Content

Sustained Release Coatings Market Size and Growth 2025 to 2034

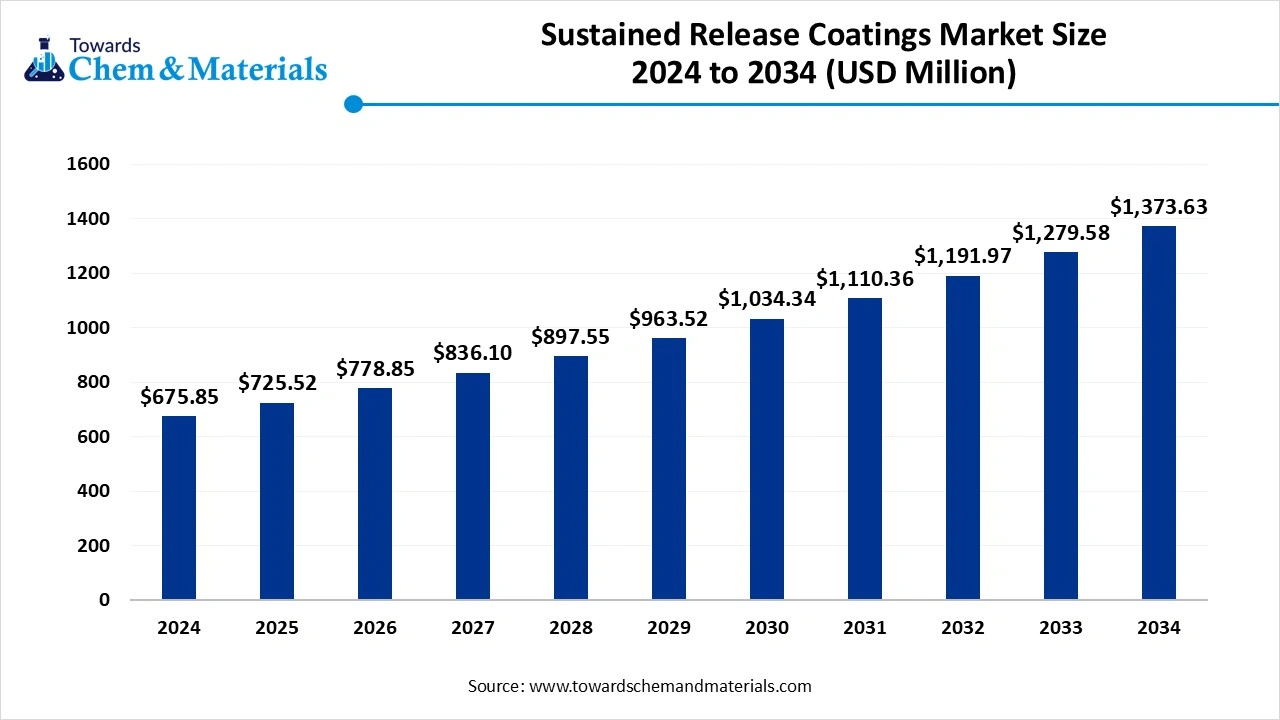

The global sustained release coatings market size was reached at USD 675.85 million in 2024 and is expected to be worth around USD 1,373.63 million by 2034, growing at a compound annual growth rate (CAGR) of 7.35% over the forecast period 2025 to 2034. The increased global focus on healthcare services has accelerated the industry's potential in recent years.

Key Takeaways

- By region, North America dominated the sustained release coatings market with approximately 40% industry share in 2024, due to modern healthcare infrastructure and access to the latest manufacturing technology.

- By region, Asia Pacific expected to grow at a notable rate in the future, owing to an enlarged population and increased cases of diseases.

- By polymer type, the ethylcellulose segment led the market with approximately 35% industry share in 2024, due to its being highly effective in the production of sustained release formulations and its safety.

- By polymer type, the methacrylic polymers segment is expected to grow at the fastest rate in the market during the forecast period, akin to its flexibility.

- By coating technology, the aqueous coating segment emerged as the top-performing segment in the market with approximately 45% industry share in 2024, due to its eco-friendly nature and suitability with modern pharmaceutical regulations.

- By coating technology, the hot melt coating segment is expected to lead the market in the coming years, because it eliminates the need for water or solvents, reducing drying time and energy costs.

- By substrate type, the tablet segment led the market with approximately 55% share in 2024, because they are the most common and widely used drug form worldwide.

- By substrate type, the capsules segment is expected to capture the biggest portion of the market in the coming years, because they allow more flexibility in combining multiple drugs or complex formulations.

- By drug release mechanism type, the diffusion control segment led the market with approximately 40% industry share in 2024, because it is a simple, reliable, and cost-effective mechanism for sustained release drugs.

- By drug release mechanism type, the osmotic control segment is expected to grow at the fastest rate in the market during the forecast period, because it provides greater precision and reliability in drug release.

- By therapeutic application, the cardiovascular & diabetes segment led the market with approximately 50% industry share in 2024. These chronic diseases affect millions of patients worldwide, especially in developed countries

- By therapeutic application, the oncology and CNS disorders segment is expected to capture the biggest portion of the market in the coming years, because these diseases require highly controlled, targeted, and long-term therapies.

- By end use, the pharmaceutical companies segment led the market with approximately 60% industry share in 2024. because they are the primary developers and manufacturers of sustained-release drugs.

- By end use, the CDMOs segment is expected to capture the biggest portion of the market in the coming years, as more pharmaceutical companies outsource coating and drug development to reduce costs and speed up innovation.

Market Overview

Transforming Drug Delivery with Advanced Sustained Release Coatings

The global sustained release coatings market refers to the use of specialized polymer-based coatings applied to pharmaceutical dosage forms such as tablets, capsules, and granules to control the release rate of active pharmaceutical ingredients (APIs) over an extended period. These coatings are designed to maintain therapeutic drug levels in the bloodstream, reduce dosing frequency, and improve patient compliance.

Sustained release coatings include functional polymers like ethylcellulose, polyvinyl acetate, methacrylic acid copolymers, and other film-forming agents. The market is driven by increasing demand for controlled drug delivery systems, the rise in chronic disease prevalence, technological advancements in coating materials, and the growing generics and biosimilars industry.

- For Instance, the recent report published by scientists, that compression-coated tablets are seen as offering a relatively cost-effective alternative to the osmotic pump system, as per the study.(Source : www.sciencedirect.com )

Market Momentum Builds as Lifestyle Diseases Drive Demand

The global rise in chronic diseases has been actively pioneering market breakthroughs in recent years, as diseases like cancer, hypertension, and diabetes are considered the prominent drivers of the industry.

Moreover, by providing the steady and controlled release of medicines instead of the multiple daily doses, the sustained release coating has been increasingly acknowledged in professional forums in the past few years. Furthermore, factors such as lifestyle changes and an aging population have played a major role in advancing the industry in recent years, as per the recent global industry survey.

Market Trends

- The sudden shift towards aqueous coatings has immensely commanding growth curves of the industry in the past few years, as the aqueous coatings are majorly preferred for their safety and sustainability standards.

- The integration of the digital process control in coatings is supporting demand-driven expansion in the sector currently. Moreover, companies are heavily adopting innovative technologies for precision in coatings.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 725.52 million |

| Expected Size by 2034 | USD 1373.63 million |

| Growth Rate from 2025 to 2034 | CAGR 7.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Polymer Type, By Coating Technology, By Substrate, By Drug Release Mechanism, By Therapeutic Application, By End-Use, By Region |

| Key Companies Profiled | ASF SE, Evonik, Colorcon, Coating Place, Inc., Teva Pharmaceutical Industries Ltd., Pfizer, Inc., Sun Pharmaceutical Industries Ltd., Novartis AG, AstraZeneca, GlaxoSmithKline plc, AbbVie Inc. |

Market Opportunity

Sustained Release Coatings Gain Traction Amid Generic Market Expansion

The growth of the generic drug market is estimated to deliver exceptional commercial potential to the industry during the forecast period. Also, the generic manufacturers are seen under the heavy adoption of the sustained release coatings, where the patents for popular drugs expire, which is expected to become a topic of interest among market analysts. Furthermore, with the expansion into a personalized drug industry, manufacturers are likely to spark widespread industry engagement in the upcoming years.

- For Instance, In June 2025, Hikma Pharmaceutical is planning to expand its footprint in the United States generic drug industry by investing the capital of $1billion. Also, this investment can take a couple of years, and the motive behind the investment is to expand the manufacturing and R&D capabilities of generic drugs, as per the company’s claim.(Source: www.pharmtech.com)

Market Challenge

Capital Intensive Development Slows Momentum in Drug Delivery Innovation

The higher development cost of the sustained release coatings is expected to act as a drag on growth-focused strategies in the coming years. Moreover, the expensive factors like R&D, quality testing, and regulatory approvals are projected to disrupt planned expansion efforts within the sectors during the forecast period. Furthermore, these expenses can suppress profit margins and deter investment in sectors for the future period, as per the recent market environment observation.

Regional Insights

North America Global Sustained Release Coatings Market Trends

North America dominated the global sustained release coatings market in 2024, akin by modern healthcare infrastructure and access to the latest manufacturing technology. Moreover, factors such as the higher prevalence of chronic diseases and greater demand for effective sustained-release formulations have gained prominence in innovation-led discussions in the country in recent years. Also, having one of the modern and advanced regulatory bodies like the FDA and others is actively providing intense attention towards the region from all over the globe.

Healthcare Awareness Fuels Sustained Release Adoption Across the United States

United States maintained its dominance in the market, owing to stronger commercial demand and greater investment in R&D for drug innovation. In the country, the healthcare specialists are seen under the heavy promotion of the sustained-release drugs due to the greater awareness of their benefits. Furthermore, major brands are observed in the development of new coating polymers, which are expected to emerge as a key point of interest from major industry players during the projected period.

Asia Pacific Global Sustained Release Coatings Market Trends.

Asia Pacific expected to capture a major share of the global sustained release coatings market during the forecast period, owing to an enlarged population and increased cases of diseases. Also, the positive response and greater acceptance of the innovative therapeutics have pushed the sales of the sustained-release coatings in the region. Moreover, the heavy drug manufacturing infrastructure of the region is expected to create a beneficial environment for the sustained coatings manufacturer in the upcoming years.

- For Instance, In August 2024, the Sigachi introduced their latest pharmaceutical coating products in India. The newly launched product is called the PureCoat and UltraMod. Behind the launch of these products, the company is trying to improve drug stability while enhancing bioavailability, as per the report published by the company.(Source: www.indianpharmapost.com)

Segmental Insights

Polymer Type Insights

How did the Ethycellulose Segment Dominate the Global Sustained Release Coatings Market in 2024?

The ethylcellulose segment held the largest share of the market in 2024, due to its being considered highly effective in the production of sustained release formulations and its safety. Moreover, providing stability and consistent drug release rates, ethycellulose has gained major awareness among venture and commercial backers in recent years. Furthermore, ethyl cellulose has greater versatility and ability with tablets, capsules, and pellets have been fundamental to the industry’s recent expansion.

The methacrylic polymers segment is expected to grow at a notable rate during the predicted timeframe, akin to its flexibility. Also, the engineered pH sensitivity, the methacrylic polymer has enabled target releases in the stomach and intestine as per the recent observation. Furthermore, the precision of the methacrylic polymers segment is likely to gain major industry attention in the coming years.

Coating Technology Insights

Why does the Aqueous Coating Segment Dominate the Global Sustained Release Coatings Market by Technology?

The aqueous coating segment held the largest share of the global sustained release coatings market in 2024, due to its eco-friendly nature and suitability with modern pharmaceutical regulations. Moreover, by the reduction of the toxic residues, the aqueous coatings have gained major acceptance in the healthcare field for patients in recent years. Also, the stronger acceptance from the major regulatory bodies like the FDA and EMA, the aqueous coating is likely to maintain its dominance in the upcoming years, as per the future industry expectations.

The hot melt coating segment is expected to grow at a notable rate because it eliminates the need for water or solvents, reducing drying time and energy costs. This makes the process faster, more efficient, and environmentally sustainable. Hotmelt coatings are also highly uniform, ensuring consistent drug release. With pharmaceutical companies under pressure to cut costs while improving sustainability, hotmelt technology offers clear advantages.

Substrate Type Insights

How did the Tablet Segment Dominate the Global Sustained Release Coatings Market in 2024?

The tablet segment dominated the market with the largest share in 2024 because they are the most common and widely used drug form worldwide. Affordable, easy to produce, and convenient for patients, tablets make up most prescriptions. Sustained-release coatings on tablets improve patient compliance by reducing dosing frequency while ensuring consistent effectiveness. Tablets are also easier to coat compared to other substrates, making them the industry's preferred choice.

The capsules segment is expected to grow at a significant rate because they allow more flexibility in combining multiple drugs or complex formulations. With rising demand for personalized and combination therapies, capsules are becoming the preferred choice. Sustained-release coatings applied to capsules can be tailored for precise release rates or multi-drug release, which is harder to achieve with tablets

Drug Release Mechanism Insights

What Makes Diffusion Control the Most Trusted Method in Drug Delivery?

The diffusion control segment held the largest share of the market in 2024 because it is a simple, reliable, and cost-effective mechanism for sustained release drugs. In this method, the drug slowly diffuses through the polymer coating at a controlled rate, ensuring steady therapeutic levels in the body. This mechanism has been used for decades and is well-validated by regulatory bodies. It is widely applied in treatments for cardiovascular disease, diabetes, and other chronic conditions.

The osmotic control segment is expected to grow at a notable rate during the predicted timeframe because it provides greater precision and reliability in drug release. Unlike diffusion, osmotic systems use pressure to push the drug out at a nearly constant rate, independent of the environment inside the body. This results in more predictable outcomes, which is critical for sensitive therapies like oncology and CNS disorders.

Therapeutic Application Insights

What Makes Extended-Release Tablets a Game-Changer for Long-Term Therapies?

The cardiovascular & diabetes segment dominated the market with the largest share in 2024. These chronic diseases affect millions of patients worldwide, especially in developed countries. Sustained-release coatings are essential here because they improve compliance by reducing the number of daily doses. Patients managing long-term therapies prefer extended-release tablets, which simplify treatment and maintain stable drug levels.

The oncology and CNS disorders segment is expected to grow at a significant rate because these diseases require highly controlled, targeted, and long-term therapies. Cancer and neurological conditions often involve toxic drugs where precise release is critical to reduce side effects. Sustained release coatings enable steady delivery, improving patient safety and treatment outcomes.

End Use Insights

How Do Pharma Giants Integrate Coating Technologies into Drug Development?

The pharmaceutical companies segment dominated the market with the largest share in 2024 because they are the primary developers and manufacturers of sustained-release drugs. Most coating technologies are integrated directly into their drug development pipelines, making them the largest end users. These companies invest heavily in coating R&D, equipment, and partnerships with coating suppliers to create differentiated drug products.

The CDMOs segment is expected to grow at a significant rate as more pharmaceutical companies outsource coating and drug development to reduce costs and speed up innovation. Smaller biotech firms, which are highly active in oncology and CNS drug development, rely heavily on CDMOs for expertise and production. CDMOs are also investing in state-of-the-art coating technologies, including hotmelt and osmotic systems, to attract global clients.

Sustained Release Coatings Market Value Chain Analysis

- Distribution to Industrial Users: The industrial users and distributors of sustained-release coatings are pharmaceutical companies and other industries. Also, some of the pharmaceutical companies have in-house coating abilities.

- Key Players: Eastman Chemical Company, Evonik Industries AG, and Merck KGaA

- Chemical Synthesis and Processing: The chemical synthesis and processing of the sustained release coating are mainly between polymers, which includes polymerization and then synthesis, as per the published reports.

- Regulatory Compliance and Safety Monitoring: Safety monitoring of the sustained release coating is compulsory to undergo with regulatory body surveys like the FDA and EMA. Also, tests like quality control and testing.

Recent Developments

- In February 2025, BioInteractions unveiled its latest implant coatings. The newly introduced coating is known as the surface-active therapeutic coating. Also, the motive behind the launch of the coatings is that the company is trying to enhance medical implant efficacy and safety, as per the report published by the company.(Source: www.medicaldesignandoutsourcing.com)

- In February 2025, Roquette introduced an innovative coating platform. Also, the newly launched platform includes two major coating systems, such as TabShield ready-to-use film coating systems and plant-based ready-to-use coating systems by ReadiLYCOAT, as per the company's claim.(Source: www.contractpharma.com)

Global Sustained Release Coatings Market Top Companies

- ASF SE

- Evonik

- Colorcon

- Coating Place, Inc.

- Teva Pharmaceutical Industries Ltd.

- Pfizer, Inc.

- Sun Pharmaceutical Industries Ltd.

- Novartis AG

- AstraZeneca

- GlaxoSmithKline plc

- AbbVie Inc.

Segment Covered

By Polymer Type

- Ethylcellulose

- Polyvinyl Acetate

- Methacrylic Acid Copolymers

- Polyethylene Glycol (PEG)

- Cellulose Acetate

- Others (Povidone, Acrylates, etc.)

By Coating Technology

- Aqueous Coating

- Solvent-Based Coating

- Hot-Melt Coating

- Modified/Advanced Coating Techniques

By Substrate

- Tablets

- Capsules

- Pellets/Granules

By Drug Release Mechanism

- Diffusion-Controlled

- Dissolution-Controlled

- Osmotic-Controlled

- Ion-Exchange Controlled

By Therapeutic Application

- Cardiovascular Diseases

- Diabetes & Metabolic Disorders

- Central Nervous System (CNS) Disorders

- Gastrointestinal Diseases

- Oncology

- Others (Infectious Diseases, Respiratory, etc.)

By End-Use

- Pharmaceutical Companies

- Biotechnology Companies

- Contract Development & Manufacturing Organizations (CDMOs)

- Research Institutes

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait