Content

What is the U.S. Nanomaterials Market Size ?

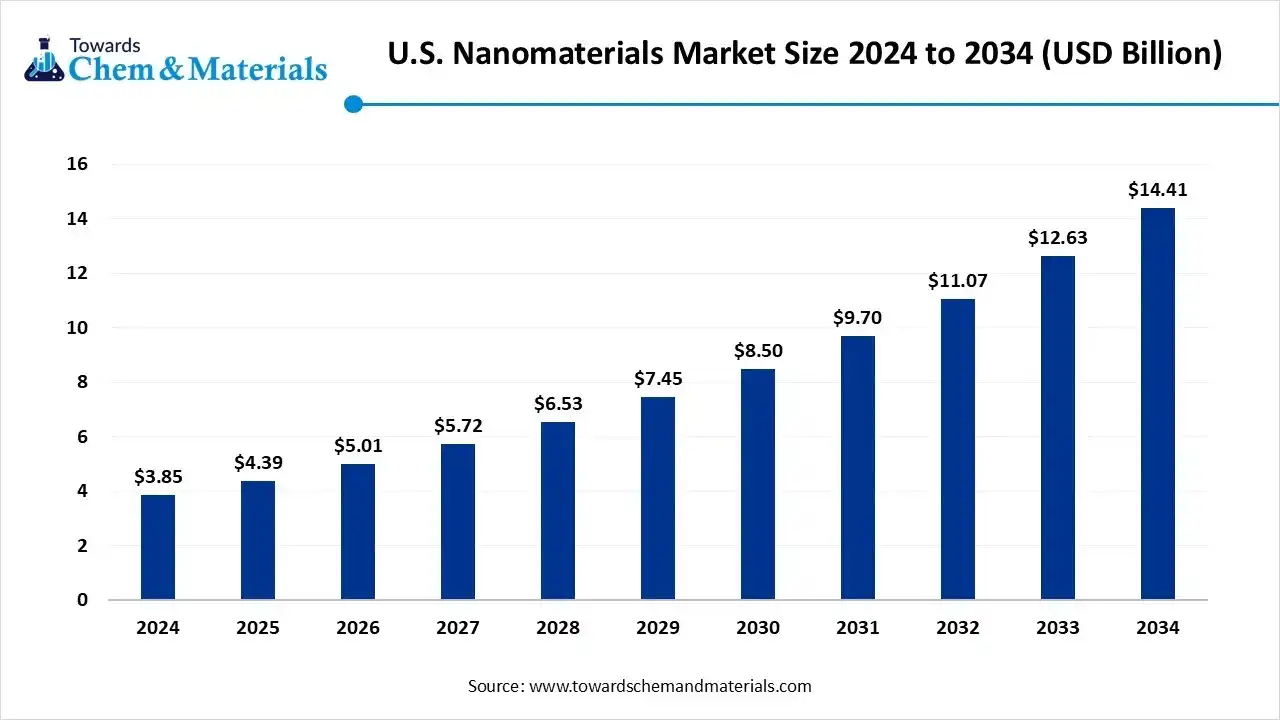

The U.S. nanomaterials market size was reached at USD 3.85 billion in 2024 and is expected to be worth around USD 14.41 billion by 2034, growing at a compound annual growth rate (CAGR) of 14.11% over the forecast period 2025 to 2034. The growing development of electronic components and the advancement in drug delivery drive the market growth.

Key Takeaways

- By material type, the metal & metal oxide nanoparticles segment held approximately a 32% share in the U.S. nanomaterials market in 2024.

- By material type, the carbon-based nanomaterials segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end-use industry, the electronics segment held approximately a 28% share in the market in 2024.

- By end-use industry, the others (textiles, cosmetics, food processing) segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By product form, the nanopowders segment held approximately a 40% share in the market in 2024.

- By product form, the nanosuspensions & colloids segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By synthesis method, the physical methods segment held approximately a 33% share in the market in 2024.

- By synthesis method, the biological & green synthesis segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By distribution channel, the direct sales segment held approximately a 46% share in the U.S. nanomaterials market in 2024.

- By distribution channel, the online marketplaces segment is expected to grow at the fastest CAGR in the market during the forecast period.

What are the Growth Factors for the U.S. Nanomaterials Market?

The U.S. nanomaterials market growth is driven by increasing government investment in nanotechnology R&D, development of targeted therapies, rising manufacturing of high-tech electronic components, increasing need for energy storage, and the rise in commercialization of specific nanomaterials.

What are Nanomaterials?

Nanomaterials are microscopic materials with at least one external dimension measuring between 1 and 100 nanometers.They are available in tubes, fibers, particles, films, and rod forms. They possess enhanced chemical reactivity, magnetic properties, high strength, and a high surface-area-to-volume ratio. Nanomaterials are made up of metal-based, polymeric, carbon-based, semiconductor, and metal oxide-based materials.

U.S. Nanomaterials Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the industry is expected to see accelerated growth in high-margin applications such as advanced electronics, targeted drug delivery systems, flexible displays, and medical diagnostics. Growth is being reinforced by growing end-user industries like energy, healthcare, and electronics in areas like Texas, New York, and California.

- Sustainability Trends: Sustainability is transforming the U.S. nanomaterials industry, with the adoption of green solvents, bio-based synthesis, and renewable feedstocks. For instance, Cour Pharmaceuticals uses a bio-based process to produce nanoparticles to treat autoimmune disease.

- Major Investors: Corporate investors, government agencies, and venture capital firms are actively investing in the nanomaterials development, drawn by growing applications in areas like electronics, clean energy, and medicine. For instance, DuPont de Nemours, Inc. is investing in R&D of a nano-based product range.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 5.01 Billion |

| Expected Size by 2034 | USD 14.41 Billion |

| Growth Rate from 2025 to 2034 | CAGR 14.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Material Type, By End-Use Industry, By Product Form, By Synthesis Method, By Distribution Channel |

| Key Companies Profiled | NanoComposix, Arkema Inc., Cabot Corporation, Honeywell International Inc., BASF Corporation (U.S.), 3M Company, Nanophase Technologies Corporation, Quantum Materials Corp., American Elements, US Research Nanomaterials, Inc., Hyperion Catalysis International, Inc., Luna Innovations Inc., Nanostructured & Amorphous Materials, Inc. (NanoAmor), NanoSonic, Inc., NN-Labs (Nanomaterials & Nanofabrication Laboratories), Advanced Nano Products Co., Ltd. (U.S. presence), Nanoco Technologies Ltd. (U.S. operations), NanoIntegris Technologies, Thomas Swan & Co. Ltd. (U.S. distribution) |

Key Technological Shifts in the U.S. Nanomaterials Market:

The U.S. nanomaterials market is undergoing key technological advancements driven by the demand for performance efficiency and optimizing the manufacturing process. One of the most significant innovations is the adoption of artificial intelligence, which accelerates the R&D process and supports automated synthesis. AI identifies promising candidates efficiently for faster discovery of material. AI develops nanomaterials with specific properties and offers high-throughput virtual screening. AI optimizes the manufacturing process and detects defects in real-time.

- For instance, Exabyte, a San Francisco-based company, uses AI for designing and discovering new nanomaterials. and the

- For instance, Nanowear New York-based company, uses an AI-based platform for the development of remote medical diagnostic tools.

Trade Analysis of U.S. Nanomaterials Market: Import & Export Statistics

- The United States exported 97 shipments of carbon nanotubes.(Source: www.volza.com)

- The United States exported 10 shipments of fullerene.(Source: www.volza.com)

- The United States exported 13,423 shipments of titanium dioxide.(Source: www.volza.com)

- The United States exported 7 shipments of quantum dots.(Source: www.volza.com)

U.S. Nanomaterials Market Value Chain Analysis

- Feedstock Procurement : The feedstock procurement is the sourcing of raw materials like metals, agricultural waste, biomass, solid graphite rods, polystyrene films, plant extracts, and many more.

- Key Players: US Research Nanomaterials, Inc., Nanopartz, American Elements, ACS Material, Cheap Tubes, Inc.

- Chemical Synthesis and Processing : The chemical synthesis & processing involve methods like chemical vapor deposition, chemical reduction, sol-gel method, hydrothermal synthesis, microemulsion, and co-precipitation.

- Key Players: Cabot Corporation, Thermo Fischer Scientific, 3M, American Elements, DuPont de Nemours, Inc.

- Quality Testing and Certifications : Quality testing involves testing of properties like particle size, morphology, crystallinity, chemical composition, elemental composition, & surface area, and certifications include FDA, OSHA, EPA, & ASTM.

Tiny Tech Big Impact: Nanomaterials Manufacturers to Watch in the U.S.

| Company | Location | Nanomaterial Produced | Support Applications |

| Altair Nanotechnologies | Nevada | Nano-lithium-titanate |

|

| American Elements | California | Nanoparticles |

|

| DuPont de Nemours | Delaware | High-Performance Polymers Nanomaterials Nanoscale Coatings |

|

| Nanophase Technologies Corporation | Illinois | Metal Oxides like iron oxide, zinc oxide, & aluminum oxide |

|

Segmental Insights

Material Type Insights

Why Metal & Metal Oxide Segment Dominates the U.S. Nanomaterials Market?

The metal & metal oxide segment dominated the U.S. nanomaterials market with approximately 32% share in 2024. The growing development of sensors, microelectronics, and other electronic components increases demand for metal & metal oxide. The strong focus on pollution control and the development of a drug delivery system requires metal & metal oxide. The cost-effectiveness and unique electrical properties of metal & metal oxide drive the overall market growth.

The carbon-based nanomaterials segment is the fastest-growing in the market during the forecast period. The growing manufacturing of flexible displays and transparent conductive films increases demand for carbon-based nanomaterials. The increasing need for energy storage and the development of lithium-ion batteries require carbon-based nanomaterials. The growing manufacturing of lightweight vehicle materials and the development of medical imaging require carbon-based nanomaterials, supporting the overall market growth.

The polymeric & lipid-based nanoparticles segment is significantly growing in the market. The growing manufacturing of hydrophobic and hydrophilic drugs increases the adoption of polymeric & lipid-based nanoparticles. The strong focus on the preservation of food and the development of new agricultural materials requires polymeric & lipid-based nanoparticles, driving the overall market growth.

End-Use Industry Insights

How did the Electronics Segment hold the Largest Share in the U.S. Nanomaterials Market?

The electronics segment held the largest revenue share of approximately 28% in the U.S nanomaterials market in 2024. The growing development of electronic components and the manufacturing of advanced sensors increases the adoption of nanomaterials. The increasing manufacturing of miniaturized electronic devices and the rise in the adoption of wearable devices require nanomaterials. The strong focus on the development of advanced memory and improving displays drives the overall growth of the market.

The others (textiles, cosmetics, food processing) segment is experiencing the fastest growth in the market during the forecast period. The growing adoption of organic & natural ingredients in cosmetics products and the development of superior UV protection sunscreens require nanomaterials. The focus on enhancing food texture and the need for extending the shelf life of food products require nanomaterials, supporting the overall growth of the market.

The healthcare & life sciences segment is growing at a significant rate in the market. The growing manufacturing of medical imaging, contrast agents, and nanosensors requires nanomaterials. The development of targeted drug delivery systems and the use of regenerative medicine increases the adoption of nanomaterials. The development of new treatments and the adoption of minimally invasive procedures require nanomaterials, driving the overall market growth.

Product Form Insights

Which Product Form Segment Dominated the U.S. Nanomaterials Market?

The nanopowders segment dominated the U.S. nanomaterials market with approximately 40% share in 2024. The growing need for catalysis in chemical reactions and the development of electronic components increase the adoption of nanopowders. The development of functional & protective coatings and the high need for energy storage require nanopowders. The increased manufacturing of biomedicine and the need for antimicrobial coatings require nanopowders, driving the overall market growth.

The nanosuspensions & colloids segment is the fastest-growing in the market during the forecast period. The growing development of oral drugs, nebulizers, and inhalers requires nanosuspensions. The increased utilization of shampoos, sunscreens, and hair conditioners requires nanosuspensions. The growing manufacturing of agrochemicals and focus on enhancing the stability of food products require nanosuspensions, supporting the overall market growth.

The nanotubes & nanowires segment is growing at a significant rate in the market. The development of energy-efficient electronic components and a focus on improving energy storage capacity require nanotubes & nanowires. The increasing manufacturing of fuel-efficient vehicles and the development of advanced drug delivery systems require nanotubes & nanowires. The growing production of lightweight aircraft components drives the overall growth of the market.

Synthesis Method Insights

Why Physical Methods Segment Held the Largest Share in the U.S. Nanomaterials Market?

The physical methods segment held the largest revenue share of approximately 33% in the U.S nanomaterials market in 2024. The increasing need for a high-purity level of nanomaterials and the development of uniform products increase the adoption of physical methods. The versatility of the physical process across various materials like alloys, metals, and ceramics helps market growth. The strong focus on industrial scale-up and lower environmental impact drives the market growth.

The biological or green synthesis methods segment is experiencing the fastest growth in the market during the forecast period. The presence of abundant biological sources and low processing costs helps market growth. The strong focus on lowering the consumption of energy and increasing demand for high-purity nanomaterials uses biological or green synthesis methods, supporting the overall market growth.

The chemical methods segment is significantly growing in the market. The high-volume production of nanomaterials and a less energy-intensive process increase the adoption of chemical methods. The growing manufacturing of polymeric materials, graphene, metal oxides, and quantum dots increases demand for chemical methods. The strong focus on controlling the size of nanoparticles and the development of unique nanomaterial properties requires chemical methods, supporting the overall market growth.

Distribution Channel Insights

How the Direct Sales Segment Dominated the U.S. Nanomaterials Market?

The direct sales segment dominated the U.S. nanomaterials market with approximately 46% share in 2024. The need for specialized product knowledge and focus on direct interaction increases the adoption of direct sales. The growing development of customized products and limited mass production of nanomaterials requires direct sales, driving the overall market growth.

The online specialty marketplaces segment is the fastest-growing in the market during the forecast period. The presence of a broad range of suppliers and a large inventory of nanomaterials on online platforms helps market growth. The direct access to technical information and the presence of global buyers on online marketplaces support the overall market growth.

The distributors & industrial suppliers segment is significantly growing in the market. The focus on maintaining the product integrity and the need for continuous supply of products increases demand for distributors & industrial suppliers. The direct access to a diversified portfolio and focus on simplifying the procurement process increase demand for distributors & industrial suppliers, supporting the overall market growth.

State-Level Insights

West Coast Wonders: California Golden State of Nanomaterial Production

California is a major contributor to the U.S. nanomaterials market. The growing production of advanced electronics components and the presence of a robust healthcare system increase demand for nanomaterials. The strong focus on clean energy technology and the well-established biotechnology industry increases the adoption of nanomaterials. The growing collaboration between institutions like UC Berkeley and Stanford for the commercialization of nanomaterials drives the overall market growth.

How Texas Powers the United States Nanomaterial Industry?

Texas is rapidly growing in the U.S. nanomaterials market. The well-established semiconductor manufacturing hub and the development of electronic components increase demand for nanomaterials. The increasing chip production projects and strong federal support for nanotechnology advancement increase the adoption of nanomaterials. The rise in Electric Vehicles manufacturing and the development of nanomedicine require nanomaterials, supporting the overall market growth.

From Finance to Fabrication: New York Footprint in Nanomaterials

New York is growing in the U.S. nanomaterials market. The increasing government investment in nanotechnology R&D and a strong focus on microelectronics increase demand for nanomaterials. The well-established nanotechnology infrastructure and increased manufacturing of biomedicine require nanomaterials. The presence of vast transportation networks and the expansion of the energy sector require nanomaterials, supporting the overall market growth.

Recent Developments

- In May 2025, Zeon Corporation and Sino Applied Technology collaborated to expand the single-walled carbon nanotube (SWCNTs) conductive paste product line, LSC1101 & LSC2102. SWCNTs increase battery energy density and are useful in advanced battery formulations. SWCNTs are widely used in lithium batteries for applications in renewable energy, drones, automated robotics, electric vehicles, and EVTOL aircraft.(Source: www.businesswire.com)

- In April 2023, Penn State developed a rapid test for mpox using 2-dimensional hafnium disulfide nanoplates & 0-dimensional spherical gold nanoparticles to detect the virus within minutes.(Source: www.psu.edu)

- In July 2025, the US Patent & Trademark Office granted a patent to Nanovace Technologies for its energy storage nanomaterials.(Source: www.saurenergy.com)

Top U.S. Nanomaterials Market Companies

DuPont de Nemours, Inc

Corporate Information

- Name: DuPont de Nemours, Inc.

- Headquarters: Wilmington, Delaware, U.S.

- Industry: Specialty materials, advanced chemicals, technology based materials & solutions.

Segments (as of recent):

- Electronics & Industrial

- Water & Protection

- Corporate & Other

- Purpose / Mission: DuPont describes itself as a “global innovation leader in technology based materials and solutions that help transform industries and everyday life.”

History and Background

- The original company was founded in 1802 by Éleuthère Irénée du Pont as E. I. du Pont de Nemours & Company, initially manufacturing gunpowder.

- Over the 20th century the company diversified into chemicals, materials, fibers, etc.

Key Developments and Strategic Initiatives

- Divestiture: In Feb 2022, DuPont announced the sale of a majority of its Mobility & Materials segment (including engineering polymers) to Celanese Corporation for about US$11 billion.

- Business separation/spin off: In May 2024, DuPont announced plans to separate (spin off) its Electronics business into an independent publicly traded company, while retaining its Water & Protection unit and core industrial materials business.

- Innovation recognition: In June 2025, 13 of DuPont’s scientists were named “Heroes of Chemistry” by the American Chemical Society for breakthroughs in semiconductor lithography (embedded barrier layer technology) that support AI and advanced computing.

Mergers & Acquisitions

- Acquisition of Laird Performance Materials: Completed July 1, 2021. Strengthened DuPont’s Electronics & Industrial (“E&I”) segment in thermal management and electromagnetic shielding.

- Acquisition of assets from C3Nano Inc.: August 2024. Acquired silver nanowire technology and business assets to expand in transparent/flexible films & inks.

Partnerships & Collaborations

- While specific partnership details are less publicly highlighted in the sources we reviewed, DuPont’s recognition by ACS for semiconductor lithography innovation implies substantial collaboration with industry and possibly technology partners (from the ACS article).

- DuPont’s acquisition and integration of companies indicate strategic collaboration through buy in of complementary capabilities (e.g., Laird, C3Nano).

Product Launches / Innovations

- The semiconductor lithography breakthrough using “embedded barrier layer technology” enabled improved yield/reduced defects in 193 nm immersion lithography.

- Materials for electronics: DuPont’s E&I segment offers advanced materials for semiconductors, advanced packaging, printed circuit boards, electromagnetics & thermal management, displays, etc.

Key Technology Focus Areas

- Advanced materials for electronics & industrial applications: semiconductors, advanced packaging, interconnect solutions, metallization, substrates, thermal management.

- Water & protection: engineered products integrated systems for worker safety, water purification/separation, medical packaging, building materials.

- High performance engineered materials enabling next gen automotive (mobility), industrial technologies, etc. (as per strategic initiative)

- Sustainability and innovation: The 2025 Sustainability Report outlines commitment to “Innovate for good / Protect people and the planet / Empower people to thrive.”

R&D Organisation & Investment

- DuPont emphasizes innovation via its global technology centers and research teams (e.g., the ACS award of scientists). From the ACS article: “teams of current and former scientists and engineers” developed the lithography technology.

- The sustainability report indicates a commitment to R&D and innovation across its business units.

SWOT Analysis

Strengths:

- Long heritage, strong brand recognition in specialty materials and chemicals.

- Broad portfolio across high growth segments (electronics, water & protection, industrial).

- Strong innovation capabilities and technology leadership (e.g., the ACS award).

- Global presence, diversified geographies and end markets.

Weaknesses:

- Complexity of portfolio and ongoing restructuring/spin offs could lead to transitional costs and management challenges.

- Legacy liabilities (historical chemical business, regulatory/environmental risk) though specific items are not detailed in our sources.

- Dependence on cyclical end markets (electronics, industrial) which may be vulnerable to downturns.

Opportunities:

- Growth in semiconductor materials (AI, 5G, advanced packaging) offers major upside.

- Water purification & protection markets (especially with increased environmental/regulatory focus).

- Mobility / next gen automotive materials demand.

- Divestment of non core assets allows focusing resources on high margin, high growth businesses.

Threats:

- Global supply chain disruptions, trade tensions (especially in electronics).

- Regulatory risks (environmental, chemical safety).

- Competitive pressure from other materials/chemicals companies and possible technological substitution.

- Execution risk associated with the planned spin offs and restructuring.

Recent News & Strategic Updates

- February 11, 2025: DuPont raised its 2025 profit forecast on strong demand in the electronics sector (especially semiconductors).

- May 1, 2024: DuPont beat Q1 2024 profit estimates and raised full year guidance, citing electronics and water/protection segment improvement.

Other Top Companies List

- NanoComposix: The company manufactures, designs, and develops nanomaterials like silica nanoparticles, metal, & metal oxide for optical, therapeutic, or diagnostic use.

- Arkema Inc.: The specialty materials company that manufactures nanomaterial products such as carbon nanotubes, toughening agents, and nanostructured acrylic block copolymers.

- Cabot Corporation: The specialty performance materials & chemicals company offers a product range including graphene, carbon nanotubes, graphene additives, fumed metal oxides, and carbon nanostructures.

- Honeywell International Inc.: The American-based company manufactures technologies to support industries like building automation, energy transition, aerospace, and industrial automation.

- BASF Corporation (U.S.)

- 3M Company

- Nanophase Technologies Corporation

- Quantum Materials Corp.

- American Elements

- US Research Nanomaterials, Inc.

- Hyperion Catalysis International, Inc.

- Luna Innovations Inc.

- Nanostructured & Amorphous Materials, Inc. (NanoAmor)

- NanoSonic, Inc.

- NN-Labs (Nanomaterials & Nanofabrication Laboratories)

- Advanced Nano Products Co., Ltd. (U.S. presence)

- Nanoco Technologies Ltd. (U.S. operations)

- NanoIntegris Technologies

- Thomas Swan & Co. Ltd. (U.S. distribution)

Segments Covered

By Material Type

- Metal & Metal Oxide Nanoparticles (Ag, Au, TiO₂, ZnO, Fe₂O₃)

- Carbon-Based Nanomaterials (CNTs, Graphene, Fullerenes)

- Polymeric & Lipid-Based Nanoparticles

- Quantum Dots

- Nanoclays & Silica Nanoparticles

- Ceramic Nanoparticles (Al₂O₃, ZrO₂)

- Others (Nanocellulose, Dendrimers, Nanocomposites)

By End-Use Industry

- Electronics & Electricals

- Healthcare & Life Sciences

- Energy & Power

- Chemicals & Materials

- Automotive & Aerospace

- Construction & Infrastructure

- Others (Textiles, Cosmetics, Food Processing)

By Product Form

- Nanopowders

- Nanotubes & Nanowires

- Nanocomposites

- Nanofilms / Coatings

- Nanosuspensions & Colloids

- Others (Hydrogels, Aerogels)

By Synthesis Method

- Physical Methods (Evaporation, Laser Ablation, Ball Milling)

- Chemical Methods (Sol–Gel, Co-precipitation, Chemical Vapor Deposition)

- Biological / Green Synthesis (Plant & Microbe Mediated)

- Electrochemical & Plasma Methods

- Others (Template-Assisted, Spray Pyrolysis)

By Distribution Channel

- Direct Sales (Manufacturers → OEMs)

- Distributors & Industrial Suppliers

- Online Specialty Marketplaces

- Research & Academic Consortia Procurement