Content

Polymer Foam Market Size and Forecast 2025 to 2034

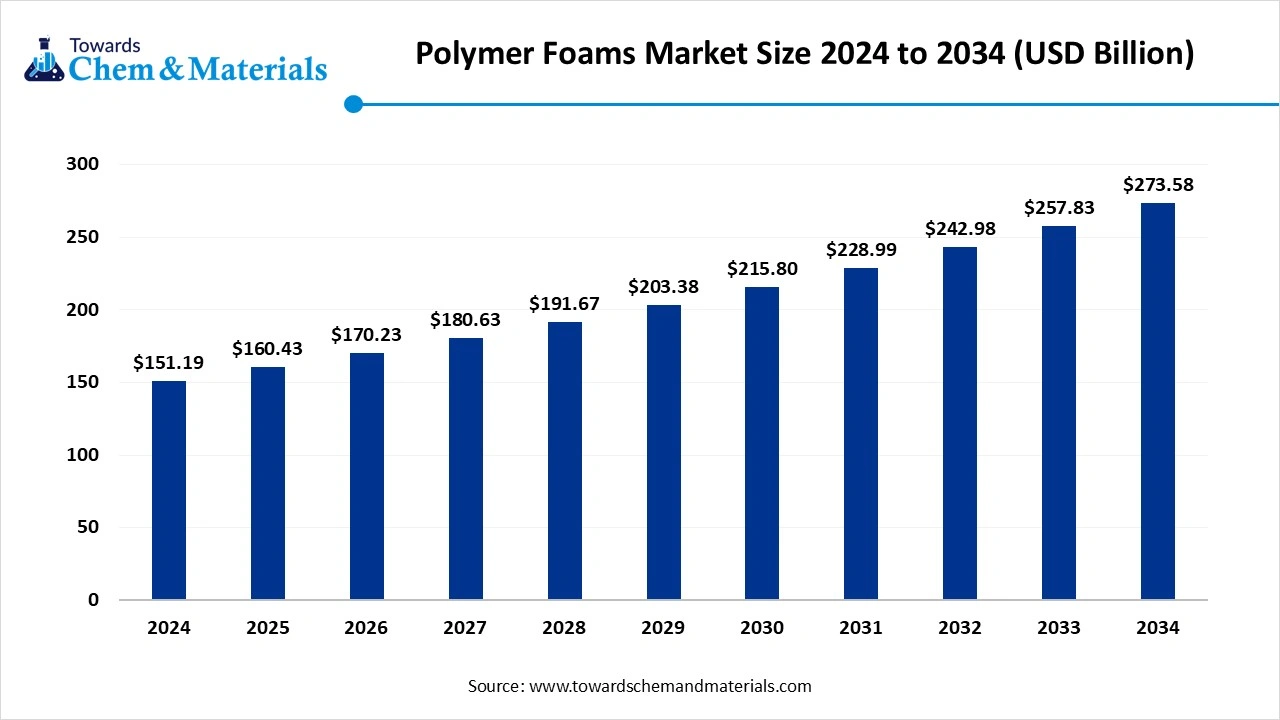

The global polymer foam market size was approximately USD 160.43 billion in 2025 and is projected to reach around USD 273.58 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 6.11% between 2025 and 2034. The growth of the market is driven by the growing demand for lightweight materials from various industries like construction, packaging, and automotive, which drives the growth of the market.

Key Takeaways

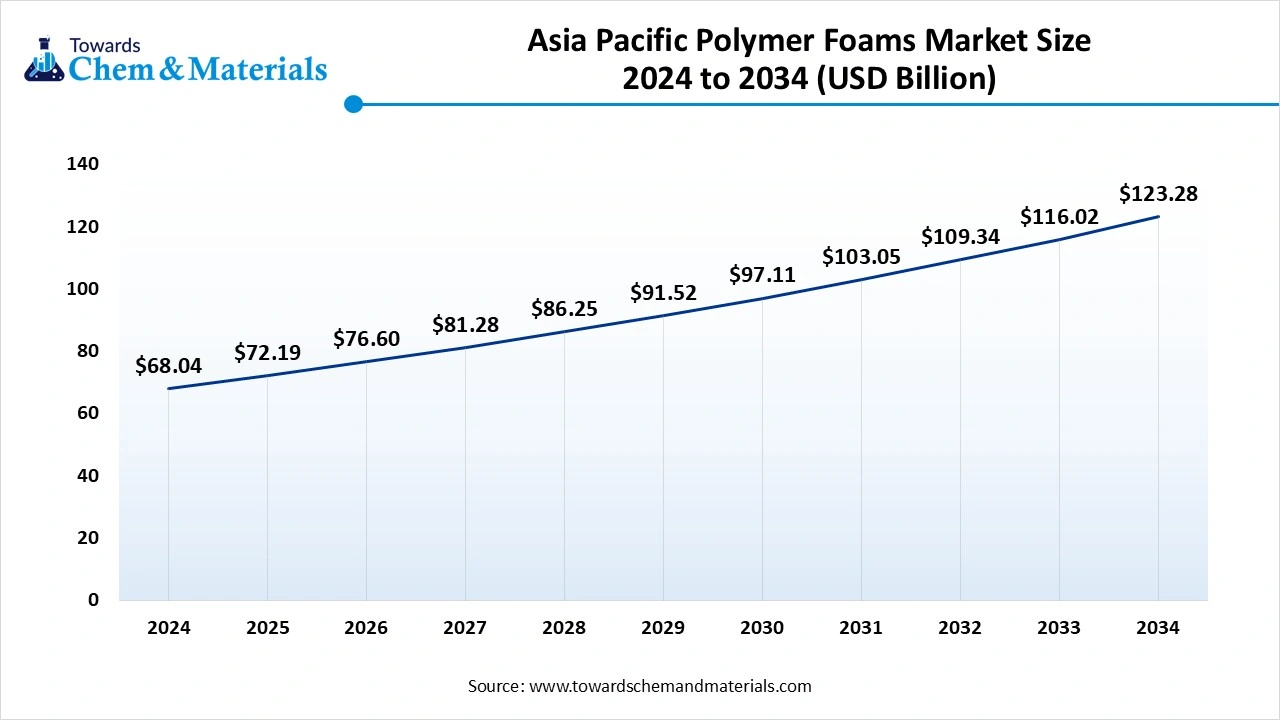

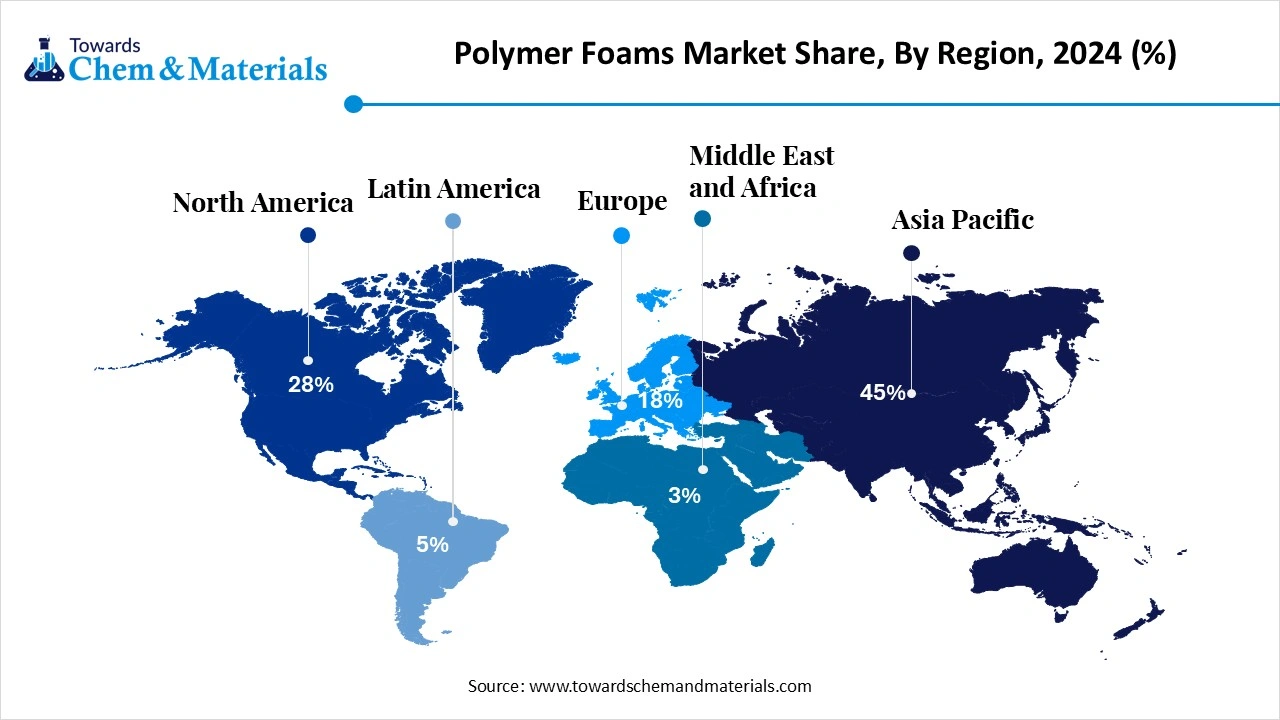

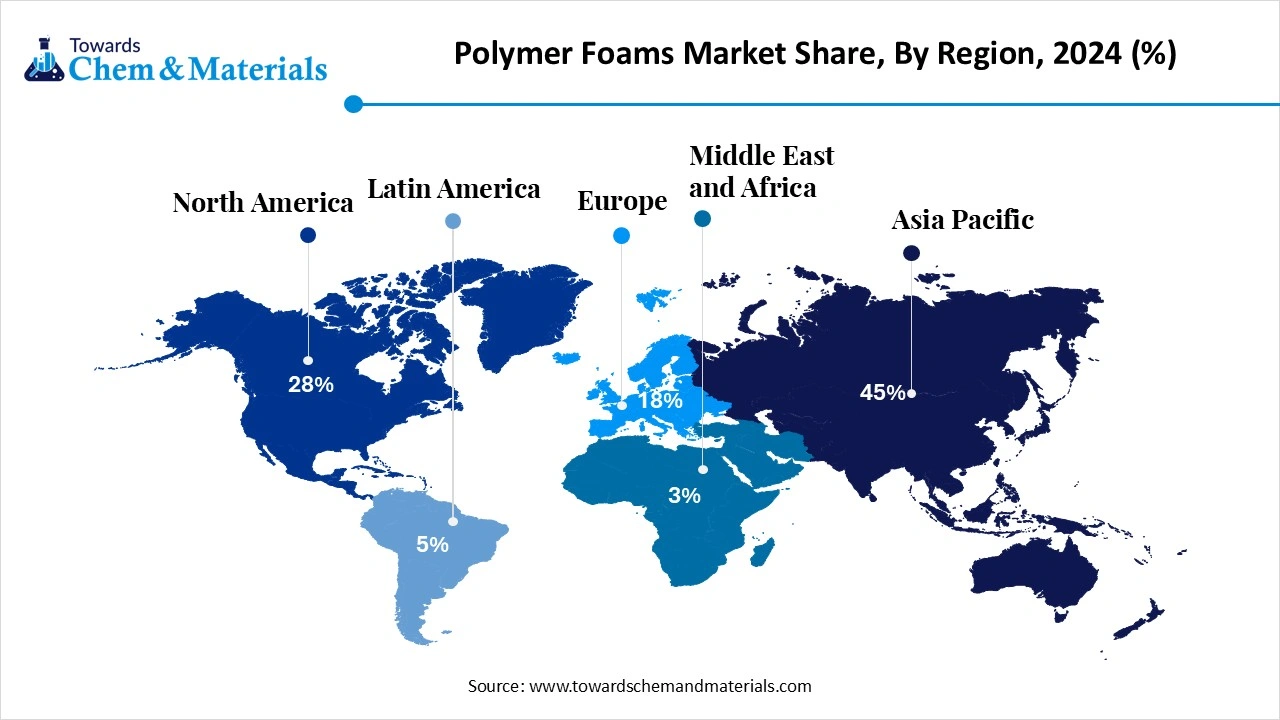

- By region, Asia Pacific dominated the market with a share of 45% in 2024.

- By region, Latin America is expected to have significant growth in the market in the forecast period.

- By foam type, the rigid foam segment dominated the market with a share of 55% in 2024.

- By foam type, the flexible foam segment is expected to grow significantly in the market during the forecast period.

- By resin type, the polyurethane foam segment dominated the market with a share of 40% in 2024.

- By resin type, the polyolefin foam segment is expected to grow in the forecast period.

- By cell structure, the closed-cell foam segment dominated the market with a share of 65% in 2024.

- By cell structure, the open-cell foam segment is expected to grow in the forecast period.

- By application, the building & construction segment dominated the market with a share of 35% in 2024.

- By application, the automotive segment is expected to grow in the forecast period.

Market Overview

What Is The Significance Of The Polymer Foam Market?

The polymer foam plays a significant role in various industries due to its properties like lightweight, durability, insulation, and cushioning, which are important for industries like packaging, automotive, and construction, increasing the demand for the market.

The innovation in energy efficiency, consumer product functionality, and safety also plays a crucial role, which drives the growth of the market. The economic growth, infrastructure development, e-commerce growth, and technological advancements are also key growth factors for the market, which play a significant role.

Polymer Foam Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the polymer foam market is projected to grow steadily, supported by demand in the packaging, automotive, construction, and furniture sectors. Lightweight, insulating, and cushioning properties make foams critical for energy efficiency and safety applications.

- Sustainability Trends: The market is shifting toward eco-friendly and recyclable foam solutions, with stricter regulations on single-use plastics and emissions driving innovation. Bio-based polyols, water-blown foams, and recyclable thermoplastic foams are gaining traction.

- Global Expansion: Leading producers are expanding manufacturing capacities in Asia-Pacific and the Middle East to meet growing regional demand. Partnerships with automotive OEMs and packaging companies are common to secure long-term supply agreements.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 160.43 Billion |

| Expected Size by 2034 | USD 273.58 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Foam Type, By Resin Type, . By Cell Structure, By Application, By Region |

| Key Companies Profiled | BASF SE, The Dow Chemical Company , Huntsman Corporation , Recticel S.A. , Rogers Corporation , Sealed Air Corporation , Borealis AG, Exxon Mobil Corporation , Finproject Group , Hanwha Solutions Chemical Division , JSP Corporation , Kaneka Corporation , SABIC , Sekisui Chemical Co., Ltd. , Trocellen GmbH |

Key Technological Shifts In The Polymer Foam Market:

Major technological advances in the polymer foam sector include the emergence of sustainable options like bio-based and recyclable foams, the development of "smart" foams with functionalities such as self-healing and thermal regulation, progress in additive manufacturing (3D printing) for bespoke products, and enhancements in material science to improve strength, durability, and acoustics. These changes are motivated by the demand for eco-friendly products, higher performance, and new applications in fields like healthcare, electronics, and automotive.

Trade Analysis Of the Polymer Foam Market: Import & Export Statistics

- Vietnam leads the world in polymer foam exports, followed by China and South Korea.

- The largest destinations for foam products from Vietnam include Vietnam itself, Cambodia, and the United States.

- Rapid growth in countries like China and India fuels the demand for polymer foams.

- Major importers include Vietnam, India, and Russia. The U.S. and Southeast Asian countries also show significant import activity.

- Vietnam, Mexico, and Uzbekistan are leading importers of polyethylene foam.

- Top suppliers of polyethylene foam to major markets include Vietnam, China, and Japan.

- Vietnam, India, and Russia lead imports of polymer polyol chemicals.

- China, Thailand, and the Netherlands are among the top exporters of polymer polyol.

Polymer Foam Market Value Chain Analysis

- Chemical Synthesis and Processing: Polymer foam synthesis and processing primarily involve a blowing agent in a polymer matrix to create a cellular structure.

- Key players BASF SE, Covestro AG, The Dow Chemical Company, and Huntsman Corporation

- Quality Testing and Certification: The polymer foam requires CertiPUR-US and CertiPUR, OEKO-TEX Standard 100, BIS Standard Mark, and GREENGUARD Certification.

- Key players: Indian Polyurethane Association, EUROPUR, Bureau of Indian Standards, and

- Distribution to Industrial Users:The polymer foam is distributed to the packaging, automotive, consumer goods, and construction industries.

- Key players: Alpha Foam Limited, Owens Corning, Zotefoams plc, and Carpenter Co.

Polymer Foam Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | U.S. EPA, CPSC (Consumer Product Safety Commission), ASTM International | - EPA Clean Air Act (restrictions on blowing agents, e.g., HFCs) - CPSC flammability standards (16 CFR Part 1632/1633 for mattresses) - ASTM C578 (rigid foam insulation) |

- Emission limits (VOC/HFC) - Fire safety - Building insulation standards |

Transition from high-GWP blowing agents to low-GWP alternatives (HFOs) is ongoing. LEED/green building codes influence foam formulations. |

| European Union | ECHA, CEN, European Commission | - REACH (chemical restrictions, e.g., diisocyanates in PU foams) - CLP Regulation (hazard communication) - EN 13165 (PU/PIR insulation) - EU Green Deal & Circular Economy Action Plan |

- Worker safety (isocyanates) - Fire & building performance - Recycling & sustainability |

Ban/restrictions on single-use EPS packaging; strict diisocyanate training requirements came into force in 2023. |

| China | Ministry of Ecology and Environment (MEE), SAC (Standardization Administration of China) | - GB/T 10801 (EPS insulation boards) - GB/T 17794 (XPS insulation) - MEE Order No. 12 (chemical registration) |

- Building insulation standards - Fire safety - Environmental compliance |

Strong regulations on the flammability of foams in construction. Domestic recycling mandates for EPS packaging are being strengthened. |

| India | BIS (Bureau of Indian Standards), CPCB (Central Pollution Control Board) | - IS 12436 (PU rigid foam for thermal insulation) - IS 4671 (EPS for thermal insulation) - Plastic Waste Management Rules, 2016 (amended 2022) |

- Thermal insulation standards - Plastic waste management - Safety in packaging and building |

Ban on single-use polystyrene in several states. BIS standards apply to construction foams. Extended Producer Responsibility (EPR) is being enforced. |

| Japan | JIS (Japanese Industrial Standards), MLIT (Ministry of Land, Infrastructure, Transport and Tourism) | - JIS A 9511 (urethane foam insulation) - JIS A 9521 (EPS insulation) - JIS fire testing standards |

- Building safety - Fire resistance - Energy efficiency |

Japan emphasizes energy-efficient foams for green buildings. Strong focus on durability and flame resistance in insulation products. |

Segmental Insights

Foam Type Insights

Which Foam Type Segment Dominated The Polymer Foam Market In 2024?

The rigid foam segment dominated the market with a share of 55% in 2024. Rigid polymer foams are widely used for thermal insulation and structural applications, particularly in building and construction. They offer superior strength-to-weight ratios, energy efficiency, and dimensional stability. These foams are essential in insulation boards, roofing, and wall systems.

Their durability and resistance to moisture make them a preferred choice in infrastructure and cold chain applications. The growing emphasis on sustainable construction and energy conservation continues to fuel demand for rigid foam materials in both residential and commercial projects.

The flexible foam segment expects significant growth in the polymer foam market during the forecast period. Flexible foams are characterized by their softness, elasticity, and cushioning properties, making them suitable for seating, bedding, and automotive interiors. They are also used extensively in packaging and consumer goods due to their shock-absorbing capabilities. In the automotive sector, flexible foams enhance passenger comfort while reducing vehicle weight, contributing to better fuel efficiency.

Advancements in foam formulations, including bio-based alternatives, are driving innovation in this segment. The diverse range of applications and adaptability keep flexible foams in high demand across end-use industries.

Resin Type Insights

How Did The Polyurethane Foam Segment Dominate The Polymer Foam Market In 2024?

The polyurethane foam segment dominated the market with a share of 40% in 2024. Polyurethane (PU) foam is one of the most versatile polymer foams, available in both rigid and flexible forms. Rigid PU foam is a leading material for insulation in buildings, appliances, and refrigeration, while flexible PU foam dominates in furniture, bedding, and automotive seating. Its balance of performance, cost-effectiveness, and adaptability makes it highly popular. Growing demand for energy-efficient buildings and lightweight automotive components continues to drive the adoption of polyurethane foam across multiple industries globally.

The polyolefin foam segment expects significant growth in the market during the forecast period. Polyolefin foams, including polyethylene (PE) and polypropylene (PP) foams, are valued for their chemical resistance, recyclability, and lightweight nature. They are extensively used in automotive, packaging, and sports equipment. In the automotive sector, polyolefin foams are used for vibration damping, thermal insulation, and protective packaging of components. Their low density and durability also support widespread use in consumer goods and construction. Increasing demand for recyclable and sustainable materials is positioning polyolefin foams as a growing segment within the market.

Cell Structure Insights

Which Cell Structure Segment Dominated The Polymer Foam Market In 2024?

The closed-cell foam segment dominated the market with a share of 65% in 2024. Closed-cell foams are dense, rigid, and highly resistant to water and air penetration, making them ideal for insulation, flotation devices, and high-performance packaging. Their structure provides superior compressive strength and energy absorption, ensuring long-term durability in demanding environments. Widely used in building and construction as well as in industrial applications, closed-cell foams are integral to projects requiring thermal and moisture barriers. The growing need for energy-efficient infrastructure continues to support its strong adoption in global markets.

The open-cell foam segment expects significant growth in the polymer foam market during the forecast period. Open-cell foams are lighter, softer, and more breathable compared to closed-cell foams. They are frequently used in cushioning, soundproofing, and acoustic insulation applications. Due to their flexibility, open-cell foams are popular in furniture, mattresses, and automotive interiors. They also find applications in packaging for delicate products where shock absorption is critical. The rising demand for comfort-driven products, along with growth in residential construction and consumer goods, is driving market opportunities for open-cell foam manufacturers.

Application Insights

How Did The Building And Construction Segment Dominate The Polymer Foam Market In 2024?

The building & construction segment dominated the market with a share of 35% in 2024. In building and construction, polymer foams are extensively used for insulation, soundproofing, and lightweight structural components. Rigid foams, especially polyurethane, dominate this segment by improving energy efficiency in residential, commercial, and industrial buildings. Their moisture resistance and load-bearing properties make them suitable for roofing, walls, and flooring. With global sustainability goals and regulations emphasizing energy-efficient building practices, the adoption of polymer foams in green construction and retrofitting projects is expected to rise steadily in the coming years.

The automotive segment expects significant growth in the market during the forecast period. The automotive industry relies on polymer foams to reduce vehicle weight, enhance fuel efficiency, and improve passenger comfort.

Flexible foams are used for seating, headrests, and interior trims, while rigid and polyolefin foams provide vibration damping and impact resistance. Lightweight foams contribute to emissions reduction while supporting safety and comfort standards. As electric vehicles expand, polymer foams are gaining traction for thermal insulation in battery systems and lightweighting solutions. Growing automotive production and consumer demand for comfort continue to drive this segment.

Regional Insights

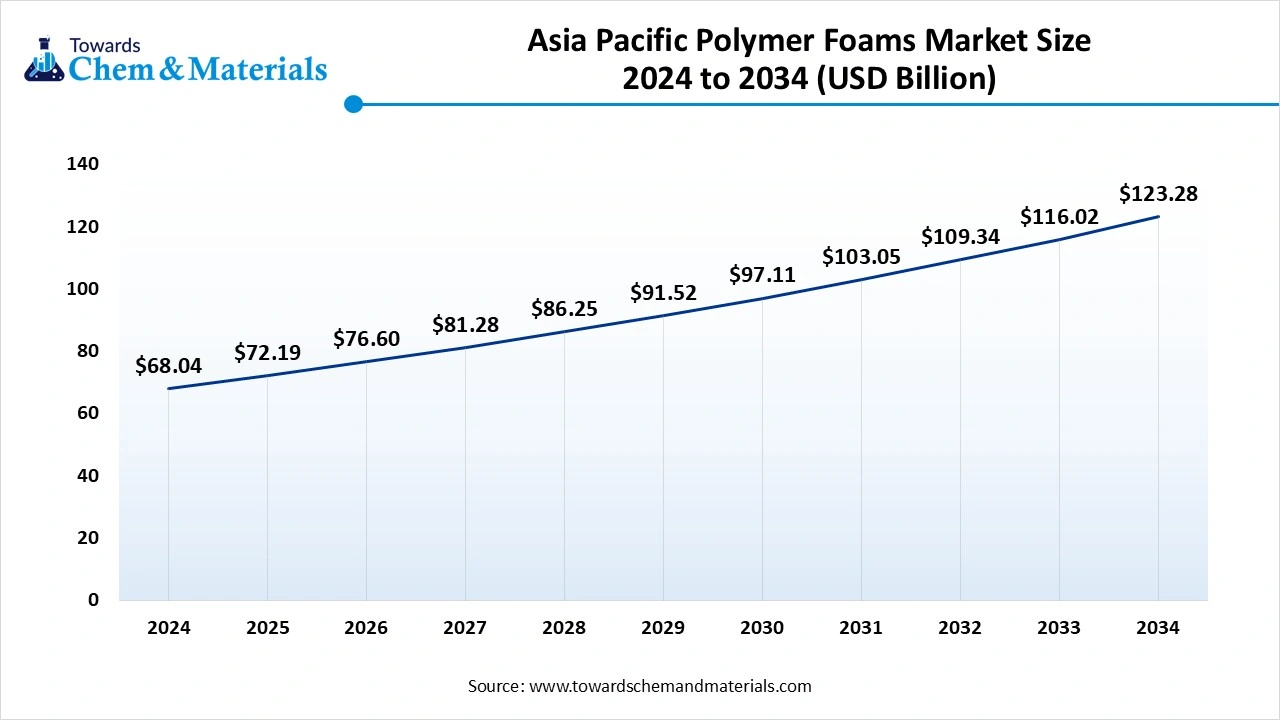

Asia Pacific Polymer Foam Market Size, Industry Report 2034

The Asia Pacific polymer foam market size was valued at USD 68.04 billion in 2024 and is expected to surpass around USD 123.28 billion by 2034, expanding at a compound annual growth rate (CAGR) of 6.12% over the forecast period from 2025 to 2034. Asia Pacific dominated the polymer foam market with a market share of 45% in 2024.

The growth of the market is driven by the rapid urbanization and construction activity in the region due to increasing demand for infrastructure development, demanding polymer foams in building insulation, flooring, and roofing. The high disposable income and changing lifestyle also increase the demand for packaging, automobiles, and consumer goods, which is driving the demand for polymer foams and is driving the growth and expansion of the market in the region, aligning with rapid industrialization.

China Has Seen Significant Growth, Driven By Technological Advancement In The Material.

China has seen significant growth in the market. The growth of the market is driven by the technological advancements in foam technology, which enable the development of lighter, stronger, and more versatile materials, expanding their applications across industries, which drives the growth of the market in the country. Growing urbanization and rising incomes in China fuel demand for PU foams in furniture and bedding for comfort and durability, driving the growth and expansion of the market in the country.

Latin America Has Seen Significant Growth, Driven By Rising Demand From Various Industries.

Latin America is expected to experience significant growth in the market in the forecast period. The growth of the market is driven by the growing push for using energy-efficient building materials, which drives demand for high-performance foam insulation, driving the growth of the market. Factors like the increasing demand for lightweight structural materials and continued growth in key application sectors are expected to support this expansion. The growth and strong demand from industries like automotive, furniture/bedding, and construction further support the growth and expansion of the market in the region.

Country-level Investments & Funding Trends for the Polymer Foam Market Industry:

- India: India's polymer sector has attracted significant investment. For instance, BASF SE is building a new polyurethane applications lab in Mumbai.

- India: The government has launched the Startup India Seed Fund Scheme (SISFS) with an outlay of ₹945 Crore ($113.3 million) to provide financial assistance to startups in various sectors, including potentially those in polymer innovation and sustainability.

- USA: The US has attracted significant investment in the broader polymers sector, with $1.02 billion in total funding over the past 10 years.

- USA: The US government has provided substantial funding for specific foam-related technologies. For example, a $5 million grant from the US Department of Energy was awarded to Algenesis to scale up production of bio-based isocyanates from algae oils for PU systems.

- China: International players like Covestro AG are investing in facilities in China, such as a mechanical recycling compounding line for polycarbonates in Shanghai.

- China: The Chinese government is heavily investing in new construction projects, including a 6.8 trillion yuan ($1 trillion) construction initiative, driving demand for insulation and structural foams.

Top players in the Polymer Foam Market & Their Offerings:

- ARMACELL: global leader in flexible foam for equipment insulation and a provider of engineered foams. A key innovator in technical insulation, the company develops and manufactures thermal, acoustic, and mechanical solutions that create sustainable value for its customers.

- Sheela Foam Limited: It is a prominent Indian multinational company specializing in polyurethane foam and related comfort products. Known for its flagship brand "Sleepwell," the company has built its market position through extensive manufacturing capabilities, a wide distribution network, and strategic acquisitions.

- Kingspan Insulation, LLC: Is a subsidiary of the global building materials company Kingspan Group, which is headquartered in Ireland. The LLC manufactures technical insulation products for applications ranging from architectural panels to mechanical insulation.

- Owens Corning: Is an American company specializing in building and composite materials, with a significant portfolio of polymer foam products. The company is known for its insulation products, including the signature pink-colored insulation and its FOAMULAR® line of extruded polystyrene (XPS).

- Zotefoams plc: Is a UK-based global leader in the development, manufacture, and distribution of advanced cellular materials. It specializes in high-performance, lightweight closed-cell foams produced through a unique, environmentally friendly process that uses nitrogen expansion.

Market Top Companies

- BASF SE

- The Dow Chemical Company

- Huntsman Corporation

- Recticel S.A.

- Rogers Corporation

- Sealed Air Corporation

- Borealis AG

- Exxon Mobil Corporation

- Finproject Group

- Hanwha Solutions Chemical Division

- JSP Corporation

- Kaneka Corporation

- SABIC

- Sekisui Chemical Co., Ltd.

- Trocellen GmbH

Recent Developments

- In May 2025, Borealis is investing over €100 million to triple the production capacity of its fully recyclable polymer foam solution, Daploy High Melt Strength polypropylene (HMS PP), at its Burghausen, Germany facility, with the new line expected to be operational in the second half of 2026.(Source:www.indianchemicalnews.com)

- In September 2025, Cirql, a sustainable footwear materials brand, launched rTPU50, a foam midsole made with 50% post-industrial recycled Thermoplastic Polyurethane (TPU) using a chemical-free foaming process. This new material, available in Q3 2025, is designed for various footwear types and supports glueless construction options.(Source: endurance.biz)

- In April 2025, Scientists at the University of Texas at Dallas developed a 3D-printed foam using catalyst-free dynamic phosphodiester bonding, which offers enhanced durability, recyclability, superior mechanical strength, and better energy dissipation compared to traditional foams.(Source: 3dprintingindustry.com)

Segments Covered

By Foam Type

- Flexible Foam

- Rigid Foam

By Resin Type

- Polyurethane Foam

- Polystyrene Foam

- Polyolefin Foam

- PVC Foam

- Phenolic Foam

- Melamine Foam

- Others (e.g., Polyethylene Foam, Polypropylene Foam)

By Cell Structure

- Closed Cell Foam

- Open Cell Foam

By Application

- Building & Construction

- Insulation

- Roofing

- Flooring

- Wall Panels

- Packaging

- Protective Packaging

- Food Packaging

- Industrial Packaging

- Furniture & Bedding

- Mattresses

- Cushions

- Pillows

- Automotive

- Seats

- Headliners

- Dashboards

- Door Panels

- Footwear

- Insoles

- Outsoles

- Sports & Recreation

- Sports Equipment

- Protective Gear

- Healthcare

- Medical Devices

- Orthopedic Supports

- Electronics

- Shock Absorption

- Insulation

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait