Content

U.S. Pressure Vessels Market Size, Share and Industry Analysis

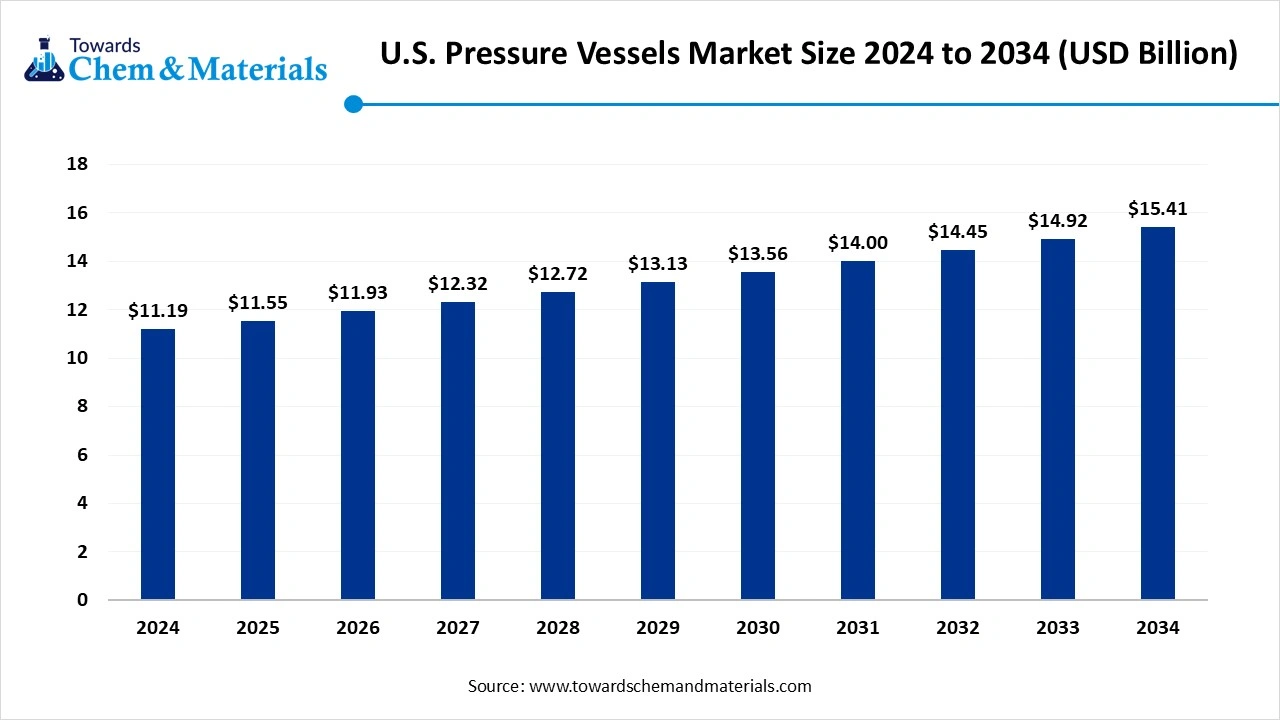

The U.S. pressure vessels-market size was valued at USD 11.19 billion in 2024, grew to USD 11.55 billion in 2025, and is expected to hit around USD 15.41 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.25% over the forecast period from 2025 to 2034. The rapid expansion of the oil & gas and chemical industries is the key factor driving market growth. Also, the ongoing development of hydrogen-based economies, coupled with the growing trend towards energy efficiency, can fuel market growth further.

Key Takeaways

- By material, the carbon steel segment dominated the market with a 48% share in 2024. The dominance of the segment can be attributed to its robust properties and cost-effectiveness with growing energy demand.

- By material, the composites segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing demand for more durable and lightweight storage for clean energy applications.

- By pressure class, the medium pressure segment held a 45% market share in 2024. The dominance of the segment can be linked to the growing product demand from escalating energy infrastructure.

- By pressure class, the high-pressure segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing investment in large-scale infrastructure projects like water treatment plants, etc.

- By application, the storage vessels segment dominated the market by holding a 38% share in 2024. The dominance of the segment is owed to the stringent government safety standards and regulations across different industries.

- By application, the heat exchangers segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the robust infrastructure expansion and industrialization.

- By end-use industry, the oil & gas segment held a 35% market share in 2024. The dominance of the segment can be attributed to the surge in oil and gas production and growing investments in energy infrastructure.

- By end-use industry, the renewable energy & hydrogen segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the growing adoption of hydrogen fuel cell vehicles and the innovations in materials science.

Technological Advancements Are Expanding Market Growth

Pressure vessels are engineered enclosures designed to contain gases, vapours, or liquids at internal or external pressures different from ambient, fabricated under applicable codes such as ASME, and used for storage, processing, or transport across industries. Innovations in materials science, like the adoption of stronger, lighter, and more durable composite materials, improve the efficiency and performance of pressure vessels.

What Are the Key Trends Influencing the U.S. Pressure Vessels Market?

- Growing demand for energy generation, especially from renewable sources like wind and solar power, is the latest trend in the market. The transition towards cleaner energy requires advanced pressure vessels that can bear high temperatures and pressures related to renewable energy technologies.

- The rapid advancements in production technologies like additive manufacturing, also called 3D printing, are transforming the production of pressure vessels in the market. Also, major companies are heavily investing in innovative technologies, which leads to more customized and efficient pressure vessel solutions for different applications.

- The ongoing trend towards lightweight materials is fuelled by growing pressure vessel use in the automotive industry, along with the need for efficient fuel storage, particularly for hydrogen fuel cells and natural gas vehicles. Advancements in materials, design, and fabrication can lead to the development of safer, efficient, and specialized pressure vessels.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 11.55 Billion |

| Expected Size by 2034 | USD 15.41 Billion |

| Growth Rate from 2025 to 2034 | CAGR 3.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Material, By Pressure Class, By Application / Product Type, By End-use Industry, |

| Key Companies Profiled | Chart Industries, Worthington Enterprises , Pentair , CST Industries , TransTech Energy , Rexarc International , Houston Vessel Manufacturing , Hanson Tank (Roy E. Hanson Jr. Mfg.) , Gulf Coast Alloy Welding , Modern Welding Company , Boardman Inc. , Alloy Products Corporation , Vector Systems , Precision Custom Components, Monarca Technical , Steelhead Composites , Infinite Composites Technologies, Luxfer Gas Cylinders , NPROXX , Bendel Tank & Heat Exchange |

Market Opportunity

Increasing Adoption of Advanced Materials

The market is rapidly adopting more advanced materials like alloys, composites, and hybrid materials to improve safety, performance, and durability. Furthermore, this shift is largely fuelled by industries such as automotive, aerospace, and hydrogen storage, where minimizing weight while keeping structural integrity is crucial, creating lucrative opportunities in the market soon.

Market Challenge

Economic Uncertainty

Geopolitical tensions, macroeconomic conditions, and inflationary pressures can affect investment patterns in major sectors such as petrochemicals, power generation, and oil and gas, which is the key factor hindering market growth. Moreover, some projects can be postponed or delayed during periods of economic uncertainty, affecting the demand for pressure vessels.

Country Insight

U.S. Pressure Vessels Market Trends

The South region dominated the market with a 40% share in 2024. The dominance of the region can be attributed to the growing demand for energy, along with the expansion of the petrochemical and chemical sectors. In addition, robust infrastructure projects, especially in the chemical, oil and gas, and power generation sectors, promoted by increasing investment in energy and production, can propel regional growth further.

The West region is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing pressure vessel demand from the growing energy sectors, coupled with the rapid industrialization in the manufacturing and chemical sectors. Furthermore, ongoing investment in industrial facilities and energy infrastructure across the country directly contributed to market expansion.

Segmental Insight

Material Insight

Which Material Type Segment Dominated the U.S. Pressure Vessels Market in 2024?

The carbon steel segment dominated the market in 2024. The dominance of the segment can be attributed to its robust properties and cost-effectiveness, with growing energy demand and industrial growth in sectors such as power generation and petrochemicals. Additionally, Carbon steel's high durability, tensile strength, and affordability make it a favourable material for pressure vessels in different applications.

The composites segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing demand for more durable and lightweight storage for clean energy applications such as CNG transport and fuel cell vehicles. Moreover, the use of composites can also facilitate material savings, further improving the economic viability and appeal of these cutting-edge storage solutions.

Pressure Class Insight

Why Medium Pressure Segment Dominated The U.S. Pressure Vessels Market In 2024?

The medium pressure segment held the largest market share in 2024. The dominance of the segment can be linked to the growing product demand from escalating energy infrastructure, especially power generation and oil and gas. Also, advancements in high-performance alloys and other materials can improve the safety of pressure vessels, supporting their adoption further.

The high-pressure segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing investment in large-scale infrastructure projects like water treatment plants, etc. The expansion of the petrochemical and chemical sector requires high-grade pressure vessels for processing, storing, and transporting harmful substances under specific pressure conditions.

Application Insight

How Much Share Did the Storage Vessels Segment Held in 2024?

The storage vessels segment dominated the market in 2024. The dominance of the segment is owed to the stringent government safety standards and regulations across different industries, which require the adoption of high-quality and advanced storage vessels. Furthermore, the construction and operation of new thermal, nuclear, and renewable power plants are creating lucrative demand for pressure vessels soon.

The heat exchangers segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the robust infrastructure expansion and the industrialization, especially in the petrochemical, chemical, and power generation sectors. Heat exchangers are crucial in processes necessitating the handling of extreme temperatures and pressures in various industries.

End-Use Industry Insight

Which End use Industry Segment Dominated the U.S. Pressure Vessels Market in 2024?

The oil & gas segment held the largest market share in 2024. The dominance of the segment can be attributed to the surge in oil and gas production, growing investments in energy infrastructure, and the need for reliable transportation and storage of high-pressure fluids. Innovations in material science and production processes are leading to the development of more durable, lighter, and more corrosion-resistant pressure vessels.

The renewable energy & hydrogen segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the growing adoption of hydrogen fuel cell vehicles and the innovations in materials science, such as lightweight carbon composites, which improve performance and safety. Furthermore, hydrogen is crucial for storing intermittent renewable energy sources, which fuels the demand for pressure vessels.

U.S. Pressure Vessels Market Value Chain Analysis

- Feedstock Procurement: It refers to the acquisition of the raw materials required for the production and fabrication of pressure vessels.

- Chemical Synthesis and Processing: This stage refers to the demand for pressure vessels by the petrochemical and chemical industries. These vessels are a crucial component used to contain and control chemical reactions.

- Packaging and Labelling: It is a compulsory certification and marking needed for pressure vessels, along with the practical packaging for safe transport.

- Regulatory Compliance and Safety Monitoring: This is an important stage due to inherent hazards related to high-pressure systems. Periodic inspections are crucial for ensuring vessel safety.

Recent Development

- In November 2024, Siemens launched its fluorinated-gas-free gas-insulated switchgear in the United States market. This switchgear has a lower carbon footprint and supports an arc-resistant design to help minimize the equipment and personnel safety.(Source: www.siemens.com)

U.S. Pressure Vessels Top Companies

- Chart Industries

- Worthington Enterprises

- Pentair

- CST Industries

- TransTech Energy

- Rexarc International

- Houston Vessel Manufacturing

- Hanson Tank (Roy E. Hanson Jr. Mfg.)

- Gulf Coast Alloy Welding

- Modern Welding Company

- Boardman Inc.

- Alloy Products Corporation

- Vector Systems

- Precision Custom Components

- Monarca Technical

- Steelhead Composites

- Infinite Composites Technologies

- Luxfer Gas Cylinders

- NPROXX

- Bendel Tank & Heat Exchange

Segments Covered

By Material

- Carbon steel

- Low-alloy steel

- Stainless steel (304/316/316L)

- Duplex / Super-duplex stainless steel

- Nickel alloys (Inconel, Hastelloy, Monel)

- Aluminum alloys

- Composites (FRP, filament-wound carbon/Glass)

- Clad / Lined (metal-clad, glass-lined, rubber-lined)

By Pressure Class

- Low pressure (≤10 bar / ≤145 psi)

- Medium pressure (10–100 bar / 145–1450 psi)

- High pressure (100–1000 bar / 1450–14,500 psi)

- Ultra-high pressure (>1000 bar / >14,500 psi)

By Application / Product Type

- Storage vessels (gas/liquid storage)

- Process reactors

- Separators (two-phase, three-phase)

- Heat exchangers (pressure shells)

- Autoclaves / Sterilizers

- Air receivers / Accumulators

- Cylinders (portable, DOT/ISO rated)

- Filters / Filter housings

- Surge vessels / Knockout drums

- Scrubbers / Absorbers

By End-use Industry

- Oil & Gas (upstream, midstream, downstream)

- Petrochemical & Chemical processing

- Power generation (thermal, nuclear)

- Renewable energy & Hydrogen (electrolyzers, H₂ storage)

- Industrial gases & Cryogenics (LNG, LOX, LIN, LAR)

- Food & Beverage

- Pharmaceutical & Biotech

- Water & Wastewater treatment

- Mining & Minerals

- Marine & Shipbuilding

- Aerospace & Defense

- Construction & HVAC