Content

U.S. Bimodal HDPE Market Size and Growth 2025 to 2034

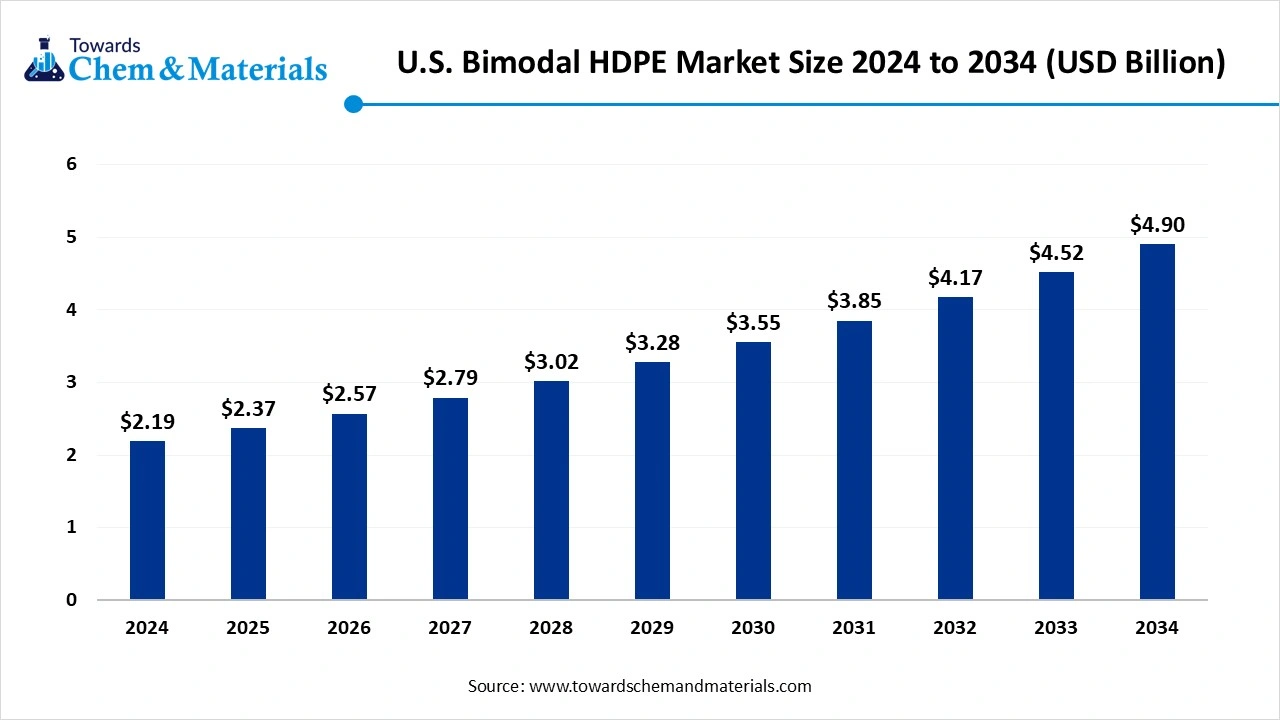

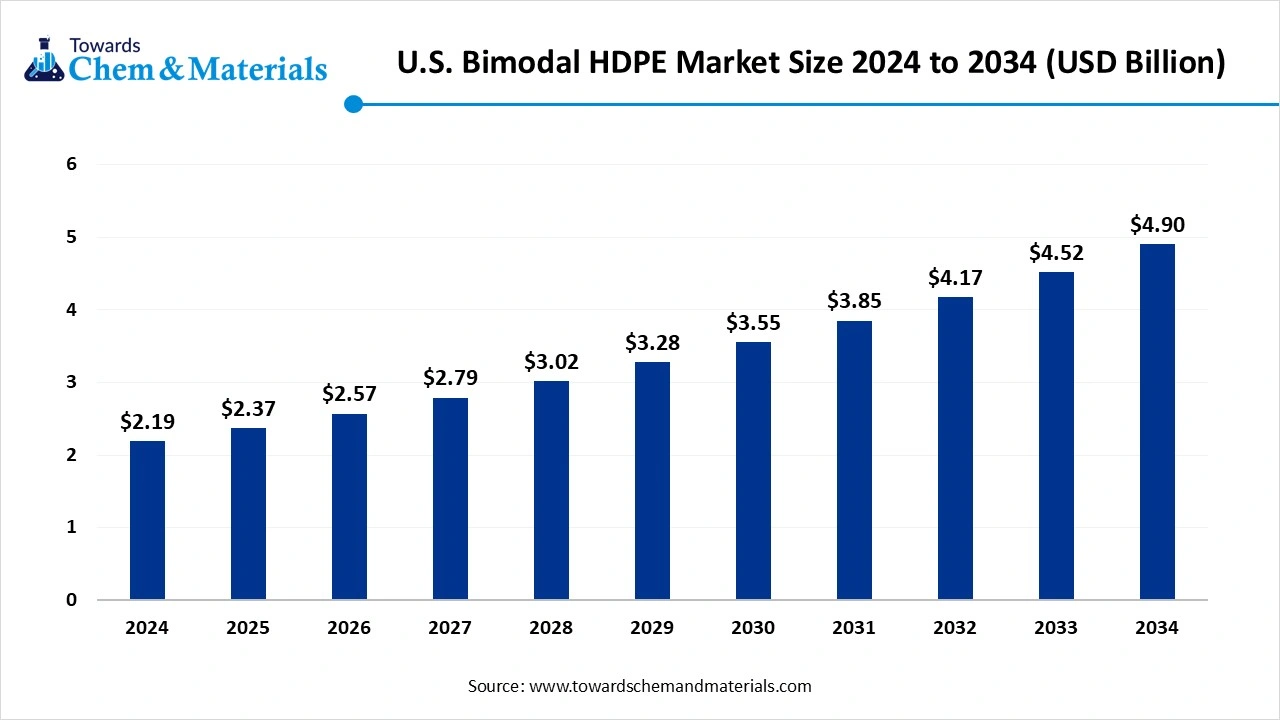

The U.S. bimodal hdpe market size was estimated at USD 2.19 billion in 2024 and is predicted to increase from USD 2.37 billion in 2025 to approximately USD 4.9 billion by 2034, expanding at a CAGR of 8.39% from 2025 to 2034. The increasing need for lightweight and durable materials in the consumer goods and automotive sector is the key factor driving market growth. Also, the increasing trend towards resin customization coupled with innovations in bimodal catalyst technologies can fuel market growth further.

The market refers to the industry within the wide HDPE market that emphasizes bimodal high-density polyethylene, which offers improved properties such as impact resistance, strength, and stress crack resistance. Bimodal HDPE is utilized in blow molding, injection molding, pressure pipes, and film production with substantial use in gas and water pipelines, packaging, and automotive components. The dual structure of bimodal HDPE gives good processability and toughness as compared to standard HDPE, which makes it preferable for high-stress applications.

Key Takeaways

- By processing method, the Extrusion dominated the market, accounting for a revenue share of 53.48% in 2024.The dominance of the segment can be attributed to the innovations in polymerization and catalyst technologies along with the material's superior durability, strength and chemical resistance.

- By processing method, the blow molding segment is anticipated to grow at a significant CAGR of 8.55% through the forecast period. The growth of the segment can be credited to the growing need for lightweight and durable materials in different industries.

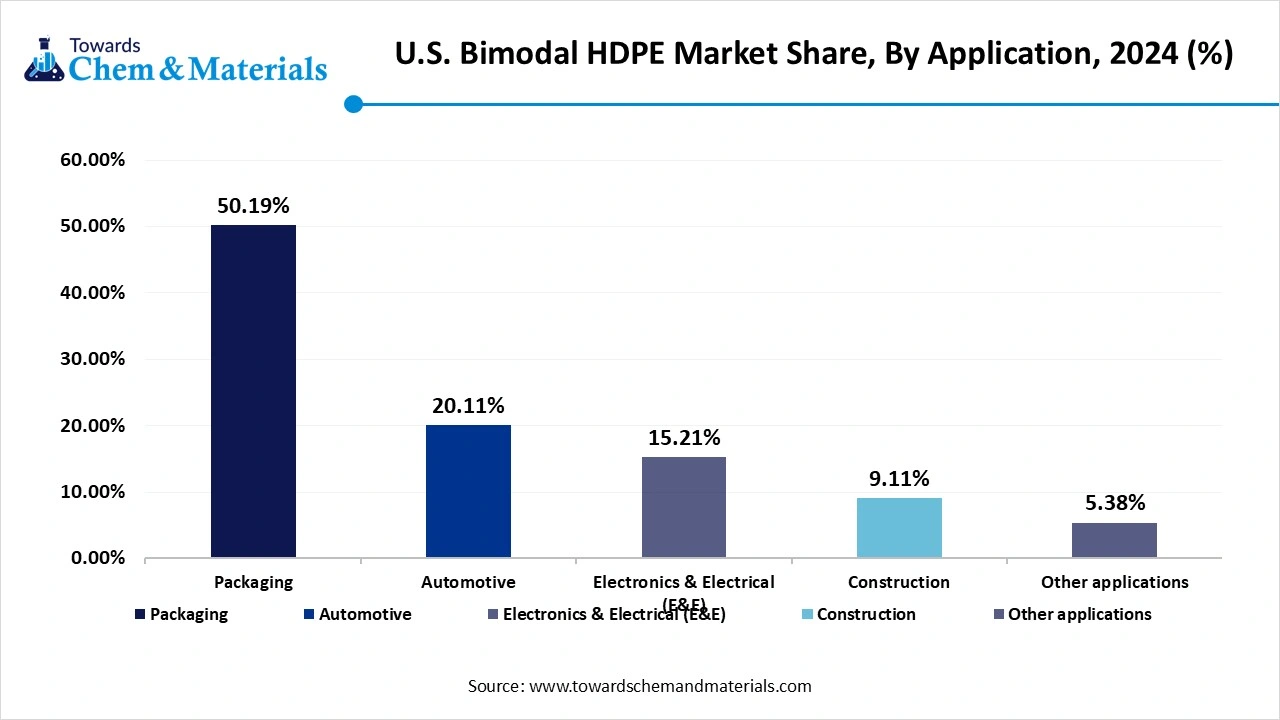

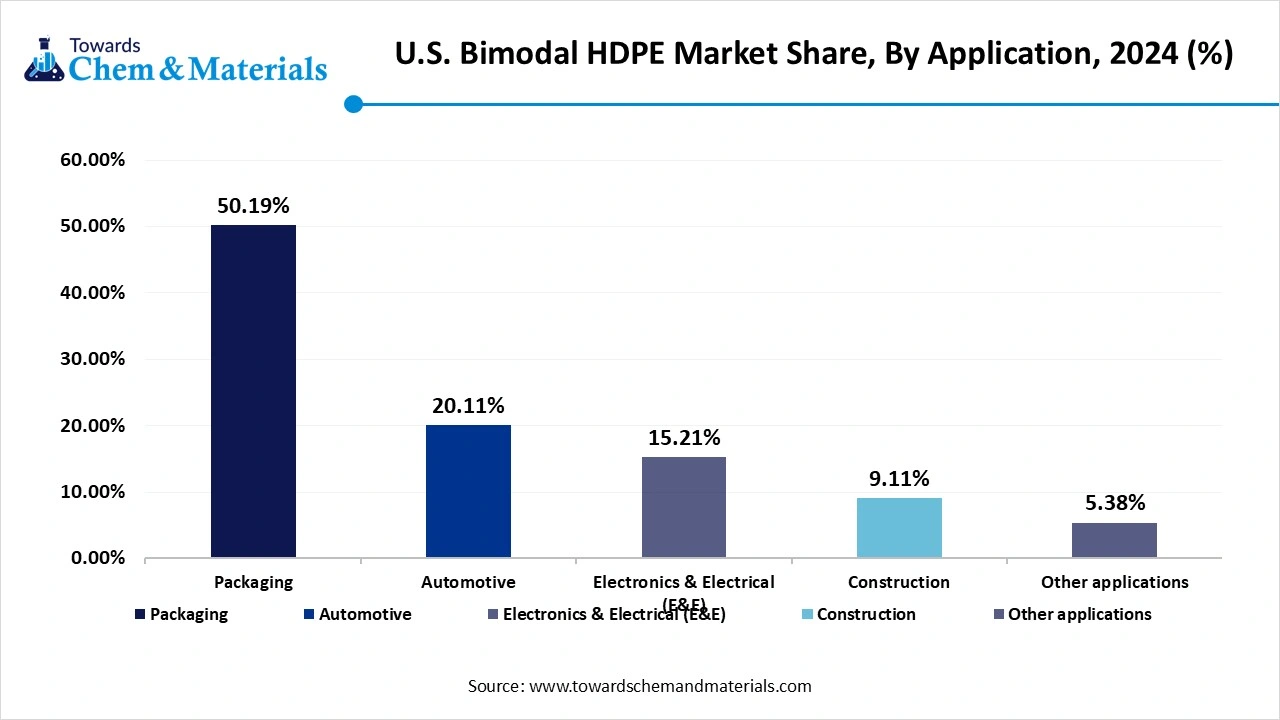

- By application, the Packaging dominated the market, accounting for a revenue share of 50.19% in 2024. The dominance of the segment can be linked to the increasing demand for lightweight and durable packaging solutions.

- By application, the automotive segment is projected to experience a rapid CAGR of 8.51% throughout the forecast period. The growth of the segment can be driven by the rise of electric vehicles, the surge in vehicle light-weighting initiatives, and increasing fuel efficiency.

What Are the Key Trends Influencing the U.S. Bimodal HDPE Market?

- Expansion of oil and gas infrastructure projects has created a significant demand for innovative piping materials that bear harsh environmental conditions. The surge in the construction activities of long-distance energy pipelines, especially in developing countries, is fueling the adoption of bimodal HDPE because of its toughness, excellent stress crack resistance, and long service life.

- The US regulatory authority is increasingly focusing on sustainable materials, allowing manufacturers to adopt bimodal HDPE, which is often considered a more convenient option than conventional plastics. Also, major manufacturers are adopting cutting edge blow molding and extrusion techniques to improve cost-efficiency and overall material performance.

- Growth in the packaging industry is the major trend driving market growth. Different industries such as chemicals, food and beverage and personal care are demanding containers that are durable and lightweight along with recyclable and sustainable. Bimodal HDPE fulfils these criteria by providing excellent barrier properties, high impact strength, and design flexibility for different shapes and sizes of containers.

How is the Government Supporting the U.S. Bimodal HDPE Market?

The U.S. government is supporting the market through investments in infrastructure, especially in gas and water distribution systems, and by supporting sustainable packaging solutions. Also, regulations emphasizing environmental safety and leak-proof piping are propelling the demand for bimodal HDPE. Furthermore, stringent regulations regarding recyclability and plastic waste are impelling manufacturers to develop eco-friendly bimodal HDPE grades to enhance recycling processes.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 2.37 Billion |

| Expected Size by 2034 | USD 4.9 Billion |

| Growth Rate from 2025 to 2034 | CAGR 8.39% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Processing Method , By Application |

| Key Companies Profiled | Dow Inc., Braskem, SABIC, INEOS, FKuR Plastics Corp., Chevron Phillips Chemical Company, Exxon Mobil Corporation, Mitsui Chemicals Inc. |

Market Opportunity

Increasing need for HDPE hoses and pipes

Many projects in the large to medium market are now utilizing HDPE pipes and hoses. Contemporary HDPE multi-layer pipes are utilized in hydraulic engineering projects along with new construction projects, creating lucrative opportunities in the U.S. bimodal HDPE market. Furthermore, High-density polyethylene pipe has different features such as high internal pressure and high strength to handle water resistance and external loads to water hammer pressure. It also offers improved performance in tough soils.

Market Challenge

Environmental Regulations

Stringent regulations regarding sustainability and plastic waste are major factor hindering market growth. Though bimodal HDPE is recyclable, the negative perception around plastics as a harmful material can negatively affect the overall demand. Moreover, the strong presence of growth-inhibiting options like high-density polyethylene, as PET is the prominent alternative to high-density polyethylene resin can hamper market growth soon.

Country Insight

The growth of the US bimodal HDPE market is attributed to the innovations in polymer processing technologies, growing demand for high-performance plastics and increasing focus on sustainable packaging solutions. In addition, producers in the region are rapidly optimizing molecular weight distribution by using cuting edge catalyst technologies to produced bimodal HDPE grades specific for high-performance applications.

Who are the Top Polyethylene Exporters and Suppliers in the USA in 2023-24?

| Exporter and Supplier | Export Value (USD) |

| Dow Chemical Company | 11.5 billion |

| ExxonMobil Chemical | 9.7 billion |

| LyondellBasell | 8.4 billion |

| Chevron Phillips Chemical | 6.8 billion |

| Westlake Chemical | 870 million |

Segmental Insight

Processing Method Insights

Which Processing Method Segment Dominated the U.S. Bimodal HDPE Market in 2024?

The extrusion segment dominated the market in 2024. The dominance of the segment can be attributed to the innovations in polymerization and catalyst technologies along with the material's superior durability, strength, and chemical resistance, which makes it crucial for demanding applications. Also, fabricators and producers benefit from cost-effective extrusion processes, where bimodal HDPE boosts uniform density and melt strength. This factor is valuable for large-diameter pipes.

- In June 2024, JianTai a major player in plastic machinery, announced the launch of its cutting edge Recycled Plastic Extrusion Machine. This revolutionary machine is designed to improve the effectiveness and efficiency of plastic recycling, to meet the changing demands of industry.(Source: wate.com)

The blow molding segment is expected to grow at fastest CAGR over the forecast period. The growth of the segment can be credited to the growing need for lightweight and durable materials in different industries. Advancements in lightweight and catalyst design have enhanced the bimodal HDPE's properties and minimizes the overall production costs, which makes it more attractive and accessible to an extensive range of applications.

Application Insights

Why Does the Packaging Segment Held the Largest U.S. Bimodal HDPE Market Share in 2024?

The packaging segment dominated the market in 2024. The dominance of the segment can be linked to the increasing demand for lightweight and durable packaging solutions especially in the food and beverage industry, and the raised use of bimodal HDPE in durable consumer goods. Also, the ongoing surge of e-commerce industry has raised the demand for packaging that can bear the rigors of shipping and handling, which makes bimodal HDPE a convenient choice.

The automotive segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment can be driven by the rise of electric vehicles, the surge in vehicle light-weighting initiatives, and the increase in fuel efficiency. Furthermore, Automakers are increasingly finding new ways to minimize vehicle weight and enhance fuel efficiency to minimize emissions. Bimodal HDPE provides a lighter alternative to conventional materials such as metal, which leads to raised adoption in different applications.

Recent Developments

- In November 2024, BASF unveiled EasiplasTM the latest brand of HDPE, along with achieving substantial construction milestones at the HDPE plant at the Zhanjiang Verbund site. These innovations underlines BASF's commitment to deliver customer-centric offerings.(Source: hydrocarbonengineering.com)

- In May 2024, Clariant launched AddWorks® PPA a new solution to minimize the environmental impact of plastics at NPE 2024.A range of innovative solutions to enhance plastics recycling, increase performance and decrease environmental impacts are being featured at the event.(Source: clariant.com)

Top Companies List

- Dow Inc.

- Braskem

- SABIC

- INEOS

- FKuR Plastics Corp.

- Chevron Phillips Chemical Company

- Exxon Mobil Corporation

- Mitsui Chemicals Inc.

Segments Covered

By Processing Method

- Extrusion

- Blow Molding

- Injection Molding

- Compression Molding

By Application

- Packaging

- Automotive

- Electronics & Electrical (E&E)

- Construction

- Other applications