Content

Performance Additives Market Size and Growth 2025 to 2034

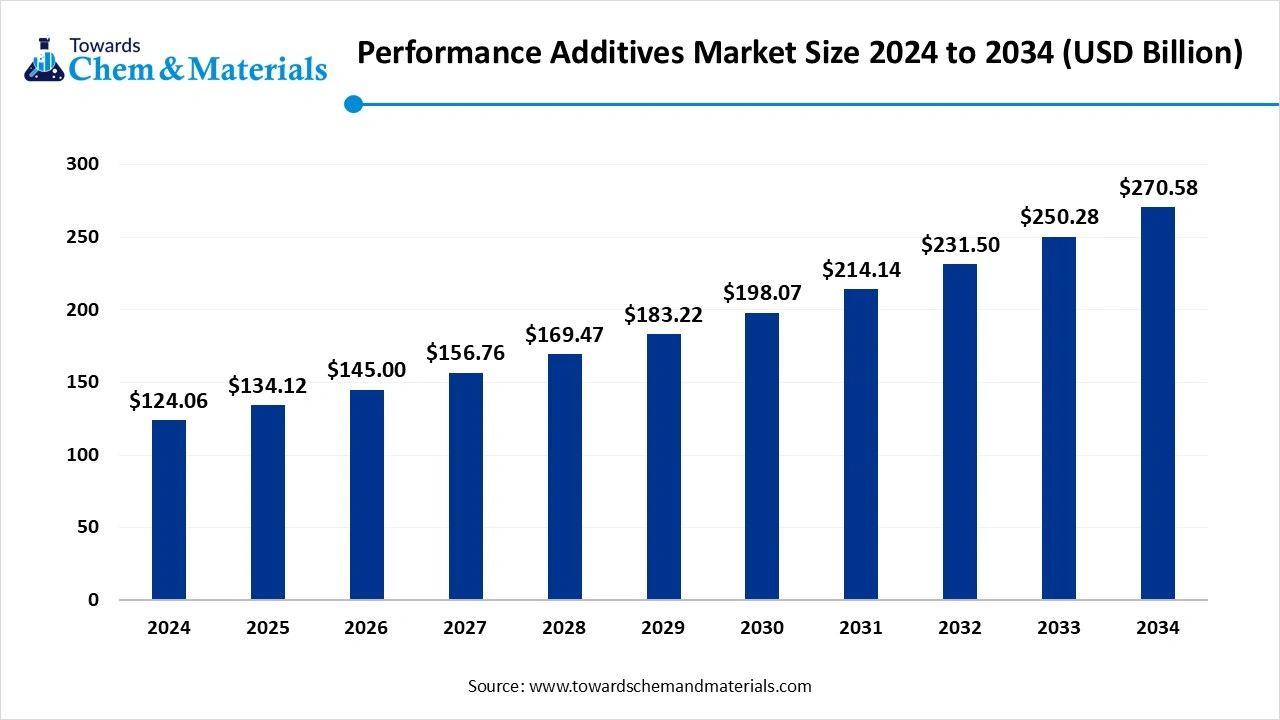

The global performance additives market size accounted for USD 124.06 billion in 2024, grew to USD 134.12 billion in 2025, and is expected to be worth around USD 270.58 billion by 2034, poised to grow at a CAGR of 8.11% between 2025 and 2034. Rising performance needs in end-use applications are the key factor driving market growth. Also, advancements in polymer and material science, coupled with the stringent environmental regulations, can fuel market growth further.

Key Takeaways

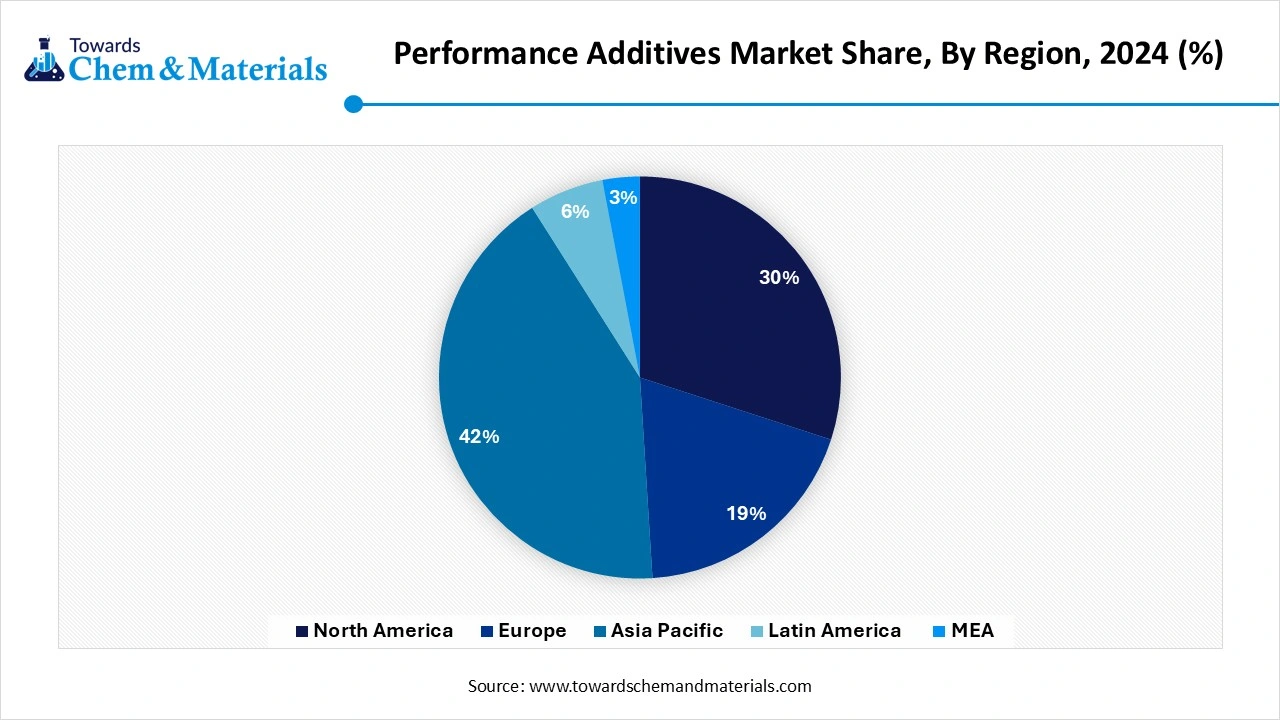

- The Asia Pacific performance additives market held the largest Share of 42% of the global market in 2024.

- By type, the plastic additives segment dominated the market with 35% market share in 2024. The dominance of the segment can be attributed to the extensive use of these additives across a wide range of industries.

- By type, the paint & coating additives segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for sustainable and bio-based additives.

- By functionality, the durability & weatherability segment held a 28% market share in 2024. The dominance of the segment can be linked to the rising demand from various industries.

- By functionality, the UV Resistance segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment can be driven by the growing demand for materials that can sustain prolonged exposure to UV radiation and sunlight.

- By form, the powder segment dominated the market with a 40% share in 2024. The dominance of the segment is owed to the stringent environmental regulations and the growing need for high-performance materials.

- By form, the liquid segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment can be attributed to the growing adoption of innovative farming techniques.

- By end-use industry, the automotive segment led the market by holding 25% market share in 2024. The dominance of the segment can be credited to the surge in vehicle production.

- By end-use industry, the packaging segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be driven by increasing demand for materials that provide enhanced durability properties.

- By source, the synthetic segment held an 85% market share in 2024. The dominance of the segment can be linked to the growing need for high-performance materials, especially in packaging.

- By source, the bio-based segment is expected to grow at the fastest CAGR over the foreseeable future. The growth of the segment is due to the technological innovations in bio-based additive development.

Surge in Demand for Performance Additives Expanding Market Growth

Performance additives are specialty chemicals added in small quantities to enhance or modify the physical and chemical properties of end-use products. These additives improve the performance, durability, and appearance of materials such as plastics, paints, coatings, rubber, adhesives, and lubricants. They are critical in industries like automotive, construction, packaging, electronics, and consumer goods. The innovative market trend is propelling advancements in material design, promoting regulatory compliance, and increasing the application scope for these additives among many high-growth sectors.

What Are the Key Trends Influencing the Performance Additives Market?

- The rising need for developed, high-performance materials in sectors like aerospace, automotive, and construction is substantially fuelling the demand for performance additives. Also, the increasing emphasis on energy efficiency and lightweight materials in above above-mentioned sectors is enhancing material performance while minimizing overall weight.

- The increasing regulatory and consumer emphasis on sustainability is the latest trend presenting good opportunities in the market to develop bio-based and sustainable solutions. Major players are exploring natural additives that decrease environmental impact while keeping high material performance standards.

- The ongoing expansion of the electrical and electronic sectors is positively impacting overall market growth. With rapid innovations in technology, the demand for electronic devices rises. This adds to establishes a key position in these sectors by offering diverse functionalities such as thermal conductivity, UV resistance, and flame retardancy.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 134.12 Billion |

| Market Size by 2034 | USD 270.58 Billion |

| Growth rate from 2024 to 2025 | CAGR 8.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Functionality, By Form, By End-use Industry, By Source, By Region |

| Key Companies Profiled | BASF SE, Evonik Industries AG, Dow Inc., Clariant AG, Arkema Group, Huntsman Corporation, Lanxess AG, Solvay S.A., Lubrizol Corporation, Croda International Plc, Eastman Chemical Company, Ashland Global Holdings Inc., Altana AG, Cabot Corporation, BYK-Chemie GmbH (A division of Altana), Momentive Performance Materials Inc., Münzing Chemie GmbH, Perstorp Holding AB, SABO S.p.A., King Industries, Inc. |

Market Opportunity

Growing Use of Additives in Cosmetics Products

Use of performance additives in cosmetics and personal care is increasing. These additives help offer a higher benefit to the formulation, improving its overall aesthetics and performance properties. In Skincare practices, these additives offer improvements in texture and moisturization by offering stability and a luxurious feel. Furthermore, manufacturers and formulations are increasingly finding advanced additives specific to various consumer needs, hence opening the window for diversification for this sector.

- In December 2024, Clariant announced the expansion of its Cangzhou production site to produce the multifaceted additive Nylostab S-EED. This new production line will be owned and operated by Clariant and its other partners.(Source: www.clariant.com)

Market Challenge

Evolving Industry Demands

Different industries have evolving and diverse needs for performance additives. For instance, the automotive sector might need lightweight and heat-resistant materials. While the packaging sector promotes recyclability and durability. Moreover, the market faces competition from alternative materials, including nanomaterials and bio-based solutions. This competition needs continuous differentiation and innovation to maintain market share.

Regional Insights

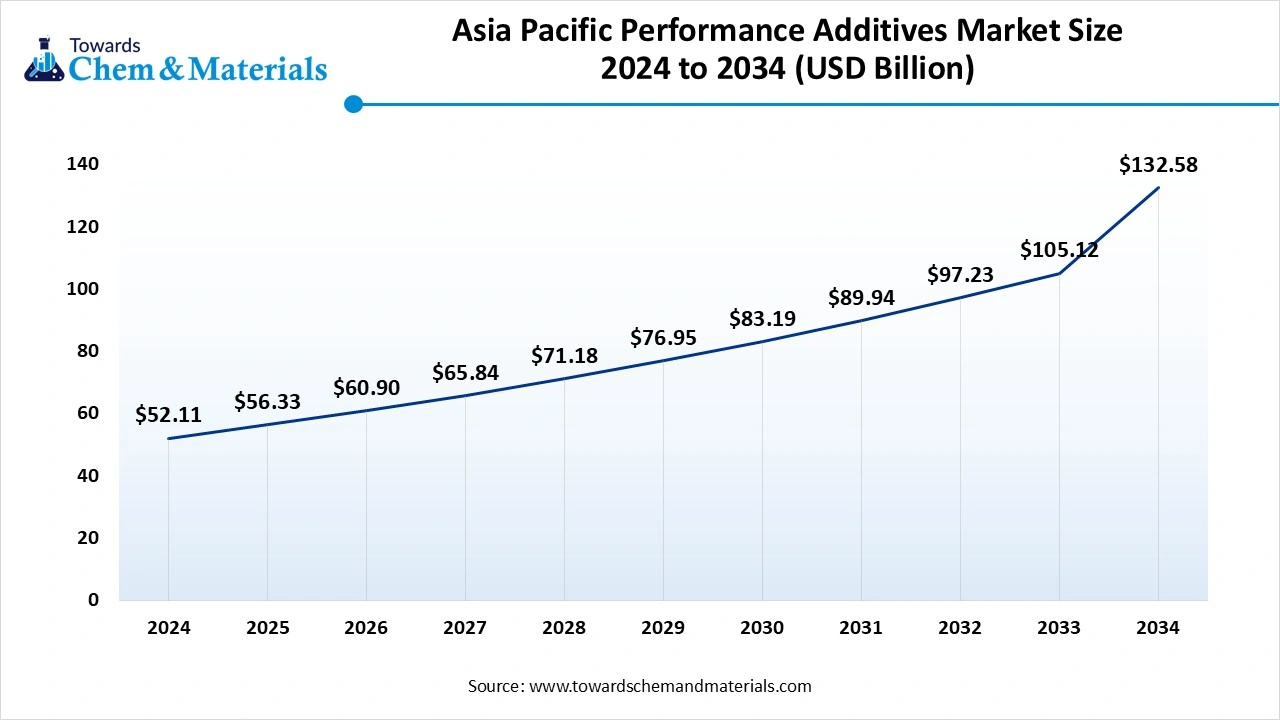

The Asia Pacific performance additives market size accounted for USD 56.33 billion in 2025 and is forecasted to hit around USD 132.58 billion by 2034, representing a CAGR of 9.79% from 2025 to 2034. Asia Pacific dominated the performance additives market with 42% in 2024, the region is observed to sustain the position during the forecast period. The growth of the region can be attributed to the increasing application of these additives in adhesives & sealants, lubricants & fuels, and paints & coatings in the emerging economies such as China and India. In addition, ongoing advancements in the building & construction sectors and the automotive industry across this region have resulted in a significant increase in the demand for performance additives.

Performance Additives Market in China

In Asia Pacific, China led the market owing to the ongoing industrialization, especially in the construction and automotive, and electronics sectors. Also, China's identity as a global production hub and its flourishing economy further boosts the market's positive trajectory. The expanding automotive industry in China is propelling the demand for lubricant additives to improve fuel and performance efficiency.

North America is expected to grow at a significant CAGR over the forecast during the forecast period. The growth of the region can be credited to the technological innovations, strict environmental regulations, and demand for improved material performance, especially in the construction, automotive, and electronics industries. Furthermore, the United States is a major market in the region, with a robust presence of major chemical producers such as Honeywell, Huntsman Corporation, and AkzoNobel.

Who is the Top 5 Biggest 3D Printing Companies in 2025?

| Company | Revenue |

| Stratasys, Ltd. (SSYS) | $564.45 million |

| 3D Systems Corp. (DDD) | $431.76 million |

| Protolabs Inc. (PRLB) | $499.21 million |

| Materialise NV (MTLS) | $274.36 million |

| Desktop Metal Inc. (DM) | $188.98 million |

Segmental Insight

Type Insight

Which Type Segment Dominated the Performance Additives Market in 2024?

The plastic additives segment dominated the market with 35% market share in 2024. The dominance of the segment can be attributed to the extensive use of these additives across a wide range of industries such as packaging, automotive, household goods, building and construction, and consumer products. Also, these additives play a crucial role in specific polymer properties to fulfil diverse application requirements.

The paint & coating additives segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for sustainable and bio-based additives, with major players developing VOC-free and eco-friendly solutions. Moreover, the automotive, construction, and energy sectors are significant consumers of paints and coatings, and their growth directly affects the demand for additives.

Functionality Insight

Why Durability & Weatherability Segment Dominated the Performance Additives Market in 2024?

The durability & weatherability segment held a 28% market share in 2024. The dominance of the segment can be linked to the rising demand from various industries such as automotive, construction, and packaging, for materials that can bear harsh conditions. Additionally, there's an increasing focus on using and developing sustainable performance additives to reduce overall environmental impact, leading to segment expansion.

The UV Resistance segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment can be driven by the growing demand for materials that can sustain prolonged exposure to UV radiation and sunlight. Advancements in UV additives like UV absorbers, quenchers, and new hindered amine light stabilizers (HALS) are enhancing their compatibility and effectiveness with different materials.

Form Insight

How Did the Powder Segment Held the Largest Performance Additives Market Share in 2024?

The powder segment dominated the market with a 40% market share in 2024. The dominance of the segment is owed to the stringent environmental regulations, growing need for high-performance materials, and ongoing research and development initiatives. Innovations in manufacturing technologies and the emphasis on sustainability are impacting positive segment growth soon.

The liquid segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment can be attributed to the growing adoption of innovative farming techniques, increasing global population, along changing emission standards. Also, there is an increasing trend towards environmentally friendly and bio-based products, as companies strive to comply with stringent regulations.

End-Use Industry Insight

Which End-use Industry Segment Dominated the Performance Additives Market in 2024?

The automotive segment led the market by holding 25% market share in 2024. The dominance of the segment can be credited to the surge in vehicle production, stringent environmental regulations, and the need for durability and fuel efficiency. Furthermore, higher production volumes directly convert to a raised need for performance additives utilized in lubricants, engine components, and other parts.

The packaging segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be driven by increasing demand for materials that provide enhanced durability, sustainability, and barrier properties. Also, the expansion of international trade and e-commerce has propelled the packaging requirement, driving segment growth shortly.

Source Insight

Why Did Synthetic Segment Dominated the Performance Additives Market in 2024?

The synthetic segment held an 85% market share in 2024. The dominance of the segment can be linked to the growing need for high-performance materials, especially in the packaging, automotive, and construction industries. Advancements in multifunctional additives and smart coatings that provide features such as self-healing, self-cleaning, or temperature sensitivity are gaining momentum in different sectors.

The bio-based segment is expected to grow at the fastest CAGR over the foreseeable future. The growth of the segment is due to the technological innovations in bio-based additive development, which are driving the development of high-performance additives that can efficiently compete with traditional options, impacting positive segment growth.

Recent Developments

- In February 2025, Arxada introduces the polyboost multifunctional additive. An innovative multifunctional additive designed to improve an extensive range of paint and coating properties. The performance improvements imparted by Polyboost are remarkable.(Source: www.coatingsworld.com)

- In November 2024, EnerG Lubricants and GAT GmbH introduced high-performance automotive additives in India. The new range of additives includes engine care, car care, body care, fuel system cleaners, and car detailing products.(Source: www.autocarpro.in)

Top Companies List

- BASF SE

- Evonik Industries AG

- Dow Inc.

- Clariant AG

- Arkema Group

- Huntsman Corporation

- Lanxess AG

- Solvay S.A.

- Lubrizol Corporation

- Croda International Plc

- Eastman Chemical Company

- Ashland Global Holdings Inc.

- Altana AG

- Cabot Corporation

- BYK-Chemie GmbH (A division of Altana)

- Momentive Performance Materials Inc.

- Münzing Chemie GmbH

- Perstorp Holding AB

- SABO S.p.A.

- King Industries, Inc.

Segments Covered

By Type

- Plastic Additives

- Impact Modifiers

- UV Stabilizers

- Flame Retardants

- Antioxidants

- Antistatic Agents

- Paint & Coating Additives

- Rheology Modifiers

- Dispersants

- Defoamers

- Wetting Agents

- Flow Additives

- Lubricant Additives

- Anti-wear Agents

- Corrosion Inhibitors

- Detergents

- Viscosity Index Improvers

- Friction Modifiers

- Adhesive & Sealant Additives

- Tackifiers

- Thickeners

- Surfactants

- UV Curing Agents

- Inks Additives

- Slip Agents

- Anti-settling Agents

- Leveling Agents

- Rubber Additives

- Processing Aids

- Curing Agents

- Antiozonants

- Accelerators

By Functionality

- Performance Enhancement

- Durability & Weatherability

- Surface Modification

- Process Aid

- Flame Retardancy

- UV Resistance

- Corrosion Inhibition

By Form

- Liquid

- Powder

- Granules

- Pellets

By End-use Industry

- Automotive

- Construction

- Packaging

- Paints & Coatings

- Electronics & Electrical

- Consumer Goods

- Textiles

- Agriculture

- Aerospace

- Oil & Gas

- Pharmaceuticals

By Source

- Synthetic

- Bio-based / Green Additives

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait