Content

What is the Current Wastewater Treatment Services Market Size and Share?

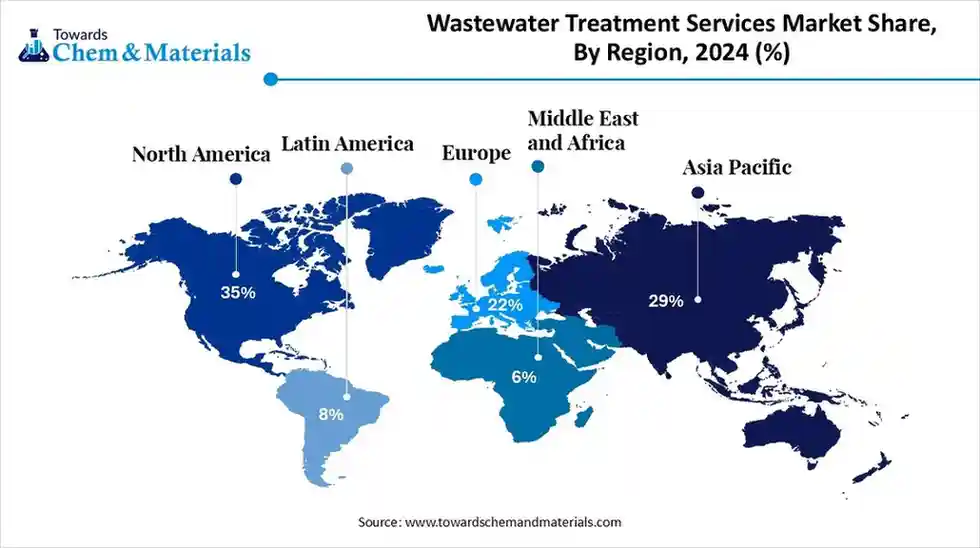

The global wastewater treatment services market size is estimated at USD 67.56 billion in 2025, it is predicted to increase from USD 72.22 billion in 2026 to approximately USD 131.78 billion by 2035, expanding at a CAGR of 6.91% from 2025 to 2035. North America dominated the wastewater treatment services market with a market share of 35% the global market in 2024. Surge in population and urbanization is the key factor driving market growth. Also, stringent government regulations coupled with the increasing water scarcity can fuel market growth further.

Key Takeaways

- By region, North America dominated the market with a 35% share in 2024.

- By region, Asia Pacific held 30% market share and is expected to grow at the fastest CAGR over the forecast period.

- By region, Europe holds 22% market share and is expected to grow at a notable CAGR over the forecast period.

- By service type, the O&M services segment dominated the market with a 28% share in 2024.

- By service type, the retrofit & upgrade services segment held 9% market share and is expected to grow at the fastest CAGR over the forecast period.

- By end user industry, the municipal utilities & municipalities segment dominated the market with a 36% share in 2024.

- By end user industry, the pharmaceuticals & biotechnology segment held 5% market share in 2024 and is expected to grow at the fastest CAGR over the forecast period.

By technology, the biological treatment segment held 32% market share in 2024. - By technology, the membrane technologies segment held 21% market share in 2024 and is expected to grow at the fastest CAGR during the projected period.

- By delivery mode, the on-site engineered (built-in-place) plants segment dominated the market with 62%share in 2024.

- By delivery mode, the packaged / modular solutions segment held 28% market share in 2024 and is expected to grow at the fastest CAGR over the study period.

What are Wastewater Treatment Services?

Increasing awareness regarding water pollution's impact on public health is a major market driver. The wastewater treatment services market comprises professional services, engineering, procurement and construction (EPC), operations & maintenance (O&M), monitoring & laboratory testing, sludge handling & disposal, retrofit and upgrade services, and recurring chemical supply and performance contracts that treat municipal and industrial wastewater to meet regulatory discharge limits or enable reuse.

Services span design and build of full-scale plants and modular systems, commissioning, long-term plant operation, performance guarantees, sludge management, and digital/remote monitoring.

Global Wastewater Treatment Services Market Outlook:

- Industry Growth Overview: Governments are increasingly enforcing strict rules on wastewater discharge, compelling municipalities and industries to invest or upgrade in better treatment services. Also, increases industrial activity, particularly in sectors such as food and beverage, chemicals, and manufacturing, generates large amounts of wastewater, which needs treatment.

- Sustainability Trends: The market is emphasizing sustainability trends heavily, fuelled by strict regulations and water scarcity. There is a strong emphasis on minimizing the substantial energy consumption of wastewater treatment plants, which can impact positive market growth soon.

- Major Investors: Major investors in the market include huge multinational corporations that operate in the sector. Key players in the market, such as Veolia, Xylem Inc., and Ecolab Inc., are focusing on developing sustainable water technology infrastructure.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 72.22 Billion |

| Expected Size by 2035 | USD 131.78 Billion |

| Growth Rate from 2025 to 2035 | CAGR 6.91% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2035 |

| Leading Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segment Covered | By Service Type, By End-User Industry, By Technology / Process, By Delivery Mode, By Region |

| Key Companies Profiled | SUEZ, Black & Veatch, Jacobs Solutions, AECOM, Arcadis, Stantec, Xylem Inc., Evoqua Water Technologies, Ecolab Inc., Kurita Water Industries Ltd., Kemira Oyj, VA Tech WABAG (WABAG), Thermax Ltd., Doosan / Doosan Enerbility, Aquatech International, Fluence Corporation, FCC Aqualia (Grupo FCC), Saur, SNF Floerger |

How Cutting Edge Technologies are Revolutionising the Wastewater Treatment Services Market?

Advanced technologies are revolutionising the market mainly by growing operational efficiency through smart systems and automation, enabling sustainability and optimising the creation of highly effective, specialized formulations. The advent of technologies such as supercritical CO2 and hydrogen peroxide cleaning has raised the demand for less harmful and compatible solvents.

Trade Analysis of Wastewater Treatment Services Market: Import & Export Statistics:

- China is one of the top chemical-importing countries globally, with an estimated total chemical import value of around $800 billion in 2024. (Source: www.importglobals.com )

- During the financial year 2023-24, India exported 151,704 metric tons of hydrochloric acid 33%, with a total export value of $14.99 million USD.(Source: elchemy.com)

Wastewater Treatment Services Market Value Chain Analysis

- Feedstock Procurement : It refers to the strategic process of sourcing the required raw materials for treatment operations and converting them into valuable byproducts.

- Chemical Synthesis and Processing : It is the market stage that focuses on the production, supply, and application of specialized chemical products used to purify water.

- Packaging and Labelling : It refers to the advent of prefabricated, modular "packaged wastewater treatment plants" created for quick and easy installation.

- Regulatory Compliance and Safety Monitoring : It involves sticking to environmental regulations like those to safeguard public health and the environment.

Wastewater Treatment Services Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations/Investments |

| United States | The U.S. Environmental Protection Agency (EPA) sets national primary drinking water regulations to limit over 90 contaminants in public water systems. |

| European Union | Urban Wastewater Treatment Directive: This regulation focuses on the collection, treatment, and discharge of wastewater from urban areas. The rules were updated in 2024 to extend their application to more urban areas and cover a broader range of pollutants. |

| China | China's wastewater and water quality standards are primarily driven by the National Food Safety Standard for Drinking Water Quality (GB5749-2022), which took effect on April 1, 2023. |

Segment Insights

Service Type Insights

How Much Share Did the O&M Services Segment Held in 2024?

- The O&M services segment dominated the market with a 28% share in 2024. The dominance of the segment can be attributed to the growing need for efficiency, continuity, and compliance with stringent regulations. O&M services are generally aided by predictive maintenance and digital monitoring technologies.

- The retrofit & upgrade services segment held 9% market share and is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for improved operational efficiency and cost reduction, along with the rapid adoption of cutting-edge digital technologies.

- The EPC & turnkey projects segment held a 22% market share in 2024. The primary driver of the segment is the ability of the turnkey/EPC model to shift much risk and burden of large capital projects from the buyer to the single, accountable EPC contractor.

- The consulting & design services segment held 10% market share in 2024. Governments across the globe are rapidly enforcing and implementing stringent rules on wastewater discharge to safeguard water bodies and public health, pushing municipalities and industries to invest in compliant treatment systems.

End-User Industry Insights

Which End-User Type Segment Dominated the Wastewater Treatment Services Market in 2024?

- The municipal utilities & municipalities segment dominated the market with a 36% share in 2024. The dominance of the segment can be linked to the rising demand to upgrade aging infrastructure with ongoing urbanization and population growth. Municipalities are treating wastewater for high-grade non-potable uses like irrigation and industrial cooling.

- The pharmaceuticals & biotechnology segment held 5% market share in 2024 and is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing emphasis on water sustainability and reuse, coupled with the ongoing growth of the global pharmaceutical industry.

- The industrial power & energy segment held 15% market share in 2024. The rapid depletion of freshwater resources because of industrialization and population growth is a major driver of the segment. Also, wastewater treatment facilities are energy-intensive, which can minimize operational costs and environmental impact.

- The industrial oil & gas & petrochemical segment held 10% market share in 2024. The complexity of petrochemical wastewater and oil & gas, which contains heavy metals, organic pollutants, and hydrocarbons, requires sophisticated treatment methods. Technological innovations can boost the segment expansion further.

Technology Insights

Which Technology Type Segment Dominated the Wastewater Treatment Services Market in 2024?

- The biological treatment segment held 32% market share in 2024. The dominance of the segment is owing to the increasing need for energy-efficient and advanced wastewater treatment solutions, along with the rising scarcity of freshwater resources globally. Governments globally are enforcing stringent standards for water quality and discharge.

- The membrane technologies segment held 21% market share in 2024 and is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to ongoing investment in new upgrades and infrastructure, particularly in emerging economies. Growing public concern regarding water pollution is driving segment growth soon.

- The chemical treatment segment held 12% market share in 2024. The ability of chemical treatment to address an extensive range of pollutants, such as emerging contaminants, contributed to the overall segment expansion. The increasing utilisation of specialty chemicals, such as corrosion and scale inhibitors, is fuelling segment growth further.

- The disinfection segment held 6% market share in 2024. The growth of the segment is largely driven by a surge in water scarcity, stringent environmental regulations, and innovations in technologies such as ozone disinfection. These innovations offer superior performance in removing contaminants, such as pharmaceuticals.

Delivery Mode Insights

How Much Share Did the On-Site Engineered (built-in-place) Plants Segment Held in 2024?

- The on-site engineered (built-in-place) plants segment dominated the market with a 62%share in 2024. On-site engineered plants can be catered to meet specific local demand and the unique characteristics of the wastewater generated by a specific facility, providing better flexibility than centralized municipal systems.

- The packaged / modular solutions segment held 28% market share in 2024 and is expected to grow at the fastest CAGR over the study period. The growth of the segment can be attributed to rising demand for rapidly deployable, flexible, and cost-effective solutions that address the challenges of water scarcity, urbanisation, and stringent environmental regulations.

- The mobile/temporary units segment held 6% market share in 2024. Mobile units are crucial for offering immediate access to clean water in areas where conventional water infrastructure is unavailable or damaged. Also, their fast deployment capability (often within 72 hours) is a major advantage.

- The remote monitoring / digital-only services segment held 4% market share in 2024. Digital solutions allow for real-time monitoring and data analytics, enabling operators to make data-driven and informed decisions smoothly. In many regions, wastewater infrastructure needs modernization.

Regional Insights

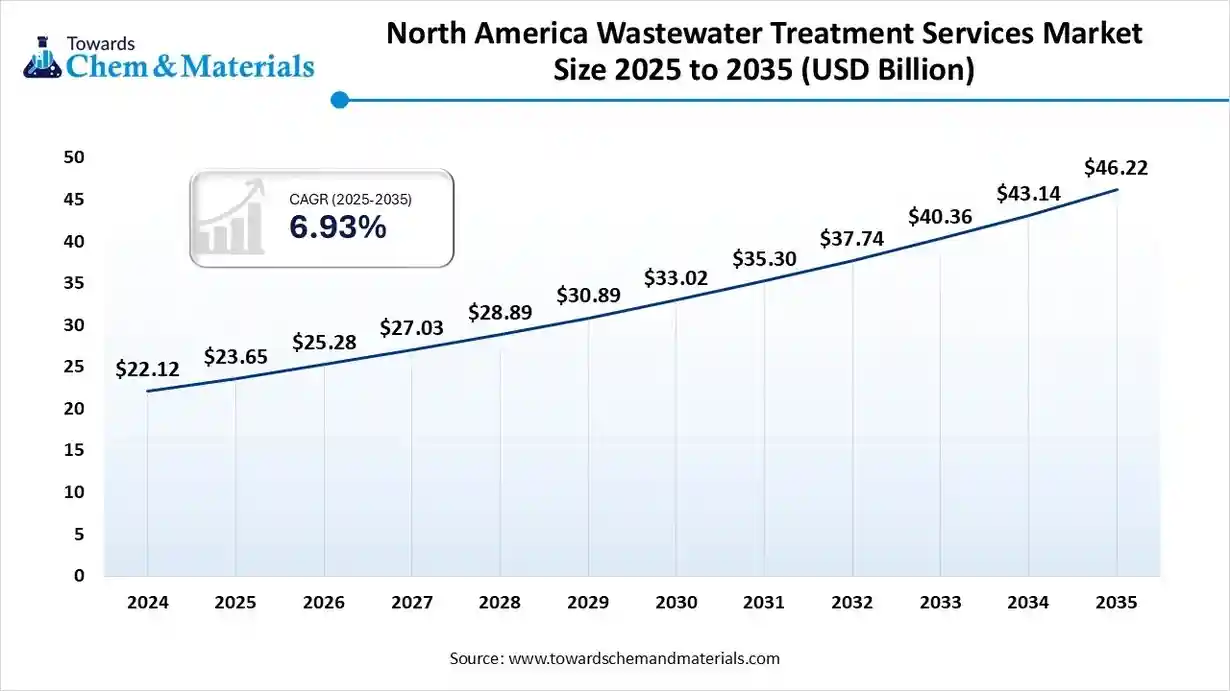

The North America wastewater treatment services market size was valued at USD 23.65 billion in 2025 and is expected to reach USD 46.22 billion by 2035, growing at a CAGR of 6.93% from 2025 to 2035. North America dominated the market with a 35% share in 2024.

The dominance of the region can be attributed to the rapid industrial and government investment in infrastructure, along with the adoption of cutting-edge technologies such as process and membrane control systems. In addition, industrial sectors such as food and beverage and power generation are benefiting from advanced wastewater solutions.

U.S. Wastewater Treatment Services Market Trends

In North America, the U.S. led the market due to the increasing demand for water reuse and conservation technologies in the major cities. Also, stringent government regulations and mandates for high-grade effluent standards fuel the demand for advanced treatment services to safeguard the environment.

Which Is The Fastest Growing Region In The Market?

Asia Pacific held a 30% market share and is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the ongoing urbanisation and industrialization across emerging countries, coupled with the surge in awareness of water scarcity. Moreover, advancements in treatment technologies are enhancing treatment efficiency.

China Wastewater Treatment Services Market Trends

In the Asia Pacific, China dominated the market due to expansion in water-intensive industries such as chemicals, manufacturing, and food processing. The Chinese government is rapidly investing in the growth and modernization of water treatment infrastructure, leading to market growth in the country in the near future.

Europe holds 22% market share and is expected to grow at a notable CAGR over the forecast period. The growth of the region can be driven by innovations in efficient and smart treatment technologies, along with the stringent environmental regulations. The EU's commitment to environmental sustainability and protection fuels investments in upgrading old infrastructure.

Germany Wastewater Treatment Services Market Trends

Germany held the largest market share in 2024. Germany has a strong commitment to environmental protection promoted by regulations such as the Water Framework Directive. The need for more sustainable and efficient solutions is propelling the adoption of advanced technologies like membrane bioreactors (MBRs).

Latin America is experiencing significant growth in the market due to rapid urbanization, industrial expansion, and increasing environmental regulations. Governments across the region are investing in modern infrastructure to address water scarcity and pollution challenges, driving demand for advanced treatment technologies. Countries like Brazil, Mexico, and Chile are leading in adopting public-private partnerships to enhance wastewater management systems.

- Additionally, rising awareness about sustainable water use and the implementation of stricter discharge standards are encouraging industries to adopt efficient wastewater treatment solutions, fueling steady market expansion across the region in the coming years.

Brazil Wastewater Treatment Services Market Trends

In Brazil, the wastewater treatment services market is gaining strong momentum. The growth of the market is driven by stricter environmental regulations, rapid industrialisation and growing adoption of advanced treatment technologies like membrane filtration and activated sludge.

Middle East expects the notable growth in the wastewater treatment services market. The market is driven by severe water scarcity, population growth and expanding industrial and urban infrastructure. Countries like Saudi Arabia and the United Arab Emirates are leading investments in reuse of treated water, advanced technologies (membranes, modular systems) and stringent discharge regulations.

Saudi Arabia Wastewater Treatment Services Market Trends

Saudi Arabia’s wastewater treatment services market is growing rapidly, driven by severe water scarcity, industrial expansion, and strong government initiatives under Vision 2030. The government’s National Water Strategy emphasizes wastewater reuse, modern infrastructure, and private-sector participation. Increasing industrial activity in oil, gas, and manufacturing sectors is boosting demand for advanced treatment technologies, including modular and membrane systems.

Recent Developments

- In September 2025, Veolia introduced its advanced Hubgrade Center to revolutionize wastewater treatment services in the western US. The facility integrates human expertise with artificial intelligence to optimise wastewater and water treatment for municipalities.(Source: www.indianchemicalnews.com)

- In February 2024, ABB introduced an energy management solution for water and wastewater to boost the sustainability and efficiency of plants. Through controlled visibility of multiple assets, the digital optimization solution can help to minimize both energy cost and energy use.(Source: new.abb.com)

Top Wastewater Treatment Services Market Companies

Veolia Environnement

Corporate Information

- Veolia Environnement S.A. is a French multinational company traded on Euronext Paris (ticker: VIE).

- In 2023, the group had consolidated revenues of approximately €45.351 billion.

- The Group operates across five continents, employing around 218,000 people.

- Its three core business lines are: water management, waste & hazardous waste management, and energy services (including heating/cooling, decarbonization, etc.).

History and Background

- Veolia’s origins date back to 14 December 1853 with the founding of Compagnie Générale des Eaux (CGE) in France.

- Over the decades, the company expanded from water supply into waste management and energy services.

- In 2003 the company took the name “Veolia Environnement” reflecting its wider environmental services scope.

Key Developments and Strategic Initiatives

- In March 2024, Veolia launched its “GreenUp 2024 2027” strategic plan which focuses on three “growth boosters”: decarbonization, water technologies & new solutions, and hazardous waste treatment.

Mergers & Acquisitions

- A major M&A event: Veolia completed its acquisition of SUEZ in January 2022 for about €12.9 billion, making it a global consolidation in the environmental services space.

- In May 2025 Veolia announced the planned acquisition of the remaining 30% stake in its subsidiary Water Technologies & Solutions (WTS) from CDPQ, valued at ~$1.75 billion, to gain full control of its water technology arm.

Partnerships & Collaborations

- Veolia and Mistral AI announced a strategic partnership in February 2025 to deploy generative AI (large language models) for monitoring and managing industrial sites (water, waste, energy).

- In October 2025, Veolia and Solvay (in Brazil) achieved a partnership where they upgraded an industrial plant’s water reuse system to 94% reuse, leveraging Veolia’s ZeeWeed™ membrane technology.

Product Launches / Innovations

- Water reuse and advanced wastewater treatment - e.g., the Brazil project announced July 2025 (450 litres/sec capacity, 85% reuse of municipal wastewater).

- Membrane bioreactors, reverse osmosis, and high efficiency modular solutions for water scarcity contexts.

- Hazardous waste treatment capacity expansion: In June 2025, Veolia announced adding 530,000 tonnes new treatment capacity by 2030, across US/Japan/Brazil.

R&D Organisation & Investment

- Veolia reports having [per press release] 14 research centres around the world dedicated to innovation, including water technologies and digital/AI.

- As part of the GreenUp plan, Veolia is committing an additional €200 million to innovation - designing the technologies of the future (water, energy, waste).

SWOT Analysis

Strengths

- Global scale and diversified operations (water, waste, energy) - helps cross sell and manage resource loops.

- Strong brand in ecological transformation and sustainability focus.

- Technological capabilities in advanced water and waste treatment (membranes, reuse, AI).

- Strategic clarity via the GreenUp plan and high commitment R&D/innovation.

Weaknesses

- Very large scale - complexity, integration challenges post major acquisitions (e.g., Suez).

- Margins in utility style contracts can be relatively modest; high regulatory exposure.

- Large balance sheet and debt risk (given infrastructure and M&A scale).

Opportunities

- Growing global demand for water reuse, circular economy, hazardous waste treatment, decarbonization.

- Emerging markets (Asia, Latin America, Middle East) where infrastructure is still being built.

- Digital transformation (AI, IoT) in resource management operations.

- Unlocking full value of water tech subsidiary via full ownership (WTS).

Threats

- Regulatory risk (environment, waste, utilities) - changing laws can increase costs or terminate contracts.

- Competition from other global players in water/waste services and technology.

- Exposure to commodity/energy price volatility (especially in energy services).

- Execution risks in large contracts and integrations (M&A, new markets).

Recent News & Strategic Updates

- In March 2025, Veolia reported it “exceeded all its 2024 targets” and confirmed its global leadership in ecological transformation under its GreenUp strategy.

- June 25, 2025: Veolia announced expansion in hazardous waste treatment 530,000 tonnes new capacity by 2030, five acquisitions so far in the year (~€300 million).

Other Top Companies

- SUEZ: SUEZ is a global leader in wastewater treatment services, providing comprehensive solutions for both municipal and industrial clients. The company offers a wide range of services, including the design, construction, operation, and maintenance of treatment plants.

- Black & Veatch: Black & Veatch provides engineering, design, construction, and consulting services for municipal and industrial wastewater treatment projects globally.

- Jacobs Solutions

- AECOM

- Arcadis

- Stantec

- Xylem Inc.

- Evoqua Water Technologies

- Ecolab Inc.

- Kurita Water Industries Ltd.

- Kemira Oyj

- VA Tech WABAG (WABAG)

- Thermax Ltd.

- Doosan / Doosan Enerbility

- Aquatech International

- Fluence Corporation

- FCC Aqualia (Grupo FCC)

- Saur

- SNF Floerger

Segments Covered in the Report

By Service Type

- O&M Services

- EPC & Turnkey Projects

- Consulting & Design Services

- Retrofit & Upgrade Services

- Monitoring, Testing & Laboratory Services

- Sludge Treatment & Disposal Services

- Industrial Water Reuse & ZLD Services

- Chemical Supply & Dosing Services

- Rental / Temporary Solutions

By End-User Industry

- Municipal Utilities & Municipalities

- Industrial -Power & Energy

- Industrial -Oil & Gas & Petrochemical

- Industrial -Chemicals & General Manufacturing

- Food & Beverage

- Metals & Mining

- Pharmaceuticals & Biotechnology

- Pulp & Paper

- Others (Construction, Hospitality, Small Commercial)

By Technology / Process

- Biological Treatment (activated sludge, MBBR, conventional plants)

- Membrane Technologies (MBR, RO, UF, NF)

- Chemical Treatment (coagulation, flocculation, chemical dosing)

- Physico-chemical (sedimentation, filtration, clarification)

- Sludge Treatment (digestion, dewatering, sludge drying)

- Disinfection (UV, chlorination)

- Advanced Oxidation Processes (AOPs)

- Thermal Processes & Evaporation

- Other / Emerging (electrochemical, ion exchange, niche tech)

By Delivery Mode

- On-site engineered (built-in-place) plants

- Packaged / Modular solutions

- Mobile / Temporary units

- Remote monitoring / digital-only services

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA