Content

Biocides Market Size and Growth 2025 to 2034

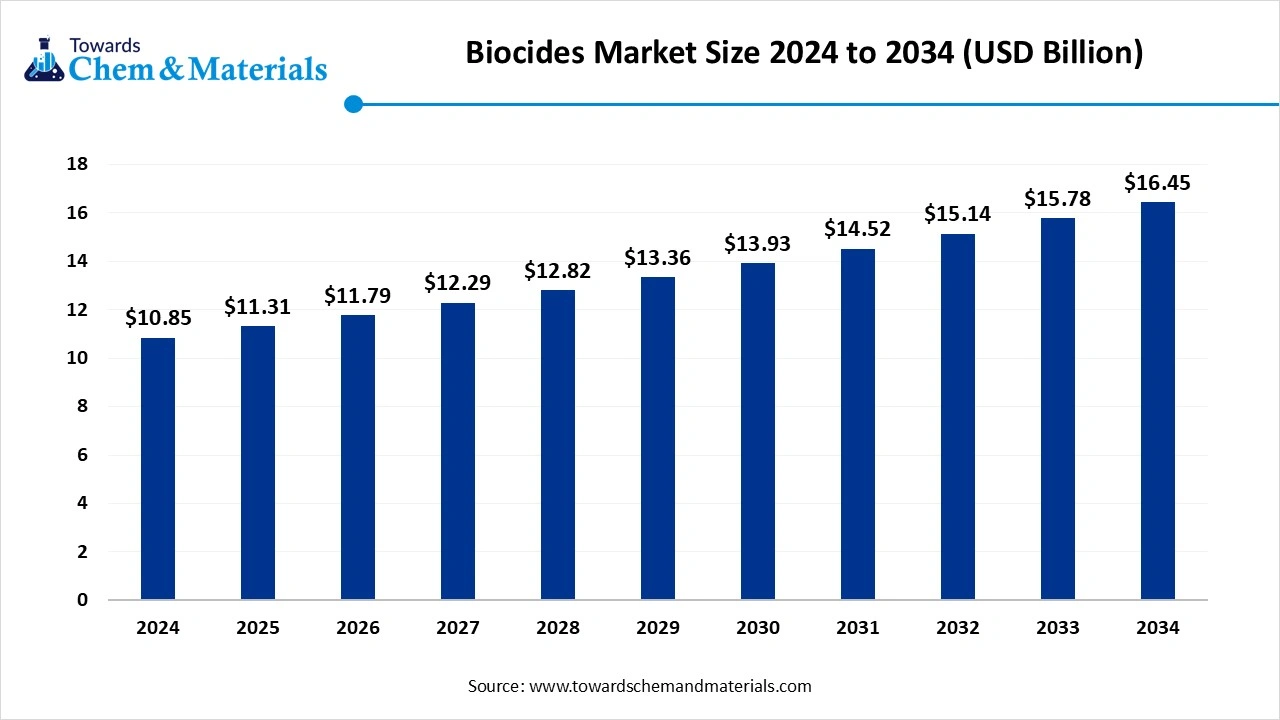

The global biocides market size was reached at USD 10.85 billion in 2024 and is expected to be worth around USD 16.45 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.25% over the forecast period 2025 to 2034. The growing demand for biocides from different sectors is the key factor driving market growth. Also, surging demand for personal care products coupled with the increasing awareness of hygiene can fuel market growth further.

Key Takeaways

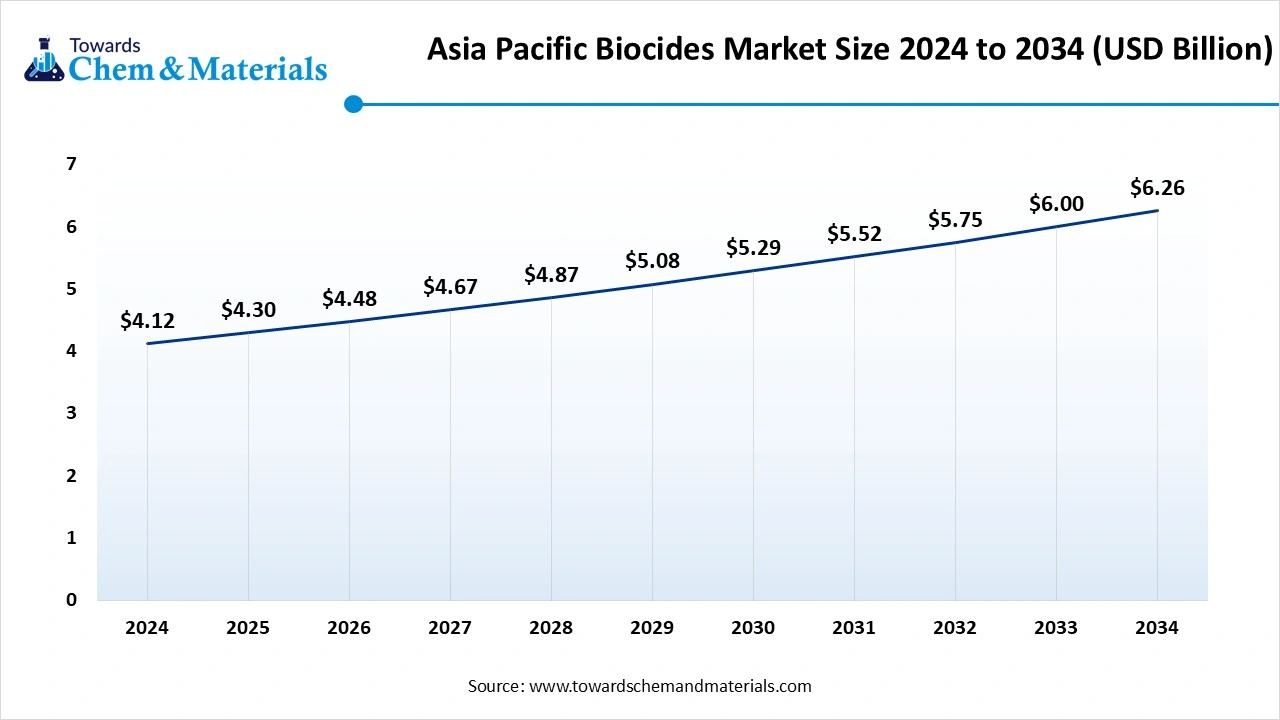

- The Asia Pacific biocides market size was estimated at USD 4.12 billion in 2024 and is expected to reach USD 6.26 billion by 2034, growing at a CAGR of 4.27% from 2025 to 2034.

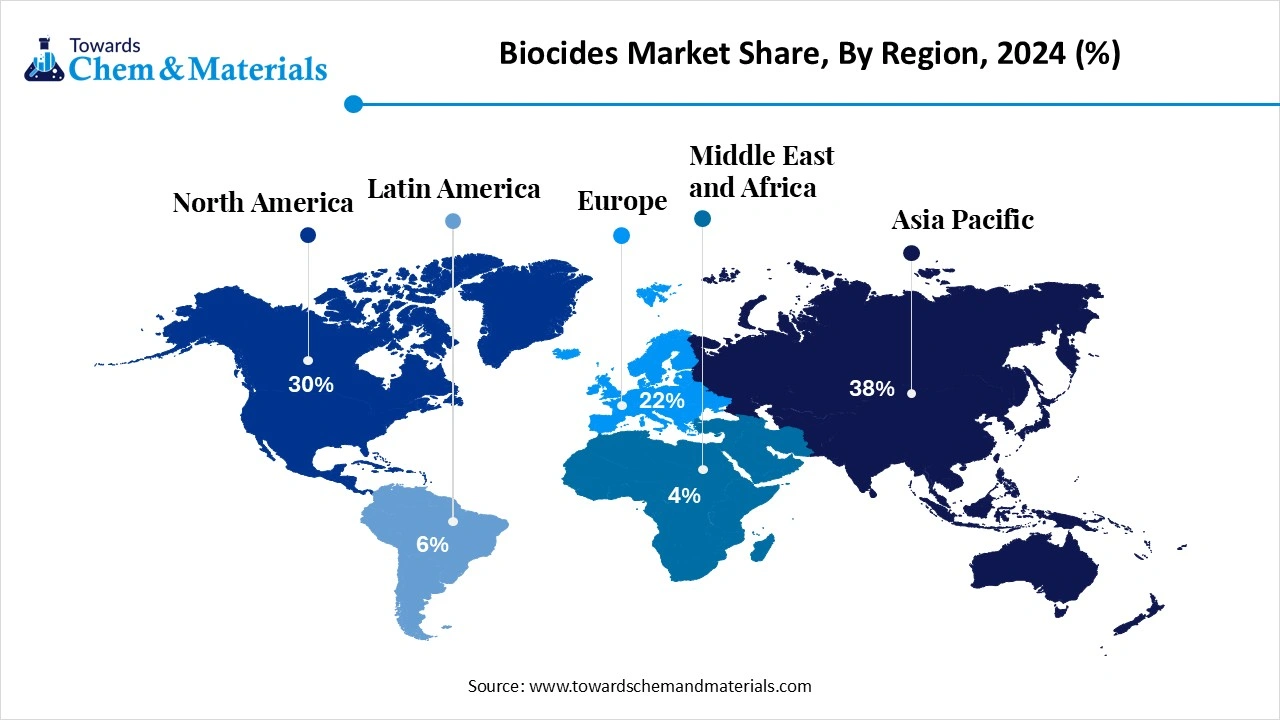

- By region, the Middle East & Latin America are expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the rapid urbanization and industrialization, coupled with the increasing demand for clean water.

- By product type, the halogen-based biocides segment held a 35% market share in 2024. The dominance of the segment can be attributed to the growing utilisation of halogens like chlorine, iodine, and fluorine in biocide compositions.

- By product type, the isothiazolinones & quats segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the raised demand for hygiene and water treatment products.

- By form, the liquid segment led the market by holding 63% market share in 2024. The dominance of the segment can be linked to the growing product demand from paints and coatings, water treatment, and personal care industries.

- By form, the gaseous segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by ongoing investment in research and development by market players.

- By function, the antimicrobial segment held a 43% market share in 2024. The dominance of the segment can be attributed to the surging awareness regarding the importance of hygiene and the potential health risks associated with microbial contamination.

- By function, the disinfectant segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be linked to the ongoing R&D activities in biocides.

- By application, the water treatment segment dominated the market with 39% market share in 2024.The dominance of the segment is owning to the stringent water regulations and surging water scarcity.

- By application, the paints & coatings segment is expected to grow at fastest CAGR over the forecast period. The growth of the segment is due to the growing demand for hygienic products.

- By distribution channel, the direct sales segment led the market with 48% market share in 2024. The dominance of the segment is due to the ongoing development of sustainable biocides, rapid industrialization, and urbanization.

- By distribution channel, the indirect sales segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be driven by expanding municipal and industrial water treatment, especially in emerging regions.

Innovations in Biocide Formulations are Expanding Market Growth

The Biocides Market refers to the global industry involved in the manufacturing and application of chemical and biological agents designed to inhibit or eliminate harmful microorganisms. These agents are used to preserve products, disinfect surfaces, and control microbial activity in water, industrial processes, consumer goods, and healthcare settings. The market plays a crucial role in sectors such as water treatment, paints & coatings, food & beverages, personal care, and pharmaceuticals, especially amid growing hygiene awareness and regulatory standards. Companies are increasingly involved in mergers and acquisitions, which can positively impact market growth positively.

What Are the Key Trends Influencing the Biocides Market?

- Enhanced environmental and safety regulations are a key trend in the market. Where companies are obligated to bring out newer products to comply with more stringent regulations. Also, the new regulations enable the industry to innovate and find new formulations to ensure the effectiveness of biocides.

- The growing demand for sustainable biocides is the major trend shaping a positive market trajectory. The increasing environmental concerns and consciousness regarding the impact of chemicals on ecosystems have led to a considerable push for eco-friendly alternatives in many sectors.

- Biocides are important in municipal and industrial water treatment to prevent biofilm formation, microbial contamination, and corrosion in cooling systems and pipelines. The rising scarcity of clean water and the growth of water reuse systems are driving dependence on efficient biocidal solutions for convenient water management, driving market growth shortly.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 11.31 Billion |

| Expected Size by 2034 | USD 16.45 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Form, By Function, By Application, By Distribution Channel, By Region |

| Key Companies Profiled | Lonza Group AG, Ecolab Inc., LANXESS AG, Solvay SA, Veolia Group, Dow Inc., BASF SE, Stepan Company, Clariant AG, Kemira Oyj, Troy Corporation (Arxada), Thor Group Limited, Italmatch Chemicals S.p.A., Albemarle Corporation, Enviro Tech Chemical Services, Hubbard-Hall Inc., Vink Chemicals GmbH, Akzo Nobel N.V., ICL Group Ltd., Akema Fine Chemicals |

Market Opportunity

Growing Demand from the Paints & Coatings Industry

Increasing product demand from the demand from paints & coatings industry is the major factor presenting lucrative market opportunities. In this sector, the biocides are used to protect the surface painted on from microbial contamination, including bacterial and fungal growth, due to air pollution. Furthermore, growing applications in the automotive sector to safeguard the interior and exterior parts of automobiles, like handles, body, and brakes, are leading to market growth soon.

- In July 2025, Lonza launched the latest addition to the Proxel range of preservatives in Europe. This advanced in-can preservative is created to address the growing market need for Methylisothiazolinone (MIT)- free biocide formulations.(Source: www.coatingsworld.com)

Market Challenges

Shift towards Bio-based Alternatives

There is an increasing shift towards natural and bio-based biocides due to stricter regulations and environmental concerns. Developing highly efficient bio-based alternatives to conventional petroleum-based biocides is a challenging and complex process. Moreover, some biocides can cause health risks to humans, such as respiratory problems and skin irritation, hindering market growth further.

Regional Insights

The Asia Pacific biocides market size was estimated at USD 4.12 billion in 2024 and is anticipated to reach USD 6.26 billion by 2034, growing at a CAGR of 4.27% from 2025 to 2034.

Asia Pacific dominated the biocides market with 38% market share in 2024. The dominance of the region can be attributed to the ongoing urbanization, growing industrial water treatment demands, along the increasing need for hygienic consumer goods. In addition, supportive government policies for clean water regulations and the increasing investments in industrial as well as municipal sanitation projects are boosting market growth shortly.

What is the Biocide Export Data of India in 2024?

| Product Description | Quantity |

| GLUTARALDEHYDE 50%, BROAD SPECTRUM BIOCIDE | 230 KGS |

| PS-C-16 BIOCIDE CHEMICAL | 200 KGS |

| RAGOL BIOCIDE 500 CHEMICALS FOR PAPER MFG. ING PLANT | 2 MTS |

| NON OXIZIDING BIOCIDE (COOLING TOWER) | 619 KGM |

| Biocide (HABER 9120) | 2191 KGS |

Biocides Market in China

In the Asia Pacific, China led the market owing to the increasing awareness of waterborne diseases, ongoing industrialization, along stringent environmental regulations. Also, China's growing industrial sector, particularly in areas such as water treatment, requires the use of biocides to protect from microbial contamination and ensure proper product quality and safety, propelling market growth in the country further.

The Middle East & Latin America are expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the rapid urbanization and industrialization, coupled with the increasing demand for clean water. Furthermore, middle-income countries face significant water scarcity, which leads to increased funding for water treatment and purification. Biocides play an important role in preventing microbial contamination in water systems, such as pipelines, storage tanks, and cooling towers.

Biocides Market in Saudi Arabia

In the Middle East, Saudi Arabia dominated the market by holding the largest market share, due to stringent health and environmental regulations, which are boosting the development and adoption of safer and more eco-friendly biocide products, optimising the innovation and market growth in the country. Saudi Arabia's major oil & gas reserves also contribute to market expansion, as biocides are crucial for controlling microbial contamination in drilling, manufacturing, and storage processes.

Segmental Insight

Product Type Insight

Which Product Type Segment Dominated the Biocides Market in 2024?

The halogen-based biocides segment held a 35% market share in 2024. The dominance of the segment can be attributed to the growing utilisation of halogens like chlorine, iodine, and fluorine in biocide compositions. Among these, chlorine is the most used halogen, which is highly efficient as an oxidizing and antibacterial agent, making it crucial for wastewater treatment facilities and municipal drinking water plants, among several other applications.

The isothiazolinones & quats segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the raised demand for hygiene and water treatment products and increasing consciousness regarding health hazards from microbial contaminants, with ongoing industrial applications.

Form Insight

Why Liquid Segment Held a Largest Biocides Market Share in 2024?

The liquid segment led the market by holding 63% market share in 2024. The dominance of the segment can be linked to the growing product demand from paints and coatings, water treatment, and personal care industries. Additionally, halogen-based biocides, like iodine and chlorine compounds, are extensively used due to their vast antimicrobial activity and cost-effectiveness, which makes them a substantial part of the liquid biocides segment.

The gaseous segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by ongoing investment in research and development by market players, which leads to the development of sustainable, effective and specialized biocides. Biocides are necessary for preventing microbial growth in oil and gas pipelines and other facilities.

Function Insight

How Much Share Did the Antimicrobial Segment Held in 2024?

The antimicrobial segment held a 43% market share in 2024. The dominance of the segment can be attributed to the surging awareness regarding the importance of hygiene and potential health risks associated with microbial contamination. Regulations regarding sanitation and hygiene are becoming increasingly stricter, which leads to escalating adoption of biocides in different sectors.

The disinfectant segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be linked to the ongoing R&D activities in biocides, which lead to the development of more sustainable and effective products, contributing to segment expansion in the market further.

Application Insight

Why the Water Treatment Segment Dominate the Biocides Market in 2024?

The water treatment segment dominated the market with 39% market share in 2024. The dominance of the segment is owed to the stringent water regulations, surging water scarcity, and the increasing demand for efficient water purification across different industries. Moreover, the rising preference for water-based paints and coatings, especially in the automotive and construction industries, is propelling the demand for biocides as preservatives in these products.

The paints & coatings segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the growing demand for hygienic products along with the protection against microbial contamination. The growing inclination towards water-based paints over oil-based paints is fuelling market growth soon.

Distribution Channel Insight

Why Direct Sales Segment Dominated the Biocides Market in 2024?

The direct sales segment led the market with 48% market share in 2024. The dominance of the segment is due to the ongoing development of sustainable biocides, rapid industrialization, and urbanization, coupled with the expanding healthcare sector with its emphasis on sterile environments and infection control. Also, advancements in biocide formulations and innovations such as multi-functional biocides are contributing to segment growth soon.

The direct sales segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be driven by expanding municipal and industrial water treatment, especially in emerging regions, creating opportunities for indirect sales via suppliers and distributors specific to biocide objects.

Recent Developments

- In February 2024, LANXESS showcased its wide range of products for the Paints & Coatings industry, which took place at Goregaon, Mumbai. Three business units, Inorganic Pigments (IPG), Material Protection Products (MPP), and Polymer Additives (PLA), showed their recent achievements in product innovations.(Source: https://www.manufacturingtodayindia.com)

- In March 2024, Univar Solutions Brasil Ltda. announced a new agreement of distribution with Arxada for an extensive range of preservatives, biocides, and performance additives. These additives are utilized for industrial applications such as lubricants, paints, and coatings.(Source: www.coatingsworld.com)

Top Companies List

- Lonza Group AG

- Ecolab Inc.

- LANXESS AG

- Solvay SA

- Veolia Group

- Dow Inc.

- BASF SE

- Stepan Company

- Clariant AG

- Kemira Oyj

- Troy Corporation (Arxada)

- Thor Group Limited

- Italmatch Chemicals S.p.A.

- Albemarle Corporation

- Enviro Tech Chemical Services

- Hubbard-Hall Inc.

- Vink Chemicals GmbH

- Akzo Nobel N.V.

- ICL Group Ltd.

- Akema Fine Chemicals

Segments Covered

By Product Type

- Halogen-Based Biocides

- Metallic Compounds

- Organic Acids & Derivatives

- Phenolics

- Quaternary Ammonium Compounds

- Aldehydes

- Isothiazolinones & quats

- Others

By Form

- Liquid

- Powder/Granules

- Gaseous

By Function

- Antimicrobial

- Antifouling

- Preservative

- Disinfectant

- Pest Control

By Application

- Water Treatment

- Industrial Water

- Municipal Water

- Cooling Towers

- Paints & Coatings

- Wood Preservation

- Food & Beverage

- Oil & Gas

- Pharmaceuticals

- Personal Care & Cosmetics

- Pulp & Paper

- Agriculture

By Distribution Channel

- Direct Sales (Industrial Contracts)

- In-Direct Sale

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait