Content

What is the Current Aerospace Plastics Market Size and Share?

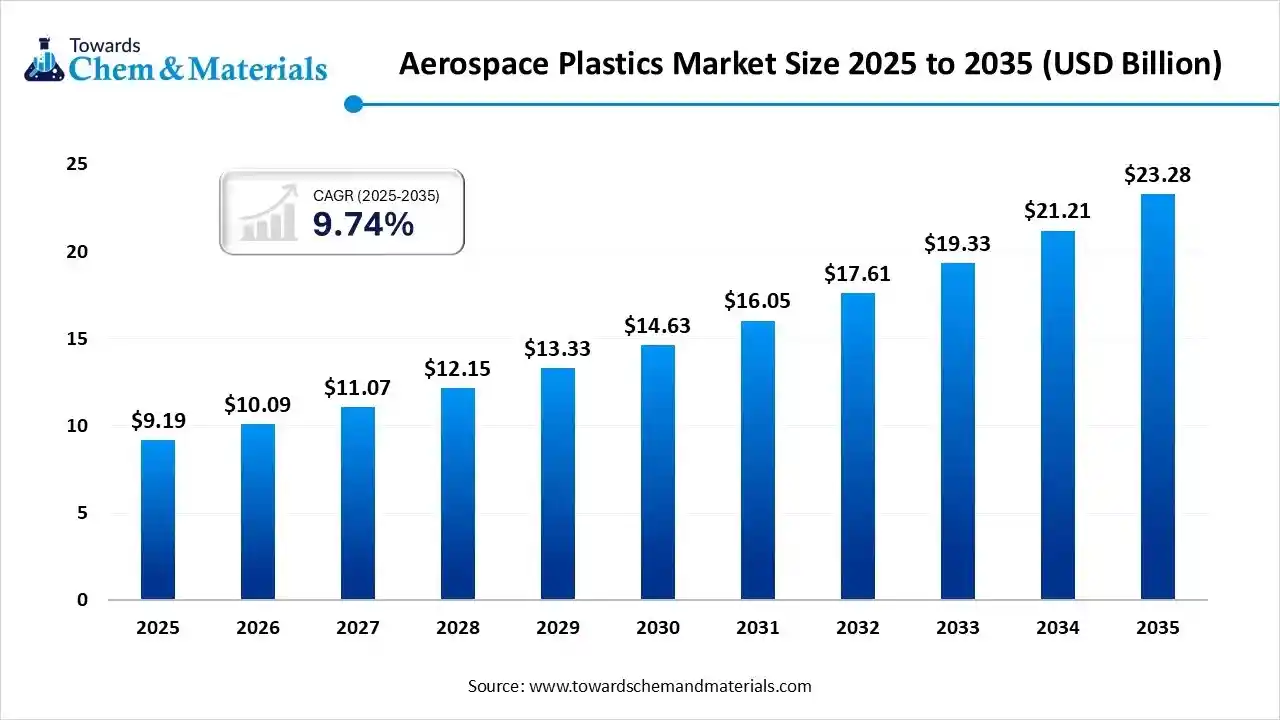

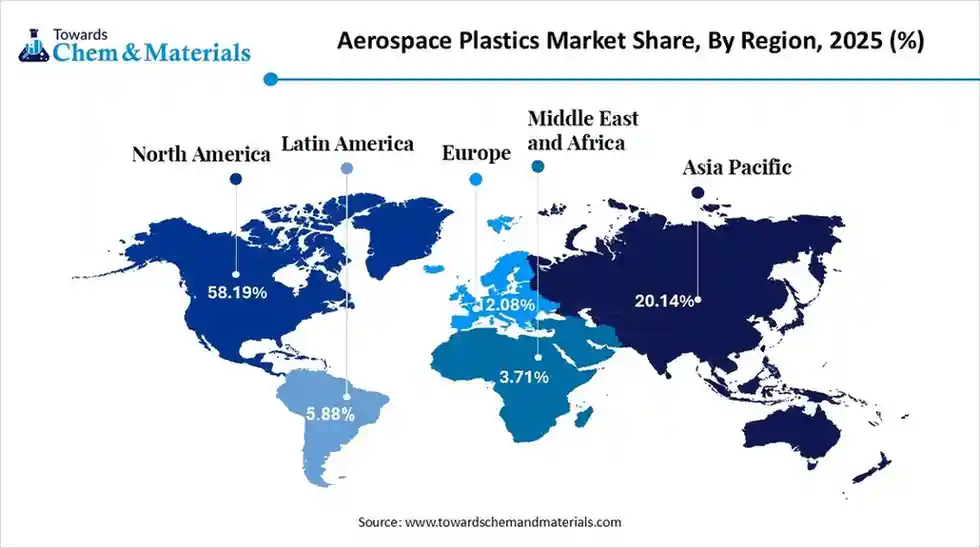

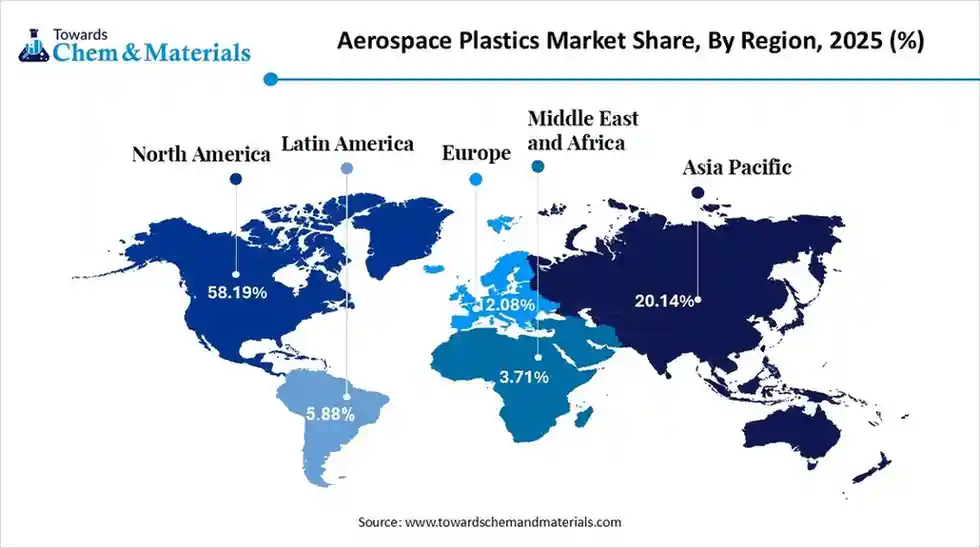

The global aerospace plastics market size is calculated at USD 9.19 billion in 2025 and is predicted to increase from USD 10.09 billion in 2026 and is projected to reach around USD 23.28 billion by 2035, The market is expanding at a CAGR of 9.74% between 2026 and 2035. North America dominated the aerospace plastics market with a market share of 58.19% the global market in 2025.The market growth is driven by various factors, including increasing global demand for lighter aircraft to improve fuel efficiency and meet emission reduction mandates.

Key Takeaways

- By region, North America led the aerospace plastics market with the largest revenue share of over 58.19% in 2025.

- By product, the polyetheretherketone segment led the market with the largest revenue share of 62.51% in 2025.

- By process, the injection moulding segment led the market with the largest revenue share of 38% in 2025.

- By application, the structural components segment accounted for the largest revenue share of 30.06% in 2025.

- By end user, the commercial & freighter aircraft segment dominated with the largest revenue share of 73% in 2025.

Market Overview

What Is The Significance Of The Aerospace Plastics Market?

The significance of the aerospace plastics market lies in its contribution to lightweight, fuel-efficient aircraft through high-performance, durable, and versatile materials. This reduces operating costs and environmental impact, supports the growth of both commercial and defence aviation, and enables modern design flexibility for applications ranging from interior cabin components to structural parts.

Aerospace Plastics Market Growth Trends:

- High-performance polymers: Materials like PEEK, polyimides, and polyphenylene sulfide are gaining traction due to their superior strength-to-weight ratio and high-temperature resistance.

- Structural and interior applications: Plastics are used in a wide range of applications, from structural components like spars and radomes to a variety of interior elements such as seating, overhead bins, and lighting.

- Transparent plastics: Materials like polymethyl methacrylate (PMMA) are widely used for aircraft canopies, windows, and windshields.

- Technological advancements: New manufacturing methods like additive manufacturing (3D printing) allow for the creation of complex, customised parts, accelerating the use of innovative plastics.

- Demand for lightweight materials: Aerospace plastics are crucial for reducing aircraft weight, which directly leads to better fuel efficiency and lower operating costs.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 10.09 Billion |

| Revenue Forecast in 2035 | USD 23.28 Billion |

| Growth Rate | CAGR 9.74% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | North America |

| Fastest Growing Region | Europe |

| Segments covered | By Product, By Process, By Application, By End Use, By Region |

| Key companies profiled | Victrex plc, Solvay SA, Evonik Industries AG, SABIC Specialities, DuPont, Toray Industries Inc, Ensinger GmbH, BASF SE, Saint Gobain Aerospace, Celanese Corporation, Sumitomo Chemical Co., Ltd., Covestro AG, the Mitsubishi Chemical Group of companies, PPG Industries, Inc., Röchling |

Key Technological Shifts In The Aerospace Plastics Market:

The aerospace plastics market is mainly driven by technological changes emphasising lightweight designs for better fuel efficiency, innovative manufacturing techniques like 3D printing, and the creation of high-performance, sustainable materials. Ongoing research aims to develop smart plastics embedded with sensors for real-time structural health monitoring, aiding in maintenance prediction and safety enhancement.

- Additionally, 3D printing has shifted from a prototyping tool to a manufacturing method capable of producing complex, flight-critical, and customised parts with reduced material waste and quicker production times than traditional approaches.

Trade Analysis Of Aerospace Plastics Market: Import & Export Statistics

- According to India Export data, India exported 1,321 shipments of Aerospace Parts. These exports were made by 41 Indian Exporters to 18 Buyers.

- Most of the Aerospace Parts exports from India go to the Philippines and, the United States.

- Globally, the top three exporters of Aerospace Parts are the Philippines, the United States, and India. The Philippines leads the world in Aerospace Parts exports with 16,282 shipments, the United States with 8,598 shipments, and India taking the third spot with 1,321 shipments.

- According to Global Export data, the World exported 28,886 shipments of Aerospace. These exports were made by 993 Exporters to 650 Buyers.

- Most of the Aerospace exports from the World go to the United Kingdom, the United States, and Philippines.

- Globally, the top three exporters of Aerospace are Indonesia, India, and the United States. Indonesia leads the world in Aerospace exports with 18,524 shipments, India with 3,743 shipments, and the United States taking the third spot with 2,414 shipments.

Aerospace Plastics Market Value Chain Analysis

- Chemical Synthesis and Processing: Aerospace plastics are manufactured from high-performance polymers such as PEEK, PPS, PEI, and polycarbonate through polymerisation and advanced processing methods, including injection moulding, thermoforming, compression moulding, and CNC machining.

- Key players: Victrex PLC, Solvay S.A., SABIC, Mitsubishi Chemical Group, and Ensinger.

- Quality Testing and Certification: The Aerospace plastics are tested for flame retardancy, smoke and toxicity (FST), mechanical strength, and thermal resistance under standards like FAR 25.853, ASTM D638, and ISO 9001 / AS9100 for aerospace quality compliance.

- Key players: UL Solutions, ASTM International, SGS, TÜV SÜD

- Distribution to Industrial Users: Aerospace plastics are supplied to aircraft manufacturers, component suppliers, and MRO companies for use in interiors, structural components, insulation, and electrical systems.

- Key players: Solvay S.A., Victrex PLC, SABIC, Mitsubishi Chemical Group, Ensinger.

Aerospace Plastics Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| North America (USA & Canada) | FAA, NASA, US DoD, US EPA, Transport Canada | FAR 25.853 (flammability), MIL-STD-810, TSCA, EPA Clean Air Act | Flammability, smoke & toxicity (FST), material safety, emissions | Aerospace plastics used in interiors and structures must meet strict FST requirements; TSCA impacts polymer additives and monomers. |

| Europe | EASA, European Commission, ECHA, ESA | EASA CS-25, REACH Regulation, CLP Regulation, EU Ecodesign and Circular Economy policies | Fire safety, chemical compliance, and environmental impact | REACH restricts hazardous substances in high-performance polymers; aerospace OEMs are shifting toward low-toxicity and recyclable thermoplastics. |

| Asia Pacific | CAAC (China), JCAB (Japan), DGCA (India), China MEE, Japan METI | China GB/T aerospace material standards, Japan CSCL, Draft India Chemicals Management Rules | Aircraft material certification, new chemical registration, and sustainability | China and Japan follow systems aligned with EASA/FAA while adding national chemical registration requirements for polymers and composites. |

| Russia & CIS | IAC (Interstate Aviation Committee), Russian Ministry of Industry and Trade | AP-25 Airworthiness Standards, Russian Technical Regulations | Airworthiness certification, local material qualification | Growing focus on domestic material certification and reduced reliance on imported aerospace polymers. |

| Middle East | GCAA (UAE), GACA (Saudi Arabia) | GCAA CAR Part V, SASO technical regulations | Aircraft material compliance, import standards | The Middle East is aligning closely with FAA and EASA standards while tightening import certification for aerospace materials. |

| South America | ANAC (Brazil), National Civil Aviation Authorities | RBAC-25, local aviation material standards | Aircraft safety compliance, import/export material approval | Brazil (via ANAC) follows global standards with additional local aerospace material conformity regulations. |

Segmental Insights

Product Insights

Which Product Segment Dominated The Aerospace Plastics Market In 2025?

The polyetheretherketone segment dominated the market with a share of 64% in 2025. PEEK is a high-performance thermoplastic widely used in aerospace due to its exceptional mechanical strength, high temperature resistance, and chemical stability. Its compatibility with additive manufacturing and superior fatigue resistance are driving demand in next-generation commercial and defence aviation programs.

The polyphenyl sulfone segment is expected to experience significant growth in the market during the forecast period. Polyphenyl sulfone is known for its excellent flame retardancy, impact resistance, and hydrolytic stability, making it suitable for aerospace interiors and fluid handling systems. Its durability and compliance with aviation safety standards make it a preferred material in aircraft seating components, ducting systems, and interior fittings, particularly in commercial aircraft cabins.

The polycarbonate segment has seen notable growth in the market. Polycarbonate is extensively used in aerospace due to its transparency, impact resistance, and lightweight nature. Its ability to withstand pressure, vibration, and temperature variations makes it critical for both structural and non-structural aircraft applications across commercial, military, and general aviation segments.

Process Insights

How Did The Injection Moulding Segment Dominate The Aerospace Plastics Market In 2025?

The injection molding segment dominated the market with a share of 36.95% in 2025. Injection moulding is widely used in aerospace plastics manufacturing for producing high-precision, complex components with consistent quality and high production efficiency. The ability to mass-produce components with tight tolerances and minimal waste makes injection moulding highly attractive in commercial aircraft production and maintenance supply chains.

The CNC machining process segment expects significant growth in the market during the forecast period. CNC machining is used for producing precision aerospace plastic components that require tight dimensional accuracy and excellent surface finish CNC machining allows manufacturers to work with high-performance polymers like PEEK and PPSU, supporting critical applications in both defence and commercial aerospace sectors.

The thermoforming segment has seen notable growth in market. Thermoforming involves heating plastic sheets and shaping them into desired forms using moulds, making it ideal for large and lightweight interior components. The process offers flexibility in design and cost-effective production of complex shapes, making it suitable for aircraft interior refurbishment and new aircraft production programs.

Application Insights

Which Application Segment Dominated The Aerospace Plastics Market In 2025?

The structural components segment dominated the market with a share of 29.70% in 2025. Aerospace plastics are increasingly used in structural components such as brackets, housings, support frames, and load-bearing parts. The growing focus on lightweight materials in next-generation aircraft and UAVs is boosting the use of advanced plastics in structural aerospace applications.

The cabin interiors segment expects significant growth in the market during the forecast period. Plastics play a crucial role in aircraft cabin interiors, including sidewalls, seats, overhead compartments, tray tables, and flooring panels. The increasing demand for enhanced passenger comfort, lighter interior materials, and customisation in commercial aviation is driving the growth of this segment.

The electrical, electronics, and control panel segment has seen notable growth in the market. Plastics are widely used in the electrical and electronic systems of aircraft due to their insulating properties, lightweight nature, and resistance to heat and chemicals. The growing complexity of aircraft electronic systems, including avionics and communication systems, is increasing the demand for high-performance aerospace-grade plastics in this segment.

End Use Insights

How Did The Commercial And Freighter Aircraft Segment Dominated The Aerospace Plastics Market In 2025?

The commercial & freighter aircraft segment dominated the market with a share of 73% in 2025. In commercial and freighter aircraft, aerospace plastics are used extensively to reduce fuel consumption, improve efficiency, and meet emission regulations. New aircraft production and retrofitting of older fleets are key growth drivers for this segment, especially in emerging aviation markets.

The military aircraft segment expects significant growth in the aerospace plastics market during the forecast period. Military aircraft require advanced plastics that can withstand extreme operating conditions, including high temperatures, pressure variations, and intense mechanical stress. Increased defence spending, modernisation of air fleets, and development of next-generation fighter jets and UAVs are major factors driving demand in this segment.

The general aviation segment has seen notable growth in the market. General aviation includes private aircraft, business jets, and small regional planes, where the demand for lightweight and cost-effective materials is rising. Growth in private aviation, corporate travel, and pilot training programs is supporting the steady demand for aerospace plastics in this segment.

Regional Insights

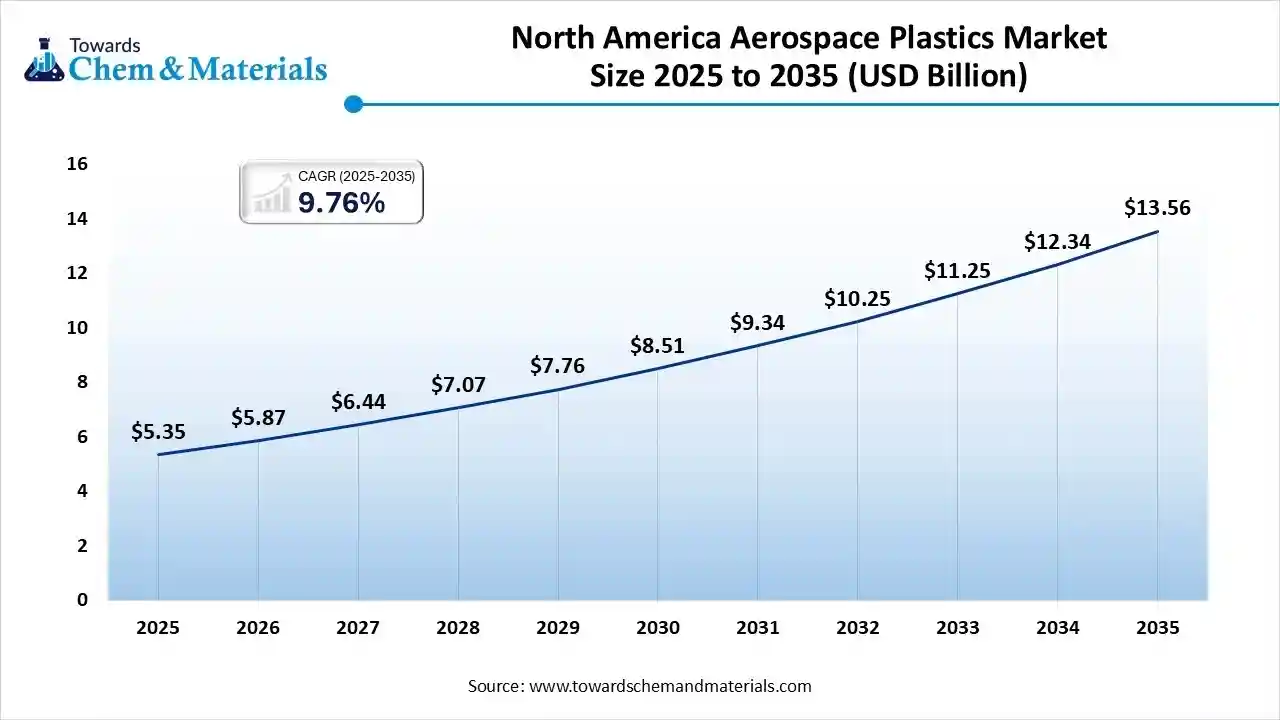

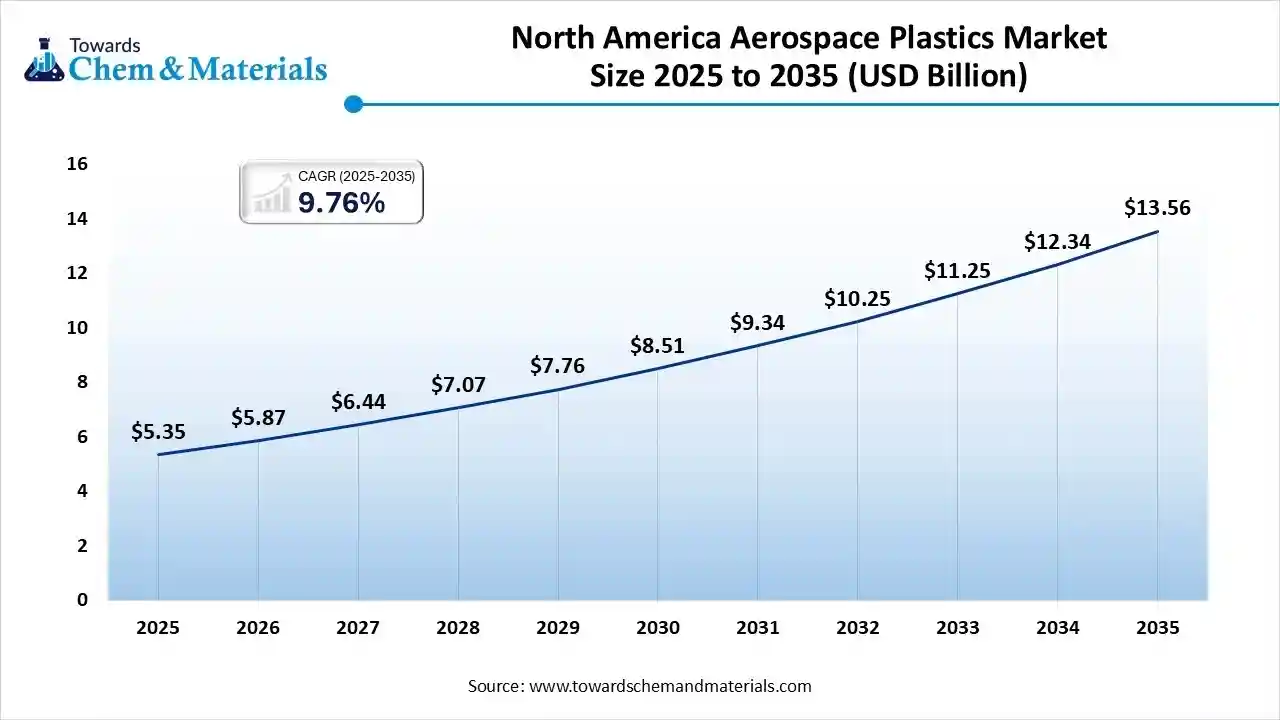

The North America aerospace plastics market size was valued at USD 5.35 billion in 2025 and is expected to reach USD 13.56 billion by 2035, growing at a CAGR of 9.76% from 2026 to 2035. North America dominates the market with a share of 58.19% in 2025.

North America dominates the market due to the strong presence of major aircraft manufacturers, component suppliers, and advanced materials companies. High investment in military aviation, space exploration, and next-generation aircraft programs is driving demand for high-performance polymers. The region also benefits from advanced R&D infrastructure and rapid adoption of lightweight composite and plastic components for fuel efficiency and emission reduction.

United States: Aerospace Plastics Market Growth Trends

The United States represents the largest share of the North American aerospace plastics market owing to its leadership in commercial aviation, defence aircraft manufacturing, and aerospace innovation. Ongoing investments in space and defence projects further strengthen the country’s long-term market growth potential.

Europe Has Seen Significant Growth Driven By Strong Support

Europe expects the fastest growth in the market in the forecast period. Europe is a key region in the market, supported by its strong aerospace manufacturing base and increasing focus on sustainable and fuel-efficient aircraft. Strict environmental regulations and innovation in recyclable aerospace-grade plastics are also shaping material demand across the commercial and defence aviation segments.

Germany: Aerospace Plastics Market Growth Trends

Germany plays a crucial role in the European aerospace plastics market due to its strong engineering capabilities and advanced aerospace manufacturing ecosystem. The country is a major supplier of aerospace components and materials for both commercial and military aircraft. Increasing investments in lightweight materials, automation, and next-generation aircraft technologies are boosting the demand for high-performance plastics in German aerospace manufacturing.

Asia Pacific Market Growth Is Driven By The Region's Supply Chain Management

The Asia Pacific aerospace plastics market is growing rapidly due to expanding aircraft fleets, increasing defence budgets, and rising air travel demand. Several countries are investing in domestic aircraft manufacturing programs and upgrading airport infrastructure. The region’s growing aerospace supply chain and focus on fuel efficiency are accelerating the adoption of advanced thermoplastic materials for both structural and non-structural applications.

China: Aerospace Plastics Market Growth Trends

China is a major growth driver in the Asia Pacific aerospace plastics market, supported by its aggressive expansion of commercial airlines and indigenous aircraft manufacturing programs. The country’s focus on self-reliance in aerospace production is driving local demand for high-performance plastics used in interiors, structural components, and electronic housings. Government support for advanced material research further enhances long-term market prospects.

The Middle East & Africa Have Seen Growth Driven By The Rising Spending

The Middle East & Africa aerospace plastics market is expanding due to increasing investments in aviation infrastructure, growing airline fleets, and rising military spending. The region’s strong focus on becoming a global aviation hub, supported by large aircraft procurement and MRO expansion, is boosting demand for advanced plastics in aircraft interiors and lightweight structural applications.

United Arab Emirates (UAE): Aerospace Plastics Market Growth Trends

The UAE is emerging as a key contributor to the market in the Middle East due to its strategic investments in aviation and defence. The country’s focus on developing aerospace clusters and maintenance hubs, along with rising aircraft orders by national airlines, is increasing the demand for high-performance aerospace plastics used in interiors, insulation, and electronic systems.

South America's Growth In The Market Is Driven By The Modernisation

South America is witnessing steady growth in the market, driven by expanding commercial aviation fleets and the gradual modernisation of military aircraft. Increasing focus on regional aircraft production and maintenance capabilities is contributing to rising demand for durable, lightweight plastic components. Economic development and improved air connectivity are also supporting long-term market expansion.

Brazil: Aerospace Plastics Market Growth Trends

Brazil plays a significant role in the South American aerospace plastics market due to its strong position in regional aircraft manufacturing and aerospace component exports. The presence of globally recognised regional aircraft manufacturers has increased the utilisation of advanced plastics in aircraft structures, interiors, and cabin components. Growing government support for aerospace innovation is further driving market development.

Recent Developments

- In June 2025, Toray Advanced Composites, in partnership with Daher and Tarmac Aerosave, launched a joint End-of-Life Aerospace Recycling program to recover and reuse continuous fibre-reinforced thermoplastic composite parts from decommissioned commercial aircraft, focusing initially on components from an Airbus A380.(Source: www.plasticstoday.com)

- In June 2025, Air Caraïbes and French Bee have initiated a joint in-flight program to recycle PET plastic bottles collected during flights. This program aims to recover approximately 174,000 bottles annually, processing them into flakes for reuse and diverting them from incineration.(Source: www.aerocontact.com)

- In October 2025, Bionatur Plastics launched a new, biodegradable stretch film across Europe, claiming it offers the same performance as conventional plastic wraps with the added benefit of full biodegradation within 18 months, without incurring extra costs for consumers.(Source: www.stattimes.com)

Top Players In The Aerospace Plastics Market & Their Offerings:

- Victrex plc: Victrex is a leading supplier of high-performance aerospace polymers such as PEEK and its composites. These materials are widely used in aircraft interiors, structural components, and electrical systems due to their lightweight, high-temperature resistance, and flame-retardant properties.

- Solvay SA: Solvay provides advanced thermoplastic composites and high-performance aerospace plastics, including PEI, PEEK, and PPS. Its materials are used in fuselage structures, interior panels, brackets, and aircraft electrical insulation.

- Evonik Industries AG: Evonik develops speciality polymers such as PEEK, PA12, and high-performance foams used in aerospace applications. Its solutions support lightweight design, fuel efficiency, and improved durability in aircraft components.

- SABIC Specialities: SABIC supplies aerospace-grade thermoplastics, including PEI (ULTEM™), PPS, and PC blends. These materials are used in aircraft interiors, seating, and structural components due to their high strength-to-weight ratio and flame, smoke, and toxicity (FST) compliance.

- DuPont: DuPont offers advanced polymers such as Kapton® polyimide films and Kevlar® composites used in aerospace insulation, wiring systems, and lightweight structural parts in commercial and defence aviation.

- Toray Industries Inc: Toray provides high-performance thermoplastics and composite materials for aerospace structures, interior applications, and engine components. The company focuses on carbon fibre reinforced plastics and advanced polymer solutions for aircraft weight reduction.

- Ensinger GmbH: Ensinger specialises in high-performance plastic materials such as PEEK, PEI, and PPS for aerospace machining and semi-finished products, supporting critical aircraft component manufacturing.

Top Companies in the Aerospace Plastics Market

- BASF SE

- Saint Gobain Aerospace

- Celanese Corporation

- Sumitomo Chemical Co., Ltd.

- Covestro AG

- the Mitsubishi Chemical Group of companies

- PPG Industries, Inc.

- Röchling

Segments Covered:

By Product

- Polyetheretherketone (PEEK)

- Polyphenylsulfone (PPSU)

- Polycarbonate (PC)

- Polyetherimide (PEI)

- Polymethyl Methacrylate (PMMA)

- Polyamide (PA)

- PolyPhenyleneSulfide (PPS)

- Polyamide-imide (PAI)

- Polyphenylene ether (PPE)

- Polyurethane (PU)

- Others

By Process

- Injection Moulding

- CNC Machining

- Thermoforming

- Extrusion

- 3D Printing

- Others(Blow and Roto Molding)

By Application

- Cabin Interiors

- Structural Components

- Electrical, Electronics, and Control Panel

- Windows & Windshields, Doors, and Canopies

- Flooring & Wall Panels

By End Use

- Commercial & Freighter Aircraft

- General Aviation

- Military Aircraft

- Rotary Aircraft

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa