Content

What is the Current Ammonia Fuel Market Size and Share?

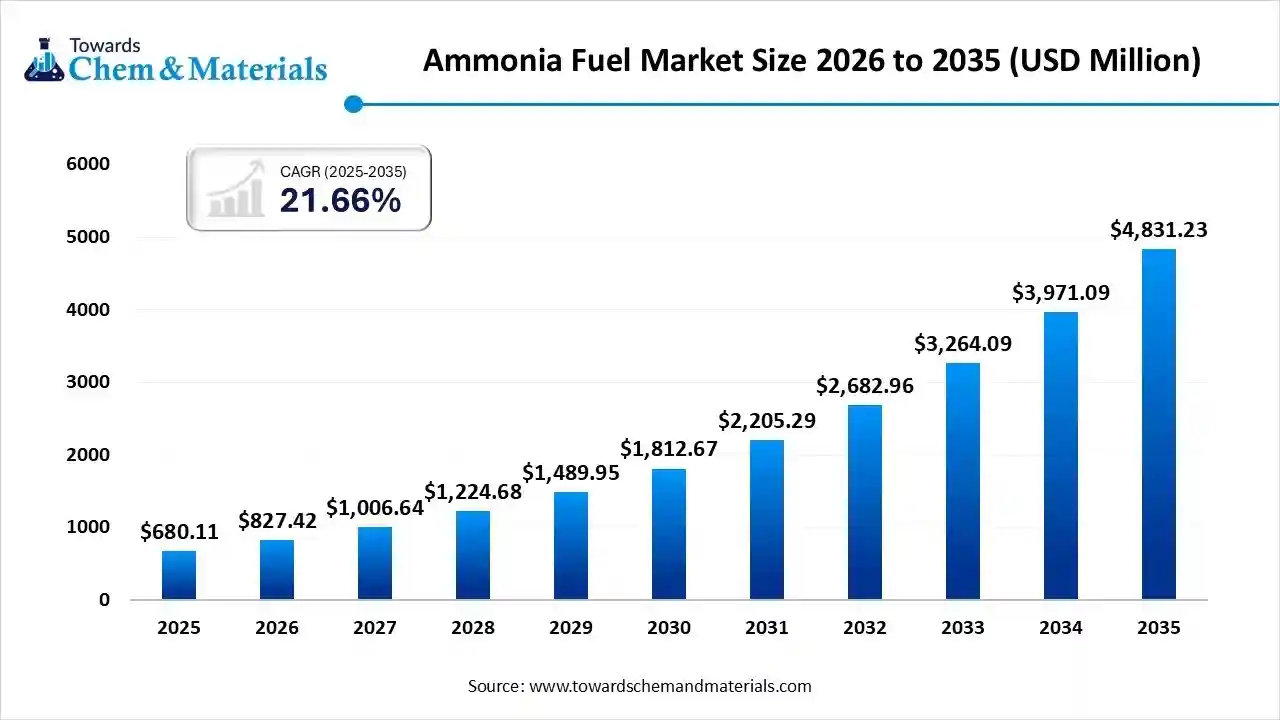

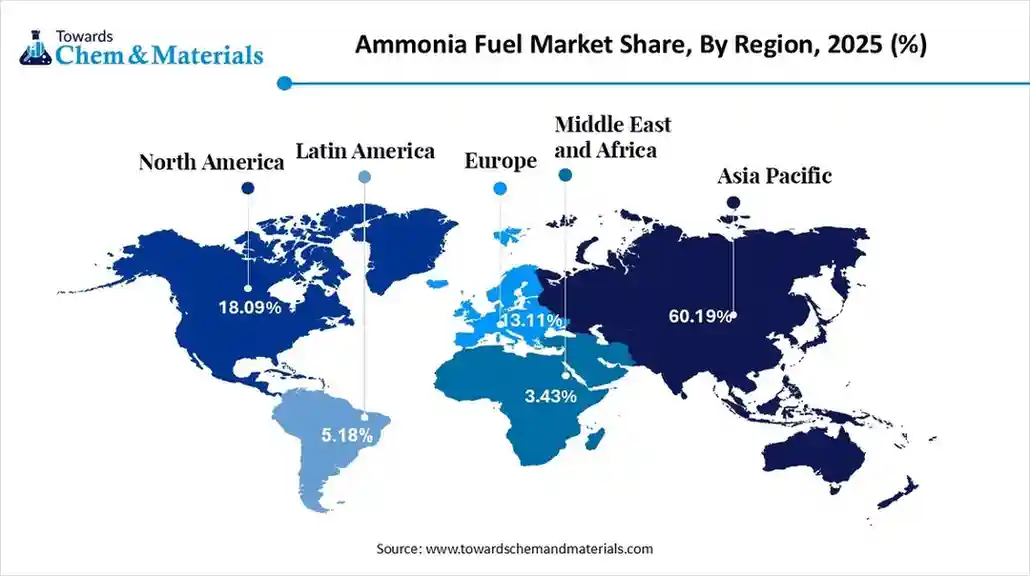

The global ammonia fuel market size was estimated at USD 680.11 million in 2025 and is predicted to increase from USD 827.42 million in 2026 and is projected to reach around USD 4,831.23 million by 2035, The market is expanding at a CAGR of 21.66% between 2026 and 2035. Asia Pacific dominated the ammonia fuel market with a market share of 60.19% the global market in 2025.The initiative towards the minimization of fossil fuel dependence has fueled industry potential in recent years.

Key Takeaways

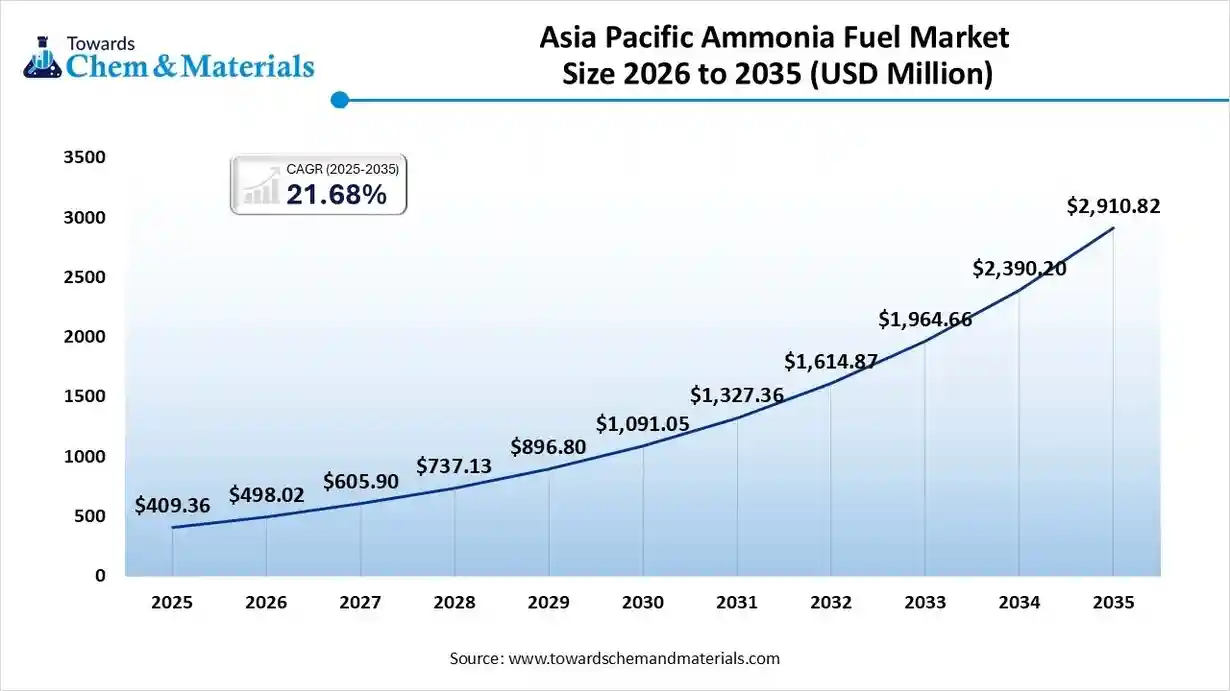

- The Asia Pacific led the ammonia fuel market with the largest revenue share of over 60.19% in 2025, owing to the greater power demand and early government push for the zero-emission fuel.

- By region, North America is anticipated to capture a greater portion of the market with a significant CAGR in the future, due to the stronger technology integration and policy-driven decarbonization.

- By product type, the blue ammonia segment led the market with the largest revenue share of 67.19% in 2025, due to it being considered the fastest option to scale.

- By product type, the green ammonia segment is expected to grow at the fastest CAGR of 22.12% from 2025 to 2035, akin to its ability to remove total dependence on fossil fuels.

- By application type, the power generation fuel segment led the market with the largest revenue share of 67.21% in 2025, akin to its operational flexibility and infrastructure compatibility.

- By application the Industrial process & heat fuel segment is expected to grow at the fastest CAGR of 25.67% from 2026 to 2035, segment is expected to grow at a rapid CAGR during the forecast period. As the industrial sector represents the next growth phase for ammonia fertilization due to its persistent demand for thermal energy.

Beyond Chemicals: Ammonia Steps into the Clean Fuel Spotlight

The ammonia fuel is the ammonia that is used as a usable energy carrier instead of its regular use, such as chemical feedstock or other sources. Moreover, by storing hydrogen in a transportable form and cracking it into fuel cells, ammonia has emerged as the ideal fuel option in recent years. Furthermore, the green ammonia, which shows better sustainability, has driven investor confidence in the industry’s future.

Ammonia Fuel Market Trends

- The increased demand for ammonia in ship and heavy transport as a fuel has improved the financial performance and sector scalability in the past few years. Also, by solving both problems, like batteries being too heavy and hydrogen being very hard to store, ammonia has emerged as a catalyst for unlocking the sector's complete potential in recent years.

- The heavy establishment of the green ammonia production hubs is in place, with wind and cheap solar energy plants having gained industry attention. Moreover, these initiatives are seen in changing global energy trade patterns in the current period.

- Several times, ammonia has been used as the hydrogen carrier. Ammonia has released two options for the manufacturing industry, where it can be directly burned or split into hydrogen when needed, and this versatility has driven the strategic transformation in the sector nowadays, as per the recent observations.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 827.42 Million |

| Revenue Forecast in 2035 | USD 4,831.23 Million |

| Growth Rate | CAGR 21.66% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segment Covered | By Product, By Application, By Region |

| Key companies profiled | Yara International ASA, CF Industries Holdings, Inc, ExxonMobil Corporation, Royal Dutch Shell plc, Eni S.p.A., OCI N.V., QatarEnergy, SABIC, BASF SE, Air Liquide S.A. |

From Standalone Trails to System-Level Optimization in Ammonia Energy

A significant technological shift in the industry is the adoption of system-level optimization. Early-stage developments highlighted separate technologies, such as ammonia combustion tests or hydrogen cracking units, in recent years. Also, current innovation integrates renewable ammonia production, specialized storage infrastructure, and optimized end-use technologies. This approach enables better energy efficiency, consistent fuel quality, and safer handling practices.

Trade Analysis of the Ammonia Fuel Market: Import, Export, Consumption, and Production Statistics

- The United States has emerged as one of the heavy anhydrous ammonia exporters in the world, with the $328,774.72K and quantity 1,035,870,000Kg export in 2024 as per the published report.

- China has seen a sophisticated export of ammonia in 2024, which was approximately valued at around $43.3 million, as per the survey.

Value Chain Analysis Of The Ammonia Fuel Market:

- Distribution to Industrial Users: The ammonia fuel market for industrial users is in an early growth phase, with distribution largely handled by established global chemical and fertilizer companies leveraging existing infrastructure. Key players are forming strategic partnerships to build out future low-carbon ammonia supply chains and distribution networks.

- Key Players: Yara International ASA, and CF Industries Holdings, Inc

- Chemical Synthesis and Processing: Ammonia fuel is produced using variations of the century-old Haber-Bosch (HB) process, adapted with low-carbon hydrogen sources and modern processing technologies to minimize or eliminate greenhouse gas emissions. Key players include major chemical and engineering firms that provide both the technology and the production capacity.

- Key Players: BASF SE and Nutrien Ltd

- Regulatory Compliance and Safety Monitoring: Regulatory compliance and safety monitoring for the market are critical due to ammonia's classification as a toxic and hazardous chemical. Compliance is managed through a patchwork of established industrial regulations and emerging specific guidelines for fuel use, overseen by a variety of international and national agencies and classification societies.

- Key Agencies: International Maritime Organization (IMO) and National Regulatory Bodies (e.g., OSHA, EPA)

Ammonia Fuel Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Environmental Protection Agency (EPA) | RMP Rule (40 CFR Part 68) | Ensuring safety and preventing accidental releases of toxic ammonia |

| European Union | European Commission (EC) | Renewable Energy Directive (RED III) | Achieving climate neutrality by 2050 |

| China | National Development and Reform Commission (NDRC) and National Energy Administration (NEA) | Interim Rules for the Technology and Inspection of Ammonia Fuel-Powered Ships | Fostering domestic technological innovation and R&D in the ammonia energy sector |

Segmental Insights

Product Type Insights

How did the Blue Ammonia Segment Dominate the Ammonia Fuel Market in 2025?

By product type, the blue ammonia segment led the market with the largest revenue share of 67.19% in 2025, akin to it is considered the fastest option to scale. Moreover, having factors like affordability, less risk, and quick processing has made blue ammonia the ideal option for the manufacturing sector nowadays. Moreover, several industries and governments are considering blue ammonia as the transition fuel, akin to it allows building supply immediately without waiting for the large renewable projects nowadays.

The green ammonia segment is expected to grow at the fastest CAGR of 22.12% from 2025 to 2035, due to the ability to remove total dependence on fossil fuels. Moreover, the global shift towards zero carbon emissions and sustainability is likely to create lucrative opportunities for the segment in the coming years. Also, green ammonia has seen cheaper than blue ammonia in recent years.

Application Type Insights

Why does the Power Generation Segment Dominate the Ammonia Fuel Market?

The power generation fuel segment led the market with the largest revenue share of 67.21% in 2025, owing to its operational flexibility and infrastructure compatibility. Large-scale plants can adopt ammonia as a supplementary or primary fuel to support renewable energy integration. The sector benefits from ammonia's long-term storage capability and its suitability for baseload and backup power.

The Industrial process & heat fuel segment is expected to grow at the fastest CAGR of 25.67% from 2026 to 2035, segment is expected to grow at a rapid CAGR. As the industrial sector represents the next growth phase for ammonia fertilization due to its persistent demand for thermal energy. Unlike power generation, industrial heat applications lack widespread electrification options. Ammonia's ability to deliver stable, high-temperature heat positions it as a strategic fuel choice.

Regional Insights

The Asia Pacific ammonia fuel market size was valued at USD 409.36 million in 2025 and is expected to reach USD 2,910.82 million by 2035, growing at a CAGR of 21.68% from 2026 to 2035. Asia Pacific dominated the market in 2025, akin to the greater power demand and early government push for zero-emission fuel. Moreover, the presence of heavy industrial bases, which need to be sustainable, and a large amount of fuel options, which are leading the sales of the ammonia fuel in recent years, as per the observation. Moreover, rapid urbanization has played a major role in industry’s growth in recent years.

Scale and Demand Sustain China’s Dominance in Ammonia Fuel

China maintained its dominance in the market, due to the country is known as the world's leading ammonia producer and energy consumer at the same time. Moreover, the increased energy demand for the local hubs has allowed the stakeholders to capitalize on growth opportunities. Also, China has seen under a heavy investment in renewable-powered ammonia production in recent years.

North America Ammonia Fuel Market Examination

North America is expected to capture a major share of the market with a rapid CAGR, due to the stronger technology integration and policy-driven decarbonization. Also, the region has integrated energy hubs, which position the industry for long-term expansion. Moreover, stronger safety standards and well-established regulatory framework have contributed to the industry's potential in recent years.

Renewables and Policy Support Propel the United States Ammonia Fuel Market

The United States is expected to emerge as a prominent country for the market in the coming years, due to the presence of vast renewable energy sources like wind and solar, and advanced hydrogen research. Moreover, the government in the country has released various advantages and subsidies for sustainable manufacturing practices, which boosted the adoption of the green ammonia fuel in recent years in the United States.

Europe Ammonia Fuel Market Evaluation

Europe is a notably growing region, akin to the implementation of green standards and limited fossil resources. Furthermore, the regions have actively prioritized the safety standards and certifications, which have increasingly accelerated the ammonia industry in recent years, as per the latest industry survey.

Ammonia Imports and Industrial Heat Fuel Germany’s Energy Transition

Germany is expected to gain a major industry, due to the stronger engineering base and increased sustainable fuel consumption in recent years. Also, Germany has seen under a heavy investment in ammonia import terminals and industrial heat application, which enabled the sector to explore untapped potential in the current period.

Ammonia Fuel Market Study in the Middle East and Africa

The Middle East and Africa are expected to capture a notable share of the industry, driven by low production costs and long-term energy planning. The region has experience handling large energy projects and is now adding renewable energy to produce cleaner ammonia. Ammonia allows these countries to stay competitive as the world moves toward cleaner fuels.

Saudi Arabia Positions Ammonia Fuel as the Next Global Energy Export

Saudi Arabia is expected to emerge as a prominent country for the market in the coming years, akin to country is trying to stay a global energy leader even as fossil fuels decline. The country is building large ammonia projects and using its strong industrial base to reduce costs. Ammonia can be shipped easily, making it perfect for exports.

South America Ammonia Fuel Market Evaluation

South America is a notably growing region, due to its strong renewable energy potential. The regional countries see ammonia to add value to clean electricity and support industrial growth. Also, the region has strong wind, solar, and hydro resources that support green ammonia production in recent years. Instead of wasting excess renewable energy, it can be used to make ammonia.

Brazil’s Renewable Strength Fuels the Rise of Green Ammonia

Brazil is expected to gain a major industry akin to the country wants cleaner energy for industries and exports. Its strong renewable energy base supports green ammonia production. Ammonia helps Brazil store energy, reduce fossil fuel use, and support industrial heating.

Recent Developments

- In July 2025, Envision Energy unveiled green marine ammonia bunkering. Moreover, this bunkering has powered the ammonia fueling, which results in net zero shipping fuel, and it is the world's first initiative to produce this type of ammonia fuel, as per the company's claim.(Source: www.prnewswire.com)

Top Vendors in the Ammonia fuel market & Their Offerings:

- Yara International ASA: A Norwegian chemical company with a global presence, specializing in crop nutrition products and precision farming solutions, while also exploring the use of green ammonia as a sustainable energy carrier.

- CF Industries Holdings, Inc.: A global leader in the manufacturing of hydrogen and nitrogen products for fertilizer applications and clean energy initiatives, including significant production of ammonia.

- ExxonMobil Corporation: A major multinational energy and chemical company that is involved in every aspect of the oil and gas industry and is investing in low-carbon solutions, including hydrogen and carbon capture technologies.

- Royal Dutch Shell plc: A global group of energy and petrochemical companies that is actively involved in the transition to a low-carbon energy system, investing in hydrogen, biofuels, and renewable power solutions.

Other Key Players

- CF Industries Holdings, Inc.

- ExxonMobil Corporation

- Royal Dutch Shell plc

- Yara International ASA

- Eni S.p.A.

- OCI N.V.

- QatarEnergy

- SABIC

- BASF SE

- Air Liquide S.A.

Segments Covered in the Report

By Product

- Green Ammonia

- Blue Ammonia

- Grey Ammonia

- Other Product

By Application

- Power Generation Fuel

- Maritime Shipping Fuel

- Industrial Process & Heat Fuel

- Other Application

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa