Content

What is the Current Coated Fabrics Market Size and Share?

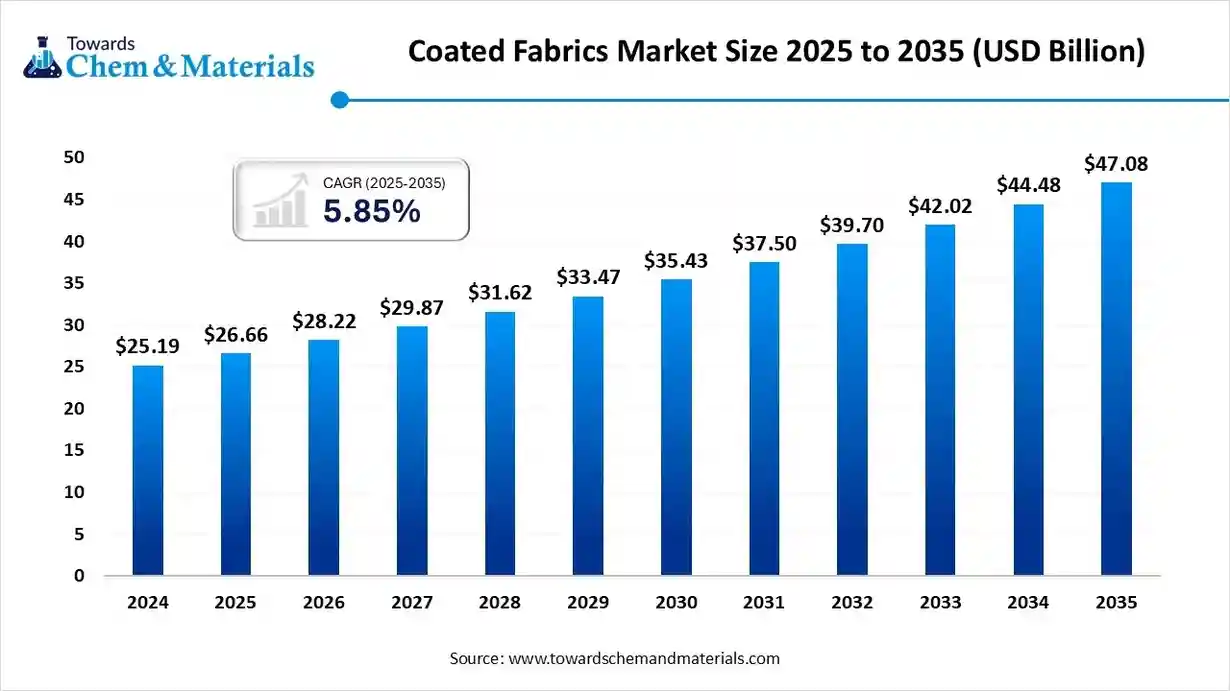

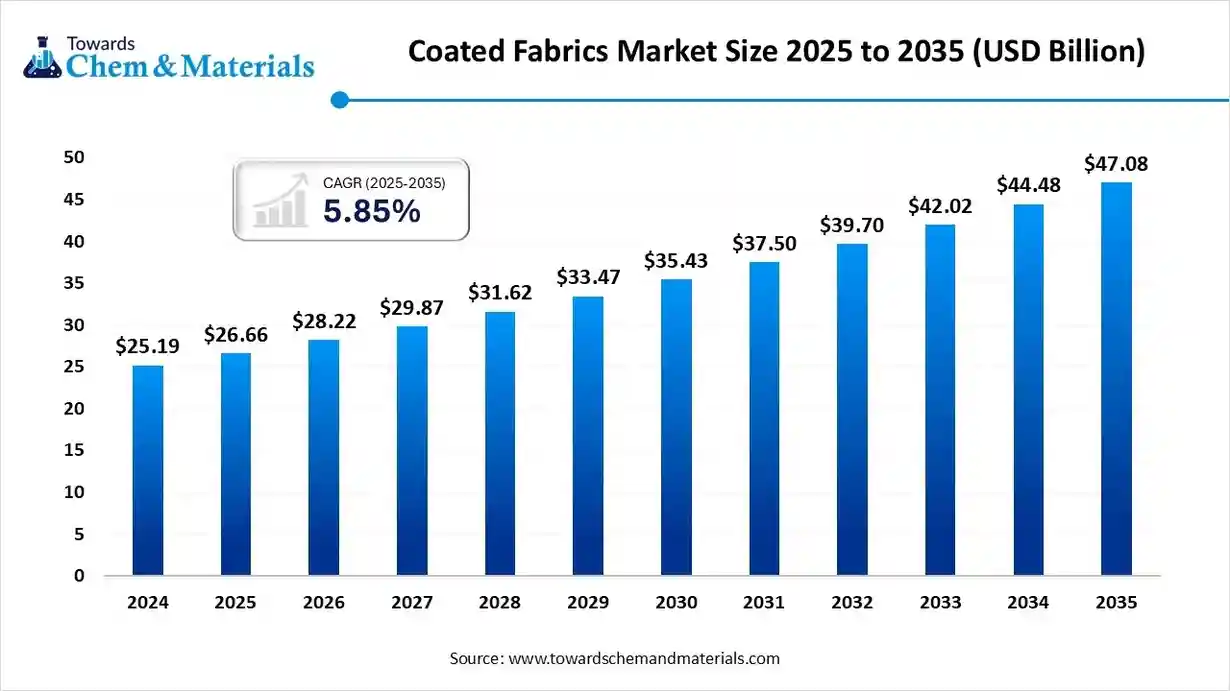

The global coated fabrics market size is calculated at USD 26.66 billion in 2025 and is predicted to increase from USD 28.22 billion in 2026 and is projected to reach around USD 47.08 billion by 2035, The market is expanding at a CAGR of 5.85% between 2025 and 2035. Asia Pacific dominated the coated fabrics market with a market share of 45% the global market in 2024. The growing demand for lightweight, durable materials is the key driver of market growth. Also, heightened safety regulations across various industries, coupled with rapid innovation in sustainable coatings, can further fuel market growth.

Key Takeaways

- By region, the Asia-Pacific region dominated the market with a 45% share in 2024 and is expected to grow at the fastest CAGR over the forecast period.

- By region, the Middle East & Africa is expected to grow at a substantial rate over the forecast period.

- By material type, the polymer-coated fabrics (PVC / Vinyl) segment dominated the market with an approximate share between 40–50% in 2024.

- By material type, the silicone coated fabrics segment is expected to grow at the fastest CAGR over the forecast period.

- By form, the rolled goods segment held the largest share in the coated fabrics market during 2024.

- By form, the cut & sewn components segment is expected to grow at the highest CAGR over the forecast period.

- By application, the transportation/automotive segment dominated the coated fabrics market by holding an approximate share of between 30 and 35% in 2024.

- By application, the medical & healthcare segment is expected to grow at the fastest CAGR during the forecast period.

- By end user, the OEMs segment held the largest share in the coated fabrics market during 2024.

- By end user, the textile converters & manufacturers segment is set to grow at the fastest rate during the projected period in the market for coated fabrics.

- By distribution channel, the direct sales to OEMs and the industrial buyers segment held the largest share in the market during 2024.

- By distribution channel, the specialist textile converters segment is expected to grow at the fastest CAGR over the study period.

What are Coated Fabrics?

Ongoing industrialization in emerging economies and a surge in construction activity worldwide are the major factors driving market growth. Coated fabrics are textile substrates (woven or non-woven) that are coated or laminated with polymeric or elastomeric layers (e.g., PVC, PU, silicone, fluoropolymers, rubber) to impart water-/ water-/chemical-resistance, mechanical strength, flame retardancy, UV stability, and specific surface properties. They are used in transportation (seat covers, upholstery, interior panels), construction (membrane roofs, awnings, tents), protective clothing & PPE, industrial covers (tarpaulins, conveyor belts), medical/backcare products, and specialty applications (inflatable structures, architectural façades).

Coated Fabrics Market Outlook:

- Industry Growth Overview: Strict safety regulations and the need for protective wear in military, healthcare, and industrial sectors boost the demand for coated fabrics with properties such as wear resistance, durability, and chemical resistance.

- Sustainability Trends: Sustainability trends in the market include the use of eco-friendly materials such as natural fibers and recycled plastics, along with the development of bio-based coatings.

- Major Investors: Major investors in the market include established companies such as Trelleborg, Saint-Gobain, and SRF Limited. These companies are heavily investing in strategic partnerships, acquisitions, and product innovation to expand their market presence.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 28.22 Billion |

| Expected Size by 2035 | USD 47.08 Billion |

| Growth Rate from 2025 to 2035 | CAGR 5.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2026 - 2035 |

| Leading Region | Asia-Pacific |

| Fastest Growing Region | Middle East & Africa |

| Segment Covered | By Material / Coating Type, By Form, By Application, By End User, By Distribution Channel, By Region |

| Key Companies Profiled | Serge Ferrari Group, Sioen Industries NV, Trelleborg AB, Saint-Gobain Performance Plastics, Continental AG, Low & Bonar (Freudenberg Performance Materials), SRF Limited (Coated Fabrics Division), MarvelVinyls / Marvel Group, J K Texbond / JK Files & Co., B&V Membrane |

How Cutting Edge Technologies are revolutionizing the Coated Fabrics Market?

Cutting-edge technologies are reshaping the coated fabrics market by improving material durability, weather resistance, and environmental performance. Innovations such as nanotechnology coatings are enhancing abrasion resistance, stain repellence, and UV protection. Smart coating systems allow fabrics to respond to temperature, moisture, or pressure changes, making them suitable for automotive interiors and protective clothing. The growing use of bio-based polymers and waterborne coating processes is also promoting sustainability, reducing VOC emissions, and helping manufacturers meet stricter environmental regulations.

Trade Analysis of Coated Fabrics Market: Import & Export Statistics:

- In 2024, Canada was the United States' top exporter of PVC-coated fabrics, with a total export value of $112.618 million. This makes Canada the leading supplier of this material to the U.S. market.(Source: www.alchempro.com)

- China is the second-largest exporter of PVC-coated fabrics to the US. While its export volume, valued at $76.969 million, is lower than Canada's, China maintains the most competitive pricing in the market at just $3.80 per kg. This makes Chinese PVC-coated fabrics a preferred and cost-effective solution for bulk buyers.(Source: www.alchempro.com)

- As per the UN COMTRADE database on international trade, India's exports of impregnated, coated, or laminated textile fabric in 2024 were valued at US$494.48 million.(Source:tradingeconomics.com)

Value Chain Analysis: Coated Fabrics Market

- Feedstock Procurement : It is the strategic process of identifying, sourcing, and purchasing the essential raw materials required to produce these specialized textiles.

- Major Players: Continental AG, Trelleborg AB, and Saint-Gobain S.A.

- Chemical Synthesis and Processing : This stage involves producing the polymers, coatings, and finishing agents that give coated fabrics their specific properties.

- Major Players: BASF SE, Huntsman Corporation

- Packaging and Labelling : It is a crucial stage for product protection, supply chain efficiency, and regulatory compliance rather than consumer-facing marketing.

- Major Players: Continental AG, Sioen Industries NV, and Saint-Gobain S.A.

- Regulatory Compliance and Safety Monitoring : It refers to adhering to complex national and international regulations, standards, and rules governing product quality, environmental impact, etc.

- Major Players: SRF Limited, Sioen Industries NV, and Spradling International.

Coated Fabrics Market Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| United States (USA) | Consumer Product Safety Commission (CPSC): Administers the Flammable Fabrics Act (FFA), which sets mandatory flammability standards for clothing textiles (16 CFR part 1610), children's sleepwear, mattresses, and upholstered furniture. |

| European Union (EU) | A key regulation that requires companies manufacturing or importing chemical substances into the EU in quantities over one tonne per year to register them with the European Chemicals Agency (ECHA). |

| India | Bureau of Indian Standards (BIS): Develops and enforces national standards for textiles and related products. Compliance with specific BIS standards (IS series) is necessary for quality assurance and market entry. |

Segment Insights

Material Type Insights

How Much Share Did the Polymer-Coated Fabrics (PVC / Vinyl) Segment Held in 2024?

- The polymer-coated fabrics (PVC/Vinyl) segment dominated the coated fabrics market, accounting for 40-50% of the market share in 2024. The segment's dominance can be attributed to its increasing adoption driven by versatility, cost efficiency, and weather resistance, as well as greater adoption in awnings and industrial covers.

- The silicone-coated fabrics segment is expected to grow at the fastest CAGR over the forecast period. The segment's growth can be attributed to rising demand for chemical/temperature resistance and long service life in aerospace, industrial, and specialty architectural membranes.

- The growth of the polyurethane (PU) coated fabrics segment can be driven by rising consumer demand for durable goods and the rapid development of sustainable, eco-friendly coatings. PU-coated fabrics are extensively used in awnings, roofing membranes, and tensile structures.

- The rubber-coated segment held a significant market share in 2024. The segment's growth is fuelled by the growing need for weather-resistant, durable materials in construction projects across various applications, such as waterproof barriers and tarpaulins.

Form Insights

Which Form Segment Dominated the Coated Fabrics Market in 2024?

- The rolled goods segment held the largest market share in 2024. The segment's dominance can be linked to growing product demand from high-growth end-use industries such as construction, automotive, and protective clothing, as well as an increasing focus on material durability and performance.

- The cut & sewn components segment is expected to grow at the fastest rate between 2025-2034. The segment's growth can be driven by rising demand for textiles with antiviral and antimicrobial properties, especially in healthcare settings and public spaces.

- The coated films/laminates segment is propelled by the ongoing shift towards solvent-free and bio-based coatings. Coated films and laminates enhance base fabrics with properties such as high tensile strength, elasticity, and chemical resistance, making them suitable for a wide range of applications.

- The specialty preforms & panels segment held a major market share in 2024. The segment's growth is driven by technological innovations in material properties and production processes. Modern coating techniques enable the creation of customized solutions with specific properties.

Application Insights

Which Application Type Segment Dominated the Coated Fabrics Market in 2024?

- The transportation and automotive segment dominated the coated fabrics market, accounting for 30–35% in 2024. The segment's dominance is driven by the growing use of coated fabrics in applications such as seat covers, headliners, interior trims, and truck covers. Increasing demand for lightweight, durable, and aesthetically enhanced materials in passenger and commercial vehicles is further propelling segment growth. Moreover, the rising adoption of eco-friendly, flame-retardant coatings aligns with stricter safety and sustainability standards set by automotive manufacturers.

- The medical & healthcare segment is expected to grow at the fastest CAGR during the forecast period. The segment's growth is driven by rising demand for protective clothing (PPE) and rapid technological advances in materials science. Medical applications require fabrics that are lighter and more durable.

- The construction & architectural membranes segment is driven by the rising demand for durable, lightweight, and aesthetically appealing building materials globally. Advancements in coating technologies are improving the properties of coated fabrics.

- The industrial & protective segment held a significant market share in 2024. There is increasing demand for highly durable, lightweight materials for use in both protective and industrial applications, such as tents, tarpaulins, and protective gear, leading to strong segment growth soon.

End User Insights

Which End-User Industry Segment Dominated the Coated Fabrics Market in 2024?

- The OEM segment held the largest market share in 2024, driven by the growing preference for durable, lightweight, and high-performance materials in manufacturing. OEMs are actively integrating coated fabrics made from recycled and ocean waste materials to meet stringent environmental regulations and corporate sustainability goals. This shift reflects a broader industry move toward circular-economy practices, reducing reliance on virgin raw materials and minimizing carbon footprints.

- The textile converters & manufacturers segment is expected to grow at the fastest CAGR over 2025-2034. The segment's growth can be credited to technological innovations in coating materials and processes. Industries are increasingly adopting lightweight materials to enhance fuel efficiency.

- The retail segment held a major market share in 2024. The segment's growth is fuelled by the growing emphasis on stringent regulations and worker safety. The sector also benefits from advancements in coating technology, as vehicle and consumer goods manufacturing surge.

- The growth of the government & defense segment can be driven by rising government spending on defense and the rising demand for protective, high-performance materials for military applications. Coated fabrics are utilized in the construction of military vehicles and aircraft.

Distribution Channel Insights

Which Distribution Channel Type Segment Dominated the Coated Fabrics Market in 2024?

- The direct sales to OEMs and industrial buyers segment held the largest market share in 2024, with its dominance attributed to the rising demand for coated fabrics that offer enhanced mechanical strength, chemical resistance, and weather durability. This growth is further supported by the expansion of major end-use sectors such as construction, automotive, and protective clothing, where high-performance materials are critical for safety and longevity. Direct procurement channels enable OEMs and industrial buyers to maintain consistent quality standards, streamline supply chains, and implement customized coating formulations tailored to specific application requirements.

- The specialist textile converters segment is expected to grow at the fastest CAGR over the study period. The segment's growth can be driven by a surge in environmental concerns and stringent regulations on the use of harmful chemicals, pushing the industry towards more sustainable solutions. These converters are increasingly investing in advanced coating technologies and bio-based polymers to enhance fabric performance while ensuring compliance with global sustainability standards.

- The distributors & wholesale suppliers segment held a major market share in 2024. The segment's growth can be fuelled by rising demand for durable, stylish, and easy-to-clean materials in both commercial and residential settings. Also, market players are increasingly developing innovative products, such as smart textiles.

- The growth of the online B2B marketplaces segment is driven by greater accessibility and convenience, along with the demand for transparency across the industry. B2B marketplaces enable suppliers to connect with a broader customer base without relying on expensive traditional channels.

Regional Insights

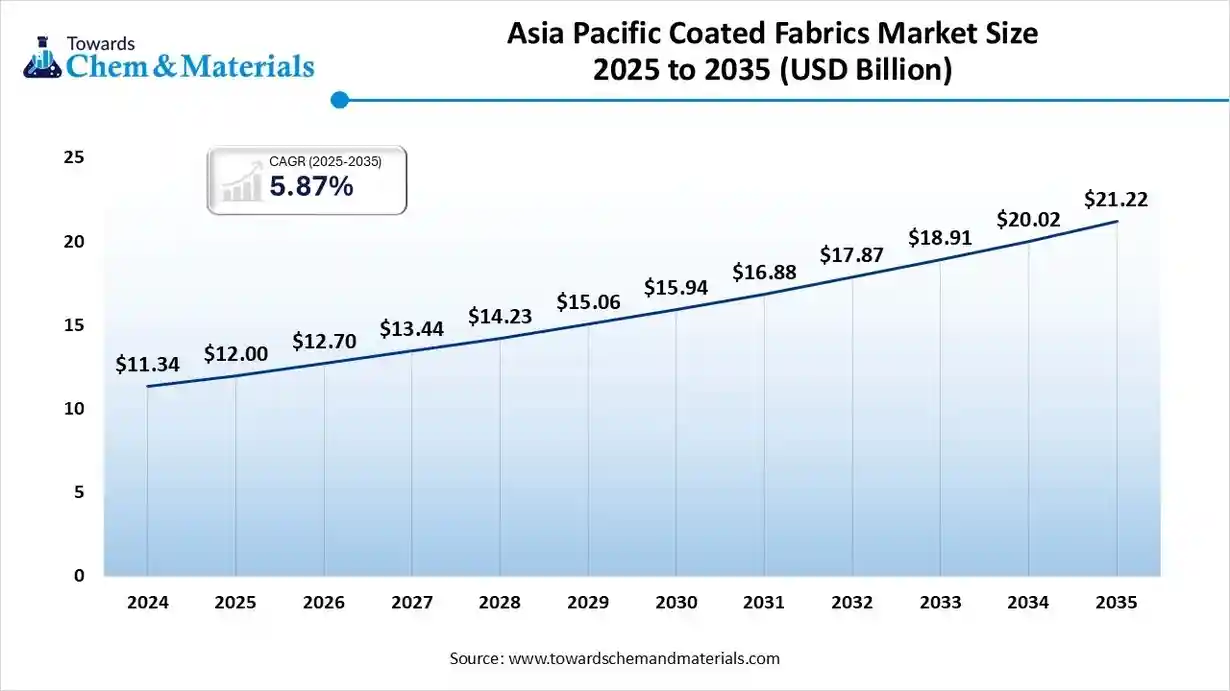

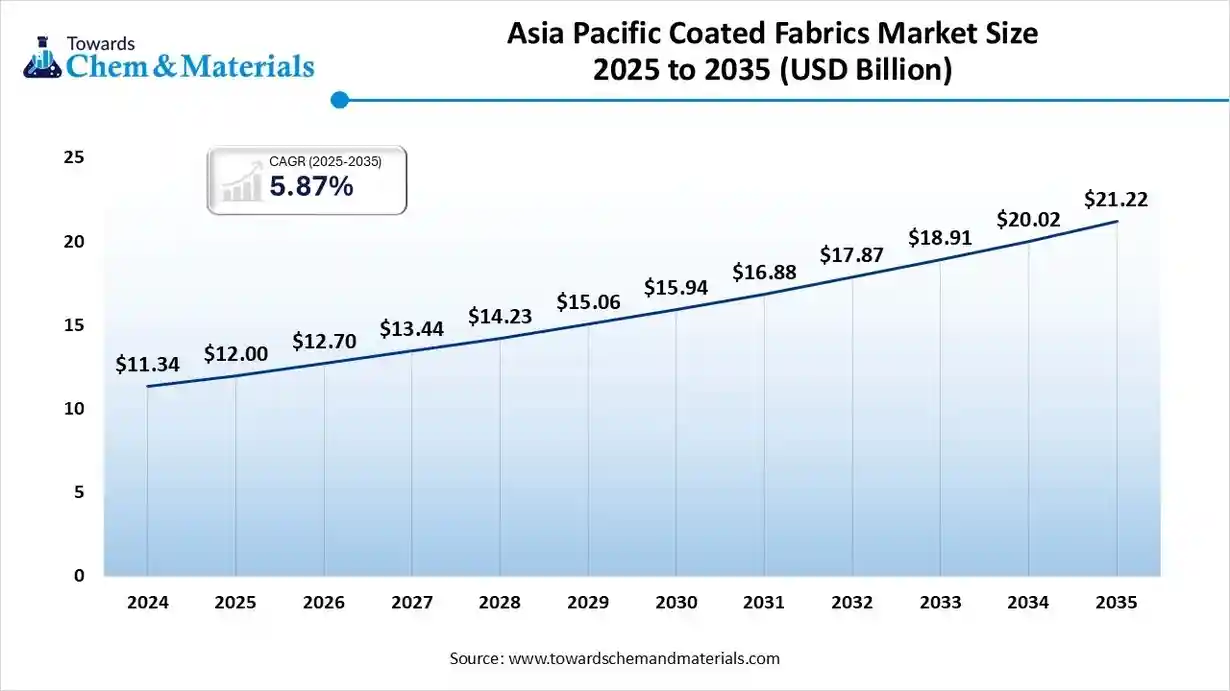

The Asia-Pacific coated fabrics market size was valued at USD 12.00 billion in 2025 and is expected to surpass around USD 21.22 billion by 2035, expanding at a compound annual growth rate (CAGR) of 5.87% over the forecast period from 2025 to 2035. The Asia-Pacific region dominated the market with a 45% share in 2024 and is expected to grow at the fastest CAGR over the forecast period.

The dominance and growth of the region can be attributed to the large production bases of the automotive and construction industries, coupled with robust textile and coating capacities in China, India, Japan, and South Korea. Expanding infrastructure investments, rising vehicle production, and the rapid adoption of advanced coating technologies are further fueling demand.

Government initiatives promoting sustainable manufacturing and the availability of low-cost raw materials and labor are strengthening the region’s competitive edge. Increasing exports of coated fabrics from Asia-Pacific to North America and Europe also highlight its growing influence in the global supply chain.

India Coated Fabrics Market Trends

Among countries in the Asia-Pacific region, India held a significant market share due to rapid infrastructure development, accelerating industrialization, and a sharp increase in vehicle production. The country’s expanding automotive manufacturing base, supported by government initiatives such as “Make in India,” has driven demand for high-performance coated fabrics for interior, seating, and protective applications.

The growth of the construction and furniture sectors has boosted the use of architectural and decorative coated textiles. Consumers in India are also increasingly preferring premium features, including coated fabrics that offer enhanced durability, easy maintenance, and a wide range of customizable textures, colors, and finishes, further supporting market growth.

The Middle East & Africa are expected to grow at a notable CAGR over the forecast period. The region's growth can be attributed to rising demand for high-performance protective materials across industries such as construction, defense, and automotive. The region's hot climate underscores the need for durable, weather-resistant coated fabrics for various applications.

Saudi Arabia Coated Fabrics Market Trends

Among the Middle Eastern nations, Saudi Arabia dominated the market due to rising demand for sustainable, environmentally friendly products, along with a growing emphasis on safety and worker protection. The oil and gas sector is a major consumer of coated fabrics for applications such as tarpaulins and equipment coverings.

North America held a significant market share in 2024. The region's growth can be driven by the ongoing trend towards developing and using sustainable coated fabrics made from natural and recycled materials. Furthermore, ongoing advancements in high-performance coated fabrics for applications such as industrial, medical, and transportation sectors are a major growth driver.

Coated Fabrics Market Share, By Region, 2024 (%)

| Regional | Revenue Share |

| North America | 25% |

| Europe | 18% |

| Asia Pacific | 45% |

| Latin America | 7% |

| Middle East and Africa | 5% |

U.S. Coated Fabrics Market Trends

In North America, the U.S. led the market due to stringent safety regulations, especially in industries with hazardous conditions, such as oil and gas. The country is a major market for industrial coated fabrics used in protective clothing.

The growth of the European market is fuelled by stringent sustainability and safety regulations and the expanding automotive industry. The need for durable materials is growing across sectors such as industrial and construction manufacturing, driving further market growth in the region.

Germany Coated Fabrics Market Trends

In Europe, Germany held the largest market share due to its emphasis on research and development, which has led to continuous advancements in coating technologies, creating cutting-edge products with improved functionality and quality.

Recent Developments

- In June 2025, Valuetex Coating India Pvt. Ltd, headquartered in Surat, has acquired expertise to offer not just one functional finish on a fabric, but also various other functional finishes on the same fabric. The Valuetex Coating production facility is built on 6,500 sq. metres of land, while the built-up area is 4,000 sq. metres.(Source: www.indiantextilemagazine.in)

- In April 2025, Michelin announced to invest ₹564 crore in strengthening its Chennai plant to manufacture passenger vehicle (PV) tires in the expanding indian market. The investment will allow the company to produce tires suited to local road conditions.(Source: themachinemaker.com)

Top Coated Fabrics Market Companies

- Serge Ferrari Group – Serge Ferrari Group is a global leader in flexible composite and coated fabrics, offering high-performance materials for architectural structures, modular buildings, industrial equipment, and marine applications. The company’s products combine durability, UV resistance, and recyclability, supporting sustainable and energy-efficient construction and design solutions.

- Sioen Industries NV – Sioen Industries specializes in technical textiles and coated fabrics for industries such as transportation, protective clothing, marine, and building. The company produces PVC-, PU-, and silicone-coated textiles with advanced resistance to fire, weather, and chemicals, making it one of the most diversified players in the coated fabric sector.

- Trelleborg AB – Trelleborg develops engineered polymer and coated fabric solutions for aerospace, automotive, and industrial applications. Its coated fabrics provide high flexibility, airtightness, and chemical resistance, widely used in safety gear, inflatable structures, and sealing systems.

- Saint-Gobain Performance Plastics – Saint-Gobain manufactures PTFE- and silicone-coated fabrics under brands such as Chemfab and Saint-Gobain Seals, serving applications in architecture, food processing, and electronics. The company’s coated fabrics are valued for thermal stability and non-stick properties in extreme environments.

- Continental AG – Continental produces coated fabrics and composite materials as part of its textile and rubber division, supplying the automotive, aerospace, and industrial sectors. The company’s coated products are used in air suspension systems, seating, and protective coverings, emphasizing strength, elasticity, and resistance to abrasion.

- Low & Bonar (Freudenberg Performance Materials) – Low & Bonar, now part of Freudenberg, manufactures coated performance fabrics and technical textiles for construction, civil engineering, and transportation. Its products include PVC-coated and polymer-enhanced fabrics that combine mechanical strength with weather and UV resistance.

- SRF Limited (Coated Fabrics Division) – SRF Limited is an Indian multinational producing industrial fabrics, belting fabrics, and coated materials for the automotive and defense sectors. Its coated fabrics are designed for tensile strength, water resistance, and flame retardancy, catering to global infrastructure and transport markets.

- MarvelVinyls / Marvel Group – MarvelVinyls manufactures PVC- and PU-coated fabrics for furniture, automotive, marine, and tarpaulin applications. The company focuses on custom-engineered coatings that deliver weather resistance, flexibility, and extended durability for heavy-duty applications.

- J K Texbond / JK Files & Co. – J K Texbond produces industrial coated textiles and synthetic fabrics for tarpaulins, awnings, and geotextile applications. The company’s coated fabrics are recognized for their cost efficiency, waterproofing, and tensile strength, serving both commercial and industrial markets.

- B&V Membrane – B&V Membrane manufactures specialty coated fabrics and membrane materials used in architecture, water storage, and environmental protection systems. Its range includes high-performance PVC and PTFE-coated membranes, designed for long-term structural stability and sustainability.

Segments Covered in the Report

By Material / Coating Type

- Polymer-coated fabrics (PVC / Vinyl) (Dominant)

- Silicone coated fabrics

- Rubber coated (neoprene, chloroprene)

- Fluoropolymer coated fabrics (PTFE, PVDF) (niche, high-spec)

- Composite / multi-layer laminated fabrics (e.g., fabric + membrane + topcoat)

By Form

- Rolled goods / Rolls

- Cut & Sewn Components

- Coated Films / Laminates

- Specialty Preforms & Panels

By Application

- Transportation / Automotive Construction & Architectural Membranes (tensioned roofs, awnings)

- Industrial & Protective (tarpaulins, conveyor belts, protective clothing)

- Furniture & Upholstery

- Tents, Events & Sports (commercial tents, inflatable structures)

- Medical & Healthcare (mattress covers, sterile drapes)

- Others (marine, military, consumer goods)

By End User

- OEMs (Automotive, Construction OEMs)

- Industrial Buyers (Manufacturing, Logistics)

- Textile Converters & Manufactures

- Retail / Contract Furnishing

- Government & Defense

By Distribution Channel

- Direct Sales to OEMs and Industrial Buyers

- Distributors & Wholesale Suppliers

- Specialist Textile Converters / Coating Houses

- Online B2B Marketplaces

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa