Content

What is the Current Paraxylene Market Size and Volume?

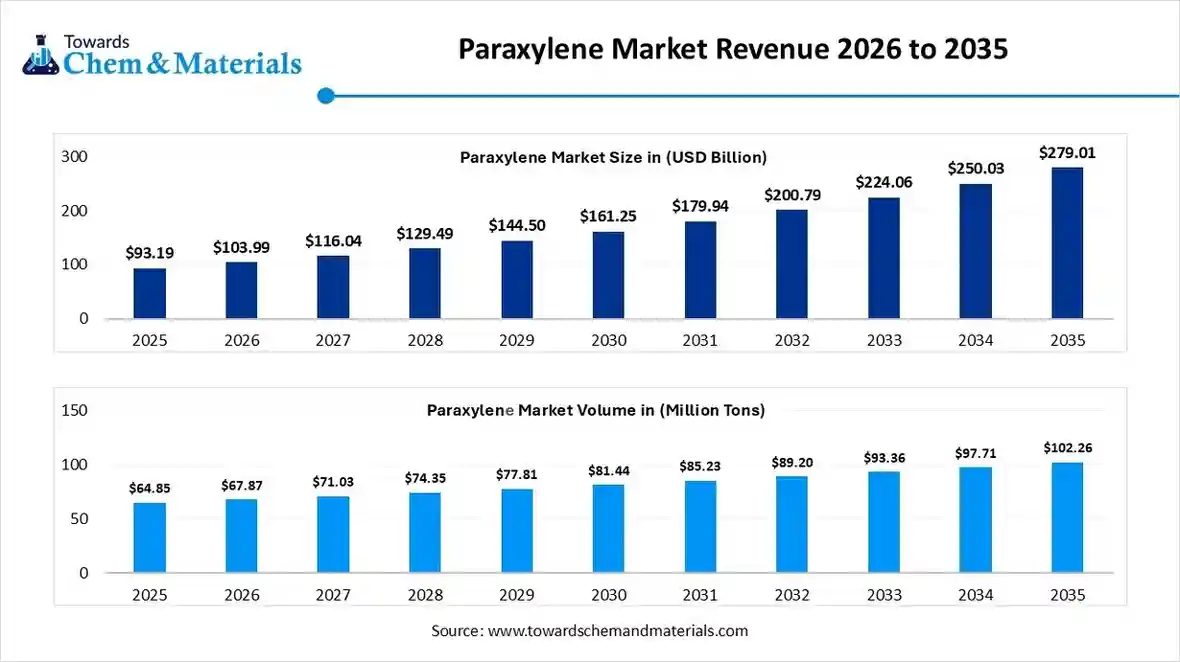

The global paraxylene market size was estimated at USD 93.19 billion in 2025 and is expected to increase from USD 103.99 billion in 2026 to USD 279.01 billion by 2035, growing at a CAGR of 11.59% from 2026 to 2035.The sudden expansion of the polystyrene industry and sustainable practices is accelerating industry potential in the current period.

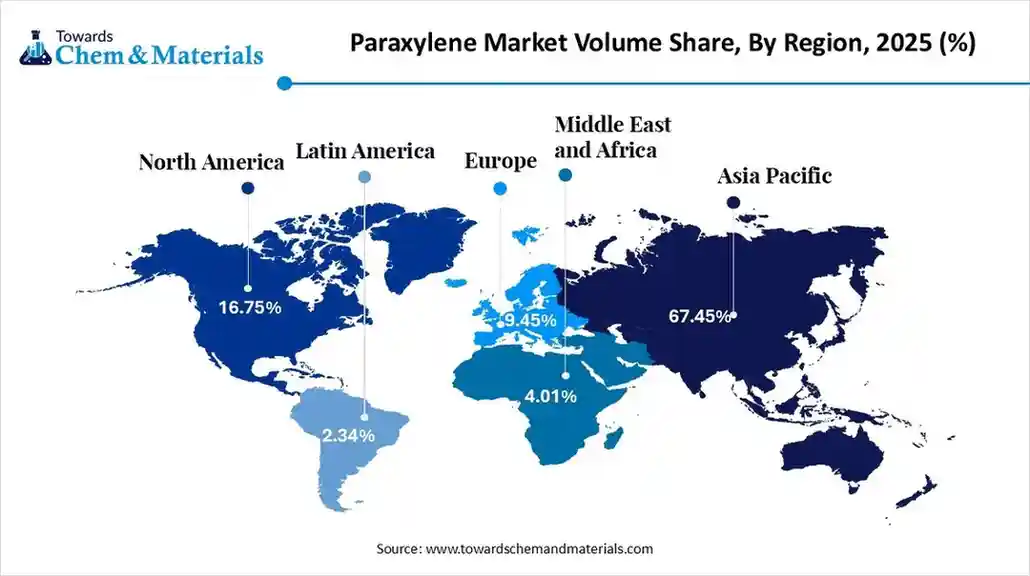

The global paraxylene market volume was estimated at 64.85 million tons in 2025 and is projected to reach 102.26 million tons by 2035, growing at a CAGR of 4.66% from 2026 to 2035. Asia Pacific dominated the Paraxylene market with the largest volume revenue share of 67.45% in 2025.

Report Highlights

- The Asia Pacific dominated the global paraxylene market with the largest volume share of 67.45% in 2025.

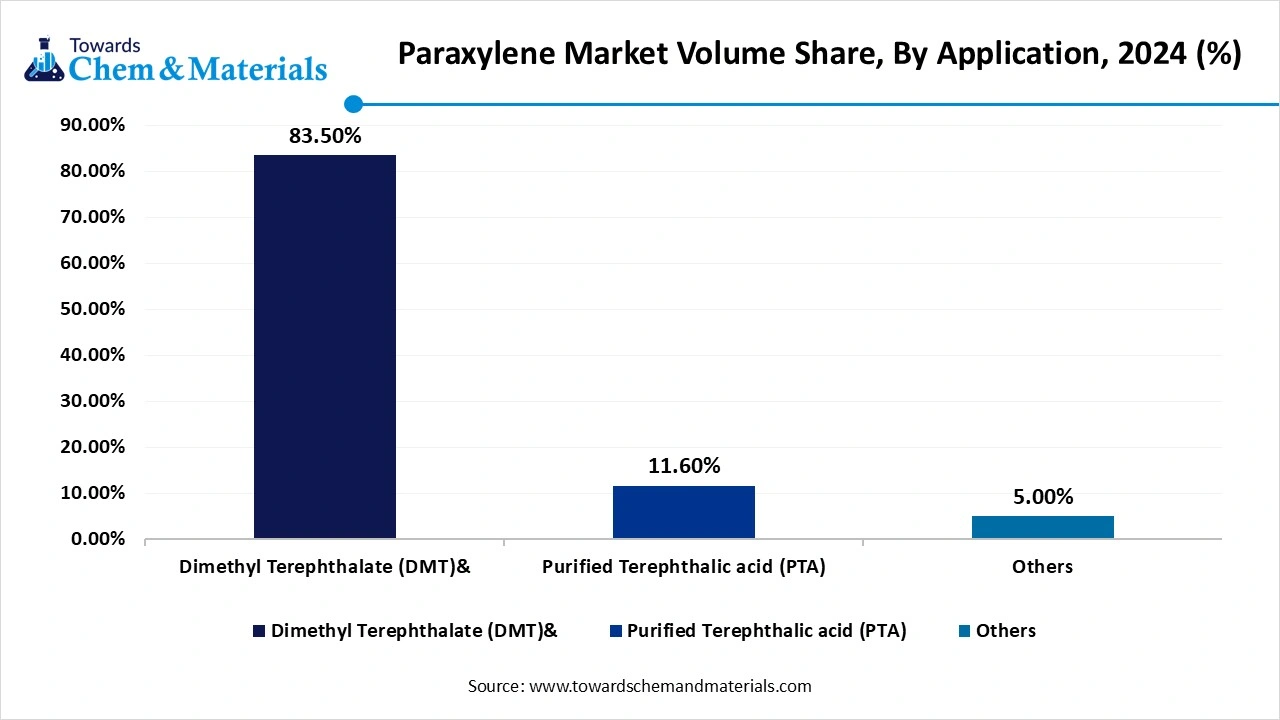

- By application, the Dimethyl Terephthalate (DMT) segment dominated the market and accounted for the largest revenue share of 83.98% in 2025.

- By application, the Purified Terephthalic acid (PTA) segment is expected to witness the fastest CAGR of 6.64% from 2026 to 2035

Paraxylene Market Surges on Polyester Demand and Regional Growth

The paraxylene market is experiencing fast-paced growth, primarily driven by its critical role in the production of purified terephthalic acid (PTA), which is increasing the market momentum in the polyester value chain. With rising global demand for polyester-based products in textiles and packaging, paraxylene consumption continues to increase, which can create greater opportunities for manufacturers. Also, regions like Asia-Pacific remain the dominant region due to their extensive manufacturing base and high polyester output in the current period.

Moreover, growing urbanization, lifestyle changes, and increased consumption of ready-to-wear apparel and bottled beverages are seen as fueling demand for paraxylene in recent years. The global shift toward lightweight, durable materials for consumer goods and industrial use also supports market expansion. Also, refinery integration and capacity expansions are becoming more common, as manufacturers are aiming to optimize margins and meet regional demand shifts. As sustainability becomes a central focus, the market is also witnessing several

The increasing global demand for polyester, especially in the textile and packaging sectors, is expanding the paraxylene market potential in the current period. Also, paraxylene is considered a crucial component to produce PTA, which is then used to manufacture polyethylene terephthalate (PET), a key component in fabrics, bottles, and food packaging. The growing consumption of modern fashion and the expansion of e-commerce have led to an increase in polyester usage, particularly in developing economies in the current period. Furthermore, the global beverage industry’s rising use of PET bottles continues to push paraxylene demand higher, which has contributed to market growth recently.

This strong consumption has encouraged major players to increase paraxylene production capacity and streamline operations while maintaining supply stability. Moreover, the sudden shift toward recycling and sustainable packaging is influencing investment in more efficient production technologies, as per the observation.

Value Chain Analysis

- Feedstock Sourcing & Refining: This involves sourcing crude oil and refining heavy naphtha to produce a catalytic reformate stream rich in C8 aromatic hydrocarbons.

- Key Players: ExxonMobil, Sinopec, Reliance Industries, BP, and Saudi Aramco.

- Paraxylene Production & Purification : In this, the mixed xylene stream is processed using techniques like isomerization, toluene disproportionation, and transalkylation.

- Key Players: ExxonMobil, Sinopec, Reliance Industries, GS Caltex, and JXTG Nippon Oil & Energy.

- Intermediate Chemical Production: In this, the high-purity paraxylene is a key building block for producing intermediate chemicals, primarily purified terephthalic acid (PTA) and, to a lesser extent, dimethyl terephthalate (DMT). These derivatives are the direct feedstocks for the final polymers.

- Key Players: Sinopec, Reliance Industries, Indorama Ventures, and Formosa Plastics.

- Polymer Manufacturing : In this, PTA and DMT are reacted to produce PET polymers and polyester fibers/resins.

- Key Players: Indorama Ventures, Teijin Limited, and Formosa Plastics Corporation.

- End-Product Manufacturing & Distribution : The manufactured PET and polyester are converted into a vast array of final consumer and industrial products with involving extensive distribution networks to reach global markets.

- Key Players: PepsiCo and Coca-Cola.

Paraxylene Market Trends

- Regions such as Asia-Pacific are considered a dominant force in the paraxylene market, akin to their large-scale investments in petrochemical infrastructure.

- Countries such as China and India are expanding refining and aromatics production units to improve their domestic supply. This sudden shift is enabling regional players to reduce their dependency on imports in the current period.

- Paraxylene productions are closely tied to crude oil price trends, as it is derived from naphtha, a petroleum-based raw material. Also, the fluctuations in oil prices have impacted profit margins and investment decisions across the supply chain in recent years. Moreover, producers are focusing on cost optimization and integrating operations to reduce market volatility in the current period.

- Growing focus on sustainability is driving the paraxylene market dynamics, specifically with the rising adoption of recycled PET (rPET). Also, the brands and governments are promoting initiatives, encouraging the use of recycled materials over petrochemicals. Also, manufacturers are seen as heavily investing in recycling technologies and developing hybrid supply chains that can balance and recycle products to meet ongoing regulatory and consumer expectations sustainably in the future.

Market Report Scope

| Report Attributes | Details |

| Market Size and Volume in 2025 | 67.87 Million Tons /USD 103.99 |

| Expected Size and Volume by 2035 | 102.26 Million Tons/ USD 279.01 |

| Growth Rate from 2026 to 2035 | CAGR 4.66% |

| Base Year of Estimation | 2025 |

| Forecast Period | 2026-2035 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Application, By Region |

| Key Companies Profiled |

Sinopec, JX Nippon Oil & Energy Corp, CNPC, Reliance, NPC Iran, GS Caltex, ONGC, Orpic, Oman Oil Refineries, and Petroleum Industries Company, Jurong Aromatics Corp, China National Offshore Oil Corporation (CNOOC), Lotte KP Chemical, ExxonMobil,Saudi Aramco, Dalian Fujia Dahua, Idemitsu Kosan Co.Ltd.,Toyo, Teijin Fibers |

Market Dynamics

Driver: Growing Demand From Polyester And Packaging End-Use Industries

The demand for paraxylene is primarily driven by its critical role as a feedstock in the production of purified terephthalic acid and dimethyl terephthalate, which are essential intermediates for polyester manufacturing. Polyester is widely used in textile fibers, apparel, home furnishings, and industrial fabrics, making the textile and apparel sector a major end-use driver for the paraxylene market. In addition, rising consumption of polyethylene terephthalate packaging for bottled beverages, food containers, and personal care products is supporting steady paraxylene demand. Countries such as China and India continue to expand integrated refinery and petrochemical complexes to secure a domestic supply of aromatics, including paraxylene, to support large-scale polyester value chains and reduce import dependence.

Restraints: Environmental Regulations And Feedstock Volatility

The paraxylene market faces constraints from stringent environmental regulations governing petrochemical production, emissions, and waste management. Paraxylene is derived from petroleum-based feedstocks through energy-intensive refining and aromatics extraction processes, which are subject to air quality standards, carbon emission controls, and hazardous chemical handling regulations enforced by national environmental agencies. Compliance requires continuous investment in emissions control systems, process optimization, and monitoring infrastructure. In addition, volatility in crude oil and naphtha prices directly affects paraxylene production costs, creating margin pressure for producers and increasing pricing uncertainty for downstream polyester manufacturers.

Opportunities: Capacity Integration And Circular Polyester Initiatives

Opportunities in the paraxylene market are emerging from deeper integration across refinery, aromatics, and polyester production chains, particularly in Asia. Integrated facilities allow producers to improve feedstock efficiency, reduce logistics costs, and maintain a stable supply to downstream purified terephthalic acid plants. Another key opportunity lies in the growing adoption of recycled polyester and circular economy initiatives. While recycled polyethylene terephthalate reduces virgin raw material demand, it also encourages innovation in advanced recycling technologies that still rely on paraxylene-derived intermediates to meet quality and performance standards. Government-supported sustainability programs in textiles and packaging are pushing manufacturers to invest in cleaner production routes, energy-efficient processes, and lower-emission aromatics units, creating long-term modernization opportunities for paraxylene producers.

Market Challenge : Fluctuating Oil Prices Challenge Paraxylene Profit Margins

Paraxylene production is heavily dependent on crude oil-derived raw materials, which are anticipated to hinder industry growth during the forecast period. As a result, fluctuations in global crude oil prices pose a significant challenge for manufacturers in the future. These price shifts can impact profit margins, disrupt costing, and make long-term planning more complex as per market observation. But also, companies are seeking alternative source strategies and improved cost management techniques in the current period, which gives them an industry

Market Segmental Insights

Application Insights

The purified terephthalic acid (PTA) segment dominated the paraxylene market with the largest share in 2024, akin to its key role as a primary raw material to produce polyester fibers, films, and resins is driving the segment growth in the current period. Moreover, the demand for PTA has surged across industries, especially textiles and packaging, where it is used to manufacture high-strength materials. The rising need for sustainable products and the increasing consumption of polyester in emerging markets further fuel the growth of the PTA segment during the forecast period.

The dimethyl terephthalate (DMT) segment is expected to experience notable market growth in the future, owing to its widespread use in the production of polyester, especially for bottles and packaging materials. Also, as global demand for lightweight, cost-effective packaging solutions grows, dimethyl terephthalate’s role in producing high-quality, durable polyester increases, which is expected to create huge opportunities for manufacturers in the coming years. Moreover, dimethyl terephthalate's versatility in various applications, such as in the automotive and textile industries, drives further growth, making it a key driver of market expansion in the coming years.

Paraxylene Market Volume and Share, By Application, 2025 & 2035 (%)

| By Application | Market Shares (%) 2025 | Volume (Million Tons) 2025 | Market Shares (%) 2035 | Volume (Million Tons) 2035 | CAGR (2026-2035) |

| Dimethyl Terephthalate (DMT) | 83.98% | 53.20 | 82.60% | 79.60 | 4.74% |

| Purified Terephthalic acid (PTA) | 11.65% | 8.30 | 14.40% | 13.90 | 6.64% |

| Others | 4.37% | 4.10 | 6.11% | 5.90 | 5.15% |

Regional Insights

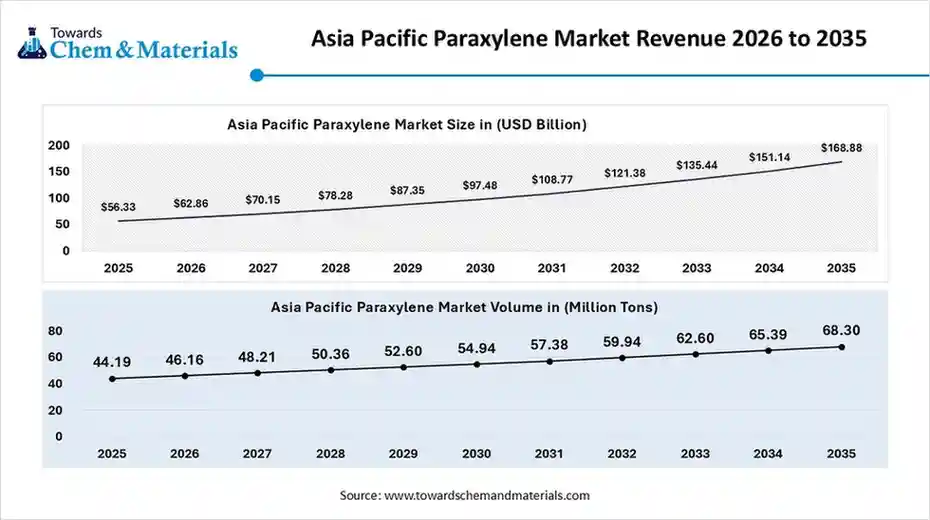

The Asia Pacific paraxylene market size was valued at USD 56.33 billion in 2025 and is expected to be worth around USD 168.88 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 11.61% over the forecast period from 2026 to 2035.

The Asia Pacific paraxylene market volume was estimated at 44.19 million tons in 2025 and is anticipated to reach 68.30 million tons by 2035, growing at a CAGR of 4.45% from 2026 to 2035, akin to its strong demand from the polyester and textile industries, particularly in countries like India, South Korea, and Japan. The region’s integrated petrochemical infrastructure and expanding production capacities support efficient large-scale output in the region. Also, rising consumer need for packaged goods and textiles continues to drive the growth of the regional industry in the current period. Moreover, regional governments are seen as supporting industrial development through favorable policies and investments in recent years. As a result, manufacturers are increasing operations and optimizing supply chains to meet rising domestic and export needs in the region nowadays.

China Sets the Pace in Global Paraxylene Production, China maintained its dominance owing to its enlarged polyester industry and domestic consumption. Also, it is the world's largest producer and consumer of paraxylene, with continued investments in new production facilities to reduce dependency on imports in the current period. From the other regional countries, China’s enterprises and industrial zones allow for rapid capacity expansion in the future. Moreover, the country’s planning and focus on self-sufficiency in petrochemicals further create growth opportunities for the manufacturers in the

North America is expected to grow at a significant pace in the coming period, akin to advancements in shale gas extraction, offering cost-effective feedstock for petrochemical production in the current period. The region can receive greater advantages from technological innovation, robust refining infrastructure, and a focus on enhancing energy efficiency in the future. As global supply chains shift, North American producers are expanding capacities to fulfill both domestic and export markets. Moreover, sustainable production practices and increasing demand for recycled PET are also expected to increase industry potential during the forecast period. Strategic investments and favorable trade dynamics are reshaping the

Energy Efficiency and Raw Material Access Supports Paraxylene Growth in United States, The United States paraxylene market is experiencing notable growth owing to its integrated petrochemical ecosystem and strong technological base. United States producers are receiving the advantages from shale-based raw materials and cost-effective energy, enhancing production efficiency in the current period. While the enlarged region is export-driven, the United States is focused on capacity expansion and innovation in processing technologies, which is expected to increase industry growth in the coming years. Also, domestic demand is supported by robust end-use industries like automotive, construction, and textiles. Moreover, regulatory support and infrastructure modernization are seen in allowing faster project execution in the execution in the country nowadays.

Paraxylene Market and Volume Share, By Region, 2025 & 2035 (%)

| By Region | Market volume Shares (%) 2024 | Market Volume (Million Tons)2024 | Market volume Shares (%) 2034 | Market Volume (Million Tons) 2034 | CAGR (2025-2034) |

| North America | 16.75% | 11.50 | 18.50% | 18.50 | 5.95% |

| Europe | 9.45% | 6.90 | 9.88% | 10.40 | 5.45% |

| Asia Pacific | 67.45% | 43.10 | 64.48% | 63.0 | 4.49% |

| Latin America | 2.34% | 2.40 | 2.66% | 3.50 | 6.37% |

| Middle East & Africa | 4.01% | 4.60 | 5.44% | 5.80 | 7.11% |

How will Europe contribute to the Paraxylene Market?

Europe is recognized as a rapidly growing region in the global market, primarily due to its strong emphasis on sustainability and recycling technologies. The presence of established, high-value end-use industries that demand high-quality, often bio-based materials further contributes to this growth. Europe’s stringent environmental regulations and a widespread commitment to the circular economy drive the demand for bio-based and recycled materials. Additionally, various national and EU-level initiatives, such as the EU's Carbon Border Adjustment Mechanism (CBAM), promote the adoption of low-carbon alternatives.

Germany Paraxylene Market Trends

Germany stands out as a mature market in Europe, driven largely by its robust automotive, packaging, and textile industries, which require high-quality polyester components and PET resins. The German market is heavily influenced by strict environmental regulations, which encourage the development and use of bio-based and recycled PET and related materials. As a result, Germany serves as a significant trading and distribution hub within Europe, characterized by consistent import and export activity.

Emergence of Latin America in the Paraxylene Market?

Latin America is also experiencing significant growth in the global market, largely fueled by rising demand for PET packaging due to urbanization and an expanding middle class. This growth is supported by strategic investments in localized manufacturing and the development of bio-based chemical alternatives. Countries like Brazil and Mexico have considerable raw material resources, such as crude oil and naphtha, which provide a competitive advantage in petrochemical production and reduce the reliance on imports, driving the demand for high-performance materials derived from paraxylene.

Brazil Paraxylene Market Trends

Brazil acts as a major consumer in Latin America, defined by a growing domestic market and a reliance on imports. The market is primarily driven by increasing demand for polyester-based products, particularly in the food and beverage industries, where PET bottles are prevalent. With a growing economy and a large population, Brazil presents significant potential for future market expansion. As domestic demand often exceeds local production capacity, Brazil becomes a key importer in the Latin American market.

How will the Middle East and Africa Surge in the Paraxylene Market?

The Middle East and Africa (MEA) region is a key contributor to the global market, thanks to its abundant, cost-advantaged feedstock, robust growth in downstream industries such as textiles and packaging, and supportive government initiatives. This region has access to plentiful and cost-effective crude oil and naphtha, the primary raw materials for paraxylene production through catalytic reforming, providing a notable competitive advantage and diversifying their economies beyond crude oil exports.

UAE Paraxylene Market Trends

The UAE plays a strategic role as a production and export hub in the Middle East and Africa by leveraging its abundant natural oil and gas resources along with a developed petrochemical infrastructure. The country has made significant investments in large-scale, integrated refining and petrochemical complexes, such as the Ruwais Derivatives Park, which aims to more than double the national chemical capacity. These facilities focus on cost-efficient, large-volume production for export.

Paraxylene Market Recent Developments

Indorama and Suntory

- Collaboration for Product Development: In October 2024, Indorama and Suntory made a partnership for the development of PET bottles. These bottles are made up of Bio-paraxylene as per the company report.

Fujian Petrochemical Co. Ltd., Saudi Arabian Oil Co., and China Petroleum & Chemical Corp.

- Plant establishment: In November 2024, Fujian Petrochemical Co. Ltd. (FPCL), Saudi Arabian Oil Co. (Aramco), and China Petroleum & Chemical Corp. (Sinopec), and created a partnership to develop a petrochemical complex in China recently. Moreover, this plant can produce 2 million tons paraxylene in the coming years, as per the company's claim.

Top Companies list

- Sinopec

- JX Nippon Oil & Energy Corp

- CNPC

- Reliance

- NPC Iran

- GS Caltex

- ONGC

- Orpic, Oman Oil Refineries, and Petroleum Industries Company

- Jurong Aromatics Corp

- China National Offshore Oil Corporation (CNOOC)

- Lotte KP Chemical

- ExxonMobil

- Saudi Aramco

- Dalian Fujia Dahua

- Idemitsu Kosan Co.Ltd.

- Toyo

- Teijin Fibers

Segment Covered in the Report

By Application

- Dimethyl Terephthalate (DMT)&

- Purified Terephthalic acid (PTA)

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- The Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait