Content

What Stainless Steel Market Size and Share ?

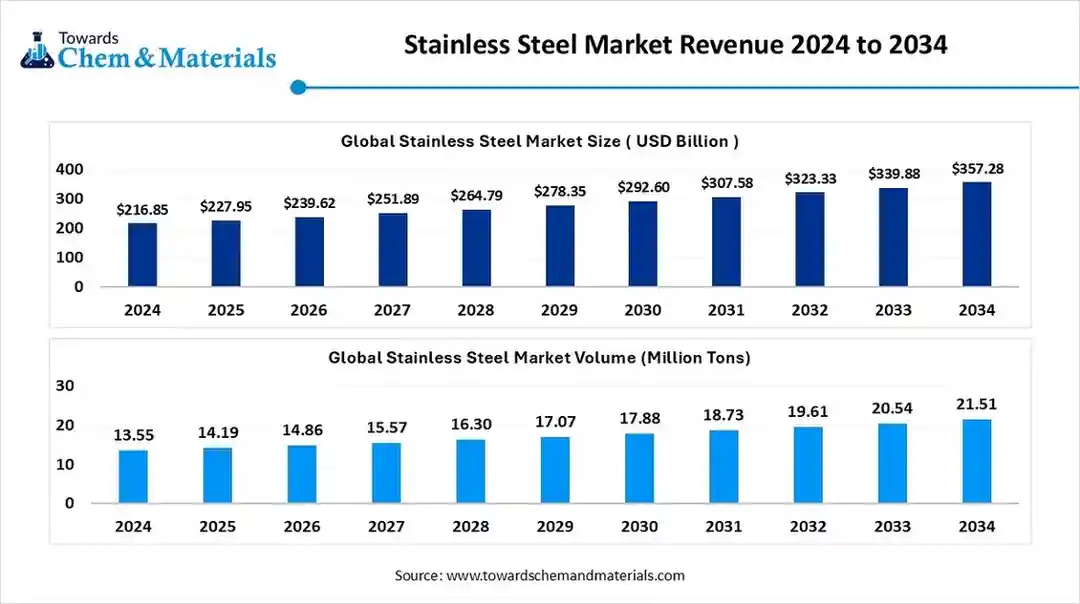

The global stainless steel market size was valued at USD 216.85 billion in 2024 and is expected to hit around USD 357.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.12% over the forecast period from 2025 to 2034. The growing construction activities and development of automotive components drive the market growth.

The global stainless steel market stood at approximately 14.19 million tons in 2025 and is anticipated to be likely to reach approximately 21.51 million tons in 2034. growing at a CAGR of 4.73% from 2025 to 2034.

Key Takeaways

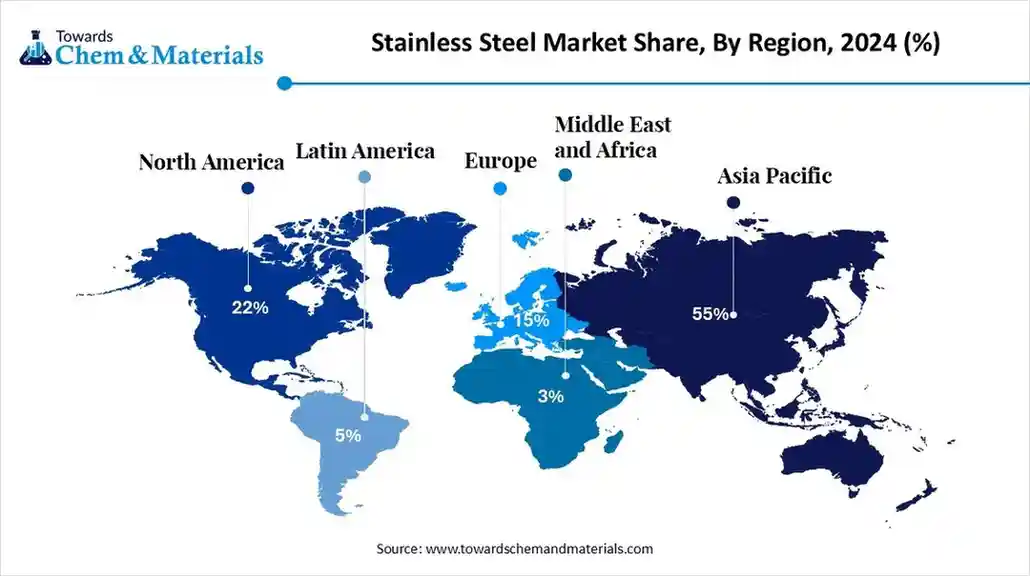

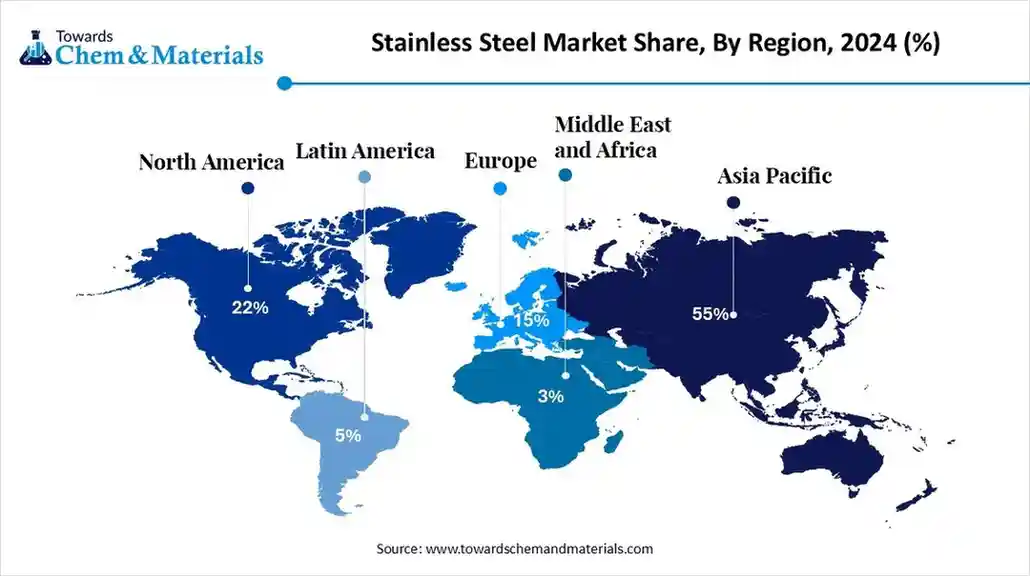

- By region, Asia Pacific held approximately a 55% share in the stainless steel market in 2024.

- By region, North America is growing at the fastest CAGR in the market during the forecast period.

- By type, the austenitic stainless steel segment held approximately a 52% share in the market in 2024.

- By type, the duplex/super duplex stainless steel segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By product form, the flat products segment held approximately a 55% share in the market in 2024.

- By product form, the tubing & pipes segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end-use industry, the construction & infrastructure segment held approximately a 45% share in the market in 2024.

- By end-use industry, the automotive & transportation segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By manufacturing process, the hot rolling segment held approximately a 50% share in the market in 2024.

- By manufacturing process, the cold rolling segment is expected to grow at the fastest CAGR in the market during the forecast period.

What is Stainless Steel?

Stainless steel market growth is driven by the development of infrastructure projects, high manufacturing of automotive components, the adoption of sustainable materials, and innovations in stainless steel products. Stainless steel is a chromium & iron alloy that is corrosion-resistant.

The stainless steel consists of a minimum 10.5% of chromium and offers longevity. It is highly durable and offers excellent strength. It is highly recyclable and maintains structural integrity in cryogenic & high temperatures. Stainless steel is widely used in surgical instruments, countertops, handrails, exhaust systems, aircraft frames, cookware, and food processing equipment.

Stainless Steel Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the industry is growing rapidly in high-margin niches such as infrastructure development, electric vehicles, and electronic materials. Growth is being reinforced by growing industrial activities, high investment in infrastructure development, and rapid urbanization Asia-Pacific region.

- Sustainability Trends: Sustainability is transforming the stainless steel industrial landscape, with the adoption of higher recycled content and the use of energy-efficient technology. For instance, Outokumpu uses 100% low-carbon electricity and a high percentage of recycled steel in the production of stainless steel to lower its carbon footprint.

- Global Expansion: Leading players and prominent manufacturers are expanding globally to align with high levels of industrialization and rapid urbanization, particularly into Japan, China, India, MEA, and Latin America. For instance, Nippon Steel expands its operations in China, Thailand, and Indonesia.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 239.62 Billion |

| Expected Size by 2034 | USD 357.28 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.12% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type / Grade, By Product Form, By End-Use Industry, By Manufacturing Process, By Region |

| Key Companies Profiled | Thyssenkrupp AG, Baosteel Group, Tsingshan Holding Group, Aperam, Allegheny Technologies Incorporated (ATI), Acerinox, Steel Authority of India Limited (SAIL), NLMK Group, Hyundai Steel, Sandvik AB |

Key Technological Shifts in the Stainless Steel Market:

The key technological shifts in the stainless steel market are driven by environmental regulations, performance efficiency, cost-efficiency, and energy efficiency. One of the significant transformations is the adoption of additive manufacturing, which increases the flexibility of design and enables the creation of complex parts. Additive manufacturing helps in creating lattice & hollow structures and develops customized products.

Additive manufacturing lowers material waste and speeds up the innovation process. It helps in enhancing supply chain operations and creates lightweight parts. For instance, the Sandvik company uses additive manufacturing to manufacture 3D-printed super-duplex stainless steel components.

Trade Analysis of Stainless Steel Market: Import & Export Statistics

- India exported $429M of stainless steel wire in 2023.(Source: oec.world)

- South Korea exported $246M of stainless steel wire in 2023.(Source: oec.world)

- Germany imported $279M of stainless steel wire in 2023.(Source: oec.world)

- Germany exported $808M of flat-rolled stainless steel in 2023.(Source: oec.world)

- Italy exported $541M of flat-rolled stainless steel in 2023.(Source: oec.world)

- Chinese Taipei exported $356M of hot-rolled stainless steel bars in 2023.(Source: oec.world)

- Italy imported $275M of hot-rolled stainless steel bars in 2023.(Source: oec.world)

- Indonesia exported $5.85B of large flat-rolled stainless steel in 2023.(Source: oec.world)

Stainless Steel Market Value Chain Analysis

- Feedstock Procurement : The feedstock procurement involves the sourcing of raw materials, like virgin materials like additives, iron ore, & ferroalloys, and recycled stainless steel materials.

- Key Players: Vedanta, CMR Green Technologies, Jindal Stainless Group, Tata Steel, ArcelorMittal

- Chemical Synthesis and Processing : The chemical synthesis and processing involve techniques like pickling, chemical polishing, passivation, etching, and chemical polishing.

Key Players: Nippon Steel, JFE Steel Corporation, Acerinox, Posco, Jindal Stainless - Quality Testing and Certification : The quality testing involves testing of properties like corrosion, visual inspection, spectrometer analysis, tensile, hardness, and magnetic qualities, and certification includes BIS, CSA, DIN, & CE.

- Key Players: TUV SUD South Asia Pvt, Intertek, HQTS

What are the Types of Stainless Steel?

| Types | Description | Characteristics | Applications |

| Austenitic | The stainless steel consists of high chromium & nickel content to offer excellent corrosion resistance. |

|

|

| Ferritic | The stainless steel type belongs to the AISI 400 series, has the absence of nickel, and consists of low carbon & high chromium content. |

|

|

| Martensitic | The stainless steel type that can be hardened by heat treatment. |

|

|

| Duplex | The stainless steel type blend of approximately 50% ferrite & 50% austenite. |

|

|

Segmental Insights

Type Insights

Why Austenitic Stainless Steel Segment Dominates the Stainless Steel Market?

The austenitic stainless steel segment dominated the market with approximately 52% share in 2024. The growing development of structural components, building facades, and roofing increases demand for austenitic stainless steel. The excellent formability and superior corrosion resistance of austenitic stainless steel help the market growth. The development of automotive components and the increasing need for food processing equipment require austenitic stainless steel, driving the overall growth of the market.

The duplex/super duplex stainless steel segment is the fastest-growing in the market during the forecast period. The development of refineries, offshore platforms, and pipelines in the oil & gas sector increases demand for duplex/super duplex stainless steel. The rise in the development of infrastructure projects and growing construction activities requires duplex/super duplex stainless steel. The growing applications like marine, chemical tankers, and pulp & paper digesters require duplex/super duplex stainless steel, supporting the overall market growth.

Product Form Insights

How did the Flat Products Segment hold the Largest Share in the Stainless Steel Market?

The flat products segment held the largest revenue share of approximately 55% in the market in 2024. The growing manufacturing of automotive components like exhaust systems and panels increases the adoption of flat products. The development of structural components, facades, & roofing, and the focus on easy fabrication require flat products. The applications like cookware, appliances, and electronics require flat products, driving the overall market growth.

The tubing & pipes segment is experiencing the fastest growth in the market during the forecast period. The development of sanitation and water supply projects increases the adoption of tubing & pipes. The growing production of automotive components and the development of renewable energy infrastructure increase demand for tubing & pipes. The expansion of oil & gas transportation, exploration, and refining requires tubing & pipes, supporting the overall growth of the market.

End-Use Industry Insights

Which End-Use Industry Dominated the Stainless Steel Market?

The construction & infrastructure segment dominated the market with approximately 45% share in 2024. The growing investment in infrastructure projects like airports, highways, and railways increases demand for stainless steel. The rapid urbanization and growing commercial & residential construction activities increase the adoption of stainless steel. The focus on maintaining the structural integrity of construction components and the rise in interior design require stainless steel, driving the overall growth of the market.

The automotive & transportation segment is the fastest-growing in the market during the forecast period. The focus on extending the vehicle's lifespan and the development of structural automotive components increases the adoption of stainless steel. The growth in hybrid and electric vehicles and the focus on lowering the weight of vehicles increase demand for stainless steel. The growing production of vehicles and focus on vehicle emission control require stainless steel, supporting the overall growth of the market.

Manufacturing Process Insights

Why the Hot Rolling Segment Held the Largest Share in the Stainless Steel Market?

The hot rolling segment held the largest revenue share of approximately 50% in the market in 2024. The bulk manufacturing of stainless steel and a less expensive process help the market growth. The growing industrial applications like heavy machinery, construction, and automotive, increase the adoption of hot rolling. The development of structural beams, structural components, and large plates requires hot rolling, driving the overall market growth.

The cold rolling segment is experiencing the fastest growth in the market during the forecast period. The focus on enhancing stainless steel properties and increasing the production of smoother stainless steel surfaces requires cold rolling. The growing vehicle manufacturing and development of modern construction projects require cold rolling. The increasing manufacturing of file cabinets, appliances, and furniture increases the adoption of cold rolling, supporting the overall market growth.

Regional Insights

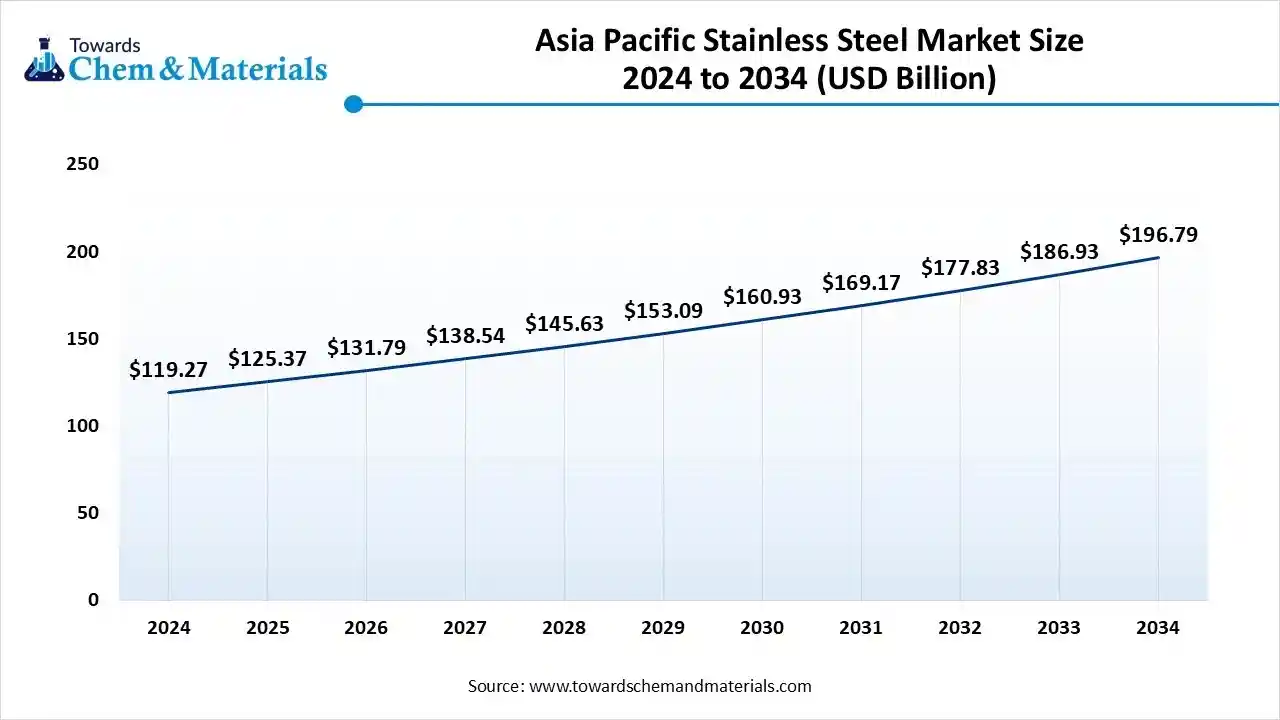

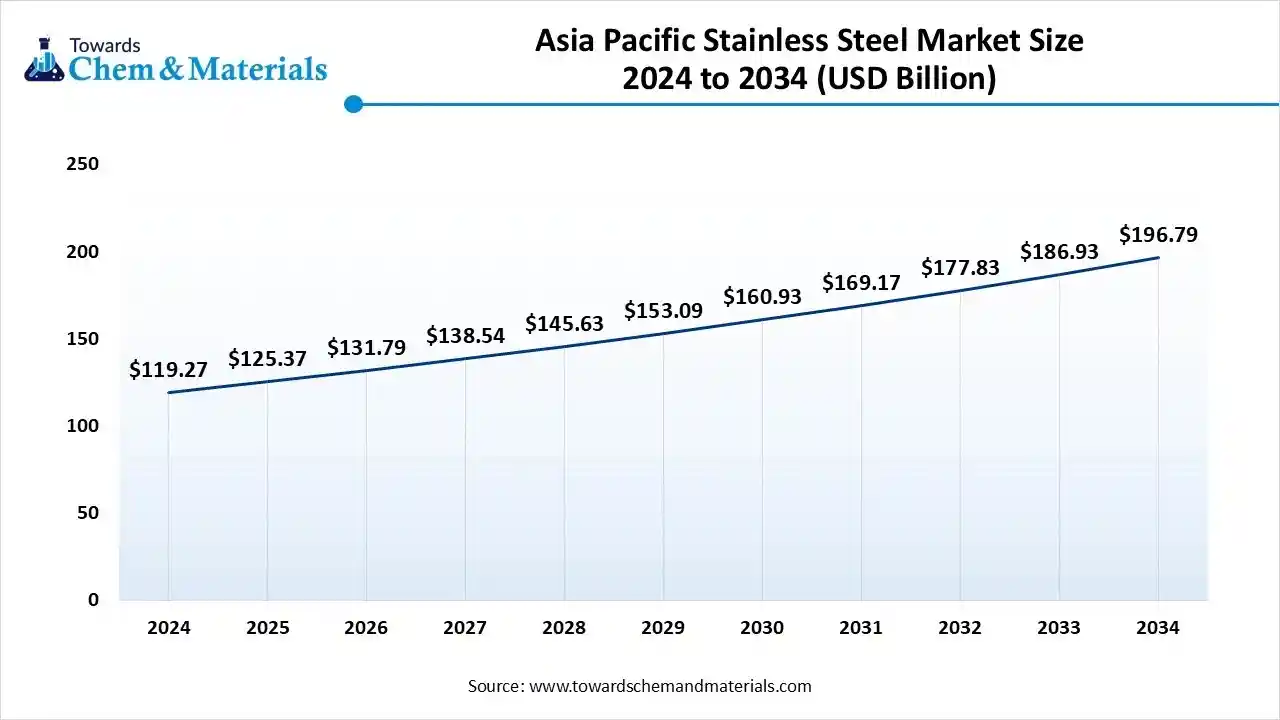

The Asia Pacific stainless steel market size is estimated at USD 125.37 billion in 2025 and is projected to reach USD 196.79 billion by 2034, growing at a CAGR of 5.14%% from 2025 to 2034. Asia Pacific dominated the stainless steel market with approximately 55% share in 2024.

The growing industrial activities and increasing investment in the development of infrastructure projects like high-rise buildings, roads, & bridges increase the adoption of stainless steel. The high production capacity of stainless steel and the manufacturing of high-grade stainless steel products help market growth. The growing expansion of the automotive sector and rise in manufacturing activities increase the adoption of stainless steel, driving the overall growth of the market.

China Stainless Steel Market Trends

China is a major contributor to the market. The development of massive infrastructure projects and the growing automotive industry increases demand for stainless steel. The increasing demand for high-end materials in applications like smart manufacturing, aerospace, & defense increases the adoption of stainless steel. The high steel production capacity and the presence of large-scale steel manufacturers support the overall growth of the market.

- China exported $5.32B of large flat-rolled stainless steel in 2023. (Source: oec.world )

- China exported $331M of stainless steel wire in 2023.(Source: oec.world )

North America Stainless Steel Market Trends

North America is experiencing the fastest growth in the market during the forecast period. The growing construction of commercial & residential projects and the increasing need for renewable energy components increase demand for stainless steel. The development of automotive components like decorative parts, exhaust systems, and others increases the adoption of stainless steel. The expansion of the consumer goods sector and the growing food processing sector increases the adoption of stainless steel, driving the overall growth of the market.

United States Stainless Steel Market Trends

The United States is a key contributor to the stainless steel market. The growing construction activities and strong government support for infrastructure development increase demand for stainless steel. The development of lightweight vehicle materials and the rise in electric vehicles increases the adoption of stainless steel. The increasing investment in the aerospace & defense industry and the expansion of the food & beverage industry require stainless steel, supporting the overall market growth.

- The United States exported $577M of flat-rolled stainless steel in 2023.(Source: oec.world)

- The United States exported $203M of stainless steel wire in 2024.(Source: oec.world)

Europe Stainless Steel Market Trends

Europe is growing at a notable rate in the stainless steel market in 2024. The expansion of renewable energy infrastructure and high investment in green infrastructure increase the adoption of stainless steel. The development of vehicle fuel systems and electric vehicle casing increases the adoption of stainless steel.

The strong government support for sustainable manufacturing and the development of hospital equipment increases the adoption of stainless steel. The growing food & beverage processing and development of commercial kitchens requires stainless steel, driving the overall market growth.

Germany Stainless Steel Market Trends

Germany is growing in the stainless steel market. The adoption of renewable energy and the focus on cleaner manufacturing increase demand for stainless steel. The rise in electric vehicles and the development of medical devices increase the adoption of stainless steel. The growing demand for stainless steel in industries like medical, automotive, and aerospace supports the overall growth of the market.

- Germany exported $808M of flat-rolled stainless steel in 2023.(Source: oec.world)

- Germany exported $65.1M stainless steel rods: hot-processed, other shapes in 2023.(Source: oec.world)

Recent Developments

- In October 2025, Jindal Stainless launched stainless steel salt tipper trailers in Gujarat. The trailers minimize weight by 25% and offer 15-20 years of service life.(Source: manufacturing.economictimes.indiatimes.com)

- In July 2025, POSCO collaborated with Franke, a European kitchen brand, to launch a stainless steel sink. The product is made up of recycled materials and reduces the carbon footprint. The product minimizes the use of virgin raw materials and adheres to international carbon regulations.(Source: www.chemanalyst.com)

- In December 2024, Sambhv Steel launched stainless steel coils. The product portfolio includes stainless steel cold-rolled coils and HRAP coils. The coils are manufactured using the Argon Oxygen Decarburization process and are useful across industries like transport, construction, automobiles, consumer goods, & architecture.(Source: www.business-standard.com)

Top Companies List

- ArcelorMittal: The largest manufacturer of iron ore & steel and supplies steel products across energy, construction, and automotive industries.

- Nippon Steel Corporation: The Japan-based steel manufacturing company produces various steel products like structural steel, high-end seamless pipes, flat products, and pipes & tubes.

- POSCO: The South Korean steel-making company manufactures products like stainless steel, hot & cold rolled steel, and plates.

- Jindal Stainless: The global leader in supplying & manufacturing stainless steel of various grades like ferritic, duplex, austenitic, and martensitic.

- Outokumpu: The leading manufacturer of sustainable stainless steel that produces products like specialized components, cold & hot rolled coils, and plates to support various industries.

Other Companies List

- Thyssenkrupp AG

- Baosteel Group

- Tsingshan Holding Group

- Aperam

- Allegheny Technologies Incorporated (ATI)

- Acerinox

- Steel Authority of India Limited (SAIL)

- NLMK Group

- Hyundai Steel

- Sandvik AB

Segments Covered

By Type / Grade

- Austenitic Stainless Steel

- 304 Grade

- 316 Grade

- Ferritic Stainless Steel

- Martensitic Stainless Steel

- Duplex / Super Duplex Stainless Steel

By Product Form

- Flat Products

- Coils & Sheets

- Plates

- Long Products

- Bars & Rods

- Wire

- Tubing & Pipes

By End-Use Industry

- Construction & Infrastructure

- Automotive & Transportation

- Aerospace & Defense

- Food & Beverage / Packaging

- Chemical & Petrochemical

- Medical & Pharmaceutical Equipment

By Manufacturing Process

- Hot Rolling

- Cold Rolling

- Precision Casting

- Forging

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait