Content

U.S. Industrial Adsorbents Market Size, Share & Industry Analysis

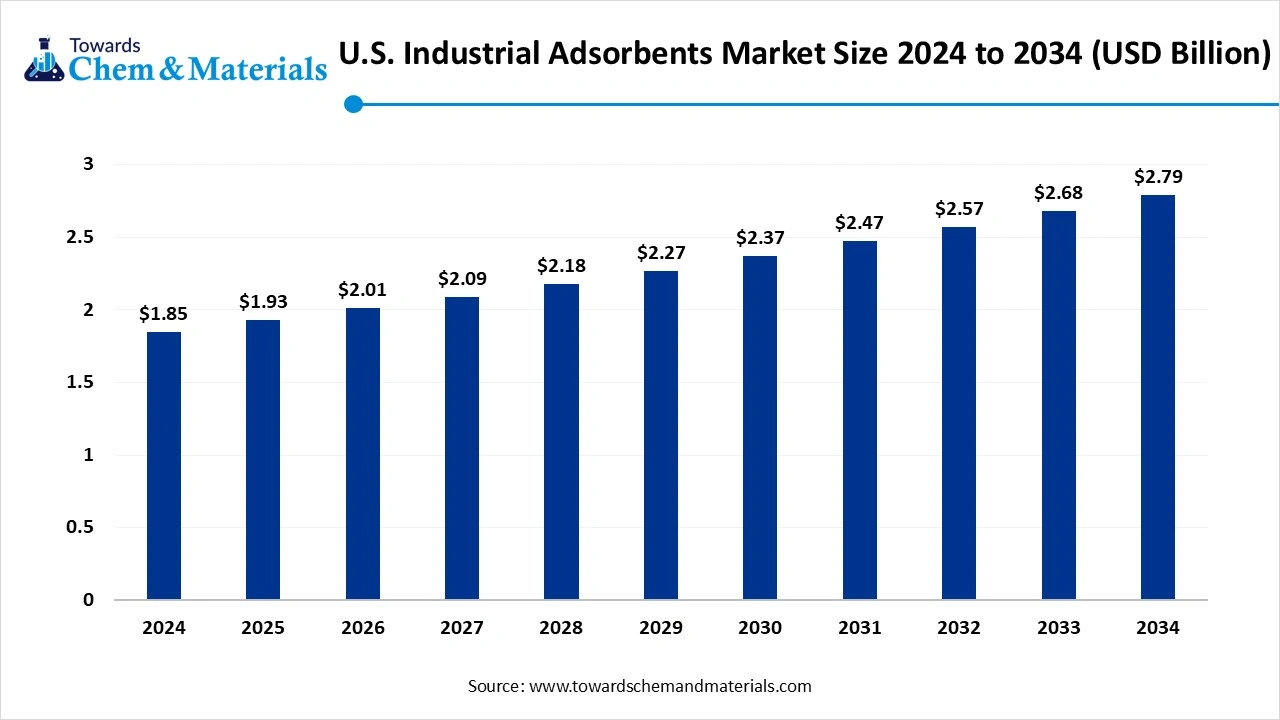

The U.S. industrial adsorbents market size was valued at USD 1.19 billion in 2024, grew to USD 1.26 billion in 2025, and is expected to hit around USD 2.18 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.25% over the forecast period from 2025 to 2034. The well-established industrial infrastructure, focus on sustainability, and stricter environmental regulations drive the market growth.

Key Takeaways

- South held a 35% share in the U.S. industrial adsorbents market in 2024 due to the well-developed petrochemical base.

- West is growing at the fastest CAGR in the market during the forecast period due to the strong presence of the manufacturing industry.

- By product type, the activated carbon segment held a 40% share in the U.S. industrial adsorbents market in 2024 due to the exceptional adsorption capabilities.

- By product type, the MOFs & emerging materials segment is expected to grow at the fastest CAGR in the market during the forecast period due to the presence of a high surface area.

- By physical form, the granules/pellets segment held a 45% share in the U.S. industrial adsorbents market in 2024 due to ease of handling.

- By physical form, the coated substrates/cartridges segment is expected to grow at the fastest CAGR in the market during the forecast period due to the superior mechanical stability.

- By application, the gas separation segment held a 25% share in the U.S. industrial adsorbents market in 2024 due to the growing processing of natural gas.

- By application, the VOC/emission control segment is expected to grow at the fastest CAGR in the market during the forecast period due to the stricter environmental regulations.

- By grade, the industrial/technical grade segment held a 60% share in the U.S. industrial adsorbents market in 2024 due to the strong industrial base.

- By grade, the high-purity/electronics grade segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing demand for pharmaceutical products.

- By distribution channel, the direct sales segment held a 55% share in the U.S. industrial adsorbents market in 2024 due to the availability of technical consultation.

- By distribution channel, the online/e-commerce segment is expected to grow at the fastest CAGR in the market during the forecast period due to faster product delivery.

Market Overview+ Market Drivers+ Growth Factors

Industrial Adsorbents: Hidden Hero Behind U.S. Purification & Manufacturing

U.S. Industrial adsorbents are materials with a high porous structure and surface area used to remove substances from gas & liquid streams. They purify liquids & gases by removing unwanted compounds, impurities, and impurities. The common industrial adsorbents are zeolites, activated alumina, molecular sieves, activated carbon, polymer based adsorbents, silica gel, and many more. They are widely used for applications like air & gas purification, processing of food & beverages, catalysis of chemical reactions, wastewater treatment, refining petrochemicals, and environmental remediation.

Factors like stricter environmental regulations, technological advancements, a well-established petrochemical industry, growing demand for purification of oil & gas, and increasing investment in the development of high-quality adsorbents contribute to the growth of the U.S. industrial adsorbents market.

- According to OEC, the United States exported $505M of activated carbon in 2023.(Source: oec.world)

- According to OEC, the United States exported $519M of activated carbon in 2024.(Source: oec.world)

- According to Volza, the United States exported 894 shipments of activated alumina.(Source: www.volza.com)

- According to Volza, the United States exported 3425 shipments of silica gel.(Source: www.volza.com)

Growing Pharmaceutical Industry Surges Demand for Adsorbents

The increasing production of various pharmaceutical products and the growing pharmaceutical industry increase demand for adsorbents for various applications. The increasing production of temperature-sensitive therapeutics and the development of advanced drug delivery systems increase demand for adsorbents. The need for purification of enzymes, vaccines, antibiotics, & bulk drugs and formulations of new drugs requires adsorbents. The focus on preserving the quality of pharmaceuticals and purifying specific drug components increases demand for adsorbents.

The high investment in R&D and stricter regulations for drug formulations increase the adoption of adsorbents. The strong focus on personalised medicine and enhancing the safety of medicines requires adsorbents. The growing pharmaceutical industry is a key driver for the growth of the U.S. industrial adsorbents market.

Market Trends

- Stringent Environmental Regulations : The stringent environmental regulations for emissions, like the EPA, increase the adoption of adsorbents for the purification of gas, air, and water.

- Strong Industrial Base : The strong presence of industrial infrastructure increases demand for adsorbents for various purposes like carbon capture, water treatment, air separation, gas purification, and many more.

- Strong Focus on Sustainability : The increasing awareness about environmental concerns and strong focus on sustainability increases the adoption of adsorbents for purposes like enhancing resource reusability & minimizing waste.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 1.26 Billion |

| Expected Size by 2034 | USD 2.18 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Physical Form, By Application, By Purity / Grade, By Distribution Channel, By Region |

| Key Companies Profiled | Cabot Corporation, Kuraray (Calgon Carbon), W. R. Grace & Co., BASF SE, Evonik Industries, Clariant AG, Honeywell UOP, Zeochem AG, Tosoh Corporation, Mitsubishi Chemical Corporation, Albemarle Corporation, Solvay SA, 3M Company, LANXESS AG, Sibelco, Zeolyst International, Heraeus Holding GmbH, Johnson Matthey plc, Porex Corporation, Porocel / Saint-Gobain Ceramics |

Market Opportunity

Growing Oil & Gas Sector Creates Market Opportunity

The growing expansion of the oil & gas industry and booming shale gas extraction in the United States increase demand for adsorbents for diverse applications. The growing NGLs and natural gas processing increase demand for adsorbents for the separation of water content from gas. The growing need for high-quality fuels and stricter quality standards for fuels increases demand for adsorbents.

The increasing adoption of cleaner fuels and focus on controlling pollution require adsorbents. The strong focus on oil spill management and the need for drying natural gas increases the adoption of adsorbents. The strong focus on recovering oil from wastewater and the need for the separation of hydrocarbons in the oil & gas industry increases demand for adsorbents. The growing oil & gas sector unlocks an opportunity for the growth of the U.S. industrial adsorbents market.

Market Challenge

High Manufacturing Cost Shuts Down Market Growth

Despite several benefits of the industrial adsorbents in various industries across the United States, the high manufacturing cost restricts the market growth. Factors like manufacturing complexity, volatility in raw material prices, energy-intensive processes, high cost for R&D, and the need for specialized equipment are responsible for the high manufacturing cost. The complex manufacturing process, like molecular sieves, and the production of energy-intensive adsorbents require high cost.

The volatility in raw material prices like polymers, alumina, & silica gel, and the need for specialized equipment for adsorbent production, increase the cost. The stricter regulatory compliance and tariffs on imported raw materials increase the cost. The development of customized adsorbents and the need for specialized chemicals increase the cost. The high manufacturing cost hampers the growth of the U.S. industrial adsorbents market.

Regional Insights

South U.S. Industrial Adsorbents Market Trends

The South region dominated the U.S. industrial adsorbents market in 2024. The well-established petrochemical & oil & gas infrastructure increases demand for adsorbents for various processes. The stricter environmental regulations and focus on pollution control increase the adoption of adsorbents. The focus on effective industrial gas separation and the need for clean water increases demand for adsorbents. The strong presence of the pharmaceutical industry and growing natural gas processing increases demand for adsorbents, driving the overall growth of the market.

West U.S. Industrial Adsorbents Market Trends

The West region is experiencing the fastest growth in the market during the forecast period. The strong presence of energy, chemicals, and manufacturing sectors increases demand for adsorbents. The stricter environmental regulations and advancements in adsorbent technologies help the market growth. The growing demand for clean water and focus on air purification increases the adoption of adsorbents. The stricter fuel standards and growing investment in petrochemical plants by corporate companies support the overall growth of the market.

Segmental Insights

By Product Type

Why did the Activated Carbon Segment Dominate the U.S. Industrial Adsorbents Market?

The activated carbon segment dominated the U.S. industrial adsorbents market in 2024. The growing demand for water treatment and a strong focus on air purification increase the demand for activated carbon. The exceptional adsorption capabilities and stricter environmental regulations increase demand for activated carbon. The increasing production of refined petrochemical products and focus on energy storage increase demand for activated carbon. The presence of activated carbon in forms like granular and powdered drives the overall market growth.

The MOFs & emerging materials segment is the fastest-growing in the market during the forecast period. The presence of a high surface area and the need for carbon capture increase demand for MOFs & emerging materials. The strong focus on energy efficiency and increasing demand for gas separation increases the adoption of MOFs & emerging materials. The growing processing of green chemical engineering and the need for purification of biogas increase the adoption of MOFs & emerging materials, supporting the overall market growth.

By Physical Form

How Granules or Pellets Segment Held the Largest Share in the U.S. Industrial Adsorbents Market?

The granules/pellets segment held the largest revenue share in the U.S. industrial adsorbents market in 2024. The ease of handling and focus on improving mechanical strength increase the adoption of granules or pellets. The growing applications, such as air purification and water treatment, increase demand for granules or pellets. The growth in large-scale applications and excellent flow characteristics increases the adoption of granules. The growing automotive emission control and need for gas separation increases demand for granular adsorbents, driving the overall growth of the market.

The coated substrates & cartridges segment is experiencing the fastest growth in the market during the forecast period. The focus on improving adsorbent efficiency and superior mechanical stability increases demand for coated substrates. The growing demand for sustainable solutions and stringent environmental regulations increases the adoption of coated substrates. The increasing applications like gas separation, water treatment, and air purification increase demand for coated substrates & cartridges, supporting the overall growth of the market.

By Application

Which Application Dominated the U.S. Industrial Adsorbents Market?

The gas separation segment dominated the U.S. industrial adsorbents market in 2024. The strong presence of the chemical and oil & gas sector increases demand for gas separation. The strong focus on purifying natural gas and growing natural gas processing increases demand for gas separation. The growing production of various industrial gases and booming shale gas exploration increase the adoption of gas separation. The increasing production of industrial gases like nitrogen & oxygen increases demand for gas separation, driving the overall market growth.

The VOC/emission control segment is the fastest-growing in the market during the forecast period. The stringent environmental regulations and corporate sustainability goals increase demand for VOC/emission control adsorbents. The growing automotive manufacturing and increasing manufacturing processes in the petrochemical industry increase the adoption of VOC/emission control adsorbents. The growing demand for paints & coatings in construction activities increases the adoption of VOC/emission control adsorbents. The strong focus on the circular economy and growing manufacturing in the electronics industry increases demand for VOC/emission control adsorbents.

By Purity / Grade

How the Industrial or Technical Grade Segment Held the Largest Share in the U.S. Industrial Adsorbents Market?

The industrial or technical grade segment held the largest revenue share in the U.S. industrial adsorbents market in 2024. The strong presence of various industries like chemical, petrochemical, oil & gas, and refining increases demand for industrial-grade adsorbents. The stricter industrial emission regulations and increasing adoption of high-performance technologies increase demand for technical-grade adsorbents.

The well-established industrial infrastructure and focus on enhancing fuel standards increase demand for technical-grade adsorbents. The growing industrial applications like air purification, water treatment, and air separation increase the adoption of industrial-grade adsorbents, driving the overall growth of the market.

The high-purity/electronics grade segment is experiencing the fastest growth in the market during the forecast period. The growing production of pharmaceutical products and the expansion of the semiconductor industry increase demand for high-purity grade adsorbents.

The strong focus on sustainability and growing demand for clean water increases the adoption of technical-grade adsorbents. The growing demand for various electronic products and the increasing production of high-tech components increase demand for electronics-grade adsorbents, supporting the overall market growth.

By Distribution Channel

What Made the Direct Sales Segment Dominate the U.S. Industrial Adsorbents Market?

The direct sales segment dominated the U.S. industrial adsorbents market in 2024. The growing demand for technical consultation and the availability of customization increase the adoption of direct sales. The customer’s strong focus on direct communication and evolving needs of customers increases demand for direct sales. The need for specialized knowledge about the product and complex applications increases the adoption of direct sales, driving the overall market growth.

The online/e-commerce segment is the fastest-growing in the market during the forecast period. The easy availability of a diverse range of products and the growing demand for advanced materials increase purchases from online platforms. The ease of use and availability of a seamless experience on online platforms help the market growth. The presence of services like faster product delivery, 24/7 availability, and easy price comparison on e-commerce platforms supports the overall market growth.

U.S. Industrial Adsorbents Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement for U.S. industrial adsorbents involves the sourcing of raw materials like forest residue, biomass, silica minerals, natural zeolite deposits, alumina hydrates, agricultural waste, and many more.

- Chemical Synthesis and Processing: The chemical synthesis & processing involve methods like polymerization, microwave-assisted synthesis, sol-gel process, functionalization, and deep eutectic solvents.

- Waste Management and Recycling: The waste management involves disposal methods like vitrification, incineration, chemical immobilization, & landfilling, and recycling includes material recovery, regeneration for reuse, & secondary utilization.

Recent Developments

- In July 2024, ZymoChem launched bio-based super absorbent polymer, BAYSE. The product supports sustainability and offers high performance. The polymer is used in industries like water treatment, agriculture, and cosmetics.(Source: www.chemanalyst.com)

Top Companies List

- Cabot Corporation

- Kuraray (Calgon Carbon)

- W. R. Grace & Co.

- BASF SE

- Evonik Industries

- Clariant AG

- Honeywell UOP

- Zeochem AG

- Tosoh Corporation

- Mitsubishi Chemical Corporation

- Albemarle Corporation

- Solvay SA

- 3M Company

- LANXESS AG

- Sibelco

- Zeolyst International

- Heraeus Holding GmbH

- Johnson Matthey plc

- Porex Corporation

- Porocel / Saint-Gobain Ceramics

Segments Covered

By Product Type

- Activated Carbon

- Molecular Sieves (3A, 4A, 5A, 13X, Li-X, Na-X)

- Silica Gel (indicator, non-indicator)

- Activated Alumina

- Natural Zeolites (clinoptilolite, mordenite)

- Synthetic Zeolites (non-molecular sieve frameworks)

- Ion-Exchange Resins (cation, anion, chelating)

- Specialty Inorganic Adsorbents (clays, diatomite, attapulgite)

- Metal-Organic Frameworks (MOFs) & Emerging Materials

- Composite / Hybrid Adsorbents (carbon/zeolite, silica/oxide)

- Functionalized Polymeric Adsorbents

- Bio-based / Biochar Adsorbents

By Physical Form

- Granules / Pellets

- Beads / Spheres

- Powder / Fine Particulate

- Extruded Monoliths / Honeycomb Structures

- Coated Substrates / Cartridges

- Structured Sheets & Laminates

- Desiccant Wheels

By Application

- Gas Separation (H₂, O₂/N₂, CO₂, hydrocarbons)

- VOC / Emission Control

- Water & Wastewater Treatment

- Solvent Recovery

- Drying / Desiccation (air & industrial gases)

- Catalyst Support & Feed Purification

- Air Purification (indoor/HVAC, cleanrooms)

- Specialty Separations (isomers, olefin/paraffin, fine chemicals)

- Protective Packaging (moisture control)

By Purity / Grade

- Industrial / Technical Grade

- Specialty Grade (tight spec industrial)

- High-Purity / Electronics Grade

- Pharmaceutical / GMP Grade

- Food-Grade / Certified Products

By Distribution Channel

- Direct Sales (OEM / End User)

- Industrial Distributors

- System Integrators / Packagers

- Online / E-commerce

By Region

- Northeast

- Midwest

- South

- West