Content

Bio-Based Textiles Market Size and Growth 2025 to 2034

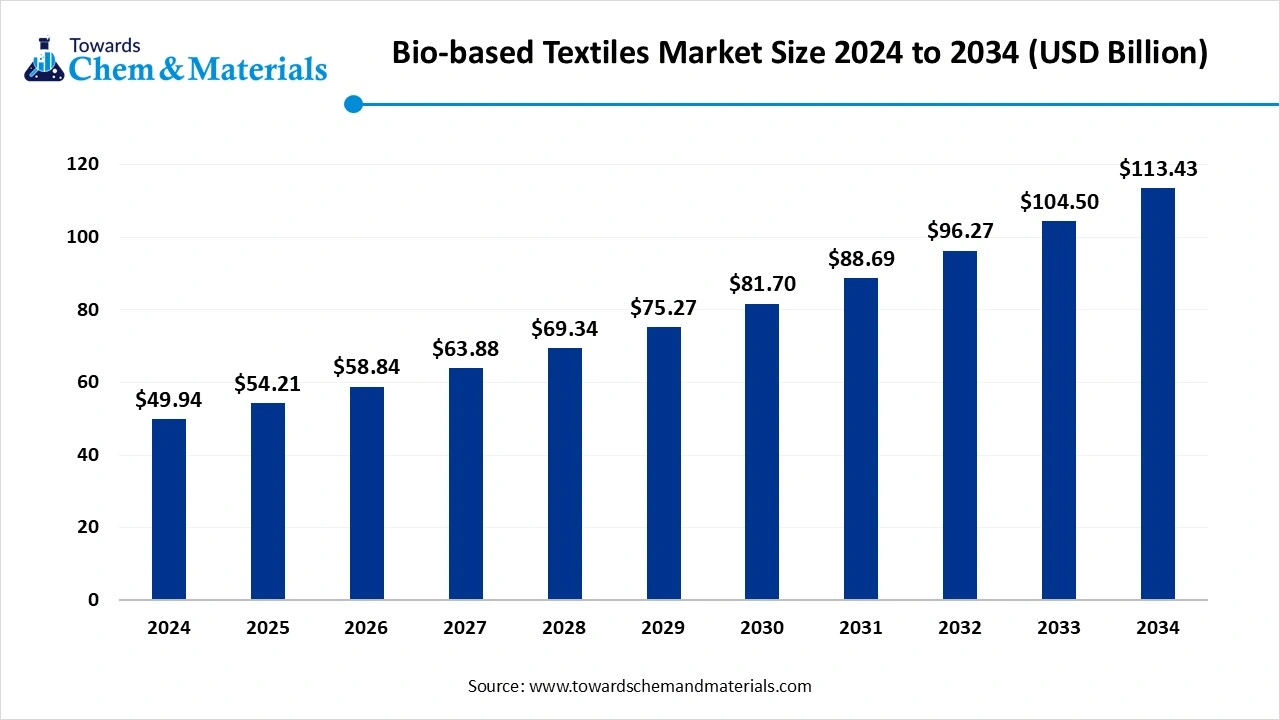

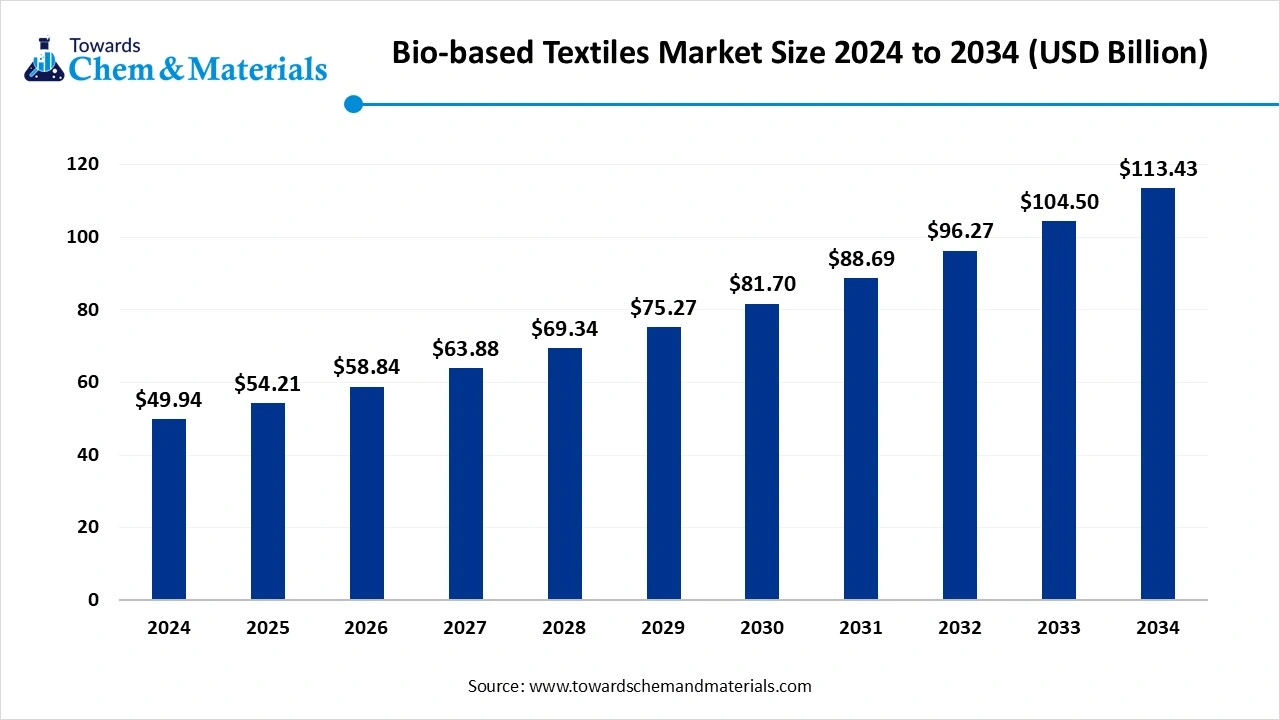

The global bio-based textiles market size reached a size of 54.21 billion in 2025, the market is further projected to grow at a CAGR of 8.55% between 2025 and 2034, reaching a size of 113.43 billion by 2034. The ongoing adoption of sustainable apparel has fueled the industry's potential in recent years.

Key Takeaways

- Europe dominated the bio-based textile market in 2024, owing to the ongoing implementation of the sustainability standards and a sophisticated eco-conscious consumer base.

- Asia Pacific is expected to grow at a notable rate in the future, akin to the presence of huge sustainable manufacturing capabilities with the latest advancements in technology.

- By fiber type, the natural biobased fiber segment led the bio-based textiles market in 2024. Under the natural biobased fiber segment, the organic cotton segment is observed to grow rapidly as a sub-segment in the current period, owing to the increased demand from major textile brands

- By source of raw material type, the plant-based segment emerged as the top-performing segment in 2024 due to its excellent renewable capacities and ongoing eco-friendly material adoption.

- By application, the apparel segment led the bio-based textiles market in 2024, owing to the current trend for sustainable and luxury clothing.

- By end user type, the bio-based textiles market was led by the fashion & retail segment in 2024, owing to the rising shift toward sustainable fashion collections.

- By distribution channel, in 2024, the offline segment emerged as the top consumer of the bio-based textiles market, as most consumers still prefer to feel and assess the quality of textiles in person before buying

- By process method, the woven segment led the bio-based textiles market in 2024, owing to its durability, strength, and widespread use in garments and home textiles.

- By blend type, in the bio-based textile industry, the bio-based blends segment is emerge as the dominating segment in 2024, because it combines the advantages of multiple natural materials to enhance strength, comfort, and sustainability.

Market Overview

Organic Origins, Sustainable Impact: Inside the Biobased Textile Surge

The bio-based textiles market encompasses fabrics and materials derived from renewable biological resources, such as plants, animals, and microbial sources, instead of conventional petroleum-based synthetics. These textiles aim to reduce environmental impact, improve biodegradability, and lower dependency on fossil fuels. Common bio-based textile fibers include organic cotton, hemp, bamboo, wool, silk, PLA-based fibers, bio-nylon, and regenerated cellulose fibers (e.g., lyocell, modal, viscose).

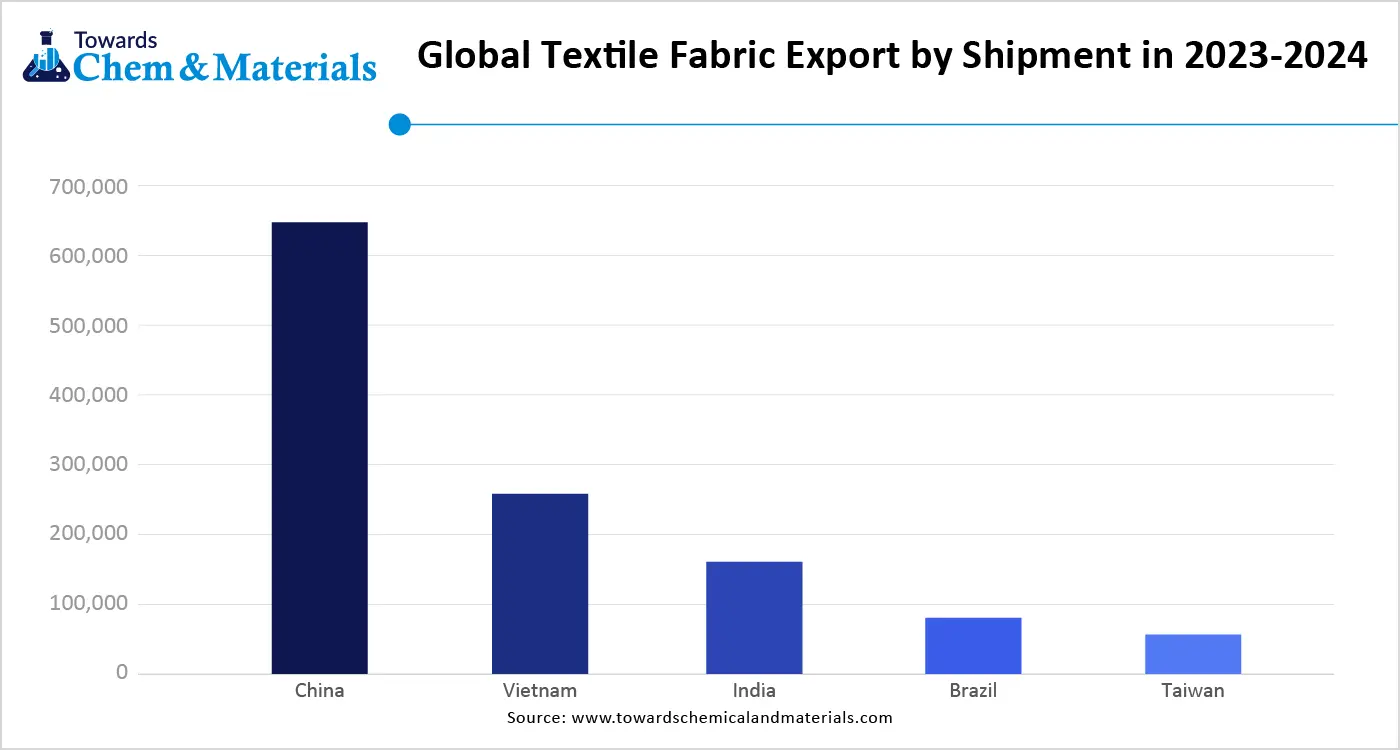

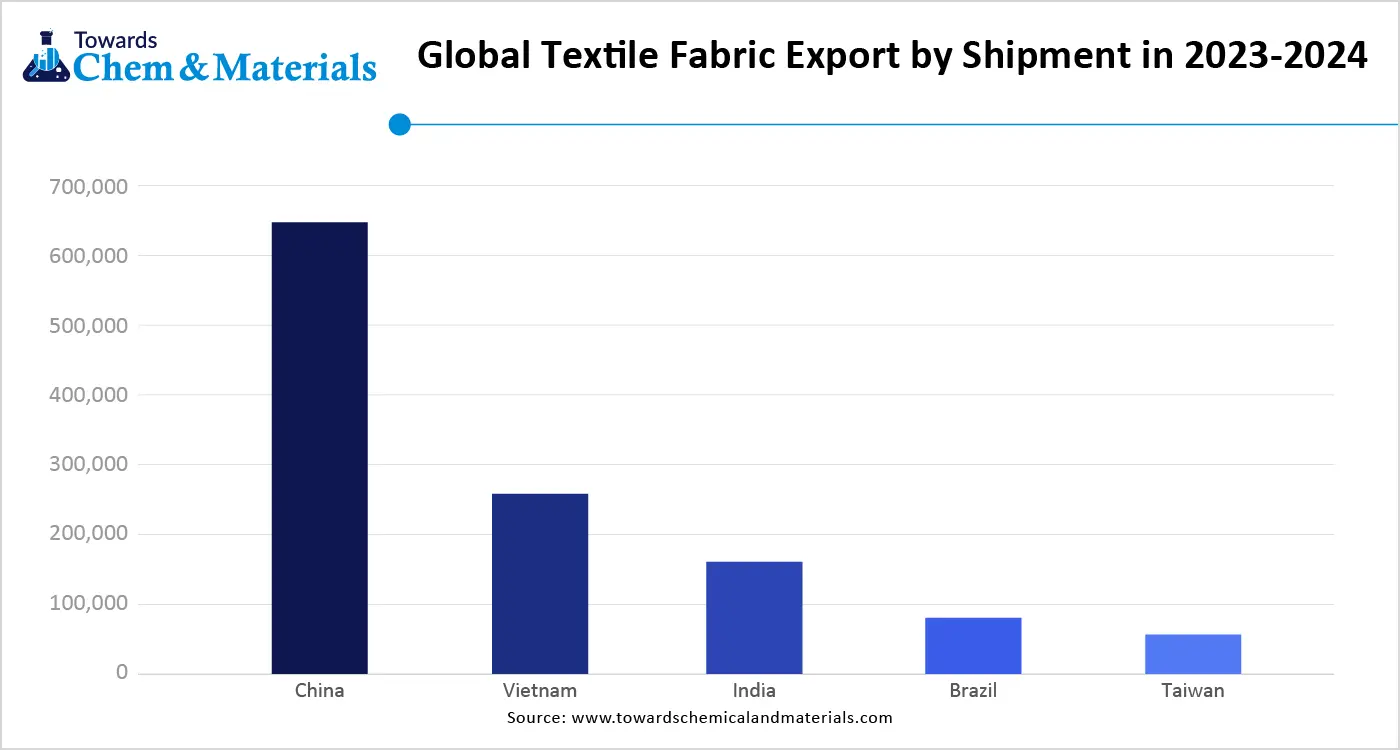

- According to a report published by Volza in 2025, China maintained its dominance with a huge textile fabric export. Additionally, Vietnam ranks second in these exports. Other countries also have higher shipment numbers during these years, according to the infographic.

Which Factor Is Driving the Growth of the Bio-based Textiles Market?

The sudden shift towards the ethical and eco-friendly clothing initiative is spearheading industry growth in the current period. Moreover, individuals have increasingly been buying clothing that has sustainability labels in recent years. Also, this sustainable clothing has turned into a premium and luxurious clothing line in the past few years. As per the recent industry observation, several buyers are demanding clothes that are made from organic cotton, hemp, and bamboo.

Market Trends:

- The versatile product launch has driven industry growth in recent years. Several major brands are increasingly seen in launching wide product lines to gain industry attention in the current period.

- The increased demand for eco-friendly and recyclability-labeled clothing is contributing to the industry's growth in recent years. Moreover, this trend is encouraging manufacturers to adopt clean manufacturing processes in the coming years.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 54.21 Billion |

| Market Size by 2034 | USD 113.43 Billion |

| Growth rate from 2024 to 2025 | CAGR 8.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Europe |

| Segment Covered | By Fiber Type, By Source of Raw Material, By Application, By End-User, By Distribution Channel, By Processing Method, By Region |

| Key Profiled Companies | Lenzing AG, DuPont Biomaterials, NatureWorks LLC, Teijin Limited, Grasim Industries Ltd (Aditya Birla Group), BASF SE, Evonik Industries, Eastman Chemical Company, Covation Biomaterials, Toray Industries Inc., Ananas Anam (Piñatex), Orange Fiber, Bolt Threads, MycoWorks, Spiber Inc., Natural Fiber Welding (NFW), Circular System, Pangaia, Ecoalf, Greenfibres |

Eco-Friendly Fabrics Carve a Niche in Non-Apparel Markets

The expansion into the non-apparel segment, like automotive interiors, medical fabrics, and upholstery, is expected to create lucrative opportunities for the manufacturers in the coming years. Moreover, with the increased need for comfort and sustainability, biobased textiles can gain major market share in sectors like healthcare, transport, and construction for the wide applications in the coming years, as per the industry expectations.

Maintaining the Green Standards Increases Operational Cost for Producers

The high price of production is expected to hinder the industry's growth in the coming years, as biobased textiles production can be expensive compared to synthetic materials, akin to factors such as the outsourcing of raw materials, the maintenance of sustainability, and several others. However, the manufacturer can take advantage of the technological advancements, such as the implementation of automation in their manufacturing plant, and other benefits.

Regional Insights

Europe

Europe accounted for the significant revenue in the current sector, akin to the ongoing implementation of the sustainability standards and a sophisticated eco-conscious consumer base. Moreover, the major fashion brands in the region have seen the heavy adoption and promotion of biobased textiles and sustainability promotions via various platforms in recent years, as consumers are aware that textile waste can limit the industry's potential in the coming years.

What Makes Germany’s Textile Infrastructure a Global Benchmark?

Germany maintained its dominance in the biobased textiles market, owing to having an enlarged and modern textile manufacturing infrastructure in the current period. As the government of the country itself is providing heavy funding for the textile recycling projects, which is severely contributing to the industry's growth in recent times. Moreover, the ongoing trend for eco labelling is leading industry growth as consumers are increasingly buying products that are certified and well labeled.

Asia Pacific is expected to capture a major share of the market, owing to the presence of huge sustainable manufacturing capabilities with the latest modern technology advancements. Moreover, the regional countries such as China, India, and Japan are increasingly seen as replacing the shift from conventional textiles to sustainable materials in the past few years. Moreover, the implementation of the green initiatives by the regional government can create beneficial advantages for the manufacturers in the coming years.

Can China’s Focus on Development Offer Long-Term Market Control?

China is expected to rise as a dominant country in the Asia Pacific region in the coming years, owing to an expanded textile industry, and the country is considered the top exporter of textiles across the world. Moreover, the major textile brands in China are seen under the heavy investment of research and development activities with technology integration, which is likely to provide a sophisticated consumer base to the market in the coming years.

Segmental Insights

By Fiber Type

How the Natural Biobased Fibers Segment Dominated the Market in 2024?

The natural bio-based fibers segment held the largest share of the market in 2024, due to increased sustainability awareness around the globe. Under the natural biobased fiber segment, the organic cotton segment is observed to grow rapidly as a sub-segment in the current period, owing to the increased demand from major textile brands and also consumers. Also, having the comfort and premium standards, several individuals are increasingly demanding this type of cotton in recent years.

By Source of Raw Material Type,

Why Do Plant-Based Segments Dominated the Market by Raw Material Type?

The plant-based segment held the largest share of the bio-based textiles market in 2024, owing to its excellent renewable capacities and ongoing eco-friendly material adoption. Moreover, plant-based fibers such the hemp, bamboo, and soybean have gained immense popularity in the past few years as their unique characteristics, such as the requirement of minimal water, biodegradability, and fast growth. Also, having easier cultivation and processing, manufacturers have increasingly preferred plant-based raw materials in recent years.

By Application Type,

Why Did the Apparel Segment Dominate the Market in 2024?

The apparel segment dominated the market with the largest share in 2024, owing to the current trend for sustainable and luxury clothing. Moreover, in the developed countries, several individuals are seen as heavily demanding luxury apparel that is eco-friendly and such innovative tags. Also, the use of raw materials like hemp, bamboo, and organic cotton, individuals are heavily using these materials for their daily activities like sport, casual wear, and even luxury clothing, as per the recent industry observation.

By End User Type,

Why is Fashion and Retail Dominating the Industry?

The fashion and retail segment held the largest share of the market in 2024 due to the rising shift toward sustainable fashion collections. Leading global brands are adopting bio-based textiles to align with ESG goals and meet consumer demand for greener products. Retailers are also emphasizing eco-labels and certifications to attract environmentally conscious buyers. As customer awareness about textile waste and pollution grows, fashion chains are launching sustainable clothing lines. Retailers benefit from promoting bio-based apparel as a premium and ethical choice. The availability of these textiles at both luxury and mass-market levels has made fashion and retail the largest consumers of bio-based textile products.

By Distribution Channel,

How Does Offline Segment Lead Market Growth?

The offline segment led the bio-based textiles market in 2024, as most consumers still prefer to feel and assess the quality of textiles in person before buying. Physical retail stores, fashion boutiques, and textile exhibitions offer customers the ability to touch and test bio-based fabrics. Brands use offline platforms to showcase sustainability features, certifications, and traceability. Also, in developing countries, offline channels remain the primary mode of textile sales. Retailers are using in-store marketing strategies to educate consumers about eco-friendly products. This direct interaction builds customer trust and helps promote the value of biobased textiles more effectively.

By Processing Method

Why Oven Segment Dominated the Market in 2024?

Woven Segment led the bio-based textiles market in 2024 due to its durability, strength, and widespread use in garments and home textiles. Woven bio-based fabrics, such as those made from organic cotton or hemp, are highly breathable and Ideal for daily wear. These fabrics maintain structure and shape, making them suitable for formal wear, upholstery, and accessories. Manufacturers favor woven methods due to their efficiency and compatibility with traditional weaving equipment. The adaptability of woven bio-based fabrics across multiple sectors has made them the most popular choice. Their long-lasting performance also appeals to sustainability-conscious consumers.

By Blend Type

How Biobased Blends Segment Maintained Its Dominance in the Current Market?

Bio-based blends segment has achieved the largest share in the biobased textiles market because it combines the advantages of multiple natural materials to enhance strength, comfort, and sustainability. Manufacturers often mix organic cotton with bamboo or hemp to create hybrid fabrics that are more breathable, stretchable, or durable. These blends are more versatile and cost-effective compared to 100% natural fibers. The blending process also allows for customization to suit different applications, such as sportswear, casual clothing, or upholstery. By offering both eco-friendliness and performance, bio-based blends have become a preferred choice for both brands and consumers in the sustainable textiles market.

Recent Developments

- In 2025, Arkema introduced its latest bio-based textile resins. Also, the main motive behind the launch of these sustainable resins is to minimize the product's carbon footprint of the high-performance textile, as per the report published by the company recently. (Source: www.recyclingtoday.com)

- In 2024, Archroma unveiled their latest product ine of the printing system. The newly launched printing system is called the NTR printing system. Also, this NTR printing system is truly based on the renewable io io-based material as per the company's claim(Source: www.archroma.com)

Top Companies list

- Lenzing AG

- DuPont Biomaterials

- NatureWorks LLC

- Teijin Limited

- Grasim Industries Ltd (Aditya Birla Group)

- BASF SE

- Evonik Industries

- Eastman Chemical Company

- Covation Biomaterials

- Toray Industries Inc.

- Ananas Anam (Piñatex)

- Orange Fiber

- Bolt Threads

- MycoWorks

- Spiber Inc.

- Natural Fiber Welding (NFW)

- Circular Systems

- Pangaia

- Ecoalf

- Greenfibres

Segment covered

By Fiber Type

- Natural Bio-based Fibers

- Organic Cotton

- Hemp

- Flax (Linen)

- Bamboo

- Ramie

- Wool

- Silk

- Regenerated Bio-based Fibers

- Viscose

- Lyocell

- Modal

- Cupro

- Bio-synthetic Fibers

- Polylactic Acid (PLA)

- Bio-based Polyester

- Bio-based Nylon

- Polyhydroxyalkanoates (PHA)

By Source of Raw Material

- Plant-based

- Animal-based

- Microbial/Bioengineered

By Application

- Apparel

- Casual Wear

- Sportswear

- Intimate Wear

- Outdoor Wear

- Home Textiles

- Bed Linen

- Curtains

- Upholstery

- Towels

- Industrial Textiles

- Automotive

- Geotextiles

- Packaging

- Medical Textiles

- Bandages & Gauze

- Surgical Wear

- Footwear & Accessories

By End-User

- Fashion & Retail

- Hospitality

- Healthcare

- Automotive

- Agriculture

- Industrial/Technical

By Distribution Channel

- Online

- Offline

- Retail Stores

- Specialty Stores

- Wholesale

By Processing Method

- Woven

- Non-woven

- Knitted

By Blend Type

- 100% Bio-based

- Bio-based Blends (with recycled PET, synthetic fibers, etc.)

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE