Content

What is the Current Bioethanol Market Size and Share?

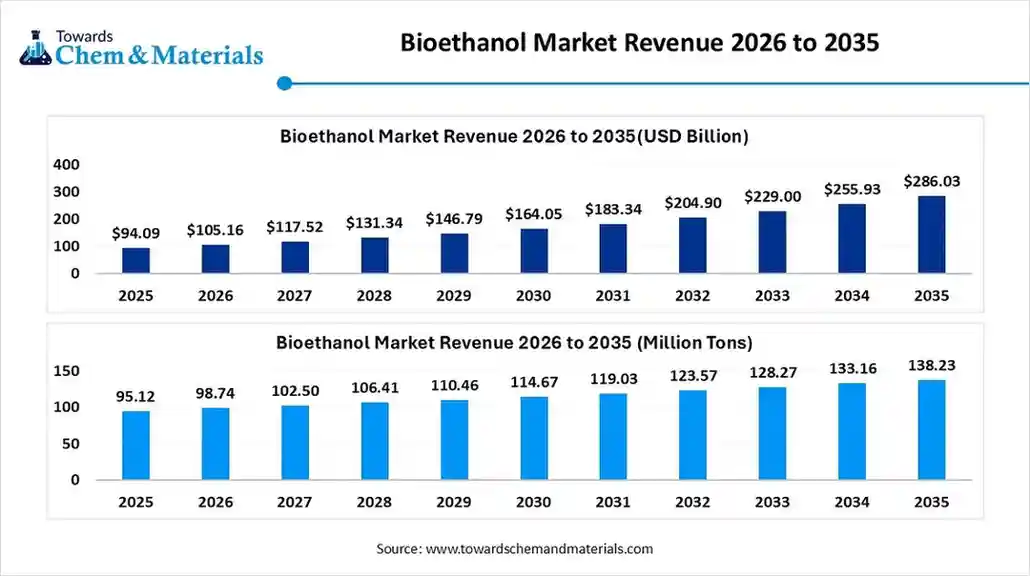

The global bioethanol market volume was estimated at 95.12 million tons in 2025 and is predicted to increase from 98.74 million tons in 2026 and is projected to reach around 138.23 million tons by 2035, The market is expanding at a CAGR of 3.81% between 2026 and 2035. North America dominated the Bioethanol market with a market share of 34.31% the global market in 2025.

The global bioethanol market size was valued at USD 94.09 billion in 2025 and is expected to hit around USD 286.03 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 11.76% over the forecast period from 2026 to 2035.

Key Takeaways

- By region, North America led the green gas market with the largest revenue volume share of over 34.31% in 2025, akin to the region considering bioethanol as a core fuel, not an alternative

- By region, Asia Pacific is anticipated to capture a greater portion of the market with a significant CAGR in the future, due to the region focused to reduction of fuel imports and air pollution while supporting farm income.

- By feedstock type, the starch-based segment led the market with the largest revenue volume share of 58% in 2025, due to its being considered the safest and fastest option to lead production.

- By feedstock type, the cellulosic/lignocellulosic segment is expected to grow during the forecast period, akin to the sustainability standards and social acceptance.

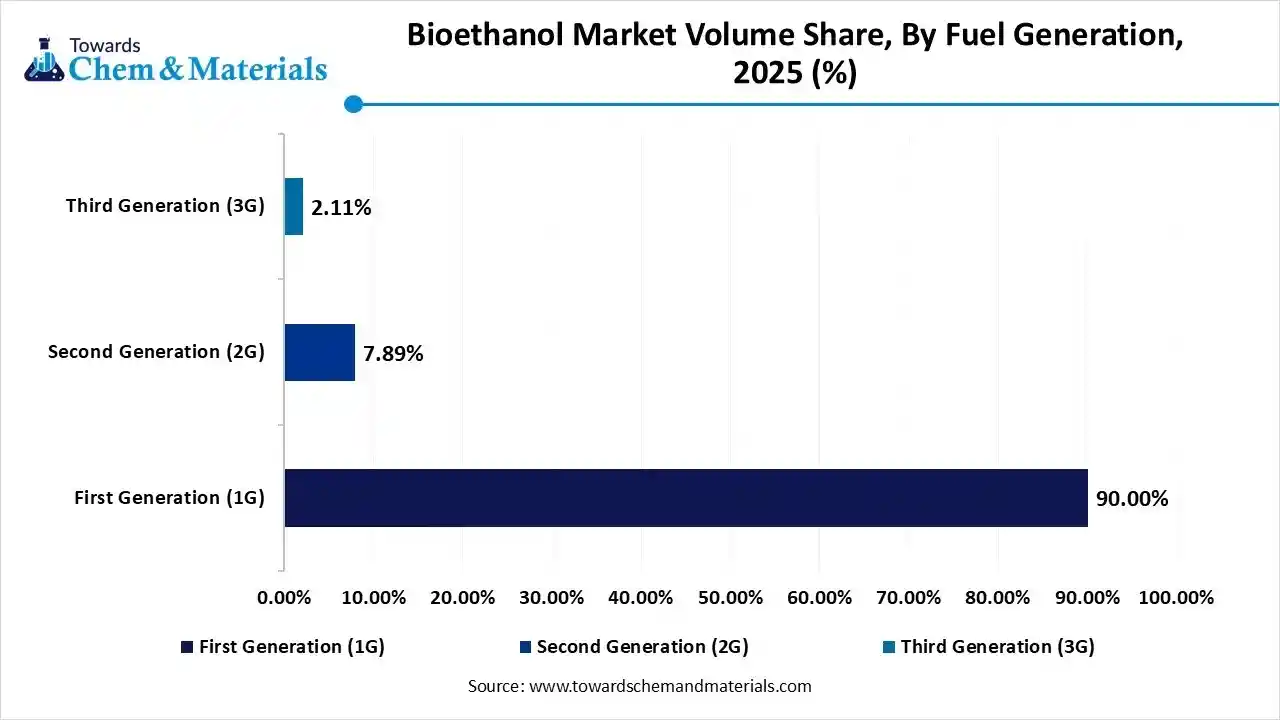

- By fuel generation type, the first-generation segment led the market with the largest volume share of 90% in 2025, akin to its technological maturity and rapid scalability.

- By fuel generation type, the second-generation segment is expected to grow at a rapid CAGR during the forecast period as it represents a structural advancement focused on sustainability and resource efficiency.

- By end-use industry, the transportation segment accounted for the largest revenue volume share of 88% in 2025, due to the compatibility of bioethanol with existing fuel systems and large-scale demand.

- By end-use industry, the food and beverages segment is expected to grow during the forecast period, akin to the growing demand for natural and renewable ingredients.

Green Fuel Economies: Bioethanol Strengthens Producer Earnings

Bioethanol refers to the fuel that is made from the plant based material such as grains, sugar crops, and agricultural waste. Moreover, the manufacturers are converting the plants' sugar into alcohol known as bioethanol through the fermentation process. Also, by burning cleaner and helping lower greenhouse gas, the bioethanol has elevated earning potential for producers in the past few years, as per the survey.

Bioethanol Market Trends:

- The shift towards the integration of biofuel into chemical and industrial products is seen as a high-margin opportunity for manufacturers in the coming years. Moreover, several manufacturers have observed under the usage of bioethanol for the production of solvents, packaging material, and personal care ingredients in recent years.

- The emergence of non-food raw materials for bioethanol making may lead to robust revenue growth across the sector during the projected period. Moreover, this integration has gained public acceptance by addressing the food versus fuel concerns in the current period, as per the observation.

- The move toward s the localisation of the bioethanol production for the regional fuel security is likely to support stronger cash flows for manufacturing enterprises in the upcoming years. Additionally, the global government is actively supporting the local manufacturing initiatives to reduce the dependence on imports, which is expected to crate grater industry environment for the bioethanol manufacturers in the coming years.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | 98.74 Million Tons |

| Revenue Forecast in 2035 | 138.23 Million Tons |

| Growth Rate | CAGR 3.81% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | North America |

| Segment Covered | By Feedstock Type, By Fuel Generation, By End-Use Industry, By Region |

| Key companies profiled | POET LLC, Archer Daniels Midland (ADM), Valero Energy Corporation, Green Plains Inc., Raízen (Joint venture between Shell and Cosan) , The Andersons, Inc. , Tereos S.A. , CropEnergies AG (Südzucker Group) , Alto Ingredients, Inc. , Flint Hills Resources Cargill, Incorporated , Abengoa Bioenergia , Shree Renuka Sugars Ltd. , Cristal Union , Pannonia Bio Zrt. , Bunge Limited ,E.I.D. Parry (India) Limited , BP p.l.c. (BP Bunge Bioenergia) , Marquis Energy , Balrampur Chini Mills Limited |

One Optimized System: Transforming Bioethanol Manufacturing Through Technology

Technology integration has gained major industry attention in the modern era. Bioethanol production is becoming smarter than before. Instead of using separate steps, modern plants connect everything into one optimized system. Raw materials are treated, fermented, and processed together for better results. New enzymes work faster and convert more input into ethanol. At the same time, digital controls monitor temperature and timing to avoid losses.

Value Chain Analysis of the Bioethanol Market:

- Distribution to Industrial Users: Bioethanol distribution is dominated by the transportation sector, driven by global mandates like India’s E20 program, requiring over 10 billion liters annually. Industrial users in pharmaceuticals, cosmetics, and chemicals utilize high-purity ethanol for solvents and sanitizers.

- Key Players: Raízen (Brazil) and Praj Industries

- Chemical Synthesis and Processing: The chemical synthesis and processing of bioethanol center on maximizing yield from diverse feedstocks ranging from traditional sugary crops (1G) to non-food cellulosic waste (2G) using advanced biotechnological pathways.

-

- Key Players: Archer-Daniels-Midland (ADM) and Tereos

- Regulatory Compliance and Safety Monitoring: Regulatory compliance for bioethanol is governed by a multi-tiered framework that ensures environmental sustainability, fuel quality, and operational safety. Key agencies oversee these aspects globally, with a significant shift toward higher blending mandates and stricter safety monitoring.

- Key Agencies: Environmental Protection Agency (EPA) and the European Commission (EU)

Bioethanol Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Environmental Protection Agency (EPA) | Renewable Fuel Standard (RFS) | Strengthening United States energy independence |

| European Union | European Chemicals Agency (ECHA) | Renewable Energy Directive (RED III) | Enhancing sustainability verification through mandatory mass balance traceability |

| China | National Energy Administration (NEA) | 14th Five-Year Plan (2021–2025) | Achieving large-scale production of cellulosic ethanol by 2025 |

Segmental Insights

Feedstock Type Insights

How did the Starch-Based Segment Dominate the Bioethanol Market in 2025?

The starch-based segment dominated the market with 58% industry share in 2025, owing to its being considered the safest and fastest option to lead production. Moreover, having factors like easy processing, enlarged availability, and supported by farming logistics systems, the corn and wheat cops has generated the value-added opportunities for the industry participants in recent years, as per the observation.

The cellulosic/lignocellulosic segment is expected to grow with a rapid CAGR, akin to the sustainability standards and social acceptance. Moreover, by using the nonfood material like crop residues, agricultural waste, and plant fibers, the segment has gained major industry attention in recent years. Also, the government supports the fuel that does not affect or create any burden on food prices or social expenses has contributed to the segment growth in recent years.

Fuel Generation Type Insights

Why does the First Generation(1G) Segment Dominate the Bioethanol Market?

The first-generation segment dominated the market with 90% industry share in 2025, owing to its technological maturity and rapid scalability. Established conversion processes, reliable feedstock supply, and integrated distribution networks enabled efficient commercialization. This generation met early renewable fuel requirements with minimal infrastructure disruption.

The second-generation segment is expected to grow at a rapid CAGR as it represents a structural advancement focused on sustainability and resource efficiency. By utilizing non-foam biomass, it addresses environmental and social concerns associated with first-generation fuels. Improved processing technologies and regulatory support position second-generation ethanol as a long-term solution aligned with evolving carbon reduction frameworks.

Bioethanol Market Volume and Share, Fuel Generation Type, 2025- 2035 (%)

| By Fuel Generation | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| First Generation (1G) | 90.00% | 85.61 | 119.13 | 3.36% | 86.18% |

| Second Generation (2G) | 7.89% | 7.50 | 16.77 | 8.37% | 12.13% |

| Third Generation (3G) | 2.11% | 2.01 | 2.34 | 1.53% | 1.69% |

End Use Industry Insights

How did the Transportation Segment Dominate the Bioethanol Market in 2025?

The transportation segment dominated the market with 88% industry share in 2025, akin to the compatibility of bioethanol with existing fuel systems and large-scale demand. Ethanol blending provided a practical pathway to reduce emissions without major vehicle modifications. Policy mandates and fuel security objectives further reinforced transportation's dominance.

The food and beverages segment is expected to grow with a rapid CAGR, due to the growing demand for natural and renewable ingredients. Bioethanol's purity, safety profile, and versatility make it suitable for processing and extraction uses. This shift supports stable premium demand beyond fuel markets.

Regional Insights

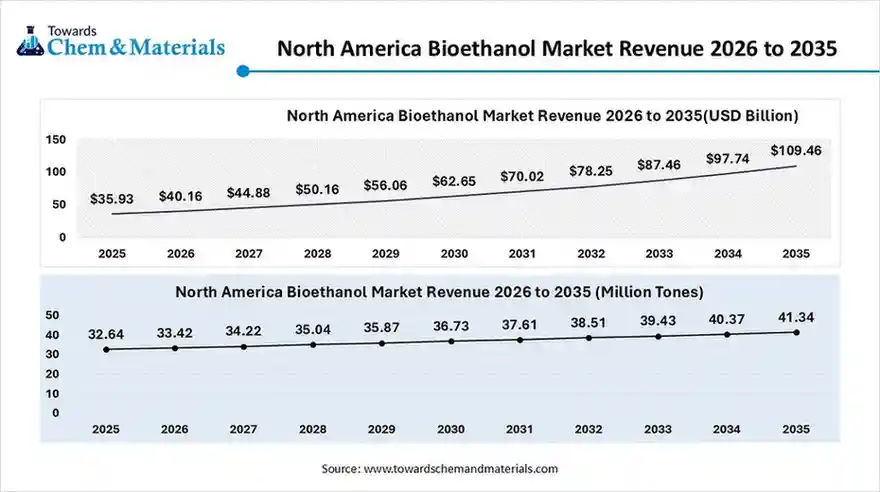

The North America bioethanol market volume was valued at 32.64 million tons in 2025 and is expected to surpass around 40.35 million tons by 2035, expanding at a compound annual growth rate (CAGR) of 2.39% over the forecast period from 2026 to 2035.

The North America bioethanol market size was estimated at USD 35.93 billion in 2025 and is projected to reach USD 109.46 billion by 2035, growing at a CAGR of 11.78% from 2026 to 2035.

North America dominated the bioethanol market with 34.31% industry share in 2025, akin to the region considering bioethanol as a core fuel, not an alternative. Moreover, the region has already built fuel systems and supply chains around ethanol blends, as per the observation. Furthermore, the regional countries are getting attention due to their enlarged corn supply in recent years.

Technology Upgrades Reinforce United States Leadership in Bioethanol

The United States maintained its dominance in the bioethanol market, due to the country has seen under the heavy usage of bioethanol as a strategic carbon reduction tool. Moreover, the regional producers are actively improving efficiency while reducing water use in recent years. Furthermore, the farmers in the country are considering the corn as income security after the bioethanol trend emerged. Also, several manufacturers are upgrading older plants with new technology-integrated systems.

Bioethanol Market Volume and Share, By Region, 2025- 2035 (%)

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 34.31% | 32.64 | 41.34 | 2.39% | 29.19% |

| Europe | 18.23% | 17.34 | 21.34 | 2.33% | 15.44% |

| Asia Pacific | 27.45% | 26.11 | 48.56 | 7.14% | 35.13% |

| South America | 15.34% | 14.59 | 22.27 | 4.81% | 16.11% |

| Middle East & Africa | 4.67% | 4.44 | 5.71 | 2.83% | 4.13% |

Asia Pacific Bioethanol Market Examination

Asia Pacific is expected to capture a major share of the bioethanol market with a rapid CAGR, due to the region has focused to reduction of fuel imports and air pollution while supporting farm income. Furthermore, the regional countries such as India, China, and Japan have observed pushing blending mandates aggressively in their regions to reduce oil dependence in recent years.

China’s Path to Energy Resilience

China is expected to emerge as a prominent country for the bioethanol market in the coming years, due to the country has been considering bioethanol as an energy security strategy over the years. also, by linking bioethanol plants with local farmers, the country has projected to unlock new business opportunities for producers in the coming years.

Europe Bioethanol Market Evaluation

Europe is a notably growing region, akin to a heavy environmental protection regulation implementation in the region. The greater government support for sustainable fuel options has enhanced the industry participation for bioethanol manufacturers in the region. Also, the region has observed a high demand for high-quality bioethanol supply in recent years.

Germany Redefines Industrial Advancement

Germany is expected to gain a major industry, due to a major shift towards water-based feedstocks and sustainability adoption. Additionally, the German manufacturers are focused on process optimization rather than capacity expansion in recent years, as per the country survey. Moreover, having a greater engineering infrastructure and advanced manufacturing systems driving the industry growth in Germany nowadays.

Bioethanol Market Study in the Middle East and Africa

The Middle East and Africa are expected to capture a notable share of the industry, driven by increased structural energy needs rather than short-term policy incentives in the region nowadays. The region views bioethanol as a complementary energy source that enhances fuel security and economic inclusion. Gradual implementation allows infrastructure learning and market readiness.

Saudi Arabia’s Structural Energy Journey Towards Long Term Resilience

Saudi Arabia is expected to emerge as a prominent country, as the country has focused on capability building rather than immediate scale. The country is testing value chains, technical feasibility, and regulatory frameworks. This structured approach supports informed decision-making and gradual adoption within the national energy portfolio in Saudi Arabia in recent years.

South America Bioethanol Market Evaluation

South America is a notably growing region, akin to strong agricultural capacity and established production experience. The region is transitioning from expansion focused growth to efficiency-driver optimization in the current period. Also, this shift improves sustainability performance and long term competitiveness.

Brazil Prepares Its Industry for Fuel Transitions

Brazil is expected to gain a major industry, akin to the country evolving toward resilience and adaptability. The country has been preparing production systems that can respond to future fuel transitions while maintaining supply stability and sustainability performance in recent years. The country is improving plant efficiency and using by-products more effectively.

Recent Developments

- In November 2025, ADM has unveiled their first and enlarged bioethanol carbon capture facility. The newly launched facility can store carbon dioxide as per the published report.(Source : www.feedandgrain.com)

Top Vendors in the Bioethanol Market & Their Offerings:

- POET LLC: As the world's largest producer of biofuels, POET operates 33 bioprocessing facilities across the U.S. and is a leader in developing advanced cellulosic ethanol and bio-based products.

- Archer Daniels Midland (ADM): A global leader in agricultural processing and nutrition, ADM operates major dry-mill and wet-mill ethanol plants, producing billions of gallons of bioethanol annually.

- Valero Energy Corporation: A Fortune 50 company and the first traditional refiner to enter the ethanol space, Valero is now one of the largest renewable fuel producers in the world with 12 ethanol plants.

- Green Plains Inc.: A prominent biorefining company focused on the transformation of renewable crops into high-value ingredients, including low-carbon bioethanol and specialized animal proteins.

Top Companie in the Vendors in the Bioethanol Market

- POET LLC

- Archer Daniels Midland (ADM)

- Valero Energy Corporation

- Green Plains Inc.

- Raízen (Joint venture between Shell and Cosan)

- The Andersons, Inc.

- Tereos S.A.

- CropEnergies AG (Südzucker Group)

- Alto Ingredients, Inc.

- Flint Hills Resources

- Cargill, Incorporated

- Abengoa Bioenergia

- Shree Renuka Sugars Ltd.

- Cristal Union

- Pannonia Bio Zrt.

- Bunge Limited

- E.I.D. Parry (India) Limited

- BP p.l.c. (BP Bunge Bioenergia)

- Marquis Energy

- Balrampur Chini Mills Limited

Segments Covered in the Report

By Feedstock Type

- Starch-Based

- Corn (Maize)

- Wheat

- Cassava

- Barley and Other Grains

- Sugar-Based

- Sugarcane

- Sugar Beet

- Molasses

- Cellulosic/Lignocellulosic (Advanced)

- Agricultural Residues (Corn Stover, Wheat Straw, Rice Husk)

- Wood and Forestry Waste

- Energy Crops (Switchgrass, Miscanthus)

- Other/Emerging Feedstocks

- Municipal Solid Waste (MSW)

- Industrial Waste/Flue Gas

- Algal Biomass

By Fuel Generation

- First Generation (1G): Derived from edible food crops.

- Second Generation (2G): Derived from non-edible lignocellulosic biomass and waste.

- Third Generation (3G): Derived from algal biomass.

By End-Use Industry

- Transportation

- Passenger Vehicles (Flexible Fuel Vehicles & Conventional)

- Commercial Vehicles

- Aviation (as a precursor for Sustainable Aviation Fuel - SAF)

- Food & Beverages

- Alcoholic Beverages

- Food Grade Solvents/Extractants

- Pharmaceuticals

- Active Pharmaceutical Ingredient (API) Solvent

- Disinfectants and Antiseptics

- Cosmetics & Personal Care

- Perfumes and Fragrances

- Hair and Skincare Products

- Industrial & Chemical

- Chemical Intermediates (Ethyl Acetate, Ethylene)

- Paints and Coatings Solvents

- Power Generation (Fuel Cells and Combined Heat & Power)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa