Content

Aerospace Foam Market Size and Companies Analysis

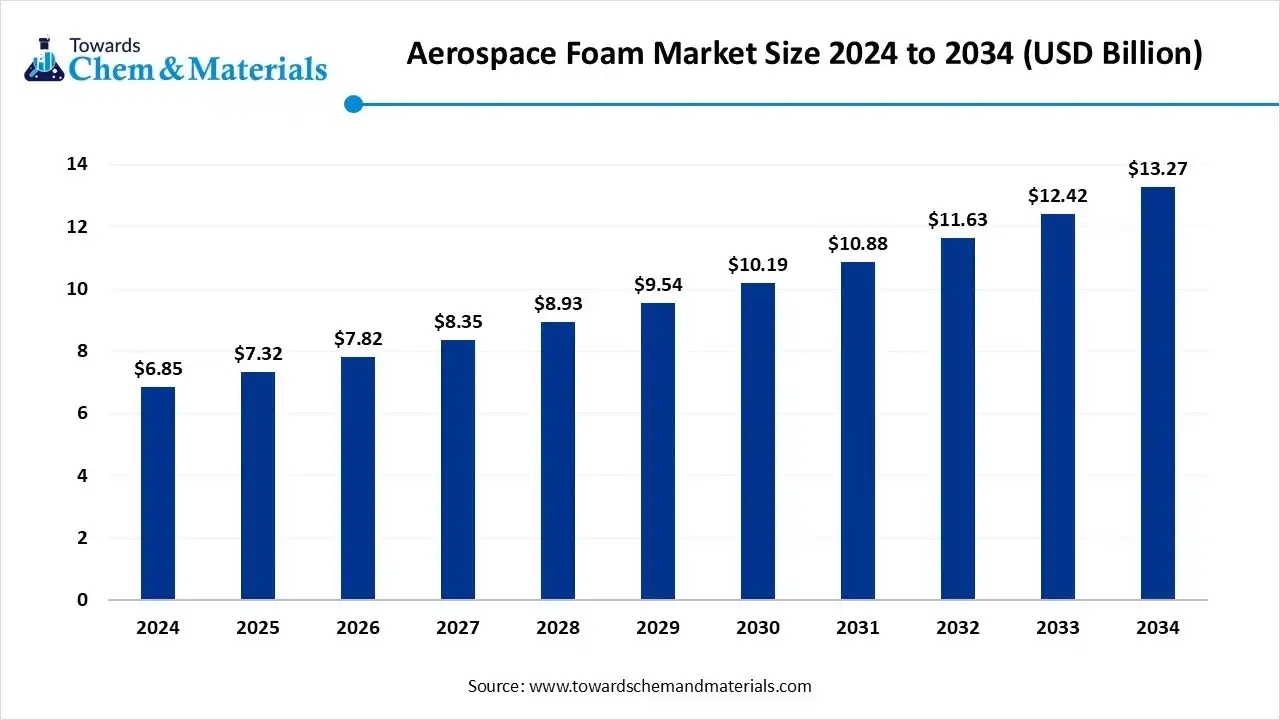

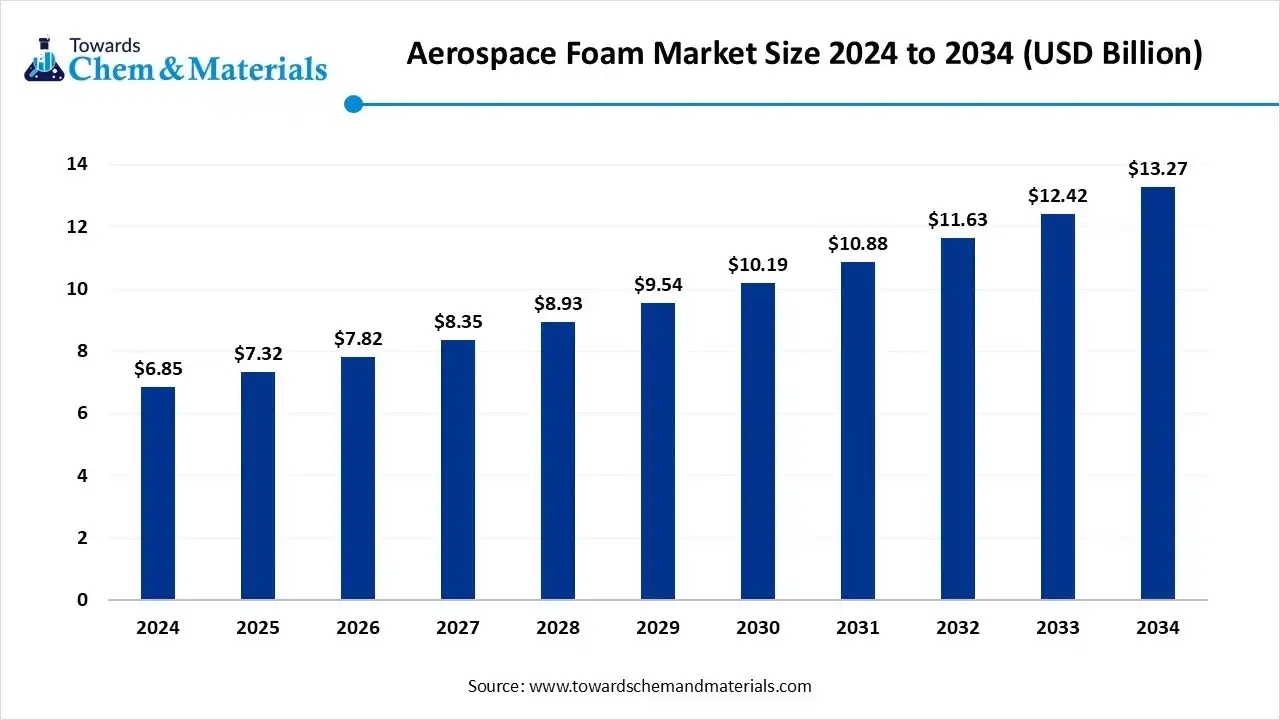

The global aerospace foam market size was approximately USD 6.85 billion in 2024 and is projected to reach around USD 13.27 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 6.84% between 2025 and 2034. The growth of the market is driven by eth growing demand for lightweight and efficient materials by the sectors and advanced proprietary materials.

Key Takeaways

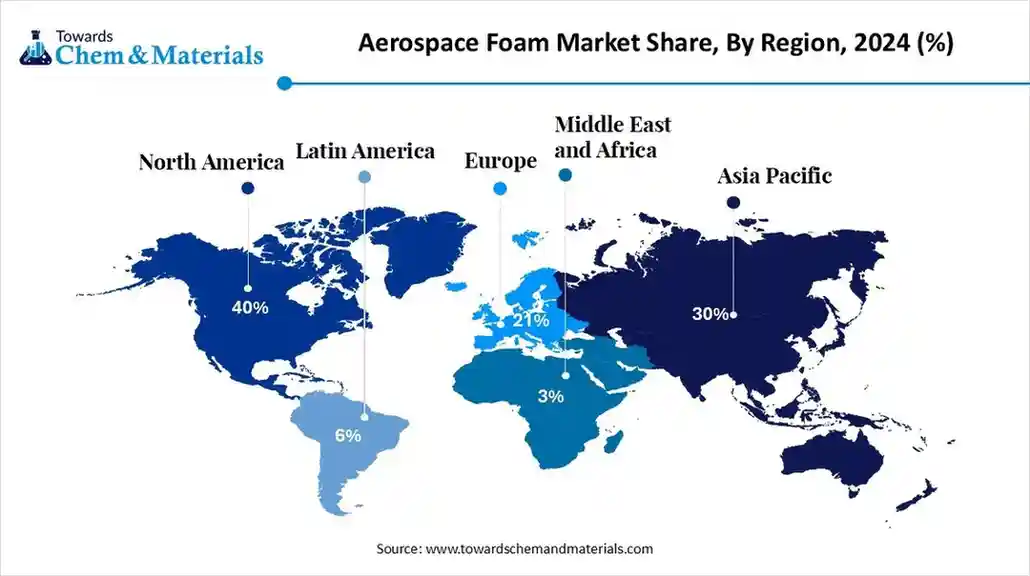

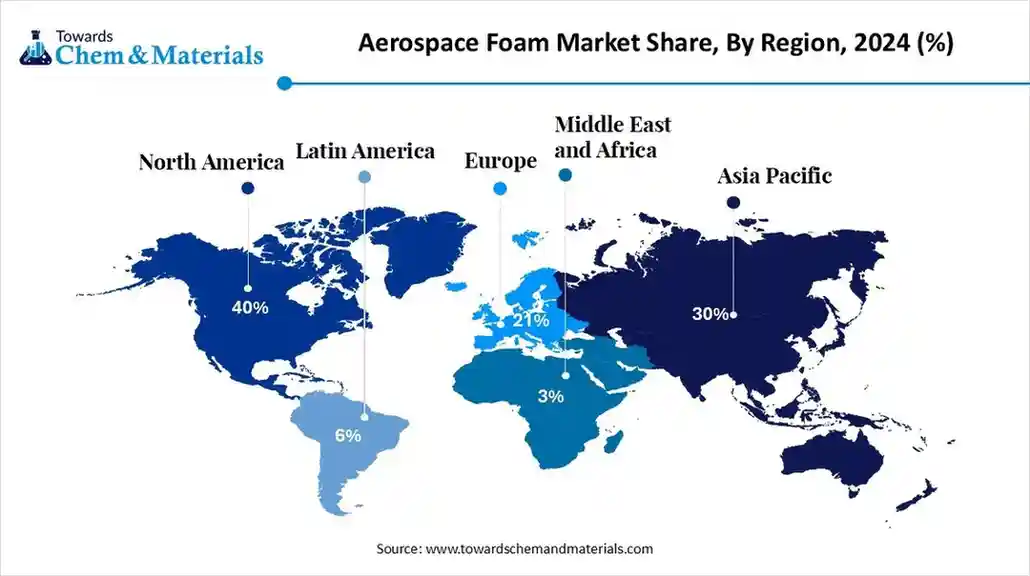

- The North America aerospace foam market dominated the global market and accounted for the largest revenue share of 40% in 2024.

- The Asia Pacific, including key markets such as China and India, is the fastest-growing region in the aerospace foam industry, capturing around 11.14% of global demand.

- Based on foam type, the Polyurethane (PU) segment dominated the global aerospace foam market and accounted for the largest revenue share of 35.10% in 2024.

- By foam type, the polyurethane segment is expected to grow at the fastest CAGR of 7.44% from 2025 to 2034

- Based on End-use, the Commercial aviation segment held the largest revenue share of 30.14% in 2024.

- By End-use, The general aviation segment is expected to grow at a substantial CAGR of 6.65% during the forecast period.

- Based on Application, the Cabin walls & ceilings led the aerospace foam industry, accounting for a revenue share of 27.19% in 2024.

- By application, the flight deck pads segment is expected to grow at a substantial CAGR of 6.7% over the forecast period.

Market Overview

What is the significance of the aerospace foam market?

The significance of the aerospace foam market lies in its role as a provider of lightweight, high-performance materials crucial for modern aircraft, which leads to improved fuel efficiency, enhanced passenger comfort, and greater safety. Driven by the demand for more fuel-efficient planes, increased air travel, and advancements in material science, these foams are essential for applications like insulation, soundproofing, and structural components, making the market a vital and growing segment of the aerospace industry.

Aerospace Foam Market Outlook:

Industry Growth Overview: Between 2025 and 2034, the aerospace foam market is expected to witness steady growth, driven by the recovery of the aviation sector, increasing aircraft production, and rising demand for lightweight materials. Polyurethane, polyethene, and metal foams are widely used in aircraft seating, insulation, and structural components to enhance comfort, durability, and fuel efficiency.

Sustainability Trends: Sustainability is becoming central to aerospace material innovation, with a focus on recyclable and low-emission foams that reduce environmental impact. Manufacturers are developing eco-friendly polyurethane and PET foams with improved flame retardancy and reduced volatile organic compounds (VOCs).

Global Expansion & Partnerships: Leading foam manufacturers and aerospace OEMs are collaborating to develop advanced materials with enhanced mechanical strength, thermal stability, and fire resistance. Investments in R&D and regional production facilities are increasing to ensure compliance with aerospace safety standards and meet growing global demand.

Key Technological Shifts In The Aerospace Foam Market:

Changes in the aerospace foam market are prompted by the need for lighter, more fuel-efficient, and safer aircraft, alongside emerging manufacturing methods. Innovations emphasise advanced materials and next-generation production techniques to satisfy stricter performance and environmental regulations.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 7.82 Billion |

| Expected Size by 2034 | USD 13.27 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.84% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Foam Type, By Application, By End-use, By Region |

| Key Companies Profiled | Boyd Corporation, ERG Aerospace Corporation, SABIC, ZOTEFOAMS PLC, General Plastics Manufacturing Company, Solvay, UFP Technologies, Inc., NCFI Polyurethanes, DuPont |

Trade Analysis Of Aerospace Foam Market: Import & Export Statistics

- The World exported 182,874 shipments of Foam products from Nov 2023 to Oct 2024 (TTM).(Source: www.volza.com)

- These exports were made by 5,784 Exporters to 6,006 Buyers, marking a growth rate of 179% compared to the preceding twelve months(Source: www.volza.com)

- In Oct 2024 alone, 7,802 Foam Product export shipments were made Worldwide(Source: www.volza.com)

- Most of the Foam Product exports from the World go to Vietnam, Cambodia, and the United States.(Source: www.volza.com)

- Globally, the top three exporters of Foam products are Vietnam, China, and South Korea.(Source: www.volza.com)

- Vietnam leads the world in Foam Product exports with 192,795 shipments, followed by China with 53,373 shipments, and South Korea taking the third spot with 9,429 shipments.(Source: www.volza.com)

Aerospace Foam Market Value Chain Analysis

- Chemical Synthesis and Processing : Aerospace foams are produced using polymers such as polyurethane, polyethene, and polyimide through processes like polymerisation, extrusion, moulding, and chemical foaming. These foams are engineered for lightweight strength, insulation, and flame resistance.

- Key players: BASF SE, Evonik Industries AG, Recticel NV, Rogers Corporation, Zotefoams Plc.

- Quality Testing and Certification : Aerospace foams are tested for flammability, thermal stability, density, and impact resistance under standards such as ASTM D3574, FAR 25.853, and ISO 9001 for aerospace material quality compliance.

- Key players: ASTM International, UL Solutions, SGS, TÜV SÜD.

- Distribution to Industrial Users : Aerospace foams are supplied to aircraft manufacturers and maintenance sectors for use in seating, insulation, flooring, and structural components.

- Key players: The Boeing Company, Airbus SE, Lockheed Martin Corporation, Safran S.A.

Aerospace Foam Regulatory Landscape: Global Regulations

| Region / Country | Regulatory Body | Key Regulations / Standards | Focus Areas | Notable Notes |

| United States | Federal Aviation Administration (FAA), Environmental Protection Agency (EPA), Occupational Safety and Health Administration (OSHA) | - FAA 14 CFR Part 25.853 – Flammability standards for aircraft interiors - FAA AC 25.856-1A – Thermal and acoustic insulation standards - EPA TSCA (Toxic Substances Control Act) - OSHA Hazard Communication Standard (29 CFR 1910.1200) |

- Fire, smoke, and toxicity testing (FST) - Thermal/acoustic insulation - Chemical safety and labelling |

All aerospace foams must pass FAA flammability and smoke tests. Use of CFC-based blowing agents is banned under EPA rules; replacement with HFOs and CO₂ is encouraged. |

| European Union | European Union Aviation Safety Agency (EASA), European Chemicals Agency (ECHA), European Commission (DG ENV) | - EASA CS-25.853 – Flammability and smoke density limits - REACH Regulation (EC 1907/2006) - CLP Regulation (EC 1272/2008) - EU Regulation (EC) 1005/2009 – Ozone-depleting substances |

- Fire resistance and toxicity compliance - Chemical registration and labelling - Restriction of CFC/HFC-based foams |

EASA and REACH jointly ensure foam materials meet flammability and environmental criteria. Polyurethane foams must comply with low-VOC and halogen-free formulations. |

| China | Civil Aviation Administration of China (CAAC), Ministry of Ecology and Environment (MEE) | - CCAR-25-R4 – Airworthiness standards (mirrors FAA Part 25) - GB 8624-2012 – Fire performance classification for building materials - MEE Order No. 12 – Management of new chemical substances |

- Fire and thermal safety - Chemical management and approvals - VOC and environmental compliance |

China follows international airworthiness rules; locally developed aerospace foams must meet CAAC FST and environmental standards. HFC phase-down is in progress under the Kigali Amendment. |

| India | Directorate General of Civil Aviation (DGCA), Bureau of Indian Standards (BIS), Ministry of Environment, Forest and Climate Change (MoEFCC) | - CAR 21 (DGCA) – Aircraft design and safety approval - IS 15061:2002 – Flammability of polymeric materials - Hazardous Chemicals Rules (1989) - Ozone Depleting Substances Rules (2000) |

- Fire resistance and material certification - Environmental and chemical safety - Lead/CFC restrictions |

India’s regulations are harmonised with FAA and EASA norms. Manufacturers must use non-halogenated and CFC-free foams for aerospace interiors. |

| Middle East (UAE, Saudi Arabia) | General Civil Aviation Authority (GCAA), General Authority of Civil Aviation (GACA), SASO | - GCAA CAR-25 – Airworthiness and FST standards - SASO 2879:2021 – Chemical emissions and safety |

- Aircraft cabin safety - Chemical compliance - VOC control |

GCC countries follow FAA-equivalent standards for aerospace safety. Emphasis is shifting toward lightweight, flame-retardant foams in line with Vision 2030 aerospace initiatives. |

Segmental Insights

Foam Type Insights

Which Foam Type Segment Dominates The Aerospace Foam Market In 2024?

The polyurethane segment dominated the market in 2024. Polyurethane foams are extensively used in aerospace applications for cabin walls, ceilings, and seating due to their superior cushioning, fire retardancy, and thermal insulation properties. They provide passenger comfort while meeting strict safety regulations. Their lightweight nature reduces aircraft weight, improving fuel efficiency. Polyurethane foams also contribute to noise reduction, vibration absorption, and structural support, making them the preferred choice for modern commercial and general aviation interiors.

The polyethene segment is expected to grow significantly in the market during the forecast period. Polyethene foams are lightweight, durable materials commonly used in flight deck pads, protective padding, and vibration-damping applications. Their flexibility and shock absorption properties make them ideal for safeguarding critical aircraft components and enhancing cockpit ergonomics. Polyethene foams are valued for their thermal stability and resistance to moisture, ensuring long-term performance. These foams complement polyurethane applications in aerospace, providing additional support where structural integrity and safety are paramount.

Application Insights

How Did Cabin Walls And Ceilings Segment Dominates The Aerospace Foam Market In 2024?

The cabin walls & ceilings segment dominated the market in 2024. Foams used in cabin walls and ceilings provide critical thermal insulation, fire resistance, and noise reduction. Polyurethane foams dominate this application due to their cushioning properties and compliance with aviation safety standards. These foams enhance passenger comfort while minimising aircraft weight, contributing to fuel efficiency. They are essential in both commercial and general aviation aircraft for interior durability, performance, and operational safety.

The flight deck pads segment is expected to grow in the forecast period. Flight deck pads rely on polyurethane and polyethene foams for vibration damping, shock absorption, and pilot comfort. Polyurethane foams provide insulation and cushioning, while polyethene foams enhance durability and flexibility. These applications are critical for cockpit ergonomics, safety, and operational efficiency. Aerospace manufacturers prioritise high-performance foams in flight deck pads to meet strict safety regulations and reduce long-term maintenance requirements.

End Use Insights

Which End-Use Segment Dominates The Aerospace Foam Market In 2024?

The commercial aviation segment dominated the market in 2024. Commercial aviation dominates aerospace foam consumption, primarily using polyurethane foams in cabin walls, ceilings, and seating for comfort, fire resistance, and insulation. Polyethene foams are applied in flight deck pads and structural support areas. The demand is driven by increasing passenger traffic, airline fleet expansions, and modernisation programs, which require lightweight, durable, and safe foam solutions to enhance operational efficiency and passenger experience.

The general aviation segment is expected to grow in the forecast period. General aviation, including private jets, helicopters, and smaller aircraft, employs polyurethane and polyethene foams for cushioning, vibration damping, and thermal insulation. Polyurethane foams provide comfort and fire safety in cabin interiors, while polyethene foams are used in flight decks and structural padding. The growing market for private aviation and business aircraft supports continued adoption of specialised aerospace foams tailored to lightweight, safe, and efficient applications.

Regional Insights

How Did North America Dominate The Aerospace Foam Market In 2024?

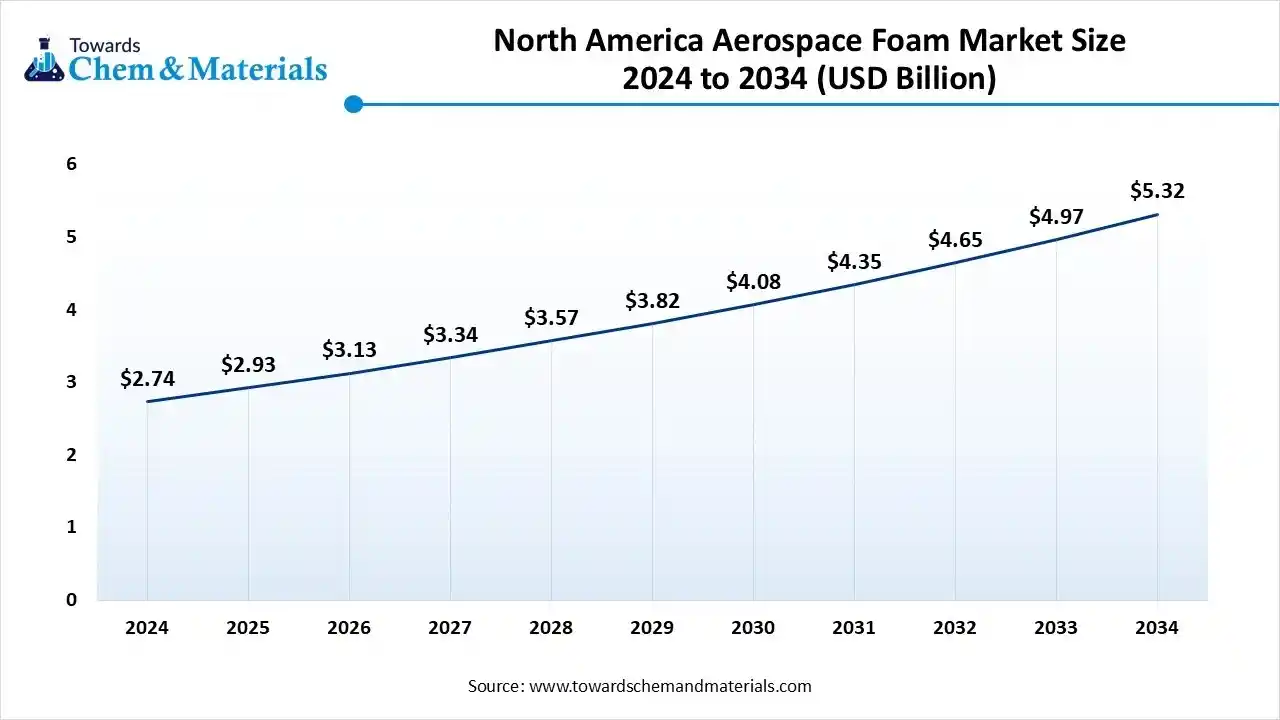

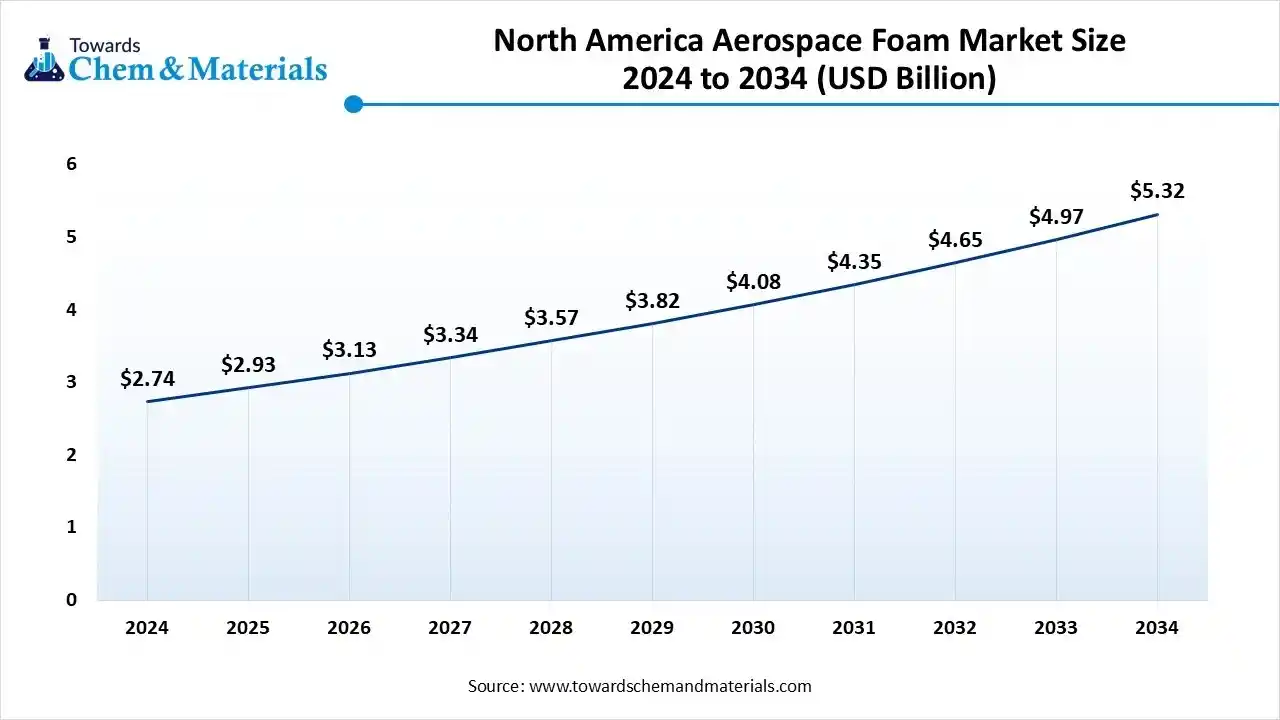

The North America aerospace foam market size is valued at USD 2.93 billion in 2025 and is expected to reach USD 5.32 billion by 2034, growing at a CAGR of 6.86% from 2025 to 2034. North America dominated the market in 2024. The North American aerospace foam market is expanding steadily due to a strong presence of commercial and general aviation sectors. Polyurethane foams are widely used in cabin walls, ceilings, and seating for cushioning, thermal insulation, and fire retardancy. Polyethene foams are preferred for flight deck pads and vibration damping. Increasing aircraft production, maintenance, and retrofitting activities in the US drive the demand for lightweight, high-performance foams designed for safety and comfort in aviation interiors.

U.S. Has Seen Significant Growth Driven By Growing Demand

In the U.S., aerospace foam demand is driven by commercial aviation growth and modernisation programs. Polyurethane foams are predominantly used in cabin interiors for seating and insulation, offering fire resistance and acoustic efficiency. Polyethene foams find applications in flight deck pads, vibration damping, and structural support. The expansion of MRO services and airline operations further reinforces the need for advanced foam solutions, supporting both safety and passenger comfort in modern aircraft.

Asia Pacific Aerospace Foam Market Trends

Asia Pacific is expected to have significant growth in the market in the forecast period. The Asia Pacific aerospace foam market is witnessing significant growth due to rapid commercial aviation expansion, particularly in China and India. Polyurethane foams are used in cabin interiors to provide comfort, thermal insulation, and fire resistance, while polyethene foams offer lightweight vibration damping and structural support. Rising airline operations and maintenance, repair, and overhaul (MRO) services drive the adoption of high-performance foams in the region’s growing aviation sector.

China's Market Growth is Driven By A Strong Manufacturing Base Presence

China’s aerospace foam demand is fueled by growing aircraft manufacturing and commercial aviation expansion. Polyurethane foams are widely applied in cabin walls, ceilings, and seating for fire safety, comfort, and acoustic efficiency, while polyethene foams support flight deck pads and vibration-damping needs. Investments in MRO facilities, domestic airline growth, and infrastructure modernisation contribute to sustained demand for advanced aerospace foam solutions in the Chinese market.

Europe Aerospace Foam Market Analysis

Europe is expected to experience notable growth in the market. Europe’s aerospace foam market benefits from advancements in lightweight, durable materials that enhance cabin safety and comfort. Polyurethane foams are utilised extensively in walls, ceilings, and seating, providing thermal insulation and fire retardancy. Polyethene foams are applied for vibration damping and protective padding. Countries like Germany drive the adoption of innovative foam technologies, supported by growth in commercial and business aviation sectors, focusing on enhanced aircraft interiors and operational efficiency.

Germany has Seen Growth In The Market, Driven By The Growing applications.

Germany emphasises high-quality aerospace foams in commercial and general aviation applications. Polyurethane foams dominate cabin walls, ceilings, and seating, offering fire safety, insulation, and cushioning. Polyethene foams are used for flight deck pads and vibration-damping applications. The country’s focus on technologically advanced aircraft manufacturing, retrofitting, and modernisation programs ensures steady demand for speciality foam solutions that combine safety, performance, and comfort.

Recent Developments

- In November 2024, according to the American Composites Manufacturers Association, Rocket Lab's composite Neutron rocket has cleared another milestone towards its launch. This vehicle utilises carbon composite materials for reusability, aiming for reduced costs and increased launch frequency.(Source: acmanet.org)

- In September 2024, L&L Products introduced two new InsituCore foaming materials designed for composite manufacturing processes, offering heat-activated solutions to form composite parts more efficiently. (Source: www.businesswire.com)

Top players in the Analytical Chemistry Market & Their Offerings:

- BASF SE (Germany): Offers a broad range of polyurethane and polyethene foams used in aircraft interiors, insulation, and seating applications, designed for lightweighting, durability, and fire resistance.

- Evonik Industries AG (Germany): Provides high-performance speciality foams such as ROHACELL® PMI foams used in aircraft structures, radomes, and interior panels for superior stiffness-to-weight ratios.

- Rogers Corporation (USA): Specialises in advanced foam materials, including urethane and silicone foams, used in vibration damping, sealing, and insulation for aerospace and defence components.

- Recticel NV (Belgium): Manufactures polyurethane and polyethene foams tailored for aerospace seating, cabin comfort, and thermal insulation applications with a strong focus on safety and performance.

- Armacell International S.A. (Luxembourg): Supplies lightweight, flexible foam materials, including elastomeric insulation and structural foams designed for energy efficiency and vibration control in aircraft systems.

Other Top Players Are

- Boyd Corporation

- ERG Aerospace Corporation

- SABIC

- ZOTEFOAMS PLC

- General Plastics Manufacturing Company

- Solvay

- UFP Technologies, Inc.

- NCFI Polyurethanes

- DuPont

Segments Covered:

By Foam Type

- Polyurethane Foam

- Polyethene Foam

- Melamine Foam

- Metal Foam

- Polyimide Foam

- Polyethene Terephthalate Foam

- Polyvinyl Chloride Foam

- Speciality High Performance Foam

By Application

- Flight Deck Pads

- Cabin Walls & Ceilings

- Aircraft Seats

- Aircraft Floor

- Others

By End-use

- General Aviation

- Commercial Aviation

- Military Aircraft

- Rotary Aircraft

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait