Content

What is the Current Aerospace and Defense Materials Market Size and Share?

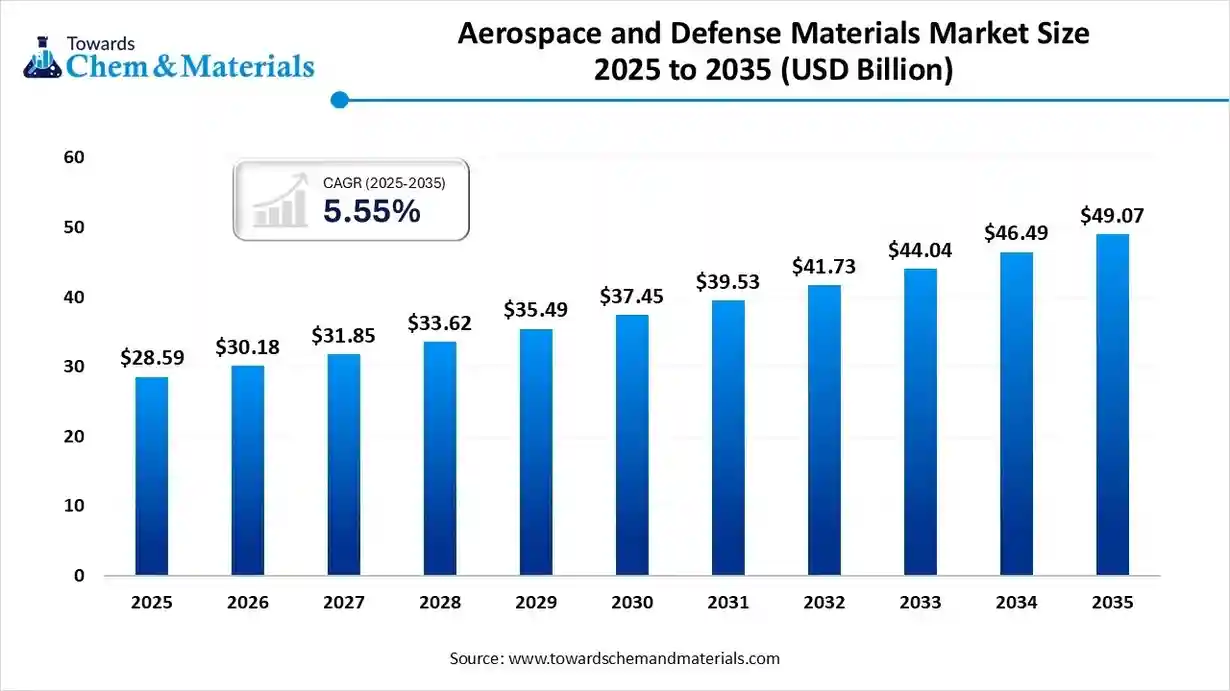

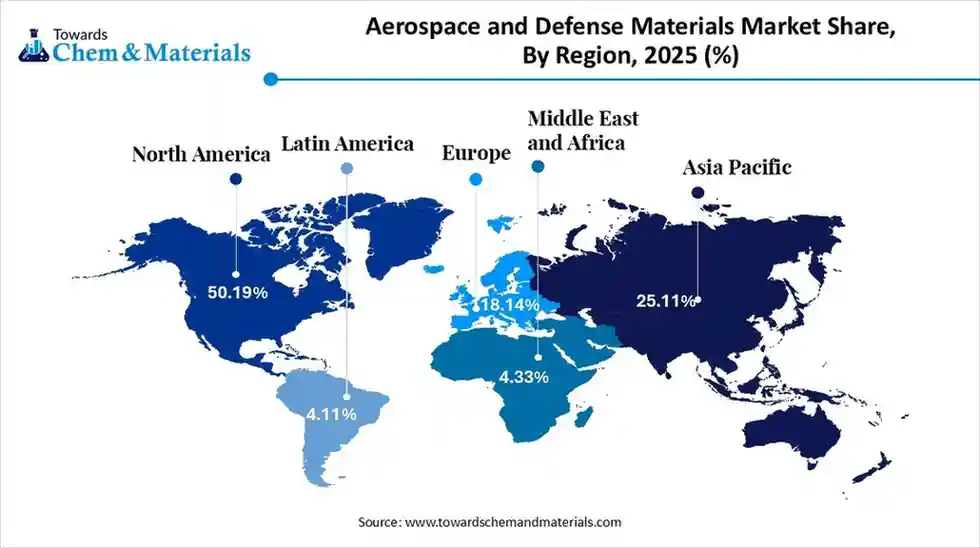

The global aerospace and defense materials market size is calculated at USD 28.59 billion in 2025 and is predicted to increase from USD 30.18 billion in 2026 and is projected to reach around USD 49.07 billion by 2035, The market is expanding at a CAGR of 5.55% between 2026 and 2035. Asia Pacific dominated the aerospace and defense materials market with a market share of 50.19% the global market in 2025. The strong focus of airlines on lowering carbon emissions and the rise in air passenger traffic drive the market growth,

Key Takeaways

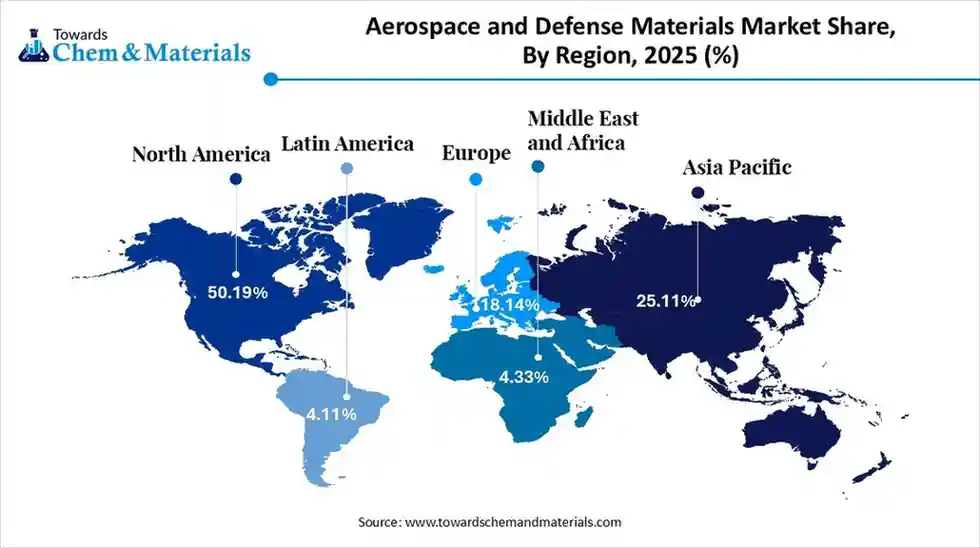

- North America dominated the aerospace and defense materials market with a revenue share of 50.19% in 2025.

- By material type, the metals & alloys segment led the market and accounted for 45% of the global revenue share in 2025.

- By aircraft type, the commercial aircraft segment accounted for the largest revenue share of 44% in 2025.

- By property, the lightweight & high strength materials segment dominated with the largest revenue share of 42% in 2025.

- By end-use sector, the commercial aviation OEMs segment dominated the market and accounted for the largest revenue share of 37% in 2025.

- By distribution channel, the direct supply segment accounted for the largest market revenue share of 55% in 2025.

What is Driving the Future of Aerospace and Defense Materials?

The aerospace and defense materials market is experiencing rapid growth, driven by a rise in global air travel, the modernization of military equipment, increased defense budgets, innovations in aircraft designs, a focus on modernizing military fleets, and increasing investment in space programs. The strong focus of manufacturers and airlines on the development of fuel-efficient vehicles increases demand for lightweight materials to enhance safety and improve performance.

The growing government investment in domestic defense capabilities & the manufacturing of aerospace, and rising spending on defense equipment, military aircraft, & weapon systems, leads to higher demand for stealth & high-strength materials.

What are Aerospace and Defense Materials?

Aerospace and defense materials are advanced materials that have been developed to meet the extreme performance requirements of military equipment, aircraft, and spacecraft. These material has high durability, corrosion resistance, strength-to-weight resistance, fatigue resistance, and heat resistance. The diverse materials used in aerospace and defense applications are composite, polymeric, metallic, and ceramic.

In aerospace applications, the specialized or advanced material is used in spacecraft, airframes, aircraft structures, & engines, whereas in defense applications is used in defense systems, radar, military aircraft, satellites, and armored vehicles.

Aerospace and Defense Materials Market Trends:

- Growing Commercial Aviation:- The growing middle-class population globally and the expansion of the economy, particularly in the Asia Pacific, increase demand for commercial aviation. The rise in air travel supports fleet renewal and the modernization of airlines, which increases the adoption of advanced aircraft. The growing international tourism and increasing government investment in airport infrastructure increase demand for commercial aviation. For instance, Air India ordered over 500 new aircraft from Boeing & Airbus to modernize its fleet with fuel-efficient planes.

- Defense System Modernization:- The geopolitical tensions, unresolved border disputes, and growing budgets of defense increase the modernization of defense systems, which fuels demand for advanced materials. The modernization of military vehicles, infrastructure, equipment, and aircraft requires advanced materials to enhance survivability and performance.

- Shift Towards Lightweight Materials:- The strong emphasis on enhancing fuel efficiency, lowering GHG emissions, and enhancing the performance of military and commercial aircraft increases demand for lightweight materials. The materials like carbon fiber-reinforced polymers and advanced titanium & aluminum alloys lower the weight of aircraft and offer a high strength-to-weight ratio. The stricter regulatory pressures and growing environmental concerns are leading to a shift towards lightweight materials.

- Additive Manufacturing:- The strong focus of aircraft manufacturers to lower waste of materials and create complex parts increases demand for additive manufacturing. The growing development of lighter parts and focus on rapid customization of components requires additive manufacturing. Parts like engine components, drone components, interior parts, thrust chambers, RF antennas, customized spares, satellite structures, and many more are created using additive manufacturing.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 30.18 Billion |

| Revenue Forecast in 2035 | USD 49.07 Billion |

| Growth Rate | CAGR 5.55% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segments covered | By Material Type, By Aircraft / Platform Type, By Property / Material Performance Requirement, By End-Use Sector, By Distribution Channel, By Region |

| Key companies profiled | Allegheny Technologies, Cytec Solvay Group, Hexcel Corporation, Novelis, Constellium N.V, SGL Carbon, thyssenkrupp Aerospace, Formosa Plastics Corporation, U.S.A, Strata Manufacturing PJSC, Teijin Limited |

Key Technological Shifts in the Aerospace and Defense Materials Market:

The technological innovation in aerospace and defense materials focuses on the development of heat-resistant, lightweight, and stronger parts using advanced materials. The key technological innovations include nanomaterials use, 3D printing, digitalization, electrification, and hypersonic technologies support the development of new generation defense and aircraft systems.

One of the major transformations is the integration of artificial intelligence to optimize manufacturing processes and enhance the performance of materials.

AI analyzes large datasets of materials and identifies new composite or alloy materials for the development of aircraft and spacecraft parts. AI creates durable & lightweight components and predicts engine or system failures. AI detects surface defects, microscopic cracks, & other defects, and also optimizes flight paths to lower consumption of fuel.

Artificial Intelligence performs tasks like assembly, drilling, and painting to accelerate production timelines, enhance consistency, and minimize errors. AI develops autonomous systems to perform tasks like engaging targets & tracking. However, AI is redefining the aerospace and defense materials industry by offering the highest quality standards, managing complexity, and providing safety.

Trade Analysis of Aerospace and Defense Materials Market: Import & Export Statistics

- France exported $44.7B of aircraft and spacecraft.

- India exported 19226 shipments of aluminum alloys.

- Russia exported 11640 shipments of titanium alloys.

- India exported 1077 shipments of glass fiber reinforced plastic.

- China exported 9423 shipments of elastomers.

- The United States exported $25.9B of aircraft parts.

Aerospace and Defense Materials Market Value Chain Analysis

- Feedstock Procurement :The feedstock procurement is the process of sourcing & acquiring raw materials like titanium alloy, copper, nickel, aluminum alloy, tungsten, carbon fiber-reinforced polymers, and glass fiber composites to manufacture military systems, aircraft, and spacecraft.

- Key Players: Alcoa Corporation, Constellium SE, Mishra Dhatu Nigam, ATI, Hexcel Corporation

- Quality Testing and Certifications :Quality Testing involves diverse tests like fatigue, vibration, thermal stability, fluid susceptibility, and non-destructive testing to ensure components meet performance & stringent safety. Certifications like NANDCAP, AS9100, and AMS ensure material safety and performance.

- Key Players: SGS SA, Applus+ Laboratories, Element Materials Technology, Intertek Group plc

- Regulatory Compliance and Safety Monitoring :Regulatory compliance ensures operational integrity, high levels of safety, & national security through quality management systems, environmental regulations, & airworthiness standards. Safety monitoring involves documentation, incident investigation, testing, and data analysis to ensure the functionality of systems, materials, and components.

- Key Players: DEKRA, SGS SA, Element Materials Technology, TÜV SÜD, Bureau Veritas

Classification of Key Aerospace and Defense Materials Category

| Type | Examples | Used in |

| Metals |

|

|

| Composites |

|

|

| Polymers |

|

|

| Ceramics |

|

|

Segmental Insights

Material Type Insights

Why the Metals & Alloys Segment Dominates the Aerospace and Defense Materials Market?

The metals & alloys segment dominated the aerospace and defense materials market with approximately 45% share in 2025. The high strength-to-weight ratio, temperature resistance, and fatigue resistance of metals & alloys help market growth. The growing manufacturing of high-stress components like bulkheads, engine parts, fuselages, and landing gear increases demand for metals & alloys. The presence of titanium alloys, steel alloys, aluminum alloys, and nickel-based superalloys drives the market growth.

The composites segment is the fastest-growing in the market during the forecast period. The strong focus on enhancing the fuel efficiency of vehicles and increasing the payload in aircraft increases the adoption of composites. The growing demand for enhancing the performance of military & commercial fleets and lower maintenance costs increases demand for composites. The development of modern aircraft supports the overall market growth.

The ceramics & ceramic matrix composites segment is growing significantly in the market. The strong focus on lowering emissions and improving the efficiency of aerospace increases demand for ceramics & ceramic matrix. The presence of superior wear & corrosion resistance and the lightweight of ceramics helps market growth. The development of military aircraft and commercial airlines requires ceramic matrix, supporting the overall market growth.

Aircraft Type Insights

How did the Commercial Aircraft Segment hold the Largest Share in the Aerospace and Defense Materials Industry?

The commercial aircraft segment held the largest revenue share of approximately 40% in the aerospace and defense materials industry in 2025. The growing modernization of the fleet and the development of cargo aircraft increase demand for advanced materials. The rising air travel and expansion of the fleet require materials like metals, composites, & metals. The strong focus on enhancing the fuel efficiency of aircraft and the presence of maintenance, repair, and overhaul services drive the market growth.

The spacecraft & launch vehicles segment is experiencing the fastest growth in the market during the forecast period. The growing commercial space sector and rapid deployment of satellite constellations require advanced materials. The increasing investment in space exploration programs and the growing demand for space-based services help market growth. The presence of private space companies like Rocket Lab, SpaceX, and Blue Origin supports the overall market growth.

Additionally, the military aircraft segment is growing significantly in the market. The growing modernization of military forces and the development of modern military aircraft require advanced materials. The strong focus on lowering the aircraft’s radar cross-section and the development of fuel-efficient military aircraft drive the market growth.

Property Insights

Why the Lightweight & High Strength Materials Segment is Dominating the Aerospace and Defense Materials Market?

The lightweight & high strength materials dominated the aerospace and defense materials market with approximately 42% share in 2025. The strong focus on enhancing the fuel efficiency of aircraft and lowering maintenance costs increases the adoption of lightweight materials. The focus on increasing the payload capacity of aircraft and the development of next-generation satellites & aircraft increases the adoption of high strength & lightweight materials, supporting the overall market growth.

The high-temperature & thermal-resistant materials segment is the fastest-growing in the market during the forecast period. The increasing need to lower the consumption of fuel and the development of greater engine thrust require high-temperature materials. The extreme operating environments in aircraft and defense vehicles require thermal-resistant materials. The strong focus on enhancing safety in the aerospace and defense sector drives the market growth.

The wear & corrosion resistance material segment is substantially growing in the market. The growing operations of defense systems, aircraft, and spacecraft in harsh conditions and the increasing need for preventing structural failures increase demand for wear resistance materials. The strong focus on enhancing the performance of military & aircraft vehicles and the need to lower MRO costs require wear & corrosion resistant materials, supporting the overall market growth.

End-Use Sector Insights

Which End-Use Sector Held the Largest Share in the Aerospace and Defense Materials Industry?

The commercial aviation OEMs segment held the largest revenue share of approximately 37% in the aerospace and defense materials industry in 2025. The growing expansion of commercial airlines and the modernization of air fleets increases demand for titanium alloys & advanced composites. The increasing global air travel and expansion of e-commerce require commercial aviation. The presence of companies like Embraer, Boeing, and Airbus drives the market growth.

The space agencies & private space companies segment is experiencing the fastest growth in the market during the forecast period. The growing deployment of satellites and exploration of space requires materials like advanced ceramics, titanium alloys, and superalloys. The strong government support for space expansion through ISRO, NASA, & ESA, and the presence of companies like Blue Origin & SpaceX, support the overall market growth.

The defense OEMs segment is growing significantly in the market. The growing terrorist attacks and increasing geopolitical tensions increase the demand for defense OEMs. The rapid growth in defense budgets and the modernization of military fleets increases demand for advanced materials, driving the overall growth of the market.

Distribution Channel Insights

How Direct Supply Segment Dominated the Aerospace and Defense Materials Market?

The direct supply segment dominated the aerospace and defense materials market with approximately 55% share in 2025. The growing customization of aircraft parts and focus on direct collaboration between manufacturers & suppliers increases demand for direct supply. The presence of specialized expertise and focus on streamlining logistics requires direct supply. The greater control over quality and a consistent & stable supply drive the market growth.

The specialized material service centers segment is the fastest-growing in the market during the forecast period. The rigorous testing needs and stricter safety & quality standards increase demand for specialized material service centers. The ability of service centers to manage customization, sourcing, and processing of complex materials helps market growth.

The distributors & tier-2 or tier-3 suppliers segment is substantially growing in the market. The specialization of tier-2 or tier-3 in manufacturing processes, components, and materials helps market growth. The strong focus on managing inventory & logistics and the need to lower lead times requires distributors, supporting the overall market growth.

Regional Insights

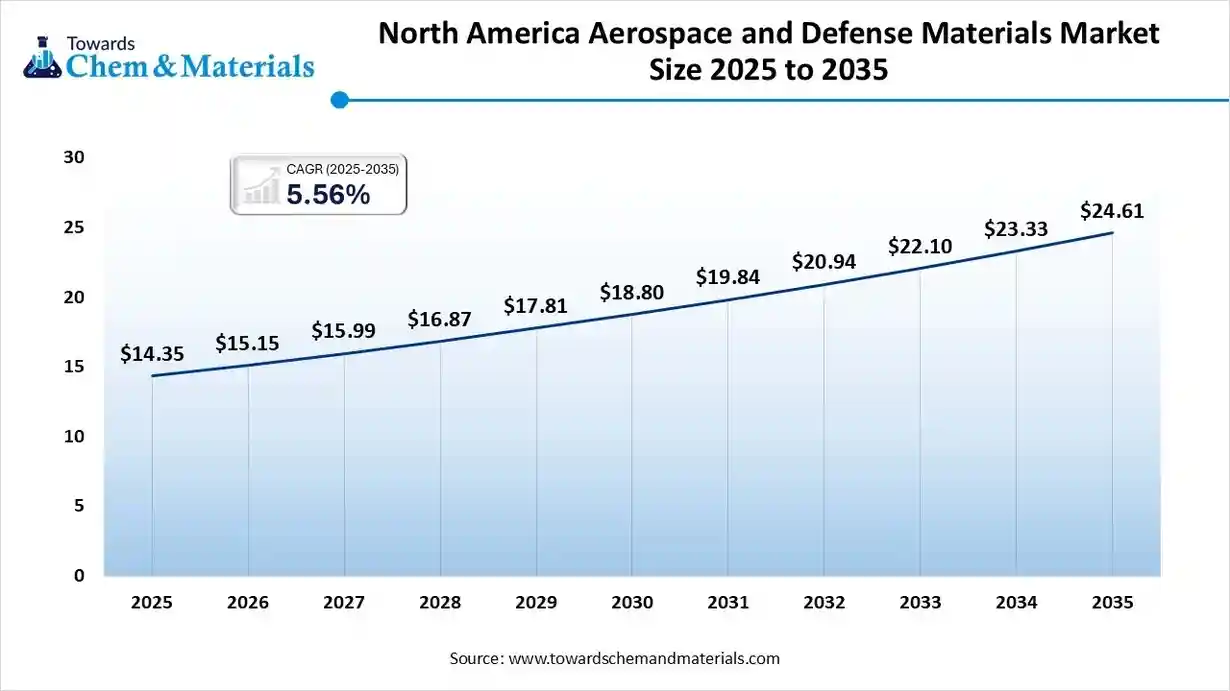

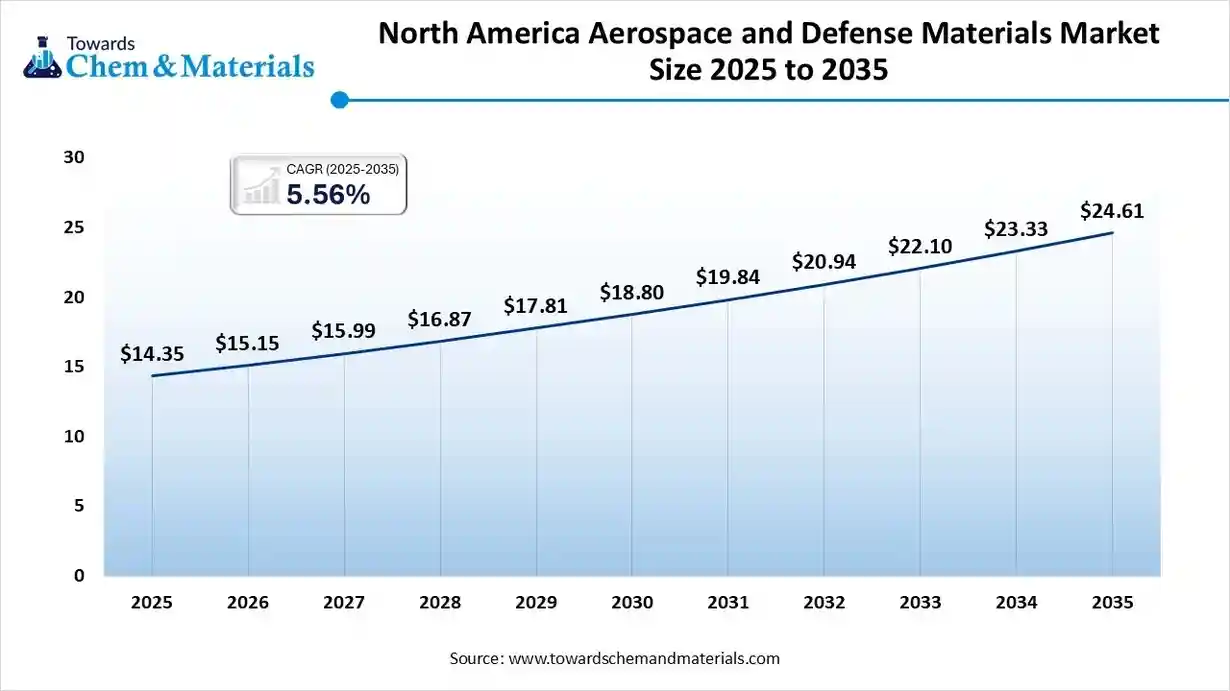

The North America aerospace and defense materials market size was valued at USD 14.35 billion in 2025 and is expected to reach USD 24.61 billion by 2035, growing at a CAGR of 5.56% from 2026 to 2035. North America dominated the market with approximately 50.19% share in 2025.

The growing government spending on fleet modernization, advanced aircraft, and space systems increases demand for aerospace & defense materials. The increasing air travel and development of new commercial aircraft require aerospace materials. The presence of a mature aerospace manufacturing ecosystem and increasing development of new materials like advanced alloys & composites helps market growth. The strong presence of manufacturers like Lockheed Martin and Boeing drives the market growth.

Setting Standards: United States Excellence in Aerospace and Defense Materials

The United States is a key contributor to the aerospace and defense materials market. The growing spending on defense increases demand for advanced materials for the development of military systems, aircraft, & drones. The strong presence of commercial aircraft production and space exploration programs like SpaceX increases demand for advanced materials. The presence of defense contractors and Original Equipment Manufacturers supports the overall market growth.

- The United States exported 58580 shipments of aluminum alloys. (Source: www.volza.com)

Asia Pacific Aerospace and Defense Materials Market Trends:

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The growing modernization of air fleets and the commercial aviation boom increase demand for advanced materials. The growing regional security concerns and geopolitical tensions in countries like Japan, China, & India increase defense spending. The increasing expansion of maintenance, repair, & overhaul facilities and focus on self-reliance in defense production drives the market growth.

Advanced Material: Pillar Behind China Aerospace and Defense Materials

China is a major contributor to the market. The growing modernization of military systems, like next-generation aircraft, advanced flight systems, and avionics, increases demand for advanced materials. The increasing demand for civilian aviation and the rising number of air travel passengers require advanced materials. The high production capacity of composites and titanium supports the overall market growth.

China exported 17698 shipments of aluminum alloys.(Source: www.volza.com)

Europe Aerospace and Defense Materials Market Trends:

Europe is growing at a notable rate in the market. The growing spending on defense in countries like Poland & Germany and the rise in air passenger traffic increase demand for aerospace & defense materials. The development of new commercial aircraft and innovations in cutting-edge technologies requires aerospace materials. The growing maintenance, repair, and overhaul activities and the strong commercial aerospace sector drive the market growth.

Precision Materials: Germany’s Power in the Aerospace and Defense Sector

Germany is growing substantially in the aerospace and defense materials industry. The growing commercial air travel and increasing defense investments require aerospace & defense materials. The increasing defense budget and rising investment in sustainable aviation technologies require aerospace & defense materials. The presence of leading companies like Rheinmetall and Airbus supports the overall market growth.

Middle East & Africa Aerospace and Defense Materials Market Trends:

The Middle East & Africa are growing significantly in the market. The growing investment in modernizing military capabilities in countries like the UAE, Egypt, Saudi Arabia, and Israel increases demand for defense materials. The expansion of civil aviation and a strong focus on creating fuel-efficient civilian & military aircraft require aerospace & defense materials, driving the overall market growth.

United Arab Emirates Aerospace and Defense Materials Market Trends:

The United Arab Emirates is growing substantially in the market. The increasing government investment in defense modernization and the development of aerospace infrastructure requires aerospace & defense materials. The growing fleet sizes and expansion of international & domestic airlines like Etihad & Emirates support the overall market growth.

South America Aerospace and Defense Materials Market Trends:

South America is growing in the market. The growing modernization of naval & air fleets and increasing expansion of civil aviation require materials like alloys & composites. The growing investment in domestic aerospace manufacturing capabilities in countries like Brazil and the well-established commercial aircraft & military industry drives the overall market growth.

From Forest to Flight: Brazil’s Intelligence in Aerospace and Defense Materials

Brazil experiences significant growth in the market. The increasing investment in the defense modernization industry and the expansion of commercial aviation services increase demand for advanced materials. The strong government support through programs like airport privatization and the presence of major aerospace & defense hubs like Sao Paulo support the overall market growth.

Recent Developments

- In September 2025, Aerolloy Technologies launched an advanced superalloy manufacturing facility. The facility enhances India’s self-reliance and lowers the import dependence of defense and aerospace materials. The facility specializes in advanced VIM of large castings & superalloys.(Source: scanx.trade )

- In October 2025, Rajnath Singh inaugurated a titanium and superalloy plant on a 50-acre campus for the defense sector in Lucknow. The plant focuses on manufacturing aviation-grade superalloys & titanium. The material supports the development of missiles, satellites, fighter jets, and naval systems. (Source: currentaffairs.adda247.com)

- In April 2025, Cambium launched a new high-temperature resin system, ApexSheild 1000, for aerospace manufacturers. The system supports the production of rocket nozzle extensions, hypersonic glide bodies, and other components. The system minimizes hypersonic parts fabrication by 70-80% and supports cost-effective production.(Source: www.prnewswire.com)

Top Companies List:

- Huntsman International LLC: The company supplies advanced materials like polyurethane-based resins, epoxy resins, adhesives, and acrylic resins for the aerospace & defense industries.

- Toray Composites America, Inc.: The company produces advanced materials like thermoset prepreg and carbon fiber to support diverse industries like defense, sports equipment, aerospace, automotive, and wind energy.

- VSMPO-AVISMA: The Russian-based company supplies titanium & its alloys to major aircraft manufacturers like Pratt & Whitney, Airbus, and Boeing.

- Arconic Inc.: The company manufactures architectural products, aluminum extrusion, sheets, & plates, and 3D printed aerospace parts to support diverse industries.

- Kobe Steel, Ltd: The Japan-based company supplies advanced aluminum and titanium materials to support aerospace and defense applications like aircraft components, aircraft engines, landing gears, and other structural components.

Other Companies List

- Allegheny Technologies

- Cytec Solvay Group

- Hexcel Corporation

- Novelis

- Constellium N.V

- SGL Carbon

- thyssenkrupp Aerospace

- Formosa Plastics Corporation, U.S.A

- Strata Manufacturing PJSC

- Teijin Limited

Segments Covered

By Material Type

- Metals & Alloys

- Aluminum Alloys

- Titanium Alloys

- Steel & Superalloys

- Composites

- Carbon Fiber Reinforced Polymers (CFRP)

- Glass Fiber Composites (GFRP)

- Aramid Fiber Composites (Kevlar)

- Ceramics & Ceramic Matrix Composites (CMCs)

- Elastomers & Rubber Materials

- Adhesives, Sealants & Coatings

By Aircraft / Platform Type

- Commercial Aircraft

- Military Aircraft

- Helicopters

- UAVs / Drones

- Spacecraft & Launch Vehicles

- Naval & Marine Defense Platforms

By Property / Material Performance Requirement

- Lightweight & High Strength

- High-Temperature & Thermal Resistance

- Wear & Corrosion Resistance

- Impact & Ballistic Resistance

- Electrical & EMI Shielding Properties

- Fire-Resistant & Low-Smoke Materials

By End-Use Sector

- Commercial Aviation OEMs

- Defense OEMs

- MRO (Maintenance, Repair & Overhaul)

- Space Agencies & Private Space Companies

- Defense Vehicle Manufacturers (land & naval)

By Distribution Channel

- Direct Supply (OEM Contracts)

- Distributors & Tier-2/Tier-3 Suppliers

- Specialized Material Service Centers

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa