Content

What is the Current Aerospace Materials Market Size and Share?

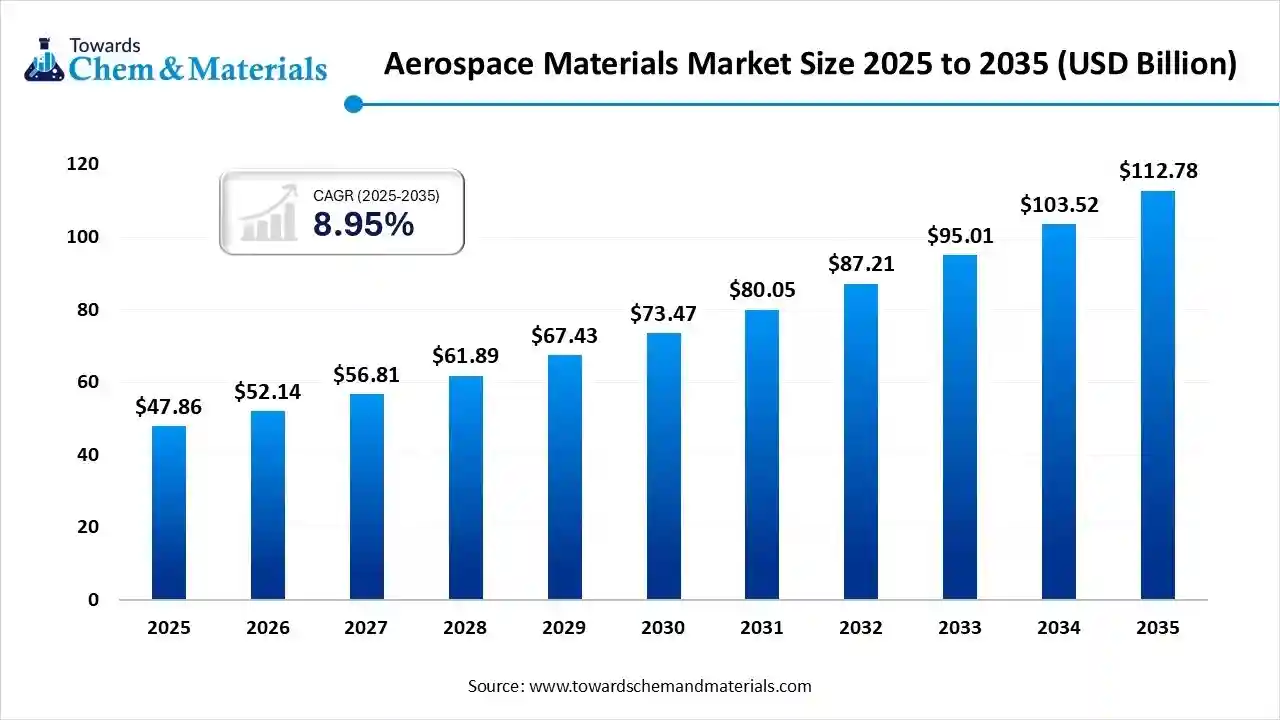

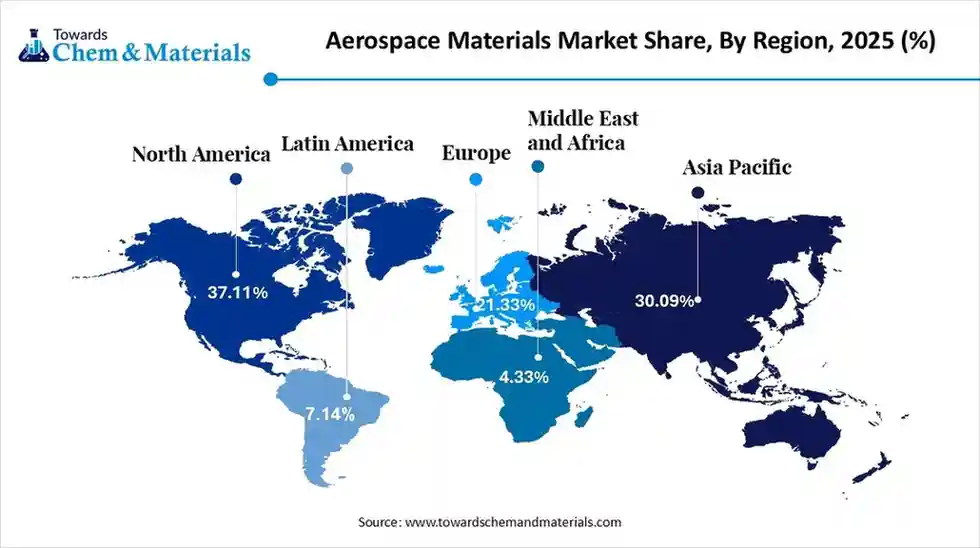

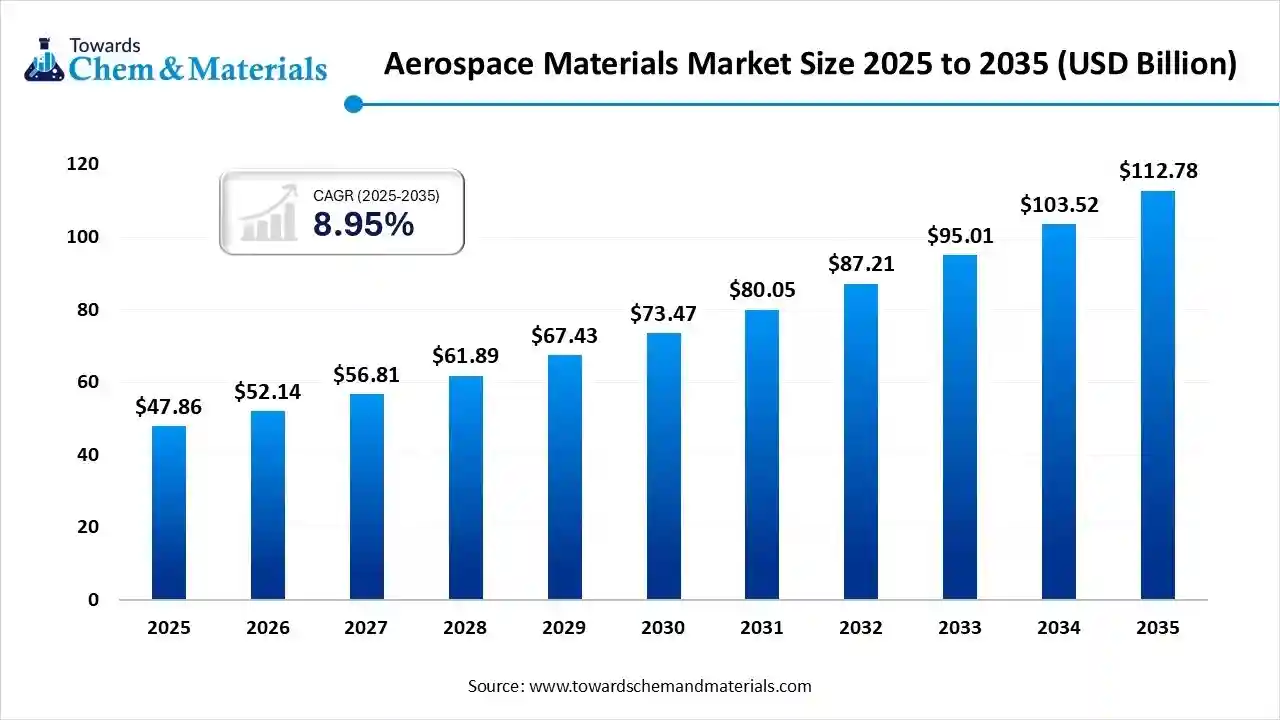

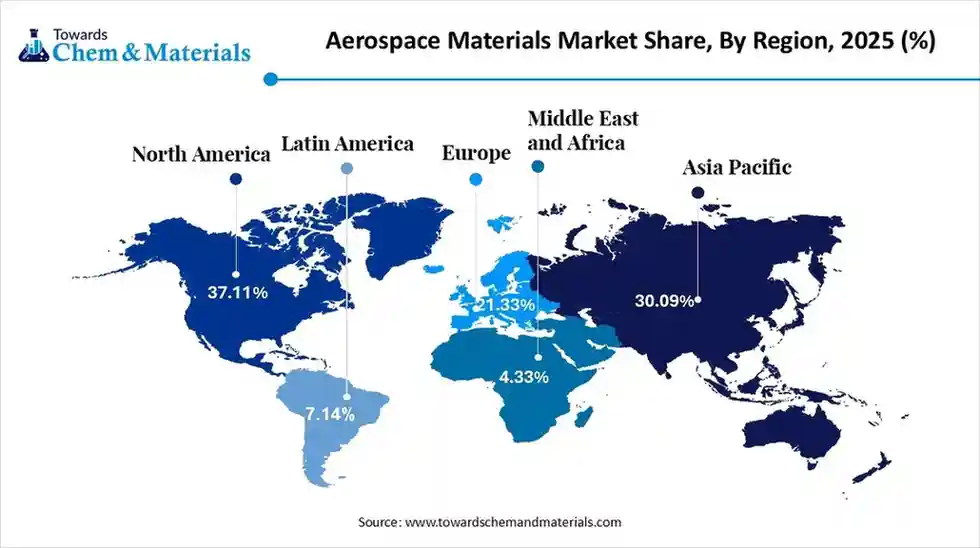

The global aerospace materials market size is calculated at USD 47.86 billion in 2025 and is predicted to increase from USD 52.14 billion in 2026 and is projected to reach around USD 112.78 billion by 2035, The market is expanding at a CAGR of 8.95% between 2026 and 2035. North America dominated the aerospace materials market with a market share of 37.11% the global market in 2025. The rise in air travel and the growing use of lightweight materials in aerospace drive the market growth.

Key Takeaways

- North America dominated the aerospace materials market with the largest revenue share of 37.11% in 2025.

- By type, the aluminum alloys segment led the market with the largest revenue share of 52.66% in 2025.

- By aircraft type, the commercial aircraft segment led the market with the largest revenue share of 42.13% in 2025.

- By application, the exterior segment dominated the market in terms of revenue, accounting for a 49.67% share in 2025.

What’s Propelling the Growth of Aerospace Materials?

The aerospace materials market growth is driven by the growing modernization of defense aircraft, rapid growth in the space industry, innovations in manufacturing technologies, rise in global air travel, and strong focus on minimizing aircraft weight. The growing expansion of airline fleets increases demand for aerospace materials.

The rapid expansion of online shopping increases demand for passenger & cargo aircraft, which require advanced aerospace materials. The growing development of fuel-efficient vehicles and the rapid growth in commercial aviation increase demand for aerospace materials.

What are Aerospace Materials?

Aerospace materials are polymeric-based or metal alloy materials used for the development of spacecraft, aircraft, and helicopters. The various types of metallic materials used in the aerospace industry are aluminum alloys, stainless steel, titanium, magnesium alloys, and nickel-based superalloys. The non-metallic materials like ceramics, nanomaterials, CMCs, composite materials, SMAs, and graphene are used in the aerospace industry.

Aerospace materials are widely used in the manufacturing of spacecraft & aircraft structures like landing gear, spacecraft, airframes, fuel tanks, engines, electronic systems, internal structures, rocket bodies, wings, and thermal protection systems.

Aerospace Materials Market Trends:

- Growing Air Travel: The rapid urbanization and growing disposable incomes increase the preference for air travel. The growing worldwide air travel increases the expansion of airline fleets and the development of new aircraft that require aerospace materials like carbon fiber composites, aluminum alloys, titanium alloys, and others.

- Rising Defense Spending: The growing geopolitical conflicts and strong focus on self-reliance increase spending on defense. The increasing need for unmanned aerial vehicles, next-gen fighter aircraft, and military transport requires durable & high-strength aerospace materials.

- Stricter Environmental Regulations: The stringent environmental regulations for lowering carbon emissions and enhancing the fuel efficiency of aircraft increase demand for aerospace materials. The stricter regulatory pressure heavily invests in the development of sustainable aerospace materials.

- Shift Towards Advanced Materials: The strong focus of the aerospace industry on achieving higher performance and lowering the weight of aircraft increases demand for advanced materials like titanium alloys and composites.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 52.14 Billion |

| Revenue Forecast in 2035 | USD 112.78 Billion |

| Growth Rate | CAGR 8.95% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segments covered | By Type, By Aircraft Type, By Region |

| Key companies profiled | Avdel , Constellium, Solvay , DOW , Hexcel Corporation, Hindalco - Almex Aerospace Limited , Kaiser Aluminum , KOBE STEEL, LTD , Koninklijke Ten Cate bv. , Lee Aerospace , Materion Corporation , PARK AEROSPACE CORP , Renegade Materials Corporation , SGL Carbon , TATA Advanced Materials Limited , Sofitec Aero, S.L. |

Key Technological Shifts in the Aerospace Materials Market:

The aerospace materials market is undergoing key technological shifts driven by the demand for lighter parts, performance efficiency, enhanced strength, and production of complex parts. The technological innovations, like smart materials, robotics, nanomaterials, additive manufacturing, automation, and laser welding, enable the development of lightweight parts, enhanced self-healing capabilities, and lower material waste. One of the major shifts is the adoption of artificial integration (AI).

AI helps in the discovery of superior performance materials, like enhanced heat resistance and strength. AI supports the development of advanced materials and helps to identify the structural behavior of materials. AI helps in optimizing additive manufacturing parameters like heat management & layer deposition and maintains the integrity of intricate parts. AI handles manufacturing tasks like assembly, drilling, & painting, and predicts potential failures.

- Additionally, AI offers higher safety standards, faster innovation, and enhanced performance standards.

For instance, QuesTek Innovations LLC uses AI for the development of superior-performance novel metal alloys for aerospace applications.

Trade Analysis of Aerospace Materials Market: Import & Export Statistics

- The United States exported $25.9B of aircraft parts in 2023.

- France imported $11B of aircraft parts in 2023.

- Italy exported 17,381 shipments of composite material.

- India exported 23,897 shipments of aluminum alloy.

- Vietnam exported 81,491 shipments of steel alloys.

- Russia exported 12,499 shipments of titanium alloys.

Aerospace Materials Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement is the sourcing of raw materials like steel, aluminum, polymer matrix composites, titanium, and metal matrix composites for the development of aerospace parts.

- Key Players:- Hexcel Corporation, ATI Inc., Alcoa Corporation, Toray Industries, Constellium SE, Solvay S.A.

- Chemical Synthesis and Processing:The chemical synthesis is a process of creating fundamental components for advanced materials using steps like high-performance polymer synthesis, production of nanoparticles, creation of specialty cermics & synthesis of coatings, and chemical processing involves steps like composite manufacturing, additive manufacturing, powder metallurgy, heat treatment & curing.

- Key Players:- Mitsubishi Chemical Group Corporation, Evonik Industries, Toray Industries, Syensqo, Hexcel Corporation

- Quality Testing and Certifications:Quality testing is the evaluation of properties like hardness, thermal expansion, tensile strength, corrosion resistance, defects, smoke density, elasticity, chemical composition, and adhesion. Certifications required for aerospace materials are NADCAP, AMS, AS9100, and ISO 9001.

- Key Players:- SGS, Applus+ Laboratories, Element Materials Technology, Intertek, TUV SUD

Material Giants: Nation Shaping Aerospace Future

| Country | Key Regulations | Aerospace Materials Produced | Key Players |

| China |

|

|

|

| United States |

|

|

|

| Germany |

|

|

|

| Brazil |

|

|

|

Segmental Insights

Type Insights

Why the Aluminum Alloys Segment Dominates the Aerospace Materials Market?

The aluminum alloys segment dominated the aerospace materials market share of 52.66% in 2025. The strong focus on sustainable aircraft development and minimizing carbon emissions increases demand for aluminum alloys. The increasing need to lower aircraft weight and focus on enhancing payload capacity requires aluminum alloys. The high corrosion resistance and high strength-to-weight ratio of aluminum alloys help market expansion. The cost-effectiveness and ease of manufacturing of aluminum alloys drive the overall market growth.

The composite materials segment expects the fastest growth in the market during the forecast period. The strong focus on enhancing the fuel efficiency of aircraft and the need to minimize weight increases demand for composite materials. The presence of design flexibility and the superior strength-to-weight ratio of composite materials helps market growth. The growing demand for minimizing maintenance and extending aircraft components' lifespan requires composite materials, supporting the overall market growth.

The steel alloys segment is growing significantly in the market. The growing modernization of defense and the rise in commercial air travel increase demand for steel alloys. The increased manufacturing of components like bulkheads, landing gear, and fuseglass frames increases demand for steel alloys. The high temperature resistance and cost-effectiveness of steel alloys support the overall market growth.

Aircraft Type Insights

Which Aircraft Type Segment held the Largest Share in the Aerospace Materials Market?

The commercial aircraft segment held the largest revenue share in the aerospace materials market share of 42.13% in 2025. The growing air passenger numbers and the rise in the modernization of the fleet increase demand for aerospace materials. The development of commercial aircraft components like engines, fuselage, and wings increases demand for advanced materials. The growing demand for lightweight aircraft materials and the presence of a sheer volume of commercial aircraft drive the overall market growth.

The military aircraft segment is experiencing the fastest growth in the market during the forecast period. The increasing budgets of defense and the rise in modernization of military aircraft increase demand for aerospace materials. The increasing global tensions and focus on enhancing survivability in combat environments increase demand for advanced materials in military aircraft. The growing development of next-generation military aircraft supports the overall market growth.

The helicopter segment is growing at a significant rate in the market. The growing operations like search & rescue, law enforcement, disaster relief, and emergency medical care increase demand for helicopters that require aerospace materials. The strong government support for the modernization of rotary-wing fleets and the increasing need for fast point-to-point transportation require helicopters, supporting the overall market growth.

Regional Insights

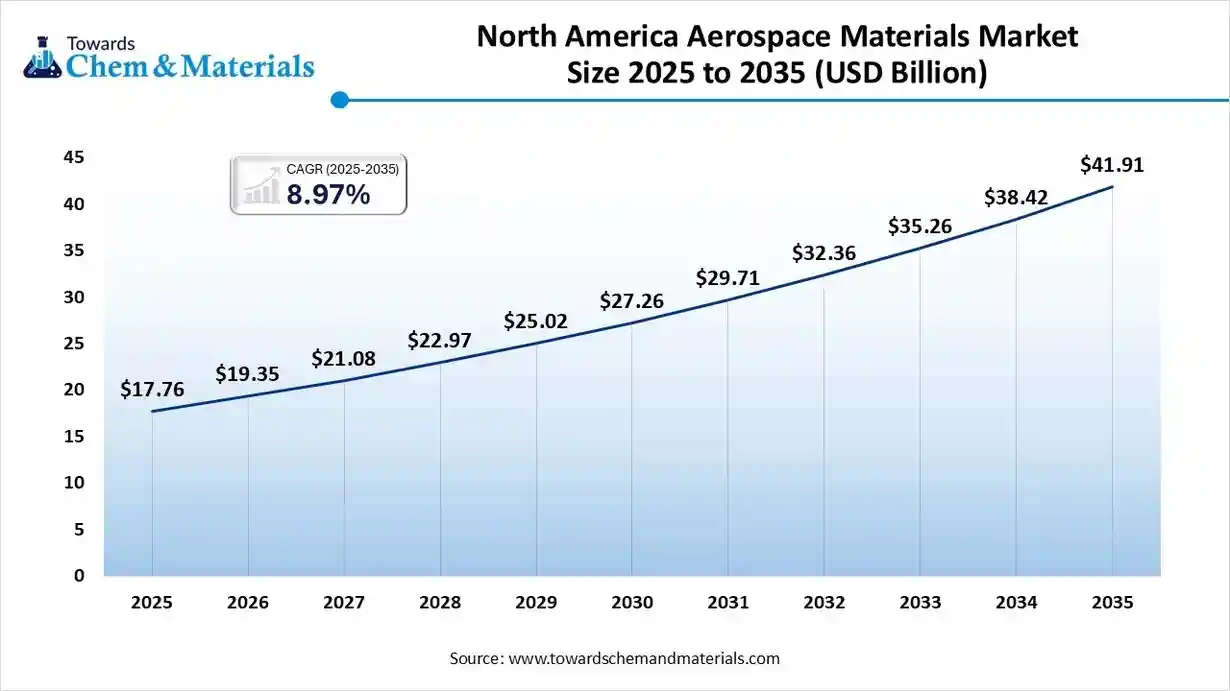

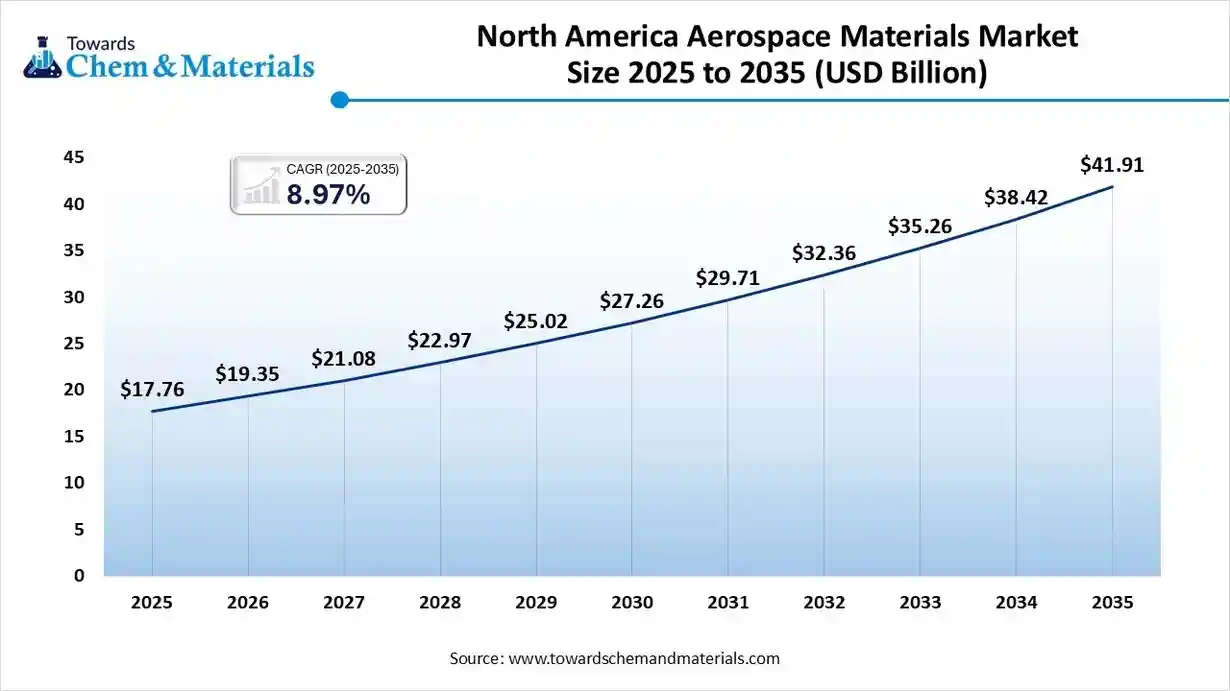

The North America aerospace materials market size was valued at USD 17.76 billion in 2025 and is expected to reach USD 41.91 billion by 2035, growing at a CAGR of 8.97% from 2026 to 2035. North America dominated the market share 37.11% in 2025. The growing government investment in space exploration and defense modernization increases demand for aerospace materials.

The rise in commercial aviation and a well-established aerospace manufacturing base increases demand for aerospace materials. The increased modernization of military aircraft and a strong focus on sustainable aviation require aerospace materials. The presence of key players like Northrop Grumman, Boeing, and Lockheed Martin drives the overall market growth.

Powering Flight: U.S. at the Centre of Aerospace Materials Evolution

The United States is a key contributor to the market in 2025. The rise in the number of air travelers and the growth in the development of new commercial aircraft increase demand for aerospace materials. The increased spending on military aircraft and strong government support for space programs increases demand for aerospace materials. The strong presence of aerospace manufacturers and increasing investment in space exploration drive the overall market growth.

- The United States exported $123B of aircraft parts in 2024.

- The United States exported 61,181 shipments of aluminum alloy.

Europe Aerospace Materials Market Trends

Europe is experiencing the fastest growth in the market during the forecast period. The rise in air passenger traffic and the increasing defense budget increase demand for aerospace materials. The strong government focus on sustainable aviation and stricter environmental regulations for lowering emissions increases demand for advanced aerospace materials. The growing development of military aircraft and the expansion of fleets require aerospace materials. The presence of companies like Rolls-Royce and Airbus drives the overall market growth.

Fueling Flight: How Germany Advances Aerospace Materials Performance

Germany is growing notably in the market. The strong emphasis on defense programs and growing space exploration increases demand for aerospace materials. The growing development of sustainable aviation technologies and a strong focus on the development of the new space sector require aerospace materials. The strong presence of Airbus supports the overall market growth.

- Germany exported 22,922 shipments of composite material.

Asia Pacific Aerospace Materials Market Trends

Asia Pacific is growing at a notable rate in the market. The growing expansion of commercial aviation and the development of military aircraft increase demand for aerospace materials. The ongoing expansion of the fleet and the rise in MRO facilities increase demand for aerospace materials. The well-established domestic manufacturing hubs and shift towards advanced materials drive the overall market growth.

China's Role in the Development of Next-Gen Aerospace Materials

China is a major contributor to the market in the Asia Pacific region. The strong government support for domestic aerospace manufacturing and the expansion of China’s civil aviation industry increase demand for aerospace materials. The high availability of raw materials like titanium sponge and the rising aerospace and defense programs increase the production of aerospace materials, supporting the overall market growth.

- China exported 27,974shipments of composite material.

Middle East & Africa Aerospace Materials Market Trends

The Middle East & Africa are growing significantly in the market. The growing replacement of aging fleets and the rise in air passenger traffic increase demand for aerospace materials. The increasing number of general aviation and commercial aircraft requires aerospace materials. The growing upgradation of military fleets in countries like Egypt, the UAE, and Qatar, and increasing investment in spacecraft require aerospace materials, driving the overall market growth.

Saudi Arabia Aerospace Materials Market Trends

Saudi Arabia is growing substantially in the market. The growing defense expenditure and expansion of the commercial aviation sector increase demand for aerospace materials. The ongoing expansion of cargo & commercial fleets and the rising use of Unmanned Aerial Vehicles require aerospace materials. The growing domestic production of carbon fiber composites, aluminum, and titanium is supporting the overall market growth.

South America Aerospace Materials Market Trends

South America is growing in the market. The well-established aircraft manufacturing and the growing development of fuel-efficient aircraft increase demand for aerospace materials. The increasing commercial air travel and the rising defense sector require aerospace materials. The growing expansion of aerospace infrastructure and exploration of space drives the overall market growth.

From Earth to Sky: How Brazil is Expanding in Aerospace Materials

Brazil is substantially growing in the market. The growing manufacturing of commercial jets and strong government support for local aircraft manufacturing increase demand for aerospace materials. The increasing investment in the defense & commercial sector and the rise in modernization of commercial fleets require aerospace materials, supporting the overall market growth.

Recent Developments

- In October 2025, Hanwha Aerospace collaborated with KIMS to launch a Hanwha Materials Joint Research Centre to manufacture domestic aircraft engine materials. The centre develops heat-shield coatings, nickel, and titanium alloys by using forging and casting processes.(Source: defensemirror.com)

- In January 2025, PTC Industries introduced India’s first private sector vacuum arc remelting furnace for manufacturing aerospace-grade titanium. The annual melting capacity of the facility is 1500 metric tonnes, and high-quality titanium is widely used in airframes & jet manufacturing.(Source: defence.in )

- In May 2025, Defense Minister Rajnath Singh and UP’s Chief Minister Yogi Adityanath opened the world’s largest aerospace-grade superalloy and titanium unit in Lucknow. The annual capacity of the facility is 6000 tonnes, and technologies like EB, VIM, VAR, & PAM are present.(Source: timesofindia.indiatimes.com)

Top Companies List

- Alcoa Corporation: The company supplies advanced materials like nickel-based superalloy, aluminum, and titanium for the development of structural and jet engine components.

- Aleris Corporation: The company is a leading manufacturer of aluminum rolled products to support the development of aerospace components like landing gear parts, wing components, fuel adapters, fuseglass panels, and others.

- AMG Advanced Metallurgical Group: The company provides advanced vacuum furnace systems, specialty metals, and alloys for manufacturing critical aircraft components.

- AMI Metals: The company supplies materials like specialty metal products, aluminum, & titanium, and processing services like precision shearing, machining, sawing, & cutting for the development of aircraft components.

- Air Transport International, Inc.: The Ohio-based company provides passenger and cargo charter flights to transport aerospace components and materials globally.

Top Companies in the Aerospace Materials Market

- Avdel

- Constellium

- Solvay

- DOW

- Hexcel Corporation

- Hindalco - Almex Aerospace Limited

- Kaiser Aluminum

- KOBE STEEL, LTD

- Koninklijke Ten Cate bv.

- Lee Aerospace

- Materion Corporation

- PARK AEROSPACE CORP

- Renegade Materials Corporation

- SGL Carbon

- TATA Advanced Materials Limited

- Sofitec Aero, S.L.

Segments Covered

By Type

- Aluminum Alloys

- Steel Alloys

- Titanium Alloys

- Super Alloys

- Composite Materials

- Others

By Aircraft Type

- Commercial Aircraft

- Military Aircraft

- Business & General Aviation (BGA)

- Helicopter

- Other

By Application

- Interior

- Passenger Seating

- Galley

- Interior

- Panels

- Others

- Propulsion Systems

- Airframe

- Tail & Fin

- Windows & Windshields

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa