Content

U.S. Paints & Coatings Market Size | Top Companies Analysis

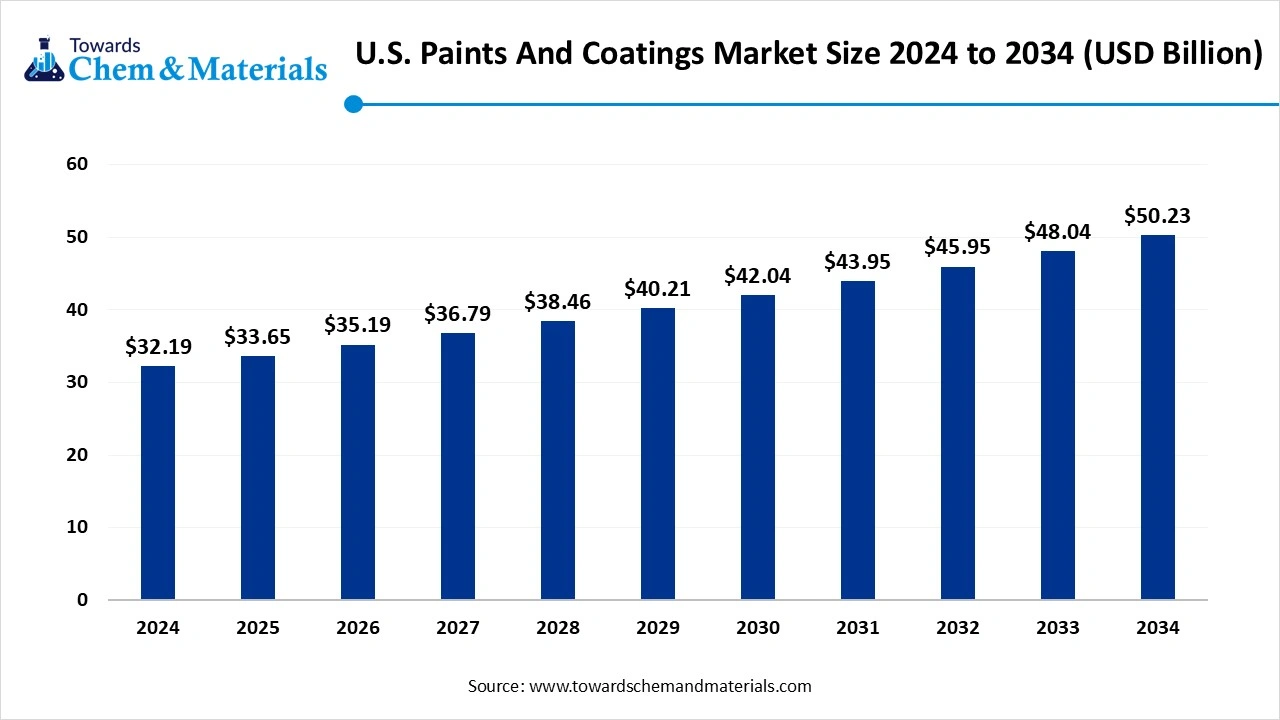

The U.S. paints & coatings market size was reached at USD 32.19 billion in 2024 and is expected to be worth around USD 50.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.35% over the forecast period 2025 to 2034. The rapid expansion in the construction and infrastructure sectors is the key factor driving market growth. Also, an ongoing shift towards sustainable formulations coupled with the rise in popularity of e-commerce can fuel market growth further.

Key Takeaways

- By resin type, the acrylic resins segment dominated the market with approximately 35% share in 2024. The dominance of the segment can be attributed to the increasing demand for automotive coatings.

- By resin type, the Epoxy segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the surging construction and infrastructure sectors.

- By technology, the water-based coatings segment held approximately 50% market share in 2024. The dominance of the segment can be linked to the rapid innovations in water-based coating technology.

- By technology, the powder coating segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the increasing use of powder coatings in construction and architectural applications.

- By function, the decorative/architectural coatings segment led the market by holding approximately 55% share in 2024. The dominance of the segment is owed to the growing popularity of DIY home enhancement projects.

- By function, the protective/industrial coatings segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment is due to the growing demand for sustainable and low-VOC compounds.

- By application, the architectural segment dominated the market by holding approximately 50% share in 2024. The dominance of the segment can be attributed to the growing consumer demand for aesthetically pleasing coatings.

- By application, he automotive & transportation segment is expected to grow at the fastest CAGR over the study period. The growth of the segment can be credited to the rapid surge in vehicle production, particularly electric vehicles.

- By end-use industry, the building & construction segment held approximately 52% market share in 2024. The dominance of the segment can be linked to the ongoing population growth and urbanisation in the country.

Technological Advancements Are Expanding Market Growth

The U.S. paints & coatings market refers to the production and application of decorative, industrial, and specialty coatings used for protecting, enhancing, and finishing surfaces across residential, commercial, industrial, and infrastructure sectors. These coatings include solvent-based, water-based, powder-based, and high-performance formulations designed to provide durability, corrosion resistance, weatherability, and aesthetic appeal.

The U.S. market is driven by robust demand in construction, automotive, aerospace, industrial equipment, marine, and packaging industries, along with ongoing shifts toward sustainable, low-VOC, and high-performance coatings. Growth is further supported by infrastructure modernization, residential housing developments, and advanced coating technologies such as nanocoatings and smart coatings.

What Are the Key Trends Influencing the U.S. Paints & Coatings Market?

- The rapid surge in construction activities in the country is the key trend impacting positive market growth. The region is increasingly investing in infrastructure and development projects, which can directly boost the paints and coatings sector because of this change.

- The strict environmental regulations have created a huge demand for paints & coating products, shifting consumer behaviour more toward utilizing and purchasing sustainable products by propelling the popularity of green building initiatives, leading to market growth further.

- Advancements aimed at improving coating performance are another major trend in the market, shaping a positive market trajectory. Market players are rapidly innovating to enhance properties such as corrosion resistance, durability, and fire protection.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 33.65 Billion |

| Expected Size by 2034 | USD 50.23 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Resin Type, By Technology, By Function, By Application, By End-Use Industry, By Region |

| Key Companies Profiled | The Sherwin-Williams Company, Axalta Coating Systems, LLC, PPG Industries, Inc., RPM International, Inc., BASF SE, 3M, Sika AG |

Market Opportunity

The Increasing Adoption of UV-Curable Coatings

The rising adoption of UV-curable coatings creates lucrative opportunities in the market. These coatings are rapidly being adopted in different sectors, underlining a major trend in the market. Furthermore, the market is experiencing substantial innovations, especially in the sector of ultraviolet (UV)-curable coatings. These coatings provide a superior performance and offer quick assembly-line benefits, which makes them a crucial choice for different industries.

- In February 2025, Arxada introduced a multifunctional additive called Polyboost™. An advanced additive created to improve an extensive range of paint and coating properties. It can also enhance the pH and viscosity of paint formulations.(Source: www.coatingsworld.com)

Market Challenge

Regulatory and Environmental Pressures

The federal and state governments are implementing stringent regulations on VOC emissions from paints and coatings, which is the major factor hindering market growth. Moreover, the cost of essential raw materials, like resins, titanium dioxide, and sovens, can change due to energy costs, global events, and manufacturing plant closures, which in turn squeezes profit margins and necessitates market players to pay a premium for materials.

Country Insight

U.S. Paints & Coatings Market Trends

The south region dominated the market with a 35% share in 2024. The dominance of the region can be attributed to the ongoing urbanization and population growth, along with the renovation and construction projects for both commercial and residential properties. In addition, the region's surging automotive industry impacts the demand for paints and coatings utilized in vehicle production and maintenance.

The west region is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the growing demand for low-VOC and sustainable products, coupled with the innovations in high-performance and smart coatings. Furthermore, some areas in the West region are witnessing a trend of producing reshoring, which includes heavily investing in new facilities and renovating current ones.

Segmental Insight

Resin Type Insight

Which Resin Type Segment Dominated the U.S. Paints & Coatings Market in 2024?

The acrylic resins segment dominated the market in 2024. The dominance of the segment can be attributed to the increasing demand for automotive coatings and strict government regulations supporting water-based acrylics. Additionally, this resin offers exceptional hardness, adhesion, gloss, and weather and chemical resistance, which makes it a perfect binder for high-grade paints and coatings across various industries.

The epoxy segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the surging construction and infrastructure sectors, which need epoxy's adhesion, durability, and resistance to chemicals and wear. In addition, epoxy's capability to offer an aesthetically pleasing, high-gloss, and easy-to-clean surface is preferred in various industrial applications.

Technology Insight

Why Water-Based Coatings Segment Dominated the U.S. Paints & Coatings Market in 2024?

The water-based coatings segment held the largest market share in 2024. The dominance of the segment can be linked to the rapid innovations in water-based coating technology, which makes them more effective and durable by contributing to their wider adoption. Moreover, water-based coatings use resins such as acrylic, which provide benefits like excellent durability, color retention, and flexibility.

The powder coating segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by increasing use of powder coatings in construction and architectural applications for durability and aesthetics, coupled with advancements in powder coating technology. Furthermore, powder coatings contain a lower amount of volatile organic compounds (VOCs), which makes them a crucial alternative to conventional solvent-based coatings.

Function Insight

How Much Share Did the Decorative/Architectural Coatings Segment Held in 2024?

The decorative/architectural coatings segment led the market in 2024. The dominance of the segment is owed to the growing popularity of DIY home enhancement projects and rising product demand from commercial and residential construction sectors.

Also, market players are increasingly developing new products to fulfil specific consumer demands, leading to further segment growth. The protective/industrial coatings segment is expected to grow at the fastest CAGR over the projected period.

The growth of the segment is due to the growing demand for sustainable and low-VOC compounds, along with the adoption of protective coatings from the oil and gas sector. Innovations in material science have boosted the adoption of coatings that give improved resistance to chemicals, abrasion, and extreme temperatures.

Application Insight

Which Application Type Segment Dominated U.S. Paints & Coatings Market in 2024?

The architectural segment dominated the market in 2024. The dominance of the segment can be attributed to the growing consumer demand for aesthetically pleasing coatings and favourable government initiatives supporting green building. In addition, an ongoing trend in DIY projects and home improvement fuels the demand for decorative and protective paints.

The automotive & transportation segment is expected to grow at the fastest CAGR over the study period. The growth of the segment can be credited to the rapid surge in vehicle production, particularly electric vehicles, along with the demand for high-performance and aesthetic coatings. Additionally, a growing number of vehicle collisions and accidents creates a huge demand for coatings utilized in automotive repair and maintenance.

End-Use Industry Insight

How Much Share Did the Building & Construction Segment Held in 2024?

The building & construction segment held the largest market share in 2024. The dominance of the segment can be linked to the ongoing population growth and urbanisation, which leads to increased construction of commercial and residential buildings. These coatings offer crucial protective properties like corrosion resistance and waterproofing while giving aesthetic appeal to buildings.

U.S. Paints & Coatings Market Value Chain Analysis

- Feedstock Procurement: It is the process of getting the raw materials required to manufacture paints and coatings. The market depends on an extensive variety of chemicals, sourced from plastics, petrochemicals, and chemical industries.

- Chemical Synthesis and Processing: This stage refers to the upstream production sector responsible for manufacturing raw materials that are formulated into finished coatings and paints.

- Packaging and Labelling: It is an important process of designing, producing, and applying protective covering to paint and coating products. This involves both the physical container and information on it.

- Regulatory Compliance and Safety Monitoring: This stage is important for safety monitoring and regulatory compliance and is necessary for ensuring product quality, environmental responsibility, and worker well-being.

Recent Developments

- In July 2025, Nature Coatings created a revolutionary bio-based pigment named BioBlack, which is changing the coating sector. BioBlack is a high-performing, bio-based, and carbon-neutral solution to the conventional petroleum-based carbon black pigment.(Source: www.coatingsworld.com)

U.S. Paints & Coatings Market Top Companies

- The Sherwin-Williams Company

- Axalta Coating Systems, LLC

- PPG Industries, Inc.

- RPM International, Inc.

- BASF SE

- 3M

- Sika AG

Segments Covered

By Resin Type

- Acrylic

- Alkyd

- Epoxy

- Polyester

- Polyurethane

- Fluoropolymer

- Vinyl

- Others (Silicone, etc.)

By Technology

- Water-Based Coatings

- Solvent-Based Coatings

- Powder Coatings

- UV-Cured Coatings

- High-Solids Coatings

By Function

- Decorative / Architectural Coatings

- Protective / Industrial Coatings

- Specialty Coatings (marine, aerospace, packaging, etc.)

By Application

- Architectural (residential, commercial, infrastructure)

- Automotive & Transportation

- Industrial Equipment & Machinery

- Aerospace & Marine

- Wood & Furniture

- Packaging (metal cans, plastics, etc.)

- Others (electronics, appliances)

By End-Use Industry

- Building & Construction

- Automotive & Transportation

- Aerospace & Defense

- Marine & Offshore

- Packaging & Consumer Goods

- Industrial & Machinery

- Others