Content

What is the Current Biogas Market Size and Share?

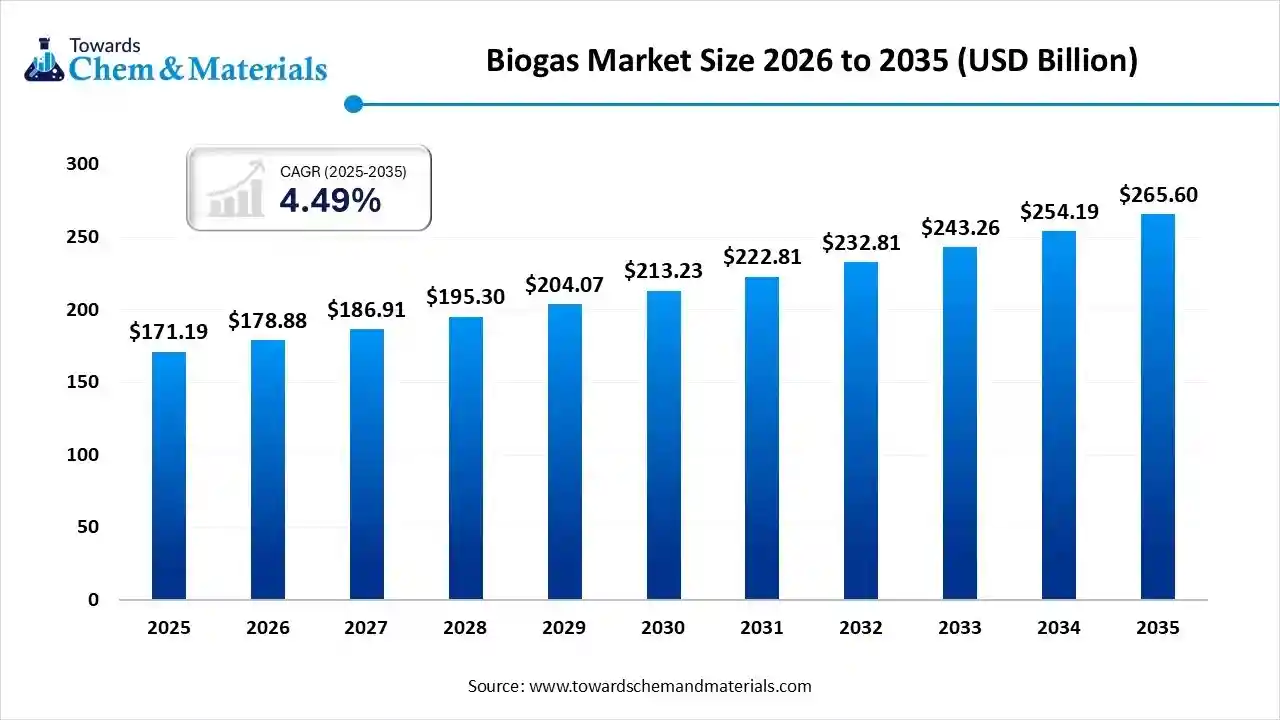

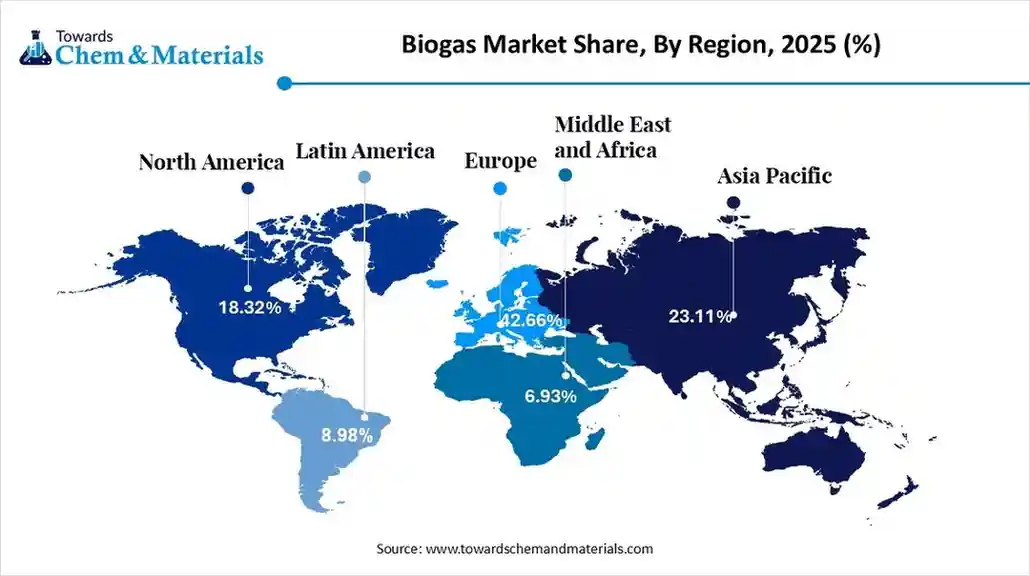

The global biogas market size was estimated at USD 171.19 billion in 2025 and is predicted to increase from USD 178.88 billion in 2026 and is projected to reach around USD 265.60 billion by 2035, The market is expanding at a CAGR of 4.49% between 2026 and 2035. Europe dominated the biogas market with a market share of 42.66% the global market in 2025. Government support, increasing waste generation, rising energy demand, and the global push for renewable energy to cut fossil fuel reliance and GHG emissions drive the growth of the market.

Key Takeaways

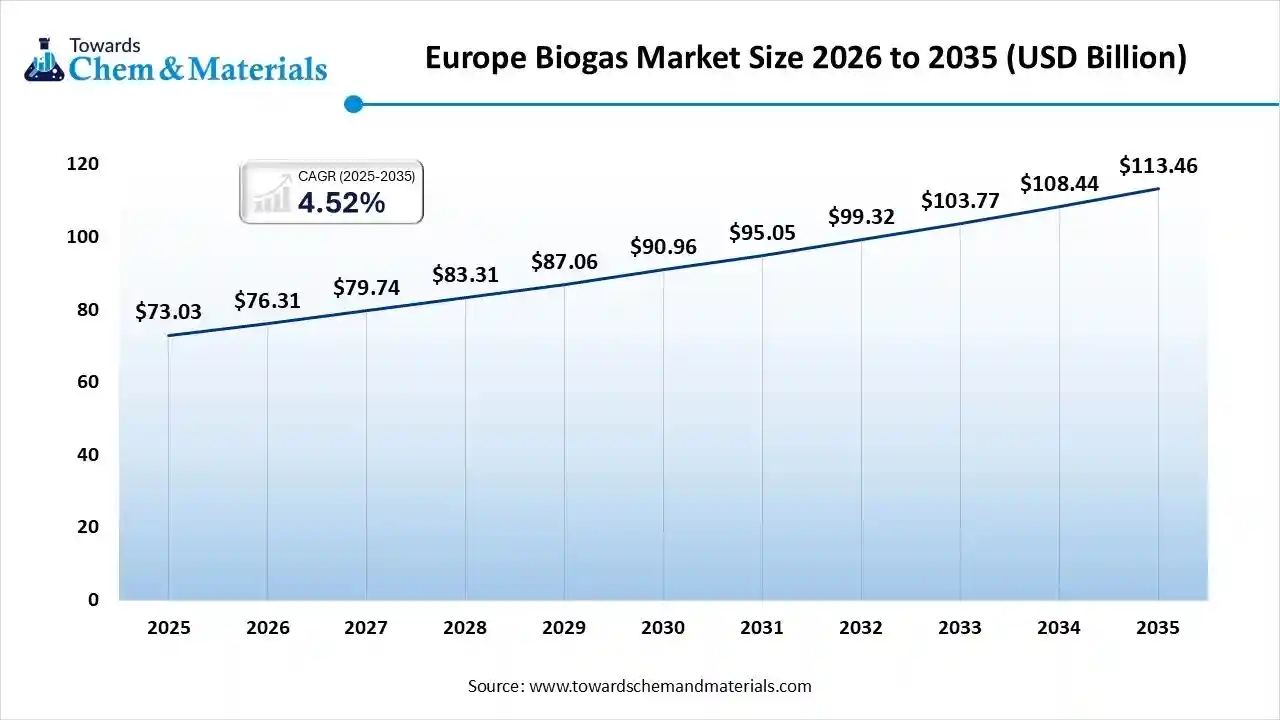

- By region, Europe led the market with the largest revenue share of over 42.66% in 2025. Stringent climate targets and initiatives drive the growth.

- By region, Asia Pacific is expected to have fastest growth in the market in the forecast period between 2026 and 2035. Sustainability initiatives and growing environmental concerns drive the growth.

- By source, the municipal segment led the market with the largest revenue share of 43.11% in 2025. Governments and municipal supportive initiatives drive the growth.

- By source, the industrial segment is projected to grow at a CAGR between 2026 and 2035. The growing demand for industrial biogas for plants drives the growth.

- By application, the electricity segment led the market with the largest revenue share of 32.55% in 2025.Captive power generation models drive the demand for the market.

- By application, the upgraded biogas segment is projected to grow at a CAGR between 2026 and 2035. Compatibility with natural gas infrastructure supports the growth of the market.

Market Overview

What Is The Significance Of The Biogas Market?

The biogas market is significant for its role in the energy transition, offering renewable, flexible power while tackling waste management and climate change by capturing potent methane from organic waste, supporting the circular economy, boosting energy security, creating rural jobs, and improving health through cleaner cooking, especially in developing nations. It provides a stable energy source that balances intermittent renewables like wind/solar, reduces fossil fuel reliance, and turns waste streams into valuable resources.

Biogas Market Growth Trends:

- Shift to Biomethane: Moving from electricity generation to upgrading biogas to biomethane Renewable Natural Gas - RNG to use in existing gas infrastructure or as vehicle fuel.

- Feedstock Diversification: Expanding beyond manure to include food waste, industrial organic waste, energy crops, and sewage sludge, increasing efficiency.

- Government Support: Initiatives like India's SATAT and global climate goals (Paris Agreement) boost investment and adoption.

- Waste Management: Biogas offers a sustainable solution for municipal and industrial organic waste, reducing landfills and GHG emissions.

- Energy Security: Biogas provides decentralized, local energy, reducing dependence on imported fossil fuels.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 178.88 Billion |

| Revenue Forecast in 2035 | USD 265.60 Billion |

| Growth Rate | CAGR 4.49% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Europe |

| Segment Covered | By Source, By Application, By Region |

| Key companies profiled | Wärtsilä Corporation, PlanET Biogas Group, BioConstruct GmbH, ENGIE SA, Agrinz Technologies GmbH, Air Liquide, DMT International, Gasum Oy, HomeBiogas Inc., PlanET Biogas, Scandinavian Biogas Fuels International AB, Schmack Biogas Service, Total, Xebec Adsorption Inc. |

Key Technological Shifts In The Biogas Market:

The biogas market is shifting towards smarter, more efficient technologies, focusing on advanced Anaerobic Digestion (AD) and sophisticated biogas upgrading to produce high-purity biomethane. Key trends involve IoT & automation for monitoring, integrating with biorefineries for diverse products, exploring biological upgrading, and developing decentralized systems, all aiming to cut costs, boost yields, and improve sustainability.

Trade Analysis Of the Biogas Market: Import & Export Statistics

- According to India Export data, India shipped out 505 shipments of Biogas, made by 41 Indian exporters to 94 buyers. Most of these Biogas exports from India go to Indonesia, Kenya, and the Philippines.

- Globally, the leading exporters of Biogas are India, Germany, and China. India tops the list with 496 shipments, followed by Germany with 359 shipments, and China with 164 shipments.

- Additionally, India exported 123 shipments of Biogas plant, carried out by 17 Indian exporters to 38 buyers.

- Most of the Biogas plant exports from India go to the Philippines, the Maldives, and Kenya.

- Globally, Germany, India, and Italy are the top exporters of Biogas plants. Germany leads with 158 shipments, followed by India with 114 shipments and Italy with 19 shipments.

Biogas Market Value Chain Analysis

- Production and Processing: Biogas is produced through anaerobic digestion of organic feedstocks such as agricultural waste, animal manure, food waste, sewage sludge, and industrial organic residues. Processing includes gas upgrading, purification, moisture removal, compression, and conversion into biomethane for grid injection or transport use.

- Key players: EnviTec Biogas, Wärtsilä, PlanET Biogas, Xebec Adsorption

- Quality Testing and Certification: Biogas requires certifications for gas composition, methane content, safety, sustainability, and grid compatibility. Key certifications include Renewable Energy Certificates (REC), ISCC sustainability certification, ISO environmental standards, and compliance with national gas quality regulations.

- Key players: ISO (International Organization for Standardization), TÜV SÜD, ISCC (International Sustainability & Carbon Certification), UL Solutions

- Distribution to Industrial Users: Biogas is supplied to power generation plants, combined heat and power (CHP) systems, industrial energy users, transportation fuel networks (bio-CNG/bio-LNG), and municipal utilities.

- Key players: ENGIE, Gasum, TotalEnergies.

Biogas Regulatory Landscape: Global Regulations

| Region | Market Characteristics | Key Growth Drivers | Major End-Use Sectors | Notable Notes |

| North America | Well-established biogas infrastructure with strong landfill and agricultural digestion projects | Renewable energy mandates, waste-to-energy initiatives, and government incentives | Power generation, transportation fuel (RNG), waste management | The U.S. dominates regional demand, driven by RNG adoption in transportation and utility sectors |

| Europe | Mature and highly regulated biogas market with strong integration into energy grids | EU renewable energy targets, circular economy policies, and agricultural subsidies | Electricity & heat generation, grid injection, bio-methane fuel | Germany, France, and Italy lead production; strong policy support for biomethane |

| Asia Pacific | Rapidly expanding market with large-scale adoption in rural and industrial sectors. | Rising energy demand, waste management needs, and government biogas programs | Rural energy, industrial heat, and power generation | China and India dominate installations, particularly small-scale and agricultural digesters. |

| South America | Emerging market with increasing investments in waste-to-energy projects | Urban waste management, renewable energy diversification | Power generation, industrial energy | Brazil leads regional growth due to agro-industrial waste availability |

| Middle East & Africa | Nascent but growing biogas adoption, mainly in waste and agriculture applications | Energy access initiatives, organic waste utilization | Power generation, rural electrification | Growth remains project-based, with increasing international funding support. |

Segmental Insights

Source Insights

How Did the Municipal Segment Dominated The Biogas Market In 2025?

The municipal segment dominated the market with a 43.11% share in 2025. Municipal sources form a major segment of the market, driven by the increasing generation of urban solid waste, sewage sludge, and organic municipal waste. Governments and municipalities are actively investing in waste-to-energy projects to reduce landfill pressure and meet sustainability targets. Municipal biogas projects also support circular economy models by converting waste into renewable energy and organic fertilizers.

The industrial segment is projected to grow at a CAGR between 2026 and 2035 in the market. Industrial biogas production is gaining traction due to the high organic content present in effluents from food processing, breweries, pulp and paper, and agro-industrial operations. Industries adopt biogas systems to manage waste, lower energy costs, and comply with environmental regulations. Industrial biogas plants offer higher gas yields and consistent feedstock availability, making them economically attractive for large-scale installations.

Application Insights

Which Application Segment Dominated The Biogas Market In 2025?

The electricity segment dominated the market with a 32.55% share in 2025. Electricity generation represents a key application segment for biogas, especially in regions with supportive renewable energy policies and feed-in tariffs. Biogas-powered generators provide reliable baseload power, particularly for rural areas and industrial facilities. The segment benefits from grid-connected and captive power generation models, contributing to energy security and the reduction of greenhouse gas emissions.

The upgraded biogas segment is projected to grow at a CAGR between 2026 and 2035 in the market. Upgraded biogas, also known as biomethane, is an emerging and high-growth segment due to its compatibility with natural gas infrastructure. After purification, biomethane can be injected into gas grids or used as vehicle fuel. This segment is driven by decarbonization goals, renewable gas mandates, and growing adoption in transportation and industrial heating applications.

Regional Insights

The Europe’s biogas market size was valued at USD 73.03 billion in 2025 and is expected to surpass around USD 113.46 billion by 2035, expanding at a compound annual growth rate (CAGR) of 4.52% over the forecast period from 2026 to 2035. Europe dominated the market, accounting for a 42.66% share in 2025. Europe represents one of the most mature and structured markets globally, driven by stringent climate targets, circular economy policies, and strong renewable energy mandates. Government incentives, feed-in tariffs, and decarbonization of heating and transport continue to support stable market growth across residential, industrial, and municipal applications.

Germany: Biogas Market Growth Trends

Germany is the leading biogas producer in Europe, supported by decades of investment under renewable energy legislation and strong agricultural participation. The country has a dense network of anaerobic digestion plants using agricultural residues, energy crops, and organic waste. Increasing focus on upgrading biogas to biomethane for grid injection and transport fuels, along with sustainability-driven feedstock optimization, is shaping the next phase of market development.

Asia Pacific: Biogas Market: Influenced By Sustainability Initiatives

Asia Pacific is expected to have fastest growth in the market in the forecast period between 2026 and 2035. Asia Pacific is an emerging but high-growth market, supported by rising energy demand, waste management challenges, and rural electrification initiatives. Governments across the region are promoting biogas to reduce dependence on fossil fuels and improve organic waste disposal. The market spans small-scale household digesters to industrial and municipal projects, with strong potential in agricultural economies.

India: Biogas Market Growth Trends

India’s biogas market is expanding rapidly due to strong government programs promoting compressed biogas (CBG), rural energy access, and organic waste utilization. Agricultural residues, animal waste, and municipal solid waste form the primary feedstock base. Public-private partnerships, supportive policies, and integration with clean transportation fuel initiatives are driving both decentralized and commercial-scale biogas plant development.

North America Biogas Market Growth Is Driven By Supportive Policies

North America is witnessing steady expansion in the market, fueled by landfill gas utilization, wastewater treatment applications, and renewable natural gas (RNG) adoption. Policy support at the federal and state levels, including renewable fuel standards and low-carbon fuel programs, is accelerating commercial-scale projects. The region is increasingly focusing on RNG integration into gas grids and transportation fuel systems to reduce methane emissions.

United States: Biogas Market Growth Trends

The U.S. biogas market is driven by strong demand for renewable natural gas across transportation, power generation, and industrial sectors. Agricultural digesters, landfill gas recovery, and wastewater treatment facilities dominate production. Federal incentives, carbon credit mechanisms, and corporate sustainability commitments are encouraging large-scale investments, particularly in dairy-based anaerobic digestion and RNG upgrading technologies.

South America: Biogas Market Growth Is Driven By The Waste Management Initiative And Growing Adoption

South America presents growing opportunities in the market, supported by abundant agricultural residues and expanding agro-industrial activity. The region is gradually adopting biogas for power generation, industrial heat, and waste management. While infrastructure development is still evolving, favorable renewable energy policies and increasing sustainability awareness are creating a foundation for long-term market growth.

Brazil: Biogas Market Growth Trends

Brazil is a key market in South America, leveraging its strong agribusiness sector and large volumes of sugarcane residues, livestock waste, and organic by-products. Biogas adoption is increasing in agro-industrial facilities and landfills, with growing interest in biomethane for transport and grid injection. Regulatory improvements are expected to further accelerate market penetration.

Middle East & Africa Growth Of The Market Is Driven By Energy Diversification

The Middle East & Africa region is at an early but promising stage of biogas adoption, driven by waste management needs, energy diversification goals, and sustainability initiatives. Biogas projects are mainly concentrated around municipal waste treatment, agriculture, and off-grid energy solutions. International funding and policy support are playing a crucial role in market development.

South Africa: Biogas Market Growth Trends

South Africa is emerging as a leading market in the MEA region, supported by industrial waste-to-energy projects and agricultural digesters. Biogas is increasingly used for captive power generation, reducing reliance on conventional electricity sources. Supportive renewable energy policies, combined with rising industrial energy costs, are encouraging investment in anaerobic digestion and biogas upgrading technologies.

Recent Developments

- In September 2025, Biofriends Inc. and Cheongmyeong Co. signed an MOU and launched their first commercial biomethanol plant for the shipping industry in South Korea. This project represents a global trend toward converting organic waste into high-value fuels.(Source: worldbiomarketinsights.com)

- In October 2025, Union Minister Amit Shah inaugurated India's first cooperative-run Compressed Bio-Gas (CBG) plant at the Sahakar Maharshi Shankarrao Kolhe Cooperative Sugar Factory in Kopargaon, Maharashtra. (Source : www.gktoday.in)

- In April 2025, the Kochi Corporation, the Kerala State Government, and Bharat Petroleum Corporation Limited (BPCL) signed an MoU to launch a Compressed Bio-Gas (CBG) plant at Brahmapuram. The plant will initially process 150 tonnes of waste daily to produce approximately 6 tonnes of CBG and 28 tonnes of organic manure. (Source: timesofindia.indiatimes.com)

Top Players In The Biogas Market & Their Offerings:

- ENGIE SA: ENGIE is a leading global player in the biogas and biomethane market, developing and operating anaerobic digestion plants across Europe and other regions. The company focuses on renewable gas production for grid injection, power generation, and industrial decarbonization.

- EnviTec Biogas AG: EnviTec specializes in the development, construction, and operation of biogas plants using agricultural waste, organic residues, and energy crops. The company provides turnkey biogas solutions, including gas upgrading systems for biomethane production.

- Wärtsilä Corporation: Wärtsilä supplies biogas-powered engines and integrated energy systems for electricity and heat generation. Its solutions support industrial facilities, utilities, and decentralized energy projects seeking low-carbon and renewable power generation.

- PlanET Biogas Group: PlanET is a major biogas plant manufacturer and technology provider, delivering anaerobic digestion systems for agricultural, industrial, and municipal applications. The company emphasizes efficiency optimization, digital monitoring, and long-term operational reliability.

- BioConstruct GmbH: BioConstruct designs, builds, and operates biogas and biomethane plants globally. The company focuses on waste-to-energy solutions, biogas upgrading, and sustainable energy infrastructure development for agricultural and industrial customers.

Other Top Players Are

- Agrinz Technologies GmbH

- Air Liquide

- DMT International

- Gasum Oy

- HomeBiogas Inc.

PlanET Biogas - Scandinavian Biogas Fuels International AB

- Schmack Biogas Service

- Total

- Xebec Adsorption Inc.

Segments Covered

By Source

- Municipal

- Landfill

- Wastewater

- Industrial

- Food Scrap

- Wastewater

- Agricultural

- Dairy

- Poultry

- Swine Farm

- Agricultural Residue

By Application

- Vehicle Fuel

- Electricity

- Heat

- Upgraded Biogas

- Cooking Gas

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa