Content

U.S. Transparent Plastics Market Size and Share 2034

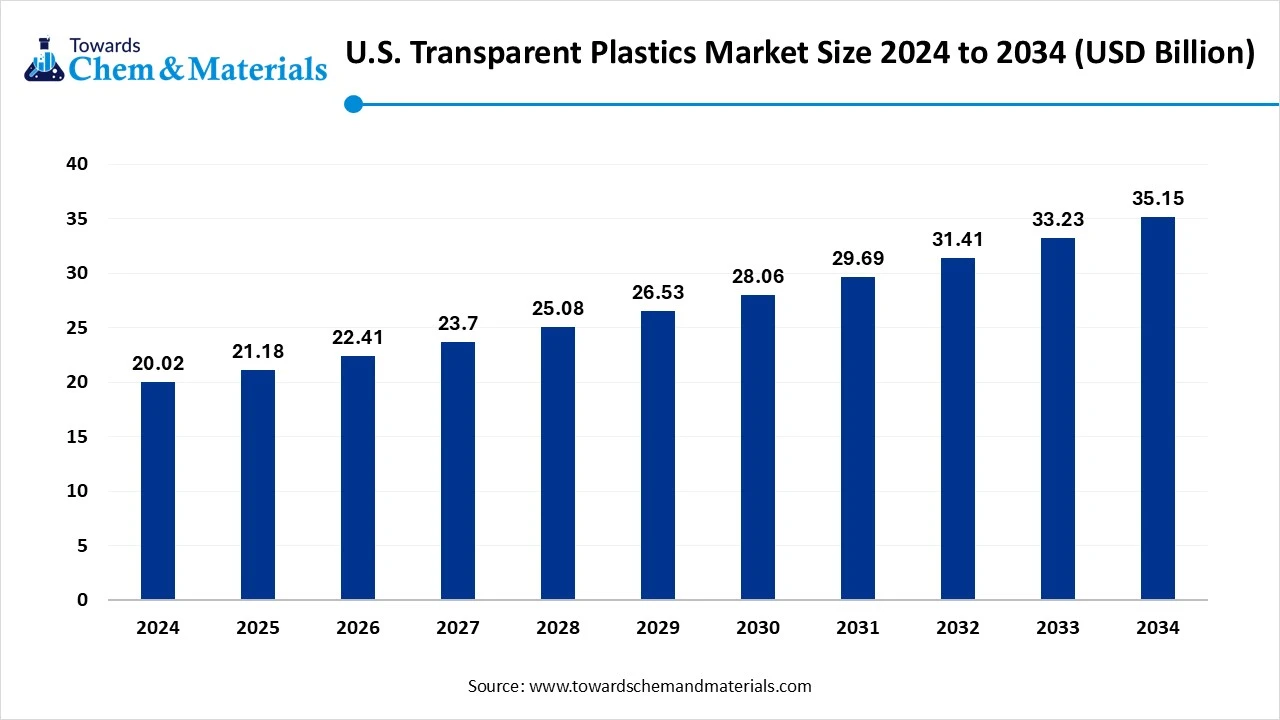

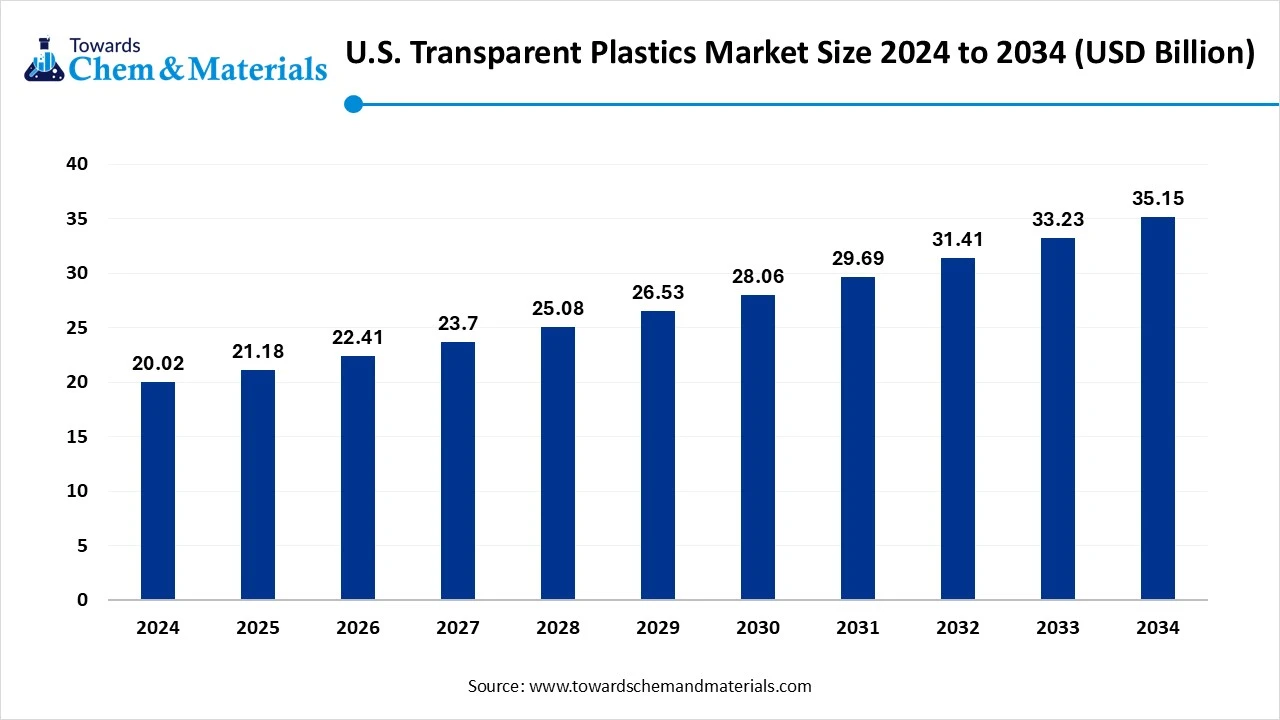

The U.S. transparent plastics market size was reached at USD 20.02 billion in 2024 and is expected to be worth around USD 35.15 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.79% over the forecast period 2025 to 2034. The growth of the market is driven by the increasing demand from the packaging industry, which supports the growth of the market in the country.

Key Takeaway

- By polymer type, the polycarbonate (PC) segment dominated the market in 2024. The polycarbonate (PC) segment held a 28% share in the market in 2024. It is used in the automotive industry due to its durability, which fuels the growth.

- By polymer type, the polymethyl methacrylate (PMMA) segment is expected to grow significantly in the market during the forecast period. Used due to its excellent optical transparency and surface hardness, influencing growth.

- By form, the rigid transparent plastics segment dominated the market in 2024. The rigid transparent plastics segment held a 68% share in the market in 2024. The high strength and stability drive the growth of the market.

- By form, the flexible transparent plastics segment is expected to grow in the forecast period. The excellent bendability and lightweight properties make it a preferred choice.

- By manufacturing process, the injection molding segment dominated the market in 2024. The injection molding segment held a 42% share in the market in 2024. Extensive use in medical devices supports the growth.

- By manufacturing process, the thermoforming segment is expected to grow in the forecast period. Good optical clarity makes it an ideal choice for various industries.

- By application, the packaging segment dominated the market in 2024. The packaging segment held a 37% share in the market in 2024. High clarity, impact resistance, and barrier properties influence the growth.

- By application, the automotive & transportation segment is expected to grow in the forecast period. Flexible design and a growing industry fuel the growth of the market.

- By end-use industry, the healthcare segment is expected to grow in the forecast period. The key properties and benefits support the growth of the market.

- By distribution channel, the direct sales to the OEMs segment dominated the market in 2024. The direct sales to the OEMs segment held a 57% share in the market in 2024. The supply and quality of application fuel the growth.

- By distribution services, the online industrial platforms segment is expected to grow in the forecast period. The convenience and affordability drive the growth of the market.

Market Overview

The U.S. transparent plastics market covers the domestic production, processing, and distribution of polymer materials that permit high light transmission with minimal scattering, offering optical clarity along with strength, lightweight properties, and design flexibility. In the U.S., transparent plastics are used extensively across packaging, construction, automotive, electronics, healthcare, and consumer goods, replacing glass in many applications due to their impact resistance, lower weight, and cost-effectiveness.

Major transparent plastics in the U.S. include Polycarbonate(PC), Polymethyl Methacrylate (PMMA), Polyvinyl Chloride (PVC), Polystyrene (PS), Polyethylene Terephthalate (PET), and Transparent Polypropylene (PP), produced through injection molding, extrusion, blow molding, thermoforming, and casting.

What Are The Key Growth Drivers That Support The Growth Of the U.S. Transparent Plastics Market?

The growth of the market is driven by the growing demand for packaging of food and beverages due to increased consumption, packaging of pharmaceuticals, and industrial products, which drives the demand and growth of the market. Growing demand for lightweight and durable materials from the automotive industry for enhancing fuel efficiency and overall performance of the vehicle. The consumer preference for authentic product presentation, cost-effectiveness, and durability also influences the growth. Technological advancements like innovation in application range, the growing e-commerce sector sustainability concerns fuel the growth of the market.

Market Trends

- The growing use of bio-based plastics and the development of biodegradable materials due to attention on sustainable alternatives to traditional practices.

- The growing demand for smart packaging solutions to enhance product visibility, shelf life, and consumer experience, and also plays a crucial role in influencing the growth.

- There's a growing trend toward using recycled transparent plastics to reduce waste and conserve resources.

- The growing healthcare application in medical packaging, implants, diagnostics, and other products to improve patient care and reduce costs influences the growth.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 21.18 billion |

| Expected Size by 2034 | USD 35.15 billion |

| Growth Rate from 2025 to 2034 | CAGR 5.79% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Type, By Feedstock Source, By Processing Technology, By End-Use Industry, By Distribution Channel, By Region |

| Key Companies Profiled | Dow Inc., Covestro AG, Eastman Chemical Company, SABIC, Arkema S.A., Mitsubishi Chemical Corporation, Evonik Industries AG, Sumitomo Chemical Co., Ltd., Teijin Limited, LG Chem Ltd |

Market Opportunity

What Are The Key Growth opportunities that support the Growth Of The U.S. Transparent Plastics Market?

The key growth opportunity that influences and supports the growth of the market is the smart packaging demand from food, beverages, and other consumer goods to enhance product visibility and shelf appeal, which results in growing demand for transparent plastics.

The demand for transparent plastics in smartphones, tablets, and devices increases the growth due to their properties and benefits, like flexibility, clarity, and durability, which fuel the growth of the market. The other key opportunities are growing demand from various industries like medical and healthcare, building and construction, automotive, and food and beverages. These factors fuel the growth and expansion of the market.

Market Challenge

What Are The Key Challenges That Hinder The Growth Of The U.S. Transparent Plastics Market?

The key challenge that hinders the growth of the market is the growing environmental concerns, raw material price volatility, regulatory compliance, and competition from alternative materials. Market maturity and saturation, and recycling challenges are some of the major and crucial challenges that limit the growth and expansion of the market.

U.S. Transparent Plastics Market - Value Chain Analysis

Chemical Synthesis and Processing

The transparent plastics are synthesised and processed through extraction, injection molding, calendaring, casting, and chemical recycling.

- Key players Emco Industrial Plastics, Inc., CS Hyde Company, Trident Plastics Inc: Industrial Plastic Supply, Inc

Quality Testing and Certification

The transparent plastics require plastic-free certification, which is offered by Control Union.

- Key players: ASTM International and UL Solutions

Distribution to Industrial Users

The transparent plastics are distributed to the packaging, automotive, electronics, and construction industries.

- Key players: Architectural Plastics Inc. and Arkay Plastics Inc.

Segmental Insights

Which Product Type Segment Dominated The U.S. Transparent Plastics Market In 2024?

By Polymer Type

The polycarbonate (PC) segment dominated the U.S. transparent plastics market in 2024. Polycarbonate is widely used in the US transparent plastics market due to its exceptional impact resistance, optical clarity, and heat tolerance. It finds applications in automotive glazing, protective equipment, medical devices, and construction materials. Its shatterproof properties make it a preferred substitute for glass in safety-critical applications. The demand is supported by the growing adoption of electric vehicles, aerospace interiors, and electronics, where lightweight yet durable transparent materials are essential.

The polymethyl methacrylate (PMMA) segment expects significant growth in the U.S. transparent plastics market during the forecast period. PMMA is a prominent polymer in the US transparent plastics market, valued for its high light transmittance, weather resistance, and ease of processing. It is commonly used in signage, lighting fixtures, aquariums, and automotive light covers. Its lightweight nature and resistance to yellowing enhance durability in outdoor applications. Growth is fueled by construction projects, retail displays, and the increasing need for aesthetic yet functional transparent materials in architectural and consumer goods.

By Form

How did the Rigid Transparent Plastics Segment dominate the U.S. Transparent Plastics Market in 2024?

The rigid transparent plastics segment dominated the U.S. transparent plastics market in 2024. Rigid transparent plastics dominate applications requiring structural integrity and high dimensional stability in the US. They are used extensively in packaging, automotive windshields, medical equipment, and consumer electronics. Their robustness ensures long service life and protection for sensitive products. Demand is driven by stringent safety regulations, the trend toward lightweighting, and advancements in extrusion and molding technologies that improve clarity, strength, and chemical resistance across various industries.

The flexible transparent plastics segment expects significant growth in the U.S. transparent plastics market during the forecast period. Flexible transparent plastics offer adaptability, lightweight handling, and resilience in bending or folding applications. In the US market, they are used for flexible packaging films, protective coverings, and soft-touch automotive interiors. These materials maintain clarity while withstanding repeated stress and are preferred in food packaging, medical pouches, and flexible displays. Demand growth is tied to e-commerce packaging needs and innovation in biobased and recyclable flexible film technologies.

By Manufacturing Process

Which Manufacturing Process Segment Dominated The U.S. Transparent Plastics Market In 2024?

The injection molding segment dominated the U.S. transparent plastics market in 2024. Injection molding is a key manufacturing process for transparent plastics in the US, enabling high-volume production of precise, complex shapes with excellent optical properties. Used for automotive lenses, consumer electronics housings, and medical components, this method supports diverse polymer grades, including polycarbonate and PMMA. Its efficiency and scalability make it popular among OEMs, with technological advancements further improving mold design, cycle times, and product transparency.

The thermoforming segment expects significant growth in the U.S. transparent plastics market during the forecast period. Thermoforming is increasingly used in the US transparent plastics market for producing large, lightweight components like packaging trays, signage panels, and vehicle interiors. This process offers cost-effective production with lower tooling investment compared to injection molding. It supports a variety of transparent polymer sheets and enables rapid prototyping. Growth is driven by demand for customized packaging, point-of-sale displays, and quick turnaround solutions in consumer and industrial applications.

By Application

How did the Packaging Segment dominate the U.S. Transparent Plastics Market in 2024?

The packaging segment dominated the U.S. transparent plastics market in 2024. Packaging is one of the largest application segments for transparent plastics in the US, covering food containers, blister packs, and retail product displays. Transparency enhances product visibility, influencing consumer purchasing decisions. Growth is supported by innovations in sustainable materials, tamper-evident designs, and e-commerce packaging needs. Both rigid and flexible transparent plastics are widely adopted to balance durability, clarity, and cost-effectiveness in consumer goods, healthcare, and electronics packaging.

The automotive & transportation segment expects significant growth in the U.S. transparent plastics market during the forecast period. In the US, transparent plastics are used in automotive glazing, lighting systems, instrument panels, and interior components. They offer weight reduction, impact resistance, and design flexibility compared to glass. Increasing adoption of electric vehicles and autonomous driving technologies is driving demand for high-performance transparent materials that meet safety, UV resistance, and aesthetic requirements. The segment also benefits from advances in coatings that enhance scratch resistance and durability.

By End-Use Industry

The healthcare segment dominated the U.S. transparent plastics market in 2024. The growth of the market is driven by the growing healthcare sector in the country, which increases the demand for transparent plastics for medical devices, implants, and other pharmaceutical product packaging, which increases the growth and demand for the market. The growing benefits and properties of transparent plastic make it a preferred choice, like strength, durability, and resistance. These factors contribute to the growth and expansion of the market.

By Distribution Channel

Which Distribution Channel Segment Dominated The U.S. Transparent Plastics Market In 2024?

The direct sales to the OEMs segment dominated the U.S. transparent plastics market in 2024. Direct sales to OEMs form a significant distribution channel in the US transparent plastics market, enabling manufacturers to supply tailored solutions directly to automotive, electronics, and medical device companies. This approach fosters strong supplier–client relationships, customization, and consistent quality control. It also allows integration into long-term contracts, ensuring stable demand. Large-scale OEMs prefer direct procurement for efficiency, cost management, and better technical support during product development stages.

The online industrial platforms segment expects significant growth in the U.S. transparent plastics market during the forecast period. Online industrial platforms are becoming a preferred channel in the US transparent plastics market, offering buyers instant access to multiple suppliers, price comparisons, and technical resources. These platforms cater to industries from packaging to electronics, enabling faster procurement cycles and competitive sourcing. SMEs and large corporations alike benefit from reduced lead times, global supplier networks, and transparency in transactions, making digital procurement increasingly influential in the sector.

Recent Developments

- In May 2025, Borealis launched HC609TF, a new high-stiffness polypropylene (PP) homopolymer which is formulated and designed for packaging and is used such as trays, cups, and containers. The company reported that this material combined enhanced stiffness, high transparency, and good processability, leading to up to a 10% reduction in manufacturing cycle times and improved efficiency.(Source: www.borealisgroup.com)

Top Companies List

- Dow Inc.

- Covestro AG

- Eastman Chemical Company

- SABIC, Arkema S.A.

- Mitsubishi Chemical Corporation

- Evonik Industries AG

- Sumitomo Chemical Co., Ltd.

- Teijin Limited

- LG Chem Ltd

Segments Covered:

By Polymer Type

- Polycarbonate (PC)

- Polymethyl Methacrylate (PMMA)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Transparent Polypropylene (PP)

- Others (COP/COC, TPU, etc.)

By Form

- Rigid Transparent Plastics

- Flexible Transparent Plastics

By Manufacturing Process

- Injection Molding

- Extrusion

- Blow Molding

- Thermoforming

- Casting

By Application

- Packaging (food, beverage, cosmetics, pharmaceuticals)

- Building & Construction (windows, skylights, panels)

- Automotive & Transportation (windshields, lighting, interiors)

- Electrical & Electronics (screens, covers, lenses)

- Medical & Healthcare (syringes, diagnostic devices)

- Consumer Goods (furniture, eyewear, sports equipment)

By End-Use Industry

- Packaging

- Construction

- Automotive

- Electrical & Electronics

- Healthcare

- Consumer Products

By Distribution Channel

- Direct Sales to OEMs

- Plastic Resin Distributors

- Online Industrial Platforms

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait