Content

U.S. Biodiesel Market Size, Share, Trends and Forecasts 2034

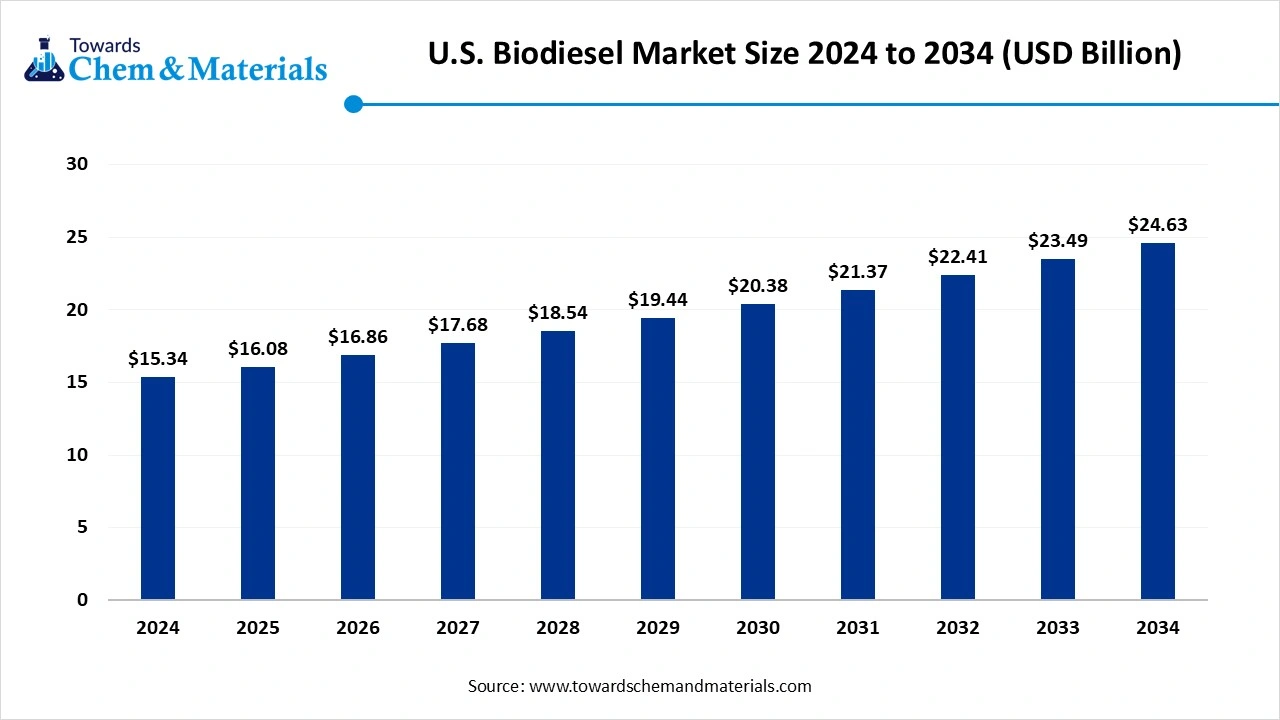

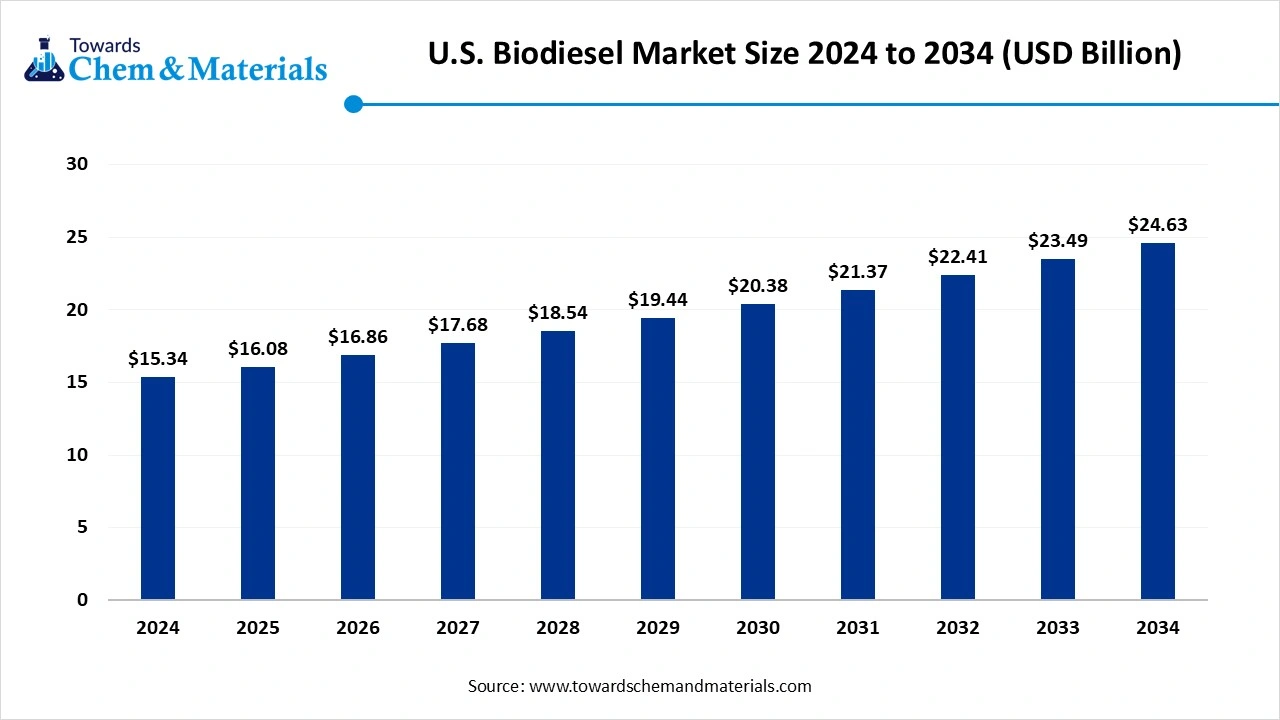

The U.S. biodiesel market size accounted for USD 15.34 billion in 2024 and is predicted to increase from USD 16.08 billion in 2025 to approximately USD 24.63 billion by 2034, expanding at a CAGR of 4.85% from 2025 to 2034. Global shift towards sustainable and cleaner fuels has driven investor confidence in the industry’s future.

Key Takeaways

- By feedstock type, the soybean oil segment led the U.S. biodiesel market with approximately 40% industry share in 2024.

- By feedstock type, the waste cooking oil / yellow grease segment is expected to grow at the fastest rate in the market during the forecast period.

- By product/fuel type, the B20 segment emerged as the top-performing segment in the market with approximately 50% of the industry share in 2024.

- By product/fuel type, the B100 / renewable diesel segment is expected to lead the market in the coming years.

- By production tech, the transesterification segment led the market with approximately 60% share in 2024.

- By production tech, the hydroprocessing/HEFA segment is expected to capture the biggest portion of the market in the coming years.

- By end user, the commercial transport fleets segment led the market with approximately 50% industry share in 2024.

- By end user, the government/municipal fleets segment is expected to grow at the fastest rate in the market during the forecast period.

Is Biodiesel the Future of Clean Transportation in America?

The U.S. biodiesel industry refers to the domestic industry involved in the production, distribution, and use of biodiesel as an alternative fuel. Biodiesel is a renewable, biodegradable fuel derived primarily from vegetable oils, animal fats, and waste cooking oils, which can be blended with conventional diesel (B5, B20, B100) for transportation and industrial applications.

The market is driven by environmental regulations, renewable fuel standards (RFS), demand for low-emission fuels, rising adoption in transportation and heavy-duty sectors, and incentives promoting biofuel production and consumption. It is blended and offers long-lasting fragrances, as per the recent industry observation.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 16.08 Billion |

| Expected Size by 2034 | USD 24.63 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Feedstock Type, By Product / Fuel Type, By Production Technology, By End-User |

| Key Companies Profiled | Pacific Biodiesel Technologies, Neste Corporation (U.S. operations) , Bunge Limited , Green Plains Inc. , World Energy , Valero Energy Corporation , Pacific Ethanol, Inc. , Tyson Foods, Inc. (animal fat feedstock partnerships) , Sustainable Oils, LLC |

U.S. Biodiesel Market Outlook:

- Industry Growth Overview: Between 2025 and 2030, the country has actively shifted towards cleaner fuel options in recent years by reducing dependence on traditional fossil fuels. Moreover, by playing a crucial role in decarbonizing transportation and logistics, biodiesel has gained recognition for its innovative potential in the past few years.

- Sustainability Trends: The biodiesel manufacturers are seen as integrating waste-based feedstock in the production of biodiesel nowadays. Furthermore, these waste feedstocks are actively reducing the dependence on food crops and lowering carbon intensity while promoting sustainability standards in the sector.

- Global Expansion: The global expansion of the biodiesel sector is primarily reflected through technology sharing and exports. Moreover, the biodiesel manufacturers of the United States are seen in exporting biodiesel to nations that are facing emission targets, like Asia and Europe, nowadays.

Key Technological Shifts in the U.S. Biodiesel Market:

The market has observed the under-technology integration while maintaining expense and using traditional refineries in recent years. Moreover, several manufacturers are investing in advanced technology, which is likely to drive the industry growth in the coming year. Also, initiatives like co-processing in existing refineries and usage for domestic feedstock are contributing to the industry's potential in recent years.

Trade Analysis of the U.S. Biodiesel Market: Import & Export Statistics

The United States has exported a heavy amount of biodiesel in 2024, which is estimated as 176.8 million gallons.(Source: www.fastmarkets.com)

Value Chain Analysis of the U.S. Biodiesel Market

- Distribution to Industrial Users: The distribution of biodiesel in the United States includes a multi-tier supply chain and major industry users

- Key Players: Cargill Inc. and Neste

- Chemical Synthesis and Processing: The chemical synthesis and the processing of the biodiesel in the United States are associated with processes like transesterification and others.

- Regulatory Compliance and Safety Monitoring: The safety and regulatory process of biodiesel in the United States revolves around the federal agencies and their key regulations.

U.S. Biodiesel Market’s Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | Environmental Protection Agency (EPA) | Renewable Fuel Standard (RFS) | Blended volumes and Greenhouse gas (GHG) reductions | The EPA is the central federal agency regulating biodiesel production and other fuels in the United States. |

Segmental Insights

Feedstock Type Insights

How did the Soybean Oil Segment Dominate the U.S. Biodiesel Market in 2024?

The soybean oil segment held approximately 40% share of the market in 2024, due to its wide availability and cost-effectiveness. Furthermore, the United States is considered one of the leading soybean producers, which has contributed to the segment's growth in recent years. Moreover, factors like a stronger domestic chain and compatibility with existing biodiesel technology, the soybean oil segment, have gained major industry share in recent years, as per the recent survey.

The waste cooking oil /yellow grease segment is expected to grow at a notable rate during the predicted timeframe, owing to the ongoing sustainability shift and circular economy models. Furthermore, these feedstocks have been seen in lower carbon intensity than regular crop-based feedstock, which is likely to create lucrative opportunities in the coming years.

Product/ Fuel Type Insights

Why does the B20 Segment Dominate the U.S. Biodiesel Market by Fuel Type?

The B20 segment held approximately 50% of the Market in 2024 because it provides the best balance of performance, cost, and ease. It works seamlessly in existing engines without modifications, making it a practical choice for fleets and drivers. B20 also delivers strong environmental benefits by reducing emissions without the supply chain challenges of pure biodiesel. Fuel stations and distributors prefer B20 because infrastructure adjustments are minimal.

The B100 / renewable diesel segment is expected to grow at a notable rate during the forecast period, because of the push for deeper decarbonization. Unlike blends, pure biodiesel and renewable diesel deliver near-total replacement for petroleum diesel. Renewable diesel is chemically identical to petroleum diesel, which means it can be used in existing infrastructure with zero modification.

Production Tech Insights

How Did The Transesterification Segment Dominate The U.S. Biodiesel Market In 2024?

The transesterification segment dominated the market with approximately 60% share in 2024, because it is simple, proven, and cost-effective. This process chemically transforms oils and fats into biodiesel using alcohol and a catalyst, making it ideal for soybean oil and other traditional feedstocks. U.S. producers favored transesterification because of its efficiency and ability to scale quickly. It became the backbone of early biodiesel production plants, ensuring consistent quality and output.

The hydroprocessing/HEFA segment is expected to grow at a significant rate during the forecast period, because it produces renewable diesel with higher quality and broader applications. Unlike transesterification biodiesel, HEFA-based renewable diesel is chemically like petroleum diesel, making it a fully "drop-in" fuel for engines, pipelines, and refineries. This technology is also better suited for scaling up large refineries, many of which are being converted into renewable fuel plants.

End User Insights

Why does the Commercial Transport Fleets Segment Dominate the U.S. Biodiesel Market?

The commercial transport fleets segment held 50% of the Market in 2024 because they are high-volume fuel consumers and need cost-effective ways to reduce emissions. Trucking companies, logistics providers, and shipping fleets embraced biodiesel because it offered immediate carbon reductions without costly engine replacements.

The government / municipal fleets segment is expected to grow at a notable rate during the forecast period, because of strict public sector sustainability mandates. Cities, states, and federal agencies are under pressure to decarbonize their vehicle operations, including buses, police cars, and public works vehicles. Unlike private fleets, governments are driven not just by cost but also by policy commitments and climate pledges.

Country-level Investments & Funding Trends for the U.S Biodiesel Industry:

- The United States Department of Energy in the United States has invested heavily in biorefinery research and development and bioenergy, which is approximately $500 million.(Source : www.ieabioenergy.com)

Recent Development

- In May 2025, The Argus has expanded its electronic price discovery platform for biodiesel in the United States. Also, the newly extended platform called the Argus Open Market, which is real real-time electronic price discovery platform, as per the report published by the company recently.(Source: www.prnewswire.com)

Top Vendors In The U.S. Biodiesel Market & Their Offerings:

- Archer Daniels Midland (ADM): The company is known for its heavy agricultural processes and crop transformations into renewable energy.

- Renewable Energy Group, Inc. (REG): The company is seen as a huge biodiesel and renewable chemicals.

Cargill, Inc.: The company has multinational headquarters and focuses on food and agriculture solutions - Louis Dreyfus Company: The company is a major processor and merchant of agricultural goods, as per the latest information.

Other Key Players

- Pacific Biodiesel Technologies

- Neste Corporation (U.S. operations)

- Bunge Limited

- Green Plains Inc.

- World Energy

- Valero Energy Corporation

- Pacific Ethanol, Inc.

- Tyson Foods, Inc. (animal fat feedstock partnerships)

- Sustainable Oils, LLC

Segments Covered in the Report

By Feedstock Type

- Soybean Oil

- Canola / Rapeseed Oil

- Animal Fats (tallow, lard)

- Waste Cooking Oil / Yellow Grease

- Algae-based Oil

- Other Vegetable Oils

By Product / Fuel Type

- B5 (5% Biodiesel, 95% Diesel)

- B20 (20% Biodiesel)

- B50 / B100 (50–100% Biodiesel)

- Renewable Diesel (HEFA / HVO)

By Production Technology

- Transesterification

- Hydroprocessing / Hydrogenation

- Enzymatic / Advanced Biofuel Processes

By End-User

- Commercial Transport Fleets (trucking, buses)

- Government Vehicles (municipal fleets, defense)

- Industrial / Manufacturing Units

- Aviation / Marine (biojet blends and marine biodiesel)