Content

What is the Current Crop Protection Chemicals Market Size and Volume?

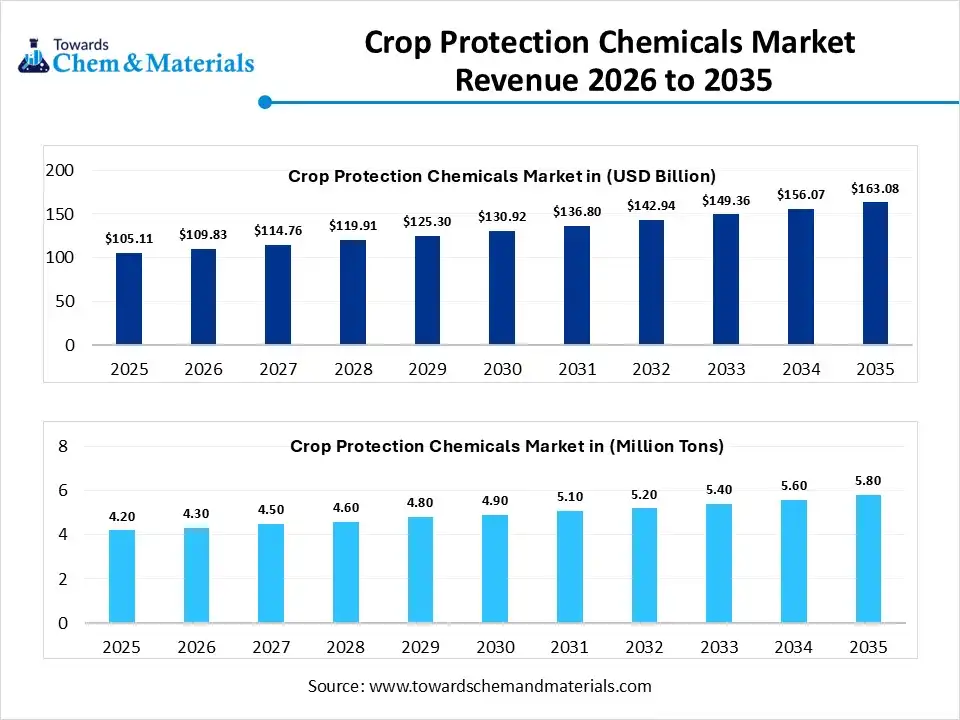

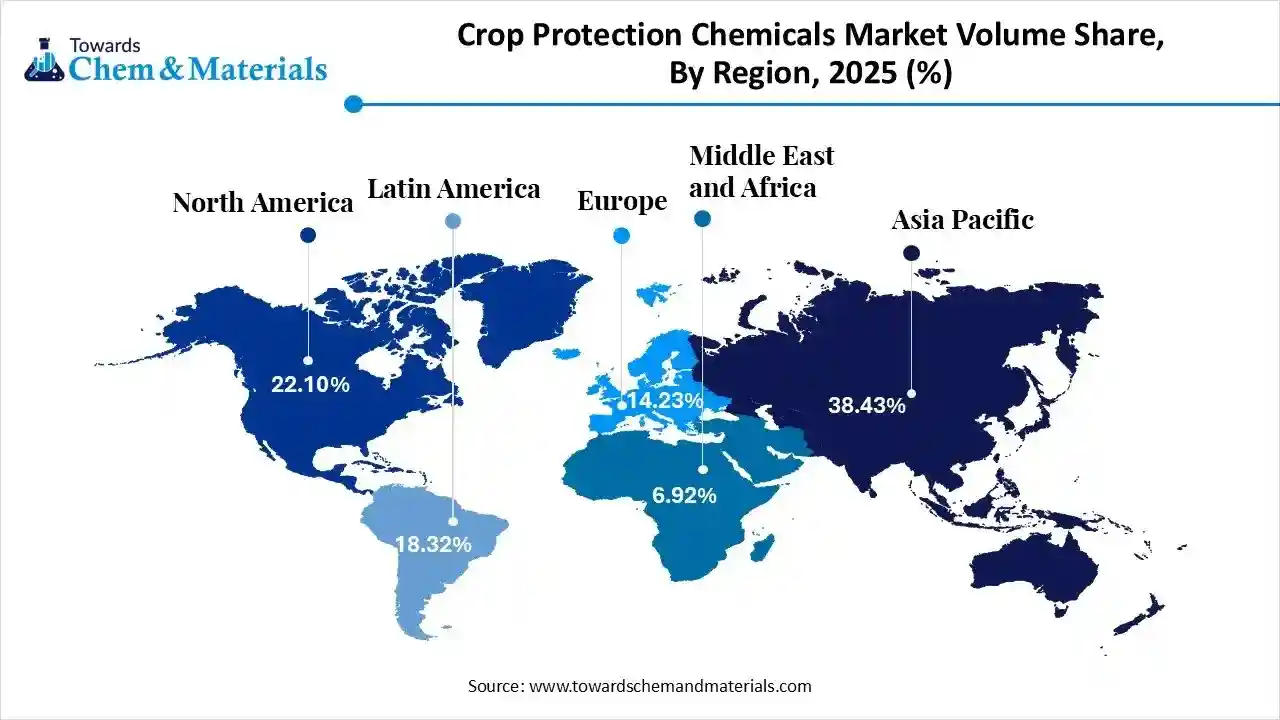

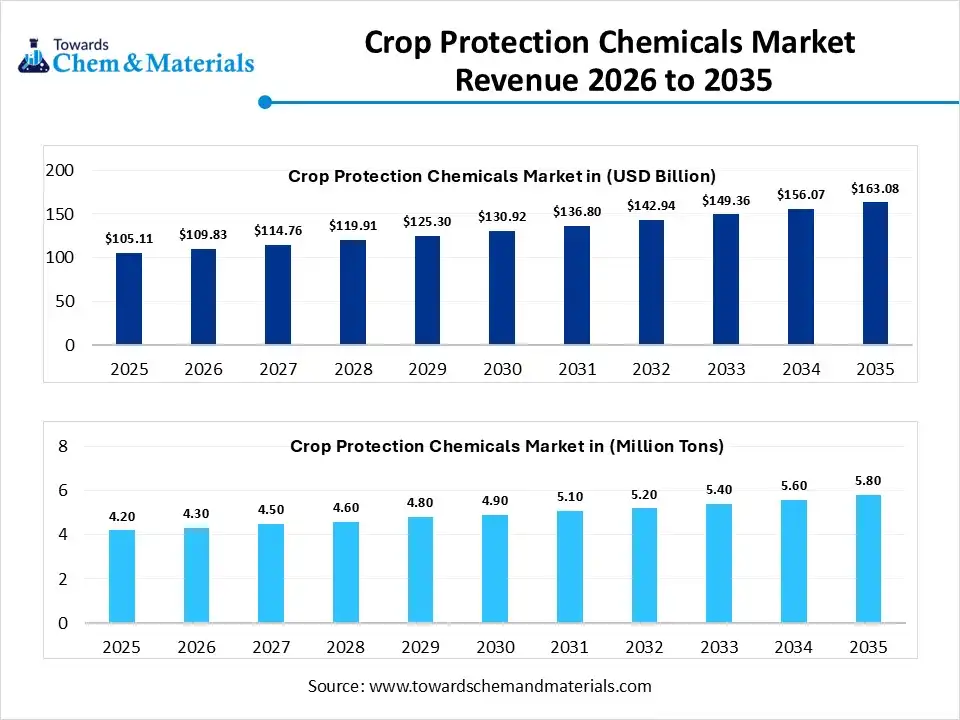

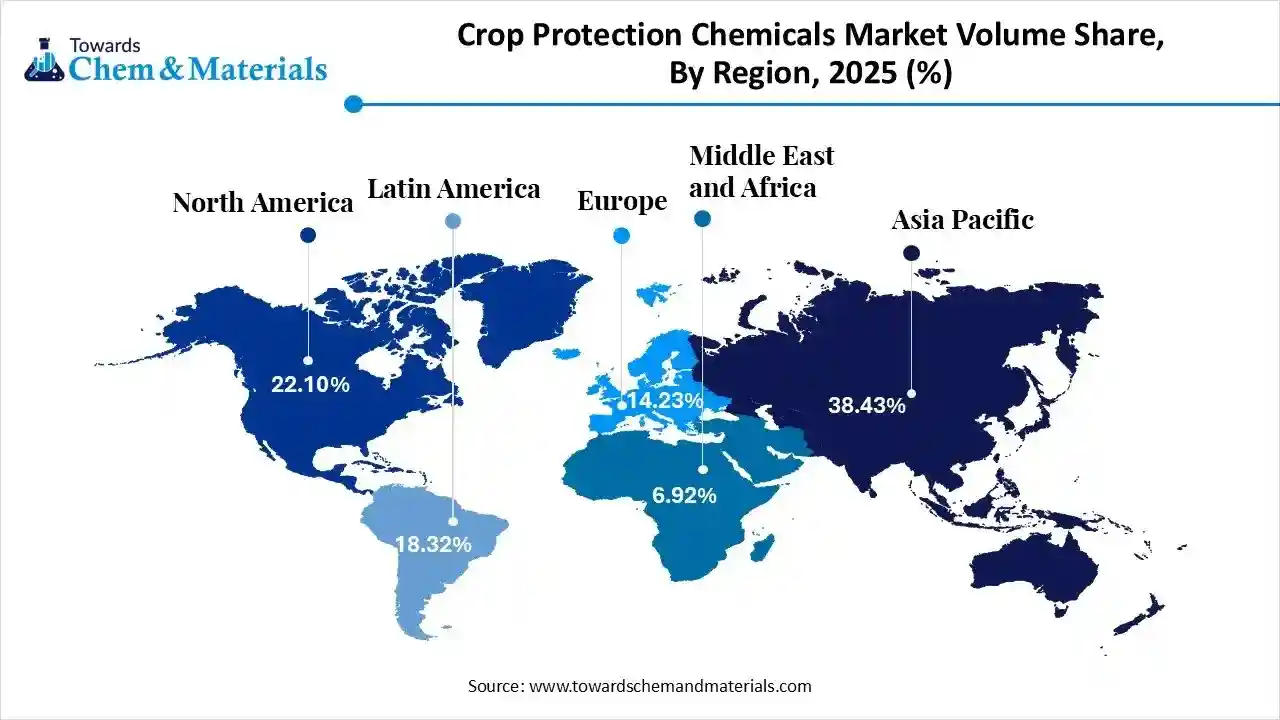

The global crop protection chemicals market size was estimated at USD 105.11 billion in 2025 and is expected to increase from USD 109.83 billion in 2026 to USD 163.08 billion by 2035, growing at a CAGR of 4.49% from 2026 to 2035. In terms of volume, the market is projected to grow from 4.20 million tons in 2025 to 5.80 million tons by 2035. growing at a CAGR of 3.21% from 2026 to 2035. Asia Pacific dominated the crop protection chemicals market with the largest volume share of 38.43% in 2025.

Market Highlights

- The Asia Pacific dominated the global crop protection chemicals market with the largest volume share of 38.43% in 2025.

- The crop protection chemicals market in North America is expected to grow at a substantial CAGR of 3.77% from 2026 to 2035.

- The Latin America polymer nanocomposites market segment accounted for the major volume share of 18.32% in 2025.

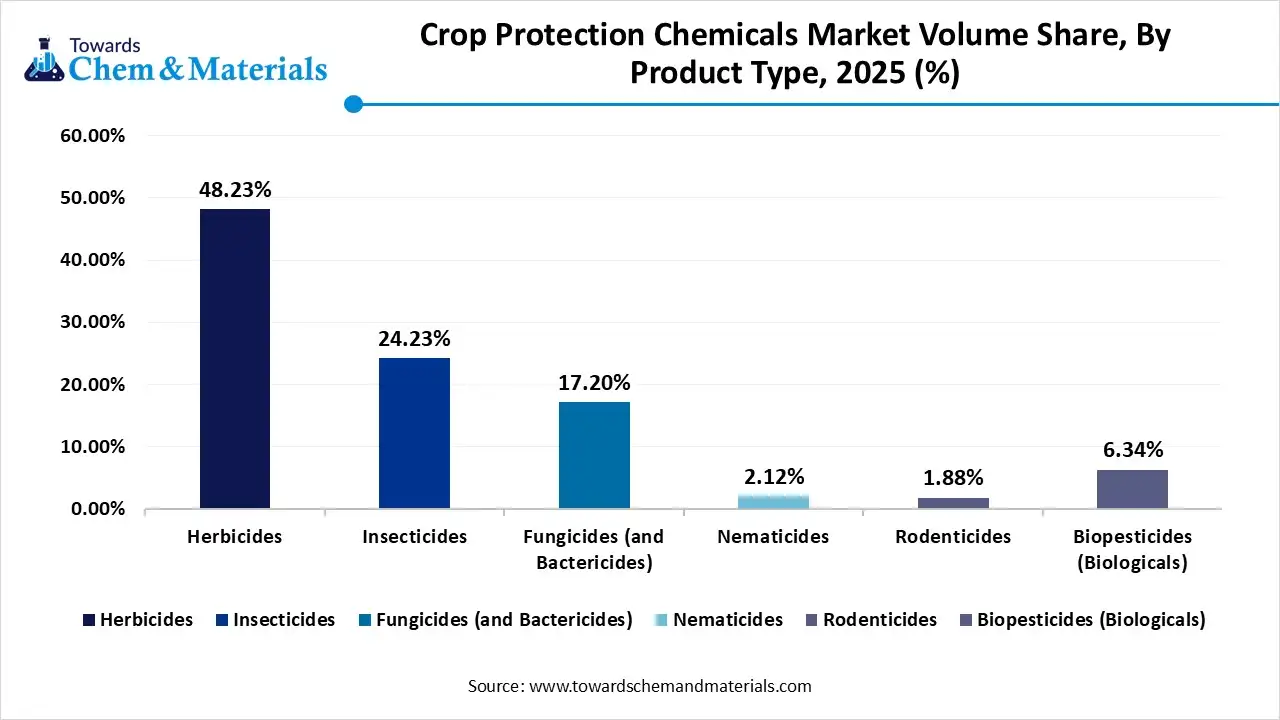

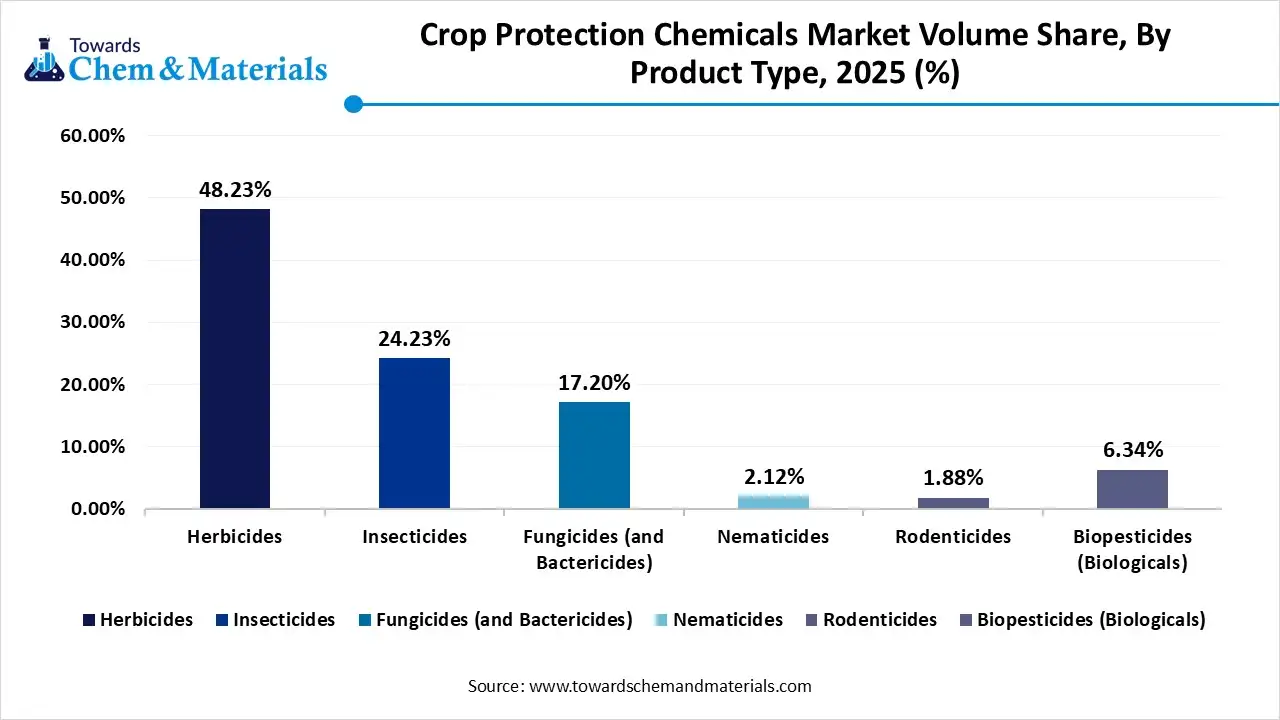

- By product type, the herbicide segment dominated the market and accounted for the largest volume share of 48.23% in 2025.

- By product type, the biopesticides segment is expected to grow at the fastest CAGR of 4.47% from 2026 to 2035 in terms of volume.

- By crop type, the cereals and grains segment led the market with the largest revenue volume share of 35.00% in 2025.

- By origin/source, the synthetic chemicals segment dominated the market and accounted for the largest volume share of 75.00% in 2025.

- By mode of application, the foliar spray segment led the market with the largest revenue volume share of 55.3% in 2025.

What are Crop Protection Chemicals?

Crop protection chemicals market growth is driven by a rise in the incidence of diseases & pests, the development of bio-based solutions, growing food demand, the use of modern farming technology, and the focus on maximizing crop yields.

Crop protection chemicals are substances used in agricultural activities to protect crops from weeds, pests, & diseases. They offer benefits like enhancing crop yields, improving the quality of the crop, extending the shelf life of agricultural products, lowering resource use, and helping in conservation. Crop protection chemicals are applied in areas like soil, plants, and storage by using methods like precision farming, spraying, & manual application.

Crop Protection Chemicals Market Trends:

- Sustainability Focus: Growing concern over environmental impact drives demand for bio-pesticides, Integrated Pest Management (IPM), and less toxic chemistries, challenging traditional chemical reliance.

- Precision Agriculture Adoption: Drones, GPS, and variable-rate applicators allow for targeted chemical use, cutting waste and improving efficacy.

- Climate Change Impact: Warmer, shifting weather patterns create new pest pressures, increasing the need for effective crop protection.

- Technological Innovation: New chemical formulations, biological treatments, and digital tools are reshaping the market.

- Rising Food Demand: The need to feed a growing global population and improve crop yields remains a primary market driver.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 109.83 Billion / 4.3 Million Tons |

| Revenue Forecast in 2035 | USD 163.08 Billion / 5.8 Million Tons |

| Growth Rate | CAGR 4.49% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Crop Type, By Origin/Source, By Mode of Application, By Regions |

| Key companies profiled | BASF SE, Dow Chemical, Sumitomo Chemical Co. Ltd,Bayer Cropscience AG, Nufarm Limited, Adama Agricultural Solutions Ltd., Arysta Lifesciences Corporation, America Vanguard Corporation, Jiangsu Yangnong Chemical Group Co. Ltd, Corteva, Syngenta Group, FMC Corporation |

Trade Analysis Of Crop Protection Chemicals Market: Import & Export Statistics

- According to India Export data, India shipped 40 units of Crop Protection from March 2024 to February 2025 (TTM). These shipments were sent by 11 Indian exporters to 15 buyers, reflecting a 90% increase compared to the previous twelve months.

- Most Indian Crop Protection exports go to Russia, Nigeria, and Vietnam.

- Globally, the top three Crop Protection exporters are the United States, China, and Russia. The United States leads with 1,075 shipments, followed by China with 950 shipments and Russia with 135 shipments.

- Based on Global Export data, the world exported 3,573 shipments of Crop Protection. These were made by 387 exporters to 361 buyers.

- Most global Crop Protection exports go to Uzbekistan, Russia, and Brazil.

Crop Protection Chemicals Market Value Chain Analysis

- Chemical Formulation and Processing: Crop protection chemicals are developed through processes such as active ingredient synthesis, fermentation, formulation blending, granulation or emulsification, encapsulation, and packaging to produce herbicides, insecticides, fungicides, and bio-pesticides.

- Key players: Bayer AG, Syngenta Group, BASF SE, Corteva Agriscience

- Quality Testing and Certification: Crop protection chemicals require certifications ensuring efficacy, safety, environmental compliance, and regulatory approval. Key certifications include GLP compliance, ISO quality standards, EPA and EU regulatory registrations, FAO/WHO pesticide specifications, and residue testing standards.

- Key players: EPA (U.S. Environmental Protection Agency), FAO, WHO, ISO (International Organization for Standardization), TÜV SÜD.

- Distribution to Industrial Users: Crop protection chemicals are distributed to agricultural producers, commercial farming operations, agrochemical distributors, cooperatives, and government-supported agrarian programs.

- Key players: UPL Limited, FMC Corporation, Nufarm Limited

Crop Protection Chemicals Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| North America (USA & Canada) | U.S. Environmental Protection Agency (EPA) Health Canada – PMRA |

FIFRA (Federal Insecticide, Fungicide, and Rodenticide Act) FFDCA (Food, Drug & Cosmetic Act) Canadian Pest Control Products Act (PCPA) |

Pesticide registration & re-registration Residue limits (MRLs) Environmental & human health risk assessment |

EPA conducts periodic re-evaluation of active ingredients, a data-intensive registration process. Canada’s PMRA closely aligns with U.S. and OECD risk assessment frameworks. |

| Europe | European Commission European Food Safety Authority (EFSA) ECHA |

Regulation (EC) No 1107/2009 Regulation (EC) No 396/2005 (MRLs) REACH & CLP (for co-formulants) |

Active substance approval Residue control & food safety Hazard-based cut-off criteria |

The EU applies hazard-based bans (e.g., endocrine disruptors). One of the strictest regimes globally; several active ingredients face non-renewal. |

| Asia Pacific | China ICAMA / MEE India CIBRC Japan MAFF Australia APVMA |

China Pesticide Administration Regulation Insecticides Act, 1968 (India) Agricultural Chemicals Regulation (Japan) Agvet Code (Australia) |

Product registration & labeling Import/export control Environmental and residue safety |

China has strengthened environmental compliance and data requirements. India is transitioning to stricter pesticide management rules with digital registration systems. |

| South America | Brazil ANVISA / IBAMA / MAPA Argentina SENASA Mexico COFEPRIS |

Brazil Pesticide Law (Law No. 7,802) National pesticide registration laws |

Product approval & toxicology review Environmental impact assessment Worker and consumer safety |

Brazil is one of the fastest-growing markets, but under increased scrutiny for environmental and health risks. Regulatory reforms are ongoing. |

| Middle East & Africa | Saudi SFDA UAE MOCCAE South Africa DALRRD |

National pesticide registration frameworks FAO/WHO Codex alignment |

Import approval & registration Residue limits & labeling Environmental safety |

Many countries rely on the FAO/WHO Codex standards. Registration timelines vary widely; import permits are critical for market access. |

Market Opportunity

Growing Agriculture Sector Drives Expansion of the Market

The growing population and expansion of the agriculture sector across various regions increase demand for crop protection chemicals. The higher demand for food and focus on the maximization of crop yields requires fungicides, insecticides, & herbicides. The increasing rate of diseases, pests, & weeds on crops, and the adoption of modern agricultural practices, require crop protection chemicals.

The increasing preference for high-value crops like vegetables & fruits and modernization in agricultural practices require crop protection chemicals. The changing dietary preferences and strong government support for sustainable agricultural practices increase demand for crop protection chemicals. The growing agriculture sector creates an opportunity for the growth of the crop protection chemicals market.

Market Challenge

High R&D Cost Creates Hurdles in Market Growth

Despite several benefits of crop protection chemicals in agricultural practices, the high R&D costs restrict market growth. Factors like complex regulatory processes, focus on product safety, discovery of new active ingredients, and comprehensive testing increase the cost.

The extensive safety evaluations and lengthy regulatory processes require a high cost. The long development process and manufacturing of environmentally friendly products require a high cost. The complex process for the development of active ingredients increases the cost. The high R&D cost hampers the growth of the crop protection chemicals market.

Segmental Insights

Product Type Insights

How Did The Product Type Segment Dominate The Crop Protection Chemicals Market In 2025?

The herbicides segment volume was valued at 2.0 million tons in 2025 and is projected to reach 2.7 million tons by 2035, expanding at a CAGR of 3.06% during the forecast period from 2025 to 2035. the herbicides segment dominated the market with a share of 48.23% in 2025. Herbicides account for a significant share of the market due to their widespread use in controlling weeds that compete with crops for nutrients, water, and sunlight. Both selective and non-selective herbicides are increasingly used across cereals, oilseeds, and plantation crops.

The biopesticides segment volume was valued at 0.3 million tons in 2025 and is expected to surpass around 0.4 million tons by 2035, and it is anticipated to expand to 4.47% of CAGR during 2026 to 2035. the Bio pesticides are gaining strong traction as sustainable alternatives to conventional chemical pesticides, driven by regulatory restrictions, residue concerns, and growing demand for organic and residue-free food. Derived from natural sources are increasingly used in integrated pest management programs. Adoption is particularly strong in horticulture and high-value crop cultivation.

Crop Protection Chemicals Market Volume and Share, By Product Type, 2025-2035

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Herbicides | 48.23% | 2.0 | 2.7 | 3.06% | 46.11% |

| Insecticides | 24.23% | 1.0 | 1.4 | 3.87% | 24.87% |

| Fungicides (and Bactericides) | 17.20% | 0.7 | 1.0 | 4.10% | 18.01% |

| Nematicides | 2.12% | 0.1 | 0.1 | 4.05% | 2.21% |

| Rodenticides | 1.88% | 0.1 | 0.1 | 3.99% | 1.95% |

| Biopesticides (Biologicals) | 6.34% | 0.3 | 0.4 | 4.47% | 6.85% |

Crop Type Insights

Which Crop Type Segment Dominates The Crop Protection Chemicals Market In 2025?

The cereals & grains segment dominated the market with a share of 35% in 2025. Cereals and grains represent a major application segment for crop protection chemicals due to their large cultivated area and critical role in global food security. Herbicides, fungicides, and insecticides are extensively used to protect crops from weeds, pests, and diseases. Yield optimization and resistance management are key factors influencing chemical usage in this segment.

The fruits & vegetables segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. The fruits and vegetables segment relies heavily on crop protection chemicals to maintain quality, appearance, and shelf life. High susceptibility to pests and diseases, combined with strict quality standards for export markets, drives demand for both synthetic and biological solutions. Growers increasingly adopt targeted and low-residue products to meet food safety regulations and consumer expectations.

Origin/Source Insights

How Did the Synthetic Chemicals Segment Dominate The Crop Protection Chemicals Market In 2025?

The synthetic chemicals segment dominated the market with a share of 75% in 2025. Synthetic chemicals continue to dominate the market due to their high efficacy, broad-spectrum action, and cost-effectiveness. These products offer reliable pest and weed control across diverse climatic and agronomic conditions. Despite regulatory pressure, synthetic solutions remain widely used, particularly in large-scale farming, where consistent performance and scalability are critical.

The biologicals segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. Biological crop protection products are witnessing rapid growth owing to increasing environmental awareness and regulatory support for eco-friendly agricultural inputs. Adoption is rising in sustainable farming systems, greenhouse cultivation, and export-oriented agriculture, supported by advancements in formulation and shelf-life stability.

Mode of Application Insights

Which Mode Of Application Segment Dominates the Crop Protection Chemicals Market In 2025?

The foliar spray segment dominated the market with a share of 55.3 % in 2025. Foliar spray is the most widely used mode of application in the crop protection chemicals market, offering direct and rapid action against pests, weeds, and diseases. It allows precise targeting of affected plant parts and is compatible with a wide range of chemical and biological products. Technological advancements in spraying equipment are improving efficiency and reducing chemical wastage.

The seed treatment segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. Seed treatment is an increasingly important application method, providing early-stage protection against soil-borne pests and diseases. This method enhances seed vigor, improves germination rates, and reduces the need for multiple foliar applications later in the crop cycle. Growing awareness of cost efficiency and environmental benefits is driving adoption among farmers and seed companies.

Regional Insights

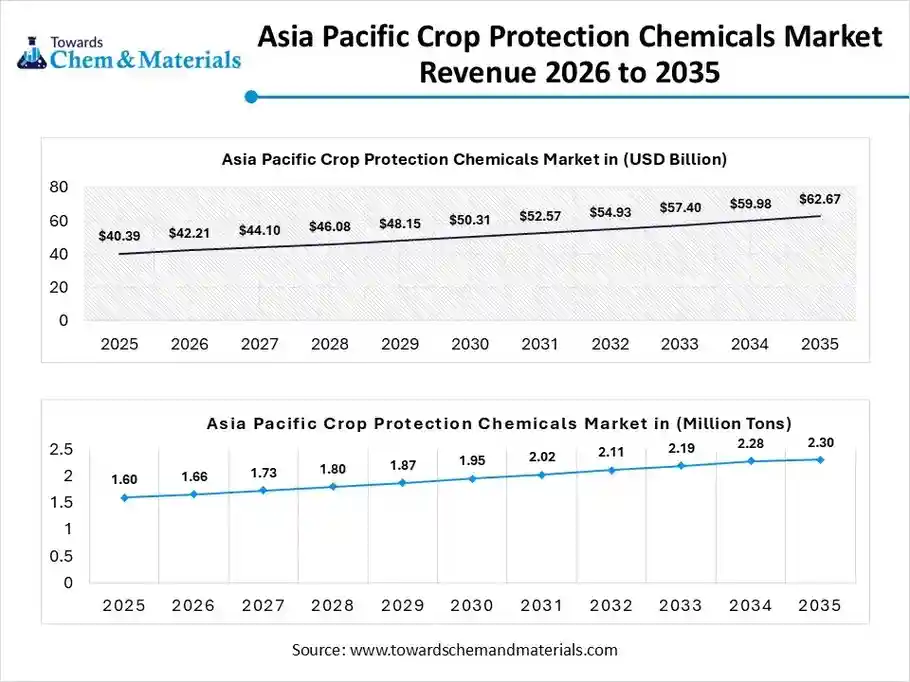

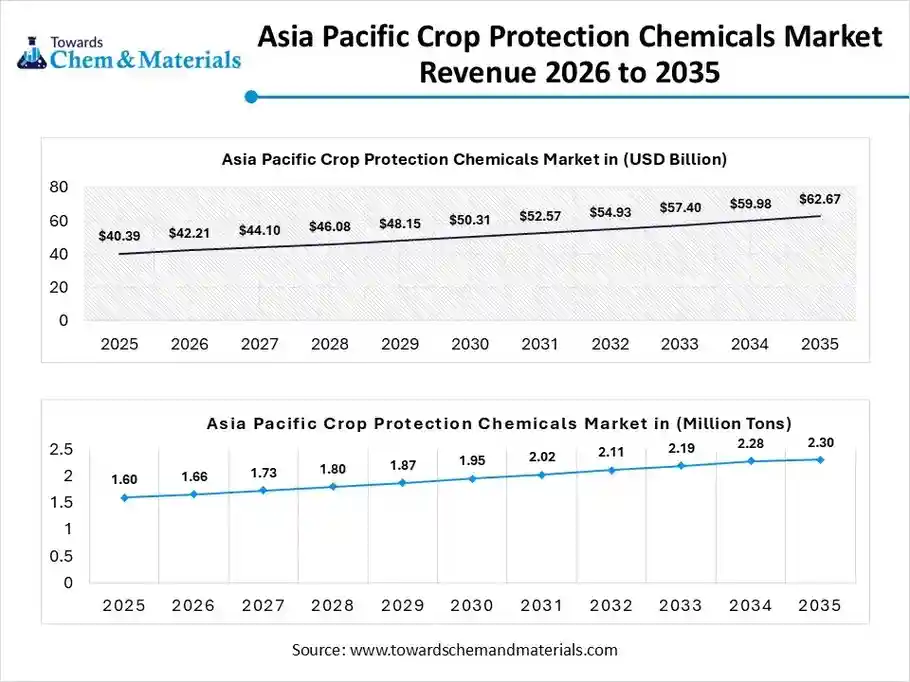

The Asia Pacific crop protection chemicals market size was valued at USD 40.39 billion in 2025 and is expected to be worth around USD 62.67 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.51% over the forecast period from 2026 to 2035.

The Asia Pacific crop protection chemicals market volume was estimated at 1.6 million tons in 2025 and is projected to reach 2.3 million tons by 2035, growing at a CAGR of 4.00% from 2026 to 2035. Asia Pacific dominated the market with a share of 38.43% in 2025. The Asia Pacific market is driven by intensive agricultural practices, rising food demand from a large population base, and increasing adoption of modern farming inputs. Rapid commercialization of agriculture, growing use of herbicides and insecticides, and government initiatives supporting crop yield enhancement continue to support strong regional demand across cereals, fruits, and cash crops.

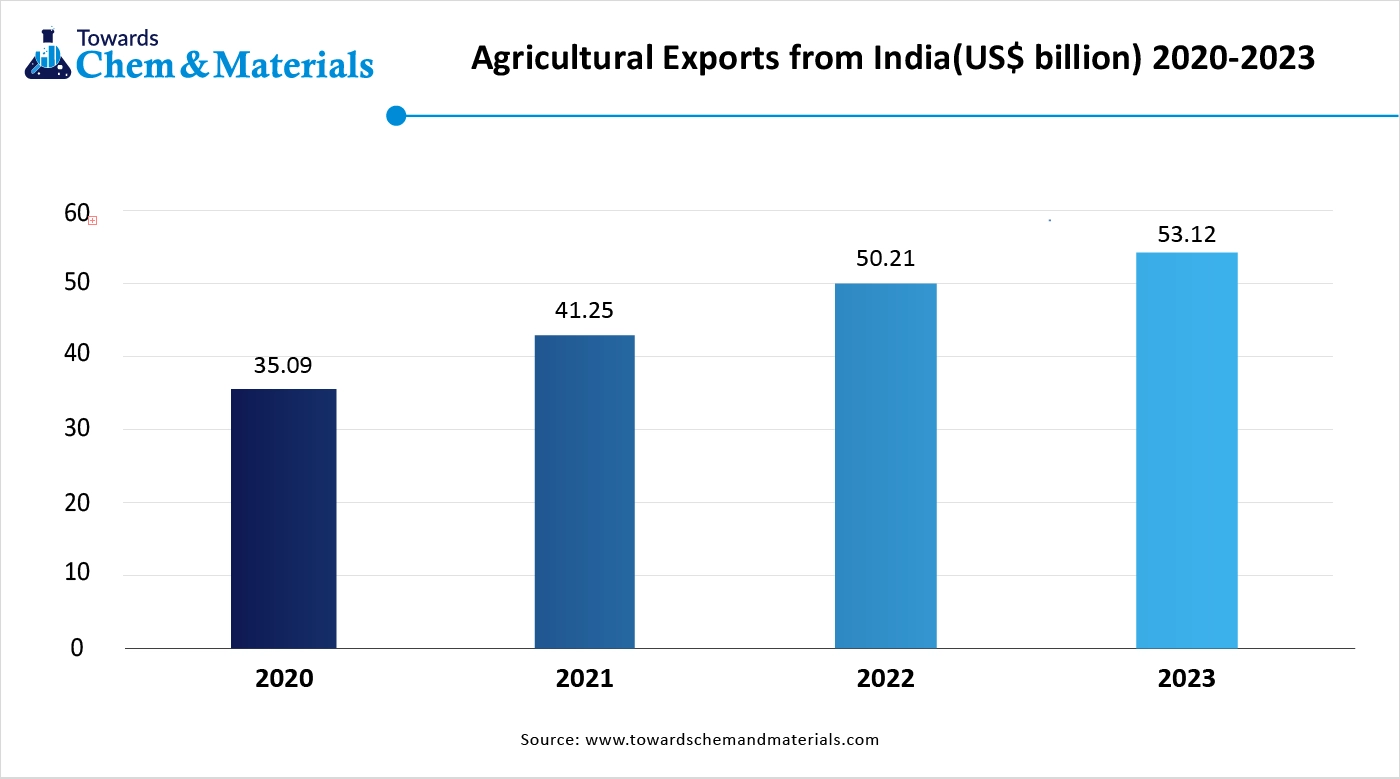

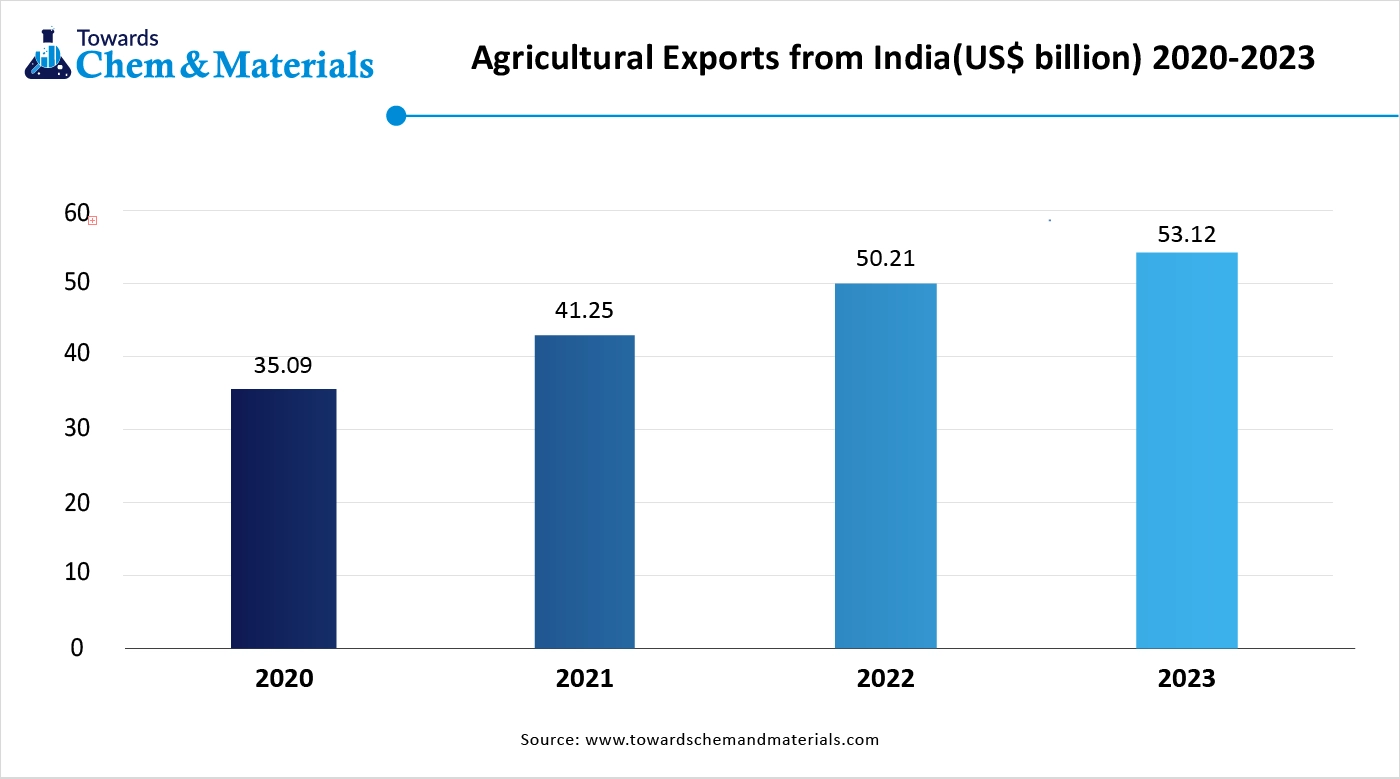

India: Crop Protection Chemicals Market

India represents a key market within Asia Pacific due to its vast agricultural land, dependence on monsoon-driven farming, and high pest pressure across crop cycles. Increasing awareness among farmers, expanding use of fungicides and bio-based crop protection products, and supportive government schemes for agricultural productivity are steadily driving market growth in the country.

North America's Growing Adoption Drives The Growth Of The Market

The North America crop protection chemicals market volume was estimated at 0.9 million tons in 2025 and is projected to reach 1.3 million tons by 2035, growing at a CAGR of 3.77% from 2026 to 2035. North America is a mature and technologically advanced market, characterized by high adoption of precision farming and integrated pest management practices. Strong demand for herbicides and fungicides in large-scale commercial farming, along with continuous innovation in formulation technologies and regulatory-approved active ingredients, supports stable market expansion across the region.

Crop Protection Chemicals Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 22.10% | 0.9 | 1.3 | 3.77% | 22.48% |

| Europe | 14.23% | 0.6 | 0.8 | 2.89% | 13.41% |

| Asia Pacific | 38.43% | 1.6 | 2.3 | 4.00% | 39.89% |

| Latin America | 18.32% | 0.8 | 1.1 | 3.73% | 18.57% |

| Middle East & Africa | 6.92% | 0.3 | 0.3 | 1.27% | 5.65% |

United States: Crop Protection Chemicals Market

The United States dominates the North American market due to the large-scale cultivation of corn, soybeans, and wheat. High mechanization levels, strong presence of leading agrochemical manufacturers, and widespread use of advanced chemical and biological crop protection solutions drive consistent demand across conventional and genetically modified crop systems.

Europe's Growth Of The Crop Protection Chemicals Market Is Driven By Sustainability Initiatives

The Europe crop protection chemicals market volume was estimated at 0.6 million tons in 2025 and is projected to reach 0.8 million tons by 2035, growing at a CAGR of 2.89% from 2026 to 2035. Europe’s crop protection chemicals market is shaped by stringent environmental regulations and a growing shift toward sustainable and low-toxicity solutions. While regulatory pressure limits certain chemical actives, demand remains steady due to intensive farming, high crop value, and increasing adoption of integrated pest management and bio-based crop protection products.

Germany: Crop Protection Chemicals Market

Germany plays a significant role in the European market, supported by advanced agricultural practices and a strong emphasis on regulatory compliance. The country demonstrates growing demand for fungicides and specialty crop protection chemicals, particularly in cereals and horticulture, alongside increasing adoption of environmentally safer and precision-applied formulations.

Latin America's Growth In The Market Is Driven By The Strong Demand For The Product

The Latin America crop protection chemicals market volume was estimated at 0.8 million tons in 2025 and is projected to reach 1.1 million tons by 2035, growing at a CAGR of 3.73% from 2026 to 2035. Latin America is a high-growth region for crop protection chemicals, driven by large-scale cultivation of soybeans, maize, and sugarcane. Favorable climatic conditions, high pest incidence, and export-oriented agriculture fuel strong demand for herbicides, insecticides, and fungicides, making the region strategically important for global agrochemical suppliers.

Brazil: Crop Protection Chemicals Market

Brazil is the largest crop protection chemicals market in South America, supported by expansive farmland and intensive row-crop farming. High pest resistance challenges, multiple crop cycles per year, and strong adoption of chemical and biological crop protection products continue to drive sustained market growth across major agricultural states.

Middle East & Africa: Rising Farming Practices Drive Growth Of The Market

The Middle East & Africa crop protection chemicals market volume was estimated at 0.3 million tons in 2025 and is projected to reach 0.3 million tons by 2035, growing at a CAGR of 1.27% from 2026 to 2035.The Middle East & Africa crop protection chemicals market is developing steadily, supported by improving agricultural infrastructure and increasing focus on food security. Demand is driven by pest management needs in arid and semi-arid climates, rising commercial farming, and the gradual adoption of modern crop protection inputs across key producing regions.

South Africa: Crop Protection Chemicals Market

South Africa serves as a key market within the MEA region, with well-developed commercial agriculture and diversified crop production. Demand for herbicides and fungicides remains strong, particularly in grains, fruits, and vineyards, supported by modern farming practices and increasing awareness of crop yield optimization.

Recent Developments

- In December 2025, Corteva Agriscience and Hexagon Bio announced a multi-million-dollar joint venture aimed at accelerating the discovery and development of nature-inspired crop protection solutions.(Source: www.indianchemicalnews.com)

- In May 2025, BASF India introduced Valexio® Insecticide and Mibelya® Fungicide in India, marking the global debut of these crop protection products designed for Indian rice farmers. These solutions aim to enhance national food security and boost rice productivity. (Source: chemindigest.com)

- In October 2025, Sumitomo Chemical announced a reorganization of its U.S. group companies, Valent BioSciences LLC (VBS), McLaughlin Gormley King Company (MGK), and Valent North America LLC (VNA) into Sumitomo Biorational Company LLC (SBC) to create a global hub for its biorational business. This initiative aims to enhance sustainable agriculture by streamlining the research, manufacturing, and sales of biorational products into a unified global structure.(Source: fareasternagriculture.com)

Market Companies

- BASF SE: The largest producer of chemicals consists of a product portfolio including herbicides, seed treatment, biosolutions, fungicides, and insecticides.

- Dow Chemical: The multinational material science company focuses on formulators & specialty additives for agrochemical products, and the company's product portfolio consists of more than 35 crop protection products.

- Sumitomo Chemical Co. Ltd: The Japan-based chemical company offers biological & chemical fungicides, plant growth regulators, insecticides, & herbicides.

- Bayer Cropscience AG: The global life science company offers biological and chemical crop protection solutions.

- Nufarm Limited: The Australian Company offers a product portfolio of insecticides, seed treatments, herbicides, and fungicides.

- Adama Agricultural Solutions Ltd.

- Arysta Lifesciences Corporation

- America Vanguard Corporation

- Jiangsu Yangnong Chemical Group Co. Ltd

- Corteva

- Syngenta Group

- FMC Corporation

Segments Covered

By Product Type

- Herbicides

- Insecticides

- Fungicides (and Bactericides)

- Nematicides

- Rodenticides

- Biopesticides (Biologicals)

- Bioherbicides

- Bioinsecticides

- Biofungicides

By Crop Type

- Cereals & Grains

- Fruits & Vegetables

- Oilseeds & Pulses

- Commercial Crops (e.g., Cotton, Sugarcane)

- Turf & Ornamental

By Origin/Source

- Synthetic Chemicals

- Biologicals (Bio-based)

By Mode of Application

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Others (e.g., Fumigation, Chemigation)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait