Content

What is the Current LNG And FSRU Market Size and Share?

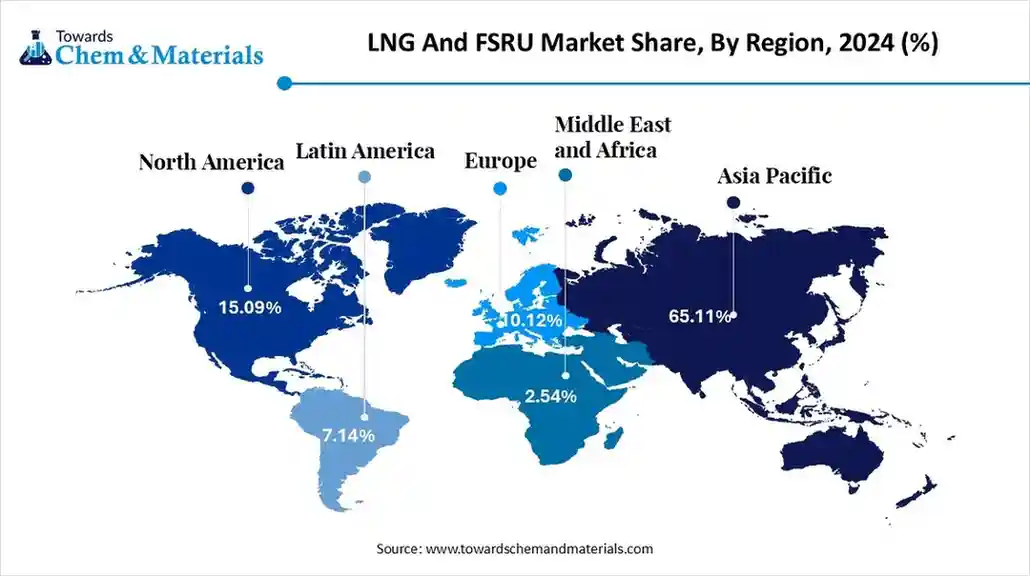

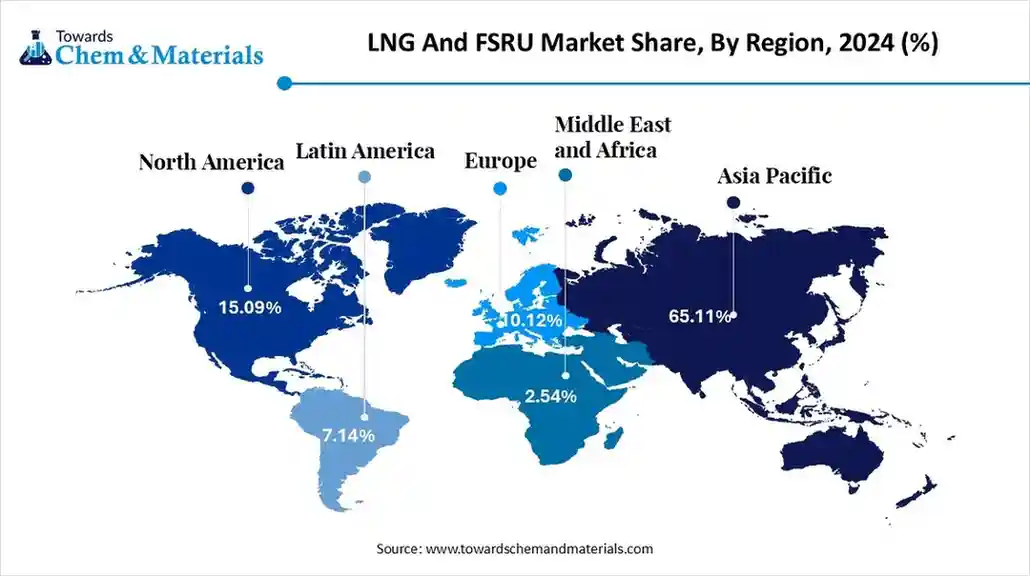

The global LNG And FSRU market size is calculated at USD 145.81 billion in 2025 and is predicted to increase from USD 162.80 billion in 2026 and is projected to reach around USD 438.92 billion by 2035, The market is expanding at a CAGR of 11.65% between 2025 and 2035. Asia Pacific dominated the LNG And FSRU market with a market share of 65.11% the global market in 2024. The growing demand for energy and the rise in industrial processes drive the market growth.

Key Takeaways

- By region, Asia Pacific held a 65.11% share of the market in 2024.

- By region, Europe is growing at a 7.8% CAGR in the market during the forecast period.

- By type, the LNG infrastructure segment held a 70.3% share in the market in 2024.

- By type, the FSRU segment is expected to grow at a 6.6% CAGR in the market during the forecast period.

- By component, the liquefaction terminals segment held a 46.4% share in the LNG and FSRU market in 2024.

- By component, the regasification terminals segment is expected to grow at a 6.8% CAGR in the market during the forecast period.

- By LNG Infrastructure Type, the onshore terminals segment held a 72.4% share in the market in 2024.

- By LNG Infrastructure Type, the offshore terminals segment is expected to grow at a 6.9% CAGR in the market during the forecast period.

- By capacity, the small-scale segment held a 68.8% share in the market in 2024.

- By capacity, the large-scale segment is expected to grow at a 7.0% CAGR in the market during the forecast period.

- By application, the power generation segment held a 48.5% share in the market in 2024.

- By application, the industrial segment is expected to grow at a 7.2% CAGR in the market during the forecast period.

Growth Engines: Key Forces Powering Expansion of LNG and FSRU Market

The LNG and FSRU market growth is driven by growing power generation, focus on cleaner energy transition, need for diversification of energy, increasing investment in FSRUs, and advancements in FSRU designs.

What is LNG and FSRU?

Liquefied natural gas (LNG) is a type of natural gas that is cooled to a liquid state and transported via ships. LNG is non-toxic, colorless, and odorless. FSRU is an acronym for Floating Storage and Regasification Unit, and is a ship-based terminal that collects LNG shipments. FSRU offers benefits like lower capital expenditure, minimal land requirements, faster implementation, lowers environmental impact, facilitates energy transition, and faster implementation.

LNG and FSRU Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the industry is expected to see accelerated growth in high-margin niches like energy security, infrastructure investment, and energy diversification. Growth is being reinforced by growing energy demand and focus on cleaner energy alternatives, particularly in Europe and Asia.

- Sustainability Trends: Sustainability is reshaping the LNG and FSRU industry, with a strong focus on methane emission reduction, adoption of dual-fuel engines, and using LNG as a transition fuel. For instance, Mitsui O.S.K. Lines integrated clean energy into Japan’s first LNG-fueled ferries to lower environmental impact.

- Global Expansion: Key players and specialized FSRU providers are expanding geographically to align with energy demand and energy transition, particularly into Asia, Europe, and South America. Companies like Shell, TotalEnergies, QatarEnergy, ExxonMobil, Excelerate Energy, and Golar LNG are expanding globally for extensive infrastructure development and development of import solutions.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 162.80 Billion |

| Expected Size by 2035 | USD 438.92 Billion |

| Growth Rate from 2025 to 2035 | CAGR 11.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2035 |

| Leading Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Segment Covered | By Type, By Component, By LNG Infrastructure Type, By Capacity, By Application, By Region |

| Key Companies Profiled | Royal Dutch Shell plc , ExxonMobil Corporation, Chevron Corporation , BP plc , Mitsui O.S.K. Lines, Ltd. (MOL), Excelerate Energy, Inc., Golar LNG Limited, BW LNG, Hyundai Heavy Industries Co., Ltd., Samsung Heavy Industries Co., Ltd., Karpowership, Petronas, GasLog Ltd. |

Key Technological Shifts in LNG and FSRU Market:

The LNG and FSRU market is undergoing key technological shifts driven by the demand for operational efficiency, safety, performance efficiency, and sustainability. One of the most significant transformations is the integration of Artificial Intelligence (AI), enabling safety, flexibility, and improving efficiency. AI offers real-time process optimization in FSRU regasification processes and liquefaction plants. AI recommends adjustments and detects inefficiencies in liquefaction processes. AI extends the lifespans of critical assets and streamlines LNG supply chains.

- For instance, Shell collaborated with Baker Hughes and C3.ai to create an AI-enabled predictive maintenance system for its Prelude FLNG facility.

Trade Analysis of LNG and FSRU Market: Import & Export Statistics

- Australia exported $46.2B of liquified natural gas in 2023.

- Qatar exported $37.3B of liquified natural gas in 2023.

- Japan imported $46.1B of liquified natural gas in 2023.

- China imported $44.4B of liquefied natural gas in 2023.

LNG and FSRU Market Value Chain Analysis

- Feedstock Procurement : Feedstock procurement for LNG is natural gas, and FSRU is liquefied natural gas.

- Quality Testing and Certifications : The quality testing involves analysis of energy content, impurity, chemical composition, & contamination, and certifications include ISO Certifications, IRClass, & FSRU Operations License.

- Regulatory Compliance and Safety Monitoring : The regulatory compliance covers operational safety, registration, technical & safety standards, and environmental protection & safety monitoring involves hazard detection, process monitoring, structural monitoring, and emergency response.

Overview of the Regional Distribution of FSRUs and LNG

| Region | Number of FSRUs | LNG Import Terminals | New Projects |

| Asia Pacific | More than 20 | Over 100 |

|

| Europe | More than 15 | 41 |

|

| South America | 10 | 9 |

|

| Middle East & Africa | 5 | 10 |

|

Segmental Insights

Type Insights

Why the LNG Infrastructure Segment Dominates the LNG and FSRU Market?

The LNG infrastructure segment dominated the LNG and FSRU market with a 70.3% share in 2024. The strong focus on clean energy sources and increasing transition of energy across various countries increases demand for LNG infrastructure. The increasing need for energy security and the growing generation of power require LNG infrastructure. The expansion of transportation, like ships and heavy-duty vehicles, requires LNG. The strong government support for LNG infrastructure development and integration of domestic LNG pipelines with traditional onshore terminals drives the overall market growth.

The FSRU segment is the fastest-growing at a CAGR of 6.6% in the market during the forecast period. The growing demand for LNG and a strong focus on energy security increase the demand for FSRU. The faster deployment process and lower upfront investment of FSRU help market growth. The ongoing advancements in FSRU, like digital automation, better regasification, and storage, support the overall market growth.

Component Insights

How did the Liquefaction Terminals Segment Hold the Largest Share in the LNF and FSRU Market?

The liquefaction terminals segment held the largest revenue share of 46.4% in the LNG and FSRU market in 2024. The growing need for cleaner fuel alternatives and the growing demand for energy increase the adoption of liquefaction terminals. The increasing diversification of energy sources and growing investment in liquefaction terminals increase the development of liquefaction terminals. The growing expansion of liquefaction terminals in countries like Qatar and the United States drives the market growth.

The regasification terminals segment is growing at a 6.8% CAGR in the market during the forecast period. The increasing need for energy security and focus on lowering environmental impact increases demand for regasification terminals. The growing demand for energy and the shift towards cleaner fuels require regasification terminals. The lower initial investment and faster deployment of regasification terminals support the overall market growth.

The storage facilities segment is growing at a significant rate in the market. The strong focus on energy security and growing power generation increases demand for storage facilities. The development of LNG import infrastructure and a focus on lowering reliance on pipelines increase the adoption of storage facilities. The growing expansion of the transportation sector requires storage facilities, supporting the overall market growth.

LNG Infrastructure Type Insights

Why Onshore Terminals Segment Dominating the LNG and FSRU Market?

The onshore terminals segment dominated the LNG and FSRU market with a 72.4% in 2024. The strong focus on significant LNG regasification & storage, and well-established LNG infrastructure increases demand for onshore terminals. The growing generation of power and the rise of industrial activities require onshore terminals. The cost-effectiveness, large-scale capacity, and operational reliability of onshore terminals drive the overall market growth.

The offshore terminals segment is the fastest-growing at a CAGR of 6.9% in the market during the forecast period. The growing industrialization and focus on energy transition increase demand for offshore terminals. The lower capital cost and operational flexibility of offshore terminals help market growth. The minimal land acquisition and faster deployment of offshore terminals support the overall market growth.

Capacity Insights

Why Small-Scale Segment Held the Largest Share in the LNG and FSRU Market?

The small-scale segment held the largest revenue share of 68.8% in the LNG and FSRU market in 2024. The lower capital expenditure and faster deployment of small-scale plants help the market growth. The growing heavy-duty transportation, like ships, trucks, and buses, increases demand for small-scale plants. The strong focus on energy security and diversification of energy sources requires small-scale plants, driving the overall market growth.

The large-scale segment is growing at a 7.0% CAGR in the market during the forecast period. The rapid industrialization and strong focus on energy transition increase the adoption of large-scale plants. The growing demand for energy and a strong focus on energy security require large-scale plants. The growing government investment in large-scale plants and energy diversification supports the overall market growth.

Application Insights

Which Application Dominated the LNG and FSRU Market?

The power generation segment dominated the LNG and FSRU market with a 48.5% in 2024. The growing demand for electricity and the transition to cleaner energy increase demand for LNG and FSRU. The rapid urbanization and strong focus on energy security require LNG and FSRU. The growing diversification of energy sources and the adoption of renewable energy sources require LNG and FSRU, driving the overall market growth.

The industrial segment is the fastest-growing at a CAGR of 7.2% in the market during the forecast period. The expansion of the shipping industry and growing power generation increases demand for LNG and FSRU. The growing manufacturing activities and increasing industrial processes require LNG and FSRU. The rapid growth in industrial activities and the expansion of the oil & gas sector require LNG and FSRU, supporting the overall market growth.

The transportation segment is significantly growing in the market. The growing utilization of commercial vehicles and heavy transport vehicles requires LNG and FSRU. The focus on a cleaner energy transition in transportation and the use of long-haul vehicles like buses & trucks requires LNG and FSRU. The growing expansion of transportation drives the overall market growth.

Regional Insights

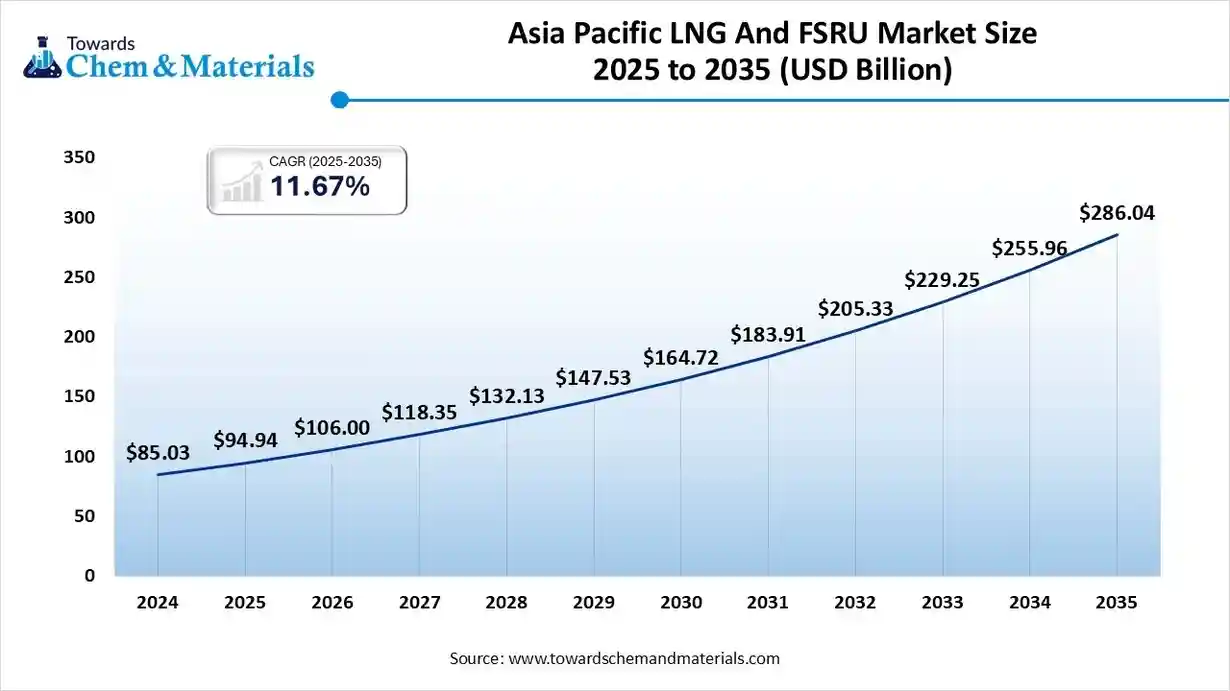

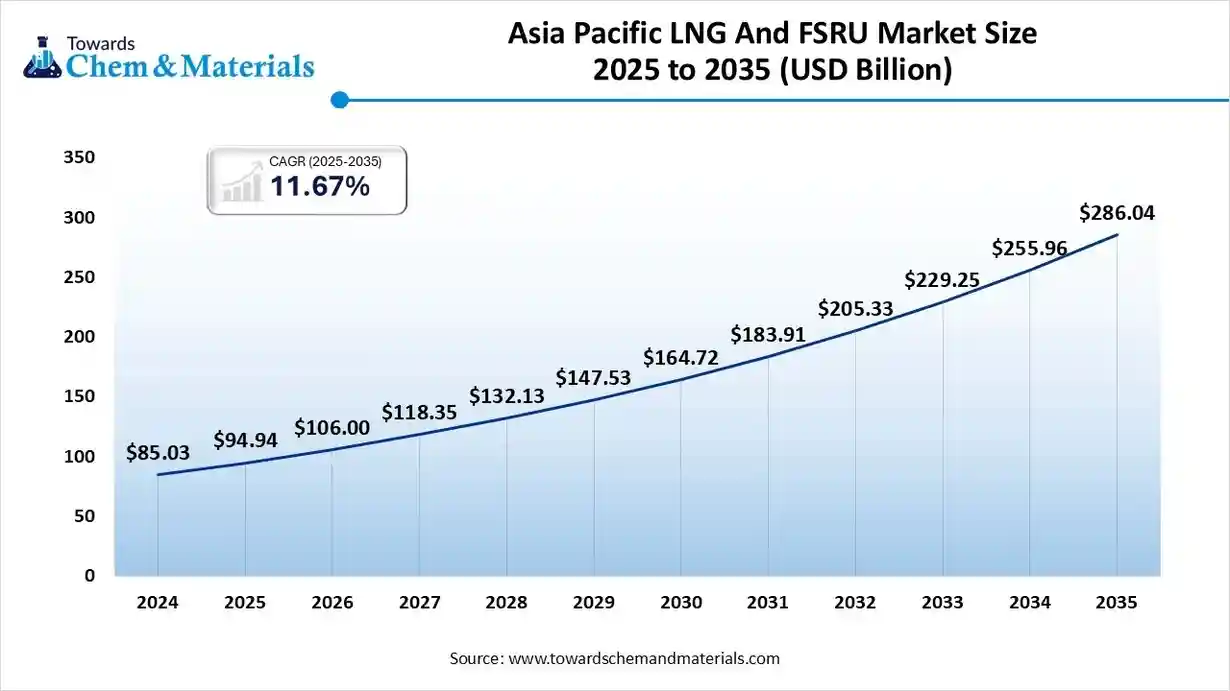

The LNG And FSRU market size was valued at USD 94.94 billion in 2025 and is expected to surpass around USD 286.04 billion by 2035, expanding at a compound annual growth rate (CAGR) of 11.67% over the forecast period from 2025 to 2035. Asia Pacific dominated the market with a 65.11% share in 2024. The rapid growth in population and the higher need for electricity increase the adoption of LNG and FSRU.

The strong focus on transition away from coal and adoption of low-emission alternatives requires LNG and FSRU. The high consumption of energy and strong focus on energy security require LNG and FSRU. The growing investment in the development of LNG infrastructure and strong LNG imports in countries like China, India, Bangladesh, South Korea, & others drives the overall market growth.

From Shore to Ship: How China Shapes LNG and FSRU Revolution

China is a key contributor to the LNG and FSRU market. The stricter environmental policies, like blue sky defense and high demand for energy, increase the adoption of LNG and FSRU. The heavy investment in natural gas infrastructure, like LNG receiving terminals and pipelines, helps market growth. The strong focus on diversifying energy sources and the development of vast LNG infrastructure support the overall market growth.

China exported $491M of liquified natural gas in 2024.

Europe LNG and FSRU Market Trends

Europe is growing at the fastest CAGR of 7.8% in the market during the forecast period. The focus on enhancing energy security and the need for diversification of energy sources increases demand for LNG and FSRU. The rapid deployment of FSRU and reduced Russian gas supply help the market growth. The growing work for the improvement of internal gas pipelines and the presence of large natural gas import terminals in countries like Belgium, Spain, &

France support the overall market growth.

Floating Forward: Germany Anchors LNG and FSRU Future in Europe

Germany is a major contributor to the market. The growing demand for energy security and strong government support for the development of LNG import infrastructure increase the adoption of LNG and FSRU. The growing diversification of energy sources and focus on long-term energy transition require LNG and FSRU. The presence of large gas storage capacities and well-established LNG pipeline networks drives the overall market growth.

North America LNG and FSRU Market Trends

North America expects notable growth in the market. The presence of abundant reserves of natural gas and the transition to cleaner energy increase demand for LNG and FSRU. The growing diversification of energy sources and focus on enhancing energy security require LNG and FSRU. The growing investment in projects like the Cedar LNG project in Canada and the expansion of LNG infrastructure support the overall market growth.

United States Catalyst in the Expansion of LNG and FSRU in the Next Phase

The United States is growing in the market. The growing production of domestic natural gas and the increasing need for energy diversification increase demand for LNG and FSRU. The development of existing LNG import facilities into export facilities and the presence of FSRU construction expertise drive the overall market growth.

The United States exported $41.8B of liquified natural gas in 2023.

Middle East & Africa LNG and FSRU Market Trends

The Middle East & Africa are growing in the market. The growing industrial activities and increasing demand for power require LNG and FSRU. The strong focus on energy security and the need to lower reliance on single energy sources require LNG and FSRU. The presence of companies like QatarEnergy, Saudi Aramco, and ADNOC supports the overall market growth.

Saudi Arabia LNG and FSRU Market Trends

Saudi Arabia contributes to the growth of the market. The focus on strengthening energy security and securing the energy portfolio requires LNG and FSRU. The growing domestic power generation and development of industrial activities increase demand for LNG and FSRU. The development of projects like the Jafurah gas project and the expansion of LNG liquefaction drives the overall market growth. Saudi Arabia exported $108M of liquefied natural gas in 2023

South America LNG and FSRU Market Trends

South America is growing in the market. The strong focus on energy security and expansion of the transportation sector increases demand for LNG & FSRU. The focus on decarbonization efforts and the presence of significant natural gas reserves increase demand for LNG & FSRU. The growing expansion of industrial sectors in countries like Argentina and Brazil supports the overall market growth.

Brazil LNG and FSRU Market Trends

Brazil is significantly growing in the market. The focus on lowering reliance on hydropower and diversification in energy sources requires LNG and FSRU. The strong focus on energy security and growing industrial activities requires LNG and FSRU. The growing expansion of LNG regasification infrastructure and development of integrated LNG to power projects drives the overall market growth.

Recent Developments

- In July 2025, Excelerate Energy launched an FSRU, Hull 3407, in South Korea. The FSRU has a capacity of delivering natural gas is 1 billion ft3/d and consists of advanced emissions-reduction systems.(Source:www.lngindustry.com)

- In September 2025, Deutsche Energy Terminal launched its second floating LNG terminal in Germany. The facility increases the capacity of natural gas by 1.9 billion cubic meters.(Source:www.intellinews.com)

- In April 2024, Mol started commercial operation of FSRU named Jawa Satu for the Jawa 1 LNG-fired power plant in Indonesia. The capacity of the plant is 1760MW, and the plant ensures a stable supply of electricity.

(Source: www.mol.co.jp)

Top LNG and FSRU Market Companies List

Hoegh LNG Holdings Ltd.

Corporate Information

- Name: Höegh LNG Holdings Ltd., formally changed to Höegh Evi Ltd. on 18 September 2024 (ticker remains HLNG).

- Headquarters: Bermuda (legal domicile) with operational presence in Norway and globally.

- Industry: Marine energy infrastructure owner/operator of Floating Storage & Regasification Units (FSRUs), LNG carriers, and increasingly floating terminals for clean energy vectors (hydrogen, ammonia) and carbon transport & storage.

History and Background

- The roots of the company trace back to Leif Høegh & Co. founded in 1927, originally in shipping and oil‐related transport.

- In 1973 the predecessor company ordered the world’s first LNG carrier with a Moss‐type containment system ("Norman Lady").

- In 2006 the business segments were restructured: Höegh LNG (floating LNG infrastructure) and Höegh Autoliners became separate with a common holding company.

Key Developments and Strategic Initiatives

- The company is arguably one of the global leaders in the FSRU market converting LNG carriers or building new floating import terminals to serve gas importing countries.

Strong performance in 2023: In its 2023 Annual Report, Höegh LNG reported the highest net result in its history, driven by FSRU deliveries to Europe. - In September 2024 the company changed its name to Höegh Evi to reflect broadened focus on “energy vector infrastructure” beyond just LNG (i.e., hydrogen, ammonia, CCS).

Mergers & Acquisitions

- In September 2022 the company completed the acquisition of all outstanding common units of Höegh LNG Partners LP (NYSE: HMLP).

- In March 2023 the company announced a completed acquisition of LNG carrier “Golar Seal” (renamed Höegh Gandria) to add to its fleet.

Partnerships & Collaborations

- On 28 June 2024, the company signed an agreement with Deutsche ReGas (Germany) to develop a floating hydrogen import terminal (Lubmin) with ammonia cracker technology producing hydrogen from imported ammonia via a floating barge solution.

- On 20 January 2025, the company (Höegh Evi) entered a Memorandum of Understanding (MoU) with SEFE (Securing Energy for Europe) to develop international clean-hydrogen supply chains using floating import infrastructure.

Product Launches / Innovations

- The company is pioneering a floating ammonia-to-hydrogen cracker concept embedded into a floating barge solution part of its hydrogen import terminal developments in Germany.

- Hybrid FSRU concept (patent-pending) announced: On the history page (2023 timeline) it mentions a “hybrid FSRU concept utilizing an industrial‐scale ammonia cracker onboard the vessel.”

Key Technology Focus Areas

- Floating Storage & Regasification Units (FSRUs): core business, providing flexible LNG import solutions.

- Hybrid/dual-vector marine terminals: extending from LNG to ammonia/hydrogen import infrastructure.

- Ammonia as hydrogen carrier + onboard ammonia cracking: technology to convert ammonia into hydrogen for downstream supply chains.

- Carbon transport & storage (CCS): development of floating CO₂ storage (FCSO), shuttle tankers, subsea injection.

R&D Organisation & Investment

- In April 2023, the company (with Wärtsilä, IFE, BASF SE, etc) received EUR 5.9 million in funding from the

- Norwegian Government’s “Green Platform” programme to develop a solution using ammonia as hydrogen carrier in floating terminals.

- The 2023 Annual Report notes the launch of a comprehensive clean energy strategy reflecting investment in new infrastructure and clean molecule import solutions.

SWOT Analysis

Strengths

- Leading position in the FSRU market with substantial fleet experience; the company is recognized as a pioneer.

- Flexible marine infrastructure business model (floating terminals) gives speed, mobility and lower land‐footprint compared to onshore terminals.

- Strong strategic partnerships and evolving portfolio into clean energy vectors (hydrogen, ammonia, CCS) which aligns with global energy transition trends.

- High recent financial performance (2023 record net result) indicating operational strength.

Weaknesses

- Heavy reliance historically on LNG import infrastructure (a fossil fuel), which may face headwinds as decarbonisation accelerates.

- Large capital expenditure requirements for fleet, conversions, and new floating infrastructure exposure to cost overruns, delays or unchartered assets.

- Regulatory, technological and market risk in hydrogen/ammonia and CCS segments newer business areas with less proven track records.

Opportunities

- Growing global demand for LNG import terminals (especially in regions shifting away from pipeline gas supply).

- Expansion into clean energy import infrastructure: green hydrogen, ammonia, and CCS offer new revenue streams and long-term relevance.

- Partnering with utilities and national governments seeking flexible, fast-deploy solutions to energy security and transition.

- Ability to repurpose or convert existing vessels into new infrastructure (hybrid terminals) offering asset‐utilization benefits.

Threats

- Energy transition risk: if LNG demand declines faster than infrastructure lifetimes, there is risk of under-utilized FSRUs.

- Competition: other major players in LNG/FSRU market may drive down pricing or capture key contracts.

- Technology and regulatory risk in clean energy segments: e.g., hydrogen cost competitiveness, ammonia supply chains, CCS acceptance.

- Geopolitical and supply chain risks: floating infrastructure often deployed in regions with regulatory/political complexity, exposure to marine incident risk.

Recent News & Strategic Updates

- Name change: On 16 September 2024 (formally registered 18 September) the company announced its rename from Höegh LNG to Höegh Evi, emphasising “energy vector infrastructure”.

- Hydrogen/Ammonia Terminal: In June 2024, the deal with Deutsche ReGas to build the “H2-Import‐Terminal Lubmin” (floating ammonia cracker for hydrogen production) was announced.

Other Top Companies List

- Royal Dutch Shell plc: The London-based company performs operations like oil & gas production, distribution, exploration, marketing, and refining.

- ExxonMobil Corporation: The largest oil & gas company consists of business divisions like upstream services, product solutions, and low carbon solutions.

- Chevron Corporation: The multinational energy company performs upstream and downstream operations for various oil & gas products.

- BP plc: The UK-based company performs downstream, upstream, and midstream operations for the oil & gas industry.

- Mitsui O.S.K. Lines, Ltd. (MOL)

- Excelerate Energy, Inc.

- Golar LNG Limited

- BW LNG

- Hyundai Heavy Industries Co., Ltd.

- Samsung Heavy Industries Co., Ltd.

- Karpowership

- Petronas

- GasLog Ltd.

Segments Covered

By Type

- LNG Infrastructure

FSRU

By Component

- Liquefaction Terminals

- Regasification Terminals

- Storage Facilities

- Transportation

By LNG Infrastructure Type

- Onshore Terminals

- Offshore Terminals

By Capacity

- Small-Scale

- Large-Scale

By Application

- Power Generation

- Industrial

- Transportation

- Residential & Commercial

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa