Content

What is the Current Europe Water Treatment Chemicals Market Size and Share?

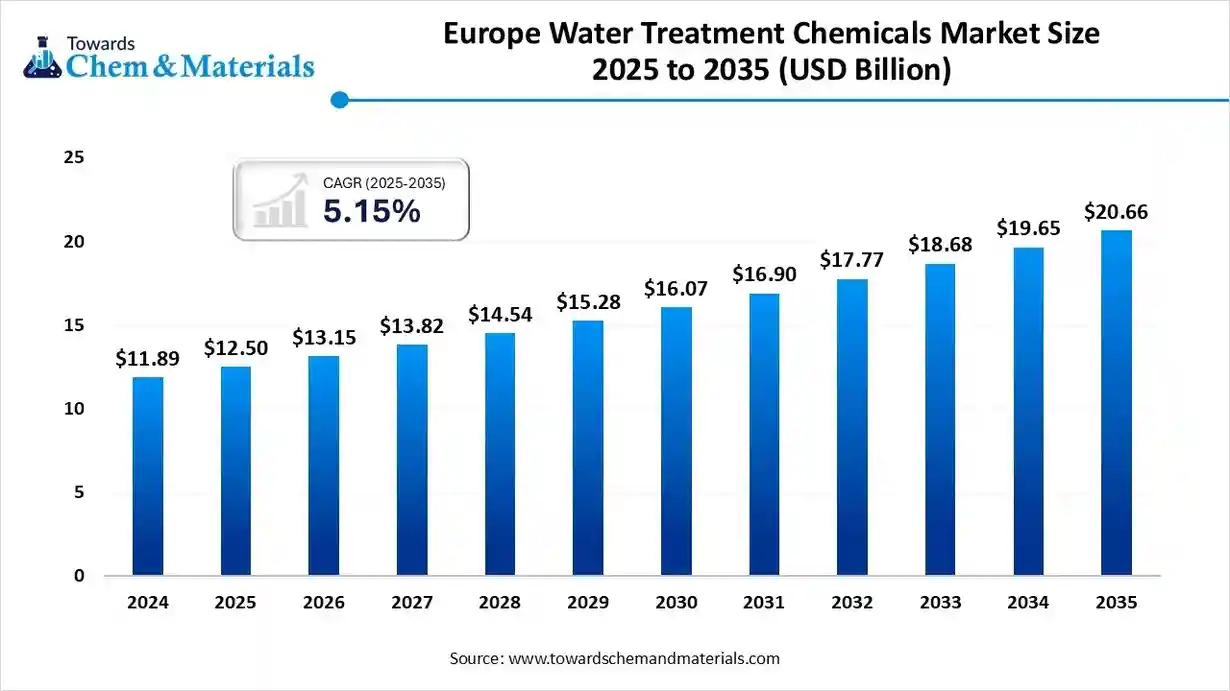

The Europe water treatment chemicals market size is estimated at USD 12.50 billion in 2025, is projected to grow to USD 13.15 billion in 2026, and is expected to reach around USD 20.66 billion by 2035. growing at a CAGR of 5.15% from 2025 to 2035. The global shift towards sustainability has fueled market growth in recent years.

Key Takeaways

- By product type, the coagulants & flocculants segment dominated the market with 32% in 2024.

- By product type, the corrosion & scale inhibitors segment is expected to grow at the fastest rate in the market during the forecast period.

- By application type, the wastewater treatment segment dominated the market with 41% industry share in 2024.

- By application type, the boiler & cooling water treatment segment is expected to grow at the fastest rate in the market during the forecast period.

- By end user industry, the municipal water utilities segment dominated the market with 35% industry share in 2024.

- By end-use industry, the power generation segment is expected to grow at the fastest rate in the market during the forecast period.

- By source type, the wastewater & effluent treatment segment dominated the market with 58% industry share in 2024.

- By source type, the freshwater treatment segment is expected to grow at the fastest rate in the market during the forecast period.

- By technology integration type, the manual dosing segment dominated the market with 63% in 2024.

- By technology integration type, the automated smart dosing segment is expected to grow at the fastest rate in the market during the forecast period.

Transforming Every Drop: Europe’s Path to Smarter, Cleaner Water

- The Europe water treatment chemicals market covers chemical formulations used to control scale, corrosion, biofouling, and impurities across municipal, industrial, and commercial water systems. These chemicals improve water quality, process efficiency, and environmental compliance in sectors such as power generation, food & beverage, pulp & paper, oil & gas, and wastewater management.

- The market is driven by tightening EU Water Framework Directive standards, circular water reuse initiatives, and decarbonization goals. Technological advances focus on eco-friendly chemistries, polymer-based inhibitors, and integrated digital dosing systems for optimized consumption and reduced environmental footprint.

Europe Water Treatment Chemicals Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the increasing initiatives of the replacement of older systems and tighter sustainability rules have raised awareness among venture and corporate backers in recent years. Also, the government is actively supporting initiatives like small towns with multiple factories, where the industrial water clusters are playing a vital role in Europe in recent years.

- Sustainability Trends: Industry in the region is known for its biodegradable chemistries, chemical recovery loops, and lower sludge. Moreover, the European manufacturers are seen in selling water circularity scores where the buyers are thinking and understanding ESG badges showing litres saved per ton of the launched product.

- Global Expansion: The European manufacturers are actively seen in exporting their high-value water chemistries across the globe where the modular systems have raised heavy demand. Furthermore, several global buyers are observed in meeting the EU and buyers' standards to adopt the latest technologies and advanced systems in recent years.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 13.15 Billion |

| Expected Size by 2034 | USD 20.66 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.15% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Application, By End-Use Industry, By Source Type, By Technology Integration, |

| Key Companies Profiled | BASF SE., Ecolab, Solenis LLC, Veolia Water Technologies , Kurita Europe GmbH , SNF Floerger , Arkema S.A. , Dow Chemical Company , Nouryon , SUEZ Group , Baker Hughes Company , Italmatch Chemicals S.p.A. , Solvay S.A. , Lenntech B.V. |

Digital Dosing: The New ERA of Smart Water Chemistry

The technology has become a trending subject among institutional investors nowadays. The European chemical manufacturers and water treatment buyers are shifting towards sensor-calibrated dosing for the engagement of the specific chemical blends. Also, several chemical suppliers are seen under the heavy usage of the cloud reports while refilling the subscriptions.

Trade Analysis of the Europe Water Treatment Chemicals Market:

- Import, Export, Consumption, and Production Statistics

- The United Kingdom exported 24 shipments of water treatment chemicals from 2024 to 2025.

Value Chain Analysis of the Europe Water Treatment Chemicals Market:

- Distribution to Industrial Users : The distribution of water treatment chemicals to industrial users in Europe has a close association with direct sales, as per the provided information.

- Chemical Synthesis and Processing: The chemical synthesis and processing of water treatment chemicals in the European market involve large-scale industrial manufacturing processes and are driven by stringent EU regulations.

- Regulatory Compliance and Safety Monitoring : Regulatory compliance and safety monitoring in the European water treatment chemicals market are governed by a robust framework of interconnected EU Directives and Regulations, as per the published report.

Europe Water Treatment Chemicals Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| European Union | European Chemicals Agency (ECHA) | REACH Regulation (EC No 1907/2006) | Protecting human health and the environment from hazardous chemicals | This is an EU agency that manages the technical and administrative aspects of the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation. |

Country / Region Regulatory Body Key Regulations Focus Areas Notable Notes

European Union

- European Chemicals Agency (ECHA) REACH Regulation (EC No 1907/2006) Protecting human health and the environment from hazardous chemicals This is an EU agency that manages the technical and administrative aspects of the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation.

Segmental Insights:

Product Type Insights

How did the Coagulants & Flocculants Segment Dominate the Europe Water Treatment Chemicals Market in 2024?

- The coagulants & flocculants segment dominated the market with 32% industry share in 2024 due to increasing need or the affordable and fast solids removal in the current period. Moreover, by helping plants to meet discharge rules without any new equipment, the coagulants and flocculants have gained major industry attention in recent years.

- The corrosion & scale inhibitors segment is expected to grow at a significant rate owing to the shift towards the reuse of systems that concentrate salts. Also, several manufacturers are actively focusing on the zero liquid discharge and hardness and salinity rise, the corrosion and inhibitors are likely to crucial role in the coming years.

- The biocides & disinfectants segment is also notably growing, akin to the threat of biofilms, which is seen in reducing the output and shortening membrane life. Furthermore, sectors like pharma, food, and electronics are increasingly providing a sophisticated consumer base to the biocide and disinfectant manufacturers in the current period.

Application Insights

Why does the Wastewater Treatment Segment Dominate the Europe Water Treatment Chemicals Market?

- The wastewater treatment segment dominated the market with a 41%industry share in 2024 because most industries and cities must clean used water before releasing or reusing it. This process needs many types of chemicals like coagulants, pH adjusters, and defoamers. Europe has strict wastewater rules, so factories spend more on these treatments. Industrial zones often share one treatment plant to reduce costs, creating a large chemical demand.

- The boiler & cooling water treatment segment is expected to grow at a rapid rate because clean water is key to energy efficiency. If scaling or rust builds up, it wastes energy and damages equipment. With Europe focusing on low-carbon power, industries are investing more in advanced treatment systems to save energy.

- The raw water treatment segment is also notably growing because Europe is running low on clean freshwater.

- Many factories now use rivers or reused water which contain impurities. Chemicals like coagulants and antiscalants help remove these impurities before water is used in processes

End User Insights

How did the Municipal Water Utilities Segment Dominate the Europe Water Treatment Chemicals Market in 2024?

- The municipal water utilities segment dominated the market with 35% industry share in 2024 market because they handle huge amounts of water for cities and towns. They buy treatment chemicals regularly in large quantities and have long-term contracts with suppliers. Their main goal is to provide safe, clean water to people and industries. Many

- European utilities are now adopting greener and safer chemical blends to reduce environmental impact.

The power generation segment is expected to grow at a significant rate because clean water is essential for running turbines and boilers efficiently. Even small impurities can cause serious equipment damage. As Europe moves to renewable and cleaner energy systems, modern plants are using advanced water treatment chemicals to prevent downtime. - The food and beverages segment is also notably growing, because clean and safe water is necessary for product quality. Companies are reusing water to cut costs and meet sustainability goals. They need gentle, food-safe chemicals that don't affect taste or safety. Breweries, dairies, and juice plants are adopting biocides that are non-toxic and easy to rinse out.

Source Insights

How did the Wastewater & Effluent Treatment Segment Dominate the Europe Water Treatment Chemicals Market in 2024?

- The wastewater & effluent treatment segment dominated the market with 58% industry share in the 2024 market, because these streams contain the most dirt, oil, and heavy metals. They need multiple treatment steps, which use a lot of chemicals. Industrial areas with shared effluent treatment plants buy chemicals in bulk, keeping the market strong.

- The freshwater treatment segment is expected to grow at a significant rate because Europe's clean water sources are becoming more polluted. Many factories must treat water before use to remove microplastics, minerals, and organic matter. Companies are now using eco-friendly oxidants and carbon-based adsorbents for better purification.

Technology Insights

Why does the Manual Dosing Segment Dominate the Europe Water Treatment Chemicals Market?

- The manual dosing segment dominated the market with 63% industry share in 2024 because it's simple, affordable, and easy to control. Many small factories in Europe still prefer adjusting chemical levels by hand, as it doesn't require automation systems or expensive sensors. Operators can make quick changes based on water quality tests.

- The automated/smart dosing segment is expected to grow at a rapid rate because it's more accurate and efficient than manual control. These systems automatically adjust chemical levels using real-time sensors. This helps reduce waste, save money, and ensure water quality stays stable.

Country Insights

Germany Water Treatment Chemicals Market Trends

Germany dominated the Europe water treatment chemicals market with a 26% industry share, owing to the presence of a greater manufacturing base, strong chemical industry, and implementation of the sustainability standards. Moreover, the German manufacturers have heavily associated with retrofit, which has maintained demand for the water treatment chemicals in recent years. Moreover, the German cluster models and small suppliers near the industrial hubs have received immense attention to the country in the past few years.

France Water Treatment Chemicals Market Analysis

France is expected to capture a major share of the Europe water treatment chemicals market because it's investing heavily in new industries like semiconductors, pharmaceuticals, and renewable energy - all of which need pure water. The French government supports green chemical manufacturing and water reuse projects through incentives. Many local companies are developing smart, ready-to-use treatment kits for export.

Recent Developments

- In September 2025, CTECH Europe introduced its latest technology for water purification, which is called PFAS purification. Moreover, this technology has been produced in collaboration with AA Environmental, as per the published report.(Source: www.ctech-europe.com)

Top Vendors in the Europe Water Treatment Chemicals Market & Their Offerings:

Kemira Oyj

Corporate Information

- Name: Kemira Oyj (listed on Nasdaq Helsinki)

- Headquarters: Helsinki, Finland

- Industry focus: Chemicals for water-intensive industries, including water treatment, pulp & paper, fiber, packaging & hygiene.

- Recent scale: In 2024, revenue around EUR 2.9 billion and over 5,000 employees.

History and Background

- Founded: 1920, and over time evolved from broader chemicals/fertilizer business into specialized industrial chemicals.

- Over the years shifted increasingly into water-intensive industries and sustainable solutions.

- Historically part of Finnish industrial chemicals heritage; has transformed business units and strategy in recent years.

Key Developments and Strategic Initiatives

- In August 2024 Kemira announced a major renewal of its operating model and Management Board, to accelerate growth strategy, increase customer centricity, speed of delivery and value creation.

- In October 2024 they started change negotiations in Finland wrt the new organization, targeting more streamlined structure and better strategic focus.

Mergers & Acquisitions

- In the Q3 2025 interim report, Kemira announced acquisition of Water Engineering, Inc. (US-based industrial water treatment services company) to expand Water Solutions business into industrial water treatment services.

(Earlier) Investment/expansion of capacities (e.g., chlorate production) and R&D facility expansion: Eg. 2018 loan for chlorate and R&D EUR 90 million.

Partnerships & Collaborations

- Partnership with International Flavors & Fragrances Inc. (IFF) to produce biobased materials via their DEB™ (Designed Enzymatic Biomaterial) platform. Joint investment ~EUR 130 million for a production facility in Finland.

- Collaboration with Bluepha Co., Ltd. on PHA (polyhydroxyalkanoate) in sustainable packaging coatings for APAC region; push into PFAS-free, renewable barrier coatings.

Product Launches / Innovations

- Completed an industrial-scale polymer plant in Finland based on the DEB™ technology (with IFF) in Sept 2024, producing renewable polymers for paper, board and water treatment applications.

- Innovation in digital water treatment services: Eg. “KemConnect® Raw Water Treatment” service offering real-time monitoring and dynamic chemical dosing for pulp & paper/water treatment operations.

Key Technology Focus Areas

- Water treatment chemistry and services (coagulants, polymers, antiscalants, digital dosing etc) for industries and municipal markets.

- Renewable/biobased materials: building alternatives to fossil-based chemicals via DEB™ platform, PHA coatings, etc.

- Digital services and analytics: Using real-time data, AI, and digital tools to optimise chemical dosage, water quality monitoring, etc.

R&D Organisation & Investment

- Kemira has significant R&D investment: For example, a EUR 50 million loan from Nordic Investment Bank (NIB) to finance R&D investments during 2023-2026 in Espoo, Finland; focused on pulp & paper and water treatment industry solutions.

- Kemira’s R&D organisation: According to their innovation story, in 2023 they filed 55 new inventions, and led their industry reference group in patent filings in Finland.

SWOT Analysis

Strengths

- Strong specialization in water-intensive industries and water treatment chemistry, which is increasingly critical globally.

- Proven track record of innovation (patents, R&D investment) and strategic repositioning towards sustainability/renewables.

- Global footprint with strong European presence and growth ambitions.

- Clear strategic focus on growth areas: water solutions, renewables, digital services.

Weaknesses

- Exposure to cyclical industries (e.g., pulp & paper) which may face slowdowns or structural changes.

- Transition to new operating model and business units may involve execution risk (restructuring, cost, organizational change).

- Dependency on raw materials and chemicals markets which face volatility (commodities, regulation, supply chain).

Opportunities

- Growth in demand for water treatment chemicals and services (municipal, industrial) due to regulation, sustainability pressure, climate change.

- Expanding into renewable/biobased material markets (e.g., packaging, molded fiber, barrier coatings) offers new growth vectors.

- Digital services and AI/analytics in water and chemical dosing present value-added service opportunities beyond traditional product sales.

- M&A and geographic expansion in emerging markets, service businesses (industrial water services) could add scale and diversify revenue.

Threats

- Regulatory risks: chemical industry increasingly subject to stringent environmental, health & safety, and chemical substance regulations (e.g., PFAS restrictions).

Commodity input cost volatility and energy cost pressure, especially given chemical production’s high energy intensity. - Competitive pressure from large global chemical players and potential new entrants in specialty water / renewable chemistry space.

- Market softness in key end-markets (e.g., paper/pulp) could reduce demand or margin pressure.

Recent News & Strategic Updates

- October 2025: Kemira secured a EUR 50 million loan from NIB to build a new biomaterials production facility in Finland in partnership with IFF, as part of its renewable solutions strategy.

- January-September 2025 Interim Report: Kemira reported improved operative EBITDA margin of 13.6% driven by sales mix and cost management. Acquired Water Engineering, Inc. to expand industrial water treatment services; partnership with CuspAI announced; investment approved for activated carbon reactivation plant in Sweden.

Other Key Players

- BASF SE: s a leading chemical company, BASF provides a range of water treatment chemicals, including flocculants and antiscalants, to municipal and industrial customers throughout Europe.

- Ecolab: Through its Nalco Water division, Ecolab is a significant player in the global water treatment chemical market with a strong European presence, providing specialized solutions to a wide array of industries.

- Solenis LLC: A global provider of water and hygiene solutions, offering a broad portfolio of water treatment chemistries and technologies to industries throughout Europe.

- Veolia Water Technologies

- Kurita Europe GmbH

- SNF Floerger

- Arkema S.A.

- Dow Chemical Company

- Nouryon

- SUEZ Group

- Baker Hughes Company

- Italmatch Chemicals S.p.A.

- Solvay S.A.

- Lenntech B.V.

Segments Covered in the Report

By Product Type

- Coagulants & Flocculants

- Aluminum sulfate, ferric chloride, PAC

- Polyacrylamide and cationic polymers

- Corrosion & Scale Inhibitors

- Phosphonates and organophosphates

- Polycarboxylates and azoles

- Biocides & Disinfectants

- Chlorine and chlorine dioxide

- Non-oxidizing biocides and quaternary ammonium compounds

- pH Adjusters & Softeners

- Acids, alkalis, and lime formulations

- Chelating agents (EDTA, NTA)

- Others (Defoamers, oxygen scavengers)

By Application

- Raw Water Treatment

- Clarification and sedimentation aids

- Pre-filtration conditioning chemicals

- Boiler & Cooling Water Treatment

- Scale and corrosion control additives

- Condensate polishing and oxygen scavenging

- Wastewater Treatment

- Coagulation–flocculation and sludge thickening

- Odor control and nutrient removal agents

- Process Water Treatment

- Food-grade and pharmaceutical-grade applications

- CIP (Clean-in-Place) sanitation

By End-Use Industry

- Municipal Water Utilities

- Drinking water and sewage treatment

- Urban wastewater reclamation

- Power Generation

- Thermal plant boiler feedwater

- Cooling tower and condensate systems

- Oil & Gas / Petrochemical

- Refining and produced-water treatment

- Downstream cooling and injection systems

- Food & Beverage

- Ingredient and process water purification

- Effluent management

- Pulp & Paper

- Fiber washing and bleaching stages

- Effluent clarification and reuse

By Source Type

- Freshwater Treatment Chemicals

- Groundwater and surface water conditioning

- Pre-filtration and disinfection systems

- Wastewater & Effluent Treatment Chemicals

- Sludge management and odor control

- Heavy-metal precipitation and flocculation

By Technology Integration

- Manual Chemical Dosing

- Conventional pump and batch dosing systems

- Operator-monitored chemical adjustments

- Automated / Smart Dosing Systems

- Real-time pH and turbidity feedback

- AI-based dosing optimization and leak detection