Content

U.S. Recycled Plastics Market Size and Forecast 2025 to 2034

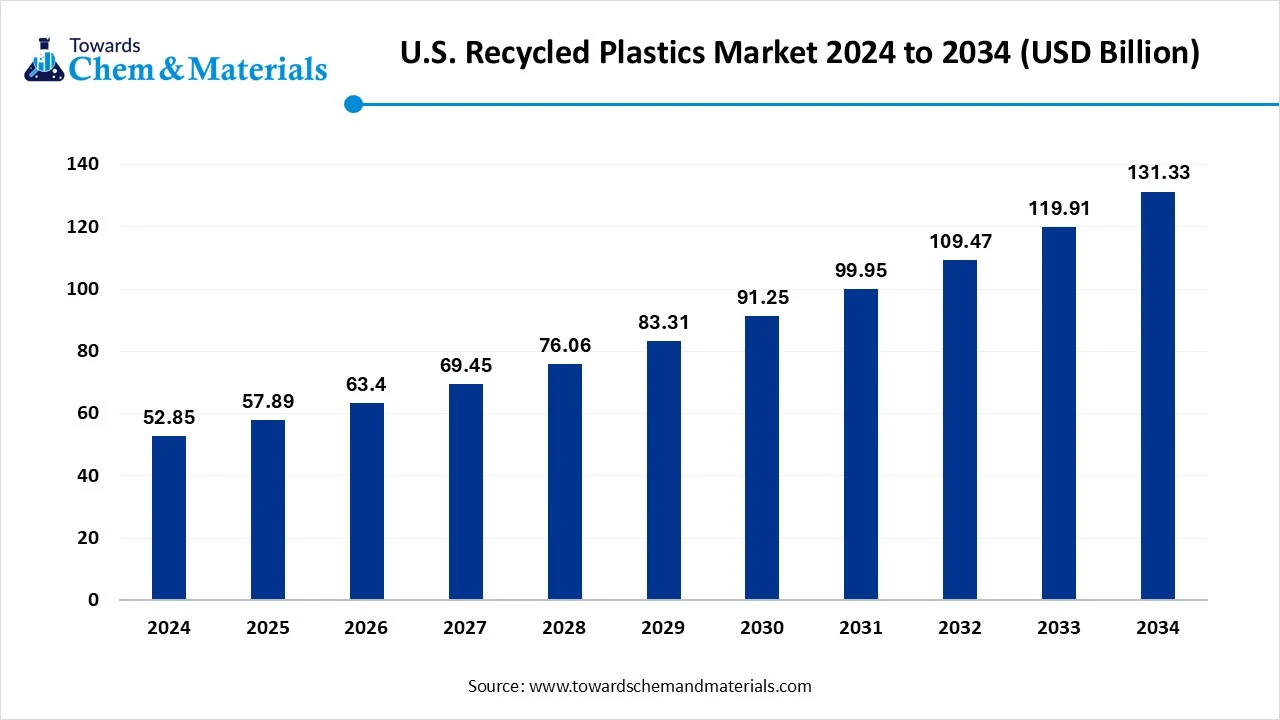

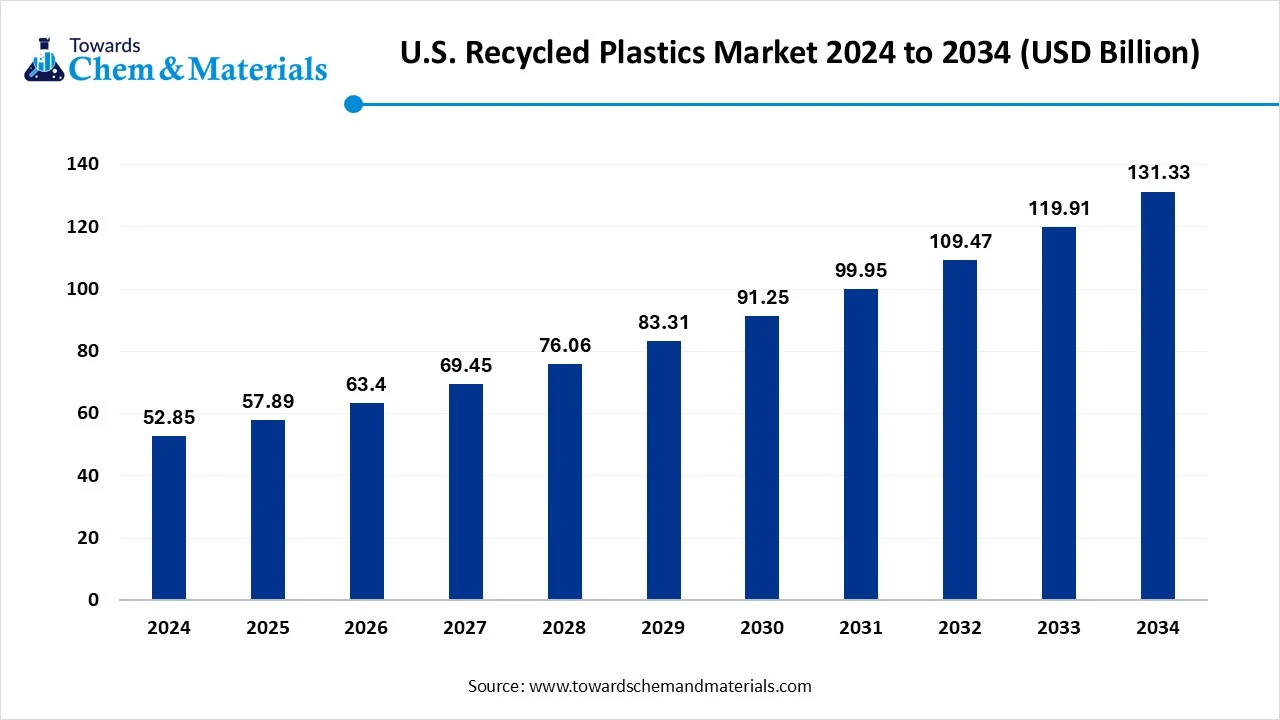

The U.S. recycled plastics market size was reached at USD 52.85 billion in 2024 and is expected to be worth around USD 131.33 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.53% over the forecast period 2025 to 2034. A sudden shift towards sustainable manufacturing practices has contributed to faster industrial growth in the region.

Key Takeaways

- By polymer type, the PET segment led the U.S. recycled plastics market in 2024 with approximately 30-35% market share, due to its wide application in sectors such as beverage bottles, containers, and packaging films.

- By polymer type, the PP & mixed polyolefins segment is expected to grow at the fastest rate in the market during the forecast period, akin to versatile usage profiles.

- By recycling technology type, the mechanical recycling segment emerged as the top-performing segment in the market in 2024, with 60% industry share, due to factors such as cost-effectiveness, widespread establishment in the country, and a simple method.

- By recycling technology type, the chemical/advanced recycling segment is expected to lead the market in the coming years, due to its ability to process complex, mixed, and contaminated plastics that mechanical grade cannot handle.

- By source, the post-consumer segment led the market in 2024 with approximately 55-60% market share because the largest supply of recyclable plastics in the U.S. comes from households and businesses.

- By source, the post-industrial segment is expected to capture the biggest portion of the market in the coming years, because they are cleaner, uniform, and easier to recycle compared to post-consumer plastics.

- By product form, the flakes and pellets segment led the market in 2024 with approximately 50% market share, due to their being the standard recycled plastic form used across industries.

- By product form, the pyrolysis oil/chemical feedstock segment is expected to grow at the fastest rate in the market during the forecast period, because of the need for higher-purity recycled plastics for sensitive industries like food, beverages, and healthcare.

- By end user type, the packaging brands and converters segment led the market in 2024 with approximately 60% market share because they are the biggest users of recycled plastics in the U.S.

- By end user type, the textile and fiber application segment is expected to capture the biggest portion of the market in the coming years, due to the fast-growing demand for sustainable fabrics.

- By distribution channel, the direct offtakes with the brands segment led the market in 2024 with 55% market share, akin to large packaging and consumer goods brands signing long-term contracts with recyclers to secure a steady supply of recycled plastics.

- By distribution channel, the resins distributors and online platforms segment is expected to grow at the fastest rate in the market during the forecast period, because of the need for flexibility, wider reach, and digital trading of recycled plastics.

Market Overview

Reinventing Waste: How Recycled Plastics are Shaping the United States' Future?

The U.S. recycled plastics market covers collection, sorting, mechanical and chemical recycling, and commercialization of recycled polymer feedstock (flakes, pellets, resins, fibers) derived from post-consumer and post-industrial plastic waste. Recycled plastics include PET, HDPE, LDPE, PP, PS, and engineered polymers reused in packaging, textiles, automotive, construction, and other sectors.

Market growth is driven by corporate sustainability targets, state & federal policy mandates, increasing demand for rPET/rHDPE in packaging, and rising investments in advanced recycling technologies.

What Factor is Driving the U.S. Recycled Plastics Market?

The increased need for sustainable packaging has played a central role in the industry's expansion in past years. Moreover, the major brands and consumers of the country are seen under the heavy push for eco-friendly packaging options, where the government is also playing a major role by implementing the sustainability standards in recent years. Furthermore, materials like PET and other polymers have attracted considerable interest from consumers in the United States, as per the recent regional survey.

- In November 2024, the United States Biden–Harris Administration unveiled the national strategy for the prevention of plastic pollution. Also, the administration is mainly focused on public health and the environment by launching this strategy as per the published report.(Source: www.epa.gov )

Market Trends

- The brands in the United States have been demanding high-quality recycled plastic in the past few years, which can lead to the industry's future in the United States.

- The increasing adoption of the advanced recycling infrastructure, such the chemical recycling and others, is expected to become a spotlight factor for stakeholders during the projected period.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 57.89 Billion |

| Expected Size by 2034 | USD 131.33 Billion |

| Growth Rate from 2025 to 2034 | CAGR 9.53% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Polymer/Resin Type, By Recycling Technology, By Source, By Product Form, By End-User, By Distribution Channel |

| Key Companies Profiled | KW Plastics, Custom Polymers, Plastipak Holdings, The Coca-Cola Company Incorporated, B. Schoenberg & Co., Fresh Pak Corporation , B&B Plastics , Green Line Polymers, Ultra Poly Corporation , Clear Path Recycling , MBA Polymers , RJM International Inc. , CarbonLite Industries LLC, Envision Plastics Industries LLC |

Market Opportunity

Advanced Recycling Capabilities Fuel Industrial Interest and Market Potential

The establishment of the modern recycling infrastructure can be estimated to foster rewarding market opportunities for the recycling players in the upcoming years in the United States. Moreover, by providing advantages like the breakdown of the complex and mixed plastics into innovative raw material, manufacturers are projected to capture the attention of the leading industry participants in the future, as per the upcoming market expectations.

- In February 2025, the Berry Global Group created a strategic collaboration with Mars. The main motive behind the collaboration is to replace traditional pantry jars for the brands such as the SKITTLES, M&M, and STARBURST with sustainable packaging.(Source : www.mars.com)

Market Challenge

Cost Constraints and Infrastructure Gaps Stall Recycling Industry Momentum

The limited collection infrastructure and the higher initial cost are anticipated to restrict industry expansion prospects. As the recycling process depends on sorting, effective collection, and processing where the efficient recycling system is considered the crucial part. Furthermore, the high prices of the installation of the advanced plant can create growth barriers for the mid-sized business, where the limited budget is a crucial factor.

Segmental Insights

Polymer Type Insights

How did the PET Segment Dominate the U.S. Recycled Plastics Market in 2024?

The PET segment held the largest share of the market in 2024, due to its wide application in sectors such as beverage bottles, containers, and packaging films. In addition, the PET is known for their easiest and most effective recycling, which has led to the segment's potential in recent years. As well, having the greater demand from the region and presence of the stronger PET recycling systems, the segment has drawn significant recognition in the industry nowadays.

The PP & mixed polyolefins segment is expected to grow at a notable rate during the predicted timeframe, akin to versatile usage profiles. Likewise, the sectors such as the food packaging and automobile have played a major role in the expansion of the segment in recent times. As per the recent country survey, the recycling rate of the PP is lower in the United States, but modern technology can provide significant attention to the segment in the future, according to industry expert opinion.

Recycling Technology Type Insights

Why does Mechanical Recycling Dominate the U.S. Recycled Plastics Market by Recycling Technology Type?

The mechanical recycling segment held the largest share of the U.S. recycled plastics market in 2024, due to factors such as cost-effectiveness, widespread establishment in the country, and a simple method. In the same vein, its consideration as the traditional method and its well-established infrastructure is actively turning into a key area of industry focus in the current period.

The chemical/advanced recycling segment is expected to grow at a notable rate due to its ability to process complex, mixed, and contaminated plastics that mechanical grade cannot handle. Furthermore, the United States plastic manufacturers are actively seeking these types of methods due to their huge, contaminated plastics stock, which is set to offer profitable prospects for manufacturers in the coming years.

Source Type Insights

How did the Post Consumer Segment Dominate the U.S. Recycled Plastics Market in 2024?

The post-consumer segment dominated the market with the largest share in 2024 because the largest supply of recyclable plastics in the U.S. comes from households and businesses. Everyday products like water bottles, packaging films, containers, and bags are collected after consumer use. Recycling programs across cities and states are designed to collect post-consumer waste, especially PET and HDPE bottles. This makes post-consumer plastics the most significant feedstock for recycling.

The post-industrial segment is expected to grow at a significant rate because they are cleaner, uniform, and easier to recycle compared to post-consumer plastics. These include manufacturing scrap, factory rejects, and packaging waste from industrial processes. Since they are less contaminated, recycling costs are lower, and output quality is higher. Companies are increasingly partnering with recyclers to ensure factory waste is collected and reprocessed into high-quality recycled resins.

Product Form Insights

What Makes Flakes and Pellets the Preferred Form of Recycled Plastic?

The flakes and pellets segment held the largest share of the market in 2024 because they are the standard recycled plastic form used across industries. Once plastics are collected and processed, they are converted into flakes or melted into pellets, which can then be directly used in manufacturing new products. They are easy to transport, store, and integrate into existing plastic production systems. U.S. packaging, textile, and consumer goods companies widely purchase recycled flakes and pellets to blend with virgin plastics.

The pyrolysis oil/ chemical feedstock segment is expected to grow at a notable rate during the predicted timeframe because of the need for higher-purity recycled plastics for sensitive industries like food, beverages, and healthcare. Chemical recycling technologies convert plastic waste into oils or feedstock, which can be reprocessed into virgin-like polymers. This allows even low-quality, mixed, or contaminated plastics to be recycled effectively.

End User Type Insights

How are Major Packaging Companies Driving Demand for Recycling Plastics?

The packaging brands and converters segment held the greater share of the market in 2024 because they are the biggest users of recycled plastics in the U.S. These companies need large volumes of recycled PET, HDPE, and PP to make bottles, films, containers, and flexible packaging. With sustainability pledges, packaging brands like Coca-Cola, PepsiCo, and Nestlé are committed to using high recycled content in their products. Converters purchase recycled plastics in the form of flakes and pellets to produce packaging for these brands.

The textile and fiber application segment is anticipated to grow at a notable rate during the predicted timeframe due to the fast-growing demand for sustainable fabrics. Recycled PET is widely used in making polyester fibres for clothing, upholstery, and carpets. With fashion and textile companies under pressure to reduce their environmental impact, many are turning to recycled fibres. Big brands like Adidas, Nike, and H&M already use recycled plastics in sportswear and apparel.

Distribution Channel Insights

What Makes Direct Offtake a Game Changer in the U.S. Recycled Plastics Market?

The direct offtake with the brands segment held a significant share of the market in 2024 because large packaging and consumer goods brands sign long-term contracts with recyclers to secure a steady supply of recycled plastics. This ensures consistency in quality and availability, helping brands meet their recycled content targets. By working directly with recyclers, companies also reduce costs, improve traceability, and build stronger sustainability credentials.

The resin distributors and online platforms segment is anticipated to grow at a notable rate during the predicted timeframe because of the need for flexibility, wider reach, and digital trading of recycled plastics. Smaller manufacturers and converters often cannot secure direct contracts with recyclers, so they rely on distributors to access recycled resins in smaller volumes. Online marketplaces are also emerging, making it easier to source recycled plastics transparently and at competitive prices.

U.S. Recycled Plastics Market Value Chain Analysis

- Distribution to Industrial Users : The recycled plastic is mainly distributed by the large-scale industrial sectors in the United States; these sources process and reintroduce plastic waste into the innovative material.

- Key Players : Custom Polymers, Inc., Ultra Poly Corporation, and Green Line Polymers

- Chemical Synthesis and Processing : The recycled plastics chemical synthesis includes major processes such as pyrolysis and depolymerization.

- Key Players : KW Plastics, WM Recycle America, and B. Schoenberg & Co.

- Regulatory Compliance and Safety Monitoring : Recycled plastic requires rigorous regulatory compliance and safety monitoring to ensure worker safety and product quality, which depends upon the sectors, such as the food sector requires regulatory permissions from the U.S Food and Drug Administration and others.

Recent Developments

- In February 2024, BASF established its latest plastic recycling unit in the United States. As this unit is called ChemCyling and it can provide the ISCC+ certified advanced recycling building blocks as per the report published by the company recently (Source: www.basf.com)

- In May 2025, the plastic recycling startup called Green Recycle USA LLC launched in the United States. This startup is planning to invest $4.3 million in its existing plant to recycle plastic waste, as per the company's claim.(Source: www.vedp.org )

U.S. Recycled Plastics Market Top Companies

- KW Plastics

- Custom Polymers

- Plastipak Holdings

- The Coca-Cola Company Incorporated

- B. Schoenberg & Co.

- Fresh Pak Corporation

- B&B Plastics

- Green Line Polymers

- Ultra Poly Corporation

- Clear Path Recycling

- MBA Polymers

- RJM International Inc.

- CarbonLite Industries LLC

- Envision Plastics Industries LLC

Segment Covered

By Polymer/Resin Type

- PET (Polyethylene Terephthalate)

- HDPE (High-Density Polyethylene)

- LDPE / LLDPE

- PP (Polypropylene)

- PS (Polystyrene)

- Engineering & Mixed Plastics

By Recycling Technology

- Mechanical Recycling

- Chemical / Advanced Recycling (Pyrolysis, Depolymerization, Solvolysis)

- Solvent-Based Purification

- Fiber-to-Fiber / Specialty Recycling

By Source

- Post-Consumer

- Post-Industrial

- Commercial & Institutional

By Product Form

- Flakes & Regrind

- Recycled Resin Pellets (rPET, rHDPE, rPP)

- Recycled Fibers & Filaments

- Pyrolysis Oils / Chemical Feedstocks

By End-User

- Packaging Brands & Converters

- Textile Manufacturers

- Automotive OEMs & Tier Suppliers

- Building & Construction Product Manufacturers

By Distribution Channel

- Direct Offtake (Brand Partnerships)

- Resin Distributors & Compounders

- Industrial Suppliers & Fabricators