Content

What is the Current Electronic Materials and Chemicals Market Size and Volume?

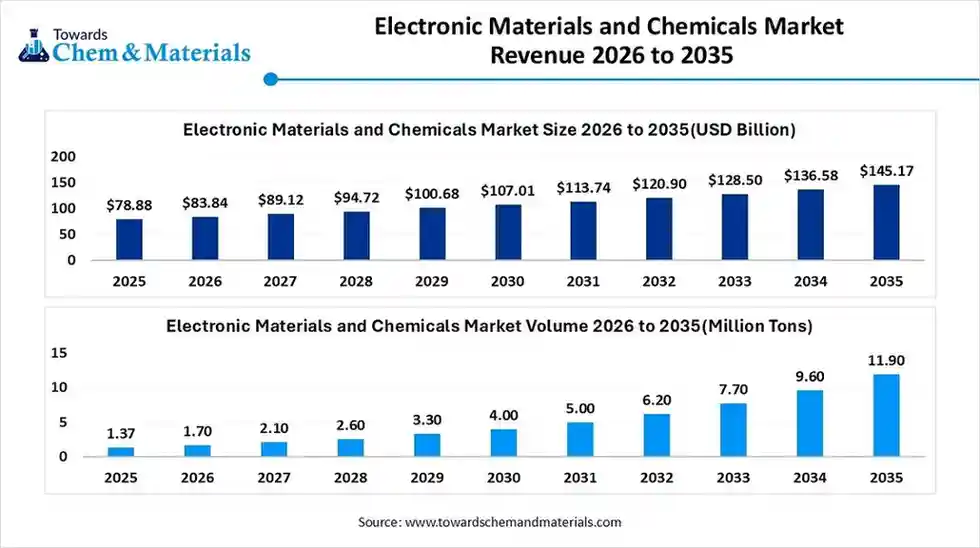

The global electronic materials and chemicals market size was estimated at USD 78.88 billion in 2025 and is expected to increase from USD 83.84 billion in 2026 to USD 145.17 billion by 2035, growing at a CAGR of 6.29% from 2026 to 2035.

The global electronic materials and chemicals market volume was estimated at 1.37 million tons in 2025 and is projected to reach 11.90 million tons by 2035, growing at a CAGR of 3.82% from 2026 to 2035. Asia Pacific dominated the electronic materials and chemicals market with the largest volume share of 60% in 2025. the increasing consumer & industrial electronics demand, growing adoption of electric vehicles, and expansion of the semiconductor & electronic goods market drive the market growth.

Key Takeaways

- By region, Asia Pacific dominated the electronic materials and chemicals market with the largest volume share of 60% in 2026, akin to the region being known as the global electronics manufacturing center in the current period.

- By region, North America is anticipated to capture a greater portion of the market volume with a significant CAGR in the future, due to the increased demand for advanced electronics and access to the latest technology.

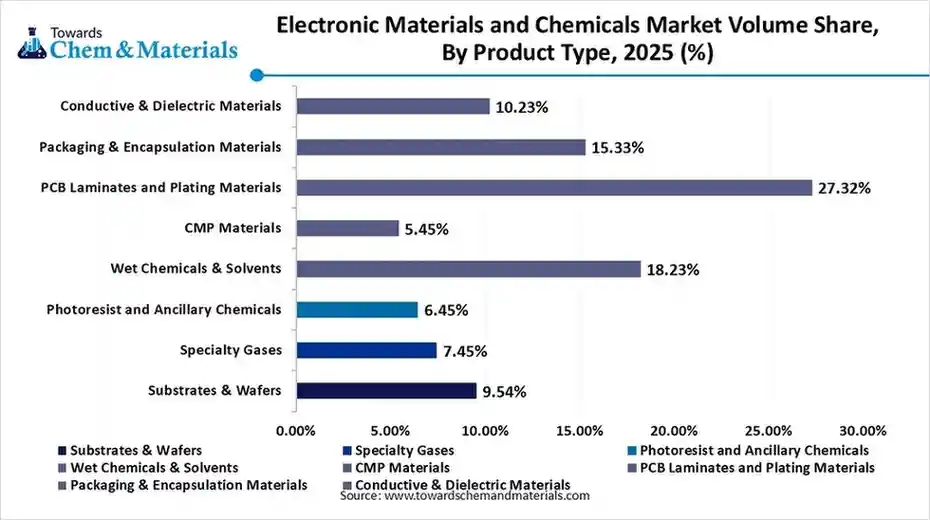

- By product type, the PCB laminates and plating materials segment dominated the market the largest volume share 27% in 2025, akin to the PCB board, known as the essential and crucial component in every electronic device.

- By product type, the photoresists & ancillary chemicals segment is expected to grow during the forecast period, akin to the sudden shift towards the smarter, smaller, and more complex electronics in recent years.

- By material form type, the solid segment dominated the market the largest volume share 56% in 2025, akin to its reliability and compatibility with high-volume electronics production.

- By material form type, the gaseous segment is expected to grow at a rapid CAGR during the forecast period, owing to the increasing precision required in semiconductor and display manufacturing.

- By end-use industry, the consumer electronics segment dominated the market the largest volume share 40% in 2025 due to its mass market nature and short replacement cycles in the current period.

- By end-use industry, the automotive segment is expected to grow during the forecast period, akin to the ongoing structural changes in vehicle design.

The Invisible Backbone of Modern Electronic Performance

Electronic materials and chemicals refer to the specific material which make an electronic device work properly and efficiently. Moreover, these material includes chips, semiconductors, displays, batteries, and many more, which help devices' working capacity. Furthermore, the electronic manufacturing has experiencing trend towards miniaturisation where smaller, smarter designs has ginning industry attention in recent years.

The Growing Adoption of Electronic Devices Surges Market Growth

The growing demand and adoption of various electronic devices computers, smartphones, wearable devices, laptops, and many more, increases demand for electronic materials and chemicals. The growing advancements in electronic devices increase demand for advanced materials, fueling demand for the electronic materials and chemicals market.

The growing demand for complex & efficient circuits in electronic devices is fueling innovation. The growing adoption of various technologies like IoT, 5G, and Artificial Intelligence (AI) increases demand for electronic materials & chemicals. The growing innovation and trend of miniaturized and powerful devices is fueling innovation in electronic materials and chemicals. The growing demand for devices like mobile phones, smart TVs, laptops, monitors, and computers increases demand for integrated circuits, memory chips, sensors, and PCBs. The growing expansion of the electronics industry and ongoing innovations are key drivers for the electronics materials and chemical market.

Market Trends

- The increased focus on purity and contamination has paved the way for economic benefit in the manufacturing sector in recent years. Moreover, the trend towards smaller devices and chip manufacturers has seen in demanding very high purity chemicals to avoid minor contamination, which can cause defects.

- The emergence and development of the custom-made formulations have boosted the revenue potential across the manufacturing landscape in the past few years. Moreover, several manufacturers preferred the custom-made formulations over the commodity chemicals for precision work in the early years.

- The move toward the local production units and supply has strengthened the bottom line of the production firms in the current period. Also, the greater support from the regional government, which has been seen the reduction of imports, can create lucrative opportunities for the manufacturer in the coming years.

Report Scope

| Report Attributes | Details |

| Market Size and Volume in 2026 | USD 83.84 Billion / 1.70 million tons |

| Expected Market Size and Volume by 2035 | USD 145.17 Billion / |

| Growth Rate from 2026 to 2035 | CAGR 6.29% |

| Base Year of Estimation | 2025 |

| Forecast Period | 2026 - 2035 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product, By Application, By End Use, By Region |

| Key Companies Profiled | Shin-Etsu Chemical Co., Ltd, Merck KGaA, Air Liquide S.A., DuPont de Nemours, Inc. , Sumitomo Chemical Co., Ltd., BASF SE , Tokyo Ohka Kogyo Co., Ltd. , JSR Corporation , Fujifilm Holdings Corporation , Dow Inc. , Mitsubishi Chemical Group Corporation , Resonac Holdings Corporation , Air Products and Chemicals, Inc. , Honeywell International Inc. , Entegris, Inc., Solvay S.A. , Arkema S.A. , Evonik Industries AG , Albemarle Corporation |

From Chemistry to Control: The Rise of Smart Materials

The industry is undergoing a significant transition toward integrated, performance-driven material solutions. Furthermore, suppliers have increasingly driven digital monitoring and process feedback mechanisms into material delivery systems in recent years. Also, these advancements allow real-time adjustment of chemical behavior during manufacturing operations.

Trade Analysis of the Electronic Materials and Chemicals Market:

Import, Export, Consumption, and Production Statistics

- The electronic machinery and electronics have become 3rd most exported product from the United States in 2024, exported valued at around $214B as per the records.

- China has observed a sophisticated export of chemical products in 2024, which is estimated to be valued at around $194B billion as per the published record.

Market Opportunity

The Growing Adoption of Renewable Energy

The growing global demand for energy and changing climate conditions increase the adoption of renewable energy. The growing adoption of renewable energy creates an opportunity for market growth. The growing adoption of solar energy increases demand for solar panels and related technologies require specialized electronics materials like cell manufacturing, silicon wafers, chemicals, and materials. The growing production of wind turbines increases demand for electronic materials and the chemicals market.

The growing demand for battery technology increases the production of electrodes, battery electrolyte, and other materials for energy storage, which helps in the market growth. The growing adoption of renewable energy sources like electric vehicles and solar energy increases demand for electronic materials and chemicals. The growing application of renewable energy creates opportunities for electronic materials and the chemical market.

Market Challenge

High Operational Cost Hinders the Growth of the Market

Despite several benefits of electronic materials and chemicals, high operational costs restrict the growth of the market. The strict regulations about the utilization of hazardous chemicals and materials increase demand for the production of lower VOC emissions, and eco-friendly manufacturing increases the overall operational costs.

Disruptions in raw materials availability due to various factors like geopolitical uncertainties and supply disruptions like transportation strikes, port congestion, and natural disaster leads to higher costs. The growing demand for specialized materials and high-purity chemicals in the electronics manufacturing industry leads to higher investment, which increases the overall cost. High operational cost due to factors like high raw materials cost, supply chain disruptions, and growing demand for high-purity materials hampers the growth of the electronic materials and chemicals market.

Value Chain Analysis of the Electronic Materials and Chemicals Market:

- Distribution to Industrial Users: The distribution of electronic materials and chemicals is a critical link in the semiconductor and electronics supply chain. Distribution is increasingly moving toward a hybrid model, where large manufacturers maintain direct-to-fab pipelines for high-volume, high-purity chemicals, while specialized distributors handle smaller nodes, regional hubs, and specialty components.

- Key Players: Linde PLC and Shin-Etsu Chemical

- Chemical Synthesis and Processing: The chemical synthesis and processing of electronic materials are undergoing a significant shift toward AI-driven discovery and ultra-high purity manufacturing to support the miniaturization of 3nm and 2nm process nodes

- Key Players: BASF SE and Merck KGaA

- Regulatory Compliance and Safety Monitoring: Regulatory compliance for the electronic materials and chemicals market is dominated by tightened restrictions on hazardous substances, particularly "forever chemicals" (PFAS), and new digital safety standards for workplace communication.

- Key Agencies: Environmental Protection Agency (EPA) and European Chemicals Agency (ECHA)

Electronic Materials and Chemicals Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Environmental Protection Agency (EPA) | TSCA Section 8(a)(7) | Collecting historical data on PFAS usage since 2011 to assess environmental and health impacts while attempting to reduce the reporting burden on small businesses and importers |

| European Union | European Chemicals Agency (ECHA) | REACH Regulation (EC 1907/2006) | Phasing out "non-essential" uses of PFAS |

| China | State Administration for Market Regulation (SAMR) | China RoHS (GB 26572-2025) | Elevating labeling and concentration limits to a mandatory national status |

Segmental Insights

Product Type Insights

How did the PCB Laminates and Plating MaterialsSegment Dominate the Electronic Materials and Chemicals Market in 2025?

The PCB laminates and plating materials segment dominated the market with 27% industry share in 2025, due to the PCB board, known as the essential and crucial component in every electronic device. Moreover, the increasing demand for smartphones, appliances, laptops, and networking devices, the PCB laminates, and plating material are projected to support stronger cash flows for manufacturing enterprises in recent years, as per the survey.

The photoresists & ancillary chemicals segment expects the fastest growth in the market during the forecast period, owing to the sudden shift towards smaller, smarter, and more complex electronics in recent years. as need for greater chemical performance in smaller devices where precision is the priority, the photoresist and ancillary chemical is expected to emerge as the ideal chemical in the past few years.

Material Form Type Insights

Why does the Solid Segment Dominate the Electronic Materials and Chemicals Market by Material Form Type?

The solid segment dominated the market with 56% industry share in 2025, owing to its reliability and compatibility with high-volume electronics production. Solid inputs provide structural support and precise dimensional control, which are critical for PCB and semiconductor manufacturing. They are easier to transport, store, and integrate into automated production lines.

The gaseous segment is expected to grow at a rapid CAGR due to the increasing precision required in semiconductor and display manufacturing. Gaseous inputs allow consistent material delivery and better reaction control compared to solid forms. They support advanced manufacturing techniques where even minor variations can impact performance.

End Use Industry Insights

How did the Consumer Electronics Segment Dominate the Electronic Materials and Chemicals Market in 2025?

The consumer electronics segment dominated the market with 40% industry share in 2025, akin to its mass market nature and short replacement cycles in the current period. Moreover, daily-use devices are produced in millions of units annually, each requiring multiple materials during fabrication. Rapid design changes increase demand for processed chemicals and materials.

The automotive segment is expected to grow with a rapid CAGR, due to the ongoing structural changes in vehicle design. Modern vehicles rely heavily on electronic control systems, power electronics, and connectivity solutions. These components require advanced materials with strict quality standards.

Product Insights

The solid segment dominated the electronic materials and chemicals market in 2024. The growing expansion of the semiconductor industry increases demand for solid materials like silicon wafers, helping in the market growth. The growing demand for consumer electronics like smartphones, computers, and laptops increases demand for electronic materials and chemicals. The growing expansion of renewable energy, particularly electric vehicles & solar panels, increases demand for solid products.

The growing technological innovations like communication technologies, AI & IoT increase demand for high-performance solid materials. The growing miniaturization of electronic devices and the growing trend of compact devices contribute to the market growth.

The gas segment is the fastest growing in the market during the forecast period. The growing production of advanced microchips and the expansion of the semiconductor industry increase demand for gas products. The growing adoption of consumer electronics devices like wearable devices, smartphones & laptops increases demand for various specialty gases. The growing production of flat panel displays, LECs, solar panels, and other components increases demand for gases. The growing demand for semiconductor fabrication for processes like doping, etching, and doping supports the growth of the market.

Application Insights

The silicon wafers held the largest share of the electronic materials and chemicals market in 2024. The growing production of integrated circuits increases demand for silicon wafers. The growing adoption and production of modern electronic devices help in the market growth. The growing demand for tablets, IoT devices, laptops, and smartphones increases demand for silicon wafers.

The growing innovation in the semiconductor industry increases demand for high-quality silicon wafers. The growing demand from the Asia Pacific region, particularly from South Korea, China, and Japan, helps in the market growth. Additionally, rapid growth of VR, AI, ML, IoT, AR technology, and expansion of 5G technology contribute to the overall growth of the market.

The photoresist segment is experiencing the fastest growth in the market during the forecast period. The rapid growth of the semiconductor & electronics industry and the growing demand for dynamic displays increases demand for photoresist, helping in the market growth. The growing technological advancements in flat-panel displays increase demand for photoresist. The growing integration of artificial intelligence and the Internet of Things helps in the market growth. The growing utilization of advanced technologies like photolithography & microelectronics, and the trend of miniaturization, increases demand for photoresist. The growing autonomous driving system and electric vehicles increase demand for photoresist, supporting the overall growth of the market.

End Use Insights

The semiconductor & integrated circuits dominated the electronic materials and chemicals market in 2024. The growing adoption of electronic devices like smartphones, laptops, computers, and many more increases demand for semiconductor & integrated circuits. The growing miniaturization of devices and semiconductor production increases demand for integrated circuits. The growing expansion of the automotive industry, including electric & hybrid vehicles fueling demand for semiconductor & integrated circuits. The growing demand for high-performance and efficient battery life in wearables and smartphones increases demand for semiconductor & integrated circuits, driving the growth of the market.

The printed circuit boards (PCBs) segment is the fastest growing in the market during the forecast period. The growing demand for consumer electronics like computers, laptops, smartphones, and tablets increases demand for advanced & high-quality PCBs. The growing expansion of electronic applications like industrial, automotive, and medical devices is fueling demand for PCBs. The rise of high-density interconnect technology increases demand for high-quality PCBs. The growing miniaturization & complexity of electronic devices in the automotive sector increases demand for reliable PCBs. The growing demand from the Asia Pacific, particularly Japan, China, and India, supports the growth of the market.

Regional Insights

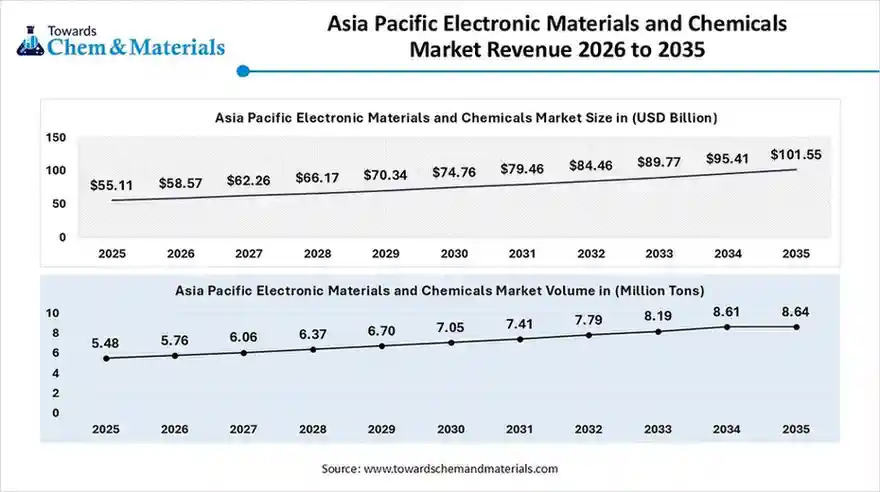

The electronic materials and chemicals market size was valued at USD 55.11 billion in 2025 and is expected to be worth around USD 101.55 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.31% over the forecast period from 2026 to 2035.

The electronic materials and chemicals market volume was estimated at 5.48 million tons in 2025 and is anticipated to reach 8.64 million tons by 2035, growing at a CAGR of 5.18% from 2026 to 2035.

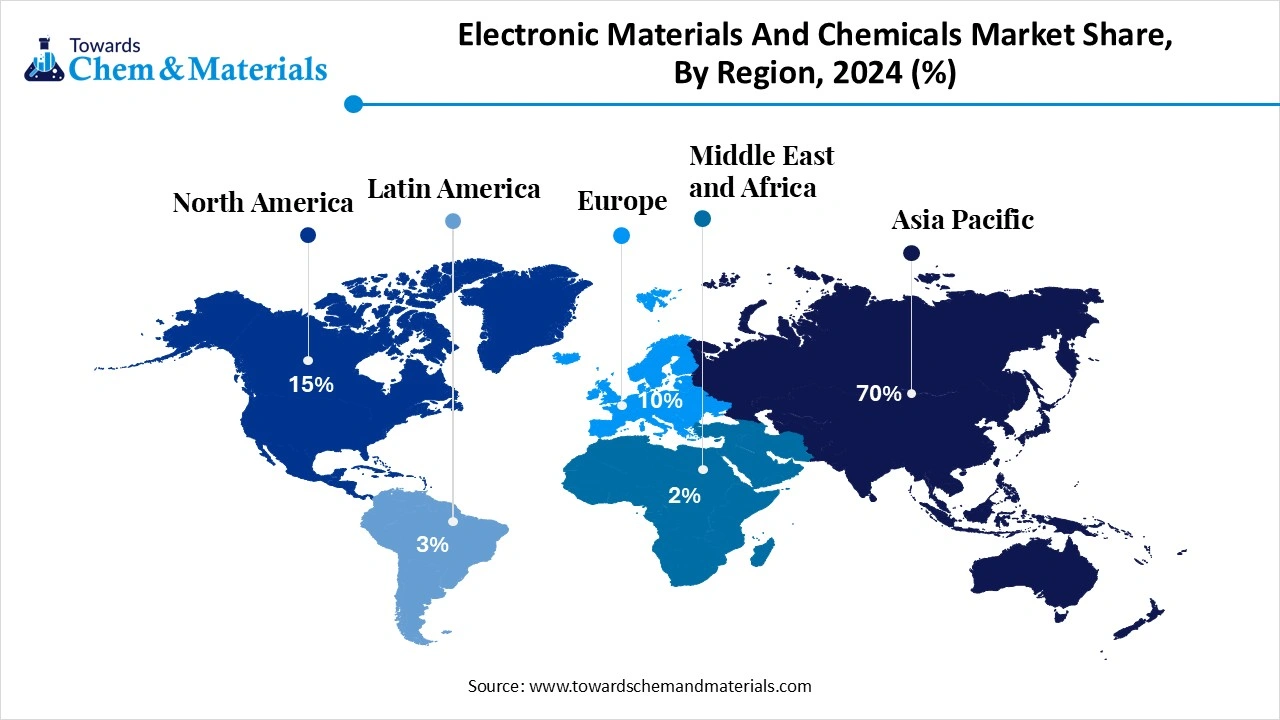

Asia Pacific dominated the electronic materials and chemicals market with 60% industry share in 2025, due to the region being known as the global electronics manufacturing center in the current period. Moreover, the presence of the enlarged chip fabs, PCB factories, and display plants, the region has generated the value added opportunities for the industry participants in recent years.

Robust Domestic Demand Fuels China’s Highest Industry Sales

China maintained its dominance in the electronic materials and chemicals market, owing to the country's prioritizing speed, operation scales, and supply chain integration in recent years. Moreover, China has witnessed the heavy local demand for electronic materials and chemicals in recent years, which has contributed to the highest sales in the industry.

North America Electronic Materials and Chemicals Market Examination

North America is expected to capture a major share of the electronic materials and chemicals market with a rapid CAGR, owing to the increased demand for advanced electronics and access to the latest technology. Moreover, the region has been seen under the heavy investments in high-end chipsets and other electronic materials over the years.

Advanced Electronics Demand Elevates the United States Market

The United States is expected to emerge as a prominent country for the market in the coming years, akin to the rapid need for ultra-pure and high-value materials in the past few years. Also, the manufacturers in united states has been seen in the following trend of prioritization of performance over cost in the current period, which is likely to unlock new business opportunities for producers in the coming years.

Europe Electronic Materials and Chemicals Market Evaluation

Europe is a notably growing region, due to the ongoing regional focus towards sustainability, precision, and regulation-driven innovation in the current period. Moreover, the region has experienced heavy recycling and sustainability trend in the electronics manufacturing industry, which is expected to enable high return ventures for the manufacturers in the coming years.

Investment in Long-Lasting Electronics Boosts Germany's Materials Market Outlook

Germany is expected to gain a major industry share, akin to the increased demand for electronic materials and chemicals in the automotive and smart manufacturing industries. Also, the German manufacturer has been heavily investing in the development of reliable and long-lasting electronics in recent years. Moreover, the demand for smart electronics like smartphones, laptops, and others can drive the future industry growth in Germany.

Electronic Materials and Chemicals Market Share, By Region, 2025 (%)

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 21.19% | 1.93 | 2.49 | 2.88% | 18.79% |

| Europe | 12.11% | 1.10 | 1.34 | 2.21% | 10.13% |

| Asia Pacific | 60.34% | 5.48 | 8.64 | 5.18% | 65.33% |

| South America | 3.23% | 0.29 | 0.44 | 4.51% | 3.30% |

| Middle East & Africa | 3.13% | 0.28 | 0.32 | 1.46% | 2.45% |

Electronic Materials and Chemicals Market Study in the Middle East and Africa

The Middle East and Africa are expected to capture a notable share of the industry, due to rising investment in manufacturing and technology infrastructure. Moreover, the regional countries are encouraging domestic electronics assembly and smart-city projects. These developments increase the need for electronic materials and chemicals. The region's growth is gradual but consistent, supported by government-led industrial strategies

Automation and Digital Investments Power Saudi Arabia’s Electronic Material Expansion

Saudi Arabia is expected to emerge as a prominent country, as the country has seen in building electronic materials demand through controlled industrial development. Investments in automation, digital infrastructure, and local manufacturing are creating new material requirements. The country is prioritizing knowledge transfer and sustainable growth, which has strengthened future demand for electronic materials and chemicals in recent years.

South America Electronic Materials and Chemicals Market Evaluation

South America is a notably growing region, as electronics manufacturing becomes more regionally focused. Governments are supporting domestic production to reduce imports and improve supply chain resilience. This trend increases local demand for electronic materials and chemicals across the region.

Domestic Manufacturing Boom Positions Brazil as a Key Materials Market

Brazil is expected to gain a major industry, akin to its strong electronics and automotive manufacturing base. Local production of consumer devices and vehicles increases demand for electronic materials. Government policies encourage domestic manufacturing, supporting market expansion. Brazil's large internal market further strengthens material consumption.

Recent Developments

- In December 2025, Mitsui & CO partnered with Kaynes Semicon. The motive behind partnership establishment is to build up and strengthen India’s semiconductor ecosystems, as per the published report.(Source: www.indianchemicalnews.com)

Top Vendors in the Electronic Materials and Chemicals Market & Their Offerings:

- Shin-Etsu Chemical Co., Ltd.: A world leader in semiconductor silicon, Shin-Etsu is the top global supplier of silicon wafers and ultra-pure chemicals like photoresists essential for advanced chip manufacturing.

- Merck KGaA: A key global enabler of next-generation computing, Merck offers one of the broadest portfolios of high-purity solvents, specialty gases, and deposition materials for semiconductor and display fabrication.

- The Linde Group: A leading global industrial gases company, Linde is a premier supplier of high-purity specialty gases and wet chemicals used in critical steps for semiconductors, displays, and solar panels.

- Air Liquide S.A.: A world leader in gases and services, Air Liquide provides advanced materials, very high-purity carrier gases, and specialized deposition precursors (Voltaix) for the semiconductor and electronics industries.

Other Key Players

- Shin-Etsu Chemical Co., Ltd

- Merck KGaA

- Air Liquide S.A.

- DuPont de Nemours, Inc.

- Sumitomo Chemical Co., Ltd.

- BASF SE

- Tokyo Ohka Kogyo Co., Ltd.

- JSR Corporation

- Fujifilm Holdings Corporation

- Dow Inc.

- Mitsubishi Chemical Group Corporation

- Resonac Holdings Corporation

- Air Products and Chemicals, Inc.

- Honeywell International Inc.

- Entegris, Inc.

- Solvay S.A.

- Arkema S.A.

- Evonik Industries AG

- Albemarle Corporation

Segments Covered in the Report

By Product Type

- Substrates and Wafers

- Silicon Wafers (Monocrystalline, Polycrystalline)

- Compound Semiconductor Wafers (GaN, SiC, GaAs)

- Glass Substrates (for Displays)

- Specialty Gases

- Deposition Gases (Silane, Ammonia)

- Etching/Chamber Cleaning Gases

- Doping Gases (Phosphine, Arsine, Diborane)

- Photoresist and Ancillary Chemicals

- Positive Photoresists

- Negative Photoresists

- Extreme Ultraviolet (EUV) Resists

- Developers, Strippers, and Primers

- Wet Chemicals and Solvents

- High-Purity Acids (Sulfuric, Hydrofluoric, Nitric)

- High-Purity Bases (Ammonium Hydroxide)

- Electronic-Grade Solvents (IPA, Acetone)

- CMP (Chemical Mechanical Planarization) Materials

- CMP Slurries (Silica, Alumina, Ceria-based)

- CMP Pads

- PCB Laminates and Plating Chemicals

- Rigid and Flexible Laminates

- Copper Clad Laminates (CCL)

- Electroless and Electrolytic Plating Chemicals

- Packaging and Encapsulation Materials

- Epoxy Molding Compounds (EMC)

- Die Attach Materials

- Underfill Materials

- Solder Fluxes and Pastes

- Conductive and Dielectric Materials

- Conductive Polymers and Inks

- Low-k and High-k Dielectrics

By Material Form

- Solid (Wafers, Pellets, Foils)

- Liquid (Solvents, Acids, Slurries)

- Gaseous (Atmospheric and Specialty Gases)

By End-Use Industry

- Consumer Electronics (Smartphones, Laptops, Wearables)

- Automotive (EV Power Electronics, ADAS, Infotainment)

- IT and Telecommunications (5G Infrastructure, Data Centers)

- Aerospace and Defense (Radar, Navigation Systems)

- Industrial and Medical Electronics

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa