Content

Asia Pacific Sustainable Chemicals Market Size | Top Companies Analysis

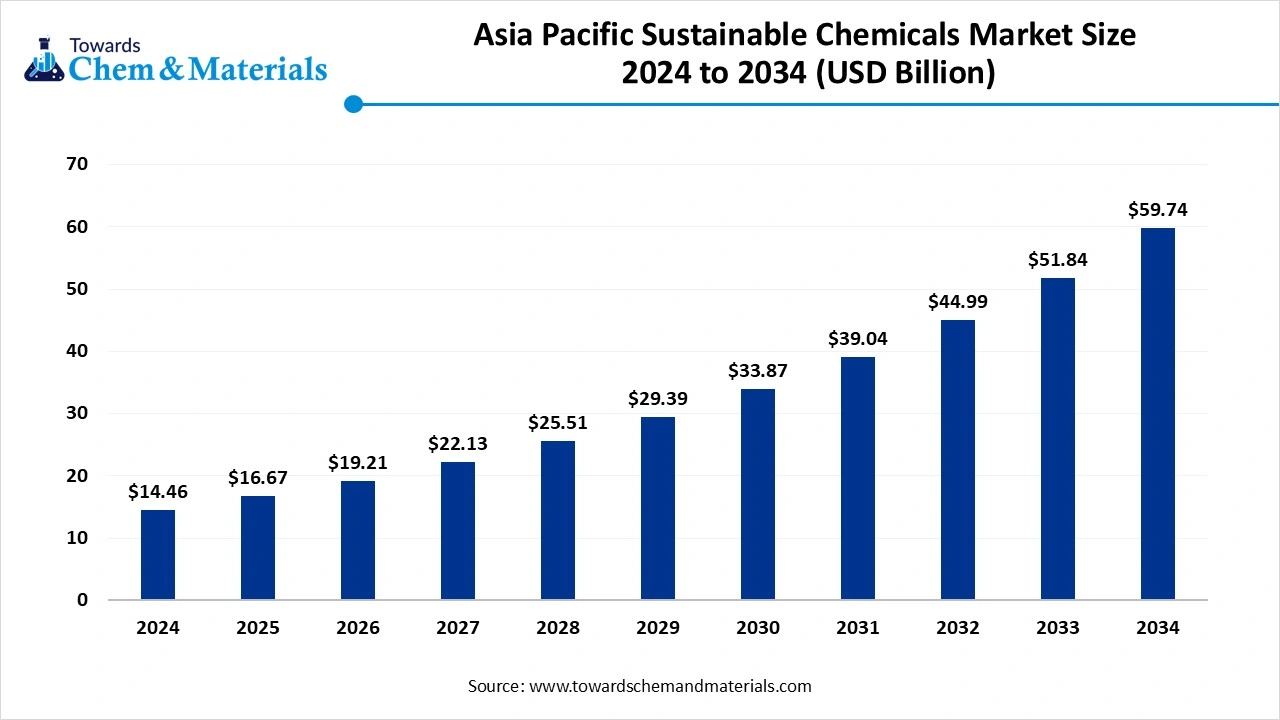

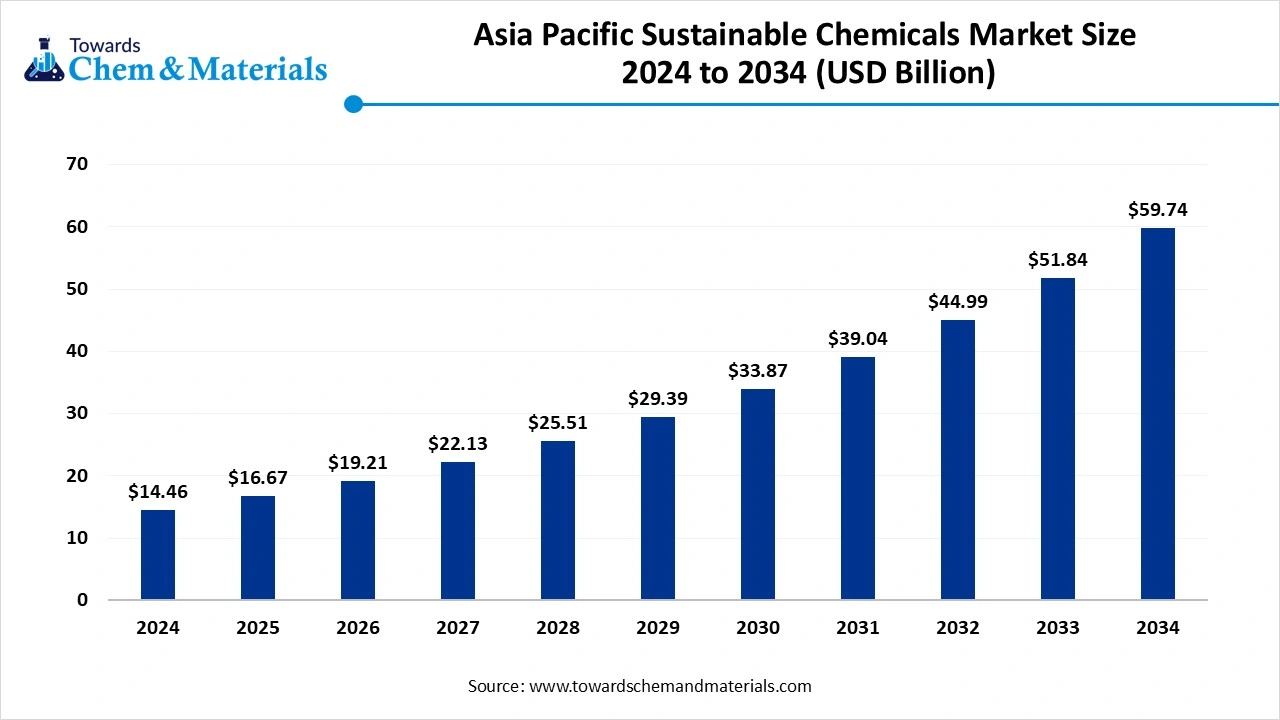

The Asia Pacific sustainable chemicals market size accounted for USD 14.46 billion in 2024 and is predicted to increase from USD 16.67 billion in 2025 to approximately USD 59.74 billion by 2034, expanding at a CAGR of 15.24% from 2025 to 2034. Growing consumer demand for sustainable products is the key factor driving market growth. Also, rapid industrialization and urbanization, coupled with the innovations in bio-based chemicals and sustainable solvents, can fuel market growth further.

Key Takeaways

- By product, the bio-alcohols segment dominated the market with approximately 35% share in 2024.

- By product, the bio-polymers segment is expected to grow at the fastest CAGR over the forecast period.

- By feedstock, the food-crop sugars segment held the largest market share in 2024.

- By feedstock, the renewable energy-derived feedstocks segment is expected to grow at the fastest CAGR over the forecast period.

- By technology, the fermentation segment dominated the market with the largest share in 2024.

- By technology, the chemical recycling segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the packaging segment held the largest market share in 2024.

- By application, the personal care & cosmetics segment is expected to grow at the fastest CAGR during the study period.

What are Sustainable Chemicals?

The market is driven by stringent environmental regulations, growing corporate sustainability targets, advancements in green chemistry technologies, and increasing consumer preference for eco-friendly products.

The Asia-Pacific sustainable chemicals market comprises chemicals that are produced or processed using environmentally friendly, low-carbon, or renewable feedstocks. These include bio-based, recycled, and circular-economy-derived chemicals designed to replace conventional fossil-based products across various industries such as packaging, textiles, automotive, construction, agriculture, and personal care. The Asia-Pacific region is emerging as both the largest and fastest-growing market due to strong policy support, abundant biomass resources, and rapid industrial investment.

Asia Pacific Sustainable Chemicals Market Outlook:

- Industry Growth Overview: Between 2025-2034, the market is expected to witness substantial growth due to ongoing investment in bio-refineries along with the availability of abundant biomass resources. Also, the shift towards circular economy principles, especially in countries such as Japan and India, is driving market growth soon.

- Sustainability Trends: Companies are heavily investing in cutting-edge green technologies and growing manufacturing capacities for sustainable solutions. Major players are also adopting circular economy initiatives to reduce waste and create more sustainable product lifespans.

- Global Expansion: Major players such as Evonik and Mitsubishi Chemical Group are expanding their market presence in the region, boosted by the increasing need for sustainable products in sectors such as automotive, electronics, and agriculture, further supported by regional industrial expansion.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 16.67 Billion |

| Expected Size by 2034 | USD 59.74 Billion |

| Growth Rate from 2025 to 2034 | CAGR 15.24% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product / Chemistry, By Feedstock / Source, By Technology / Production Route, By Application / End-use |

| Key Companies Profiled | Evonik Industries, Clariant AG, Mitsubishi Chemical Group (Japan), Sumitomo Chemical (Japan), Toray Industries (Japan), LG Chem (South Korea), Lotte Chemical (South Korea) Indorama Ventures (Thailand), Braskem Siam (Thailand JV), Corbion N.V. (Netherlands – APAC operations), NatureWorks LLC, Neste Oyj (Finland – APAC renewable feedstock partnerships), Wanhua Chemical Group (China), Sinopec (China), Formosa Plastics Group (Taiwan), Reliance Industries (India), Genomatica Inc. (U.S. – APAC collaborations), Avantium N.V. (Netherlands – APAC partnerships) |

Key Technological Shifts in the Asia Pacific Sustainable Chemicals Market:

Key technological shifts in the market are fuelled by advanced recycling techniques, biorefining, and other green chemistry advances. These shifts are facilitated by increasing consumer demand for eco-friendly products, government policies, and the need to minimize dependence on fossil fuels.

Trade Analysis of the Asia Pacific Sustainable Chemicals Market: Import & Export Statistics

- India: India's chemical imports were $75 billion in 2023, compared to $44 billion in exports, resulting in a $31 billion trade deficit.

- China: China's chemical exports are rising. Major exports include certain organic and inorganic chemicals, with countries like the US, Japan, and other Northeast Asian countries as key markets. (Source: www.manoramayearbook.in)

Value Chain Analysis of the Asia Pacific Sustainable Chemicals Market

- Feedstock Procurement : It is a process of acquiring raw materials to produce chemicals with a focus on social, environmental, and economic sustainability.

Chemical Synthesis and Processing : It is a method used to create chemicals in a resource-efficient and environmentally friendly manner. - Packaging and Labelling : This stage involves utilizing sustainable materials by combining smart technology for traceability to ensure clear, compliant, sustainable labelling.

- Regulatory Compliance and Safety Monitoring : It refers to the processes and frameworks that ensure the production of chemical products and their adherence to legal, safety, health, and environmental standards.

Asia Pacific Sustainable Chemicals Market's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| China | A new, comprehensive environmental code is being developed, which incorporates "green chemistry substitutions" and promotes the use of safer, less hazardous materials. |

| India | Chemicals (Management and Safety) Rules (CMSR)is anticipated for full enforcement by 2026; these rules are India's proposed REACH-like framework for registering and restricting chemicals. |

| Japan | Japan's regulatory landscape for chemicals includes the Chemical Substance Control Law (CSCL) for managing industrial chemicals and preventing environmental pollution. |

Market Opportunity

Increasing Adoption of Bio-Based Materials

The ongoing trend towards bio-based materials in the region represents significant market opportunities over the forecast period. These materials are derived from renewable biological resources like algae, plants, and agricultural waste. Furthermore, bio-based materials give several benefits, such as less greenhouse gas emissions, a lower carbon footprint, and reduced reliance on finite resources.

Market Challenge

Regulatory Complexity

Navigating an extensive and changing set of regulations across different countries in the region can be challenging, causing fluctuations in product approvals and market emergence. Moreover, stringent regulations such as those on hazardous substances increase overall administrative burden for market players, hindering market growth further.

Segmental Insights

Product Insight

How Much Share Did the Bio-Alcohols Segment Held in 2024?

The bio-alcohols segment dominated the market with approximately 35% share in 2024. The dominance of the segment can be attributed to the stringent government regulations and increasing consumer demand for sustainable products. The region also benefits from plentiful biomass feedstocks such as sugarcane and agricultural residues, which are used to manufacture bio-alcohols.

The biopolymers segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing adoption of supportive government policies along with a shift away from fossil fuels. Technological innovations are also enhancing biopolymer performance by reducing production costs, which makes them more competitive.

Feedstock Insight

Which Feedstock Type Segment Dominated the Asia Pacific Sustainable Chemicals Market in 2024?

The food-crop sugars segment held the largest market share in 2024. The dominance of the segment can be linked to the growing consumer demand for sustainable products and rising regulatory pressure against traditional synthetic chemicals. Also, eco-friendly chemicals derived from food-crop sugars are crucial feedstocks for the manufacturing of bioplastics like polylactic acid (PLA).

The renewable energy-derived feedstocks segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by technological innovation, strong government support, and changing consumer demand. Moreover, Research is increasing the use of abundant and diverse renewable feedstocks, such as agricultural and forestry residues.

Technology Insight

Which Technology Segment Dominated the Asia Pacific Sustainable Chemicals Market in 2024?

The fermentation segment dominated the market with the largest share in 2024. The dominance of the segment can be linked to the growing product demand from the food and beverage industry, coupled with the favourable government policies. Additionally, ongoing advancements in fermentation techniques such as microbial engineering and precision fermentation are driving segment growth shortly.

The chemical recycling segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment can be driven by a surge in plastic waste generation and growing demand for high-grade recycled content in various sectors. The chemical recycling process creates recycled materials with the same quality as virgin plastics.

Application Insight

How Much Share Did the Packaging Segment Held in 2024?

The packaging segment held the largest market share in 2024. The dominance of the segment is owed to the increasing environmental concerns and regulations, along with the surge in urbanization and e-commerce activities. Furthermore, the cost-effectiveness and recyclability of paper and paperboard are growing their demand for sustainable packaging solutions.

The personal care & cosmetics segment is expected to grow at the fastest CAGR during the study period. The growth of the segment is due to growing consumer awareness of organic and natural products and the growth of e-commerce platforms. Moreover, consumers are becoming more knowledgeable regarding product ingredients and focusing on safe and effective formulations.

Country Insights

China Asia Pacific Sustainable Chemicals Market Trends

The market growth in China is majorly driven by robust domestic demand for sustainable products and rapid investments in green innovation. Also, the governments offer financial support through mechanisms such as subsidies and green loans to optimize investment in sustainable projects and technologies.

India Asia Pacific Sustainable Chemicals Market Trends

The market expansion in India is primarily boosted by rapid economic expansion and industrialization, coupled with the growing consumer preference for green chemistry. Moreover, India's robust industrial growth, especially in sectors such as automotive, manufacturing, and textiles, creates a significant demand for specialty and sustainable chemicals.

Country-level Investments & Funding Trends for the Asia Pacific Sustainable Chemicals Market:

- India: Japan is co-investing in India's green chemicals sector. A $600 million India-Japan fund was launched in 2023 to invest in environmental sustainability.(Source: www.pib.gov.in)

- China: In 2024, China invested $940 billion in clean energy initiatives, closing the investment gap with global fossil fuels funding.(Source: www.rinnovabili.net)

Recent Development

- In August 2025, Singapore-based startup Prefer unveiled new soluble cocoa and bean-free coffee powders to help food and beverage market players negotiate limited supplies and higher prices of the sought-after commodities.(Source: agfundernews.com)

Top Vendors in the Asia Pacific Sustainable Chemicals Market & Their Offerings:

- BASF SE: BASF is a major player in the Asia Pacific sustainable chemicals market, with a strategy centered on regional innovation, circular economy principles, and enabling the "green transformation" of its customers.

- Dow Inc.: Dow Inc. is a major player in the Asia Pacific (APAC) sustainable chemicals market, focusing on developing a circular economy for plastics, reducing its carbon footprint, and innovating sustainable materials.

Other Players

- Evonik Industries

- Clariant AG

- Mitsubishi Chemical Group (Japan)

- Sumitomo Chemical (Japan)

- Toray Industries (Japan)

- LG Chem (South Korea)

- Lotte Chemical (South Korea)

- Indorama Ventures (Thailand)

- Braskem Siam (Thailand JV)

- Corbion N.V. (Netherlands – APAC operations)

- NatureWorks LLC

- Neste Oyj (Finland – APAC renewable feedstock partnerships)

- Wanhua Chemical Group (China)

- Sinopec (China)

- Formosa Plastics Group (Taiwan)

- Reliance Industries (India)

- Genomatica Inc. (U.S. – APAC collaborations)

- Avantium N.V. (Netherlands – APAC partnerships)

Segment Covered

By Product / Chemistry

- Bio-alcohols (methanol, ethanol, butanol)

- Biopolymers / Bioplastics (PLA, PHA, bio-PE, bio-PET)

- Bio-organic acids (succinic, lactic, citric, itaconic)

- Bio-surfactants & specialty bio-based intermediates

- Renewable monomers (bio-BTX, bio-PET intermediates)

- Chemicals from chemical recycling (monomers from depolymerization, pyrolysis oils)

By Feedstock / Source

- 1st-Generation / Food-crop sugars (corn, sugarcane)

- Agricultural residues & lignocellulosic biomass

- Industrial & municipal waste / waste oils

- Renewable energy-derived feedstocks (CO₂ + green hydrogen)

By Technology / Production Route

- Fermentation / Industrial biotechnology

- Catalytic conversion of bio-oils / hydroprocessing

- Chemical recycling / Depolymerization & advanced pyrolysis

- Electrosynthesis / e-chemicals (CO₂ + renewable H₂ routes)

- Hybrid bio-catalytic processes

By Application / End-use

- Packaging

- Textiles & Fibers

- Automotive & Transportation

- Construction & Building materials

- Personal Care & Cosmetics