Content

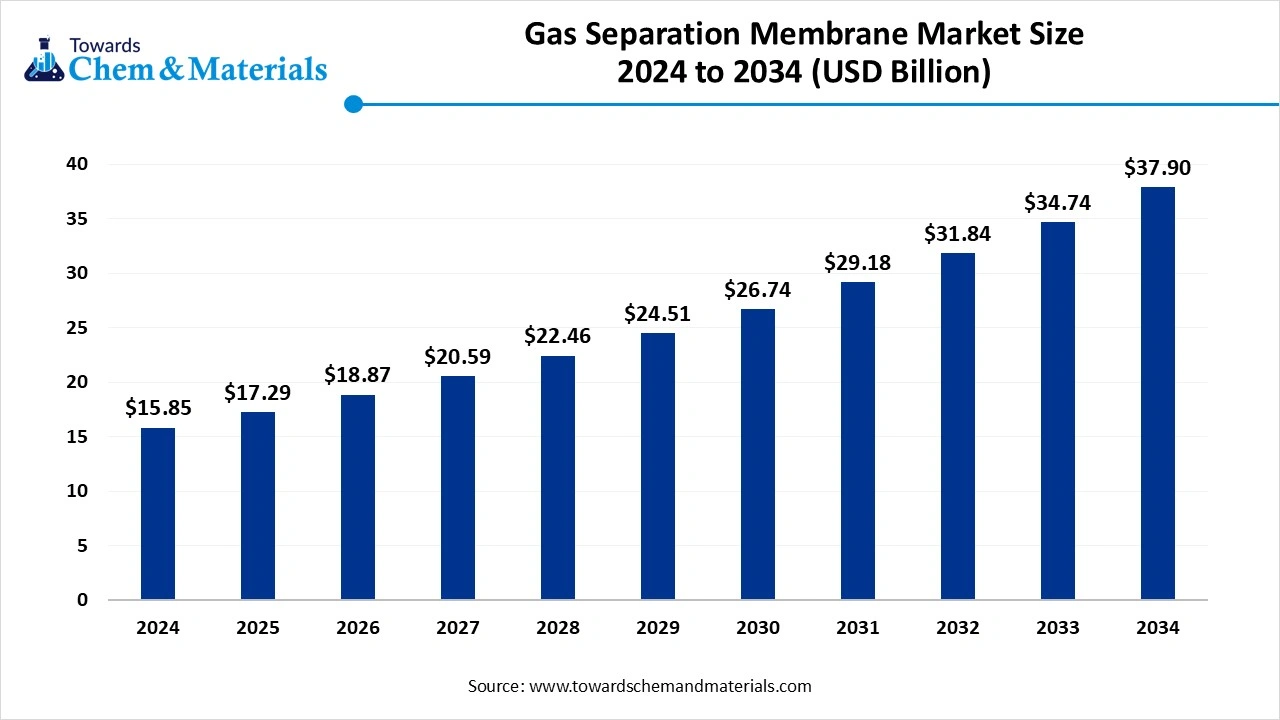

Gas Separation Membrane Market Size and Growth 2025 to 2034

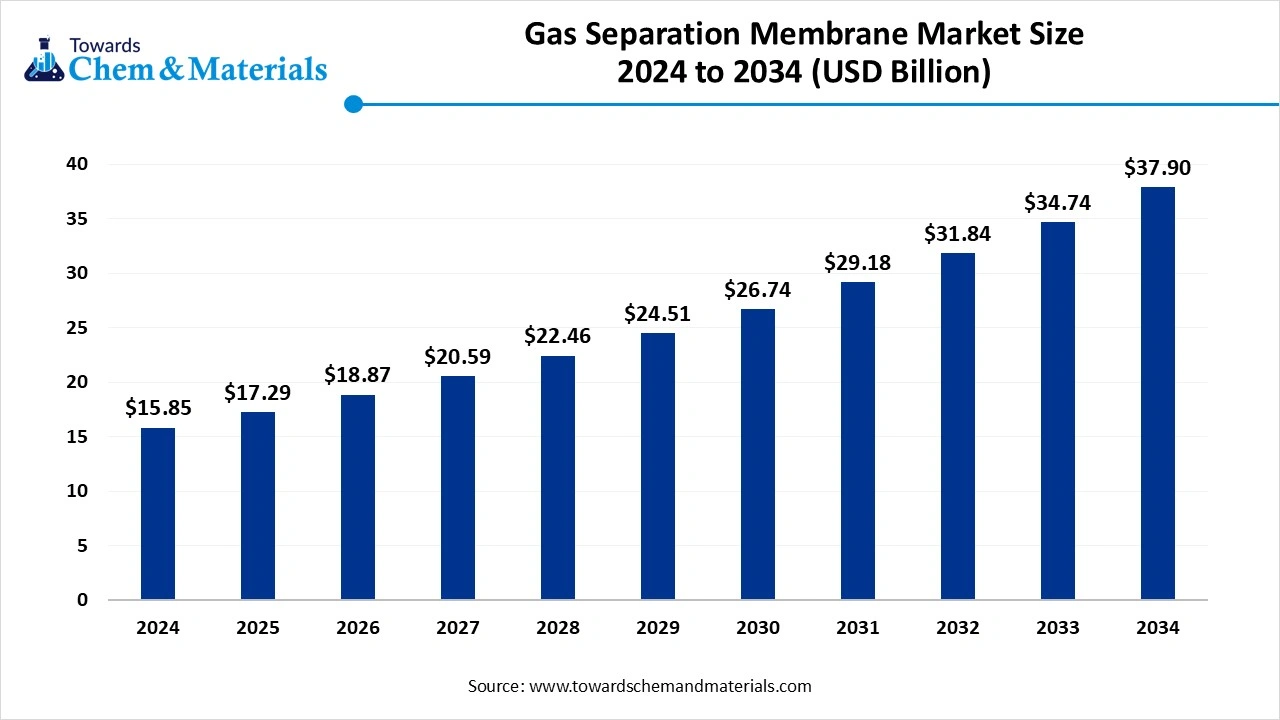

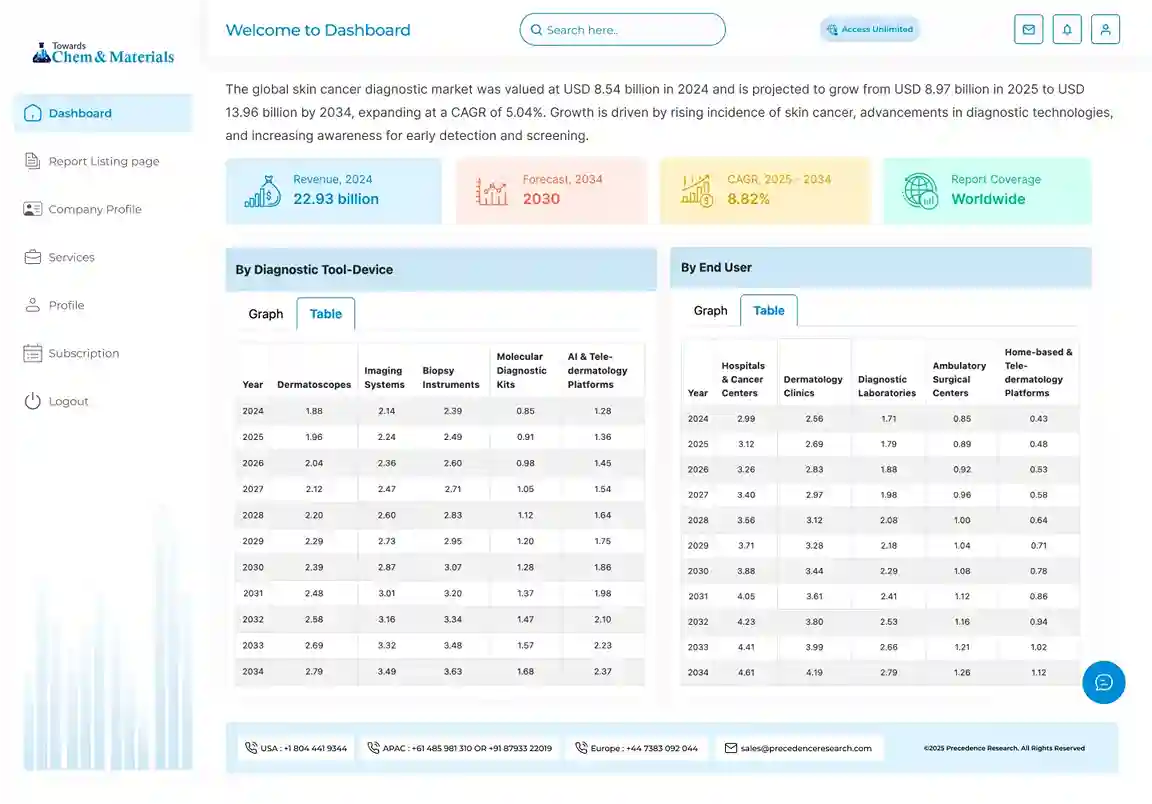

The global gas separation membrane market was valued at approximately USD 1.85 billion in 2024 and is projected to grow at a CAGR of 6.95% from 2025 to 2034, reaching a value of USD 3.62 billion by 2034.The expansion of the chemical and petrochemical industries is the key factor driving market growth. Also, stringent government regulations coupled with the increasing environmental concerns associated with climate change can fuel market growth further.

Key Takeaways

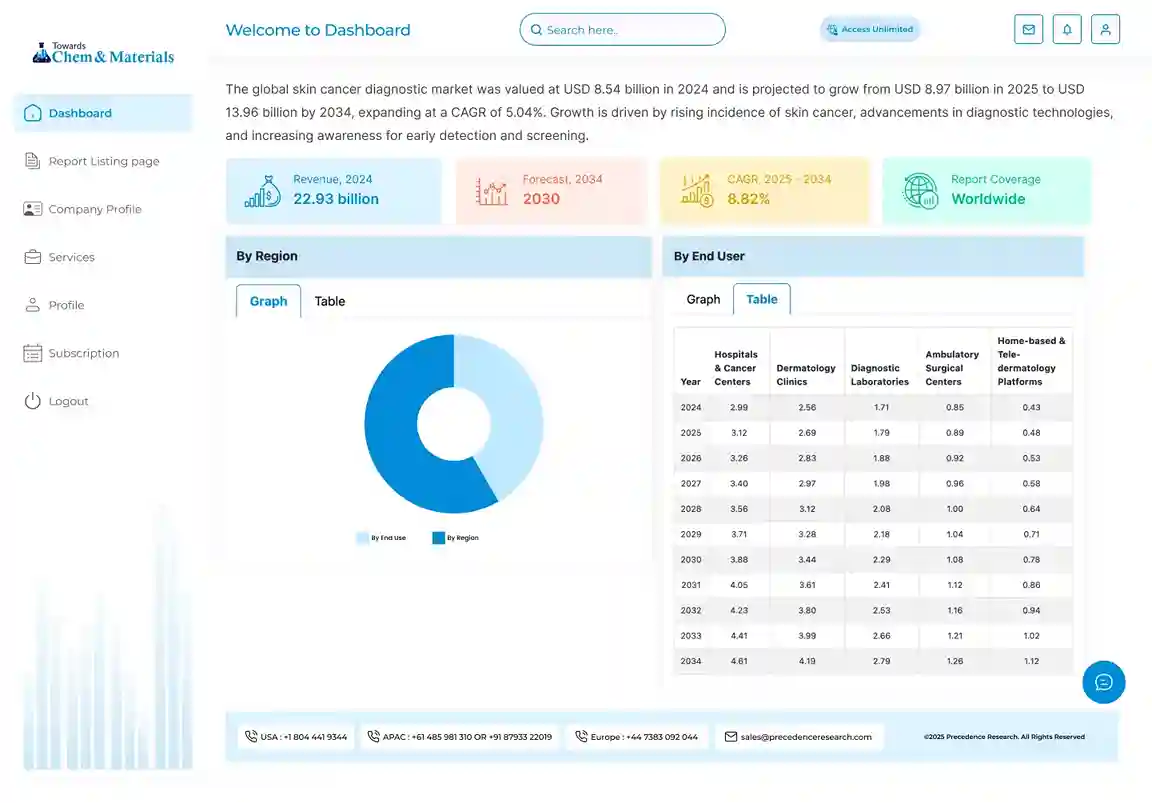

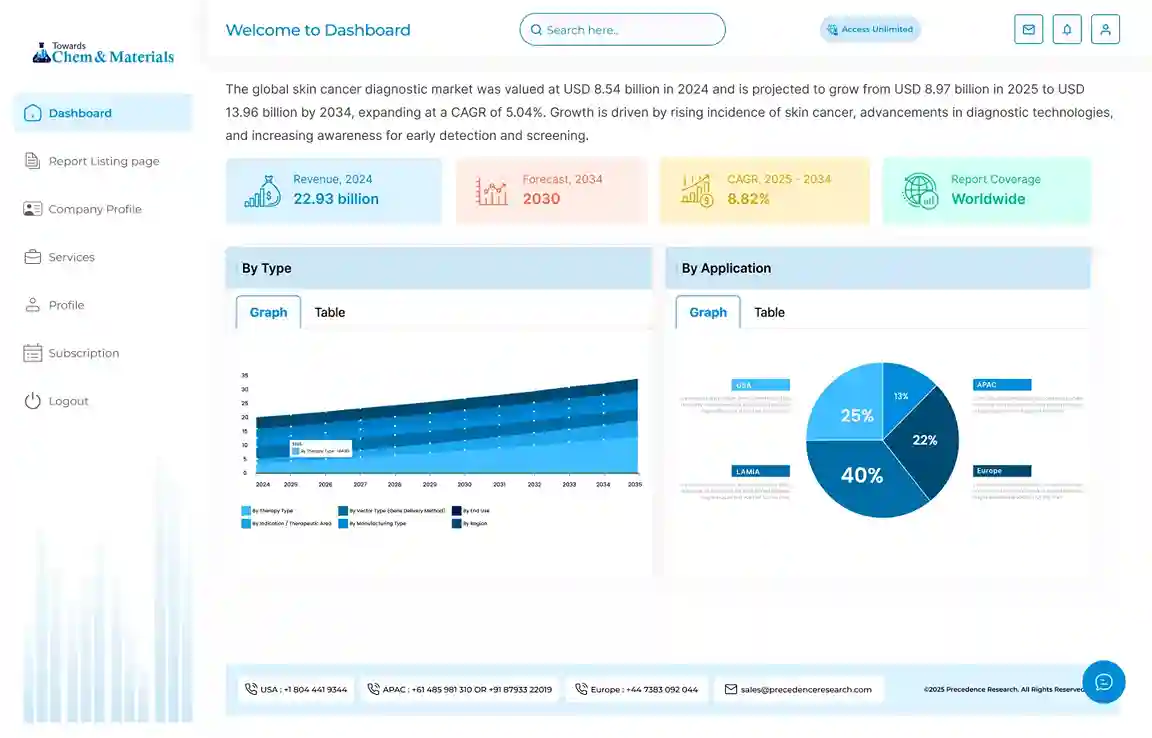

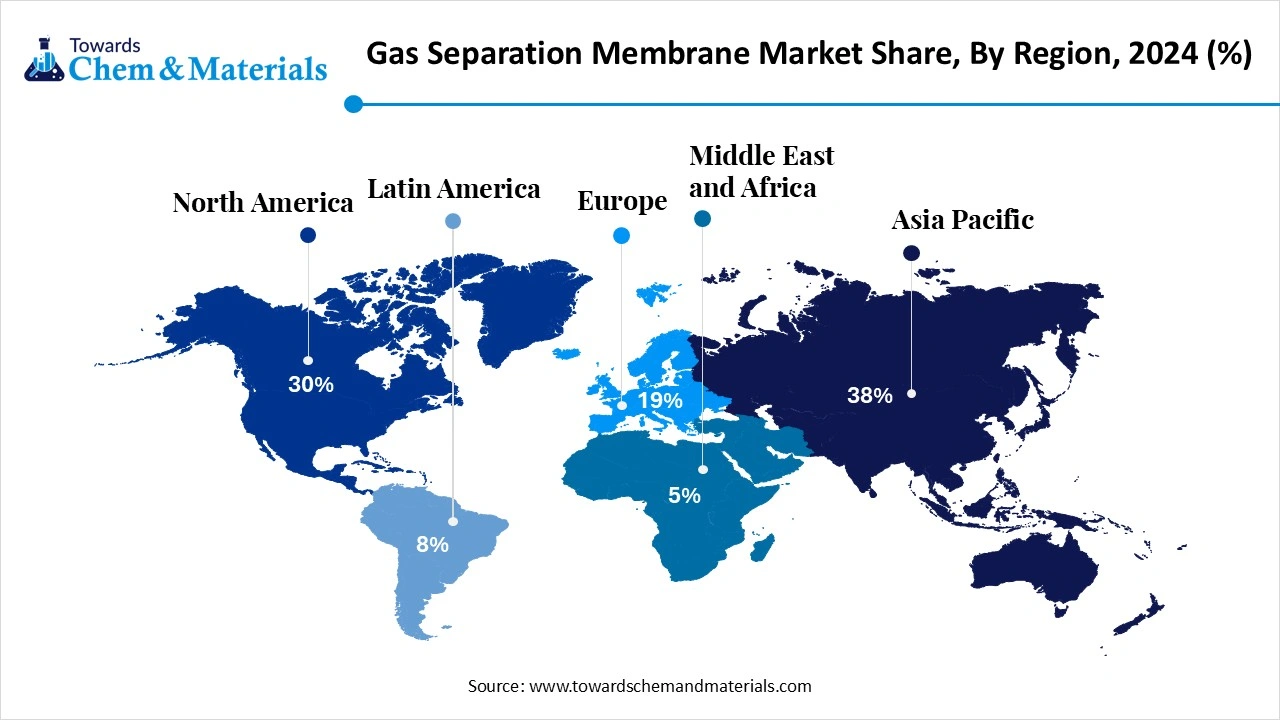

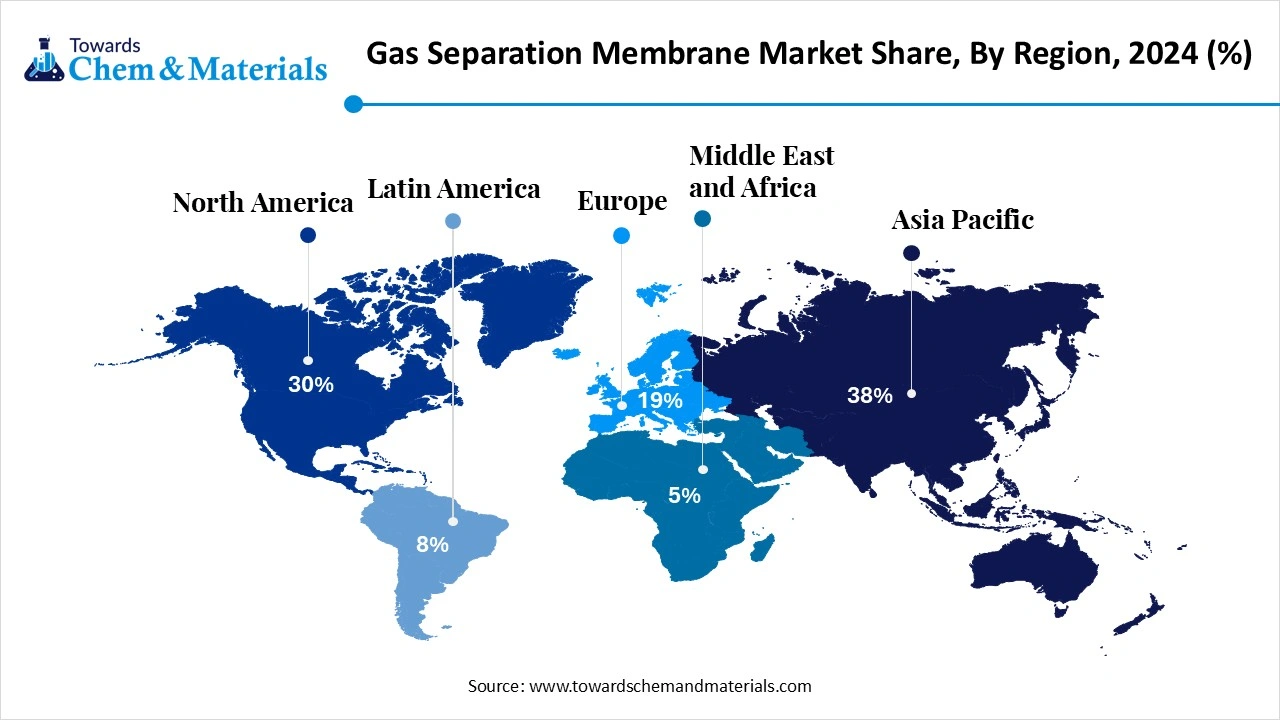

- The gas separation membrane market in Asia Pacific dominated the global industry with a revenue share of 38% in 2024.

- By region, the Middle East & Africa is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the substantial product demand in Qatar, Saudi Arabia, and the UAE.

- By material type, the polyimide & polyaramide segment held a 40% market share in 2024. The dominance of the segment can be attributed to the rising demand for these materials in different applications, along with the superior performance of polyimide & polyaramide in harsh conditions.

- By material type, the hybrid membranes (MMMs) are expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for improved membrane performance and cost-effectiveness.

- By module type, the hollow fiber segment led the market with 55% market share in 2024. The dominance of the segment can be linked to the rising demand for cost-effective and efficient gas separation techniques in numerous industries.

- By module type, the spiral wound segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by its superior permeation performance and high packing density.

- By application type, the nitrogen generation segment dominated the market with 30% market share in 2024. The dominance of the segment is owed to the increasing demand for high-purity nitrogen in applications such as electronics manufacturing.

- By application type, the CO₂ removal (Biogas) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the rising demand for biogas along with the cost-effectiveness of membrane separation.

- By end use, the oil & gas segment held a 35% market share in 2024. The dominance of the segment can be credited to the increasing use of gas separation membranes for hydrogen purification, carbon capture & storage, and natural gas processing.

- By end use, the food & beverage segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be attributed to the growing demand for safe, high-quality, and sustainable products.

Advancements in Membrane Materials are Expanding Market Growth

Gas Separation Membranes are thin, selective polymer or inorganic layers that allow certain gases to pass through more easily than others, enabling the separation of gas mixtures without phase change. These membranes are used in applications such as nitrogen generation, hydrogen recovery, carbon dioxide removal, and natural gas processing, across industries like oil & gas, petrochemicals, and food & beverage. The surge in production and utilization of biogas and natural gas, along with the need to remove impurities such as CO2 and H2S, is propelling the demand for gas separation membranes across the globe.

What Are the Key Trends Influencing the Gas Separation Membrane Market?

- The surge in global focus on reducing greenhouse gas emissions is the latest trend in the market. Gas separation membranes are a crucial component in this phase, enabling the efficient separation of CO₂ from industrial emissions. Gas separation membranes are also a major part of solutions, facilitating overall sustainability.

- The growing demand for oxygen, nitrogen in industries like fresh food packaging, healthcare, and chemical manufacturing is fuelling the adoption of gas separation membranes. These nitrogen generators are extensively utilized in electronics, oil and gas, and pharmaceutical industries because of their compact design and low operational costs.

- High energy efficiency of gas separation membranes is the major factor impacting market growth. These are the tools that can sort different gases based on the form and size of their molecules. As compared to other gas separation processes, such as absorption, distillation, or adsorption, they offer greater efficiency at a lower price.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 1.98 Billion |

| Market Size by 2034 | USD 3.62 Billion |

| Growth rate from 2024 to 2025 | CAGR 6.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Material Type, By Module Type, By Application, By End-Use Industry, By Region |

| Key Companies Profiled | Air Products and Chemicals, Inc., Air Liquide S.A., UBE Corporation, Parker Hannifin Corporation, Honeywell UOP, Membrane Technology and Research, Inc. (MTR), GENERON IGS, DIC Corporation, Fujifilm Manufacturing Europe B.V., Schlumberger Limited, Evonik Industries AG, W. L. Gore & Associates, Inc., Novamem Ltd., Compact Membrane Systems, Siemens Energy AG, Global Filter LLC, Zhejiang Jinlong Membrane Technology Co., Ltd., PermSelect Membranes (MedArray Inc.), Airrane Co., Ltd., Delta Engineering BV |

How is the Government Supporting the Gas Separation Membrane Market?

Governments across the globe are increasingly supporting the market by implementing stringent environmental regulations, which boosts the adoption of these technologies. These regulations, emphasizing minimizing emissions of harmful gases such as VOCs and CO2 to fuels the demand for gas separation membranes in sectors such as chemicals, oil & gas, and power generation. For instance, some governments might provide tax credits for companies utilising gas separation membranes in their carbon capture and storage (CCS) initiatives.

Market Opportunity

Increasing Demand for Biogas

The growing demand for biogas, a renewable energy source, is creating lucrative opportunities in the market by optimising efficient biogas upgrading technologies, which use gas separation membranes to separate out methane from biogas mixtures. Furthermore, advancements in membrane materials, like inorganic materials, advanced polymers, and hybrid systems, are improving the efficiency and performance of gas separation processes.

- In January 2025, Arkema and OOYOO announced a collaboration to advance highly functional gas separation membrane technology for carbon capture. ARKEMA will bring in its cutting-edge technology on material design and polymer synthesis to develop this new technology.(Source: www.indianchemicalnews.com)

Market Challenges

Technical Limitations

Gas separation membranes often involve an exchange between permeability and selectivity, which further can limit their efficiency in achieving the desired purity levels for different applications, especially in large-scale gas separation. Moreover, membrane materials and fabrications can be expensive, particularly for advanced materials such as 2D membranes, which can hamper their extensive adoption in other industries.

Regional Insights

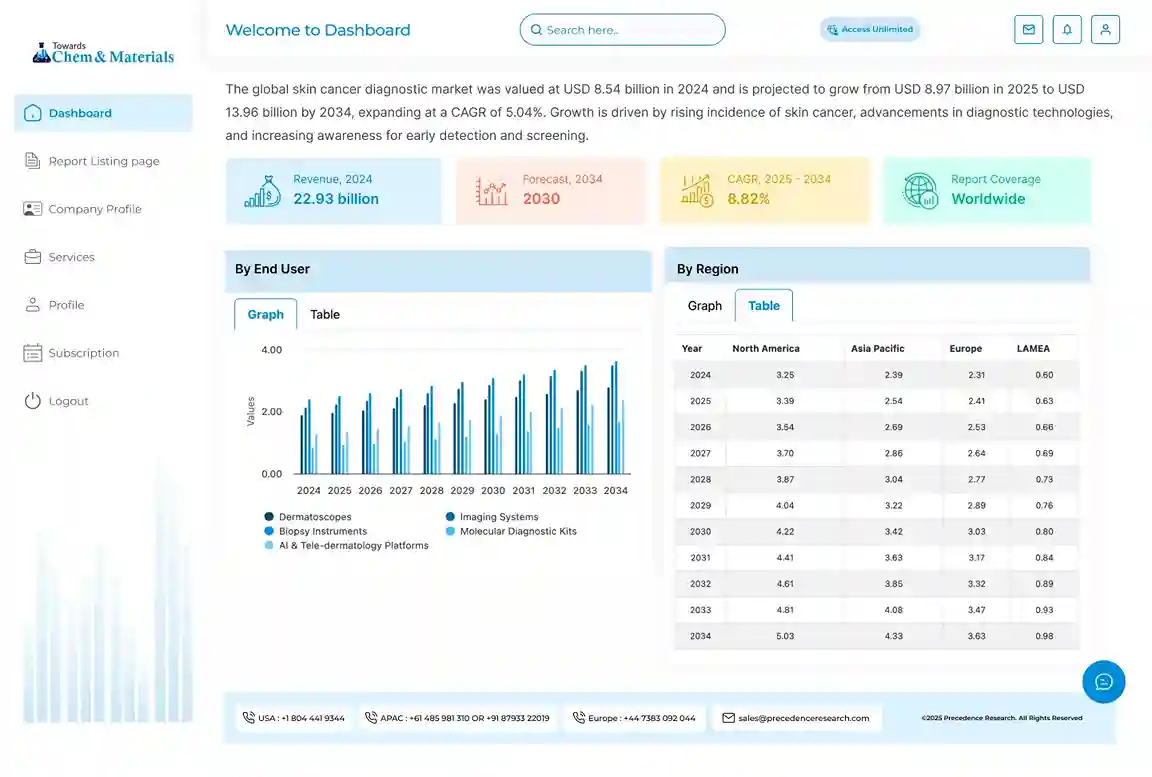

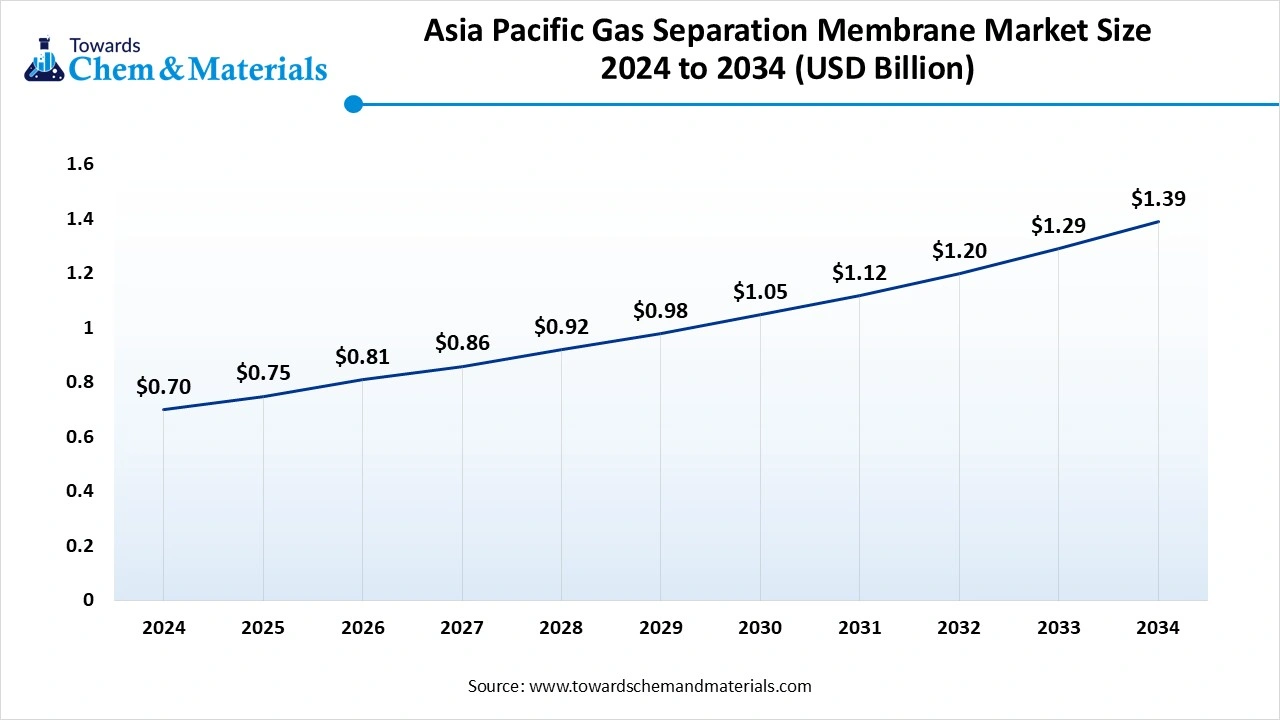

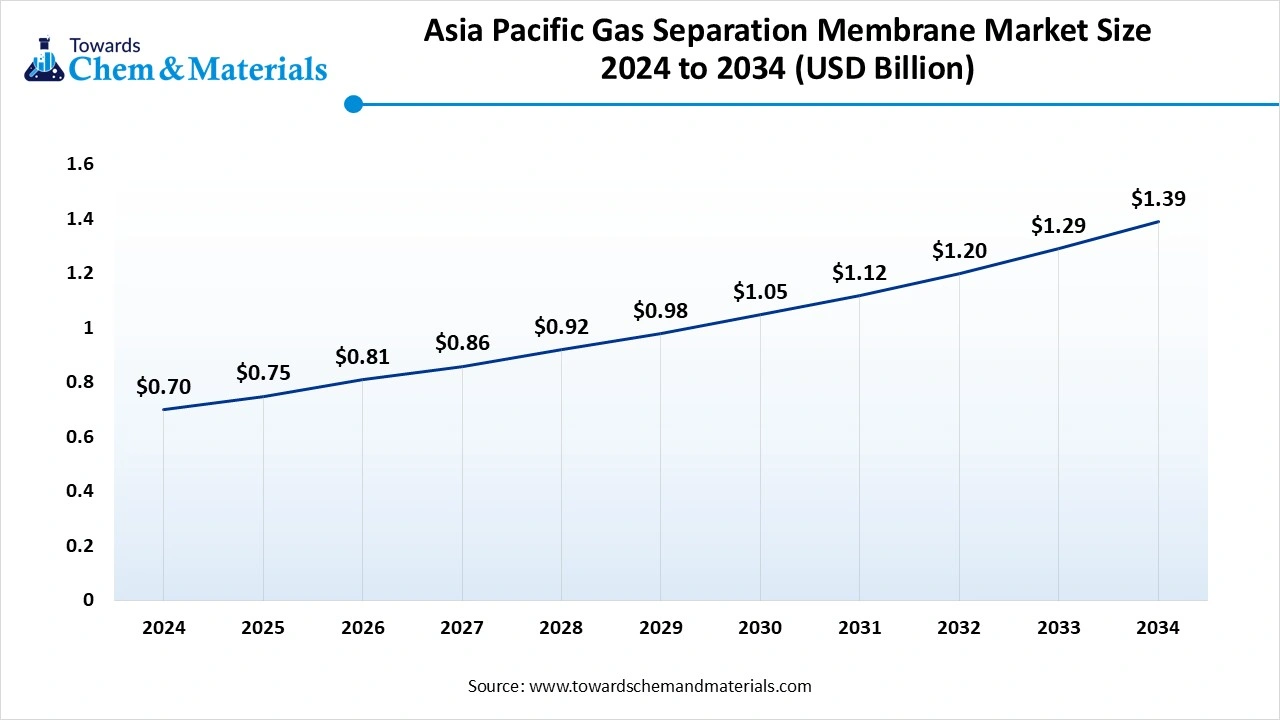

The Asia Pacific gas separation membrane market size accounted for USD 0.75 billion in 2025 and is forecasted to hit around USD 1.39 billion by 2034, representing a CAGR of 7.10% from 2025 to 2034.

Asia Pacific dominated the gas separation membrane market with a 38% market share in 2024. The dominance of the region can be attributed to the surge in investments in modernizing automotive systems, along with the increasing emphasis on developing compact computers. In addition, rapid industrialization and ongoing implementation of stringent regulations set by different governments across the world to maintain environmental quality can positively impact regional growth further.

Gas Separation Membrane Market in China

In Asia Pacific, China led the market owing to the innovations in membrane technology, rapid industrialization, and increasing emphasis on environmental regulations. Also, the rising demand for biogas and the need for storage (CCS) and carbon capture technologies are also major factors fuelling the market growth in the country.

The Middle East & Africa are expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the substantial product demand in Qatar, Saudi Arabia, and the UAE. These nations face various environmental challenges arising from massive drilling and extraction activities. Furthermore, robust government support for R&D and an emphasis on tackling water scarcity issues are boosting the regional market expansion shortly.

Gas Separation Membrane Market in Saudi Arabia

In the Middle East & Africa, Saudi Arabia dominated the market by holding the largest market share, due to environmental regulations, increased industrial activity, and the demand for smooth gas processing in industrial activity. Moreover, advancements in membrane designs and materials are improving the durability, performance, and cost-effectiveness of gas separation membranes in the country.

Who is the Top Petroleum Gas Exports Countries in 2024?

| Country | Exports in Billions |

| United States | $62.2 billion |

| Norway | $54.1 billion |

| Australia | $46.9 billion |

| Qatar | $44.7 billion |

| Russia | $40.3 billion |

Segmental Insight

Material Type Insight

Which Material Type Segment Dominated the Gas Separation Membrane Market in 2024?

The polyimide & polyaramide segments held a 40% market share in 2024. The dominance of the segment can be attributed to the rising demand for these materials in different applications, along with the superior performance of polyimide & polyaramide in harsh conditions. In addition, the membranes made of these materials provide excellent chemical resistance and thermal stability, which makes them suitable for various industrial environments.

The hybrid membranes (MMMs) are expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for improved membrane performance, cost-effectiveness, and government initiatives supporting clean energy adoption. Also, MMMs are playing an important role in biogas upgrading by selectively separating methane from other gases, which contributes to the growth of the segment.

Module Type Insight

Why Did the Hollow Fiber Segment Dominated the Gas Separation Membrane Market in 2024?

The hollow fiber segment led the market with 55% market share in 2024. The dominance of the segment can be linked to the rising demand for cost-effective and efficient gas separation techniques in numerous industries. Moreover, hollow fiber membranes are preferred for their high filtration efficiency, compact design, and suitability for continuous production processes, leading to segment growth shortly.

The spiral wound segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by its superior permeation performance, high packing density, and compatibility for large-scale industrial applications. The spiral wound modules provide a larger membrane surface area within a compact design, which leads to efficient space utilization for separation systems.

Application Insight

How Did the Nitrogen Generation Segment Held a Largest Market Share in 2024?

The nitrogen generation segment dominated the market with a 30% market share in 2024. The dominance of the segment is owed to the increasing demand for high-purity nitrogen in applications such as electronics manufacturing, food packaging, and medical oxygen enrichment. Furthermore, the energy efficiency and cost efficiency of membrane-based nitrogen generation as compared to conventional methods are also fuelling its adoption in the market.

The CO₂ removal (Biogas) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the rising demand for biogas along with the cost-effectiveness of membrane separation, particularly membrane technology is preferred for biogas upgrading because of its scalability and ease of implementation. Subsidies and incentives for biogas production and use further propel the demand for biogas upgrading technologies.

End-Use Industry Insights

Which End-Use Segment Dominated the Gas Separation Membrane Market in 2024?

The oil & gas segment held a 35% market share in 2024. The dominance of the segment can be credited to the increasing use of gas separation membranes for hydrogen purification, carbon capture & storage, and natural gas processing. In addition, gas separation membranes are utilised in the petrochemical and refining industries to separate gases such as hydrocarbons and hydrogen, which are necessary for various chemical processes.

The food & beverage segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be attributed to the growing demand for safe, high-quality, and sustainable products. Membrane technologies are used for filtration and purification processes in different applications such as juice clarification, dairy processing, and ingredient extraction, enhancing overall product quality.

Recent Developments

- In May 2025, Borna Membrane Solutions announced its plan to invest $40 million to build a facility to manufacture carbon separation technologies, flare gas recovery systems, and reinjection solutions for the Egyptian natural gas market.(Source: egyptoil-gas.com)

- In September 2024, Evonik introduced its new biogas membrane known as Sepuran Green G5X 11", which has the highest capacity among other biogas membranes. Created for updating biogas to renewable natural gas (RNG) in organic and agricultural waste and in large landfills.(Source: www.filtsep.com)

Top Companies List

- Air Products and Chemicals, Inc.

- Air Liquide S.A.

- UBE Corporation

- Parker Hannifin Corporation

- Honeywell UOP

- Membrane Technology and Research, Inc. (MTR)

- GENERON IGS

- DIC Corporation

- Fujifilm Manufacturing Europe B.V.

- Schlumberger Limited

- Evonik Industries AG

- W. L. Gore & Associates, Inc.

- Novamem Ltd.

- Compact Membrane Systems

- Siemens Energy AG

- Global Filter LLC

- Zhejiang Jinlong Membrane Technology Co., Ltd.

- PermSelect Membranes (MedArray Inc.)

- Airrane Co., Ltd.

- Delta Engineering BV

Segments Covered

By Material Type

- Polymeric Membranes

- Polyimide & Polyaramide

- Cellulose Acetate

- Polysulfone

- Polyethersulfone (PES)

- Polyvinylidene Fluoride (PVDF)

- Others

- Inorganic Membranes

- Zeolite

- Alumina

- Silica

- Carbon

- Hybrid Membranes (Mixed Matrix Membranes - MMMs)

By Module Type

- Hollow Fiber

- Spiral Wound

- Plate & Frame

- Others (Capillary Tube, Tubular)

By Application

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- Natural Gas Sweetening

- Biogas Upgradation

- Natural Gas Processing

- VOC Recovery

- Air Separation

- Others (e.g., Helium Separation, Syngas Treatment)

By End-Use Industry

- Oil & Gas

- Chemical & Petrochemical

- Food & Beverage

- Pharmaceutical

- Electronics

- Power Generation

- Metal & Mining

- Others (e.g., Water Treatment, Aerospace)

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE