Content

What is the Current Europe Recycled Plastics Market Size and Volume?

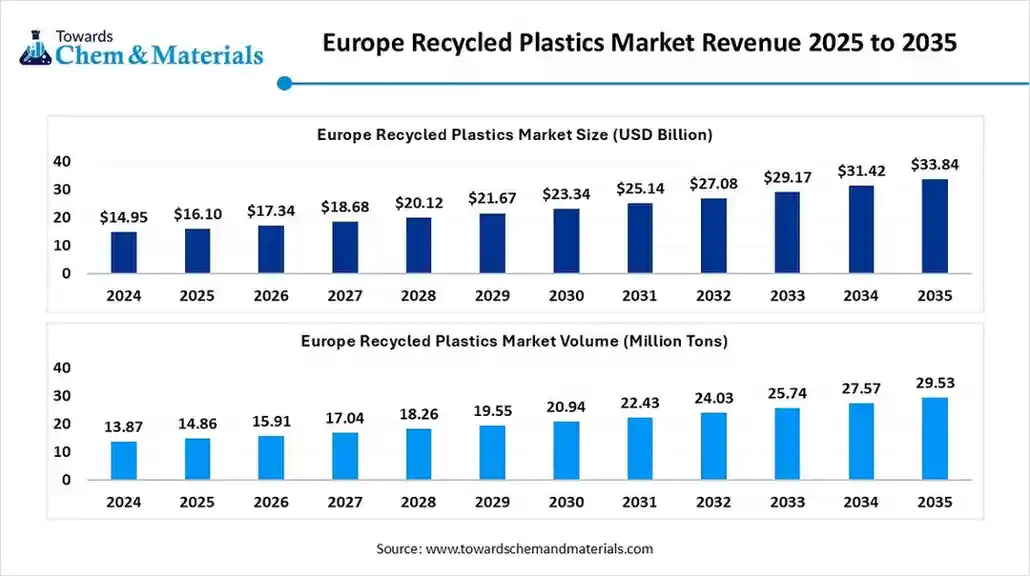

The Europe recycled plastics market size is estimated at USD 16.10 billion in 2025, it is predicted to increase from USD 17.34 billion in 2026 to approximately USD 33.84 billion by 2035, expanding at a CAGR of 7.71% from 2025 to 2035.The stringent regulations on single-use plastics and increasing awareness about sustainable products drive the market growth.

The Europe recycled plastics market stands at 14.86 million tons in 2025 and is forecast to reach 29.53 million tons by 2035, growing at a CAGR of 7.11% from 2025 to 2035.

Key Takeaways

- By polymer type, the polyethylene terephthalate (rPET) segment held a 44% share in the market in 2024.

- By polymer type, the polypropylene (rPP) segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By source, the post-consumer waste segment held a 57% share in the market in 2024.

- By source, the post-industrial waste segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By recycling technology, the mechanical recycling segment held a 62% share in the market in 2024.

- By recycling technology, the chemical recycling segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By form, the pellets segment held a 48% share in the Europe recycled plastics market in 2024.

- By form, the flakes segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end-use industry, the food & beverage segment held a 38% share in the market in 2024.

- By end-use industry, the automotive & transportation segment is expected to grow at the fastest CAGR in the market during the forecast period.

Why Europe Recycled Plastics Market Growing?

Europe recycled plastics market growth is driven by strong government support to use recycled plastics, increased utilization of eco-friendly materials, expansion of the packaging industry, presence of advanced recycled technologies, and growing construction activities.

What are Recycled Plastics?

Recycled plastic is plastic produced from recycling methods using plastic wastes like packaging, bottles, and containers. The method used for plastic recycling is chemical and mechanical recycling. The recycled plastic is used to create products like carpentry, automotive components, caps, park benches, construction materials, bottles, closures, and others. Recycled plastic offers benefits like reducing carbon footprint, lowering pollution, minimizing landfill waste, and conserving natural resources.

Europe Recycled Plastics Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the industry is expected to see accelerated growth due to circular economy goals, well-established recycling infrastructure, and government regulations. Growth is being reinforced by environmental regulations and advancements in recycling, particularly in Germany, the Netherlands, and Belgium.

- Major Investors: Large corporations, government-backed entities, and private equity firms are heavily investing in the space, drawn by the circular economy model and government regulations. Companies like Infinity Recycling, Ingka Group, TotalEnergies, and Veolia are investing in the recycled plastic industry. For instance, Veolia invested £70 million in the tray-to-tray closed-loop PET recycling facility in Shrewsbury, UK.

- Startup Ecosystem: The Europe recycled plastics startup ecosystem is innovation-driven and dynamic due to stricter EU regulations. Startups like Carbios, BlueAlp, Recycleye, and Deploy focus on the development of advanced waste recycling technology to create new products.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 17.34 Billion |

| Expected Size by 2035 | USD 33.84 Billion |

| Growth Rate from 2025 to 2035 | CAGR 7.71% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Polymer Type, By Source, By Recycling Technology, By Form, By End-use Industry |

| Key Companies Profiled | ALPLA Werke GmbH & Co KG , Indorama Ventures Public Co. Ltd. (IVL , Plastipak Holdings, Inc , SUEZ Group , Borealis AG, Tomra Systems ASA, MBA Polymers, Inc., LyondellBasell Industries N.V., Remondis SE & Co. KG, Faerch Group, Greiner Packaging International GmbH, Loop Industries Inc., EcoBlue Ltd., PolyLoop AG |

Key Technological Shifts in the Europe Recycled Plastics Market:

The Europe recycled plastics market is undergoing key technological transformations driven by the demand for creating high-quality food-grade recycled plastics and other products. One of the most significant shifts is the integration of Artificial Intelligence, which increases profitability, efficiency, and accuracy in recycling. AI easily separates & identifies various plastic types like PP, PET, HDPE, & others and develops high-quality recycled materials. AI helps to optimize waste collection routes and can create new materials. AI offers valuable information regarding recovery rates, waste composition, and generation trends.

- For instance, Tomra Recycling integrated AI into its Autosort systems to sort & identify various plastic types like non-food-grade and food-grade materials.

Trade Analysis of Europe Recycled Plastics Market: Import & Export Statistics

- From June 2024 to May 2025, the United Kingdom exported 28 shipments of recycled HDPE.

- C&E Development B.V. is the leading supplier of recycled plastic scrap in Germany.

- TESA SE is the leading supplier of recycled PET in Germany.

Europe Recycled Plastics Market Value Chain Analysis

- Feedstock Procurement : The feedstock procurement is the sourcing of raw materials like post-industrial plastic waste through manufacturing processes and post-consumer waste like household items.

- Key Players: SUEZ Recycling & Recovery, MBA Polymers, Veolia, Biffa, Plastipak

- Chemical Synthesis and Processing : Chemical synthesis and processing involve processes like gasification, hydro-cracking, pyrolysis, and depolymerization.

- Key Players: INEOS, Carbios, BASF, Eastman, Shell, Plastic Energy, ReNew ELP

- Quality Testing and Certifications : Quality testing involves testing of properties like moisture analysis, melt flow index, ash content, thermal analysis, & contamination detection, and certifications like EN 15343, PolyCert Europe, & RecyClass.

Circular Champions: Key Players Shaping Europe’s Plastic Circularity

| Company Name | Recycling Technology Used | Headquarters | Materials Used | Regional Partnerships |

| Veolia | Mechanical | France |

|

|

| Biffa | Mechanical and Chemical | United Kingdom |

|

|

| SUEZ Recycling & Recovery | Mechanical and Chemical | United Kingdom |

|

|

| Interzero | Mechanical | Germany |

|

|

| ALPLA | Mechanical | Austria |

|

|

Segmental Insights

Polymer Type Insights

Why the Polyethylene Terephthalate (rPET) Segment Dominates the Europe Recycled Plastics Market?

- The polyethylene terephthalate (rPET) segment dominated the Europe recycled plastics market with a 44% share in 2024. The growing manufacturing of products like personal care packaging, beverage bottles, and food containers increases demand for rPET. The corporate sustainability initiatives and stricter government regulations for rPET help the market growth. The growing expansion of e-commerce and the manufacturing of packaged goods requires rPET, driving the overall market growth.

- The polypropylene (rPP) segment is the fastest-growing in the market during the forecast period. The manufacturing of exterior & interior automotive parts like dashboards & bumpers increases demand for rPP. The growing demand for household and personal care products increases the adoption of rPP. The high consumption of packaged food & beverages requires rPP, supporting the overall market growth.

- The polyethylene (rPE) segment is growing significantly in the market. The increasing manufacturing of milk cartons, garbage bins, laundry detergent bottles, and cutting boards increases the adoption of rPE. The growing production of rigid and flexible packaging requires rPE. The development of automotive parts like tubing, interior & exterior parts, and fuel tanks requires rPE, driving the overall growth of the market.

Source Insights

How did the Post-Consumer Waste Segment hold the Largest Share in the Europe Recycled Plastics Market?

- The post-consumer waste segment held the largest share of 57% in the Europe recycled plastics market in 2024. The increasing awareness about plastic pollution and the adoption of sustainable packaging increases demand for post-consumer waste. The growing demand for personal care products and consumer goods increases the production of post-consumer waste. The shifting consumer preference for sustainable products requires post-consumer waste, driving the overall market growth.

- The post-industrial waste segment expects the fastest growth in the market during the forecast period. The growing manufacturing of scraps and increasing business awareness about plastic impact increase the production of post-industrial waste. The growing industries like construction, textiles, packaging, and automotive increase the production of post-industrial waste, supporting the overall market growth.

Recycling Technology Insights

Why the Mechanical Recycling Segment is Dominating the Europe Recycled Plastics Market?

- The mechanical recycling segment dominated the Europe recycled plastics market with a 62% share in 2024. The stricter regulations on single-use plastics and the presence of advanced management systems increase the adoption of mechanical recycling. The high generation of packaging waste and a strong focus on energy efficiency increase demand for mechanical recycling. The growing production of construction materials, bottles, and films requires mechanical recycling, driving the overall market growth.

- The chemical recycling segment is the fastest-growing in the market during the forecast period. The high volume of plastic waste and growing plastic pollution increase demand for chemical recycling. The growing expansion of the textiles and packaging industries requires chemical recycling. The ability to handle contaminated & plastic waste and high investment in recycling technologies like depolymerization & pyrolysis support the market growth.

- The hybrid or advanced recycling is growing at a significant rate in the market. The generation of plastics like multi-layer packaging and flexible films increases demand for advanced recycling. The strong focus on the production of virgin-quality material and circular economy initiatives increases the adoption of advanced recycling. The ongoing technological advancements, like the integration of AI with advanced recycling, drive the market growth.

Form Insights

Why the Pellets Segment Held the Largest Share in the Europe Recycled Plastics Market?

- The pellets segment held the largest share of 48% in the Europe recycled plastics market in 2024. The growing expansion of the packaging industry and the manufacturing of construction materials like roofing tiles, lumber, & insulation increases demand for pellets. The ease of handling and high compatibility with manufacturing machinery for pellets help the market growth. The growing industries like consumer goods, healthcare, packaging, electronics, and agriculture increase the adoption of pellets, driving the overall market growth.

- The flakes segment is expects the fastest growth in the market during the forecast period. The growing awareness of plastic pollution and circular economy principles increases the production of flakes. The growing industries like consumer goods, packaging, and textile increases demand for flakes. The flakes' cost-effectiveness and ease of use in the manufacturing processes support the overall market growth.

- The powder or granules segment is significantly growing in the market. The growing demand for eco-friendly products and focus on lowering carbon footprint increases demand for recycled powders or granules. The growing manufacturing of construction materials like piping, composite lumber, insulation, and window frames increases demand for powders or granules. The development of lightweight vehicle components and electrical & electronics components requires powder or granules, driving the overall market growth.

End-Use Industry Insights

Which End-Use Industry Dominated the Europe Recycled Plastics Market?

- The food & beverage segment dominated the Europe recycled plastics market with a 38% share in 2024. The growing production of plastic films, bottles, and containers increases demand for recycled plastics. The strong focus on preserving the contamination and freshness of food increases the adoption of recycled plastics. The growing expansion of the food & beverage industry increases the adoption of recycled plastics, driving the overall market growth.

- The automotive & transportation segment is the fastest-growing in the market during the forecast period. The focus on lowering vehicle weight and the development of lightweight vehicle materials increases demand for recycled plastics. The rise in electric vehicles and the focus on enhancing the fuel efficiency of vehicles increase demand for recycled plastics. The growing manufacturing of automotive components like dashboards, underbody panels, seat fabrics, and bumpers requires recycled plastics, supporting the overall market growth.

- The consumer goods segment is growing at a significant rate in the market. The growing production of personal care items like cleaning products, shampoo, and detergents increases demand for recycled plastics. The increasing expansion of accessories and apparel like textiles, clothing, & carpets requires recycled plastics. The rising manufacturing of personal care products, toys, packaging, and durable goods increases demand for recycled plastics, driving the overall market growth.

Country Insights

Circular Frontier: Germany’s Grip on Europe’s Recycled Plastic Horizon

Germany dominated the Europe recycled plastics market with a 27% share in 2024. The stricter regulations on plastic use and increasing investment in recycling infrastructure increase the production of recycled plastics. The strong presence of chemical & mechanical recycling technologies helps the market growth. The robust growth in industries like construction, automotive, and packaging increases demand for recycled plastics. The high recycling rates and presence of Extended Producer Responsibility laws drive the market growth.

Recycled Rise: U.K. Races Ahead in Europe’s Recycled Plastic Evolution

The U.K. expects the fastest growth in the market during the predicted period. The bans on single-use plastic items like stirrers, cutlery, and plates increase demand for recycled plastics. The growing concerns about plastic pollution and government regulations to reduce plastic waste have increased the production of recycled plastics. The significant investment in the development of recycling infrastructure and circular economy principles increases demand for recycled plastics. The presence of chemical recycling and advanced sorting processes supports the overall market growth.

French Loop: New Power in Europe's Recycled Plastics Industry

France is significantly growing in the Europe recycled plastics market. The presence of laws like the Anti-Waste and Circular Economy and single-use plastic directives increases demand for recycled plastics. The increasing consumer awareness about plastic waste impact and emphasis on material reuse & recycling increases demand for recycled plastics. The growing investment of companies like Veolia in expanding recycling facilities capacity drives the overall market growth.

Recent Developments

- In February 2024, LyondellBasell JV launched an advanced plastic recycling facility in Germany. The facility recycles post-consumer plastic waste, and its capacity is 70000 metric tons. The facility lowers energy consumption up to 30%. (Source: www.plasticstoday.com)

- In June 2024, Dow launched 2 new Revoloop recycled plastic resins for non-food packaging applications. One grade consists of 85% PCR, and the other grade has 100% PCR. The resins are useful in applications like protective packaging, stretch films & liners, shrink films, and heavy-duty shipping sacks.

(Source: www.recyclingtoday.com) - In June 2025, Ineos Olefins & Polymers launched recycled plastic production in Lavera, France. The facility produces water pipes, caps & closures, and milk bottles. The facility uses pyrolysis oil produced from post-consumer waste to develop recycled propylene & ethylene.

(Source: chemanager-online.com)

Top Europe Recycled Plastics Market Companies

Veolia Environnement S.A.

Corporate Information

- Name: Veolia Environnement S.A.

- Headquarters: Aubervilliers / Paris region, France.

- Founded: Originally Compagnie Générale des Eaux in 1853; current name was adopted in 2003.

- Main business segments: Water management; waste management (including collection, recycling, recovery); energy services (heating, cooling, utilities) and other services.

History and Background

- Early roots: The company traces back to Compagnie Générale des Eaux (founded 1853), which evolved into Vivendi Environnement (1998) and then became Veolia Environnement in 2003.

- Growth via expansion of services: Over the decades, Veolia broadened from municipal water supply into waste collection/treatment and energy services.

Key Developments and Strategic Initiatives

- Strategic plan “GreenUp”: Veolia launched its “GreenUp” plan to accelerate ecological transformation. As part of this plan, it will invest in growth markets (including plastics recycling), digitalization, AI, operational efficiency.

- Plastics recycling ambition: It is positioning plastics recycling as a growth driver. Example: In July 2025 announced £70 million investment in a UK “tray-to-tray” closed‐loop PET recycling facility (80,000 t/year capacity) to become operational by early 2026.

- Signing of the European Plastics Pact: Veolia signed this pact to commit to plastics reductions, recyclability, recycled content targets.

- Mergers & Acquisitions : Acquisition of its competitor SUEZ Group (not detailed here but known publicly) gave additional scale in waste & water.

- In April 2023: Veolia sold its 50% share in the joint venture Quality Circular Polymers BV (QCP) to LyondellBasell Industries N.V. Veolia remains a feedstock supplier.

Partnerships & Collaborations

- With Faurecia (automotive interior supplier): A co-research agreement signed 3 May 2022 to develop recycled plastics (average 30% recycled content) for car interiors.

- With TotalEnergies Marketing Middle East (UAE): Veolia’s RECAPP service and TotalEnergies joint initiative for recycling lubricant containers into rHDPE.

Product Launches / Innovations

- The UK “tray-to-tray” recycling facility: first of its kind in UK for food-grade PET trays will process both tray and bottle PET into food-grade packaging.

- Recycling of lubricant containers initiative in UAE (see above) converting containers to rHDPE. innovation in feedstock types.

Key Technology Focus Areas

- Mechanical recycling of plastics (washing, flaking, pelletizing) turning post-consumer bottles/trays into secondary raw material.

- Closed-loop systems: e.g., tray-to-tray PET recycling facility.

- Digital & AI-enabled waste sorting, predictive maintenance in utilities (covered under GreenUp).

R&D Organisation & Investment

- Veolia’s Universal Registration Document indicates the company has set up a plastic-recycling industrial platform across Europe & Asia.

- The GreenUp plan identifies growth markets and digitalization/AI investments.

- While exact R&D spend is not public in the sources I found, the firm clearly prioritizes innovation in circular economy, recycling, digital utilities, and advanced water technologies.

SWOT Analysis

Strengths:

- Market leader status in environmental services (water/waste/energy) with global footprint.

- Strong strategic focus on circular economy and plastics recycling giving growth potential.

- Broad technology portfolio and ability to serve industrial, municipal, and private-sector clients.

- Strong brand reputation, large scale and expertise in managing complex infrastructure.

Weaknesses:

- Margins can be under pressure in waste/recycling segments due to commodity dynamics (recycled plastic prices competition with virgin).

- Some plant closures/industry headwinds (see German plastics recycling plants closure) may demonstrate vulnerability.

- Complexity of operations across many geographies and segments may dilute focus or increase cost overheads.

- Dependence on regulatory frameworks and recycled-content mandates; if those lag, demand for recycled materials may be slower.

Opportunities:

- Growing global regulatory pressure for recycled content (especially plastics) and circular economy norms - strong tailwinds.

- Increasing demand from sectors such as automotive, packaging, consumer goods for recycled materials (partnership with Faurecia).

- Ability to convert non-recyclable plastics and expand into more challenging waste streams (e.g., PFAS, industrial plastics).

- New geographical opportunities (e.g., UK facility, Asia expansion) to replicate scalable models.

Threats:

- Economic viability of recycling can be threatened by low prices of virgin polymer (if oil/virgin feedstock is cheap).

- Operational risks in recycling plants: contamination, regulatory changes, competition, technical failures.

- Country-specific closures (see Germany) reflect that challenging market conditions exist.

- Geopolitical/regulatory risk: environmental services often depend on public contracts/regulation; changes can affect business.

Recent News & Strategic Updates

- UK Closed-Loop Plastics Facility: In July 2025 Veolia announced a £70 million investment to build the UK’s first tray-to-tray PET recycling facility (80,000 t/year) at Battlefield, Shropshire.

- German Plant Closures: Veolia announced the closure of two plastics recycling plants in Germany (Bernburg) by end of year, due to difficult market conditions. Combined capacity >70,000 t.

Other Top Companies List

- ALPLA Werke GmbH & Co KG: The Austrian family-owned company strongly focuses on bottle-to-bottle recycling to create food-grade recycled materials like rHDPE and rPET.

- Indorama Ventures Public Co. Ltd. (IVL): The key player in plastic recycling that focuses on processing the post-consumer PET bottles into recycled PET resins and other products.

- Plastipak Holdings, Inc.: The leading recycling & rigid plastic packaging industry that produces post-consumer recycled resins like rHDPE & rPET.

- SUEZ Group: The environmental services company that collects plastic waste across various industries to transform it into pellets or flakes using a mechanical recycling process.

- Borealis AG

- Tomra Systems ASA

- MBA Polymers, Inc.

- LyondellBasell Industries N.V.

- Remondis SE & Co. KG

- Faerch Group

- Greiner Packaging International GmbH

- Loop Industries Inc.

- EcoBlue Ltd.

- PolyLoop AG

Segments Covered

By Polymer Type

- Polyethylene Terephthalate (rPET)

- Beverage bottles and food-grade containers

- Polyester fibers and strapping

- Polyethylene (rPE)

- LDPE films and shrink wraps

- HDPE containers and pipes

- Polypropylene (rPP)

- Rigid packaging and automotive components

- Nonwoven and molded parts

- Polystyrene (rPS)

- Foam trays and insulation products

- Recycled PS granules for extrusion

- Others (PVC, ABS, Nylon)

By Source

- Post-consumer Waste

- Household packaging waste streams

- Beverage, film, and agricultural plastics

- Post-industrial Waste

- Manufacturing scrap

- Industrial off-spec resins and regrinds

By Recycling Technology

- Mechanical Recycling

- Sorting, washing, flaking, and pelletizing systems

- Optical sorting and contamination control

- Chemical Recycling

- Pyrolysis and depolymerization

- Solvolysis and gasification routes

- Hybrid / Advanced Recycling

- Mechanical + chemical cascade systems

- Energy recovery-integrated models

By Form

- Flakes

- PET flakes and HDPE flake feedstock

- Washed and sorted granules

- Pellets

- Food-contact and non-food-contact pellets

- Recompounded blends for film extrusion

- Powder / Granules

By End-use Industry

- Food & Beverage

- Rigid food packaging and bottles

- Cold beverage and dairy containers

- Consumer Goods

- Household products and personal care

- Durable packaging and toys

- Building & Construction

- Pipes, profiles, panels, and insulation

- Automotive & Transportation

- Components and interior systems