Content

Nickel Market- Size, Share & Industry Analysis

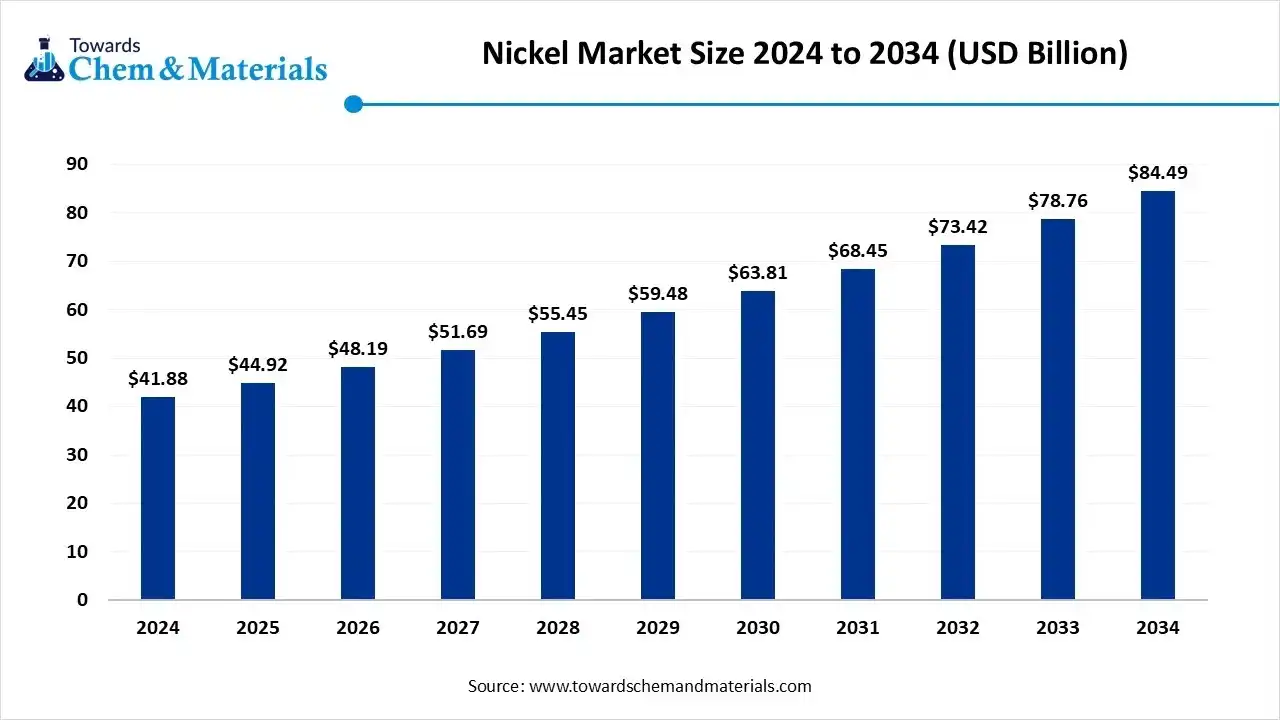

The nickel market size is calculated at USD 41.88 billion in 2024, grew to USD 44.92 billion in 2025, and is projected to reach around USD 84.49 billion by 2034. The market is expanding at a CAGR of 7.27% between 2025 and 2034. The growing use of stainless steel (SS) in vehicles is the key factor driving the growth of the market. Also, the growing use of nickel in lithium-ion batteries, coupled with the sustainability trends in the market, can fuel market growth further.

Key Takeaways

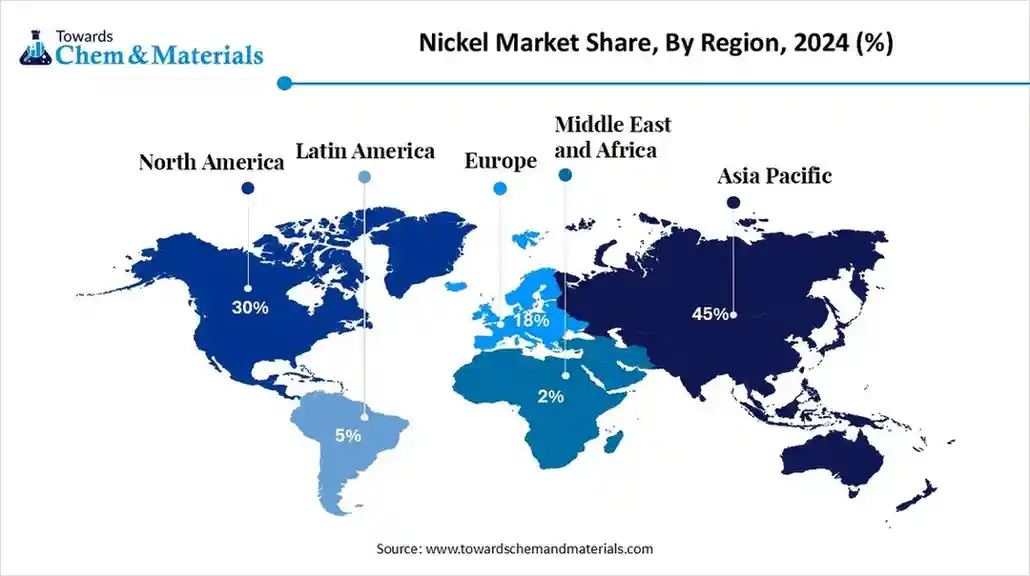

- By region, Asia Pacific dominated the market by holding approximately 45% share in 2024.

- By region, Europe is expected to grow at the fastest CAGR over the forecast period.

- By product type, the refined nickel segment dominated the market with approximately 60% share in 2024.

- By product type, the nickel sulphate segment is expected to grow at the fastest CAGR over the forecast period.

- By end-use industry, the stainless-steel production segment held approximately 70% market share in 2024.

- By end-use industry, the automotive segment is expected to grow at the fastest CAGR over the projected period.

What is Nickel?

The market refers to the system for trading nickel, a metal necessary to produce lithium-ion batteries and stainless steel for electric vehicles. It also involves mining, recycling, refining, and the sale of nickel contracts and metal. Nickel is essential in manufacturing batteries for electric vehicles and electroplating as a catalyst in chemical processes.

Nickel Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the market is expected to witness significant growth in high-margin niches like stainless steel production, electric vehicles, and electroplating. Global nickel production is mainly fulfilled by Indonesia and China, and has constantly outpaced in recent years, leading to a surplus.

- Sustainability Trends: There is an expanding market for low or green-carbon nickel, incentivizing manufacturers to adopt cleaner methods such as carbon capture, renewable energy, and recycling. Urban mining is necessary for meeting growing demand and substantially minimizing the environmental impact related to nickel production.

- Global Expansion: Major players such as BHP AND Vale are heavily investing in mining projects by securing supply agreements to fulfil increasing product demand. Manufacturers are emphasizing high-purity nickel sulfate for battery production, which can lead to further market growth.

Key Technological Shifts in the Nickel Market:

The market revolves around the increasing demand for nickel in electric vehicle (EV) batteries, boosting the demand for higher purity forms of nickel. In addition, innovations in sustainable nickel processing are enhancing efficiency and minimizing the overall environmental impact. Also, the advancements in battery cathode technology are escalating the nickel content in batteries, further increasing its demand.

Companies such as Norilsk Nickel are responding to key technological shifts in the market by heavily investing in battery technology and high-tech nickel materials to fulfil demand from renewable energy and electric vehicles. The company is also focusing on the digitalization of its production chain, enhancing manufacturing technologies, and improving its environmental sustainability through various projects.

Trade Analysis of Nickel Market: Import & Export Statistics

- China's major nickel imports came from Russia, Indonesia, and Australia. In 2023, China exported $235M and $190M nickel articles to South Korea and India.

- In 2023, the U.S. imported about $431 million of nickel-related products along with the export of $1.25 billion, to countries such as China, Mexico, and France.

- In 2023, Japan's raw nickel imports were around $1.05 billion, mainly from Madagascar, Australia, and Canada, while its exports were $541 million, mainly to India, China, and the United States.

- Vietnam was a small exporter of nickel but a major importer, bringing in $58.3 million from countries such as Japan, China, and Malaysia.

Nickel Market Values Chain Analysis

- Feedstock Procurement: It is the process of securing raw materials for industrial processes, mainly for nickel smelting and production.

- Chemical Synthesis and Processing : It refers to the cutting-edge chemical techniques used to extract, refine, and convert nickel into high-grade forms and specialized nickel compounds.

- Packaging and Labelling: In the nickel market, packaging and labeling are crucial for ensuring product safety, quality, and compliance with regulatory standards.

- Regulatory Compliance and Safety Monitoring : It involves the adherence to stringent regulatory standards governing the manufacturing, processing, handling, and use of nickel.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 44.92 Billion |

| Expected Size by 2034 | USD 84.49 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.27% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By End-Use Industry, By Region |

| Key Companies Profiled | Sumitomo Metal Mining Co., Ltd. , Anglo American Plc , Xstrata PLC , Sherritt International Corporation , Eramet Group , Zhejiang Huayou Cobalt Co., Ltd. , MMC Norilsk Nickel , Pan American Silver Corp. , China Nickel Resources Limited , First Quantum Minerals Ltd. , Jiangsu Yunnan Tin Company Limited , Inco Limited , Korea Zinc Co. Ltd. , Itronics Inc. , SMM (Sumitomo Metal Mining ) |

Market Opportunity

Increasing Electroplating Applications of Nickel

The growing adoption of Nickel in electroplating applications is the major factor creating lucrative opportunities in the market. The market is witnessing growth due to the growing demand for electroplating across sectors such as electronics, automotive, and construction. Furthermore, technological innovations in electroplating, such as the pulse plating process, give enhanced control over coating thickness and uniformity.

Market Challenge

Environmental Concerns

The adverse environmental impact of nickel mining, particularly in laterite-rich regions such as the Philippines and Indonesia, raises concerns regarding deforestation and pollution, which is the major factor hindering market expansion. Moreover, broader macroeconomic factors, such as monetary policy and the possibility of a recession, can substantially impact overall market growth further.

Nickel’s Regulatory Landscape: Global Regulations

| Country / Region | Key Regulations |

| European Union | From July 1, 2025, the EU will enforce maximum levels of nickel in 16 food categories under Regulation (EU) 2024/1987 |

| Indonesia | In 2024, Indonesia's Regulations of the Minister of Trade Nos. 10 and 11 extended export bans on several mineral products |

| United States | In April 2024, the US banned imports of Russian-origin nickel. This action was intended to decrease Russia's ability to fund its war efforts. |

| Australia | Australia regulates the transport of nickel and its compounds as waste to ensure environmental safety |

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated the Nickel Market in 2024?

The refined nickel segment dominated the market with approximately 60% share in 2024. The dominance of the segment can be attributed to the increasing demand for electric vehicles (EVs) along with the prolonged use of nickel in the stainless-steel market. Additionally, strategic investments in mining projects are focusing on ensuring proper supply, while also focusing on eco-friendly production, which aligns with global environmental goals.

The nickel sulphate segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the expanding electric vehicle (EV) market, coupled with the supportive government policies. Furthermore, the growing product demand from the global electronics industry, which utilises nickel sulphate in different components, can propel segment growth soon.

End-Use Industry Insights

How Much Share Did the Stainless-Steel Segment Held in 2024?

The stainless-steel production segment held approximately 70% market share in 2024. The dominance of the segment can be linked to the surge in the production of stainless steel across the globe and the ongoing expansion of electric vehicles (EVs). Moreover, stainless steel's properties make it crucial for use in industries such as oil and gas, chemical processing, and food and beverage.

The automotive segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment can be driven by the growing adoption of electric vehicles, as nickel is a major component in high-energy density lithium-ion batteries. Also, the push for cleaner emissions can result in a shift toward electric vehicles, which can fuel the demand for nickel in batteries.

Regional Insights

Asia Pacific Nickel Market Size, Industry Report 2034

The Asia Pacific nickel market size was valued at USD 41.88 billion in 2024 and is expected to surpass around USD 84.49 billion by 2034, expanding at a compound annual growth rate (CAGR) of 7.27% over the forecast period from 2025 to 2034. Asia Pacific dominated the market by holding approximately 45% share in 2024.

The dominance of the region can be attributed to the growing investments in nickel refining and smelting capacities, especially in the emerging economies such as China and India. In addition, in the Asia Pacific, China held the major market share due to extensive steel production, which necessitates a significant nickel input.

Europe is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the ongoing implementation of decarbonization policies and the growth of electric vehicle (EV) production in major European countries. Furthermore, growing investments in refining projects and nickel mining across the region promote supply chain stability and minimize dependence on imports.

Country-level Investments & Funding Trends for the Nickel Market:

- Indonesia: The country has the largest market share in nickel production and is attracting considerable investment from China.

- China: As a major consumer of EVs and stainless steel, the country is also investing substantially in Indonesian nickel processing.

- India: A need for more domestic manufacturers is fuelling recommendations for policy support to minimize dependence on global supply chains.

Recent Development

- In July 2025, Fastmarkets introduces the latest Indonesia nickel ore price evolution. The assessment represents a key step towards bringing transparency to one of the world's most crucial nickel manufacturing regions. The new price evolution mainly focuses on domestic trades of Indonesian laterite ores.(Source: discoveryalert.com.au)

Top Vendors in Nickel Market & Their Offerings:

- Vale S.A. : Vale S.A. is a major producer of nickel, extracting and manufacturing it alongside copper, iron ore, and other metals, with major operations in Brazil.

- Norilsk Nickel: It is a top mining and metals company and the world's largest producer of high-grade nickel and supplier of copper and other metals.

- Glencore International AG: It is a diversified natural resources company and a major player in the nickel market, both as a manufacturer and marketer of nickel products.

Other Players

- Sumitomo Metal Mining Co., Ltd.

- Anglo American Plc

- Xstrata PLC

- Sherritt International Corporation

- Eramet Group

- Zhejiang Huayou Cobalt Co., Ltd.

- MMC Norilsk Nickel

- Pan American Silver Corp.

- China Nickel Resources Limited

- First Quantum Minerals Ltd.

- Jiangsu Yunnan Tin Company Limited

- Inco Limited

- Korea Zinc Co. Ltd.

- Itronics Inc.

- SMM (Sumitomo Metal Mining

Segment Covered

By Product Type

- Nickel Ore

- Nickel Pig Iron (NPI)

- Nickel Sulphate

- Nickel Carbonate

- Nickel Matte

- Refined Nickel

- Class I Nickel

- Class II Nickel

By End-Use Industry

- Stainless Steel Production

- Flat Products

- Long Products

- Batteries

- Nickel-Cobalt-Aluminum (NCA) Batteries

- Nickel-Manganese-Cobalt (NMC) Batteries

- Electronics

- Semiconductors

- Circuit Boards

- Automotive

- Electric Vehicles (EV)

- Energy Storage

- Grid Storage

- Batteries for Renewable Energy

- Plating and Coatings

- Aerospace

- Chemical Industry

- Catalysts

- Electroplating

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait