Content

Copper Scrap Market Size | Companies Analysis 2034

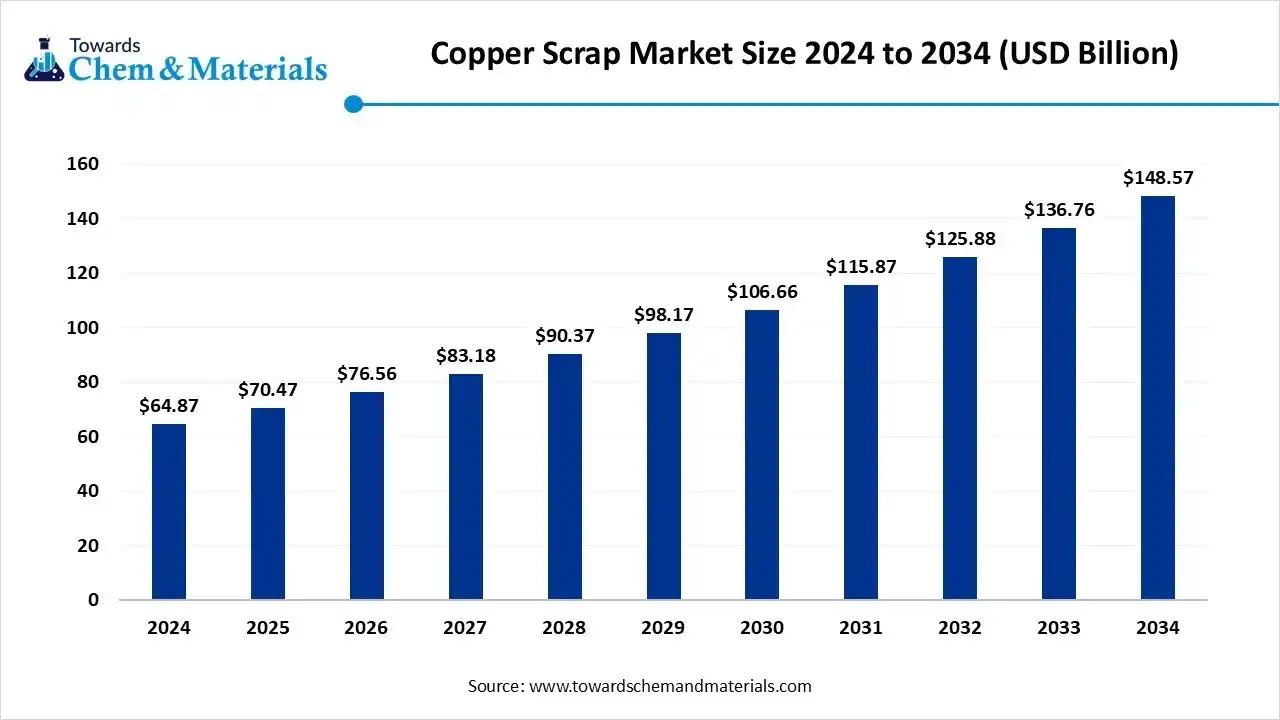

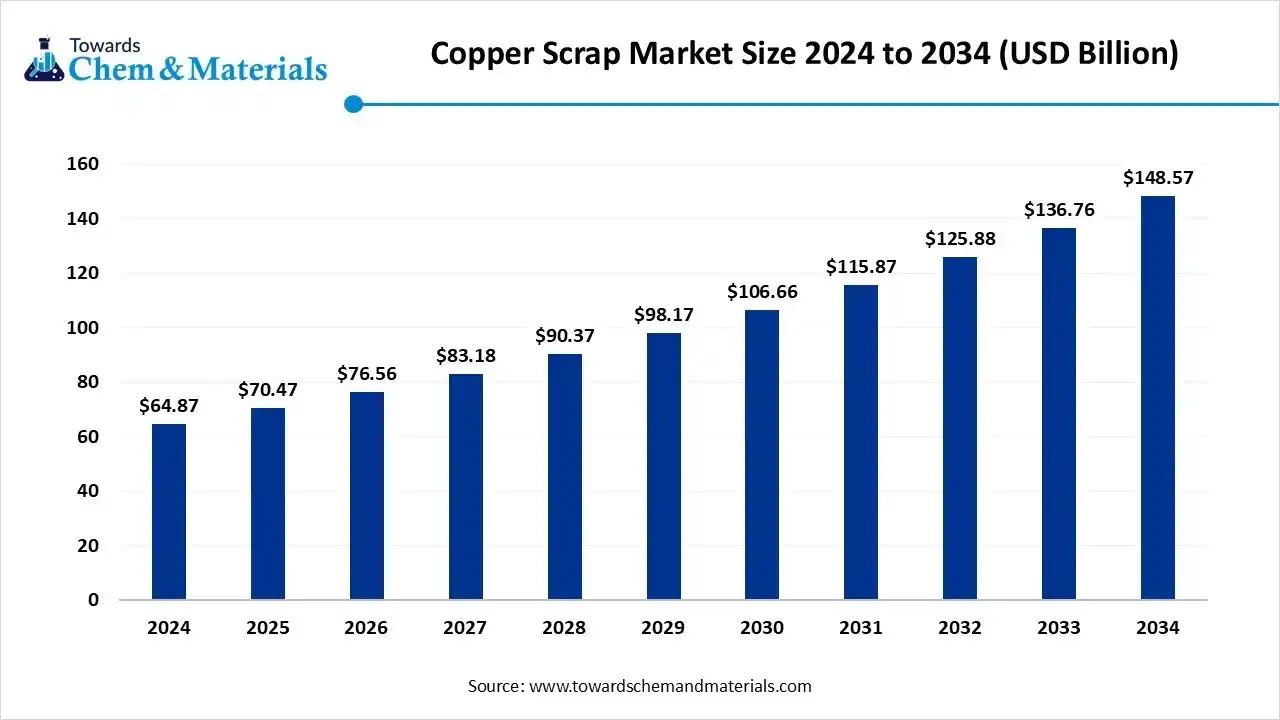

The global copper scrap market size was approximately USD 64.87 billion in 2024 and is projected to reach around USD 148.57 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 8.64% between 2025 and 2034 The growing demand for recycled copper is the major factor driving market growth. Also, the ongoing shift towards vehicle electrification, coupled with the technological innovations in recycling, can fuel market growth further.

Key Takeaways

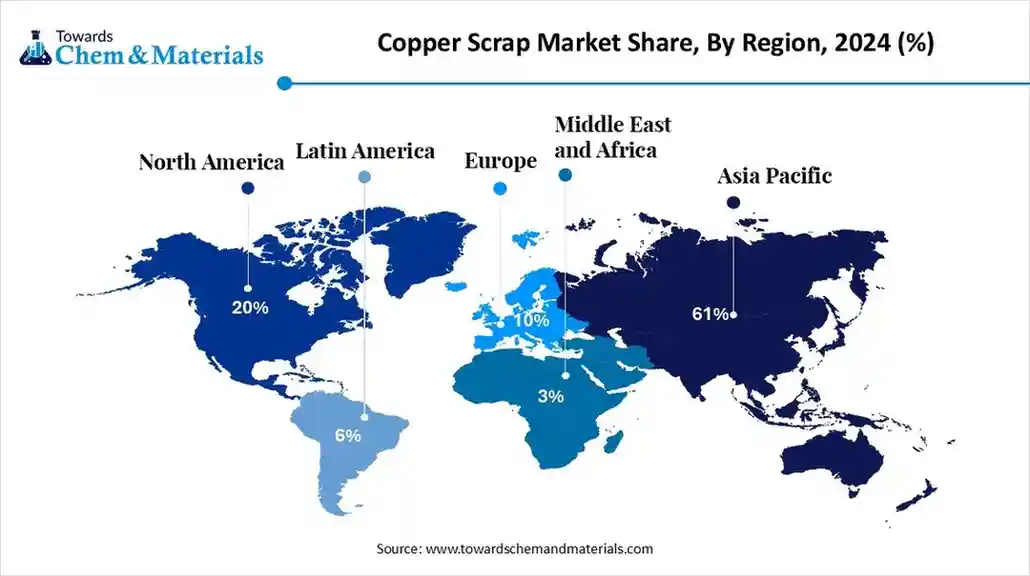

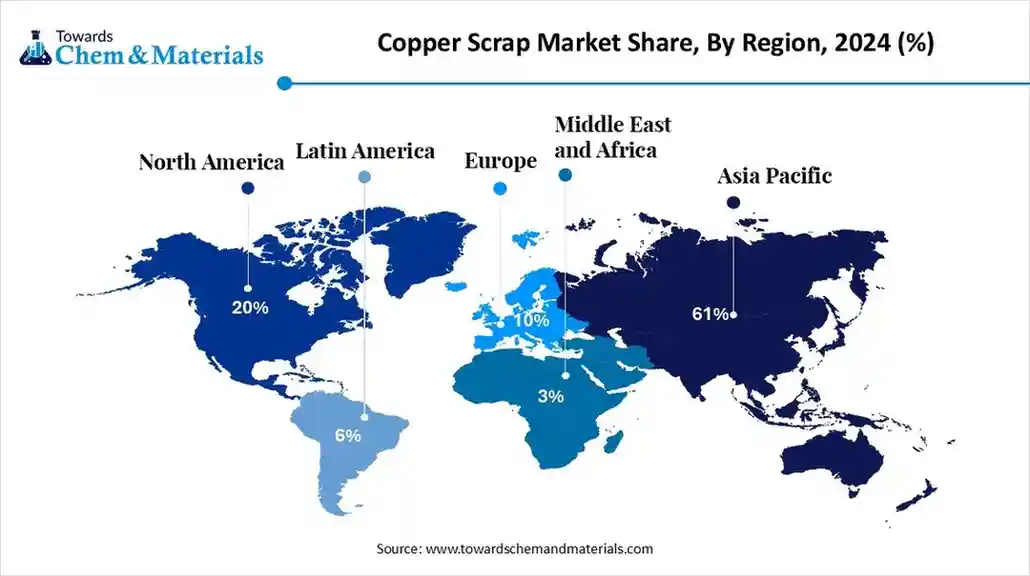

- The Asia Pacific dominated the copper scrap market with the largest revenue share of 61% in 2024.

- By feed material, the old scrap segment led the market with the largest revenue share of over 52% in 2024.

- By grade, the #2 copper scrap segment led the market with the largest revenue share of over 32% in 2024.

- By application, the brass mills segment led the market with the largest revenue share of over 64% in 2024.

- By end-use, the electrical & electronics segment dominated the market with the revenue share in 2024 and is anticipated to grow at the fastest CAGR over the forecast period.

What is Copper Scrap?

Strong urbanization and infrastructure development in developing economies are the major factors driving market growth. The market is the global sector for the collection, processing, and selling of discarded copper materials, which can be recycled again into several products while maintaining their quality. Extensive economic trends affect industrial activity and overall investment, the hence impacting the demand for copper soon.

Copper Scrap Market Outlook:

- Industry Growth Overview: Between 2025-2034, the market is anticipated to witness substantial growth due to an increasing product demand from renewable energy infrastructure and electric vehicles. Also, increasing global focus on sustainability and circular economies encourages the use of recycled copper.

- Sustainability Trends: The global push towards a circular economy and the increasing demand for copper in the green energy transition are the major sustainability trends in the market. Recycling copper substantially lowers greenhouse gas emissions, which leads to a much smaller carbon footprint for market players.

- Global Expansion: Companies are forming innovative partnerships to expand their operations. Major players are also integrating their various operations from processing and supply to control scale and quality.

- Key Technological Shifts in the Copper Scrap Market: The rapid technological shifts are transforming the market, fuelled by the demand for higher purity, efficiency, and sustainability. Advancements in sorting, processing, and digital integration are facilitating the recovery of copper from increasingly complex scrap streams, like e-waste.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 76.56 Billion |

| Expected Size by 2034 | USD $148.57 Billion |

| Growth Rate from 2025 to 2034 | CAGR 8.64% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Feed Material, By Grade, By Application, By End-use, By Region |

| Key Companies Profiled | Glencore, Global Metals & Iron Inc., JAIN RESOURCE RECYCLING PVT LTD., KGHM METRACO S.A., OmniSource, LLC., Pascha GmbH., Perniagaan Logam Panchavarnam Sdn Bhd, S.I.C. Recycling, Inc. |

Trade Analysis of Copper Scrap Market: Import & Export Statistics

- In 2024, the United States was the world's largest exporter of scrap copper, with shipments valued at approximately $4.5 billion.(Source: discoveryalert.com )

- Between October 2023 and September 2024, China's copper scrap exports grew by 63% year-over-year, reaching 243 shipments from 30 exporters to 42 buyers.(Source: www.volza.com)

Value Chain Analysis of the Copper Scrap Market:

- Feedstock Procurement : It refers to the crucial first stage of the copper recycling process, which includes searching, sourcing, collecting, and buying copper-containing materials to be processed.

- Chemical Synthesis and Processing : It involves the method for extracting, separating, and purifying copper by using aqueous chemical solutions. It's a key substitute to conventional high temperature pyrometallurgical methods.

- Packaging and Labelling : It refers to the processes utilized to prepare copper scrap for transport and sale. This stage is necessary for preserving the material's value and purity.

- Regulatory Compliance and Safety Monitoring : It involves adhering to laws and regulations governing the collection, processing, and sale of copper scrap.

Copper Scrap Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| China | As of November 15, 2024, China permits imports of high-grade recycled copper materials without restrictions by reclassifying them as resources rather than waste. |

| European Union (EU) | In July 2025, the European Commission introduced stricter monitoring of metal scrap imports and exports to ensure a sufficient supply for EU industries and prevent scarcity. |

| India | Importing copper scrap requires multiple licenses, including an Import-Export Code, environmental clearance, and a pre-shipment inspection certificate. |

Segmental Insights

Feed Material Insights

Which Feed Material Type Segment Dominated the Copper Scrap Market in 2024?

The old scrap segment dominated the market in 2024. The dominance of the segment can be attributed to the ongoing push for sustainability, along with the surge in electric vehicle (EV) manufacturing. Additionally, rapid industrialization and urbanization, particularly in emerging nations, are leading to substantial infrastructure investments in the old scrap segment.

The new scrap segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the ongoing expansion of renewable energy sources such as wind and solar power, coupled with the rapid electrification of vehicles. Also, using scrap copper is more cost-efficient than mining and processing new copper, because it needs substantially less energy.

Grade Insights

How Much Share Did the #2 copper scrap Segment Held in 2024?

The #2 copper scrap segment held the largest market share in 2024. The dominance of the segment can be linked to its extensive availability from sources such as electrical wiring, old plumbing, and construction debris. This grade of copper scrap offers a balance between affordability and quality for many industrial applications, which makes it a cost-effective option for manufacturers.

Application Insights

Which Application Segment Dominated the Copper Scrap Market in 2024?

The brass mills segment dominated the market in 2024. The dominance of the segment can be driven by robust demand for bras products in automotive, construction, and consumer goods sectors, boosted by increasing urbanization and infrastructure development. Furthermore, brass mills depend heavily on copper scrap to manufacture rods, sheets, and other semi-finished brass products.

The wire rod mills segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment is owing to its ongoing demand from infrastructure, particularly for electrical wiring and cables in renewable energy production. Moreover, the growth of the 5G infrastructure and data centers is creating a lucrative demand for high-performance copper wiring for networks.

End-use Insights

How Much Share Did the Electrical & Electronics Segment Held in 2024?

The electrical & electronics segment held the largest market share in 2024. The dominance of the segment can be attributed to the global push towards renewable energy, electrification, and electric vehicles, coupled with the constant demand for smart infrastructure and consumer electronics. Additionally, the ongoing development of 5G telecommunications infrastructure depends heavily on copper wiring and cables.

The building & construction segment is expected to grow at the fastest CAGR over the study period. The growth of the segment can be credited to the surge in environmental consciousness and increasing emphasis on sustainable building practices. Convenient shredding, sorting, and smelting processes improve recovery rates, minimize contamination, and widen the range of reusable scrap, leading to segment growth soon.

Regional Insights

The Asia Pacific copper scrap market size is valued at USD 42.99 billion in 2025 and is expected to surpass around USD 90.73 billion by 2034, expanding at a compound annual growth rate (CAGR) of 8.65% over the forecast period from 2025 to 2034.Asia Pacific dominated the market in 2024. The dominance of the region can be attributed to the increasing emphasis on sustainability, along with the ongoing adoption of innovative recycling technologies to enhance scrap quality. In addition, enhancements in the regional supply chain and growth in refining capacity also fuel the regional expansion.

China Copper Scrap Market Trends

In the Asia Pacific, China led the market owing to the substantial investment in green infrastructure and electric vehicles, along with the rapid industrialization and urbanization in the country., China's massive production and construction sector needs large volumes of the metal, driving market growth further.

The Middle East & Africa region is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the expansion of renewable energy and the rising use of electric vehicles (EVs). Moreover, the shift towards wind and solar power requires significant amounts of copper for energy systems and related infrastructure, propelling demand for recycled copper.

Saudi Arabia Copper Scrap Market Trends

Saudi Arabia is witnessing the fastest growth during the forecast period due to the growth of data centers and the rise in demand for copper in renewable energy infrastructure. The implementation of smart infrastructure fuels demand for copper in advanced wiring and other components.

North America is expected to grow at a notable CAGR over the forecast period.

The growth of the region can be driven by growing emphasis on sustainable manufacturing, coupled with the robust industrial demand from the electric vehicle sector. Also, the region has a significant recycling network, such as shredding facilities, scrap yards, and processing plants.

U.S. Copper Scrap Market Trends

In North America, the U.S. dominated the market because of rapidly expanding construction and electronics industries along with the increasing focus on recycling and sustainability. The United States possesses a well-established and large recycling infrastructure, which offers a solid foundation for the market in the region.

Recent Development

- In October 2024, Sunlite Recycling Industries Ltd, a major producer of copper products, announced its integration and expansion into new product lines. The company's stock has also shown a positive movement after this news.(Source: tradebrains.in)

- As per the news published by EUWID Recycling and Waste Management in January 2025, the copper price rises on LME and goes beyond $9,000 per tonne mark. This has also impacted the price criteria in the German non-ferrous scrap metal market.(Source: www.euwid-recycling.com)

- In July 2025, Donald Trump confirmed global 50% tariffs on imports of copper-intensive derivative products and other semi-finished copper products. "This will fuel US refining capacity by growing their operation at much lower costs," the White House says.(Source: www.business-standard.com)

Top Vendors in the Copper Scrap Market & Their Offerings:

- Ames Copper Group: Ames Copper Group is a privately held company based in Shelby, NC, known for its use of a new, more efficient copper smelter to process copper scrap.

- Aurubis AG: Aurubis AG is one of the world's largest copper recyclers, with a dual-pronged business model that combines the processing of both primary and secondary (recycled) materials.

Other Players

- Glencore

- Global Metals & Iron Inc.

- JAIN RESOURCE RECYCLING PVT LTD.

- KGHM METRACO S.A.

- OmniSource, LLC.

- Pascha GmbH.

- Perniagaan Logam Panchavarnam Sdn Bhd

- S.I.C. Recycling, Inc.

Segment Covered

By Feed Material

- Old Scrap

- New Scrap

By Grade

- Bare Bright

- #1 Copper Scrap

- #2 Copper Scrap

- Other Grades

By Application

- Wire Rod Mills

- Brass Mills

- Ingots Makers

- Other Applications

By End-use

- Building & Construction

- Electrical & Electronics

- Industrial Machinery & Equipment

- Transportation Equipment

- Consumer and General Products

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait