Content

What is the Current Refinery Catalyst Market Size and Volume?

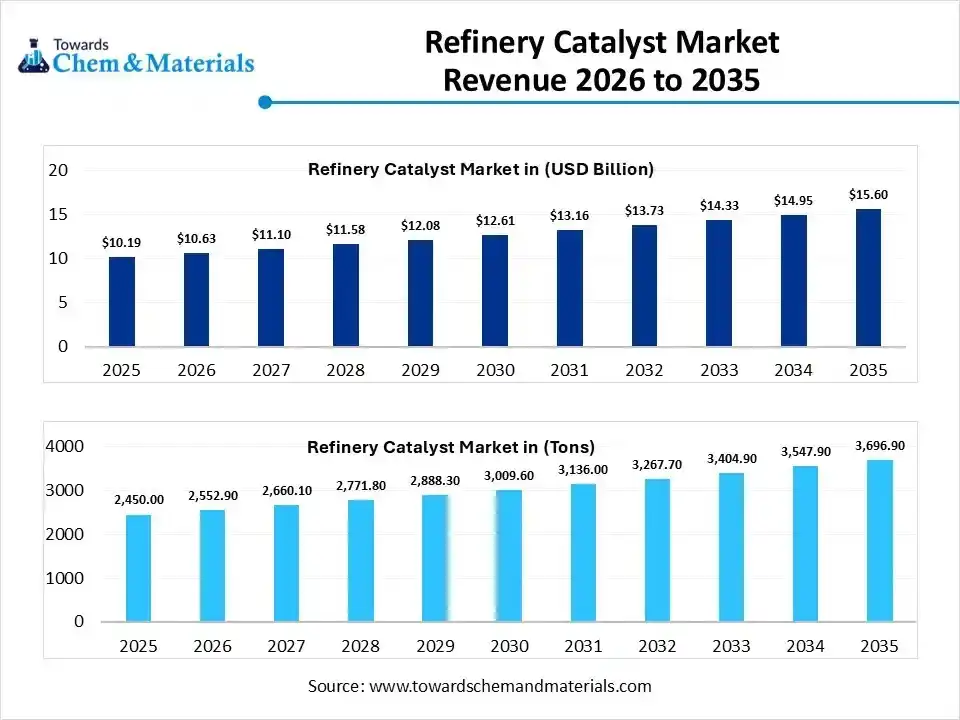

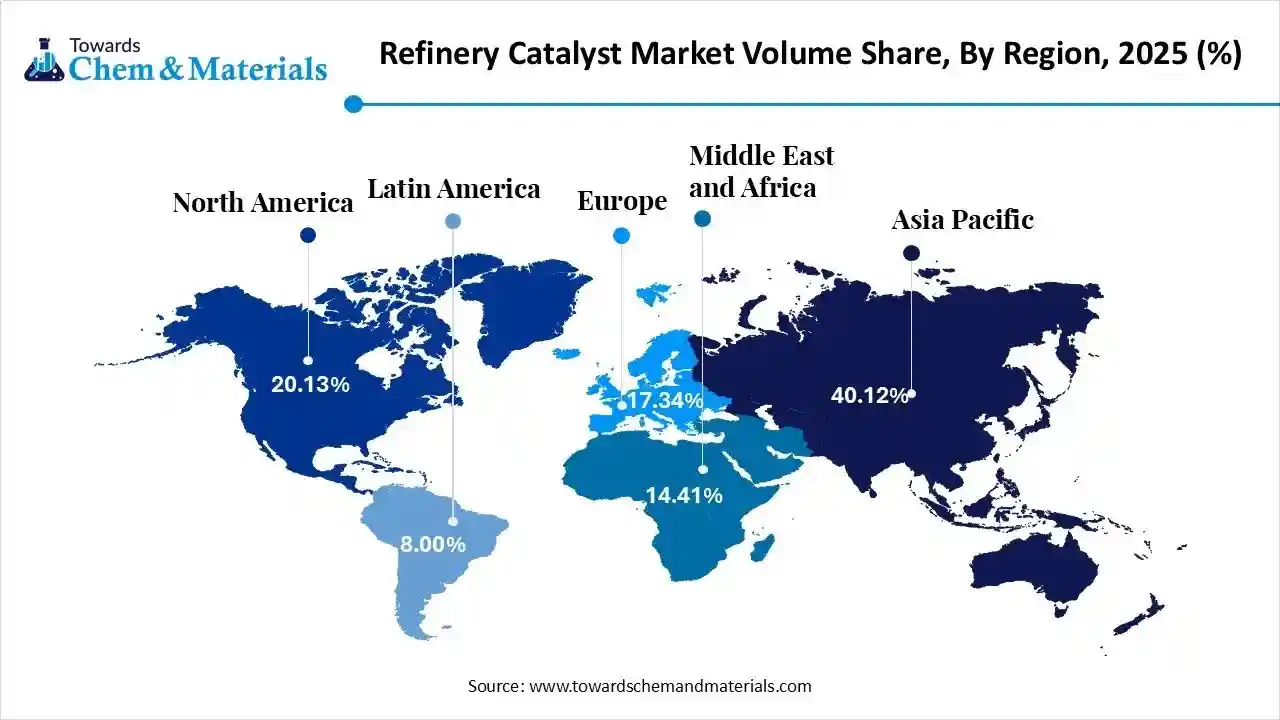

The global refinery catalyst market size was estimated at USD 10.19 billion in 2025 and is expected to increase from USD 10.63 billion in 2026 to USD 15.60 billion by 2035, growing at a CAGR of 4.35% from 2026 to 2035. In terms of volume, the market is projected to grow from 2,450.00 tons in 2025 to 3,696.90 tons by 2035. growing at a CAGR of 4.20% from 2026 to 2035. Asia Pacific dominated the refinery catalyst market with the largest volume share of 40.12% in 2025. The increased need for high-octane fuel and stricter regulations on sulfur drive the market growth.

The refinery catalyst market growth is driven by growing refining activity, rapid industrialization, increased production of ultra-low sulfur diesel, development of high-performance vehicles, strong focus on energy transition, advancement in catalyst design, and focus on lowering energy use. the Refinery catalyst is a substance that speeds up chemical reactions in petroleum refining. The lower energy cost and enhances the product quality. Refinery catalyst converts low-value crude oil into valuable products. They are widely used in applications like hydrocracking, reforming, cracking, and hydrotreating. The examples of refinery catalysts are platinum, zeolites, cobalt-molybdenum, and hydrofluoric acid.

Key Takeaways

- By region, Asia Pacific led the refinery catalyst market held the volume share of around 40.12% in 2025.

- By region, Middle East & Africa is growing at the fastest CAGR in the market during the forecast period due to the development of new refineries.

- By material, the zeolites segment led the market with the largest volume share of 45.08% in 2025.

- By material, the chemical compounds segment is growing at the fastest CAGR in the market during the forecast period due to the growing energy demand.

- By application, the FCC catalyst segment led the market with the largest volume share of 42.21% in 2025.

- By application, the hydrotreating segment is expected to grow at the fastest CAGR in the market during the forecast period due to the enhanced efficiency of the refinery.

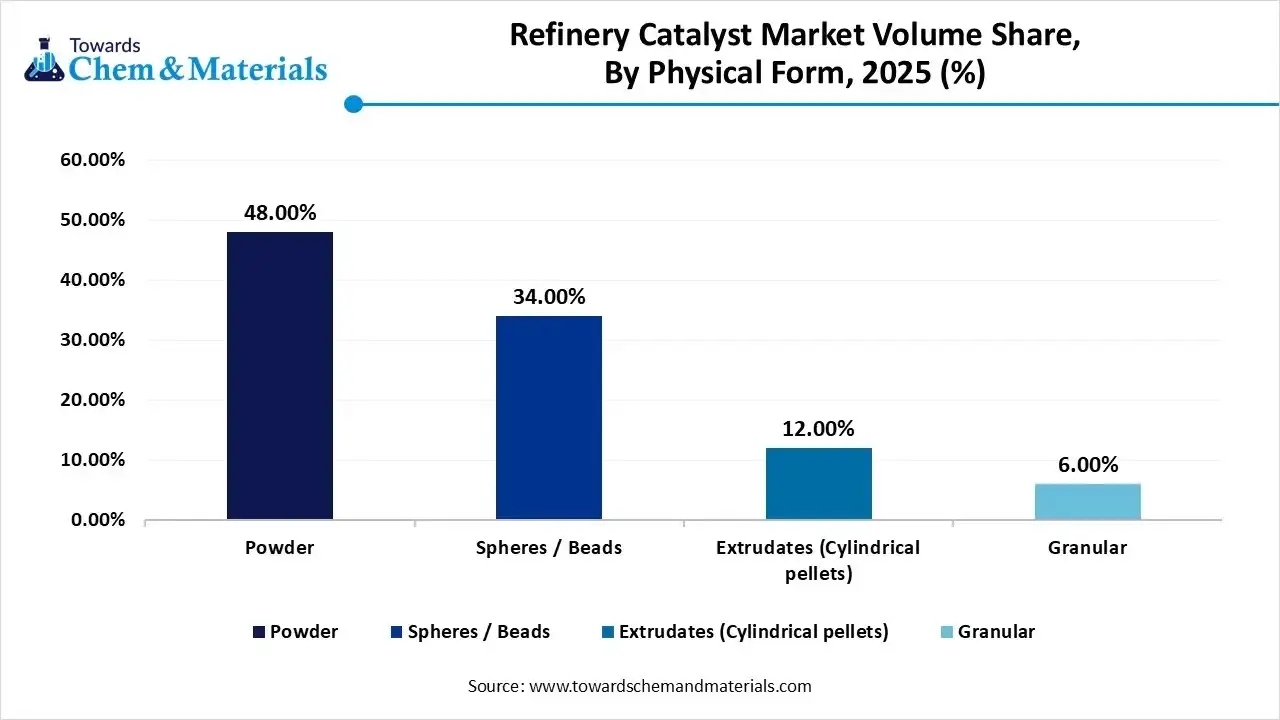

- By physical form, the powder segment accounted for the largest volume share of 48.33% in 2025.

- By physical form, the extrudates segment is expected to grow at the fastest CAGR in the market during the forecast period due to the optimal flow distribution.

- By end-use application, the transportation fuels segment dominated with the largest volume share of 50.11% in 2025.

- By end-use application, the petrochemical feedstocks segment is expected to grow at the fastest CAGR in the market during the forecast period due to the high production of petrochemical products.

Refinery Catalyst Market Trends:

- Environmental Compliance:- The stricter regulations for lowering sulfur content and a high need to minimize greenhouse gas emissions increase demand for refinery catalysts to support sustainability.

- Rise High-Octane Fuel Use:- The growing development of fuel-efficient vehicles and focus on preventing engine damage in cars increases demand for high-octane fuels, which lowers harmful emissions.

- Sustainable Catalyst Development:- The growing focus on energy transition and development of catalysts using feedstocks like waste material, biomass, and others supports the development of sustainable catalysts.

- Growth in Industrial Activities:- The growing expansion of industrial operations like manufacturing and the rapid growth in the aviation industry increases demand for refinery catalysts.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 10.63 Billion / 2,552.90 Tons |

| Revenue Forecast in 2035 | USD 15.60 Billion / 3,696.90 Tons |

| Growth Rate | CAGR 4.35% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Material / Ingredient Type, By Application (Process Type), By Physical Form, By End-Use Application, By Region |

| Key companies profiled | Haldor Topsoe A/S, Honeywell UOP, Albemarle Corporation, W. R. Grace & Co., BASF SE, Axens SA, Johnson Matthey PLC, Clariant AG, Shell Catalyst & Technologies, Sinopec Catalyst Company, Evonik Industries AG, Chevron Corporation (ART), JGC Catalyst and Chemicals Ltd., Arkema S.A., ExxonMobil Corporation, Zeolyst International, Criterion Catalyst & Technologies, Nippon Ketjen Co., Ltd., Taiyo Koko Co., Ltd., Qingdao Huicheng Environmental Technology |

Key Technological Shifts in Refinery Catalyst Market:

The refinery catalyst market is undergoing key technological shifts driven by the demand for sustainability, higher yields, and lower operational costs. The technological innovations like nanotechnology, IoT, smart catalysts, bio-based catalysts, and software platforms integration help in lowering emissions. One of the key shifts is that the incorporation of AI lowers environmental impact and enhances efficiency.

Artificial Intelligence predicts the performance of the catalyst and manufactures a new catalyst in less time. AI maximizes product yield and monitors the real-time quality of products. AI screens materials rapidly and forecasts the deactivation of the catalyst. AI predicts the performance of a catalyst in diverse conditions and minimizes waste. Overall, AI optimizes the manufacturing process of refinery catalysts and increases the profitability of the sector.

Trade Analysis of Refinery Catalyst Market: Import & Export Statistics

- The United States exported 2,226 shipments of FCC catalyst.

- Germany exported 884 shipments of FCC catalyst.

- India imported 1,771 shipments of FCC catalyst.

- China exported 2,634 shipments of zeolite.

Refinery Catalyst Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement is the process of acquiring raw materials like platinum, nickel, zeolites, palladium, alumina, cobalt, clay, silica, binders, vanadium, and fillers.

- Key Players:- BASF SE, Honeywell UOP, Clariant AG, Albemarle Corporation, Topsoe

- Chemical Synthesis and Processing: The chemical synthesis involves methods like impregnation, precipitation, & hydrothermal synthesis. The chemical process of refinery catalyst involves steps like forming, calcination, activation, quality control, and testing.

- Key Players:- W. R. Grace & Co., Haldor Topsoe A/S, Axens S.A., Shell Catalysts & Technologies, Albemarle Corporation

- Quality Testing and Certifications: The quality testing is the process of measuring properties like diameter, contaminant tolerance, surface area, selectivity, durability, and pore volume. The certifications like CSP, CPP, and API certifications.

- Key Players:- Bureau Veritas, ALS Global, Xytel, Intertek, SGS

The Catalyst Powering Refining

| Type | Feedstock Used | Refining Process | Product Formed |

| Hydrocracking Catalyst |

|

Hydrocracking |

|

| Alkylation Catalyst |

|

Alkylation |

|

| FCC Catalyst |

|

|

|

| Hydrotreating Catalyst |

|

Hydrotreating |

|

Segmental Insights

Material Insights

Why Zeolites Segment Dominates the Refinery Catalyst Market?

The zeolites segment dominated the refinery catalyst market with approximately 45.08% share in 2025. The increased production of high-quality gasoline and the increased demand for breaking hydrocarbon molecules increase the adoption of zeolites. The strong presence of FCC and the growing alkylation process requires zeolites. The increasing use of cleaner transportation fuels and the development of cleaner gasoline require zeolites. The high activity, superior thermal stability, shape selectivity, and cost-efficiency of zeolites drive the overall market growth.

The chemical compounds segment is the fastest-growing in the market during the forecast period. The strong focus on desulfurization and the increasing use of renewable energy resources increase demand for chemical compounds. The growing industrialization and increasing need for minimizing energy consumption require chemical compounds. The growing demand for enhancing the engine performance of vehicles requires chemical compounds, supporting the overall market growth.

Application Insights

How did FCC Catalyst Segment hold the Largest Revenue Share in the Refinery Catalyst Market?

The FCC catalyst segment held the largest revenue share of approximately 42.21% in the market in 2025. The increasing need for transportation fuels and focus on enhancing diesel yields increases demand for FCC catalysts. The availability of heavy feedstocks and the manufacturing of lower-sulfur fuels require an FCC catalyst. The increased production of olefin gases and focus on lowering nitrogen oxide emissions require FCC catalyst, driving the overall market growth.

The hydrotreating segment is experiencing the fastest growth in the market during the forecast period. The stringent rules on gasoline production and the increasing need to lower air pollution increase demand for hydrotreating. The strong focus on removing metals and increasing the need for enhancing hydrogen efficiency requires hydrotreating. The growing modernization of the refinery and the expanding automotive industry requires hydrotreating, supporting the overall market growth.

Physical Form Insights

Which Powder Form Dominated the Refinery Catalyst Market?

The powder form segment dominated the refinery catalyst market with approximately 48.33% share in 2025. The strong focus on the uniform distribution of the catalyst and increased refinery processes requires a powder form. The increasing demand for products like olefin gases and the higher efficiency of the FCC process require powder form. The cost-effectiveness, uniform dispersion, and high surface area of powder form drive the overall growth of the market.

The extrudates segment is the fastest-growing in the market during the forecast period. The expansion of hydroprocessing activity and focus on heat transfer in reforming increases demand for extrudates. The high thermal stability and excellent mechanical strength of extrudates help market expansion. The strong focus on removing nitrogen impurities and stricter regulations for cleaner fuel production require extrudates, supporting the overall market growth.

Refinery Catalyst Market Volume and Share, By Physical Form, 2025-2035 (%)

| By Physical Form | Market Volume Share (%), 2025 | Market Volume (Tons)2025 | Market Volume (Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Powder | 48.00% | 1,176.0 | 1,700.6 | 4.18% | 46.00% |

| Spheres / Beads | 34.00% | 833.0 | 1,294.3 | 5.02% | 35.01% |

| Extrudates (Cylindrical pellets) | 12.00% | 294.0 | 495.8 | 5.98% | 13.41% |

| Granular | 6.00% | 147.0 | 206.3 | 3.84% | 5.58% |

End-Use Application Insights

Why did the Transportation Fuels Segment hold the Largest Revenue Share in the Refinery Catalyst Market?

The transportation fuels segment held the largest revenue share of approximately 50.11% in the market in 2025. The rise in manufacturing of high-octane gasoline and the increasing need for jet fuels require refinery catalyst. The increasing use of vehicles and stricter regulations on fuel standards increase demand for refinery catalyst. The high reliance on ships and the need for improving fuel quality require refinery catalyst, driving the overall growth of the market.

The petrochemical feedstocks segment is experiencing the fastest growth in the market during the forecast period. The growing development of plastic items and the expansion of packaging applications increase demand for petrochemical feedstock. The increased use of synthetic fibers and the rising need for petrochemical products require petrochemical feedstock, which increases demand for refinery catalyst. The expanding petrochemical industry supports the overall market growth.

Regional Insights

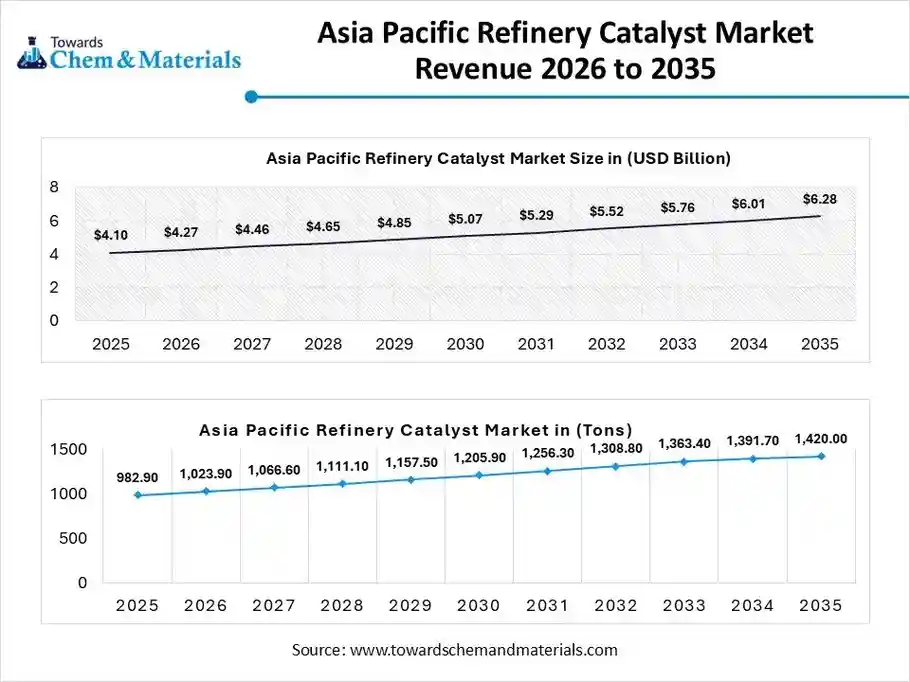

The Asia Pacific refinery catalyst market size was valued at USD 4.10 billion in 2025 and is expected to be worth around USD 6.28 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.37% over the forecast period from 2026 to 2035.

The Asia Pacific refinery catalyst market volume was estimated at 982.9 tons in 2025 and is projected to reach 1,420.00 tons by 2035, growing at a CAGR of 4.17% from 2026 to 2035. Asia Pacific dominated the market with approximately 40.12% Volume share in 2025. The growing expansion of manufacturing operations and increasing investment in refineries increases demand for refinery catalyst. The increased consumption of transport fuels and the rise in construction projects require refinery catalyst. The expanding refining capacity and strong presence of chemical manufacturing create a huge demand for refinery catalyst. The strong government support for the adoption of refinery catalyst drives the market growth.

Catalyzing Progress: India at the Core of Refinery Catalyst Production

India is a major contributor to the market. The rapid expansion of urban areas and the presence of large refining capacity increase demand for refinery catalyst. The increasing use of refining products and stricter regulations on fuel standards create demand for refinery catalyst. The shift towards high-octane fuels and growth in hydrotreating processes requires a refinery catalyst. The expansion of Numaligarh Refinery supports the overall market growth.

Middle East & Africa Refinery Catalyst Market Trends

The Middle East & Africa are experiencing the fastest growth in the market during the forecast period. The large-scale oil production and the growing expansion of the transportation sector increase demand for refinery catalyst. The stringent regulations on sulfur content and the increasing need for jet fuels require a refinery catalyst. The increasing use of petrochemical feedstock and the growing energy transition increase demand for refinery catalyst. The rising demand for hydroprocessing catalyst drives the market growth.

Heart of Refining: Saudi Arabia’s Catalyst Edge

Saudi Arabia is a key contributor to the market in the MEA region. The growing export of petrochemicals and strong mandates for cleaner fuels increase demand for refinery catalyst. The development of NEOM’s green hydrogen project and rapid growth in the petrochemical sector increase demand for refinery catalyst. The development of carbon capture projects and a strong focus on renewables requires refinery catalysts, supporting the overall growth of the market.

Refinery Catalyst Market Volume and Share, By Region, 2025-2035 (%)

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 20.13% | 493.2 | 817.0 | 5.77% | 22.10% |

| Europe | 17.34% | 424.8 | 595.9 | 3.83% | 16.12% |

| Asia Pacific | 40.12% | 982.9 | 1,420.0 | 4.17% | 38.41% |

| Latin America | 8.00% | 196.0 | 266.5 | 3.48% | 7.21% |

| Middle East & Africa | 14.41% | 353.0 | 597.4 | 6.02% | 16.16% |

North America Refinery Catalyst Market Trends

North America is growing at a notable rate in the market. The stringent environmental rules on emissions and the push towards cleaner diesel increase demand for refinery catalyst. The booming shale oil processing and growing consumer focus on better engine performance create huge demand for refinery catalyst. The increased upgradation of refineries and the development of high-octane gasoline increase demand for refinery catalysts, driving the overall growth of the market.

Powering Performance: The United States' Role in Refinery Catalyst

The United States is rapidly growing in the market. The increased consumption of cleaner fuels and rising crude processing activities increase demand for innovative refinery catalysts. The expanding biofuel sector and increased modernization of engines increase demand for refinery catalyst. The availability of renewable feedstocks increases the production of refinery catalyst, supporting the overall market growth.

Europe Refinery Catalyst Market Trends

Europe is growing substantially in the market. The strong focus on cleaner air and the EU's focus on carbon neutrality increase demand for sustainable catalyst. The growth in utilization of ultra-low sulfur diesel and increased processing of biogas requires a refinery catalyst. The expansion of the hydrocracking process and the strong presence of key refinery players drive the overall growth of the market.

Catalyst Edge: Germany’s Performance in Refining

Germany is growing significantly in the market. The integration of advanced technology in refineries and a strong focus on minimizing emissions increase demand for refinery catalysts. The growing demand for cleaner-burning fuels and the robust presence of the manufacturing industry increase demand for refining catalyst. The growing demand for energy and increasing investment in catalyst development support the overall growth of the market.

South America Refinery Catalyst Market Trends

South America is growing significantly in the market. The increased processing of heavy crude and growing demand for petrochemicals require refinery catalyst. The clean fuel and rapid expansion of industrial activity require a refinery catalyst. The development of improved hydrocracking catalysts and the utilization of higher-octane fuels drive the overall market growth.

The Story of Refining Catalyst in Brazil

Brazil is growing at a substantial rate in the market. The stricter standards of fuel quality and increasing investment in crude processing increase demand for refinery catalyst. The well-established biofuel industry and production of higher-octane fuels require a refinery catalyst. The rising demand for petroleum products and increasing investment in the upgradation of refineries support the overall market growth.

Recent Developments

- In August 2024, BASF launched Fourtiva FCC catalysts for high octane gasoline blending feedstock. The catalyst maximizes the yields of butylene and manufactures valuable products. The catalyst lowers the carbon footprint and improves matrix-zeolite interaction.(Source: www.indianchemicalnews.com)

- In March 2024, Evonik launched a sustainable catalyst, Octamax™, for refinery technology. The catalyst enhances sulfur removal performance and is cost-effective. The catalyst improves the retention of the octane level and lowers landfill waste.(Source: www.evonik.com )

- In April 2025, Clariant collaborated with Technip Energies to launch a new catalyst, StyroMax UL-100, for unprecedented low steam-to-oil ratios in the production of styrene. The catalyst offers high selectivity, enhanced sustainability performance, badger technology integration, and lower energy consumption.(Source: www.clariant.com)

Top Companies List

- Albemarle Corporation:- The company produces refinery catalysts like hydroprocessing and FCC technology to serve applications like gasoline production, hydrocracking, & hydrotreating.

- Honeywell UOP:- The company manufactures catalysts to serve refinery processes like reforming, merox, hydrotreating, isomerization, and hydrocracking.

- Haldor Topsoe A/S:- The company develops catalysts and focuses on areas like renewable fuels, clean air technologies, energy transition, and renewable chemicals.

Top Companies in the Refinery Catalyst Market

- Haldor Topsoe A/S

- Honeywell UOP

- Albemarle Corporation

- W. R. Grace & Co.

- BASF SE

- Axens SA

- Johnson Matthey PLC

- Clariant AG

- Shell Catalyst & Technologies

- Sinopec Catalyst Company

- Evonik Industries AG

- Chevron Corporation (ART)

- JGC Catalyst and Chemicals Ltd.

- Arkema S.A.

- ExxonMobil Corporation

- Zeolyst International

- Criterion Catalyst & Technologies

- Nippon Ketjen Co., Ltd.

- Taiyo Koko Co., Ltd.

- Qingdao Huicheng Environmental Technology

Segments Covered

By Material / Ingredient Type

- Zeolites

- Metals

- Chemical Compounds

By Application (Process Type)

- Fluid Catalytic Cracking (FCC)

- Hydrotreating

- Hydrocracking

- Catalytic Reforming

- Alkylation & Isomerization

By Physical Form

- Powder

- Spheres / Beads

- Extrudates (Cylindrical pellets)

- Granular

By End-Use Application

- Transportation Fuels

- Petrochemical Feedstocks

- Marine & Industrial Fuels

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa