Content

U.S. Sustainable Chemicals Market Size, Share, Trends and Forecasts 2034

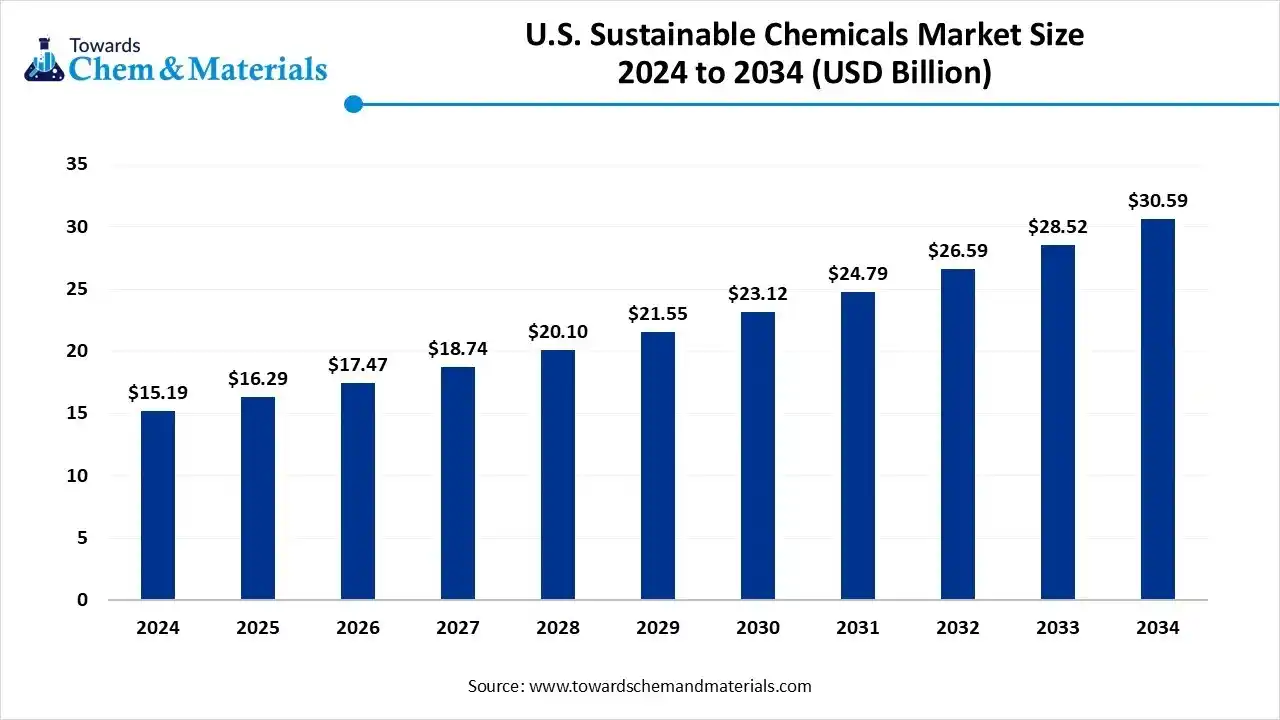

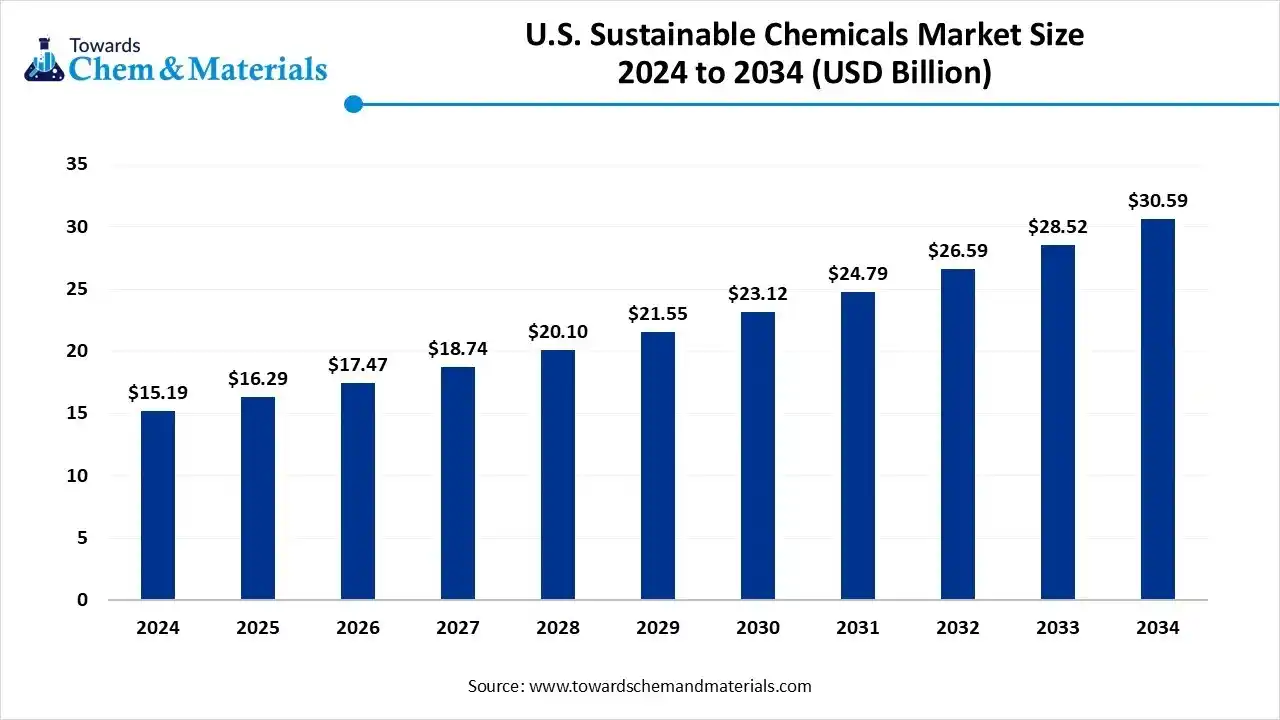

The U.S. sustainable chemicals market size was reached at USD 15.19 billion in 2024 and is expected to be worth around USD 30.59 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.25 over the forecast period 2025 to 2034. The rising shift towards green chemistry and carbon emission has driven investor confidence in the industry’s future.

Key Takeaways

- By product type, the biobased polymers segment led the market with approximately 24% industry share in 2024.

- By product type, the CO₂-derived chemicals segment is expected to grow at the fastest rate in the market during the forecast period.

- By application/end use type, the packaging segment emerged as the top-performing segment in the market with approximately 29% of the industry share in 2024.

- By application/end use type, the personal care & cosmetics segment is expected to lead the market in the coming years.

- By feedstock resource, the starch and sugar crop segment led the market with approximately 31% share in 2024.

- By feedstock resource, the lignocellulosic biomass segment is expected to capture the biggest portion of the market in the coming years.

- By production technology, the fermentation & biochemical conversion segment led the U.S. sustainable chemicals market with approximately 36% industry share in 2024.

- By production technology, the electrochemical synthesis segment is expected to grow at the fastest rate in the market during the forecast period.

- By sustainability attribute, the certified biobased content segment led the market with approximately 38% industry share in 2024.

- By sustainability attribute, the recycled content certified segment is expected to grow at the fastest rate in the market during the forecast period.

What is Sustainable Chemical?

The chemical, which is made by eco-friendly materials and methods, which are aimed at reducing harm to people and promoting eco-friendliness, is known as a sustainable chemical. Furthermore, these chemicals have mainly come from renewable sources such as algae, plants, and recycled waste instead of traditional petroleum.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 16.29 Billion |

| Expected Size by 2034 | USD 30.59 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Application / End-Use Industry, By Feedstock Source, By Production Technology, By Sustainability Attribute |

| Key Companies Profiled | Evonik Industries, LyondellBasell , Archer Daniels Midland (ADM) , Cargill (bio-chemicals) , NatureWorks , Amyris , Gevo , Solugen , Genomatica , Novozymes , Solvay , Lonza , Ingredion , Avient Corporation , Huntsman Corporation. |

U.S. Sustainable Chemicals Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the regional brands are seen shifting towards a greener production system in recent years. Moreover, the factors such as the greater government push with attractive incentives, sustainability promotion and goals, and consumer awareness are positioning the industry for long-term expansion in the current period.

- Sustainability Trends: The country’s initiative for the reduction of carbon footprint and green sourcing has enabled the sector to explore untapped potential in recent years. Moreover, the chemical manufacturers have been seen in creating partnerships with waste management firms for better resourcing in recent years in the United States.

- Global Expansion: The U.S sustainable chemical manufacturer is heavily exporting the modern green technologies globally. Also, several manufacturers have been collaborating on cross-border innovation in recent years. Furthermore, the nation has been heavily attracting foreign funding for the local biorefineries and emerging startups in the past few years.

Key Technological Shifts in the U.S. Sustainable Chemicals Market:

The U.S. sustainable chemical industry has experienced a greater shift from regular bioprocessing synthesis to AI-driven approaches in recent years. Furthermore, the manufacturers have senn in replacing their traditional reactor with the fermentation systems in the United States nowadays. Furthermore, the advanced technology is actively seen in helping manufacturers to quickly discover low-toxicity and biodegradable materials by predicting their molecular behaviours, as per the recent survey.

Trade Analysis of the U.S. Sustainable Chemicals Market: Import & Export Statistics

- The United States has exported a significant amount of organic chemicals in 2024. The estimated export value in US$51.88 billion as per the report.(Source: tradingeconomics.com)

Valus Chain Analysis Of The U.S. Sustainable Chemicals Market:

- Distribution to Industrial Users: The distributors of sustainable chemicals in the United States are offering various sustainable alternatives via digital platforms.

- Key Players: Azelis and Univar Solutions

- Chemical Synthesis and Processing: The chemical synthesis and the processing of the sustainable chemicals in the United States include processes like biomass and CO2 conversion.

- Regulatory Compliance and Safety Monitoring : The safety and regulatory process of sustainable chemicals is mainly under the Toxic Substances Control Act of the United States, as per the reports.

U.S. Sustainable Chemicals Market’s Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | Environmental Protection Agency (EPA) and Occupational Safety and Health Administration (OSHA) | Toxic Substances Control Act (TSCA) | Risk evaluation of existing chemicals | The agencies are focusing on prioritizing and evaluating existing chemicals for unreasonable risks to human health and the environment. |

Segmental Insights

Product Type Insights

How did the Biobased Polymer Segment Dominate the U.S. Sustainable Chemicals Market in 2024?

The bio-based polymer segment held approximately 24% share of the market in 2024, due to its wide usage in the different sectors such as textiles, packaging, and consumer goods in recent years. Furthermore, having easier convenience like it can replace traditional plastic without any major process changes, and is likely to maintain segment dominance in the upcoming years, as per the industry expectations.

The CO2-derived chemicals segment is expected to grow at a notable rate during the predicted timeframe, owing to the ongoing trend toward carbon neutrality in the United States. Also, the nation is witnessing a greater technology shift, which is likely to create lucrative opportunities for the new industry entrants. Also, the CO2-derived segment is expected to gain major industry share in this transitional shift of the country, as per industry expectations.

Application/ End Use Insights

Why does the Packaging Segment Dominate the U.S. Sustainable Chemicals Market?

The packaging segment held approximately 29% of the U.S. sustainable chemicals market in 2024 because it is the most visible and fastest-growing area of sustainability action. Large consumer brands and retailers are replacing conventional plastics with bio-based or compostable materials to meet eco-packaging goals. The rise of e-commerce and food delivery has created huge demand for biodegradable packaging that reduces waste.

The personal care and cosmetics segment is expected to grow at a notable rate due to growing demand for clean, non-toxic, and eco-friendly products. Consumers now prefer formulations made from renewable, plant-based ingredients rather than synthetic chemicals. Major beauty brands are reformulating products using bio-derived surfactants, natural emollients, and biodegradable packaging.

Feedstock Source Insights

How Did The Starch And Sugar Crops Segment Dominate The U.S. Sustainable Chemicals Market In 2024?

The starch and sugar crops segment dominated the market with approximately 31% share in 2024, because they are abundant, affordable, and easy to process into bio-based raw materials. Com, sugarcane, and beet-derived sugars are widely used to produce bioethanol, lactic acid, and other intermediates for bioplastics and green solvents. These feedstocks offer consistent yields and strong supply chains, making them reliable for large-scale production.

The lignocellulosic biomass segment is expected to grow at a significant rate due to its long-term sustainability and low environmental footprint. Unlike food-based feedstocks, it doesn't compete with agriculture or require large farmland. Emerging biorefineries are developing efficient ways to extract valuable chemicals and fuels from cellulose and lignin.

Production Technology Insights

Why does the Fermentation and Biochemical Conversion Segment Dominate the U.S. Sustainable Chemicals Market by Production Technology?

The fermentation and biochemical conversion segment held approximately 36% of the U.S. sustainable chemicals market in 2024 due to its long-term sustainability and low environmental footprint. Unlike food-based feedstocks, it doesn't compete with agriculture or require large farmland. Emerging biorefineries are developing efficient ways to extract valuable chemicals and fuels from cellulose and lignin.

The electrochemical synthesis segment is expected to grow at a notable rate due to its long-term sustainability and low environmental footprint. Unlike food-based feedstocks, it doesn't compete with agriculture or require large farmland. Emerging biorefineries are developing efficient ways to extract valuable chemicals and fuels from cellulose and lignin.

Sustainability Attribute Insights

How Did The Certified Biobased Content Segment Dominate The U.S. Sustainable Chemicals Market In 2024?

The certified biobased content segment dominated the market with approximately 38% share in 2024, because it provides credibility and transparency to eco-friendly claims. Certifications like USDA BioPreferred assure buyers that a product is genuinely derived from renewable biological sources. This helps companies attract environmentally conscious consumers and meet regulatory and corporate sustainability targets.

The recycled content certified segment is expected to grow at a significant rate as circular economy goals become central to corporate strategies. Instead of only focusing on renewables, companies are now emphasizing reuse and closed-loop material cycles. Verified recycled content ensures that products help reduce waste and resource consumption.

Country-level Investments & Funding Trends for the U.S. Sustainable Chemical Industry:

- The United States Department of Energy has announced that it will release US$1.2 billion in funds for the chemical and refining companies in the United States in recent years. The aim behind the investment is to reduce carbon emissions in manufacturing.(Source: www.indianchemicalnews.com)

Recent Development

- In July 2025, the Gordon and Betty Moore Foundation invested $100 million for the green chemistry initiative, and it will participate in green engineering in the United States as per the published report.(Source: www.chemistryworld.com)

Top Vendors in the U.S. Sustainable Chemicals Market & Their Offerings:

- Dow: An American multinational chemical corporation that is the operating subsidiary of Dow Inc.

- DuPont (DD): A global specialty chemicals company that spun off from DowDuPont in 2019. It focuses on specialty chemical production.

- Eastman Chemical Company: A worldwide specialty materials organization. It produces a range of products for everyday use, with a focus on higher-margin, specialty offerings.

- BASF: A German multinational chemical company headquartered in Ludwigshafen, Germany.

Other Key Players

- Evonik Industries

- LyondellBasell

- Archer Daniels Midland (ADM)

- Cargill (bio-chemicals)

- NatureWorks

- Amyris

- Gevo

- Solugen

- Genomatica

- Novozymes

- Solvay

- Lonza

- Ingredion

- Avient Corporation

- Huntsman Corporation.

Segments Covered in the Report:

By Product Type

- Bio-based polymers (PLA, PHA, bio-PE, bio-PET)

- Biobased monomers & intermediates (bio-ethylene, bio-propylene, bio-BDO)

- Green solvents (bio-ethanol, ethyl lactate, ionic liquids)

- Biosurfactants & bio-emulsifiers

- Biobased adhesives & sealants

- Biobased coatings & resins (bio-epoxy, alkyd alternatives)

- Agricultural biochemicals (bio-pesticides, bio-stimulants)

- Natural pigments & dyes (plant-based, low-impact synthetics)

- Recycled-content chemicals (depolymerized monomers, chemical recycling outputs)

- CO₂-derived chemicals (formic acid, methanol, polyols)

- Industrial enzymes & biocatalysts

- Green water-treatment chemicals (bio-flocculants, biodegradable coagulants)

- Biobased additives & stabilizers (plasticizers, antioxidants, UV stabilizers)

By Application / End-Use Industry

- Packaging

- Personal care & cosmetics

- Household & industrial cleaning

- Agriculture

- Paints, coatings & inks

- Automotive

- Textiles & apparel

- Construction materials

- Electronics & semiconductors

- Pharmaceuticals & nutraceuticals

- Food & beverages

- Oil & gas

- Pulp & paper

- Water & wastewater treatment

By Feedstock Source

- Starch & sugar crops (corn, sugarcane)

- Lignocellulosic biomass (wood, agri-residues)

- Vegetable oils & fats (soy, canola, algae oils)

- Algae & microalgae biomass

- Industrial & municipal waste (plastics, waste oils)

- Captured CO₂ and C1 feedstocks

- Microbial fermentation pathways (engineered microbes, synthetic biology)

By Production Technology

- Fermentation & biochemical conversion

- Enzymatic synthesis/biocatalysis

- Thermochemical conversion (pyrolysis, gasification)

- Catalytic hydrogenation & upgrading

- Electrochemical synthesis (CO₂ utilization, green routes)

- Chemical recycling (depolymerization, solvolysis, pyrolysis recycling)

- Process intensification (continuous flow, solventless)

By Sustainability Attribute

- Certified bio-based content

- Biodegradable/compostable certified

- Low carbon-footprint certified

- Recycled-content certified

- Non-toxic / safer-chemicals compliant (EPA Safer Choice, GreenScreen)

- Low-VOC certified