Content

What is the Current Asia Pacific Nanocellulose Market Size and Share?

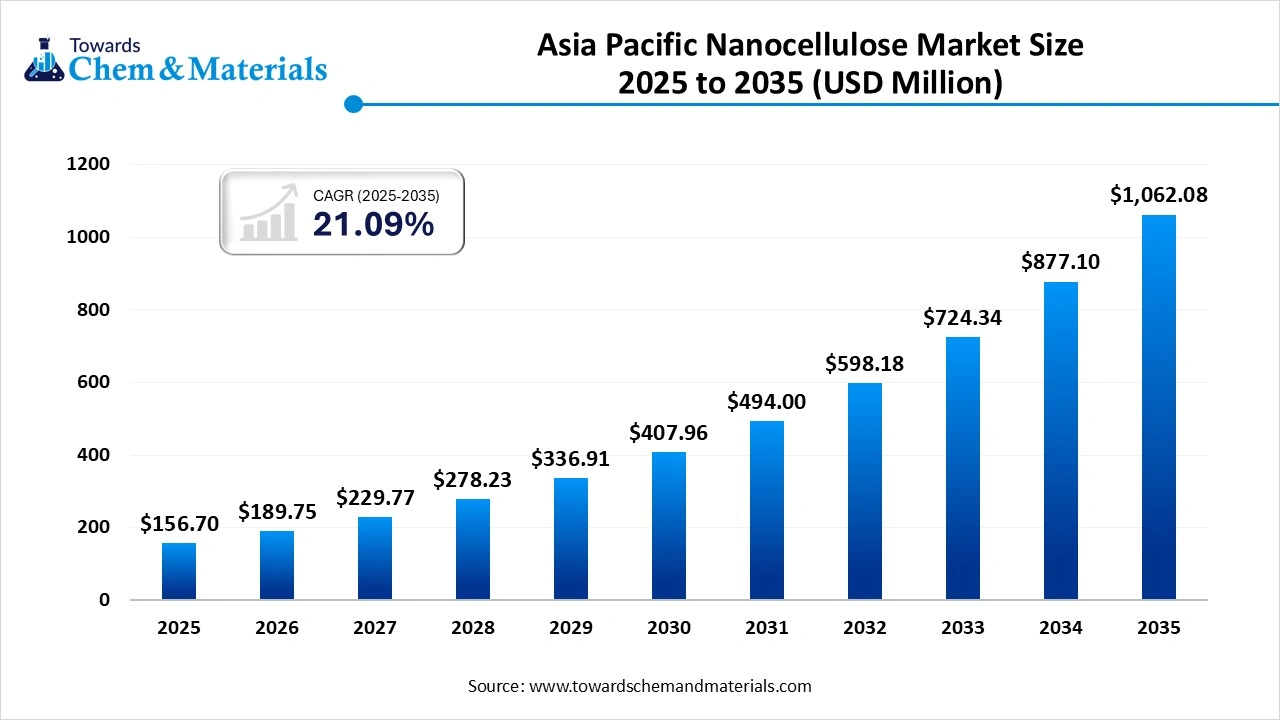

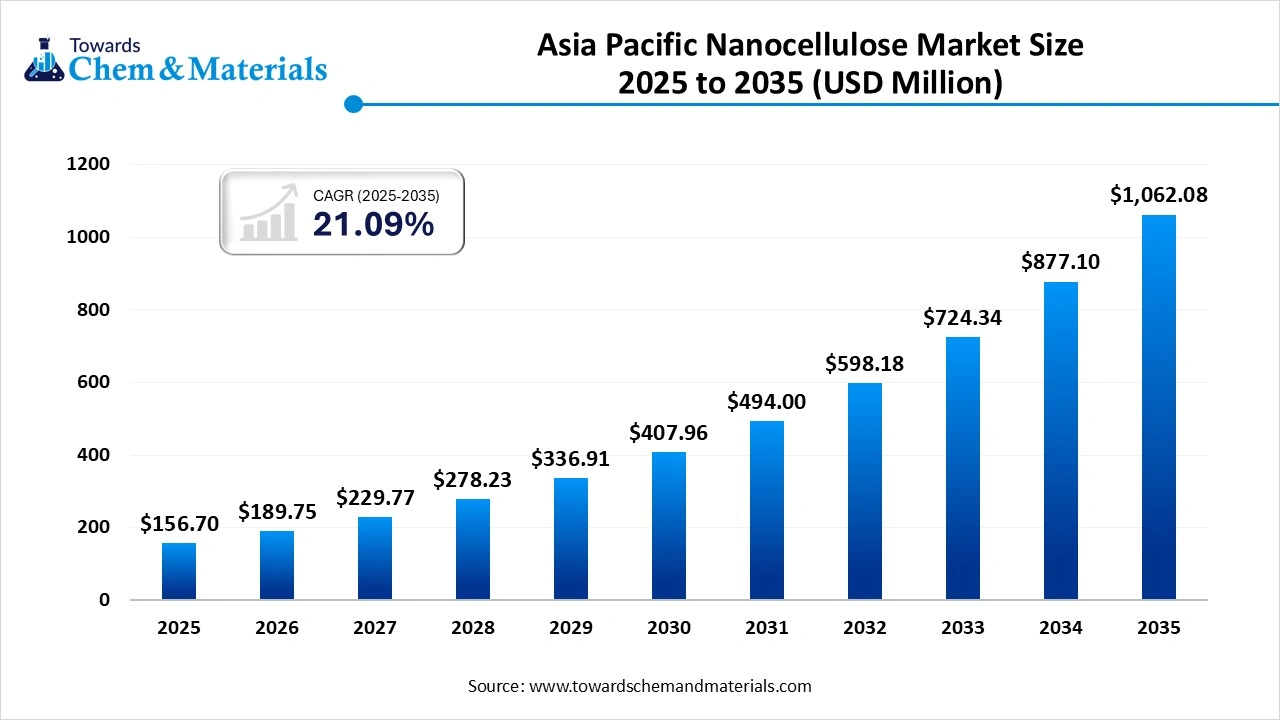

The Asia Pacific nanocellulose market size is calculated at USD 156.70 million in 2025 and is predicted to increase from USD 189.75 million in 2026 and is projected to reach around USD 1,062.08 million by 2035, The market is expanding at a CAGR of 21.09% between 2026 and 2035. The growing demand for sustainable materials is a key factor driving market growth. Also, Government support for green technologies, coupled with the extensive availability of wood-based feedstocks, can fuel market growth further.

Key Takeaways

- By product type, the nanofibrillated cellulose (NFC) segment dominated the market with the largest share in 2025.

- By product type, the cellulose nanocrystals (CNC) segment is expected to grow at the fastest CAGR over the forecast period.

- By application, the composites & packaging segment held the largest market share in 2025.

- By application, the electronics & sensors segment is expected to grow at the fastest CAGR over the forecast period.

What is Nanocellulose?

The industry refers to the region's economic activity around nanocellulose, a high-strength and biodegradable material derived from plants. The market is characterized by its role in offering lightweight, sustainable, and biodegradable material alternatives for an extensive range of industries. It enhanced the barrier properties, strength, and biodegradability of packaging materials.

Asia Pacific Nanocellulose Market Trends

- The ongoing shift towards sustainable and eco-friendly materials is the key trend in the market, as nanocellulose is seen as a crucial alternative to traditional products. The surge in demand for lightweight and biodegradable alternatives to plastic is boosting its use in the packaging sector.

- The market is witnessing a substantial growth in applications like drug delivery systems, wound dressings, and tissue engineering due to nanocellulose's non-toxic nature and biocompatibility, leading to further market expansion.

- Nanocellulose is increasingly gaining traction as a sustainable material for use in wearable technology, flexible displays, and printable electronics because of its transparency, strength, and low weight.

- The growing global initiatives to minimize carbon footprint are another major trend in the market. The use of nanocellulose in many end-use sectors may help in decreasing the overall carbon emissions in the region.

- Governments in the region are increasingly implementing incentives and policies in favour of sustainable materials and production processes, which are boosting market penetration. The combination of regulatory support and industrial development ensures that the market is dynamic and resilient.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 189.75 Million |

| Revenue Forecast in 2035 | USD 1,062.08 Million |

| Growth Rate | CAGR 21.09% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Segments covered | By Product Type, By Application |

| Key companies profiled | American Process Inc., Borregaard Chemcell, Ashai Kasei Chemicals Corporation, Chuetsu Pulp & Paper Co. Ltd., Daicel Corporation, Daio Paper Corporation, Imerys, Innventia AB, Kruger Inc., Stora Enso Ltd. |

How Cutting Edge Technologies are revolutionizing the Asia Pacific Nanocellulose Market?

Advanced technologies are transforming the market by enabling more sustainable, efficient, and cost-effective production methods, along with the unlocking of extensive high-value applications across major industries such as automotive, packaging, and healthcare. In addition, companies in the region are integrating nanocellulose composites into vehicles to enhance fuel efficiency.

Trade Analysis of Asia Pacific Nanocellulose Market Import & Export Statistics:

Exports

- In 2024, China exported $1.1B of Cellulose, being the 420th most exported product in China.

- In 2024, the main destinations of China's Cellulose exports were: India ($149M), Russia ($136M), the United States ($49.5M), Brazil ($46.7M), and Turkey ($36.4M).

Imports

- In 2024, China imported $631M of Cellulose, being the 308th most imported product in China.

- In 2024, the main origins of China's Cellulose imports were: Japan ($110M), the United States ($371M), South Korea ($37.9M), Germany ($45.2M), and Thailand ($15.7M).

- In 2024, Japan's primary export markets for cellulose fiber cement sheets were Australia (2,200 tons), South Korea (2,000 tons), and China (1,500 tons). These three nations constituted most of the trade, accounting for a combined 54% share of all exports.

Asia Pacific Nanocellulose Market Value Chain Analysis

- Feedstock Procurement : It is the primary stage of sourcing raw materials such as agricultural waste, wood pulp, bacterial cellulose, and other sources used by specialty firms for specific nanocellulose applications.

- Major Payors: Nippon Paper Industries Co., Ltd, Oji Holdings Corporation.

- Chemical Synthesis and Processing : It refers to a key stage that involves various methods to obtain and modify nanocellulose from raw biomass. This stage emphasizes using chemical treatments to achieve desired material properties for various other applications.

- Major Payors: Daicel FineChem Ltd., Melodea Ltd.

- Packaging and Labelling : It is a crucial application area fuelled by the demand for high-performance, sustainable materials. Nanocellulose offers improved barrier properties and mechanical strength.

- Major Payors: Stora Enso, Daicel FineChem Ltd.

- Regulatory Compliance and Safety Monitoring: This stage involves developing and standardizing regulations for nanocellulose. The regulatory policies for nanocellulose applications are still evolving in the region.

- Major Players: CelluForce Inc., Stora Enso.

Asia Pacific Nanocellulose Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| China | General chemical safety regulations, such as the "Measures for the Administration of Environmental Safety Assessment of Agricultural Genetically Modified Organisms" (MEE Order No. 12, 2021) also apply to products utilizing nanotechnology. |

| Japan | Government policies support research and development (R&D) and sustainability initiatives for nanocellulose, aiming for technological leadership and high-quality standards in specialized applications. |

| India | The Central Drugs Standard Control Organization (CDSCO) provides comprehensive guidelines for nano-pharmaceuticals, creating transparent regulatory pathways for medical applications. |

Segmental Insights

Product Type Insights

How Much Share Did the Nanofibrillated Cellulose (NFC) Segment Held in 2025?

The nanofibrillated cellulose (NFC) segment dominated the market with the largest share in 2025. The dominance of the segment can be attributed to its increasing use in lightweight automotive parts and growing demand for sustainable and bio-based materials in various industries.

The cellulose nanocrystals (CNC) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the strong government support and regulations that promote sustainable alternatives. CNC is used to produce biodegradable films and coatings, which aligns with the increasing emphasis on minimizing pollution.

The bacterial nanocellulose (BNC) segment held a significant market share in 2025. The growth of the segment is fuelled by increasing focus on the healthcare and biomedical sectors, along with the surge in disposable income in emerging economies. BNC's unique properties make it perfect for various medical uses.

The growth of other segments can be boosted by growing demand for improved performance in different products and rapidly growing personal care, aerospace, and battery segments that use nanocellulose for its unique features.

Application Insights

Which Application Type Segment Dominated the Asia Pacific Nanocellulose Market in 2025?

The composites & packaging segment held the largest market share in 2025. The dominance of the segment can be linked to the increasing environmental concerns over landfill waste and plastic pollution in countries such as China, India, and Malaysia. Nanocellulose improves the durability and strength of composites.

The electronics & sensors segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by rapid innovations in nanocellulose manufacturing technologies, which are enhancing scalability by enabling wider commercial adoption.

The rheology modifier segment held a major market share in 2025. The growth of the segment can be boosted by ongoing government investments in green initiatives and technologies aimed at supporting sustainable development, which are fuelling the adoption of nanocellulose in the Asia Pacific.

The growth of the pulp & paper segment can be propelled by the capability of nanocellulose to enhance paper properties such as barrier protection and strength. Nanocellulose is used to enhance paper properties like tear resistance, tensile strength, and folding endurance.

Country Insights

How did the China Thrive in the Asia Pacific Nanocellulose Market in 2025?

China dominated the market with the largest share in 2025. The dominance of the country can be attributed to the growing demand for sustainable materials along with the expansion in specific application industries such as personal care, aerospace, and packaging. In addition, supportive government policies are promoting green technologies, creating further future opportunities in the market.

Which is the Fastest Growing Country in the Region?

India expects the fastest growth in the market during the forecast period. The growth of the country can be credited to the surge in the middle-class population, which facilitates the demand for sustainable and high-performance consumer products from cosmetics to electronics. Also, policies such as the "Make in India" initiative have drawn foreign investment in the country.

Japan is expected to grow at a notable CAGR over the forecast period. The growth of the country can be driven by rising investment in commercialization and research efforts, coupled with the ongoing prevalence of advanced research activities. Moreover, various Japanese companies and universities have been involved in nanocellulose research, driving market expansion in the country shortly.

Recent Developments

- In February 2025, Gozen officially introduced the biomaterial Lunaform, a series of fermented nanocellulose textiles created by microorganisms. The founder stated that this textile-like material converts into a wide variety of textures and touches.(Source : www.designboom.com)

- In October 2024, UPM Biomedicals introduced FibGel™, the world's first injectable nanocellulose hydrogel for medical devices. FibGel is a natural hydrogel produced from renewable-sourced Finnish birch wood, providing a safe and sustainable solution.(Source: www.news-medical.net)

Asia Pacific Nanocellulose Market Companies

- American Process Inc.: American Process Inc. is a key player in the nanocellulose market, with a focus on developing and commercializing products in the Asia Pacific markets, particularly China, Japan, and other nations.

- Borregaard Chemcell: Borregaard is a key global player in the nanocellulose market, but its primary production base and market strength for nanocellulose are in Europe, with a strategic presence in the Asia-Pacific (APAC) through sales offices and local market engagement.

Top Asia Pacific Nanocellulose Market Companies

- Borregaard Chemcell

- American Process Inc

- Ashai Kasei Chemicals Corporation

- Chuetsu Pulp & Paper Co. Ltd.

- Daicel Corporation

- Daio Paper Corporation

- Imerys

- Innventia AB

- Kruger Inc.

- Stora Enso Ltd.

Segments Covered

By Product Type

- Nanofibrillated Cellulose (NFC)

- Cellulose Nanocrystals (CNC)

- Bacterial Nanocellulose (BNC)

- Others

By Application

- Rheology Modifier

- Composites & Packaging

- Pulp & Paper

- Electronics & Sensors

- Biomedical & Pharmaceuticals

- Others