Content

What is the Current U.S. Bioplastics Market Size and Share?

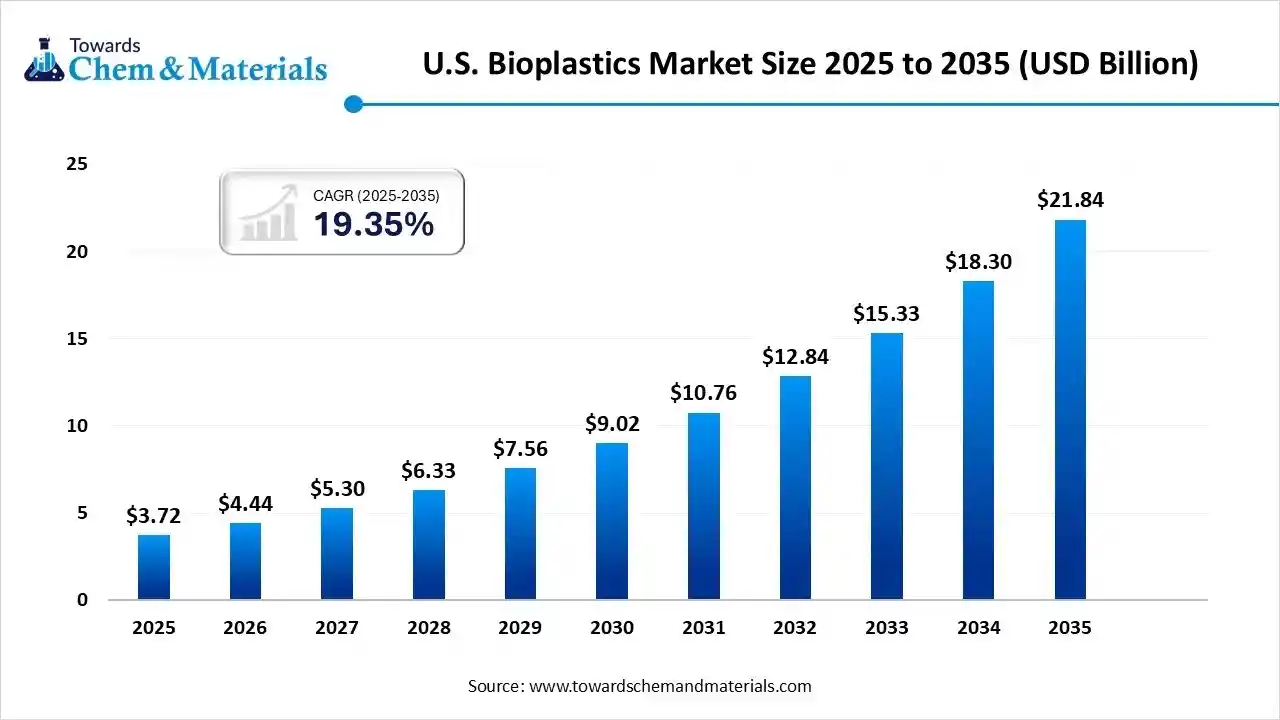

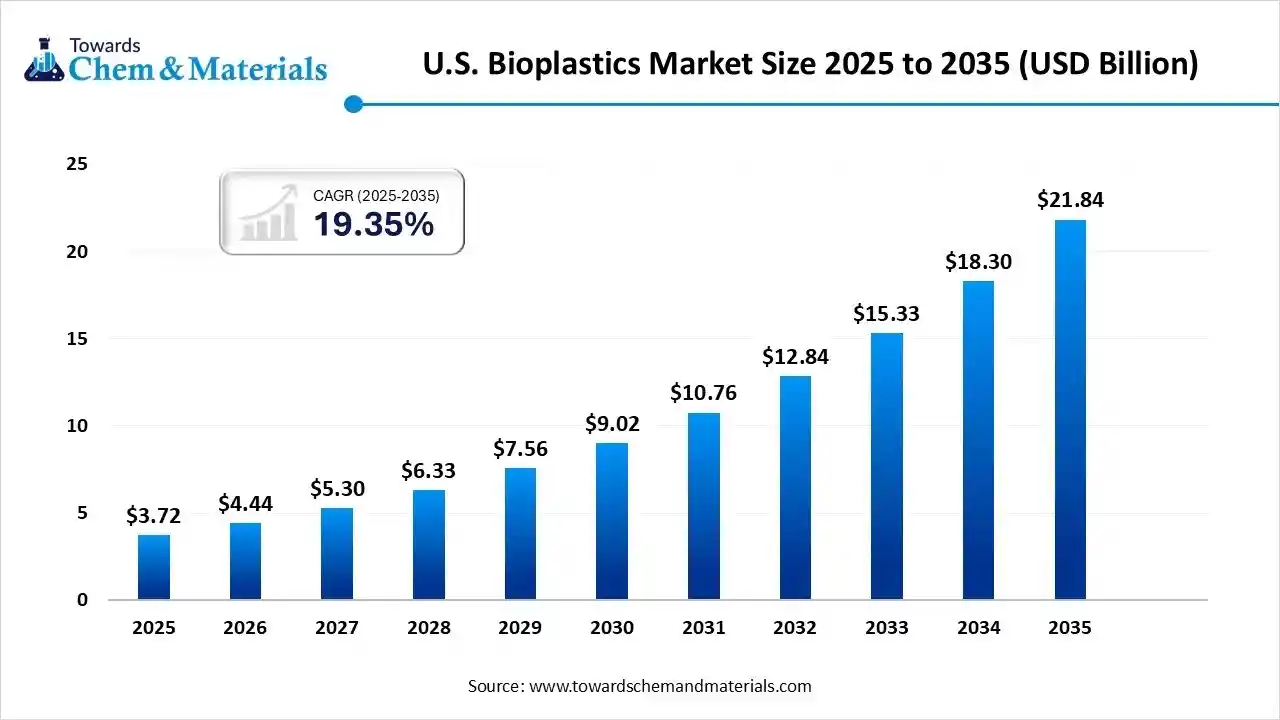

The U.S. bioplastics market size is calculated at USD 3.72 billion in 2025 and is predicted to increase from USD 4.44 billion in 2026 and is projected to reach around USD 21.84 billion by 2035, The market is expanding at a CAGR of 19.35% between 2026 and 2035. The growing environmental awareness and high availability of renewable feedstocks drive the market growth.

Key Takeaways

- By product, the biodegradable segment held a 55% share of the market in 2025.

- By product type, the non-biodegradable segment is growing at the fastest CAGR in the market during the forecast period.

- By application, the packaging segment held a 61% share of the market in 2025.

- By application, the automotive & transportation segment is expected to grow at the fastest CAGR in the market during the forecast period.

Why is the U.S. Bioplastics Market Growing?

The U.S. bioplastics market is growing due to a strong focus on minimizing carbon footprint, increasing awareness about environmental issues, stricter regulations on plastic pollution, the growing packaging industry, increasing demand for consumer goods, and innovations in bioplastics.

California is leading in bioplastics due to the presence of robust recycling programs and stringent single-use plastics regulations. Texas consists of raw materials to produce bioplastics. The growing sectors like agriculture, rigid packaging, flexible packaging, and automotive increase demand for bioplastics.

Bioplastics are plastics made up entirely or partially from renewable resources like starches, corn, cellulose, and sugarcane. They can be biodegradable or non-biodegradable. Bioplastic offers good water resistance and barrier protection. Bioplastics are widely used in bottles, takeout boxes, under-the-hood vehicle components, disposable cutlery, straws, phone casings, medical sutures, drug delivery systems, 3D printing materials, implants, plates, and cups.

U.S. Bioplastics Market Trends:

- Renewable Feedstocks Availability: The high availability of renewable raw materials like sugarcane, forestry byproducts, corn, sugar beets, agricultural residues, and organic wastes in states like California, North Carolina, Iowa, Texas, North Dakota, and Georgia increases the manufacturing of bioplastics.

- Growing Automotive Sector: The strong focus of automakers on lowering emissions and enhancing fuel efficiency of vehicles increases demand for bioplastics. The growing development of lightweight vehicle parts, interior components, and exterior components requires bioplastics.

- Stringent Regulations: The stricter restriction on single-use plastics in states like Washington, California, & New York, and federal programs like USDA’s Biopreferred Program, increases the use of alternatives like bioplastics.

- Corporate Demand: The strong focus on lowering carbon footprint and ambitious sustainability goals in the corporate setting increases demand for bioplastics. The company's focus on enhancing brand image and commitment to social responsibility increases the adoption of bioplastics.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 4.44 Billion |

| Revenue Forecast in 2035 | USD 21.84 Billion |

| Growth Rate | CAGR 19.35% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Segments covered | By Product, By Application, |

| Key companies profiled | NatureWorks LLC, Trinseo, Danimer Scientific, AgroRenew, Green Dot Bioplastics, Genomatica, Dow Inc., Hallstar Industrial, Amcor Rigid Plastics USA, LLC, Glycosbio, Lanzatech, Myriant |

Key Technological Shifts in the U.S. Bioplastics Market:

The U.S. bioplastics market is undergoing key technological shifts driven by the demand for sustainable products, environmental issues, and regulatory compliance. The technological innovations, like advanced manufacturing processes, novel feedstock use, and catalytic processes, help to reduce manufacturing costs and improve the properties of bioplastics. The major technological shift is the integration of artificial intelligence (AI) enables the development of high-performance materials.

AI accelerates the discovery process of new bioplastics and reduces the waste of materials. It optimizes the manufacturing process and minimizes the consumption of energy. AI automatically detects the flaws and helps to design recyclable plastics. AI enhances supply chain logistics operations and designs customizable bioplastic products. Overall, AI helps to overcome challenges like performance limitations and high production costs by accelerating material discovery and optimizing the manufacturing process.

- For instance, B2En collaborated with Reborn Materials to launch an AI-driven initiative for bio-plastic innovation.

Trade Analysis of U.S. Bioplastics Market: Import & Export Statistics

- The United States exported 15 shipments of bioplastics.

- The United States imported 159 shipments of bioplastics.

- The United States exported 19 shipments of biodegradable plastic.

- The United States imported 476 shipments of biodegradable plastic.

U.S. Bioplastics Market Value Chain Analysis

- Feedstock Procurement : Feedstock procurement is the sourcing of raw materials like sugarcane, soybeans, wheat straw, food waste, corn, wheat, wood chips, and used cooking oil to produce bioplastics.

- Key Players:- Danimer Scientific, Cargill, Incorporated, NatureWorks LLC, Eastman Chemical Company, Green Dot Bioplastics, Inc.

- Chemical Synthesis and Processing: The chemical synthesis and processing involve steps like the preparation of feedstocks, fermentation, purification, monomer isolation, polymerization, compounding, and processing using techniques like blow molding, extrusion, & injection molding.

- Key Players:- Eastman Chemical Company, Green Dot Bioplastics, Inc., NatureWorks LLC, Dow Inc., LanzaTech, ADM, Applied Bioplastics

- Quality Testing and Certifications: Quality testing involves testing of properties like biodegradability, tensile strength, rheology, morphology, chemical composition, biobased content, & compostability and certifications like Home Compostable Certifications, ASTM D6400, BPI, & ASTM D6868.

- Key Players:- Intertek, TUV Rheinland, Eurofins Scientific, UL Solutions, Anacon Laboratories

Green Growth: State-by-State Breakdown of America’s Bioplastic Industry

| State | Feedstock Available | Major Companies Present |

| California |

|

|

| Ohio |

|

|

| Texas |

|

|

| Louisiana |

|

|

| Minnesota |

|

|

Segmental Insights

Product Insights

Why the Biodegradable Segment Dominates the U.S. Bioplastics Market?

The biodegradable segment dominated the U.S. bioplastics market with a 55% share in 2024. The growing awareness about environmental issues and corporate sustainability goals increases demand for biodegradable products. The stringent government regulations on single-use plastics and a focus on minimizing greenhouse gas emissions increase demand for biodegradable products. The availability of renewable biomass sources like cassava, corn starch, and sugarcane increases the production of biodegradable products, driving the overall market growth.

The non-biodegradable segment is growing at the fastest CAGR in the market during the forecast period. The growing consumer demand for sustainable products and a well-established recycling infrastructure increases demand for non-biodegradable products. The growing production of construction materials, automotive components, and electronic materials increases the adoption of non-biodegradable products. The rapid growth in industries like consumer goods and packaging requires non-biodegradable plastics, supporting the overall market growth.

Application Insights

Which Application held the Largest Share in the U.S. Bioplastics Market?

The packaging segment held the largest revenue share of 61% in the U.S. bioplastics market in 2024. The growing consumer demand for rigid packaging and flexible packaging requires bioplastics. The rapid growth in online shopping and the rise in the development of eco-friendly packaging increase demand for bioplastics. The increased production of wraps, pouches, jars, trays, bottles, bags, sachets, cups, and containers requires bioplastics. The growing packaging demand across industries like pharmaceuticals, cosmetics, and food & beverage requires bioplastics, supporting the overall market growth.

The automotive & transportation segment is experiencing the fastest growth in the market during the forecast period. The strong focus on enhancing fuel efficiency and lowering the weight of vehicles increases demand for bioplastics. The rise in the adoption of electric vehicles and the development of lightweight vehicle parts require bioplastics. The automakers' focus on lowering their carbon footprint and increasing manufacturing of durable interior trims, under-the-hood parts, & heat-resistant engine components requires bioplastics, supporting the overall market growth.

The textile segment is significantly growing in the market. The growing consumer demand for sustainable home textiles and apparel increases demand for bioplastics. The increasing issues like high carbon footprint and landfill waste in the clothing industry increase demand for bioplastics. The strong focus on enhancing the production efficiency and fiber quality of textiles increases the adoption of bioplastic fibers like PHA & PLA, supporting the overall market growth.

State-Level Insights

Green Gold Rush: California Leading Force Behind Bioplastic Revolution

California is a major contributor to the market. The stringent environmental regulations, like bans on single-use plastics and growing eco-conscious consumers, increase demand for bioplastics. The compostable packaging mandates and corporate compliance require bioplastics. The research & development institutes like UCSB, University of California, Stanford, UC Davis increase the production of bioplastics, supporting the overall market growth.

From Oil to Bioplastics: Texas Sustainable Evolution

Texas is a key contributor to the market. The well-established petrochemical base and presence of abundant feedstocks like cotton gin trash, corn, & sugarcane increase the production of bioplastics. The growing research at Texas Tech University and the University of Houston increases the production of advanced bioplastics. The strong presence of chemical manufacturers like Chevron Philips, Dow Inc., and ExxonMobil are heavily investing in sustainable products, supports the growth of the bioplastic industry.

Heartland to Green Land: Ohio’s Role in Bioplastic Manufacturing

Ohio is substantially growing in the market. The well-established agricultural base and high availability of plant-based raw materials like hemp, corn, & soy increase the production of bioplastics. The growing demand for sustainable packaging and corporate sustainability initiatives increases demand for bioplastics. The strong focus on lowering fossil fuel reliance increases the adoption of bioplastics, supporting the overall market growth.

Recent Developments

- In May 2025, Intec Bioplastics Inc. launched the sustainable packaging EarthPlus Hercules Bioflex Stretch Wrap. The packaging is made up of 35% renewable plant-based materials and focuses on achieving a net-zero carbon footprint. (Source: www.waste360.com)

- In November 2024, Accredo Packaging collaborated with Fresh-Lock Closures to launch a 100% bioplastic resin pouch and zipper closure. The pouch is made up of sugarcane-derived polyethylene and applicable in industries like healthcare, food, & personal care. (Source: www.plasticstoday.com)

- In August 2025, Cortec launched compostable bioplastic packaging film, Eco Works 100. The bioplastic lowers petroleum dependency and maximizes biobased content. The packaging bags are useful in diverse applications like commercial, shopping, industrial, and waste disposal.(Sources: packagingeurope.com)

Companies List

- NatureWorks LLC: The company is the leading manufacturer of bioplastics and produces polylactic acid to support industrial applications like food serviceware, 3D printing filaments, packaging, & textiles.

- Trinseo: The company manufactures biodegradable polymers and biodegradable thermoplastic bioplastics to serve applications like appliances, footwear, medical devices, automotive parts, packaging, fashion, and personal care products.

- Danimer Scientific: The company manufactures compostable and biodegradable biopolymers like Nodax to produce diverse everyday products like fibers, aqueous coatings, films, additives, and injection-molded articles.

- AgroRenew: The company manufactures 100% biodegradable plastics using feedstocks like cover crops and crop food waste to contribute to sustainability.

- Green Dot Bioplastics: The company manufactures new bioplastic resins and offers diverse bioplastic products like compostable materials, natural fiber reinforced-composites, & biocomposites to support various applications.

Top Companies in the U.S. Bioplastics Market

- Green Dot Bioplastics

- AgroRenew

- Danimer Scientific

- Trinseo

- NatureWorks LLC

- Genomatica

- Dow Inc.

- Hallstar Industrial

- Amcor Rigid Plastics USA, LLC

- Glycosbio

- Lanzatech

- Myriant

Segments Covered

By Product

- Biodegradable

- Polylactic Acid

- Starch Blends

- Polybutylene Adipate Terephthalate (PBAT)

- Polybutylene Succinate (PBS)

- Others

- Non-biodegradable

- Polyethylene

- Polyethylene Terephthalate

- Polyamide

- Polytrimethylene Terephthalate

- Others

By Application

- Packaging

- Agriculture

- Consumer Goods

- Textile

- Automotive & Transportation

- Building & Construction

- Others