Content

Asia Pacific Biofuels Market Size and Companies Analysis 2034

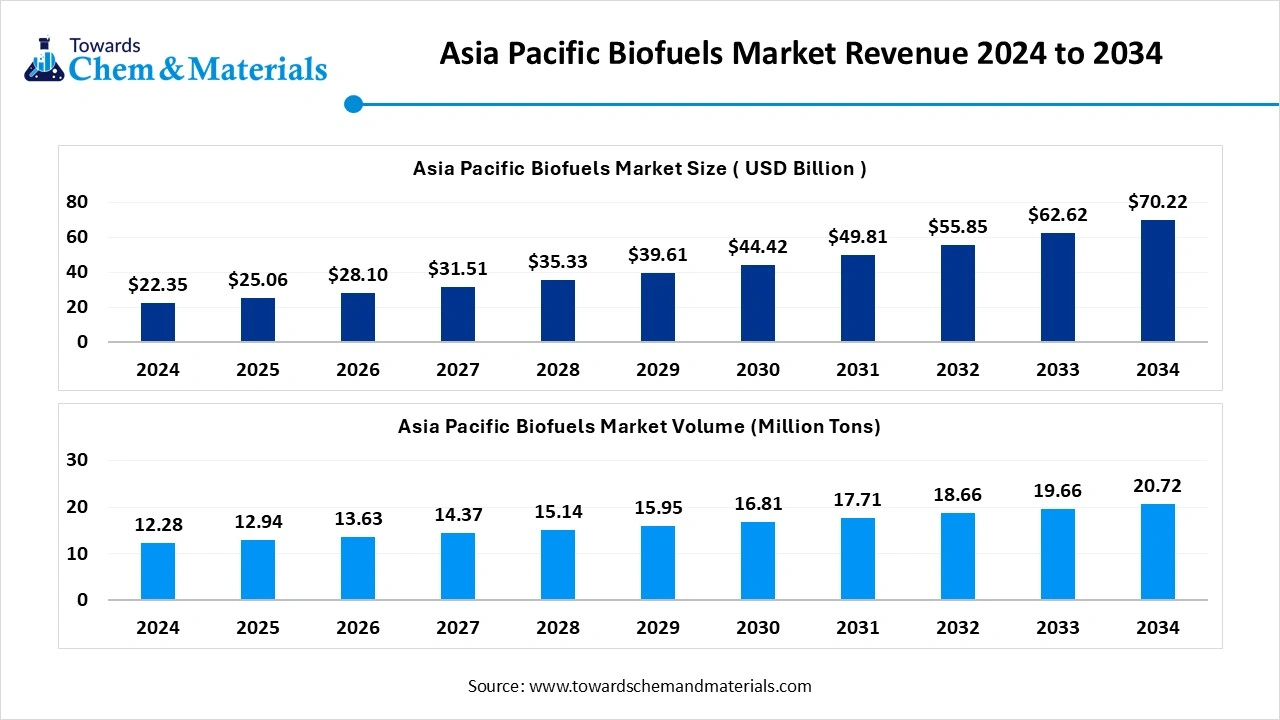

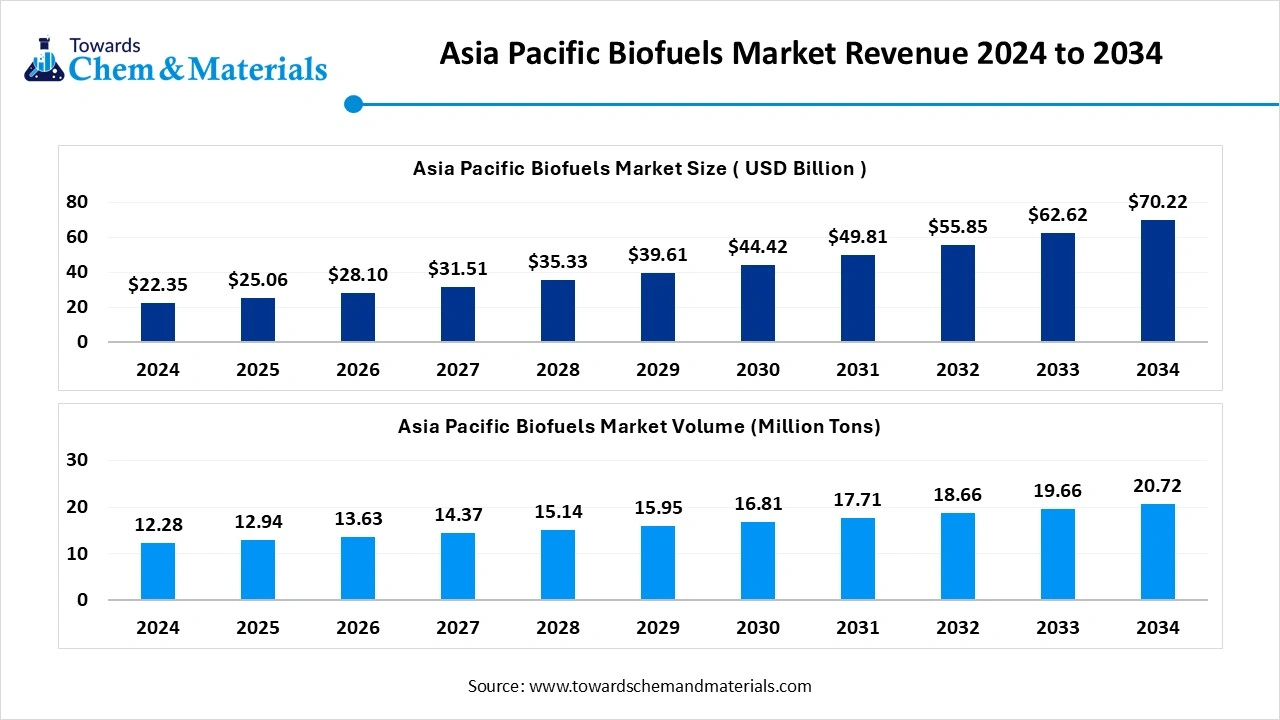

The Asia Pacific biofuels market is experiencing rapid growth, with volumes expected to increase from 12.94 million tons in 2025 to 20.72 million tons by 2034, representing a robust CAGR of 5.37% over the forecast period.

The Asia Pacific biofuels market size was valued at USD 22.35 billion in 2024, grew to USD 25.06 billion in 2025, and is expected to hit around USD 70.22 billion by 2034, growing at a compound annual growth rate (CAGR) of 12.13% over the forecast period from 2025 to 2034. A sudden surge in cleaner fuel options is projected to support stronger cash flows for manufacturing enterprises.

Key Takeaways

- By feedstock type, the edible crops segment led the Asia Pacific biofuels market with 55% industry share in 2024.

- By feedstock type, the algae & microorganisms segment is expected to grow at the fastest rate in the market during the forecast period.

- By fuel type, the biodiesel segment emerged as the top-performing segment in the market with 60% of the industry share in 2024.

- By fuel type, the biojet fuel segment is expected to lead the market in the coming years.

- By application, the transportation segment led the market with a 70% share in 2024.

- By application, the power generation segment is expected to capture the biggest portion of the market in the coming years.

- By form, the liquid biofuels segment led the market with 65% industry share in 2024.

- By form, the gaseous biofuels segment is expected to grow at the fastest rate in the market during the forecast period.

What is Biofuel?

The fuel made from eco-friendly materials like algae, plants, and organic waste is called biofuel. Furthermore, these fuels can be liquid or gaseous, and even jet fuel, which is made from biomass. Also, the discovery of fuel has emerged as a greater alternative option to the ongoing harmful carbon emissions in recent years.

Asia Pacific Biofuels Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the heavy need for energy and rising fuel import costs have actively enhanced the market readiness and future industry capabilities in recent years. Also, the regional government has seen in supporting these biofuel initiatives by releasing attractive subsidies for the manufacturers in the region nowadays.

- Sustainability Trends: The industry has been shifting rapidly towards environmentally friendly initiatives in recent years in the region. The fuel industry is following the agendas, like first generation is better than nothing, in the advanced regional spaces like Japan, India, and China.

- Global Expansion: The regional biofuel makers are increasingly expanding their business into other regional spaces like North America and Europe. Also, these manufacturers have observed in exporting licensing technologies and feedstock supplies in the past few years.

Key Technological Shifts in the Asia Pacific Biofuels Market:

The biofuel makers in the Asia Pacific are turning towards the installation of modular biorefineries, which can process multiple feedstocks and processes. Also, having access to the latest technology, the biofuel manufacturer in the region is likely to gain major industry advantages in the upcoming years, as per the recent survey.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 25.06 Billion |

| Expected Size by 2034 | USD 70.22 Billion |

| Growth Rate from 2025 to 2034 | CAGR 12.13% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Feedstock Type, By Fuel Type, By Application, By Form |

| Key Companies Profiled | Archer Daniels Midland (ADM) , China Agri-Industries Holdings, Gushan Environmental Energy, Seaoil , Renewable Energy Group, Inc. , Neste , Diamond Green Diesel , BP , Royal Dutch Shell , Valero Energy Corporation , Abengoa , Cenovus Energy , Ethanol Technologies , GranBio Investimentos SA , Green Plains Inc. , Henan Tianguan Group Co. Ltd |

Trade Analysis of the Asia Pacific Biofuels Market: Import, Export, and Consumption Statistics

- India has become the world fourth fourth-largest consumer of biofuel in 2024, and this consumption has increased by 31.8% as per the published report.(Source: www.thehindubusinessline.com)

- China has seen in heavy biodiesel export in 2024, approximately $1.17 billion.(Source: oec.world)

Valus Chain Analysis of the Asia Pacific Biofuels Market:

- Distribution to Industrial Users : Majorly, distributors in the Asia Pacific are providing biofuels shipments to the major industries like the automotive and power sectors.

- Chemical Synthesis and Processing : Chemical synthesis and the processing of Asia Pacific biofuels are processed under the laws of national energy security and environmental regulations.

- Regulatory Compliance and Safety Monitoring : The safety and regulatory process of green chemicals in the Asia Pacific is held by regions respective regulatory bodies.

Asia Pacific Biofuels Market’s Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| China | National Development and Reform Commission (NDRC) | 14th Five-Year Plan for Bioeconomic Development (2021-2025) | Shift to non-grain-based biofuels | The NDRC plays the most crucial role in setting biofuel policies and guiding industrial development. |

| India | Ministry of Petroleum and Natural Gas (MoPNG) | National Policy on Biofuels (2018), with 2022 Amendment | Ambitious blending targets | These agencies are responsible for the "National Policy on Biofuels" and overall implementation and monitoring of the biofuel program. |

| Japan | Ministry of Economy, Trade and Industry (METI) | Action Plan to Introduce E10 and E20 (2025) | Sustainable Aviation Fuel (SAF) | These agencies are setting up strategies and policies for biofuels and collaborating with the private sector to develop action plans. |

Segmental Insights

Feedstock Type Insights

How did the Edible Crops Segment Dominate the Asia Pacific Biofuels Market in 2024?

The edible crops segment held a 55% share of the market in 2024, due to their abundant supply and easy conversion into ethanol or biodiesel. Moreover, the release of the blending mandates from the regional government has provided huge attention to the segment in recent years. Also, the larger number of processing factories in the region is further driving industry growth in the current period.

The algae & microorganism segment is expected to grow at a notable rate during the predicted timeframe, owing to minimum requirements such as not needing farmland to grow, and others. Furthermore, by transforming CO2 or waste gases directly into fuels, microbial platforms like algae and others have gained major industry attention in recent years. the cost-effectiveness and minimum requirement are likely to create greater opportunities for the segment during the forecast period.

Fuel Type Insights

Why does the Biodiesel Segment Dominate the Asia Pacific Biofuels Market by Fuel Type?

The biodiesel segment held 60% of the market in 2024 because its production technology was straightforward. As transesterify vegetable oil or used cooking oil into a diesel substitute. It integrates easily into existing diesel engines as a blend and requires minimal infrastructure changes. Many countries had local vegetable oil industries, so the feedstock supply was ready. Policy incentives (diesel blending mandates, tax differentials) also favored biodiesel for road transport.

The biojet fuel segment is expected to grow at a notable rate during the forecast period, airline sector faces hard-to-abate emissions and strict targets, yet aircraft need high-energy, liquid fuels. Advanced pathways-hydroprocessed esters and fatty acids (HEFA), alcohol-to-jet, and synthesized kerosene from biomass or captured CO₂-produce drop-in jet fuels.

Application Insights

How did the Transportation Segment Dominate the Asia Pacific Biofuels Market in 2024?

The transportation segment dominated the market with a 70% share in 2024, because road and marine fuels are the largest liquid fuel consumers. Governments targeted transport first with blending mandates and subsidies, since replacing diesel and gasoline reduces imported oil dependency quickly. Trucks, buses, and some shipping lanes can use biodiesel or blends with little engine change, giving immediate climate and energy security benefits.

The power generation segment is expected to grow at a significant rate during the forecast period, because flexible electricity systems need dispatchable low-carbon fuels to balance variable renewables. Biomass-derived gas or liquid fuels can run turbines or engines for baseload or peaking power, offering grid stability. Also, co-firing biomass in existing plants reduces emissions with lower infrastructure change.

Form Insights

Why does the Liquid Biofuels Segment Dominate the Asia Pacific Biofuels Market by Form?

The liquid biofuels segment held 65% of the market in 2024 because they fit existing engines, storage, and distribution infrastructure. Fuels like ethanol and biodiesel can be blended into gasoline and diesel, using the same pumps and tanks. That drop-in compatibility drastically lowers adoption barriers and investment costs.

The gaseous biofuels segment is expected to grow at a notable rate during the forecast period, because they suit clean, decentralized energy and hard-to-electrify uses. Biogas plants convert organic waste into pipeline-ready biomethane, a near-drop-in substitute for natural gas. Renewable gases are also power industry, heavy transport, and heating with low emissions. As hydrogen economy support grows, biomass pathways producing green hydrogen will gain value in decarbonizing steel, chemicals, and shipping.

Country Insights

India Biofuels Market Trends

Is India’s Agriculture Strength Powering Its Biofuel Success?

India dominated the Asia Pacific biofuels market in 2024, owing to its enlarged agricultural base. Furthermore, the greater government's push for greener fuel options has maintained the country's dominance in the region nowadays. Also, India has applied different strategies and implemented green mandates like E20 blending target, and others have gained major industry attention in recent years.

China Biofuel Market Trends

Can Waste Oils and Algae Replace Corn in China’s Fuel Future?

China is expected to capture a major share of the market, akin to a greater shift from traditional corn-based ethanol to modern biofuel, which is made from waste oils and algae. Moreover, the country has seen under a heavy development of integrated biorefineries, which combine catalytic conversions, carbon capture, and others in the current period.

Country-level Investments & Funding Trends for the Asia Pacific Biofuel Industry:

- India has approximately produced 6.35 billion liters of ethanol in 2024, as per the published report. (Source: apps.fas.usda.gov)

- China has invested heavily in clean energy, and the investment is worth $625 billion.(Source: ember-energy.org )

Recent Development

- In April 2025, Swire Shipping started biofuel services to the South Pacific. The company is likely to transport from three of its own vessels, and it is a 2nd-generation biofuel blend as per the report published by the company recently.(Source: www.swireshipping.com)

Top Vendors in the Asia Pacific Biofuels Market & Their Offerings:

- Wilmar International: A leading Singaporean agribusiness group with integrated operations spanning oil palm cultivation, edible oils refining, sugar milling, and consumer products.

- Musim Mas: A global, vertically integrated palm oil company headquartered in Singapore that operates throughout the supply chain from plantations to consumer goods.

- PT Pertamina: The Indonesian state-owned energy company is involved in all aspects of the oil and gas industry, from exploration and production to refining and distribution.

- Solvay (Belgium): A privately held, multinational American corporation that provides food, agricultural, and financial as to the recent information.

Other Key Players

- Archer Daniels Midland (ADM)

- China Agri-Industries Holdings

- Gushan Environmental Energy

- Seaoil

- Renewable Energy Group, Inc.

- Neste

- Diamond Green Diesel

- BP

- Royal Dutch Shell

- Valero Energy Corporation

- Abengoa

- Cenovus Energy

- Ethanol Technologies

- GranBio Investimentos SA

- Green Plains Inc.

- Henan Tianguan Group Co. Ltd

Segments Covered in the Report:

By Feedstock Type

- Edible Crops

- Sugarcane

- Corn

- Soybean

- Palm oil

- Non-Edible Biomass

- Agricultural residues

- Wood chips

- Energy crops

- Algae & Microorganisms

- Microalgae

- Cyanobacteria

- Genetically Engineered / Advanced

By Fuel Type

- Biodiesel

- Bioethanol

- Biogas

- Biojet Fuel

By Application

- Transportation

- Industrial

- Residential

- Power Generation

By Form

- Solid Biofuels

- Pellets

- Briquettes

- Charcoal

- Liquid Biofuels

- Biodiesel

- Bioethanol

- Gaseous Biofuels

- Biogas

- Syngas