Content

What is the Current Biopolymer Coatings Market Size and Share?

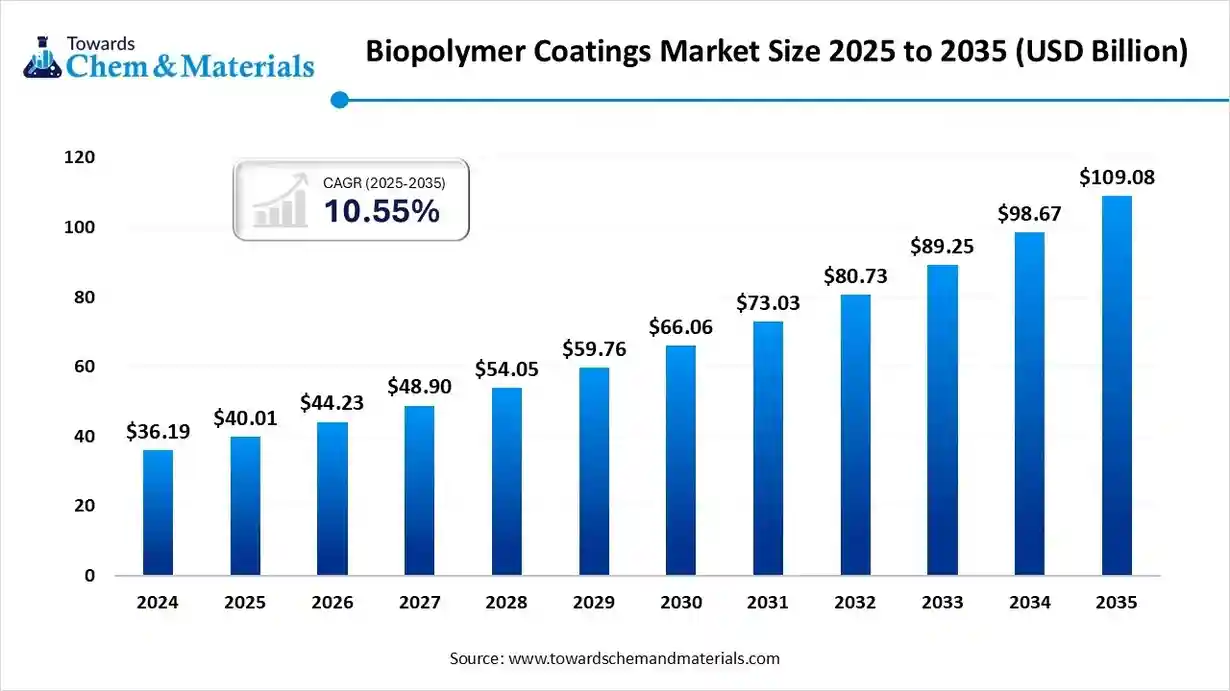

The global biopolymer coatings market size is calculated at USD 40.01 billion in 2025 and is predicted to increase from USD 44.23 billion in 2026 and is projected to reach around USD 109.08 billion by 2035, The market is expanding at a CAGR of 10.55% between 2025 and 2035. Increasing consumer demand for sustainable products is the key factor driving market growth. Also, innovations in biopolymer processing technologies, coupled with the growing demand for sustainable textiles, can further fuel market growth.

Key Takeaways

- By region, North America dominated the market with the largest share in 2024.

- By region, the Asia Pacific is expected to grow at the fastest CAGR over the forecast period.

- By region, Europe is expected to grow at a notable CAGR over the forecast period.

- By product type, the bio-PU coatings segment dominated the biopolymer coatings market with

the largest share in 2024. - By product type, the bio-PA coatings segment is expected to grow at the fastest CAGR over the forecast period.

- By application, the packaging segment held the largest market share in 2024.

- By application, the automotive segment is expected to grow at the fastest CAGR over the projected period in the biopolymer coatings market.

What are Biopolymer Coatings?

Biopolymer coatings are protective or functional layers made from renewable biological materials such as cellulose, starch, chitosan, and plant or microbial proteins. These coatings are applied to textiles, packaging materials, paper, agricultural films, and other substrates to enhance properties like moisture resistance, barrier performance, durability, and biodegradability. The growing demand for sustainable, low-impact materials is a key driver of this market, as consumers and industries shift away from petroleum-based coatings.

Biopolymer coatings are generally biodegradable, non-toxic, and compatible with circular-economy principles, which support their adoption across regulated and environmentally sensitive applications. Scientific studies consistently highlight the benefits of naturally derived polymers for reducing microplastic release and lowering overall environmental burden compared with synthetic alternatives. Their use also aligns with global sustainability goals that emphasise renewable feedstocks, reduced waste, and cleaner production methods. As innovation in bio-based chemistry continues to advance, biopolymer coatings are becoming more efficient, versatile, and commercially scalable across multiple industries.

Current Trends in Biopolymer Coatings Market

- Industry Growth Overview: Rapid research and development activities are enabling the creation of advanced biopolymer coatings with stronger barrier properties, improved moisture resistance, and better mechanical performance. Continuous progress in bio-based chemistry, fermentation technology, and polymer modification is expanding the number of commercially viable coating formulations. Market growth is also supported by rising demand in packaging, textiles, paper, and food-contact applications, where low-toxicity and biodegradable coatings are increasingly preferred.

- Sustainability Trends: Sustainability is a major driver in the biopolymer coatings market, supported by stricter global regulations targeting single-use plastics and chemical emissions. Industries such as food packaging, cosmetics, and textiles are shifting toward renewable, compostable, and bio-derived coatings to meet environmental targets and align with consumer expectations. The use of materials such as cellulose, starch, and plant-based proteins helps reduce dependence on fossil-derived polymers and supports broader circular-economy initiatives across supply chains.

- Major Investors: Large chemical and material companies such as BASF SE, Dow Inc., Cargill Incorporated, DuPont and Evonik Industries AG are investing in new production technologies and renewable feedstock development to scale biopolymer coatings. These companies are expanding pilot facilities, forming research partnerships and strengthening supply-chain capabilities to meet rising global demand. Their involvement is accelerating innovation, reducing production costs and supporting the commercial transition toward high-performance, bio-based coating solutions.

- Startup Ecosystem: Startups are contributing to market expansion by developing specialised bio-coating technologies, including functionalised polysaccharides, protein-based films and water-dispersible bio-polymer blends. Many emerging companies focus on niche applications such as edible coatings, biodegradable packaging surfaces and antimicrobial bio-films. Collaboration with research institutes and large manufacturers is helping these startups bring new materials to market more quickly and support broader industry adoption.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 44.23 Billion |

| Expected Size by 2035 | USD 109.08 Billion |

| Growth Rate from 2025 to 2035 | CAGR 10.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2026 - 2035 |

| Leading Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segment Covered | By Product Type, By Application, By Region |

| Key Companies Profiled | AkzoNobel N.V., Archer Daniels Midland (ADM) , BASF SE , Cargill Inc , Corbion, DuPont., Danimer Scientific , EcoSynthetix , Evonik Industries Meredian Holdings Group (MHG) , Mitsubishi Chemical Corporation , NatureWorks LLC , Novamont S.p.A. , Roquette Group , Safepack Industries Ltd and WestRock Company |

How Cutting Edge Technologies Are Revolutionizing the Biopolymer Coatings Market?

Advanced technologies are transforming the market mainly by improving the scalability, efficiency, and cost-effectiveness of manufacturing methods. The integration of nanoparticles into biopolymer matrices significantly improves their performance by creating a complex pathway that restricts the movement of gas and moisture molecules.

Trade Analysis of Biopolymer Coatings Market: Import & Export Statistics:

- In the year to April 2025, China's export of virgin commodity polymers surged by 25% to 6.1 million tons compared to the previous year, while its exports of fabricated plastic products grew by 11% to 6.5 million tons. This marks a significant increase in both categories for China's polymer trade during the first four months of 2025.(Source : blog.itpweb.com)

- In 2024, Japan's export of plastics and articles thereof reached $24.71 billion, representing 3.49% of its total exports, according to TradeImeX. This made plastics an important export category for Japan, which manufactures a wide array of plastic goods, from packaging materials to consumer items.(Source: www.tradeimex.in )

Biopolymer Coatings Market Value Chain Analysis

- Feedstock Procurement :Feedstock procurement involves sourcing renewable, bio-based raw materials, such as sugarcane, corn, starch, cellulose, and plant-derived oils, which serve as the foundational ingredients for producing biopolymers. This stage requires rigorous quality assessment, sustainable farming practices, and stable supply partnerships to ensure consistent feedstock composition. Companies often work closely with agricultural producers to secure non-GMO, traceable, and environmentally responsible inputs, which support the overall sustainability of biopolymer coatings.

- Major Players: Cargill, NatureWorks LLC, BASF SE, ADM

- Chemical Synthesis and Processing :Chemical synthesis and processing include fermenting, polymerising, or chemically modifying bio-based feedstocks to create functional biopolymers with desired coating properties. Techniques such as ring-opening polymerisation, blending, plasticisation and cross-linking are used to improve barrier strength, flexibility, heat resistance and biodegradability. This step also includes compounding and formulation work to ensure coatings perform effectively across paper, packaging, textile and agricultural applications. Continuous R&D advances support higher performance, lower production costs and improved scalability.

- Major Players: Arkema Group, Mitsubishi Chemical Group Corporation, TotalEnergies Corbion

- Packaging and Labelling: Packaging and labelling involve applying biopolymer coatings as protective, biodegradable layers on substrates such as paper, cardboard, films and textile surfaces. This stage focuses on enhancing moisture resistance, grease barriers and durability while maintaining environmentally friendly profiles. Sustainable packaging design also requires accurate labelling to communicate compostability, recyclability and bio-based content to consumers and regulatory bodies. Companies in this segment invest in coating technologies that balance performance with environmental certifications.

- Major Players: Danimer Scientific, Novamont S.p.A., AkzoNobel N.V.

- Regulatory Compliance and Safety Monitoring :It is a crucial process that ensures products meet stringent environmental, health, and performance standards set by governing bodies such as the FDA and EFSA.

- Major Players: DuPont de Nemours, Inc., NatureWorks LLC

Biopolymer Coatings Market's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| United States | The Food and Drug Administration (FDA) primarily regulates food contact substances. Manufacturers must ensure their biopolymer coatings are safe for their intended use and do not pose harm. |

| European Union | Regulation (EC) No 1935/2004 provides a framework for all Food Contact Materials (FCMs), requiring that they do not transfer constituents to food in harmful quantities. This is supplemented by specific regulations for different materials. |

| China | China uses a positive list approach for coatings, with GB 4806.10-2025 effective in September 2026. This standard expands its scope to cover both direct and indirect food-contact coatings. |

Segment Insights

Product Type Insights

How Much Share Did the Bio-PU Coatings Segment Hold in the Biopolymer Coatings Market During 2024?

The bio-PU coatings segment accounted for the largest share in 2024. The segment's dominance can be attributed to the growing demand for high-performance, durable coatings with lower environmental impact. The market is also benefiting from the increased use of biopolymers in the medical and pharmaceutical fields.

The bio-PA coatings segment is expected to grow at the fastest CAGR over the forecast period. The segment's growth can be attributed to growing concerns about plastic waste and the environmental impact of traditional materials. The use of biopolymers is growing across different sectors such as packaging, healthcare, and textiles.

The growth of the bio-PBS coating segment is driven by rising awareness of plastic pollution, which is pushing various industries to seek alternatives, making biodegradable options like Bio-PBS more attractive. Companies use sustainable coatings to improve their brand image and appeal.

The PLA coatings segment held a significant market share in 2024. The segment's growth can be fuelled by its versatility and properties, such as clarity, durability, and high-temperature formability. PLA is widely used in food packaging due to its safety and functional benefits.

Application Insights

Which Application Type Segment Dominated the Biopolymer Coatings Market in 2024?

The packaging segment held the largest market share in 2024. The dominance of the segment can be linked to the surge in investment in biopolymer production infrastructure, along with the enhancements in biopolymer processing and material properties.

The automotive segment is expected to grow at the fastest CAGR over the projected period. The segment's growth can be driven by increasing use of biopolymer coatings for vehicle components. The automotive industry is also emphasizing minimizing its dependence on fossil fuels.

The growth of the architectural segment can be propelled by the ongoing development of new resins, such as bio-based and epoxy resins, which expand the range of options for producing high-performance architectural coatings.

The flooring segment held a significant market share in 2024. Innovations in biopolymer synthesis and processing are enhancing the durability and performance of biopolymer coatings, which makes them more competitive with conventional options.

Regional Insights

How did North America Thrive in the Biopolymer Coatings Market in 2024?

North America dominated the market, accounting for the largest share in 2024. The region's dominance can be attributed to growing consumer demand for sustainable products and supportive government policies. In addition, the region has a robust ecosystem for innovation, with numerous research institutions and companies focused on developing and implementing biopolymer technologies.

U.S. Biopolymer Coatings Market Trends

In North America, the U.S. dominated the market due to a surge in environmental awareness and stringent government regulations on plastic waste. Also, the versatility of biopolymers is driving their adoption across sectors, boosting market growth.

Why Is Asia Pacific Set to Grow at the Fastest Rate in the Biopolymer Coatings Market?

The Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The region's growth can be credited to rising consumer demand for sustainable products, coupled with government initiatives to support eco-friendly materials. Moreover, the region's middle-class population growth is increasing demand for premium, sustainable products.

China Biopolymer Coatings Market Trends

In Asia Pacific, China led the market due to ongoing industrialization, particularly in e-commerce and food packaging. The Chinese government is increasingly implementing stringent regulations to reduce the use of non-biodegradable plastics, creating space for alternatives such as biopolymer coatings.

Europe is expected to grow at a notable CAGR over the forecast period. The region's growth can be driven by a push towards a circular economy and reduced plastic waste, as well as strong regulatory pressure from the government. Regino's robust chemical and polymer feedstock sector creates an integrated supply chain for biopolymer production.

Germany Biopolymer Coatings Market Trends

The German biopolymer coatings market is expanding steadily due to the country’s strong manufacturing base in packaging, automotive, and industrial materials, which drives consistent demand for high-performance, sustainable coatings. Government alignment with EU regulations on waste reduction, recyclability, and chemical safety continues to accelerate the shift away from conventional plastic coatings.

Germany’s emphasis on circular-economy strategies and investment in renewable feedstocks further supports innovation in bio-based coatings. In addition, local research institutions and material science companies are actively developing advanced biopolymer formulations, strengthening Germany’s role as a key contributor to sustainability-driven coating technologies in Europe.

Why Is Latin America Seeing Considerable Growth in the Biopolymer Coatings Market in 2024?

Latin America recorded notable market growth in 2024, driven by the rising adoption of biopolymer coatings across agriculture, food packaging, and industrial materials. Countries across the region are increasingly seeking bio-based alternatives that can improve crop protection, extend shelf life, and reduce plastic waste in supply chains. Rapid advancements in local research and formulation technologies are also helping manufacturers enhance the durability, barrier strength, and environmental performance of biopolymer coatings, making them more competitive with conventional petrochemical options.

In addition, biopolymer coatings support regional sustainability goals by lowering dependence on fossil-fuel-derived materials and offering biodegradable end-of-life pathways. Several Latin American governments have tightened waste management and single-use plastic regulations, encouraging industries to adopt renewable, compostable coating solutions. Strong consumer interest in natural and eco-friendly materials further reinforces demand, positioning Latin America as an emerging growth hotspot for biopolymer coatings in 2024 and beyond.

Brazil Biopolymer Coatings Market Trends

The biopolymer coatings market in Brazil is experiencing strong growth, driven by the country’s extensive agricultural sector, which provides abundant, cost-effective feedstocks for the production of bio-based materials. Brazil is one of the world’s largest producers of sugarcane and corn, providing local manufacturers with reliable access to key raw materials for biopolymer synthesis. This availability lowers production costs and supports competitive scaling of bio-based coatings across packaging, textiles, and industrial applications.

In addition, Brazil’s focus on expanding bio-economy initiatives and reducing reliance on petroleum-based materials is reinforcing industry development. Investment in biopolymer research, fermentation technologies, and processing infrastructure is increasing, supported by collaborations between universities, agribusiness companies, and material science firms.

Recent Developments

- In June 2025, Ecohelix secures €2.2M EU LIFE funding to boost the market entry of WOODMER seal biopolymer. This product is designed for food-based and fossil-based polymers in a wide range of packaging applications.(Source: news.cision.com)

- In November 2024, the ICAR-Indian Institute of Oilseeds Research (IIOR) develops an advanced seed treatment tech to safeguard microbial agents and soil nutrients. It signs MoUs with private seed companies to commercialise the patented biopolymer-based seed treatment technology.(Source: www.thehindu.com )

Top Biopolymer Coatings Market Companies

- AkzoNobel N.V. – AkzoNobel develops biopolymer-based coating solutions focused on reducing environmental impact, improving biodegradability, and supporting water-based, low-VOC formulations for packaging and industrial applications.

- Archer Daniels Midland (ADM) – ADM supplies plant-derived biopolymers, starches, and renewable ingredients used in barrier coatings for paper, packaging, and food service products. Its solutions emphasize sustainability and compostability.

- BASF SE – BASF produces bio-based polymers, dispersions, and functional additives that enhance coating performance while supporting renewable content. Its biopolymer coatings are used in packaging, agriculture, and industry.

- Cargill Inc – Cargill manufactures starch-based biopolymers and renewable coating ingredients designed for sustainable packaging, paper coatings, and food contact applications with improved barrier properties.

- Corbion – Corbion provides lactic acid and PLA-based biopolymers used in biodegradable and compostable coating systems. Its solutions improve moisture resistance and durability in food packaging and disposable products.

- DuPont – DuPont develops bio-derived materials and specialty polymers used in coating applications requiring flexibility, adhesion, and improved sustainability. Its innovations support renewable and recyclable packaging formats.

- Danimer Scientific – Danimer produces PHA-based biopolymers that are fully biodegradable and suitable for coatings used in flexible packaging, agricultural films, and food service products.

- EcoSynthetix – EcoSynthetix specializes in bio-based latex alternatives and starch-based polymers that serve as binders and coatings for paper, packaging, and industrial applications. Its materials reduce dependence on petroleum-based emulsions.

- Evonik Industries – Evonik offers bio-derived additives, coating modifiers, and renewable polymer systems designed to enhance performance in sustainable coating applications, including packaging and construction.

- Meredian Holdings Group (MHG) – MHG produces PHA-based biopolymers suitable for biodegradable coatings used in packaging, films, and disposable products. The company focuses on fully compostable materials sourced from renewable feedstocks.

- Mitsubishi Chemical Corporation – Mitsubishi Chemical manufactures bio-based polymers such as BioPBS, used in compostable coatings for paper cups, food packaging, and barrier film applications.

- NatureWorks LLC – NatureWorks produces PLA biopolymers under the Ingeo brand, widely used in compostable coatings, films, and paper products requiring renewable and food-safe materials.

- Novamont S.p.A. – Novamont develops starch-based and biodegradable polymer materials used in barrier coatings, packaging films, and compostable paper applications to support circular packaging systems.

- Roquette Group – Roquette manufactures plant-based starches, proteins, and polysaccharides used as binders and coating components in sustainable packaging and industrial applications.

- Safepack Industries Ltd and WestRock Company – Safepack provides protective biopolymer coating solutions for industrial and packaging uses, while WestRock integrates renewable coatings into fiber-based packaging to enhance barrier performance and sustainability.

Segments Covered in the Report

By Product Type

- Bio PU Coatings

- Architectural

- Decking

- Floorings

- Furniture

- Automotive

- Textiles

- Others

- Bio PA Coatings

- Automotive

- General Industrial

- Exterior

- Wire Goods

- Construction

- Electrical

- Bio PBS Coatings

- General Packaging

- Food & Beverage Packaging

- PLA Coatings

- General Packaging

- Food & Beverage Packaging

- Starch Coatings

- General Packaging

- Food & Beverage Packaging

- Pharmacy Bags

- Others

- Cellulose Esters

- Automotive

- Food & Beverages

- Furniture Coatings

- Textiles

- Others

- Nitrocellulose

- Decking

- Floorings

- Furniture

- Others

- Wax Coatings

- Edible Coatings

- General Packaging

- Food & Beverages Packaging

- Soy Protein

- Edible Coatings

- General Packaging

- Food & Beverages Packaging

- Corn Zein Protein

- Pharma

- Food & Beverage Packaging

By Application

- Architectural

- Packaging

- Decking

- Floorings

- Furniture

- Automotive

- Textiles

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa