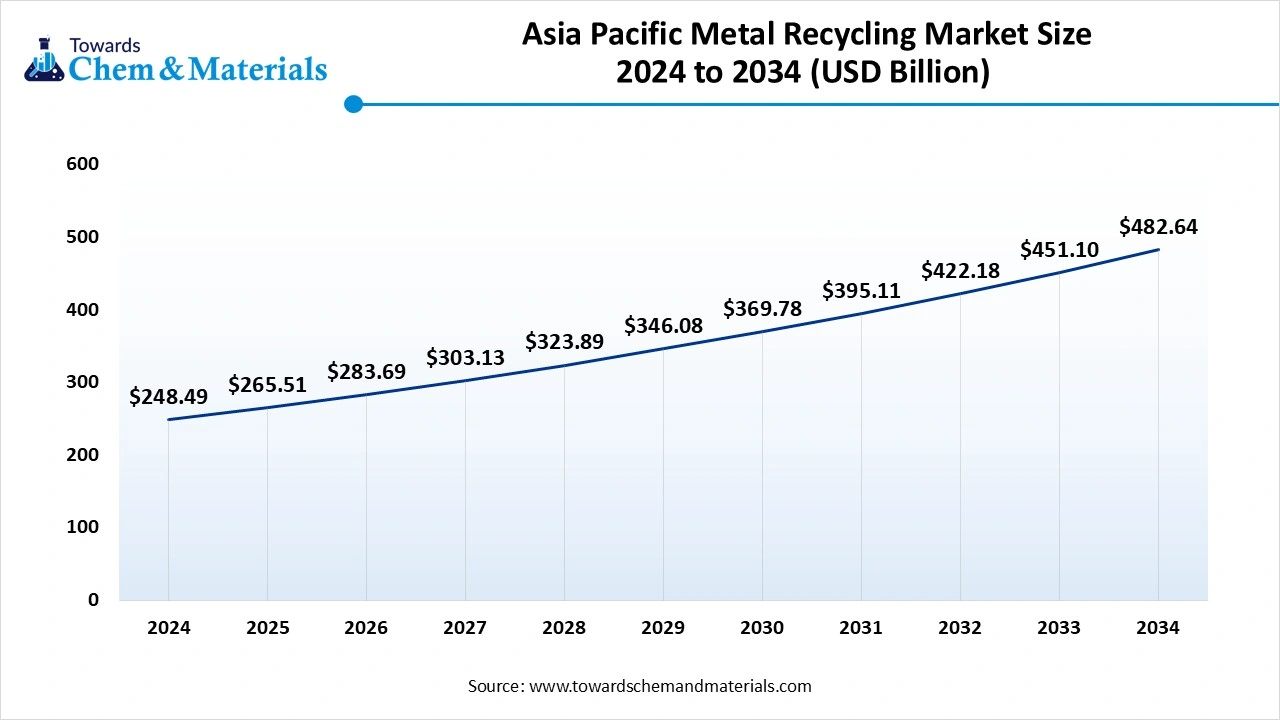

The Asia Pacific metal recycling market size was estimated at USD 248.49 billion in 2024 and is anticipated to reach USD 482.64 billion by 2034, growing at a CAGR of 6.86% from 2025 to 2034. Asia Pacific dominated the market in 2024.

The growing industrial activity and well-established manufacturing sector in countries like Japan, China, and India increase demand for metal recycling. The growing large-scale construction activities and increasing investment in infrastructure development increase the adoption of metal recycling. The stricter environmental regulations and increasing awareness about environmental issues increase demand for metal recycling. The growing demand for metal recycling in industries like construction and automotive drives the overall growth of the market.

China Metal Recycling Market Trends

China is a major contributor to the metal recycling market. The well-established metal scrap manufacturing and supportive government policies increase demand for metal recycling. The growing industrialization and presence of advanced recycling technology increase the adoption of metal recycling. The growing demand for metals in industries like electronics, construction, and automotive increases metal recycling, supports the overall growth of the market.

- From October 2023 to September 2024, China exported 243 shipments of copper scrap with a growth rate of 63% from the previous 12 months.(Source: www.volza.com)

- From October 2023 to September 2024, China exported 30 shipments of aluminum scrap with a growth rate of 20% from the previous 12 months.(Source: www.volza.com)

North America Metal Recycling Market Trends

North America is experiencing the fastest growth in the market during the forecast period. The strong government policies and growing infrastructure development increase demand for metal recycling. The ongoing technological advancements, like scrap-fed electric arc furnaces and AI-based sorting, help the market growth. The increasing awareness about sustainability and the increasing scarcity of metals increase metal recycling. The growing industries like manufacturing, automotive, and construction increase the adoption of metal recycling, driving the overall growth of the market.

United States Metal Recycling Market Trends

The United States is a key contributor to the market. The growing equipment manufacturing and production of automobiles increases demand for metal recycling. The well-established infrastructure for metal recycling and the presence of advanced technologies like AI increase metal recycling. The growing demand for metal recycling in industries like manufacturing, construction, and automotive supports the overall growth of the market.

- The United States exported $3.45B of scrap aluminum in 2023.(Source: oec.world)

- The United States exported $5.44B of precious metal scraps in 2023.(Source: oec.world)

Segmental Insights

Metal Type Insights

Why did the Ferrous Metals Segment Dominate the Metal Recycling Market?

The ferrous metals segment dominated the market in 2024. The growing utilization of ferrous metals like steel and iron in construction activities for the development of reinforcement bars and structural beams helps the market growth. The focus on lowering environmental concerns and conserving natural resources increases demand for ferrous metals. The strong focus on minimizing energy consumption and lower expenses increases the adoption of ferrous metals. The growing utilization of ferrous metals in industrial machinery and automotive manufacturing drives the overall growth of the market.

The non-ferrous metals segment is the fastest-growing in the market during the forecast period. The growing utilization of copper & aluminum in various industries and strong government support for the conservation of non-ferrous metals help the market growth. The high availability of an unlimited number of recycling times increases the adoption of non-ferrous metals. The focus on clean energy transition and conservation of valuable resources increases the adoption of non-ferrous metals. The growing use of non-ferrous metals in industries like construction, consumer appliances, automotive, and electronics supports the overall growth of the market.

Scrap Source Insights

How the Industrial Scrap Segment Held the Largest Share in the Metal Recycling Market?

The industrial scrap segment held the largest revenue share in the market in 2024. The growing infrastructure projects and increasing manufacturing activities increase the production of industrial scraps. The less extensive cleaning and sorting costs increase the adoption of industrial scraps. The growth in the shipbuilding industry increases the production of industrial scrap. The growing production of industrial scrap in industries like automotive and construction drives the overall growth of the market.

The obsolete scrap segment is experiencing the fastest growth in the market during the forecast period. The increasing production of vehicles and the adoption of electronic devices generate obsolete scrap. The growing use of consumer durables and infrastructure development increases the production of obsolete scrap. The growing industries like construction, automotive, and railways increase the adoption of obsolete scrap, supporting the overall growth of the market.

Processing Method Insights

What made the Melting & Refining Segment Dominate the Metal Recycling Market?

The melting & refining segment dominated the market in 2024. The growing demand for high-quality metal and its easy adaptability with different types of metals increases demand for melting and refining. The growing development of infrastructure projects and production of structural components increases the adoption of melting & refining technology. The increasing production of vehicle parts and development of machinery increases demand for melting & refining, driving the overall growth of the market.

The sorting & shredding segment is the fastest-growing in the market during the forecast period. The growing demand for smaller metal pieces and the increasing need for segregation of non-ferrous & ferrous metals increases demand for sorting & shredding. The stringent waste management and strong government support for sustainable practices increase demand for sorting & shredding. The increasing complexity of scrap and large metal waste increases the demand for sorting & shredding. The availability of automated sorting and the presence of high-performance shredders support the overall growth of the market.

End-Use Industry Insights

Which End-Use Industry Held the Largest Share in the Metal Recycling Market?

The construction & infrastructure segment held the largest revenue share in the market in 2024. The rapid urbanization and growing development of infrastructure increase demand for metal recycling. The increasing production of structural components, beams, and columns increases demand for metals like aluminum & steel. The growing industrial, residential, and commercial construction projects increase demand for metals. The strong focus on sustainable construction and the adoption of green building certifications increase demand for metals, driving the overall growth of the market.

The automotive segment is experiencing the fastest growth in the market during the forecast period. The growing production of vehicle parts like engine components, fenders, and doors increases demand for recycled metals. The focus on reducing the carbon footprint in vehicle production increases demand for recycled metals. The increasing manufacturing of chassis parts, car bodies, and structural components increases demand for recycled aluminum & steel. The rise in electric vehicles increases demand for recycled metals for the development of wiring and batteries, supporting the overall growth of the market.

Metal Recycling Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement for metal recycling involves the collection and processing of different metal types, like metal shavings, atomized metal powder, metal chips, scrap metal, and metal turnings.

- Chemical Synthesis and Processing: The chemical synthesis and processing involve the extraction of metal precursors using chemical reactions like electrorefining, acid washing, leaching, chemical separation & precipitation, & solvent extraction to synthesize new materials.

- Quality Testing & Certification: The quality testing involves testing of qualities like purity & contamination checks, moisture & density, composition analysis, & hazardous material detection, and certification includes GRS, BIS, and Recycled Content Certification.

Recent Developments

- In May 2025, India launched a non-ferrous metal recycling digital portal to boost the circular economy. The portal aims to strengthen industry participation, build a national platform for stakeholders, enable data collection, and create transparent infrastructure for metals like copper, zinc, aluminum, lead, and critical minerals. (Source: currentaffairs.adda247.com)

- In April 2025, Asahi Kasei collaborated with Nobian, Furuya Metal & Mastermelt to launch a recycling metal project from electrolyzer components. The project focuses on establishing a circular economy and recycling & reusing electrodes as a raw material for new components. The project aims to support the chlor-alkali industry.(Source: www.indianchemicalnews.com)

- In June 2025, Epson Atmix launched operations at a new plant, Kita-Inter, for recycling used metal. The plant helps to lower carbon dioxide emissions and conserve underground resources. The company recycles metal scraps, metal powders, and a new refining process develops high-quality products.(Source: corporate.epson)

Metal Recycling Market Top Companies

- European Metal Recycling

- CMC

- GFG Alliance

- Norsk Hydro ASA

- Kimmel Scrap Iron & Metal Co., Inc.

- Schnitzer Steel Industries, Inc.

- Novelis

- Tata Steel

- Sims Metal

- Utah Metal Works

Segments Covered

By Metal Type

- Ferrous Metals (steel, iron)

- Non-Ferrous Metals

- Aluminum

- Copper

- Lead

- Nickel

- Zinc

- Others

By Scrap Source

- Industrial Scrap

- Obsolete Scrap (end-of-life products, vehicles, appliances)

- Construction & Demolition Scrap

By Processing Method

- Collection & Sorting

- Shredding

- Melting & Refining

- Others (baling, shearing, briquetting)

By End-Use Industry

- Construction & Infrastructure

- Automotive

- Electronics & Electricals

- Packaging

- Machinery & Equipment

- Shipbuilding

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait