Content

Structural Steel Market Size | Companies Analysis 2034

The global structural steel market size was approximately USD 119.12 billion in 2025 and is projected to reach around USD 188.63 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 5.24% between 2025 and 2034. The growing demand for sustainable construction practices globally is the key factor driving market growth. Also, rapid industrialization and urbanization, coupled with the ongoing innovations in steel technology, can fuel market growth further.

Key Takeaways

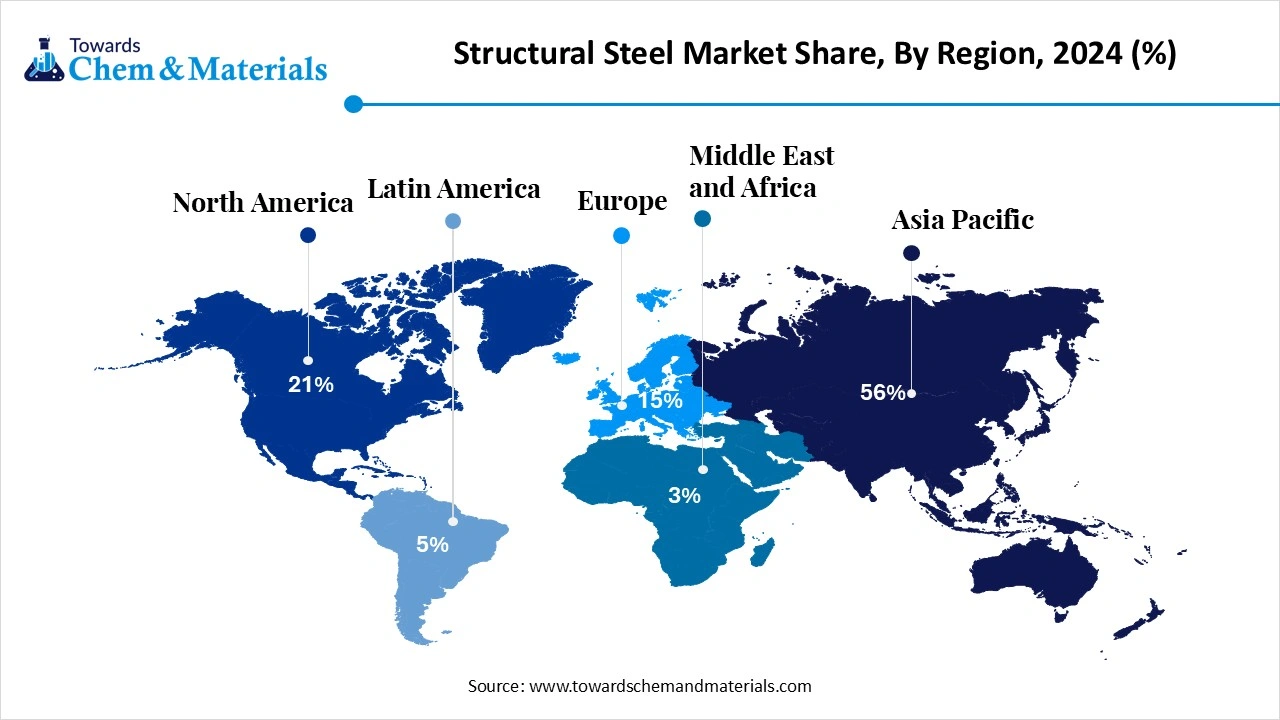

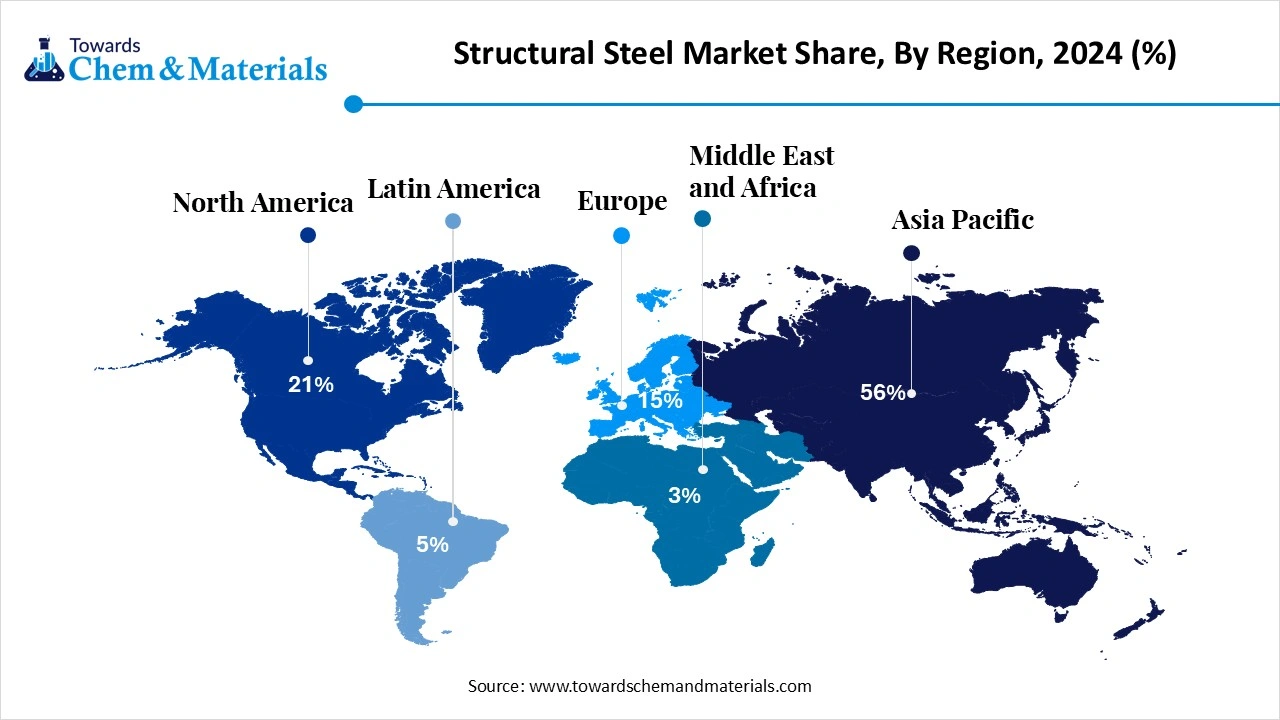

- By region, Asia Pacific dominated the market with approximately 56% share in 2024.

- By region, North America is expected to grow at the fastest CAGR over the forecast period.

- By region, Europe is expected to grow at a notable CAGR over the projected period.

- By product type, the beams segment dominated the market with approximately 50% share in 2024.

- By product type, the channels segment is expected to grow at the fastest CAGR of approximately 18% over the forecast period.

- By material type, the carbon steel segment held approximately 55% market share in 2024.

- By material type, the high-strength low-alloy (HSLA) steel segment is expected to grow at the fastest CAGR over the forecast period.

- By end user industry, the construction & infrastructure segment dominated the market with approximately 48% share in 2024.

- By end user industry, the industrial / manufacturing facilities segment is expected to grow at the fastest CAGR of approximately 20% during the projected period.

- By form, the hot rolled sections segment dominated the market with approximately 52% share in 2024.

- By form, the fabricated / prefabricated steel sections segment is expected to grow at the fastest CAGR of approximately 20% during the study period.

What is Structural Steel?

The robust government spending on public projects is the major factor propelling the market growth. The global structural steel market involves the production, fabrication, and distribution of steel products specifically designed for structural applications in construction, infrastructure, and industrial projects.

Structural steel is known for its high strength-to-weight ratio, durability, and versatility, making it suitable for buildings, bridges, industrial facilities, and offshore structures. Market growth is driven by urbanization, industrialization, government infrastructure projects, and the adoption of advanced fabrication techniques such as modular construction and automated welding.

Global Structural Steel Market Outlook:

- Industry Growth Overview: Between 2025-2034, the market is anticipated to witness substantial growth due to a surge in government spending on private and public construction projects. Also, advancements in steel technology, such as high-strength and low-alloy (HSLA) steel, have enhanced the performance and lifespan of structural steel.

- Sustainability Trends: This trend in the market includes the shift towards "green steel" made with low-carbon methods and the growing use of recycled steel to promote the circular economy, which are major factors driving market growth. Innovations are focusing on developing lightweight and high-strength steel products.

- Global Expansion: Companies such as China Steel Corporation and Nippon Steel have announced substantial investment in their structural steel businesses to expand their facilities with technological advancements.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 125.36 Billion |

| Expected Size by 2034 | USD 188.63 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.24% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Material Type, By End-Use Industry, By Form / Shape, By Region |

| Key Companies Profiled | POSCO, Jindal Steel & Power Limited, Baosteel Group, Thyssenkrupp AG, Nucor Corporation, Severstal, Tata Steel Limited, Steel Authority of India Limited (SAIL), Hyundai Steel, Outokumpu, Essar Steel, JSW Steel , Acerinox |

Key Technological Shifts in the Global Structural Steel Market:

Key technological shifts in the market include the adoption of digital tools such as BIM and Artificial Intelligence, along with the growing use of robotics and automation in manufacturing and fabrication. The rapid development of lightweight, high-strength, and high-performance steel alloys is expanding to fulfil demands for energy-efficient vehicles and buildings.

Trade Analysis of Global Structural Steel Market: Import & Export Statistics

- In 2024, US steel production decreased by 2.4% to 79.5 million tons, while global production fell by 0.9% to 1.84 billion tons. Despite the dip, the US remained in the top ten steel-producing countries.(Source: gmk.center)

- In 2024, China's steel production decreased to a five-year low of 1.005 billion tons, but its exports surged to a record 110.72 million tons. This contrast was driven by a decline in domestic demand, primarily from the construction sector, alongside government efforts to curb emissions and a long-running real estate crisis. (Source: gmk.center)

Value Chain Analysis of the Global Structural Steel Market:

- Feedstock Procurement : It refers to the process of acquiring and sourcing the raw materials required to produce steel products.

- Chemical Synthesis and Processing : It includes the chemical reactions and treatments that convert the raw materials into high-performance finished steel products.

- Packaging and Labelling : It is the comprehensive process of safeguarding, identifying, and preparing steel products for transportation, particularly across international borders.

- Regulatory Compliance and Safety Monitoring : It refers to the mandatory process of sticking to and enforcing an extensive range of regulations, laws, and industry standards.

Global Structural Steel Market's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| United States | American Society for Testing and Materials (ASTM): Establishes standard specifications for materials, including common structural steel grades like A36 and A992. |

| Canada | The Canadian Standards Association (CSA) provides comprehensive guidelines under CSA S16 for structural steel, with standards that account for the country's harsh weather, including heavy snow and ice loads. |

| Europe | Eurocodes (EN 1993): The European Committee for Standardization (CEN) developed this series of standards to harmonize structural design practices across member countries. |

Segmental Insights

Product Type Insight

Which Product Type Segment Dominated the Global Structural Steel Market in 2024?

The beams segment dominated the market with approximately 50% share in 2024. The dominance of the segment can be attributed to the growing demand for durable and high-strength building materials, along with the technological advancements in steel production. Additionally, beams are a crucial component of heavy structural steel construction projects with applications in building and bridges.

The channels segment is expected to grow at the fastest CAGR of approximately 18% over the forecast period. The growth of the segment can be credited to the rapid infrastructure development and urbanisation, coupled with the growing demand for high-performance materials in complex architectural designs. Also, structural steel is more preferred in green building construction because of its environmental benefits and recyclability.

Material Type Insight

How Much Share Did the Carbon Steel Segment Held in 2024?

The carbon steel segment held approximately 55% market share in 2024. The dominance of the segment can be linked to the growing need for cost-effective and durable materials and the rise in construction spending. Moreover, carbon steel offers a cost-effective solution and can be converted into different shapes, giving engineers and architects design freedom.

The high-strength low-alloy (HSLA) steel segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by ongoing investment in infrastructure such as energy facilities and roads, bridges, which fuels the demand for high-strength structural steel. Furthermore, HSLA's superior strength-to-weight ratio, corrosion resistance, and toughness make it a key choice for modern construction.

End-Use Industry Insight

Which End-Use Type Segment Dominated the Global Structural Steel Market in 2024?

The construction & infrastructure segment dominated the market with approximately 48% share in 2024. The dominance of the segment is owed to the ongoing government investments in infrastructure projects, coupled with the increasing emphasis on sustainable building practices. Also, governments across the globe are investing heavily in infrastructure projects like transportation networks, leading to further growth.

The industrial / manufacturing facilities segment is expected to grow at the fastest CAGR of approximately 20% during the projected period. The growth of the segment is due to the growing investment in infrastructure projects such as oil and gas and energy, along with the government initiatives to develop smart cities and industrial hubs. In addition, the expansion of the manufacturing industry also fuels demand for different steel products.

Form Insight

How Much Share Did the Hot Rolled Sections Segment Held in 2024?

The hot rolled sections segment dominated the market with approximately 52% share in 2024. The dominance of the segment can be attributed to the surge in infrastructure and construction projects in emerging regions such as the Asia Pacific. Furthermore, the high availability of hot-rolled steel and its superior properties, such as durability and strength to withstand harsh conditions, make it a preferred choice among market players.

The fabricated / prefabricated steel sections segment is expected to grow at the fastest CAGR of approximately 20% during the study period. The growth of the segment can be credited to the increasing need for cost-effective and sustainable construction solutions, coupled with the technological innovations in prefabrication and building information modelling (BIM). Prefabricated steel gives a more efficient and sustainable construction method.

Regional Insights

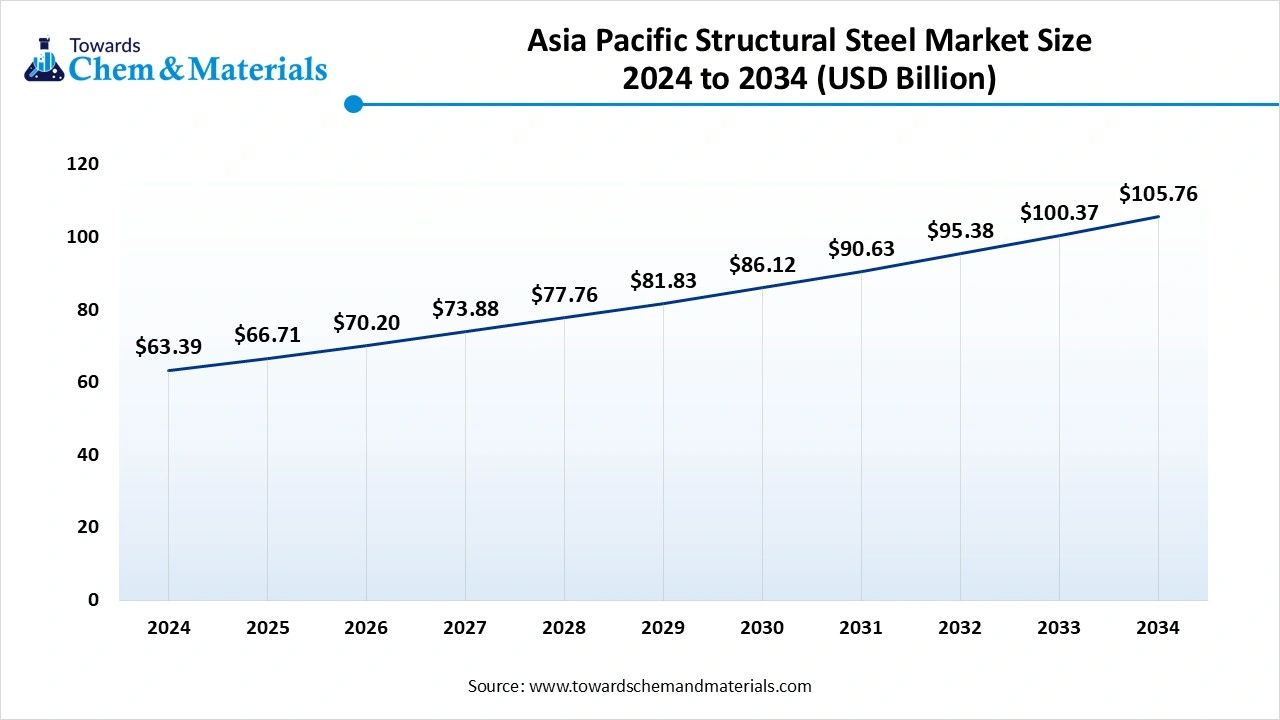

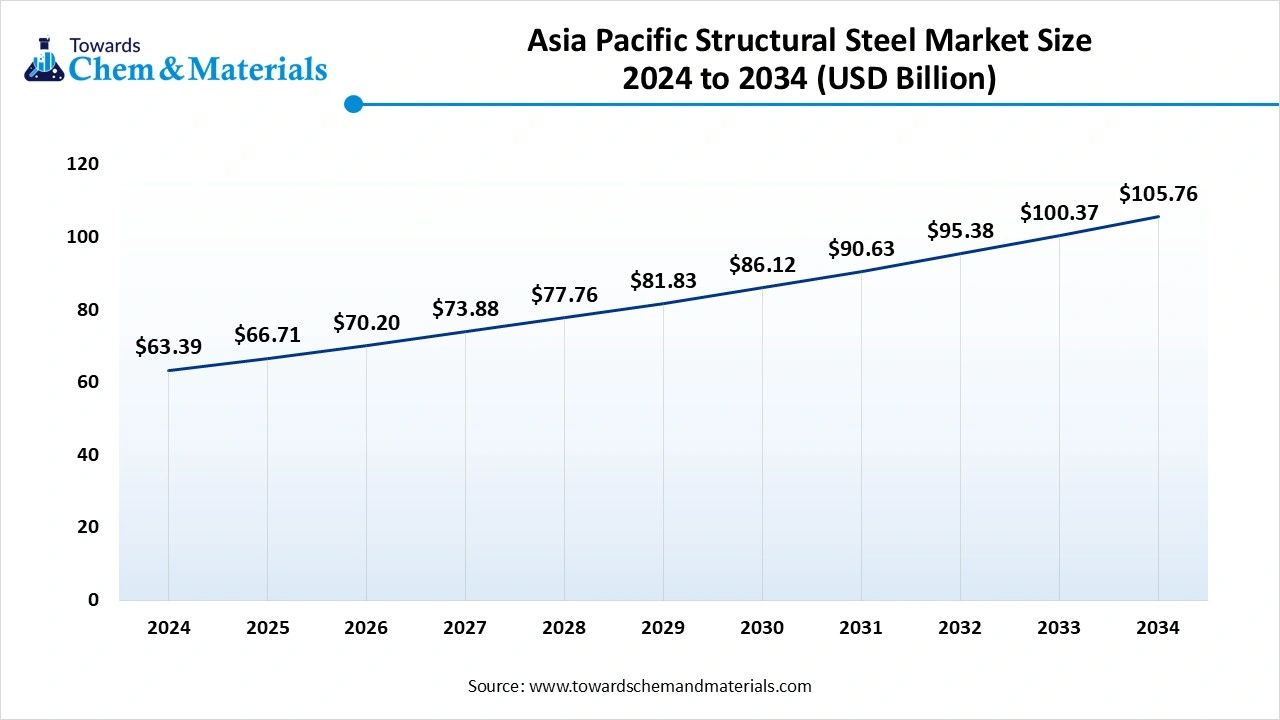

The Asia Pacific structural steel market size is valued at USD 66.71 billion in 2025 and is expected to reach USD 105.76 billion by 2034, growing at a CAGR of 5.26% from 2025 to 2034. Asia Pacific dominated the market with approximately 56% share in 2024.

The dominance of the region can be attributed to the expanding commercial and residential construction sector, along with the growing demand for high-strength steel in skyscraper construction. In addition, the growth of the aerospace, automotive, and other heavy industries needs large amounts of structural steel, driving regional growth further.

China Global Structural Steel Market Trends

In the Asia Pacific, China led the market due to the innovations in steel production and technology. China's emphasis on large-scale infrastructure projects, like bridges, airports, and high-speed rail, is a major factor in the market's exponential growth in the country.

North America is expected to grow at the fastest CAGR over the forecast period.

The growth of the region can be credited to the ongoing government investment in infrastructure projects, along with the push towards sustainable construction methods. Furthermore, stringent building regulations in the country mandate the use of high-grade durable materials, which fuels the demand for structural steel.

U.S. Global Structural Steel Market Trends

In North America, the U.S. dominated the market due to the growing adoption of prefabricated and sustainable construction methods. Also, advancements in steel fabrication and the development of high-strength steel alloys are making the construction more efficient, faster, and more cost-effective in the country.

Europe is expected to grow at a notable CAGR over the projected period.

The growth of the region can be driven by increasing emphasis on sustainability and green steel initiatives, coupled with the growing product demand from key sectors such as non-residential construction and automotive. European nations are heavily investing in sustainable manufacturing methods to enhance overall energy efficiency.

Germany Global Structural Steel Market Trends

In Europe, Germany shows significant growth, boosted by a strong export market in the country and international collaborations to ensure an ongoing supply of high-quality steel. Moreover, stringent policies such as Germany's Climate Action Plan are pushing towards lower carbon emissions and propelling the adoption of green steel production.

Recent Development

- In July 2025, JSW Steel made a strategic acquisition of Saffron Resources Private Limited. The company has also announced the plan to raise its stake in SW Severfield Structures Limited to 74.9% for up to ₹235.10 crore.(Source: scanx.trade/stock-market-news)

Top Vendors in Global Structural Steel Market & Their Offerings:

- ArcelorMittal: ArcelorMittal is a global leader in the steel industry, holding a significant position in the structural steel market as the largest producer in Europe and one of the largest in the Americas.

- Nippon Steel Corporation: Nippon Steel Corporation is a leading Japanese steel manufacturer with a significant presence in the global structural steel market, known for high-performance products like H-beams and sheet piles used in major infrastructure projects.

Other Players

- POSCO

- Jindal Steel & Power Limited

- Baosteel Group

- Thyssenkrupp AG

- Nucor Corporation

- Severstal

- Tata Steel Limited

- Steel Authority of India Limited (SAIL)

- Hyundai Steel

- Outokumpu

- Essar Steel

- JSW Steel

- Acerinox

Segment Covered

By Product Type

- Beams (I-Beams, H-Beams, Universal Beams)

- Channels (C-Channels, U-Channels)

- Angles (L-Angles, Equal / Unequal Angles)

- Plates & Sheets

By Material Type

- Carbon Steel

- High-Strength Low-Alloy (HSLA) Steel

- Alloy Steel

- Stainless Steel

By End-Use Industry

- Construction & Infrastructure

- Industrial / Manufacturing Facilities

- Oil & Gas / Energy Projects

- Transportation (Bridges, Railways, Ports)

- Marine & Offshore Structures

By Form / Shape

- Hot Rolled Sections

- Cold Formed Sections

- Fabricated / Prefabricated Steel Sections

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait