December 2025

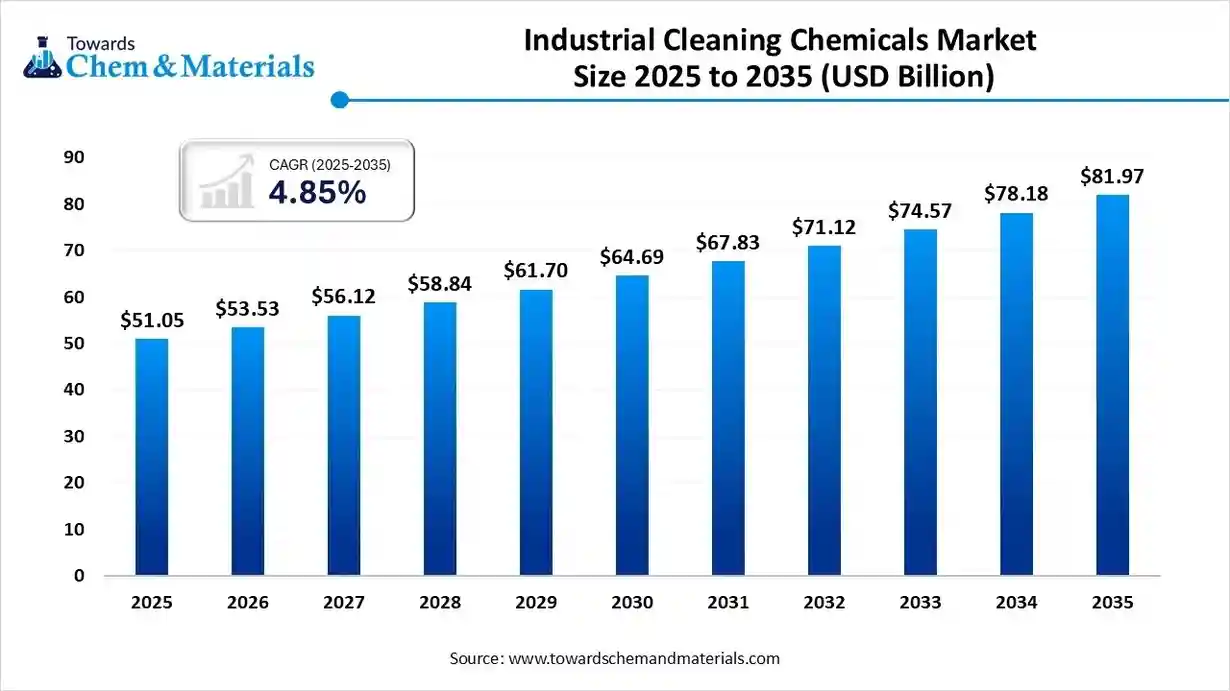

The global industrial cleaning chemicals market size was estimated at USD 51.05 billion in 2025 and is predicted to increase from USD 53.53 billion in 2026 and is projected to reach around USD 81.97 billion by 2035, The market is expanding at a CAGR of 4.85% between 2026 and 2035.The increased shift towards manufacturing automation and safety has fueled market potential in recent years.

The industrial cleaning chemicals refer to specific formulated liquids and concentrates that are primarily used to remove oil, dirt, metal fines, and strong residues from the machinery, labs, and floors. Furthermore, pushing safer production practices while controlling contamination and improving hygiene, the industrial cleaning chemicals could result in high yield outcomes for industrial players in the coming years.

| Report Attribute | Details |

| Market Size Value in 2026 | USD 81.97 Billion |

| Revenue Forecast in 2035 | USD 53.53 Billion |

| Growth Rate | CAGR 4.85% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

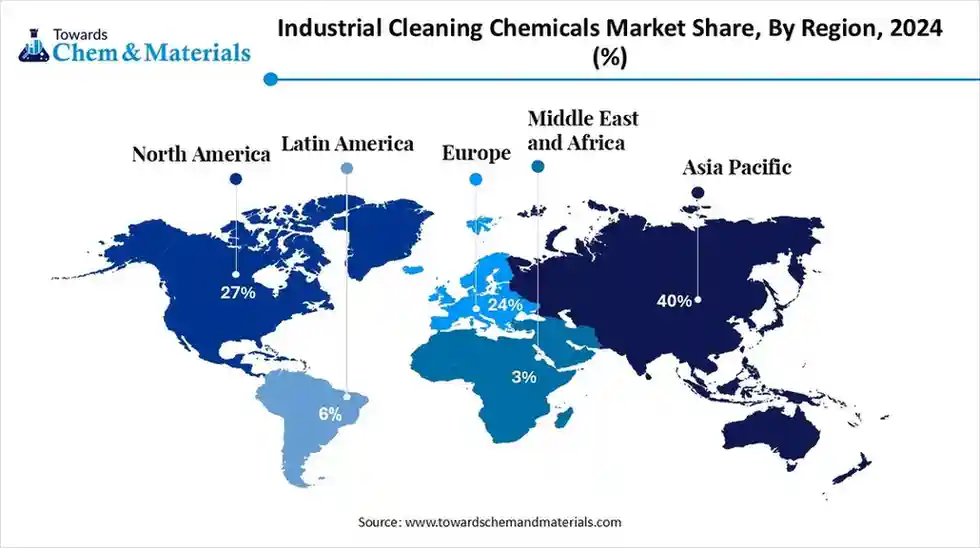

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segments Covered | By Product Type/Formulation, By Ingredient/Raw Material, By Application/End-Use Industry, By Region |

| Key companies profiled | Ecolab Inc, Diversey Holdings Ltd, Procter & Gamble (P&G Professional), Henkel AG & Co. KGaA, BASF SE , Dow Inc. , 3M Company , Reckitt Benckiser Group Plc. (Reckitt Professional) , Solvay S.A. , Stepan Company , Clariant AG , The Clorox Company (CloroxPro) , Zep, Inc. , Spartan Chemical Company, Inc. , Evonik Industries AG , Solenis LLC , Albemarle Corporation , Huntsman Corporation , Sasol Limited , PDI, Inc. |

Technology has been observed to move toward programmable chemistry, where formulations adjust their cleaning strength based on soil load, pH, temperature, and water quality. These advanced chemicals use responsive surfactants and enzyme boosters that increase activity only when heavy contamination is detected. When surfaces are lightly soiled, the formula stays mild, reducing chemical usage.

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Environmental Protection Agency (EPA) | FIFRA | Chemical registration and approval |

| European Union | European Chemicals Agency (ECHA) | REACH Regulation (EC No 1907/2006) | Ingredient safety and biodegradability |

| China | State Administration for Market Regulation (SAMR) and Standardization Administration of China (SAC) | GB Standards | Product safety and testing |

How did the General-Purpose Cleaners Segment Dominate the Industrial Cleaning Chemicals Market in 2025?

The general-purpose cleaners segment dominated the market with a 40% industry share in 2025, owing to the increasing demand for the all-in-one solution in the industrial area. Moreover, by allowing for cleaning multiple surfaces without switching products, the general-purpose cleaners have positioned industry for long-term expansion. Furthermore, these cleaners have been seen in reducing storage space, training needs, and procurement costs in recent years.

The disinfectants and sanitizers segment is expected to grow at a rapid CAGR during the forecast period, akin to the sudden shift towards microbiological safety instead of just surface cleanliness. Furthermore, the major sectors such as the pharma plants, food factories, public facilities, and logistic hubs are seeking pathogen-killing chemicals, which are likely to create lucrative industry opportunities for the segment in the coming years.

Why does the Surfactants Segment Dominate the Industrial Cleaning Chemicals Market by Ingredient Type?

The surfactant segment dominated the market with 35% industry share in 2025, due to its act as a bridge between stubborn industrial grime and the water that removes it. Furthermore, in almost every factory, from electronics plants to packaging units, cleaning begins with wetting the surface properly, and surfactants make this possible as per the recent observation.

The enzymes segment is expected to grow at a rapid CAGR during the forecast period. As enzymes have been seen as offering smart cleaning without strong chemicals. Also, they act like tiny workers that break down specific dirt, fat, milk film, protein stains, or plant residue without harming surfaces. Additionally, the industries prefer enzymes because they work in cold water and reduce the need for repeated scrubbing.

How did the Commercial & Institutional Segment Dominate the Industrial Cleaning Chemicals Market in 2025?

The commercial & institutional segment dominated the market with a 36% industry share in 2025, akin to increasing public awareness about cleaning and better infrastructure, whether it's a hospital corridor, an airport restroom, or a school classroom, surfaces must stay spotless day and night. These spaces welcome thousands of people daily, so cleaning happens continuously.

The manufacturing and industrial segment is expected to grow at a rapid CAGR during the forecast period, akin to modern machines simply can't run well unless they stay incredibly clean. Also, today's industrial equipment, like robot arms, conveyor belts, food mixers, and metal cutters, gets dirty fast and needs special cleaners that don't damage sensitive parts.

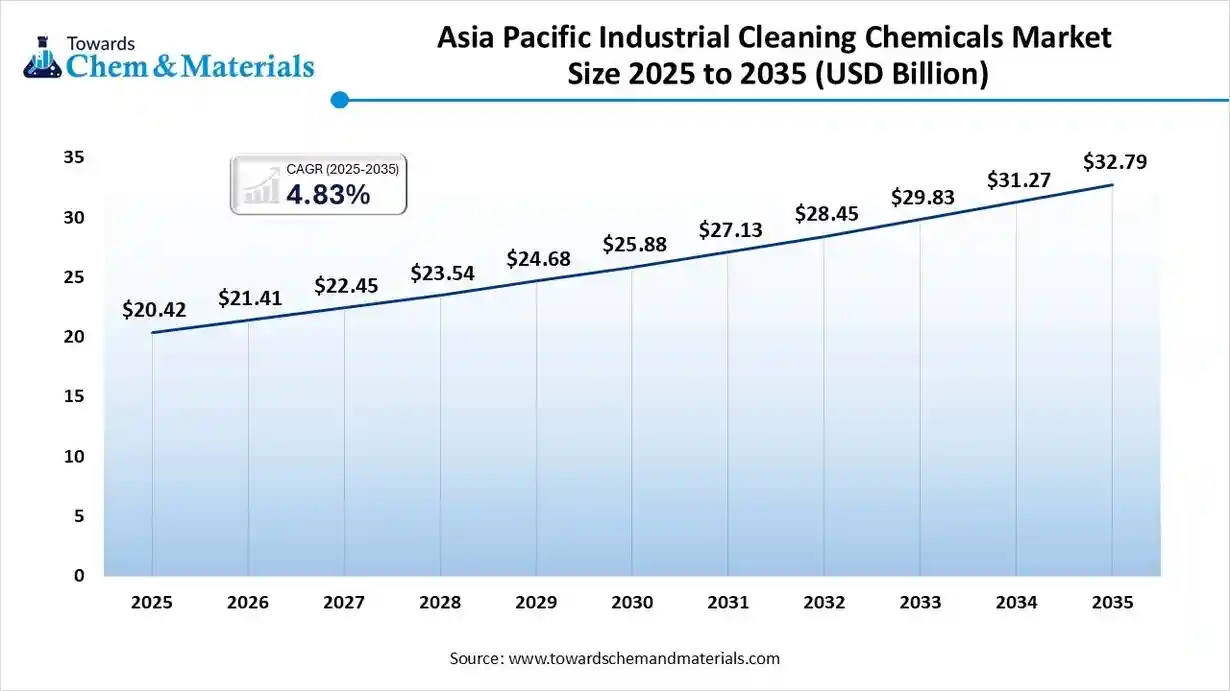

The Asia Pacific industrial cleaning chemicals market size was valued at USD 20.42 billion in 2025 and is expected to reach USD 32.79 billion by 2035, growing at a CAGR of 4.83 % from 2026 to 2035. Asia Pacific dominated the market with 40% industry share in 2025, owing to the presence of fast-food processing facilities and other heavy manufacturing infrastructure. Moreover, the regional countries such as India, China, and Japan are heavily implementing rules and regulations for the manufacturing infrastructure regarding cleanliness, specifically after COVID-19. Also, it includes professional spaces like transport hubs, hospitals, and malls as per the latest regional survey.

Automation Boom Drives China’s Dominance in Cleaning Chemicals

China maintained its dominance in the industrial cleaning chemicals market, akin to the greater shift towards high-automation manufacturing, where cleaning chemicals have become an essential element in recent years. Furthermore, the heavy exports and stricter quality audits from global buyers have strengthened the foundation for future sector growth.

North America Industrial Cleaning Chemicals Market Examination

North America is expected to capture a major share of the market with a rapid CAGR during the forecast period, akin to the increased demand for cleanroom-based products in recent years. Also, the major brands in the region are actively applying for the sustainability certifications for innovative chemistry, as per the recent regional survey.

The United States Emerges as a Powerhouse in Industrial Cleaning Solutions

The United States is expected to emerge as a prominent country for the industrial cleaning chemicals market in the coming years, due to the heavy push for advanced pharmaceutical facilities, food processing, and semiconductor fabs in the current period. Moreover, several companies in the United States have seen under a heavy adoption of smart cleaning robotics in the past few years, which is likely to support industry growth in the coming years.

Europe Industrial Cleaning Chemicals Market Evaluation

Europe is a notably growing region owing to the enlarged push for low-emission formulations in recent years. Moreover, the major industries in the European region have been seen as focused on the development of low-toxicity cleaning chemicals, which is increasingly supporting the innovative chemical production in the region nowadays. Also, the heavy manufacturing industries in Europe have seen an investment in self-owned cleaning chemicals to avoid extra charges and dependence on chemical firms in the current period.

Germany’s Precision Industries Fuel Surge in Cleaning Chemicals Demand

Germany is expected to gain a major industry due to the increasing demand for these cleaning chemicals from the medical technology producers and precision engineering plants. Also, Germany’s connected hygiene systems in public spaces and the robotic automatic industry have allowed stakeholders to capitalize on growth opportunities in the past few years.

Industrial Cleaning Chemicals Market Study in the Middle East and Africa

The Middle East and Africa are expected to capture a notable share of the industrial cleaning chemicals. The region is building new cities, hospitals, and industrial clusters faster than ever. These modern spaces demand stronger hygiene management and reliable cleaning chemicals. Also, the region has transformed into a global business hub, cleaning standards are rising, and the demand for effective chemicals is increasing.

Tourism Expansion Drives High-Performance Cleaning Needs in Saudi Arabia

Saudi Arabia is expected to emerge as a prominent country for the industrial cleaning chemicals market in the coming years. With its huge infrastructure projects and world-class tourism developments, the country needs cleaning solutions that last longer in heat, dust, and crowded public areas. Factories and warehouses are also growing rapidly, creating more need for industrial-grade cleaners.

South America Industrial Cleaning Chemicals Market Evaluation

South America is a notably growing region as industries begin modernizing and adopting global hygiene standards. Also, regional shift toward organized industrial operations, cleaner processing lines, and safer workspaces is making it one of the most active regions for industrial and institutional cleaning demand.

Brazil’s Cleaning Chemicals Boom Fueled by Tech-Driven Infrastructure

Brazil is expected to gain a major industry owing to its factories, ports, and distribution centers are becoming more technology-driven. As food exports grow, Brazilian facilities must meet strict international cleanliness requirements, increasing the use of specialized cleaning chemicals. Large cities like São Paulo and Rio are building new hospitals, airports, and shopping spaces, all needing regular commercial cleaning in recent years.

By Product Type/Formulation

By Ingredient/Raw Material

By Application/End-Use Industry

By Region

December 2025

November 2025

November 2025

November 2025