Content

Asia Pacific Polymers Market Size & Growth Analysis Report, 2034

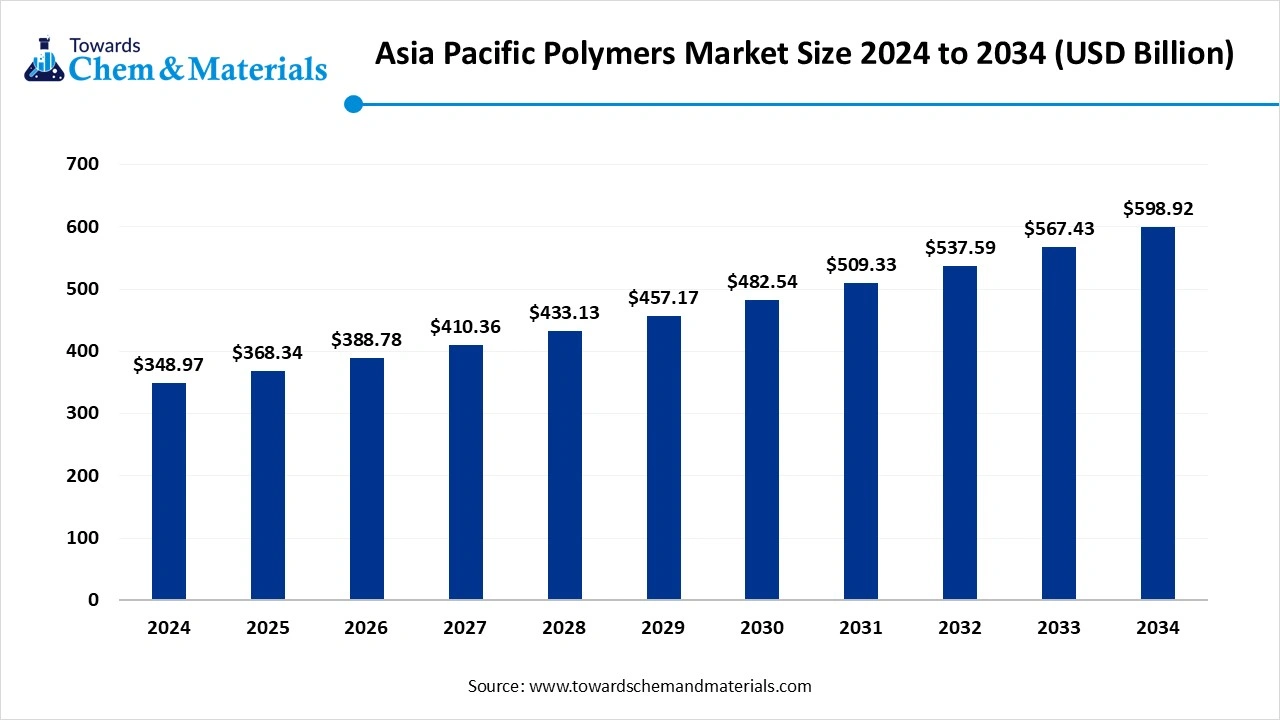

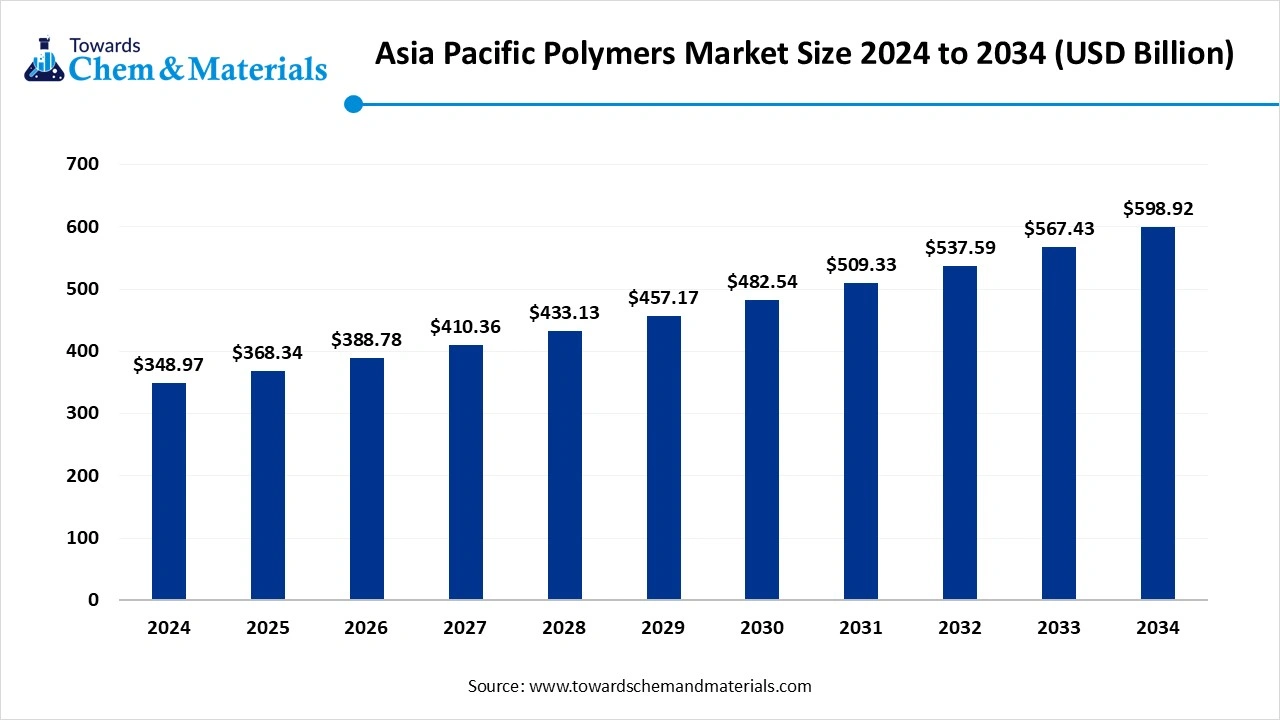

The Asia Pacific polymers market size was reached at USD 348.97 Billion in 2024 and is expected to be worth around USD 598.92 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.55% over the forecast period 2025 to 2034.

Growing polymer demand from various sectors is the key factor driving market growth. Also, a surge in urbanization and economic development in the region, coupled with innovations in manufacturing technologies, can fuel market growth further.

Key Takeaways

- By region, East Asia dominated the market with a 45% share in 2024.

- By region, the Southeast Asia region is expected to grow at the fastest CAGR over the forecast period.

- By polymer type, the polyethylene (PE) segment dominated the market with a 28% share in 2024.

- By polymer type, the polylactic acid (PLA) segment is expected to grow at the fastest CAGR over the forecast period.

By processing technology, the injection molding segment held a 32% market share in 2024. - By processing technology, the additive manufacturing (3D Printing) segment is expected to grow at the fastest CAGR during the projected period.

- By end-use industry, the packaging segment dominated the market by holding a 35% share in 2024.

- By end-use industry, the healthcare & medical segment is expected to grow at the fastest CAGR during the study period.

What is Polymer?

The increasing consumer demand for packaged products is the major factor fuelling market growth. The Asia Pacific polymers market encompasses synthetic and natural polymeric materials used across industries such as packaging, automotive, construction, electronics, and healthcare. Polymers are classified based on type, processing technology, and end-use, and are valued for their lightweight, durability, and versatile properties.

Asia Pacific Polymers Market Outlook:

- Industry Growth Overview: Between 2025-2034, the market is expected to witness substantial growth due to rapid advancements in polymer manufacturing, such as automation and precision that improve product quality and overall production efficiency. Also, the development of advanced and high-performance materials can propel market growth soon.

- Sustainability Trends: An ongoing surge in bio-based and biodegradable materials, fuelled by government mandates and environmental concerns, is the current sustainability trend in the market. The development of cutting-edge smart materials with improved performance and new functionalities is driving the adoption of sustainable production processes.

- Global Expansion: Major players in the region, such as Dow Inc. and LG Chem, are driving advancements and manufacturing in developing countries such as China and India, particularly in emulsion polymers. Countries such as China and India are providing a competitive advantage due to their robust manufacturing capabilities.

Key Technological Shifts in the Asia Pacific Polymers Market:

The market in the region is witnessing a major technological shift, boosted by a strong emphasis on sustainability and innovations in high-performance materials, with the integration of digital production techniques. Chemical recycling methods, like pyrolysis, are increasingly becoming popular as this technology breaks down plastics waste into raw oils and monomers.

Kaneka Corporation, BASF, and Dow Inc. are major players in the market, which produces high-performance and solvent-free sealants for the automotive and construction sectors. Sumitomo Chemical has recently obtained the certification for its sustainably produced acrylonitrile.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 368.34 Billion |

| Expected Size by 2034 | USD 598.92 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type / Chemical Class, By Feedstock / Raw Material, By Application / End-Use Industry |

| Key Companies Profiled | Corbion, Evonik Industries (U.S. operations), Genomatica, Inc., Novozymes, Inc., Solvay S.A. (U.S. operations), BioAmber (renewable succinic acid), Amyris, Inc., Green Biologics Ltd.LanzaTech (carbon-to-chemicals technology) |

Trade Analysis of the Asia Pacific Polymers Market: Import & Export Statistics

- China: In 2024, China was the largest producer and exporter of natural and modified natural polymers within the Asia Pacific, accounting for 93% of the region's exports in primary forms.

- Indonesia: Ranked as the second top buyer of Chinese PP in 2023, importing approximately 94,000 tons.

- Vietnam: Chinese PP imports saw a significant rebound in 2023, reaching 205,000 tons, following a decline in 2022.

Value Chain Analysis of the Asia Pacific Polymers Market

- Feedstock Procurement : It is the process of acquiring the raw materials required to produce polymers. This includes sourcing fossil-fuel-based materials.

- Chemical Synthesis and Processing : It refers to the entire lifecycle of producing polymers, from creating the chemical building blocks to converting them into a finished product.

- Packaging and Labelling : In this stage, various polymer resins are utilized to manufacture both flexible and rigid packaging materials and labels for different industries.

- Regulatory Compliance and Safety Monitoring : It involves adherence to a detailed set of national and international regulations focusing on ensuring overall product quality and worker safety.

Asia Pacific Polymers Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations and Trade Statistics |

| China | In 2024, China was the largest producer and exporter of natural and modified natural polymers within the Asia Pacific, accounting for 93% of the region's exports in primary forms. |

| India | India meets a significant portion of its domestic polymer demand through imports, estimated at 3.93 million tonnes in 2022–2023, and projected at 3.28 million tonnes for 2023–2024. |

| Japan | In 2024, Japan was the main regional importer of natural and modified natural polymers, with 38,000 tons, accounting for 34% of total imports. |

Market Opportunity

The Growing Emphasis on New Product Launches

The increasing focus on innovative product launches is a major factor creating lucrative opportunities in the market. It is necessary for businesses to focus on this area to stay updated and innovative with the latest market trends. Furthermore, one crucial trend in the market is the development of high-grade biodegradable polymers that give better properties like oxygen permeability and impact strength.

Market Challenge

Inconsistent Waste Management

Many emerging economies in the region lack the strong infrastructure for effective waste management, like kerbside collection systems, which is a major factor hindering market expansion. Moreover, trade restrictions due to geopolitical tensions can fluctuate the supply chains for raw materials and the resulting material, which can affect the overall production costs in the APAC.

Segmental Insights

Polymer Type Insight

How Much Share Did the Polyethylene (PE) Segment Held in 2024?

The polyethylene (PE) segment dominated the market with a 28% share in 2024. It is a subsegment of thermoplastic polymers. The dominance of the segment can be attributed to the rapid industrialization and urbanization in the emerging economies such as China and India. Additionally, advancements in polymer manufacturing technology, along with the surge in development of PE types, are further boosting segment growth.

The polylactic acid (PLA) segment is expected to grow at the fastest CAGR over the forecast period. It is also another subsegment of thermoplastic polymers. The growth of the segment can be credited to the growing consumer demand for sustainable products, coupled with the rising need for bioplastics in sectors such as textiles and automotive. In addition, PLA is increasingly becoming price-competitive compared to some conventional plastics.

Processing Technology Insight

Which Processing Technology Type Segment Dominated the Asia Pacific Polymers Market in 2024?

The injection molding segment held a 32% market share in 2024. The dominance of the segment can be linked to the growing product demand from the electronics, automotive, and packaging sectors, driven by strong manufacturing bases, especially in the developing nations. Furthermore, Injection molding is a crucial process for manufacturing components such as syringes and IV components.

The additive manufacturing (3D Printing) segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be driven by the growing need for customized products and ongoing innovations in 3D printing technology. Moreover, the inherent advantages of 3D printing, like lower labour costs and reduced material waste in the production process, contribute to its increasing adoption.

End-Use Industry Insight

Which End-Use Industry Segment Dominated the Asia Pacific Polymers Market in 2024?

The packaging segment dominated the market by holding a 35% share in 2024. The dominance of the segment is owed to the growing demand for durable, lightweight, and flexible packaging solutions in the personal care, pharmaceutical, and food & beverage industries. Also, polymer packaging has benefited from innovative additives that provide enhanced oxygen barriers, UV resistance, and other properties that safeguard products from degradation.

The healthcare & medical segment is expected to grow at the fastest CAGR during the study period. The growth of the segment is due to growing demand for innovative medical devices along with the surging healthcare infrastructure in the major countries. Some nations in the Asia Pacific region are also developing into medical tourism hubs, which increases the need for advanced healthcare procedures, leading to segment growth soon.

Regional Insights

East Asia dominated the market with a 45% share in 2024.

The dominance of the segment can be attributed to the growing polymer demand from booming construction, packaging, and automotive sectors, coupled with the several government initiatives supporting sustainable polymer solutions. In addition, the region's strong infrastructure and skilled labor make it a hub for polymer production and supply chains.

China Asia Pacific Polymers Market Trends

In the Asia Pacific, China dominated the market owing to the robust government support and ongoing push toward sustainability. China is a major hub for electronics production, which fuels significant demand for high-performance and specialty plastics. Also, the Chinese government heavily invested in petrochemical manufacturing facilities to ensure a stable supply of raw materials.

The Southeast Asia region is expected to grow at the fastest CAGR over the forecast period.

The growth of the region can be credited to the growing consumer awareness of environmental concerns, which drives the demand for eco-friendly and sustainable options. Furthermore, consumers in this region are rapidly preferring green products, optimising the development of biodegradable polymers and other alternatives.

India Asia Pacific Polymers Market Trends

In the Asia Pacific, India is witnessing the fastest growth during the forecast period, due to innovations in polymer technology, such as the development of bioplastics and a surge in vehicle manufacturing and production in the country. Growing consumer awareness regarding environmental issues is also creating demand for green alternatives like bio-based polymers.

Country-level Investments & Funding Trends for the Asia Pacific Polymers Market:

- China: Investments are increasing in bio-based and circular polymers. For instance, in August 2025, IKEA's investment arm backed Chinese recycling firm Re-mall, which recycles polypropylene.

- India: In 2025, venture capital funds invested $6.6 million in South Asian polymers, including Indian-based firms focused on biomaterials.

- Japan and South Korea: Companies like Japan's Nippon Shokubai are investing in biomass-derived superabsorbent polymers, aligning with carbon-neutrality goals.

Recent Development

- In June 2025, Covestro unveiled localized manufacturing of medical-grade Thermoplastic Polyurethane TPU in the Asia Pacific. It is Covestro's second facility across the globe, qualified to manufacture high-grade materials in the region, enabling more efficient and flexible regional supply to fulfil growing demand.(Source: www.covestro.com)

Top Vendors in Asia Pacific Polymers Market & Their Offerings:

- LyondellBasell Industries: LyondellBasell is a major producer of polymers in the Asia Pacific (APAC) market, with a significant presence across China, Malaysia, South Korea, and Thailand.

- SABIC: SABIC is a major player in the Asia Pacific (APAC) polymers market, with an extensive network of manufacturing sites, technology centers, and sales offices across the region.

- LG Chem: LG Chem is a leading and major player in the Asia-Pacific polymers market, leveraging its strong petrochemical foundation to expand into high-value and sustainable materials.

Other Players

- Formosa Plastics

- Sinopec

- Reliance Industries

- Mitsui Chemicals

- Sumitomo Chemical

- Dow Inc.

- ExxonMobil Chemical

- Braskem

- Idemitsu Kosan

- Covestro

- INEOS

- Toray Industries

- Ube Industries

- China National Chemical Corp (ChemChina)

- Asahi Kasei

- Hengli Group

- Wanhua Chemical

Segment Covered

By Polymer Type

- Thermoplastics

- Polyethylene (LDPE, HDPE, LLDPE)

- Polypropylene (Homopolymer, Copolymer)

- Polyvinyl Chloride (Rigid, Flexible)

- Polystyrene (GPPS, HIPS)

- Polyethylene Terephthalate (Crystalline, Amorphous)

- Acrylonitrile Butadiene Styrene (ABS)

- Polycarbonate (PC)

- Polyamide (PA6, PA66)

- Polyoxymethylene (POM)

- Polybutylene Terephthalate (PBT)

- Polyurethane (TPU, Thermoset PU)

- Polylactic Acid (PLA)

- Thermosets

- Epoxy Resins

- Phenolic Resins

- Unsaturated Polyester Resins (UPR)

- Melamine Formaldehyde

- Urea Formaldehyde

- Elastomers

- Styrene-Butadiene Rubber (SBR)

- Ethylene Propylene Diene Monomer (EPDM)

- Nitrile Rubber (NBR)

- Silicone Rubber

- Thermoplastic Elastomers (SBC, TPV, TPO, TPU)

By Processing Technology

- Injection Molding

- Blow Molding

- Extrusion

- Thermoforming

- Compression Molding

- Rotational Molding

- Additive Manufacturing (3D Printing)

By End-Use Industry

- Packaging

- Flexible Packaging (Films, Pouches, Laminates)

- Rigid Packaging (Bottles, Containers, Trays)

- Automotive

- Interior Components (Dashboard, Seats, Panels)

- Exterior Components (Bumpers, Fenders, Doors)

- Under-the-Hood Components (Engine Covers, Air Intake, Fuel Tanks)

- Construction

- Residential (Single/Multi-Family Homes, Apartments)

- Commercial (Office Buildings, Hotels, Warehouses)

- Industrial (Factories, Refineries, Power Plants)

- Electronics & Electricals

- Consumer Electronics

- Industrial Electronics

- Electrical Insulation Materials

- Healthcare & Medical

- Medical Devices

- Packaging for Pharma

- Disposable Consumables

- Textiles & Coatings

- Synthetic Fibers

- Performance Coatings