Content

What is the Current Sustainable Fuel Market Size and Volume?

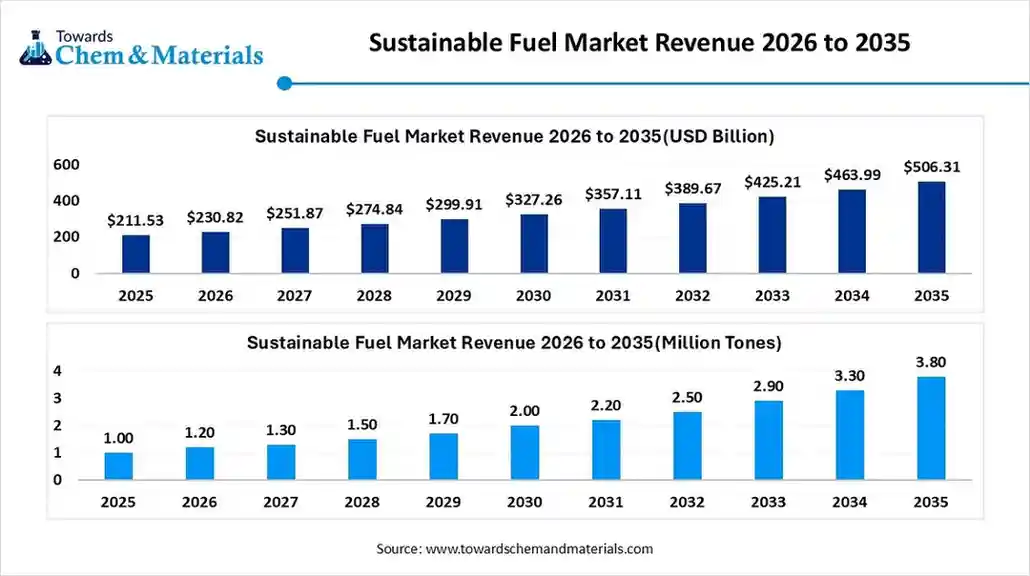

The global sustainable fuel market volume was 1 million tons in 2025 and is predicted to increase from 1.20 million tons in 2026 and is expected to be worth around 3.80 million tons by 2035, exhibiting a compound annual growth rate (CAGR) of 14.12% over the forecast period from 2026 to 2035. North America dominated the sustainable fuel market with the largest revenue volume share of 35.91% in 2025.

The global sustainable fuel market size was valued at USD 211.53 billion in 2025 and is expected to hit around USD 506.31 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 9.12% over the forecast period from 2026 to 2035. The growing consumer demand for green logistics, technological innovation, expanding renewable energy grids, and economic benefits drive the growth of the market.

Key Takeaways

- By region, North America dominated the global sustainable fuel market with a volume share of 35.91% in 2025. Strong presence and demand fuel the growth of the market.

- By region, Asia Pacific is expected to have fastest growth in the market in the forecast period between 2026 and 2035. urbanization, and government-led clean energy initiatives fuel the growth of the market.

- By fuel type, the biofuels segment dominated the market with a volume share of 80% in 2025. Their compatibility makes it a preferred choice for the market.

- By fuel type, the hydrogen-based fuels segment is projected to grow at a CAGR between 2026 and 2035. Green hydrogen, produced using renewable electricity, is gaining traction for fuel cell vehicles and sustainable aviation fuel pathways.

- By technology, the hydro-processing segment dominated the market with a volume share of 58% in 2025. Its scalability and ability to utilize diverse feedstocks influence the adoption and growth.

- By technology, the electrochemical/synthetic segment is projected to grow at a CAGR between 2026 and 2035. gaining attention for long-haul aviation and shipping, where electrification is limited.

- By source, the crop-based segment dominated the market with a volume share of 52% in 2025. Strong agricultural output drives the growth.

- By source, the waste-based segment is projected to grow at a CAGR between 2026 and 2035. Renewable energy expansion fuels the growth of the market.

- By end-use, the road transportation segment dominated the market with a volume share of 68% in 2025. The sustainability initiatives drive the growth of the market.

- By end-use, the aviation segment is projected to grow at a CAGR between 2026 and 2035. Net-zero commitments, regulatory mandates further propel the growth.

Market Overview

What Is The Significance Of The Sustainable Fuel Market?

The significance of the sustainable fuel market lies in its crucial role for decarbonizing hard-to-abate sectors like aviation, shipping, and heavy transport, offering a pathway to net-zero goals by complementing electrification, enhancing energy security through domestic production, and driving economic growth with new jobs, all while significantly reducing greenhouse gas (GHG) emissions and improving air quality compared to fossil fuels. It creates a closed carbon loop, as the CO2 released during combustion was previously absorbed from the air, preventing net atmospheric increase.

The market involves the production and scaling of low-carbon alternatives to fossil fuels, utilizing renewable feedstocks or renewable electricity to provide "drop-in" energy solutions for the aviation, marine, and heavy transport sectors.

Sustainable Fuel Market Growth Trends:

- Surge in Sustainable Aviation Fuel (SAF): SAF is a major growth area, with strong demand from airlines facing emission targets, using HEFA and synthetic pathways.

- Rise of Hydrogen & E-fuels: Green hydrogen and Power-to-Liquid e-fuels are rapidly growing, especially for heavy transport, powered by renewable electricity.

- Technological Innovation: Focus on efficient production methods like gasification, pyrolysis, Fischer-Tropsch, and advanced fermentation for e-fuels and biofuels.

- Policy & Investment: Strong government support and corporate pledges are crucial, with significant global investment pouring into the sector.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | 1.2 Million Tons |

| Revenue Forecast in 2035 | 3.8 Million Tons |

| Growth Rate | CAGR 14.12% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | North America |

| Segment Covered | By Fuel Type, By Feedstock Source, By Process/Technology, By End-Use Application , By Regions |

| Key companies profiled | Neste Corporation, BP plc, Shell plc, TotalEnergies SE, Chevron Corporation, Eni S.p.A. , Valero Energy Corporation , World Energy , LanzaJet / LanzaTech , Gevo, Inc. , SkyNRG B.V. , Diamond Green Diesel , Marathon Petroleum Corporation , Phillips 66 , Aemetis, Inc. , Prometheus Fuels , HIF Global , Air Liquide , Topsoe (Haldor Topsoe) , Sunfire GmbH |

Key Technological Shifts In The Sustainable Fuel Market:

The market is undergoing a significant transformation driven by a need to decarbonize "hard-to-abate" sectors like aviation and shipping. Key technological shifts involve moving beyond traditional, first-generation biofuels to more advanced, scalable, and genuinely low-carbon solutions, primarily focusing on advanced biofuels, hydrogen, and e-fuels.

Trade Analysis Of the Sustainable Fuel Market: Import & Export Statistics

- According to Global Export data, the world shipped 312 shipments of Green Gas from June 2024 to May 2025. These were sent by 76 exporters to 59 buyers, reflecting a 58% increase compared to the previous twelve months.

- Most Green Gas exports from the world destined to the United States, Uzbekistan, and the United Arab Emirates.

- Globally, the leading exporters of Green Gas are Colombia, China, and the United States. Colombia is the top exporter with 238 shipments, followed by China with 230 shipments and the United States with 225 shipments.

- According to India Export data, India exported 7,596 shipments of Fuel from June 2024 to May 2025. These exports handled by 389 Indian exporters to 859 buyers, with a 27% growth compared to the previous year.

- Most Fuel exports from India focus on Botswana, the United States, and Bhutan.

- The top three global Fuel exporters are the Ivory Coast, the United States, and Russia. Ivory Coast leads with 69,077 shipments, followed by the United States with 52,508 shipments, and Russia with 48,824 shipments.

Sustainable Fuel Market Value Chain Analysis

- Production and Processing : Sustainable fuels are produced through processes such as biomass conversion, hydroprocessing of vegetable oils and waste fats, Fischer–Tropsch synthesis, alcohol-to-jet pathways, anaerobic digestion, and power-to-liquid technologies.

- Key players: Neste, TotalEnergies, Shell Plc, BP, LanzaJet.

- Quality Testing and Certification: Sustainable fuels require certifications validating fuel quality, carbon intensity reduction, sustainability of feedstocks, and regulatory compliance. Key certifications include ASTM fuel standards, ISCC certification, Roundtable on Sustainable Biomaterials (RSB), EU RED II compliance, and lifecycle emissions verification.

- Key players: ASTM International, ISCC, RSB, UL Solutions

- Distribution to Industrial Users: Sustainable fuels are distributed to aviation, road transportation, marine shipping, power generation, and industrial energy consumers through fuel suppliers, pipeline networks, blending terminals, and long-term offtake agreements.

- Key players: Neste, Shell Plc, TotalEnergies, BP.

Sustainable Fuel Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| North America (USA & Canada) | U.S. EPA; U.S. DOE; USDA; Environment and Climate Change Canada (ECCC) | Renewable Fuel Standard (RFS) (USA) Inflation Reduction Act (Clean Fuel Credits) (USA) Federal and State Low Carbon Fuel Standards (e.g., California LCFS) Canada Clean Fuel Standard (CFS) |

Biofuel blending mandates Renewable identification/carbon intensity credit markets Production & lifecycle GHG reduction |

The U.S. RFS sets renewable volume obligations; LCFS/CFS drive low-carbon intensity fuels like renewable diesel and SAF. Federal incentives (IRA) accelerate investment. |

| European Union | European Commission; EEA; ECHA; Member State agencies | Renewable Energy Directive (RED II / RED III) Fuel Quality Directive (FQD) EU ETS and Effort Sharing Regulation ReFuelEU Aviation & FuelEU Maritime |

Renewable energy share targets Sustainability & GHG reduction criteria SAF and advanced fuel mandates Certification (e.g., REDcert / ISCC) |

EU mandates increasing renewable energy and low-carbon fuels across transport, aviation, and shipping. Strong sustainability, reporting, and certification requirements. |

| Asia Pacific | China NDRC / MEE; India MoPNG / MoEFCC; Japan METI / MOE; Australia DCCEEW | China Biofuel & Renewable Energy Plans India Ethanol Blending Programme (EBP) Japan Biomass Nippon Strategy Australian Renewable Energy Target (RET) / Clean Energy Regulations |

Ethanol blending (E10+), renewable diesel, SAF pilots Feedstock diversification Lifecycle emissions |

India is targeting higher ethanol blends (E20+). China is expanding regional blending mandates; Japan and Australia support renewable fuels through strategies and incentives. |

| South America | Brazil ANP; Argentina Ministry of Energy; Chile Ministry of Energy | RenovaBio (Brazil) National biofuel policies |

Biofuel blending mandates Decarbonization credit systems Sugarcane ethanol leadership |

Brazil’s RenovaBio creates tradeable decarbonization credits; strong ethanol and biodiesel mandates. Other countries are expanding national blending and incentive frameworks. |

| Middle East & Africa | National Energy & Environmental Ministries; UAE MOCCAE; South African DFFE | Emerging national renewable/low-carbon fuel policies | Fuel diversification Pilot SAF and low-carbon fuel programs Import standards |

The region is early in regulatory development, but is increasingly exploring SAF and renewable diesel; Saudi Vision 2030 and UAE green strategies include sustainable fuels. |

Segmental Insights

Product Type Insights

Which Fuel Type Segment Dominated The Sustainable Fuel Market In 2025?

The biofuels segment dominated the market, accounting for an 80% share in 2025. Biofuels represent a foundational segment of the market, driven by their compatibility with existing internal combustion engines and fuel infrastructure. Produced from biomass sources such as crops, agricultural residues, and waste oils, biofuels, including bioethanol, biodiesel, and renewable diesel, support carbon reduction targets. Government blending mandates, especially in transportation fuels, and advancements in second-generation biofuels are strengthening long-term market adoption.

The hydrogen-based fuels segment is projected to grow at a CAGR between 2026 and 2035 in the market. Hydrogen-based fuels are emerging as a high-potential segment due to their zero-emission combustion profile and applicability across mobility and industrial energy systems. Green hydrogen produced using renewable electricity is gaining traction for fuel cell vehicles and sustainable aviation fuel pathways. High production costs and infrastructure limitations remain challenges, but strong policy backing and investment momentum are accelerating commercialization.

Sustainable Fuel Market Volume and Share, By Product Type, 2025- 2035 (%)

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Biofuels (Liquid & Gaseous) | 80.00% | 0.8 | 2.9 | 15.15% | 76.01% |

| Hydrogen-Based Fuels | 14.00% | 0.1 | 0.6 | 17.72% | 16.23% |

| Synthetic Fuels | 6.00% | 0.1 | 0.3 | 19.16% | 7.76% |

Technology Insights

How did the Hydro-Processing Segment Dominate the Sustainable Fuel Market in 2025?

The hydro-processing segment dominated the market, accounting for a 58% share in 2025. Hydroprocessing technology plays a critical role in converting bio-based feedstocks into drop-in sustainable fuels such as renewable diesel and sustainable aviation fuel. This technology enables compatibility with existing refinery infrastructure while delivering fuels with superior performance characteristics. Its scalability and ability to utilize diverse feedstocks make hydroprocessing a preferred route for large-scale sustainable fuel production.

The electrochemical/synthetic segment is projected to grow at a CAGR between 2026 and 2035 in the sustainable fuel market. Electrochemical and synthetic fuel technologies involve converting captured CO₂ and green hydrogen into liquid fuels using advanced catalytic and power-to-liquid processes. Although currently capital-intensive, continuous improvements in electrolyzer efficiency and declining renewable energy costs are enhancing long-term viability.

Source Insights

Which Source Segment Dominated The Sustainable Fuel Market In 2025?

The crop-based segment dominated the market, accounting for a 52% share in 2025. Crop-based feedstocks such as corn, sugarcane, and oilseeds remain widely used due to their established supply chains and processing technologies. These sources support large-scale biofuel production, particularly in regions with strong agricultural output. However, sustainability concerns related to land use and food security are driving innovation toward improved yields and alternative non-food crop solutions.

The waste-based segment is projected to grow at a CAGR between 2026 and 2035 in the sustainable fuel market. Water-based sources, primarily associated with green hydrogen production through electrolysis, represent a rapidly expanding segment. Leveraging renewable electricity to split water into hydrogen and oxygen, this source offers a low-carbon pathway for fuel production. Its growth is closely linked to renewable energy expansion, electrolyzer deployment, and government-backed hydrogen strategies worldwide.

End-Use Insights

How did the Road Transportation Segment Dominate the Sustainable Fuel Market in 2025?

The road transportation segment dominated the market, accounting for a 68% share in 2025. Road transportation is the largest end-use segment for sustainable fuels, driven by blending mandates, emissions regulations, and fleet decarbonization goals. Biofuels and hydrogen are increasingly adopted in transport. The ability to integrate sustainable fuels with existing vehicle technologies supports near-term emissions reductions while enabling a gradual transition to cleaner mobility systems.

The aviation segment is projected to grow at a CAGR between 2026 and 2035 in the sustainable fuel market. Aviation represents a high-growth end-use segment due to the urgent need for decarbonization in long-haul air travel. Sustainable aviation fuels derived from bio-based and synthetic pathways are critical for reducing lifecycle emissions. Airline net-zero commitments, regulatory mandates, and long-term offtake agreements are accelerating demand, making aviation a strategic focus area within the market.

Regional Insights

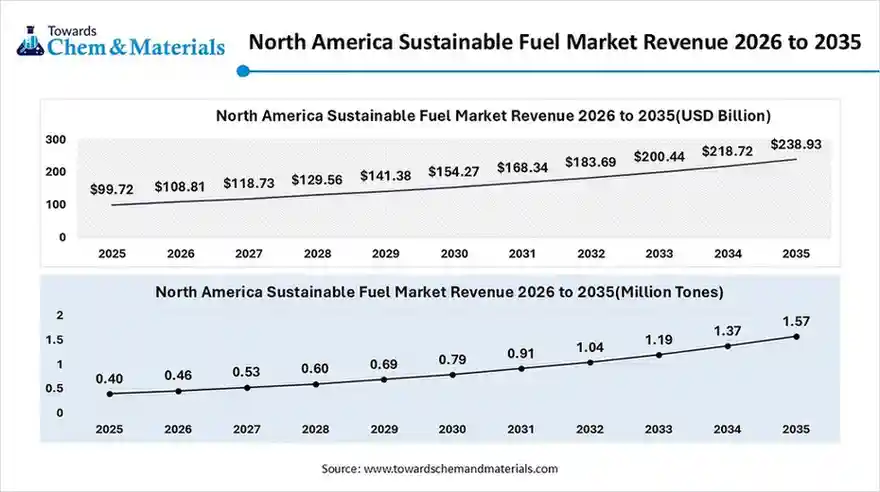

The North America sustainable fuel market size was valued at USD 99.72 billion in 2025 and is expected to surpass around USD 238.93 billion by 2035, expanding at a compound annual growth rate (CAGR) of 9.14% over the forecast period from 2026 to 2035. North America dominated the market with a share of 41% in 2025.

The North America sustainable fuel market volume was valued at 0.40 million tons in 2025 and is expected to be worth around 1.57million tons by 2035, exhibiting at a compound annual growth rate (CAGR) of 13.57% over the forecast period from 2026 to 2035.

North America represents a mature and innovation-driven sustainable fuel market, supported by strong policy frameworks, carbon reduction mandates, and large-scale investments in renewable energy and alternative fuels. The region shows high adoption of biofuels, sustainable aviation fuel (SAF), renewable diesel, and green hydrogen, driven by transportation decarbonization goals and corporate sustainability commitments across energy, aviation, and logistics sectors.

United States: Sustainable Fuel Market Growth Trends

The U.S. leads the North American sustainable fuel market due to federal programs such as the Renewable Fuel Standard (RFS), the Inflation Reduction Act incentives, and growing SAF mandates. Strong participation from oil majors, biofuel producers, airlines, and technology developers accelerates the commercialization of advanced biofuels, renewable diesel, and e-fuels, supported by large-scale production capacity and infrastructure.

Sustainable Fuel Market Volume and Share, By Region, 2025- 2035 (%)

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%), 2026-2035 | Market Volume Share (%), 2035 |

| North America | 35.91% | 0.4 | 1.1 | 13.57% | 30.12% |

| Europe | 24.23% | 0.2 | 0.9 | 16.20% | 24.98% |

| Asia Pacific | 28.12% | 0.3 | 1.2 | 17.81% | 32.80% |

| Latin America | 7.23% | 0.1 | 0.3 | 16.28% | 7.50% |

| Middle East & Africa | 4.51% | 0.0 | 0.2 | 16.06% | 4.60% |

Asia Pacific Growth Is Driven By Growing Government Initiatives Fueling Growth.

Asia Pacific is expected to have fastest growth in the market in the forecast period between 2026 and 2035. Asia Pacific is a high-growth sustainable fuel market, fueled by rising energy demand, urbanization, and government-led clean energy initiatives. The region focuses on biofuels, renewable gas, and hydrogen to reduce fossil fuel dependence and improve energy security. Rapid industrialization and transportation growth create a strong long-term demand for sustainable fuel alternatives.

India: Sustainable Fuel Market Growth Trends

India’s sustainable fuel market is driven by national biofuel blending mandates, ethanol expansion programs, and emerging hydrogen policies. Strong emphasis on agricultural residue-based biofuels, compressed biogas (CBG), and green hydrogen supports both energy transition and rural income generation. Public sector oil companies and private players actively invest in domestic production capacity and distribution networks.

Europe's Growth Is Driven By Strong Demand For Advanced Biofuel

Europe is a regulation-led sustainable fuel market characterized by aggressive climate targets, carbon pricing mechanisms, and binding renewable energy directives. The region demonstrates strong demand for advanced biofuels, SAF, renewable hydrogen, and synthetic fuels across transportation, industrial, and power sectors. Public-private partnerships and cross-border collaborations play a critical role in scaling sustainable fuel production.

Germany: Sustainable Fuel Market Growth Trends

Germany is a key contributor to Europe’s sustainable fuel market, driven by its Energiewende strategy and strong industrial decarbonization focus. The country actively invests in green hydrogen, e-fuels, and advanced biofuels for mobility and industrial applications. Strong automotive, chemical, and aviation sectors support pilot projects, large-scale demonstrations, and fuel infrastructure development.

South America's Growth In The Market Is Fueled By The Supportive Initiatives

South America is a biofuel-centric sustainable fuel market, supported by abundant agricultural resources and long-standing ethanol and biodiesel programs. The region benefits from favorable feedstock availability, cost advantages, and export potential. Governments promote sustainable fuels to enhance energy independence and reduce greenhouse gas emissions from transportation.

Brazil: Sustainable Fuel Market Growth Trends

Brazil is a global leader in sustainable fuels, particularly bioethanol and biodiesel, supported by strong sugarcane-based production and long-running blending mandates. The country’s RenovaBio program incentivizes low-carbon fuel production, while growing interest in SAF and renewable diesel positions Brazil as a key exporter in the global sustainable fuel value chain.

Middle East And Africa Growing Investments Support The Growth Of The Sustainable Fuel Market

The Middle East & Africa region is an emerging market, leveraging renewable energy potential, strategic export positioning, and diversification away from fossil fuels. Investments focus on green hydrogen, synthetic fuels, and renewable ammonia, particularly for export-oriented applications and heavy industry decarbonization.

Saudi Arabia: Sustainable Fuel Market Growth Trends

Saudi Arabia is increasingly investing in sustainable fuels as part of its Vision 2030 diversification strategy. The country focuses on green hydrogen, renewable ammonia, and synthetic fuels using its vast solar and wind resources. Large-scale mega-projects and partnerships with global energy players position Saudi Arabia as a future hub for sustainable fuel exports.

Recent Developments

- In December 2025, the American Biofuels Maritime Initiative (ABMI), a unified group of bioenergy stakeholders co-chaired by the Renewable Fuels Association and the American Biogas Council, was launched to accelerate the use of U.S. produced biofuels in the global shipping sector. This initiative aims to establish the United States as a primary supplier for maritime decarbonization efforts. (Source: biofuels-news.com)

- In December 2025, Egypt and Qatar's Al Mana Holding signed a $200 million agreement to develop a large-scale Sustainable Aviation Fuel (SAF) plant in the Suez Canal Economic Zone (SCZONE). This project is the first Qatari industrial investment in the SCZONE and aligns with Egypt's goal of becoming a regional green energy hub. (Source : thevoiceofafrica.com)

- In December 2025, Willis Sustainable Fuels (UK) Limited and the Green Finance Institute launched a Sustainable Aviation Fuel (SAF) Project Accelerator to address financing barriers and de-risking for UK-based SAF projects. The initiative aims to help WSF's Teesside project reach its Final Investment Decision and create a replicable financing model for other UK projects. (Source: www.globenewswire.com)

Top Players in the Sustainable Fuel Market & Their Offerings:

- Neste Corporation: Neste is a global leader in sustainable fuels, producing renewable diesel and sustainable aviation fuel (SAF) from waste and residue-based feedstocks. The company focuses on reducing lifecycle greenhouse gas emissions and supplies low-carbon fuels to transportation, aviation, and industrial sectors worldwide.

- BP plc: BP is actively expanding its sustainable fuel portfolio through investments in biofuels, renewable diesel, and SAF production. The company leverages its global refining and distribution network to support the transition toward low-carbon fuels across road, marine, and aviation applications.

- Shell plc: Shell produces and supplies a range of sustainable fuels, including biofuels, renewable diesel, and SAF, while investing in advanced biofuel technologies. The company supports decarbonization across mobility and industrial energy use through scalable low-carbon fuel solutions.

- TotalEnergies SE: TotalEnergies develops sustainable fuels through bio-refining, waste-to-fuel technologies, and SAF production. The company focuses on integrating renewable fuels into existing energy infrastructure to reduce emissions across transportation and aviation markets.

- Chevron Corporation: Chevron is investing in renewable fuels, renewable natural gas (RNG), and SAF through strategic partnerships and acquisitions. The company’s sustainable fuel offerings target lower-carbon transportation and industrial energy solutions, particularly in the U.S. market.

Other Top Players Are

- Neste Corporation

- BP plc

- Shell plc

- TotalEnergies SE

- Chevron Corporation

- Eni S.p.A.

- Valero Energy Corporation

- World Energy

- LanzaJet / LanzaTech

- Gevo, Inc.

- SkyNRG B.V.

- Diamond Green Diesel

- Marathon Petroleum Corporation

- Phillips 66

- Aemetis, Inc.

- Prometheus Fuels

- HIF Global

- Air Liquide

- Topsoe (Haldor Topsoe)

- Sunfire GmbH

Segments Covered

By Product Type

- Biofuels (Liquid & Gaseous)

- Renewable Diesel (HVO - Hydrotreated Vegetable Oil)

- Sustainable Aviation Fuel (SAF)

- Bio-Ethanol (1G and 2G)

- Bio-Methanol

- Renewable Natural Gas (RNG) / Biomethane

- Hydrogen-Based Fuels (Green & Blue)

- Green Hydrogen (Electrolysis)

- Blue Hydrogen (SMR with Carbon Capture)

- Liquid Hydrogen for Mobility

- Synthetic Fuels (E-Fuels / Power-to-Liquid)

- E-Kerosene (Synthetic SAF)

- E-Diesel

- E-Methanol (Marine)

- E-Ammonia (Marine/Industrial)

By Feedstock Source

- Waste-Based (Second Generation)

- Used Cooking Oil (UCO) and Animal Fats (Tallow)

- Municipal Solid Waste (MSW)

- Agricultural Residues (Corn Stover, Straw)

- Forestry Residues and Wood Waste

- Crop-Based (First Generation)

- Sugar-Based (Sugarcane, Sugar Beet)

- Starch-Based (Corn, Wheat)

- Vegetable Oils (Soybean, Rapeseed, Palm)

- Gaseous & Non-Biological Sources

- Captured Carbon Dioxide ($CO_2$)

- Industrial Waste Gases (Flue gas)

- Renewable Electricity (Wind/Solar for Electrolysis)

By Process/Technology

- Thermochemical Conversion

- Gasification and Fischer-Tropsch (FT) Synthesis

- Pyrolysis (Fast and Slow)

- Hydrothermal Liquefaction (HTL)

- Biochemical Conversion

- Anaerobic Digestion (Biogas)

- Fermentation (Ethanol/Butanol)

- Electrochemical/Synthetic (Power-to-X)

- Water Electrolysis (PEM, Alkaline, SOEC)

- Carbon Capture and Utilization (CCU)

- Hydro-Processing

- Hydroprocessed Esters and Fatty Acids (HEFA)

- Alcohol-to-Jet (AtJ)

By End-Use Application

- Aviation

- Commercial Airlines

- Military & Defense Aviation

- Business and General Aviation

- Maritime & Shipping

- International Ocean Freight

- Inland Waterway Transport

- Road Transportation

- Heavy-Duty Trucking (Long-Haul)

- Public Transit (Buses/Rail)

- Passenger Vehicles (Hybrid/Biofuel Blends)

- Industrial & Power

- Industrial Heating/Boilers

- Stationary Power Generation

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa