Content

Oil Spill Management Market Size and Share 2034

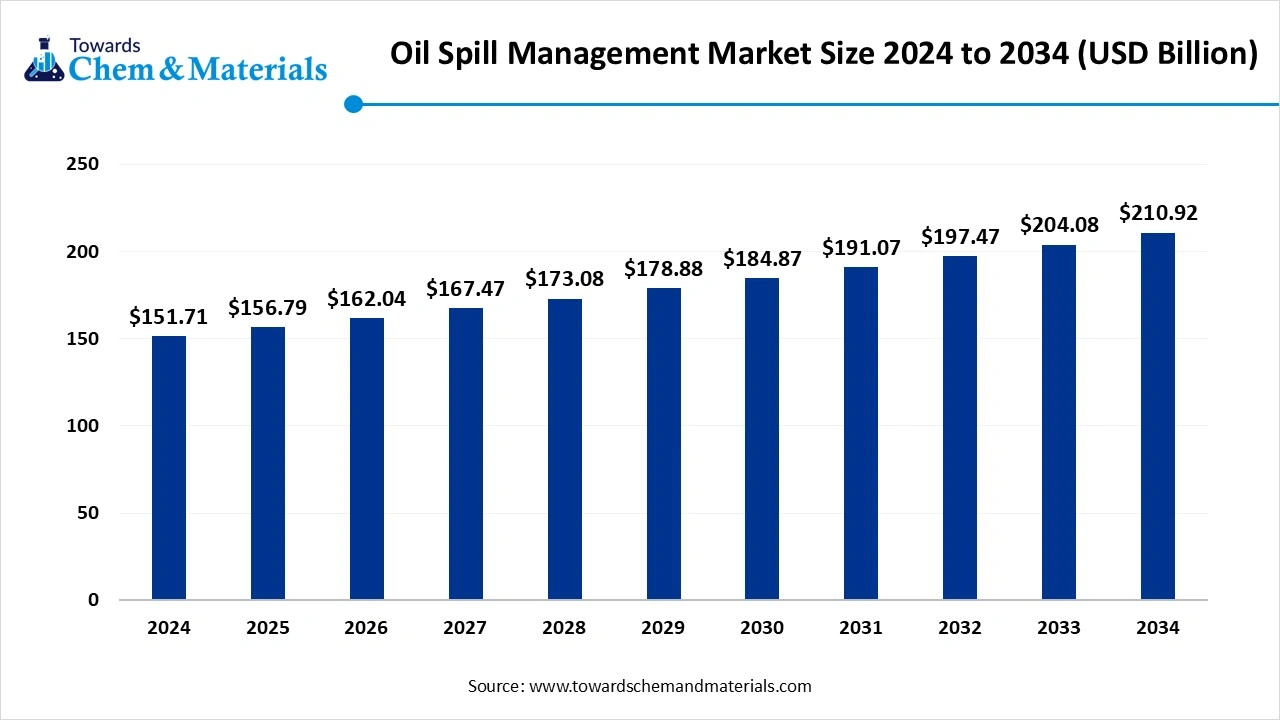

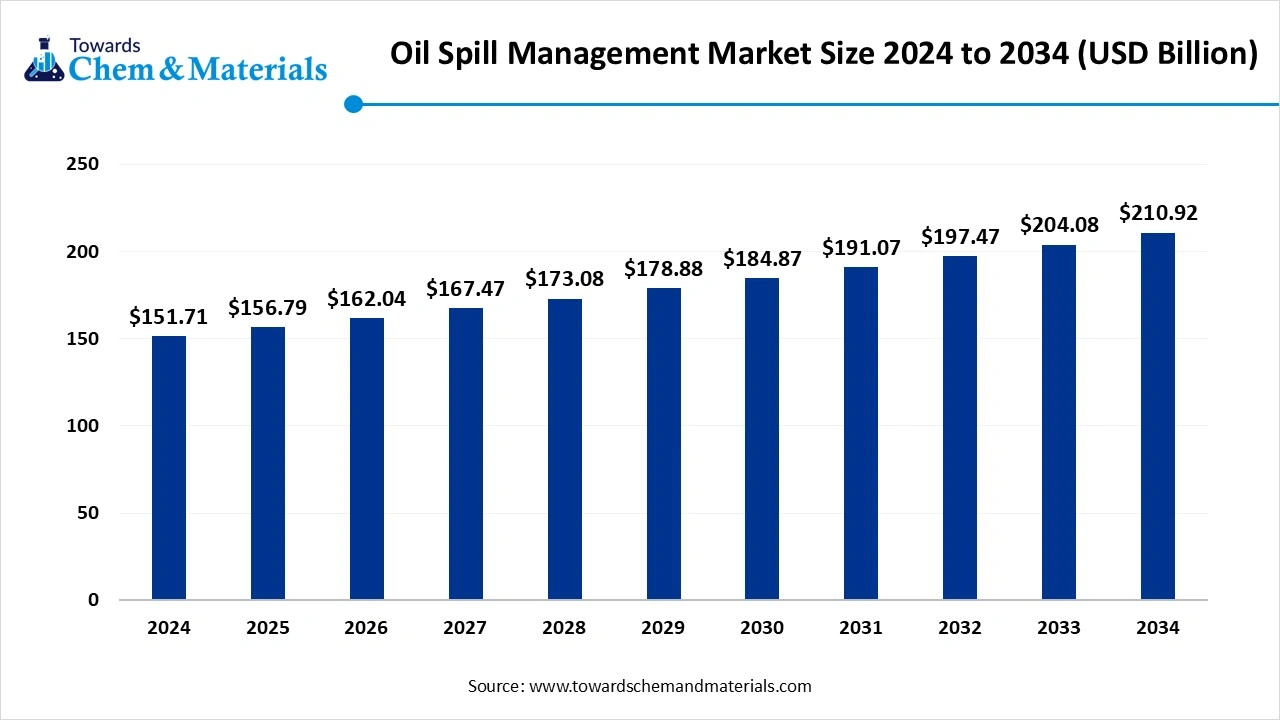

The global oil spill management market size was reached at USD 151.71 billion in 2024 and is estimated to surpass around USD 210.92 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.35% during the forecast period 2025 to 2034. The growing number of oil spill incidents, rising environmental awareness, and stricter government regulations drive the market's growth.

Key Takeaways

- The U.S. oil spill management market size is estimated at USD 46.46 billion in 2025, and is expected to reach USD 67.04 billion by 2034, at a CAGR of 4.08% during the forecast period 2025-2034

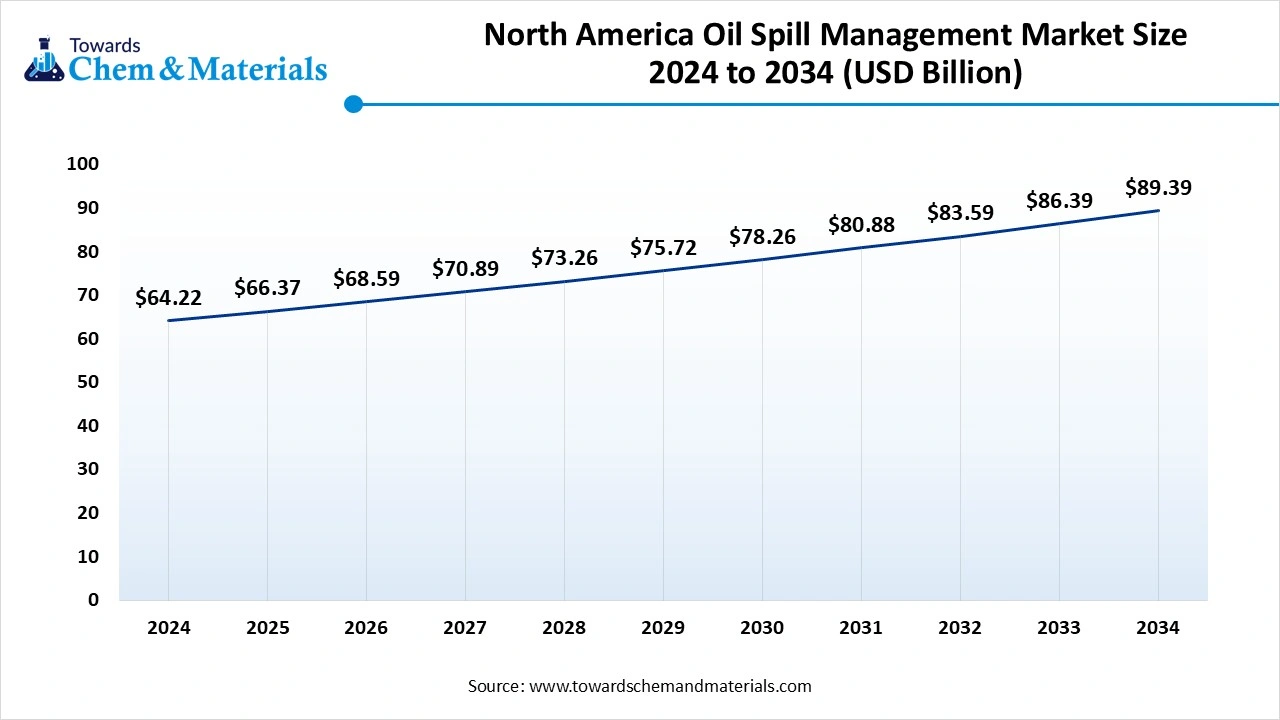

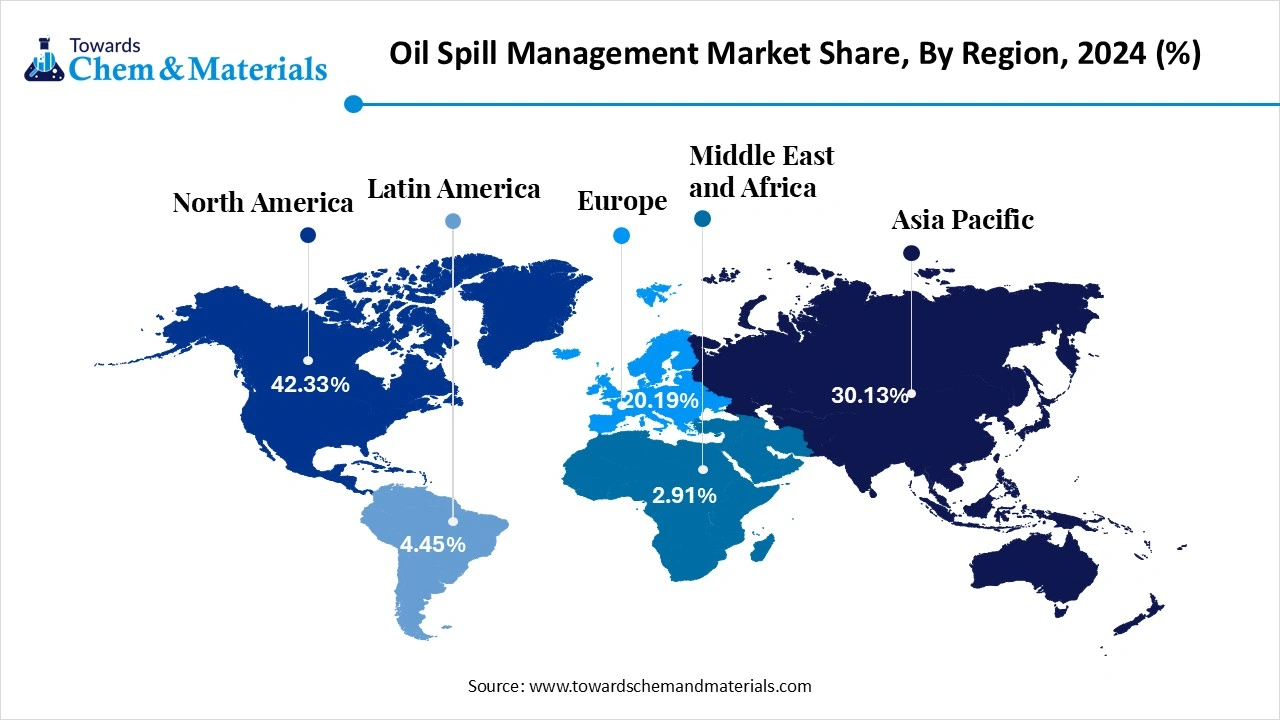

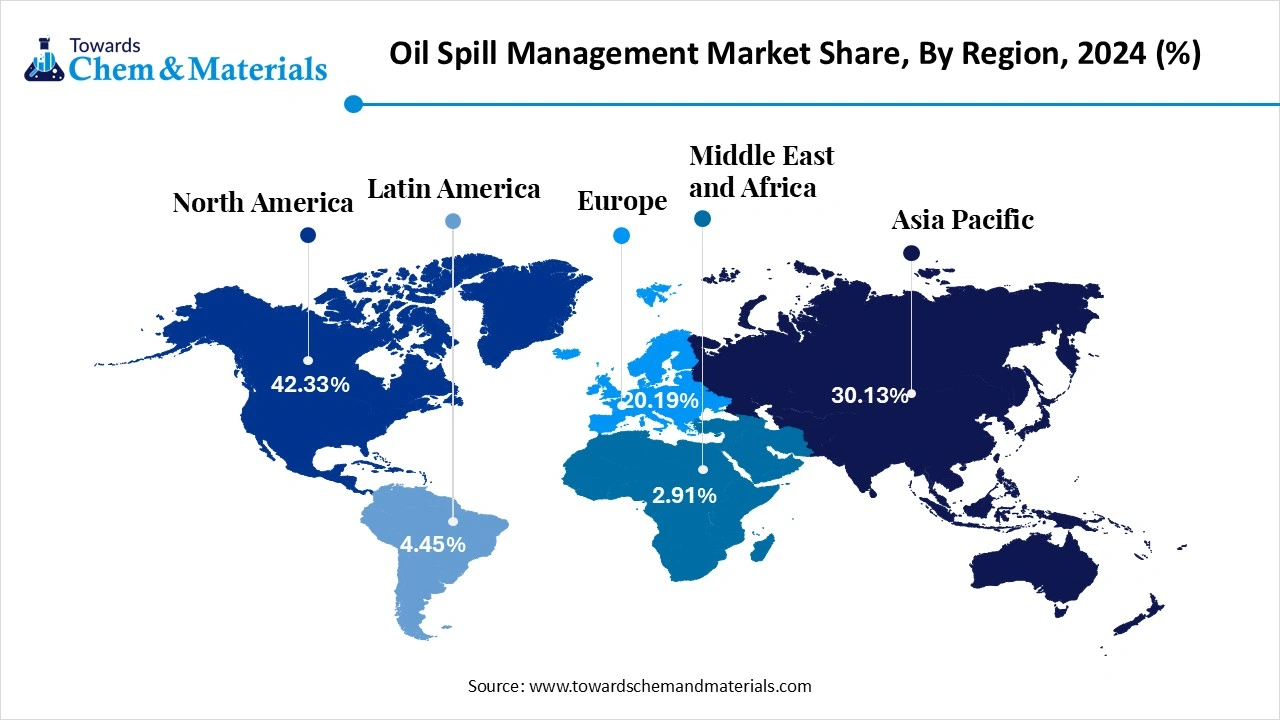

- North America dominated the global oil spill management market and accounted for a revenue share of 42.33% in 2024.

- Asia Pacific oil spill management market is expected to grow at an anticipated CAGR of 4.25% from 2025 to 2034.

- By technology, the pre-oil spill segment dominated the global industry and accounted for a revenue share of 71.11% in 2024.

- By technology, the Post oil spill segment is expected to experience a significant growth rate from 2025 to 2034.

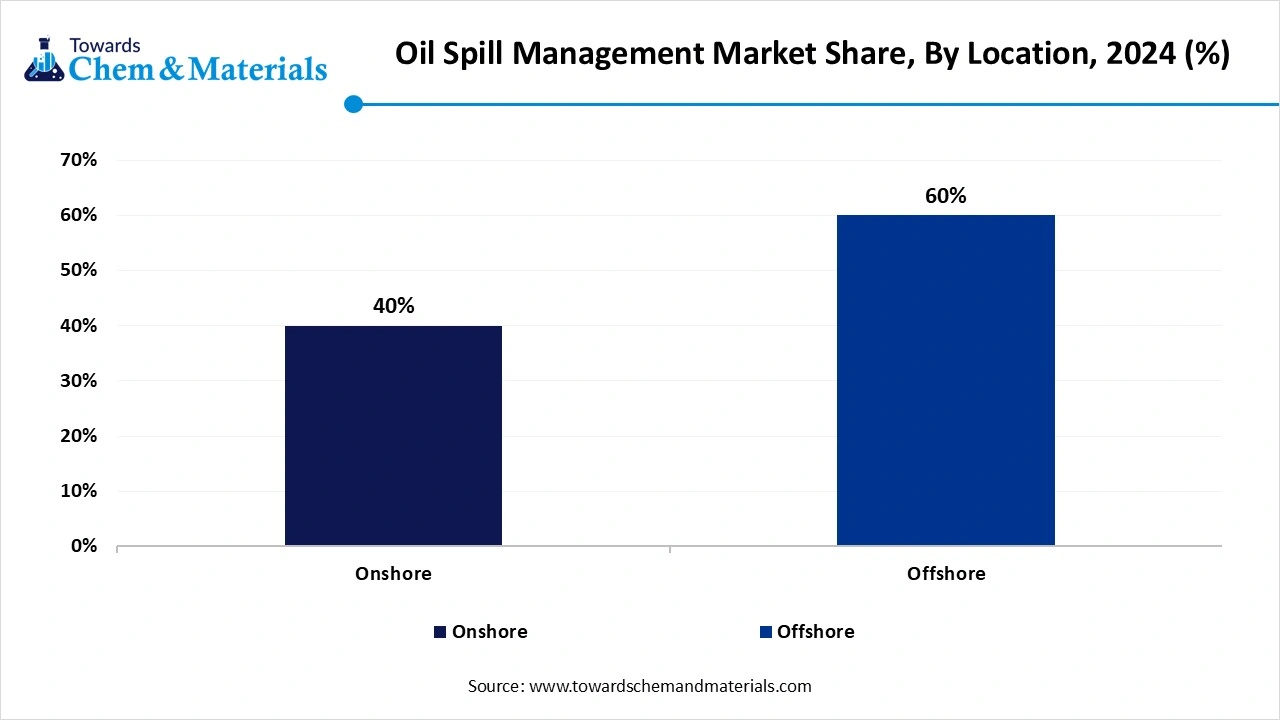

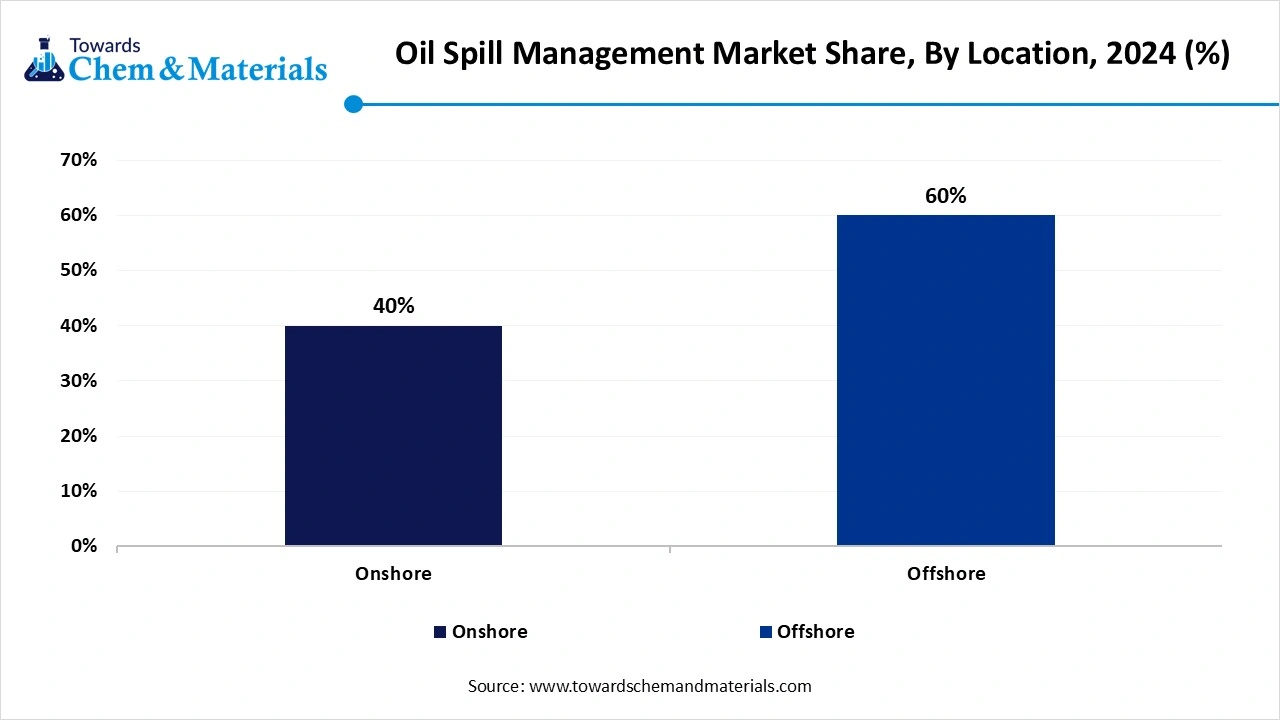

- By location, the offshore application segment accounted for the largest revenue share of 71.11 the global industry in 2024.

- By location, the Onshore oil spill management is anticipated to grow during the forecast period.

Cleansing The Currents: A Modernized Approach to Oil Spill Management

The oil spill management includes various strategies to avoid oil spills. The oil spill management key aspects include recovery, prevention, cleanup, and containment using various methods like bioremediation, physical barriers, and skimmers. The different methods for oil spill management include cleanup, containment, and recovery. Containment includes booms, berms, and containment & recovery equipment. Booms are floating barriers that prevent the spreading of spills. Berms are artificial barriers that prevent oil from reaching sensitive areas.

Containment & recovery equipment requires certain equipment like sorbents & skimmers to recover & collect oil. The recovery methods include skimming, sorbents, vacuums, and manual & mechanical removal. The cleanup involves shoreline flushing & washing, dispersants, burning, bioremediation, chemical cleaners, and natural dispersal. The growing demand for energy production & exploration increases demand for oil spill management solutions.

The growing stringent environmental regulations to lower environmental impact and protect the marine ecosystem increase demand for effective oil spill management and clean-up methods. Factors like advancements in spill response technologies, expansion of offshore activities, globalization of oil trade, and increasing oil spill incidents contribute to the oil spill management market growth.

- Ukraine exported 137934 shipments of crude oil.

- Indonesia exported 63500 shipments of crude oil.

- In 2023, crude petroleum exported by Saudi Arabia was $181 billion.

- Crude petroleum exported by Russia was $122 billion.

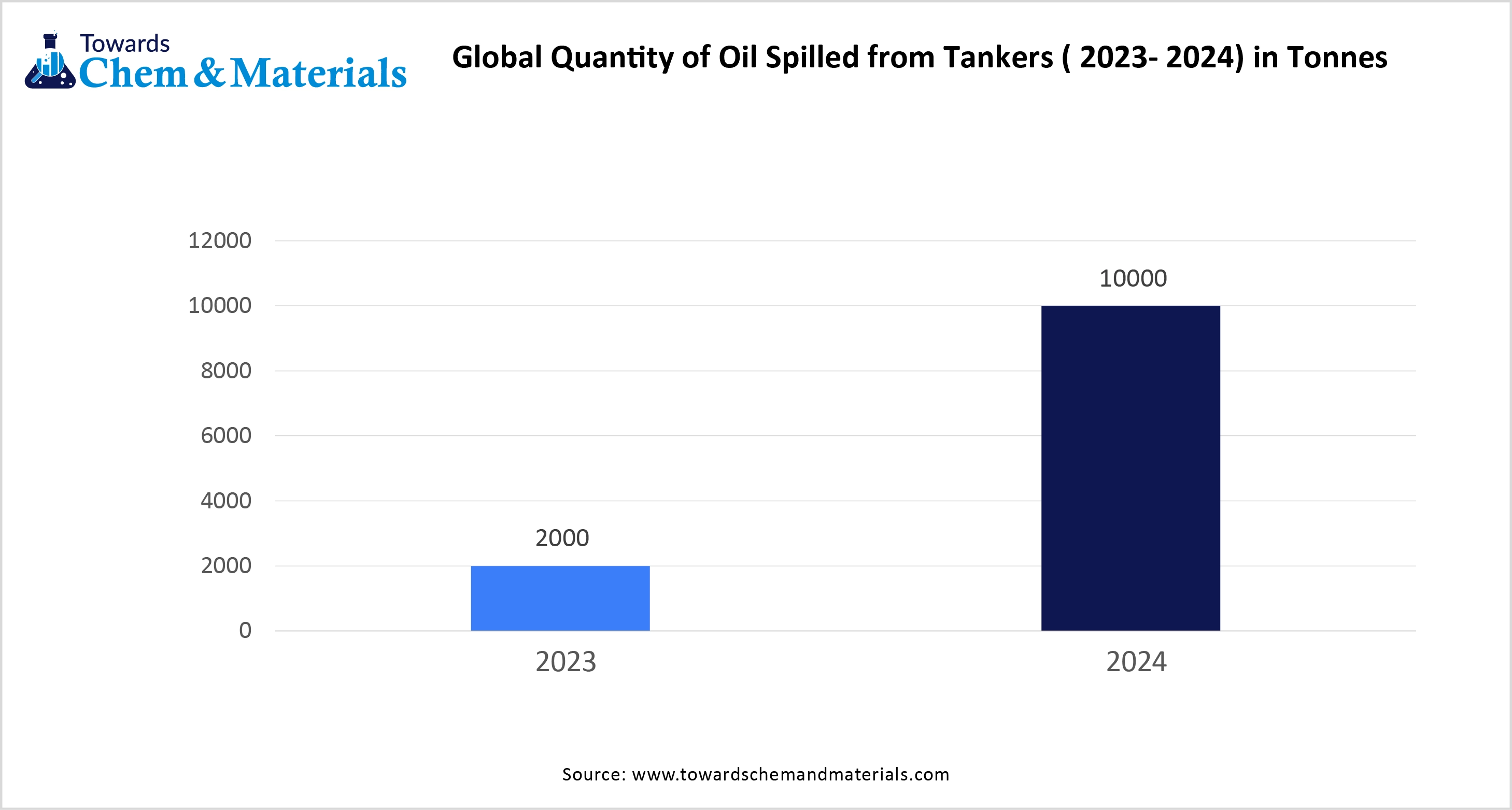

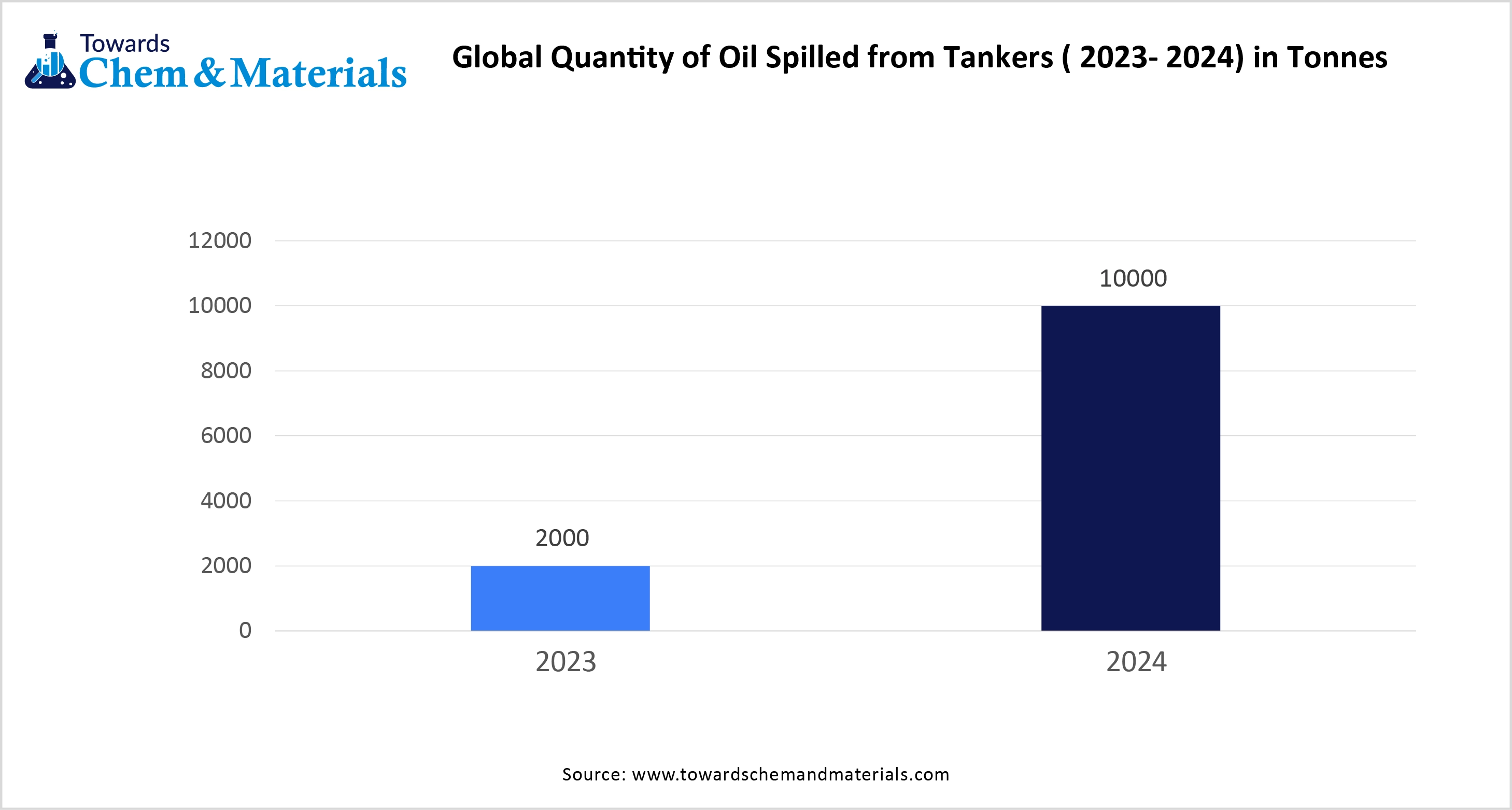

The Growing Incidence Of Oil Spills Drives Market Growth

The growth in oil transportation, production, and processing increases the risks of spills, which increases demand for effective oil spill management technologies. The aging infrastructure & pipelines and growing spill incidents in the maritime & offshore sectors increase demand for effective management solutions. The growing oil spill incidents create risks for water bodies, marine life, and the ecosystem, which increases demand for advancements or innovations in technologies to protect the environment.

The growing spill incidents are fueling the development of new solutions and technologies like preventive measures, advanced containment systems, and rapid response technologies, supporting the growth of oil spill management. The growing production & exploration of offshore applications in environments with high risks of spills & deepwater regions increases demand for specialized oil spill management solutions. Furthermore, the growing movement of marine vessels like oil tankers helps in the market growth. The growing oil spill incidence is due to various factors, like natural disasters, aging pipelines, and the growing transportation & production of oil is a key driver for the oil spill management market growth.

- In December 2024, over 9000 tonnes of fuel oil spilled into the Black Sea. The tankers are carrying a total of 9200 tonnes of fuel.

Oil Spill Management Market Trends

- Growing demand for double-hull technology: The growing demand for double-hull technology in other vessels and tankers helps in the market growth. The growing demand for double-hull technology in pre-oil spill management to lower the risk of spills supports the market growth.

- The growing energy demand: The rise in industrial processes, transportation, and electricity generation increases oil transportation, exploration, and production, fueling risks of spills, which increases demand for oil spill management solutions.

- Rise of eco-friendly and byproducts solutions: The growing focus on developing environment-friendly and innovative solutions like oil-eating microbes and bioremediation techniques is a key trend in the market.

- Increasing environmental concerns: The growing governmental & public awareness regarding oil spills leads to stringent environmental regulations and increases demand for efficient oil spill management solutions.

Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 156.79 Billion |

| Expected Size by 2034 | USD 210.92 Billion |

| Growth Rate from 2025 to 2034 | CAGR 3.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| High Dominant Region | North America |

| Segment Covered | By Technology, By Location, By Region |

| Key Companies Profiled | Oil Spill Response Limited,National Oilwell Varco, Inc.,SkimOIL, LLC,Ecolab, SWS Environmental Services Ltd., American Pipeline Solutions, Sorbcontrol, OMNI Environmental Solutions, American Green Ventures (US), Inc., Cameron International Corporation, Fender & Spill Response Services L.L.C, Osprey Spill Control |

Oil Spill Management Market Opportunity

Growing Technological Advancements Boost The Oil Spill Management Market

The growing technological advancements in oil spill management methodologies and technologies create opportunities for market growth. The advancements, like real-time spill monitoring, containment, and remote sensing, help in effective oil spill management. The growing advancements to enhance monitoring & detection include autonomous robots, remote sensing, and artificial intellegence (AI) powered analysis help in the market growth.

The innovation in cleanup methods includes magnetic soaps, graphene-based materials, MIT magnets, lotus leaf-inspired mesh, and a dual-layer mesh roller that lowers the environmental impact of spills. The growing advancements in bioremediation and emergent dispersant technologies support the market growth.

The growing advancements help to facilitate more targeted cleanup efforts, enhance the speed & efficiency of oil spill response, and lower environmental impact. The growing technological advancements and innovation in spill management technology create a strong opportunity for the oil spill management market.

Oil Spill Management Market Challenge

High Operational Costs Limit The Expansion Of The Market

Despite several benefits of oil spill management, the high operational cost restricts the market growth. Oil spill management requires expensive services, systems, and equipment, and the maintenance of equipment is also high. Large volumes of oil spills require costly & expensive cleanup operations, like logistical support, specialized equipment, and personnel support increases the overall cost. The complexity of the environment, like inland waterways, open ocean, and shoreline, leads to higher costs. The containment & recovery efforts, like deploying skimmers & booms, led to higher costs.

The growing need for remediation techniques like bioremediation, dispersants, and other techniques increases the overall cost. The high operational costs due to various factors, like long-term environmental impact, sheer scale of cleanup efforts, economic damage, and complexity of the environment, hamper the oil spill management market growth.

Regional Insights

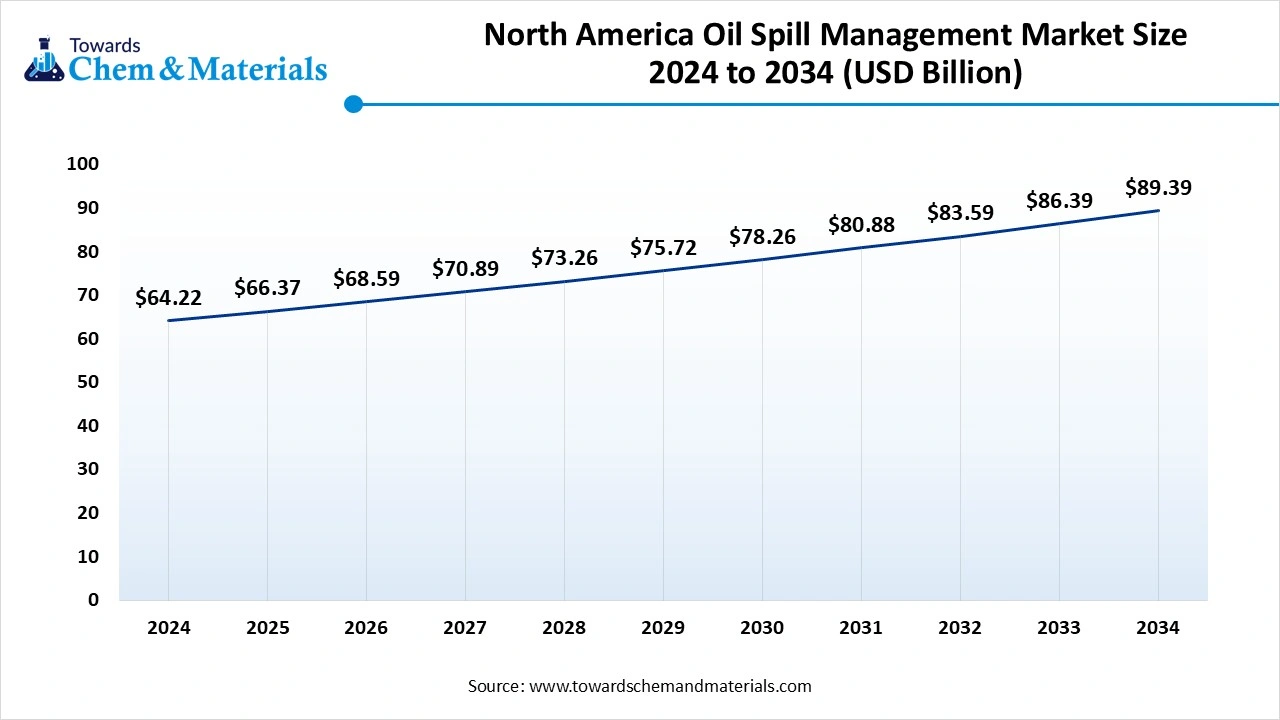

The North America oil spill management market size was valued at USD 64.22 billion in 2024 and is expected to be worth around USD 89.39 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.36% over the forecast period 2025 to 2034 , North America dominated the oil spill management market in 2024. The extensive presence of the active & large oil & gas industry in the region helps in the market growth. The well-established transportation network and production & exploration of offshore & onshore increase demand for oil spill management services & equipment.

The significant international trade in petroleum products and oil products fuels demand for a robust oil spill management system. The stricter regulations for oil & gas operations and governments' policies to lower the environmental impact of oil spills drive the market growth. Technological advancements like response strategies, new equipment, and chemicals are fueling the market growth. The major spill incidents like Deepwater Horizon and Exxon Valdez increase demand for stricter regulations for gas & oil operations, which contributes to the overall growth of the market.

United States Oil Spill Management Trends, The United States dominated the oil spill management market. The extensive presence of the offshore & onshore oil & gas industry helps in the growth of the market. The presence of a high volume of oil & gas refining, production, and transportation increases demand for oil spill management solutions. The rigorous regulation for oil & gas operations, like financial responsibility, spill prevention plans, and preparedness measures for cleanup, helps in the market growth.

The growing advancements in oil spill recovery, detection, and containment, including innovative dispersants, satellite monitoring, and advanced cleanup equipment, drive the market growth. The strong presence of international organizations, the network of government agencies, and private companies in oil spill management fuels the market growth. Additionally, the major contribution to the international oil trade supports the overall growth of the market.

- The United States exported 2385975 shipments of oil.

- Crude petroleum exported by the United States was $125 billion.

Rise Of Oil Spill Management In Asia Pacific, Asia Pacific is experiencing the fastest growth in the oil spill management market during the forecast period. The growth in the movement of ships, including vessels & oil tankers, in the transportation of oil & gas products helps in the market growth. The growing onshore & offshore oil & gas production & exploration increases the risk of oil spills, fueling demand for oil spill management solutions.

The government support & initiatives, like financial support, tax incentives, and other measures, drive the market growth. The growing urbanization and rising disposable incomes increase energy consumption, and infrastructure development leads to oil spill incidents. The advancements in oil spill management technologies, like preventive measures, containment systems, and rapid response technologies, help in the market growth.

Furthermore, international collaboration & initiatives like the Global Initiative for South East Asia and the International Maritime Organization in oil spill response & preparedness, and the presence of major shipping companies in countries like South Korea, China, and Japan support the overall growth of the market.

China Oil Spill Management Trends, China is a major contributor to the oil spill management market. The rapid economic growth, increased transportation of oil, and the need for oil & energy infrastructure help in the market growth. The growing onshore & offshore oil activities increase demand for oil spill management services.

The expansion of the fishing & shipping industries and a comprehensive legal framework, like compensation funds & regulations, increases demand for oil spill management. Additionally, China’s international corporations, like the collaboration of the International Maritime Organization and Oil Spill Response Limited, support the overall growth of the market.

- China exported 2737499 shipments of oil.

India Oil Spill Management Trends, India is growing significantly in the oil spill management market. The growing energy consumption and increasing volume of global trade help in the market growth. The growing investment in oil spill handling, like establishing response centers, developing specialized equipment, and training personnel, drives the market growth. The growing advancements in efficient and environmentally friendly oil spill cleanup methods and government initiatives drive the market growth. Furthermore, the growing development and utilization of sustainable technologies like bioremediation & alternative separation methods contribute to the overall growth of the market.

- From November 2023 to October 2024, India exported 522849 shipments of oil.

India exported 3,662,063 shipments of oil.

Segmental Insights

Technology Insights

The pre-oil spill segment dominated the oil spill management market in 2024. The growing demand for preventing spills in the first place helps in the market growth. Pre-oil spill management includes developing robust contingency plans, implementing safety protocols, and regularly maintaining equipment. The growing adoption of proactive spill management practices due to stricter environmental regulations developed by the International Maritime Organization helps in the market growth.

The growing environmental impact of oil spills on wildlife & ecosystem increases demand for pre-oil spill management techniques. Pre-oil spill management includes double-hull tankers, pipeline leak detection, and blowout preventers. The cost-effectiveness and growing demand from North America & Asia Pacific due to the presence of the oil & gas industry drive the market growth.

The post-oil spill segment expects the fastest growth in the market during the forecast period. The growing oil spill incidents in transportation and offshore oil exploration help in the market growth. The growing industry & public understanding of the consequences of oil spills on human health & marine ecosystems increases demand for post-oil spill management.

The stringent regulation implementation by international organizations & government agencies helps in the market growth. The growing oil spill incidents, like pipelines & tanker spills, increase demand for post-oil spill management. The post-oil spill management includes mechanical containment & recovery, chemical recovery, biological recovery, and physical remediation. Furthermore, growing advancements like bioremediation techniques, remote sensing, and AI-based monitoring support the overall market growth.

Location Insights

The offshore application segment held the largest share of the oil spill management market in 2024. The growing oil & gas production & exploration in locations having the risk of spills & deepwater helps in the market growth. The growing demand for specialized strategies & equipment to manage spills in harsh marine environments increases demand for offshore applications. The stringent government & international bodies' environmental compliance and regulations help in the market growth. The growing requirement for sorbents, containment booms, and skimmers drives the market growth.

The onshore application segment is the fastest growing in the market during the forecast period. The increasing awareness about the environmental impact of oil spills and stricter regulations increases demand for onshore oil spill management. The growing technological advancements for oil spill cleanup, prevention, and containment help in the market growth. The growing transportation of oil & gas products, rising oil & gas production & exploration activities, increases the risk of spills, fueling demand for onshore oil spill management. The growing pipeline failures and the rising number of onshore pipelines support the overall growth of the market.

Oil Spill Management Market Recent Developments

Miros

- Launch: In April 2025, Miros launched a cloud-based oil spill detection monitoring system. The solution introduced full accountability, a new level of real-time visibility, proactive oil spill management, and centralized collaboration. The new system empowers users to respond, track, and monitor faster and minimizes environmental impact. The centralized system improves collaboration and ensures transparent communication. The automated spill management helps operators to cut operational costs, lower manual inspections, and avoid unnecessary dispatches due to false alarms.

Goa Shipyard

- Launch: In August 2024, Goa Shipyard launched an indigenous pollution control vessel, Samudra Pratap. The new vessel's breadth is 16.5 meters, length is 114.5 meters, and displacement is 4170 tons. The vessel was manned by 115 sailors & 14 officers and features like facilities to recover & store various types of oil, side-sweeping arms to contain oil spills in motion, and an advanced radar system for oil spill detection.

Petrobras

- Launch: In February 2025, Petrobras launched a tender to charter an offshore support vessel. The tender includes the contracting of vessels for a period of twelve, eight, and ten years.

Top Companies List

- Oil Spill Response Limited

- National Oilwell Varco, Inc.

- SkimOIL, LLC

- Ecolab

- SWS Environmental Services Ltd.

- American Pipeline Solutions

- Sorbcontrol

- OMNI Environmental Solutions

- American Green Ventures (US), Inc.

- Cameron International Corporation

- Fender & Spill Response Services L.L.C

- Osprey Spill Control

Segments Covered in the Report

By Technology

- Pre-Oil Spill Management

- Blow-Out Preventers

- Double-Hull

- Pipeline Leak Detection

- Others

- Post-Oil Spill Management

- Mechanical

- Containment Booms

- Fire Booms

- Hard Booms

- Sorbent Booms

- Others

- Skimmers

- Non-Oleophilic Skimmers

- Oleophilic Skimmers

- Weir Skimmers

- Sorbent

- Others

- Skimmers

- Gelling Agents

- Dispersing Agents

- Others

- Biological

- Physical

By Location

- Offshore

- Onshore

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait