Content

What is the U.S. Fertilizers Market Size?

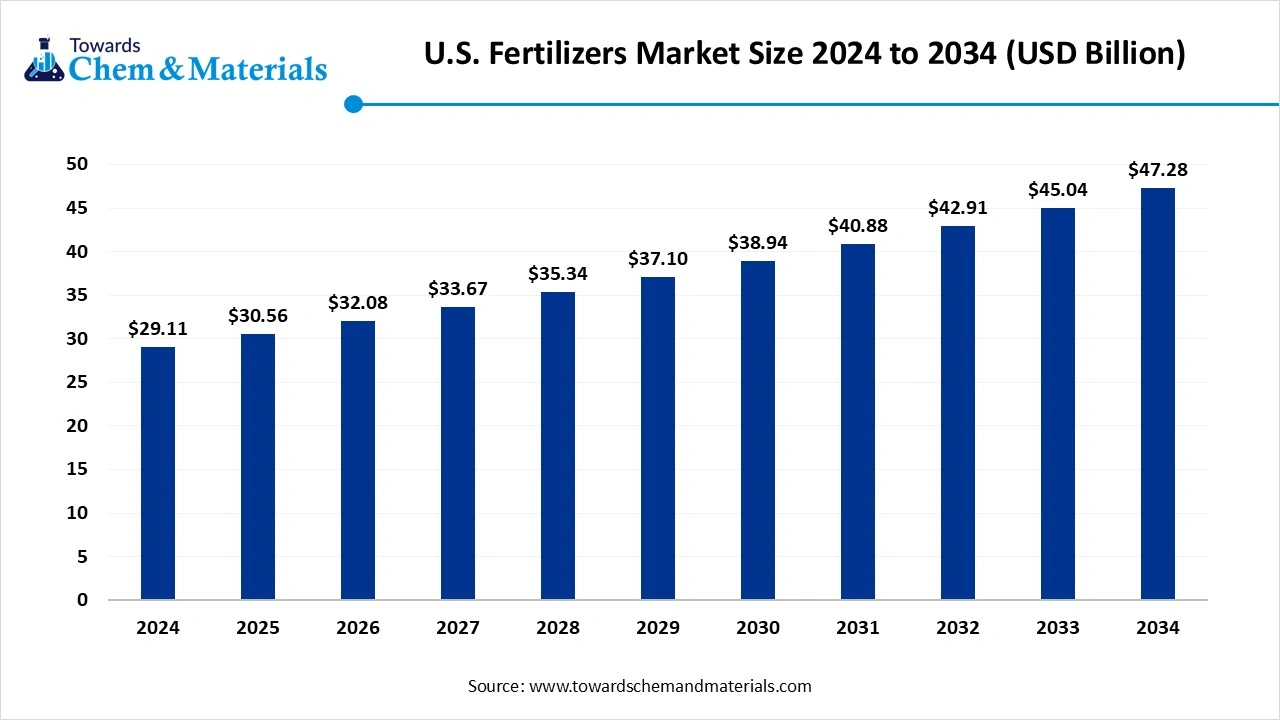

The U.S. fertilizers market size was USD 30.19 billion in 2025 and is predicted to increase from USD 31.68 billion in 2026 and is expected to be worth around USD 48.94 billion by 2035, growing at a CAGR of 4.95% from 2026 to 2035. The growth of the market is driven by the high agricultural demand due to increased farming practices, which fuel the growth of the market.

Key Takeaways

- By nutrient/product type, the nitrogenous segment dominated the market volume shareof 47% in 2025.

- By nutrient/product segment dominated the market and accounted for the largest volume share of 47.55% in 2025.

- By crop type, cereals & grains (corn & wheat) segment dominated the market and accounted for the largest volume share of 51.08% in 2025.

- By crop type, fruits & vegetables (esp. California & Florida produce) segment is expected to grow in the forecast period. Rising consumer preference for fresh produce further expands fertilizer demand.

- By application method, the soil application/broadcasting segment led the market with the largest revenue volume share of 60.32% in 2025.

- By application method, the fertigation (driven by irrigation adoption in California, Arizona, Texas) segment is expected to grow in the forecast period. Fertigation is gaining attention in agriculture, especially for high-value fruits, vegetables, and greenhouse crops

- By form, the solid/granular/prilled segment dominated the market and accounted for the largest volume share of 76.43% in 2025.

- By form, the liquid (esp. uan solutions for row crops) segment is expected to grow in the forecast period. They offer ease of blending with crop protection products and ensure faster nutrient uptake.

- By end user, the large-scale commercial farms segment led the market with the largest revenue volume share of 66.00% in 2025.

- By end user, the horticulture & protected cultivation (greenhouses, turfgrass, specialty crops) segment is expected to grow in the forecast period. Turf grass management and ornamental cultivation also rely on precise nutrient blends.

- By distribution channel, the agri-retailers & farm supply segment dominated the market and accounted for the largest volume share of 56.76% in 2025.

- By distribution channel, the online/marketplace platforms (digital ag tech adoption) segment is expected to grow in the forecast period. Ease and digital marketplaces are gaining attention.

Market Overview

Rising Demand For Durable Materials: U.S. Fertilizers Market To Expand

The U.S. Fertilizers Market covers the domestic production, imports, distribution, and application of mineral and specialty fertilizers across American agriculture. Products include nitrogen, phosphate, potash, and specialty fertilizers (water-soluble NPK, controlled/slow-release, micronutrients, biofertilizers). Growth is driven by large-scale commercial farming (corn, soybeans, wheat), rising demand for specialty fertilizers in high-value crops (fruits, vegetables, nuts), adoption of precision agriculture and fertigation systems, and sustainability regulations pushing for efficient, eco-friendly inputs.

What Are The Key Growth Drivers That Support The Growth Of the U.S. fertilizers market?

The key growth drivers that support the growth of the market are the rising food demand due to increasing global and domestic population, which increases the demand for food, resulting the higher crop yield to meet the demand, which fuels the growth of the market. The other key growth drivers of the market are soil depletion, technological advancements, sustainable practices, high-efficiency fertilizers, and government support. These factors fuel the growth and expansion of the market.

Recent Trends in the U.S. Fertilizers Market

- Precision and Digital Agriculture Adoption: Increasing use of precision farming technologies, such as GPS-guided application systems and soil nutrient mapping, is driving targeted fertilizer use and more efficient crop nutrient management across large U.S. farms.

- Growth of Enhanced-Efficiency and Controlled-Release Products: Farmers are increasingly adopting stabilized and controlled-release fertilizers that reduce nutrient losses, improve nitrogen use efficiency, and support sustainability goals amid rising regulatory and environmental expectations.

- Expansion of Specialty Crop Fertilization: Rising cultivation of fruits, vegetables, and horticultural crops is boosting demand for customized fertilizer blends tailored to specific crop nutrient profiles and soil conditions, expanding beyond traditional row crops.

- Integration of Biological and Microbial Fertilizers: Increasing interest in soil health and regenerative agriculture practices is accelerating the use of biofertilizers and microbial amendments that complement conventional fertilizers to improve soil structure and nutrient cycling.

- Focus on Environmental Compliance and Stewardship: Stricter nutrient management guidelines and water quality standards from federal and state authorities are prompting broader adoption of nutrient stewardship practices, balanced fertilization plans, and educational outreach through conservation programs.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 31.68 Billion |

| Expected Size by 2034 | USD 48.94 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Nutrient/Product Type, By Crop Type, By Application Method, By Form, By End User, By Distribution Channel, |

| Key Companies Profiled | CF Industries Holdings, Inc., The Mosaic Company, Nutrien Ltd. , Yara North America, Inc., The Andersons Inc., Koch Industries, Pivot Bio , Sigma AgriScience, LLC, Farmers Business Network (FBN), AgroLiquid, Koppert Biological Systems Inc. , Suståne Natural Fertilizer Inc. |

Market Dynamics

Market Drivers

The U.S. fertilizers market is driven by large-scale commercial agriculture, high crop productivity targets, and strong demand for staple crops such as corn, soybeans, wheat, and cotton. Precision farming adoption across the United States is increasing fertilizer consumption efficiency while sustaining overall demand volumes. Rising use of nitrogen, phosphate, and potash fertilizers is supported by advanced farm mechanization and data-driven nutrient management systems. Federal support programs and crop insurance frameworks are stabilizing farm incomes, allowing consistent fertilizer application despite commodity price volatility.

Market Restraints

The market faces restraints from increasing regulatory scrutiny on nutrient runoff and environmental impact, particularly related to nitrogen and phosphorus leaching. Agencies such as the Environmental Protection Agency are enforcing stricter water quality standards, which raise compliance costs for producers and applicators. Volatility in natural gas prices directly affects nitrogen fertilizer production costs, creating pricing uncertainty. In addition, soil nutrient saturation in intensively farmed regions can limit incremental fertilizer demand growth.

Market Opportunities

Opportunities are emerging from growing adoption of enhanced-efficiency fertilizers, including controlled-release and stabilized formulations that align with sustainability goals. Expansion of regenerative agriculture practices is creating demand for customized nutrient blends and soil health-focused fertilizer solutions. Government-backed conservation and nutrient stewardship programs administered by the U.S. Department of Agriculture are encouraging balanced fertilizer use rather than volume reduction. Growth in specialty crops, horticulture, and turf management is also opening higher-margin segments within the U.S. fertilizers market.

Market Challenges

A key challenge is balancing yield optimization with environmental compliance across diverse climatic and soil conditions in the U.S. Ensuring correct application timing and rates remains complex despite technological advances, particularly for small and mid-sized farms. Supply chain disruptions and geopolitical factors affecting potash and phosphate imports can impact availability and pricing stability. Additionally, increasing public and policy pressure to reduce agricultural emissions is forcing manufacturers to innovate rapidly while maintaining affordability and agronomic performance.

Segmental Insights

Nutrient/Product Type Insights

Which Nutrient/Product Type Segment Dominated The U.S. Fertilizers Market In 2025?

The nitrogenous segment held a 47% share in the market in 2025. Nitrogenous fertilizers form the backbone of the US fertilizer market, widely used to boost crop yields and ensure healthy plant growth. Products such as urea, ammonium nitrate, and anhydrous ammonia are applied extensively across staple crops, particularly corn and wheat. With the high nutrient demand of these crops, nitrogenous fertilizers remain indispensable for modern agriculture, sustaining productivity and meeting the food supply requirements of both domestic and export markets.

The specialty (water-soluble, srf/crf, micronutrients, biofertilizers) segment expects significant growth in the U.S. fertilizers market during the forecast period. Specialty fertilizers are gaining traction in the U.S. market due to precision farming, sustainability goals, and high-value crop cultivation. Water-soluble fertilizers are widely adopted for controlled application, while slow- and controlled-release formulations (SRF/CRF) minimize nutrient losses and improve efficiency. Micronutrients address soil deficiencies in zinc, boron, and iron, while biofertilizers enhance soil health naturally. Together, these specialty products cater to environmentally conscious farming and advanced cultivation practices.

Crop Type Insights

How Did Cereals And Grains Segment Dominated The U.S. Fertilizers Market In 2025?

The cereals & grains (corn & wheat) segment dominated the market and accounted for the largest volume share of 51.08% in 2025. Cereals and grains, particularly corn, wheat, and rice, dominate fertilizer consumption in the US. These crops have high nutrient requirements, especially nitrogen, to achieve optimal yields. Fertilizers ensure consistent grain quality and productivity, supporting both domestic food supply and exports. Rising demand for biofuels, especially corn-based ethanol, further drives fertilizer application in cereal cultivation, making this segment central to the country’s agricultural fertilizer usage.

The fruits & vegetables (esp. California & Florida produce) segment expects significant growth in the market during the forecast period. The fruits and vegetables segment is increasingly adopting advanced fertilizers, especially specialty and water-soluble products, to meet the nutritional needs of high-value crops. Fertilizers support consistent quality, appearance, and nutritional content, which are critical for consumer acceptance and export standards. Greenhouse-grown vegetables, orchards, and vineyards utilize tailored fertilizer solutions for yield optimization. Rising consumer preference for fresh produce further expands fertilizer demand in this segment.

Application Method Insights

Which Application Segment Dominated The U.S. Fertilizers Market In 2025?

The soil application/broadcasting segment dominated the market share of 60.32% in 2025. Soil application, or broadcasting, remains the most widely used method for fertilizer delivery across US farms. This approach ensures uniform distribution of nutrients over large areas, making it suitable for cereal and grain cultivation. Farmers rely on this cost-effective method for bulk fertilizer application, particularly nitrogenous products. Despite growing interest in precision techniques, broadcasting continues to be a trusted method due to its ease of use and efficiency.

The fertigation (driven by irrigation adoption in California, Arizona, and Texas) segment expects significant growth in the market during the forecast period. Fertigation is gaining popularity in US agriculture, especially for high-value fruits, vegetables, and greenhouse crops. By combining irrigation with fertilizer delivery, fertigation ensures precise nutrient management and efficient water use. This method supports the country’s shift toward sustainable practices while improving yields and crop quality. As water conservation becomes critical and protected cultivation expands, fertigation adoption is expected to rise across both large-scale and specialty farms.

Form Insights

How did the Solid/Granular/Prilled Segment Dominate the U.S. Fertilizers Market in 2025?

The solid/granular/prilled segment dominated the market share of 76.43% in 2025. Solid fertilizers, including granular and prilled forms, dominate the market due to ease of handling, storage, and broad application across various crops. They are particularly favored for broadcasting in cereal production. Solid fertilizers ensure slow nutrient release and are adaptable to large-scale farming practices. Their cost-effectiveness, compatibility with farm machinery, and ability to meet the nutrient requirements of staple crops sustain their widespread adoption.

The liquid (esp. urea solutions for row crops) segment expects significant growth in the market during the forecast period. Liquid fertilizers, particularly urea-ammonium nitrate (UAN) solutions, are increasingly used for row crops such as corn and soybeans. They offer ease of blending with crop protection products and ensure faster nutrient uptake. Liquid formulations also support precision agriculture, enabling farmers to apply nutrients more accurately during critical growth stages. Growing demand for efficiency and flexible application methods is driving the popularity of liquid fertilizers in US agriculture.

End User Insights

Which End-User Segment Dominated The U.S. Fertilizers Market In 2025?

The large-scale commercial farms segment led the market with the largest revenue volume share of 66.00% in 2025. Large-scale commercial farms account for the bulk of fertilizer consumption in the US, driven by extensive cereal and grain cultivation. These farms prioritize efficiency and high yields, relying heavily on nitrogenous and bulk solid fertilizers. Increasing mechanization, precision farming, and contract farming further influence fertilizer demand. Their large landholdings and significant contribution to national food and biofuel production ensure commercial farms remain the dominant end users.

The horticulture & protected cultivation (greenhouses, turfgrass, specialty crops) segment expects significant growth in the market during the forecast period. Horticulture and protected cultivation represent a growing end-use segment, supported by consumer demand for premium produce and expanding greenhouse operations. Fertilizers in this sector are highly specialized, with emphasis on water-soluble, micronutrient, and bio-based solutions. Turf grass management and ornamental cultivation also rely on precise nutrient blends. This segment highlights the shift toward intensive, high-value agriculture, driving innovation and adoption of sustainable fertilizer products.

Distribution Channel Insights

How Did Agri-Retailers And Farm Supply Stores Segment Dominated The U.S. Fertilizers Market In 2025?

The agri-retailers & farm supply segment dominated the market and accounted for the largest volume share of 56.76% in 2025. Agri-retailers and farm supply stores serve as the primary distribution channel for fertilizers in the US, offering farmers accessibility, advisory services, and trusted brands. These outlets supply both bulk nitrogenous fertilizers and specialized products tailored to local soil conditions. With a vast rural network, they are indispensable to fertilizer availability across the country. Strong relationships with farmers further ensure their continued dominance in fertilizer distribution.

The online/marketplace platforms (digital ag tech adoption) segment expects significant growth in the market during the forecast period. Online platforms and digital ag tech solutions are gradually transforming fertilizer distribution in the US. These platforms provide farmers with greater price transparency, direct access to suppliers, and data-driven recommendations for fertilizer use. While still emerging, digital marketplaces are gaining traction, particularly among younger farmers adopting precision agriculture practices. As e-commerce expands in agriculture, online platforms are expected to play an increasingly significant role in fertilizer sales.

How will Canada impact the U.S. Fertilizers Market?

California plays a distinctive role in the market, primarily driven by its diverse, high-value specialty crops and stringent environmental regulations, which foster innovation in fertilizer application and product type. The state is the nation's leading producer of fruits, vegetables, and nuts. These high-value crops require specialized, precise nutrient management. California's Central Valley accounts for major horticultural fertilizer tonnage in the U.S. Stringent environmental rules, such as the Irrigated Lands Regulatory Program, push farmers to adopt enhanced-efficiency products.

Emergence of Texas in the U.S. Fertilizers Market

Texas is a key contributor in the market, characterized by its vast agricultural landscape, which emphasizes large-scale field crops and benefits from key logistical infrastructure. The state is a major consumer of bulk fertilizers for crops like grains, cotton, and forage. Texas also leads the U.S. in cotton production and is a significant producer of corn, sorghum, and wheat, and it serves as a critical logistics hub with ports that receive imported potash and phosphate at competitive costs.

Emerging Initiatives in the U.S. Fertilizers Market

| Initiative Area | Description | Key Focus |

| Precision Ag (4Rs) | Applying the Right Rate, Source, Placement, and Timing for nutrients. | Maximizes uptake, minimizes nutrient loss, and provides environmental protection. |

| Digital Agriculture | Data-driven platforms, AI, and sensors for real-time nutrient management. | Smart decisions, variable rate application, and improved ROI for farmers. |

| Specialty Fertilizers | Controlled-release, slow-release, and liquid fertilizers. | Consistent nutrient supply, reduced application frequency, and lower environmental impact. |

| Biofertilizers & Microbials | Microbial inoculants and natural fertilizers. | Soil health improvement, enhanced nutrient availability, and reduced chemical reliance. |

U.S. Fertilizers Market Value Chain Analysis

- Chemical Synthesis and Processing : The fertilizers are synthesised and processed through nitrogen fertilizer synthesis, phosphate fertilizer synthesis, and potash fertilizer synthesis.

Key players: CF Industries Holdings, Inc., Mosaic Co., and Nutrien Ltd. - Quality Testing and Certification : The fertilizers require certification from the U.S. Environmental Protection Agency (EPA) and state-level fertilizer control.

- Key players: Association of Analytical Chemists, SGS SA, CIS, and HQTS

- Distribution to Industrial Users : The transparent plastics are distributed to the agricultural, horticulture, turf and landscape, and greenhouse cultivation industries.

- Key players: CF Industries Holdings, Inc., The Mosaic Company, Nutrien Ltd., and Koch Fertilizer, LLC.

Recent Developments

- In November 2025, Innovafeed announced that the U.S. Department of Agriculture had awarded $11 million to fund its groundbreaking initiative aimed at producing high-quality insect-based ingredients for animal and plant nutrition in the U.S. This initiative aims to boost domestic organic fertilizer production, contributing to sustainable agriculture, economic growth in rural regions, and enhanced options for American farmers.(Source: innovafeed.com)

- In October 2024, ICL launched the Peters Professional Canna+ Fertilizer System, which provides professional cannabis cultivators with a straightforward, holistic nutrient system specifically designed for CEA cannabis cultivation. When combined with the appropriate growing conditions, enabling cannabis professionals to eliminate complexity and uncertainty in their nutrient programs, allowing them to grow larger, better plants more efficiently, economically, and sustainably than ever before.(Source: www.cannabisbusinesstimes.com)

U.S. Fertilizers Market Top Companies

- CF Industries Holdings, Inc.

- The Mosaic Company,

- Nutrien Ltd.

- Yara North America, Inc.

- The Andersons Inc.

- Koch Industries

- Pivot Bio

- Sigma AgriScience, LLC

- Farmers Business Network (FBN)

- AgroLiquid,

- Koppert Biological Systems Inc.

- Suståne Natural Fertilizer Inc.

Segments Covered

By Nutrient/Product Type

- Nitrogenous (Urea, Ammonium Nitrate, UAN, Ammonium Sulfate)

- Phosphatic (DAP, MAP, TSP/SSP)

- Potassium (MOP, SOP)

- Specialty & Others (Water-Soluble NPK, Controlled/Slow-Release, Micronutrients, Biofertilizers)

By Crop Type

- Cereals & Grains (Corn, Wheat, Barley)

- Oilseeds & Pulses (Soybeans, Peas, Others)

- Fruits & Vegetables (Tomatoes, Lettuce, Citrus, Berries)

- Plantation & Cash Crops (Cotton, Sugarbeet, Tobacco)

- Others (Forage, Turfgrass, Horticulture)

By Application Method

- Soil Application/Broadcasting

- Fertigation (Drip/Sprinkler)

- Foliar Application

- Blends/Customized Fertilizer Application

By Form

- Solid/Granular/Prilled

- Liquid (Solutions, Suspensions, UAN solutions)

By End User

- Small & Medium Farms

- Large-Scale Commercial Farms & Agribusinesses

- Horticulture & Protected Cultivation (Greenhouses, Turf, Specialty Growers)

By Distribution Channel

- Agri-Retailers & Farm Supply Stores (e.g., Nutrien Ag Solutions, Helena Agri-Enterprises)

- Cooperatives (CHS Inc., Growmark, Local Co-ops)

- Direct Institutional & Contract Sales (Corporate growers, large agribusinesses)

- Online/Marketplace Platforms (Digital Agri-input platforms, e-commerce channels)