Content

What is the Current Packaged Wastewater Treatment Market Size and Share?

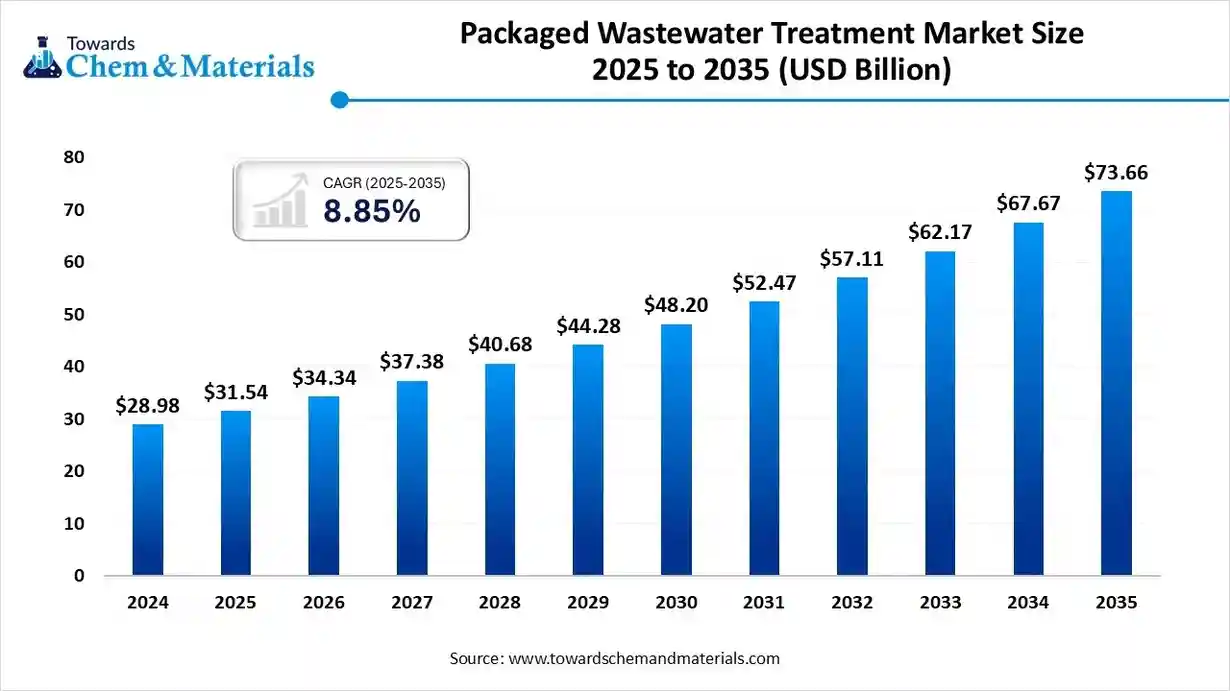

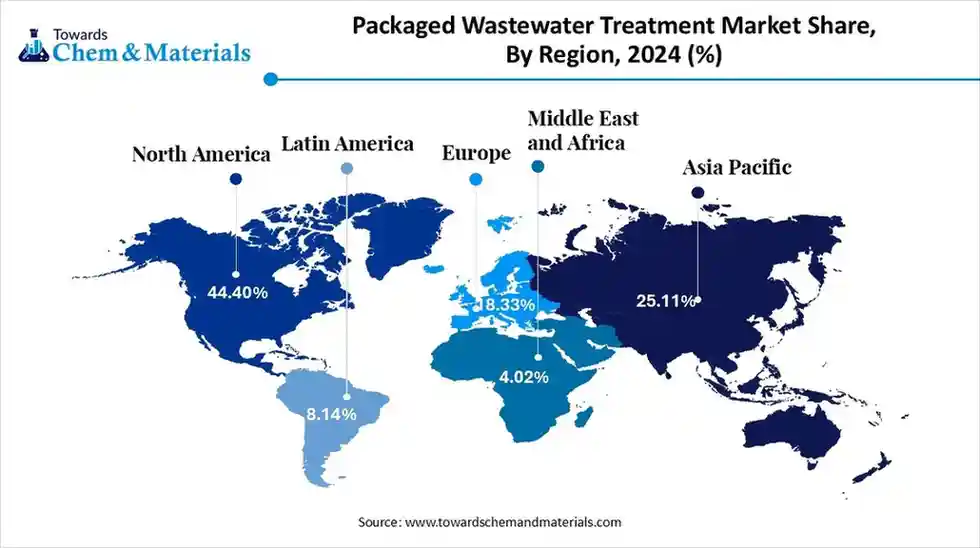

The global packaged wastewater treatment market size accounted for USD 31.54 billion in 2025 and is predicted to increase from USD 34.34 billion in 2026 to approximately USD 73.66 billion by 2035, growing at a CAGR of 8.85% from 2025 to 2035. North America dominated the packaged wastewater treatment market with a market share of 44.40% the global market in 2024.Rapid urbanization and industrialization across the globe are the key factors driving market growth. Also, ongoing technological innovations in treatment processes, coupled with the stringent government regulations on wastewater discharge, can fuel market growth further.

Key Takeaways

- By region, North America dominated the market with a 44.40% share in 2024.

- By region, Asia Pacific is expected to grow at the fastest CAGR of 8.4% over the forecast period.

- By region, Europe is expected to grow at a notable CAGR over the forecast period.

- By type, the membrane bioreactor (MBR) segment dominated the market with a 40.4% share in 2024.

- By type, the moving bed biofilm reactor (MBBR) segment is expected to grow at the fastest CAGR of 7.2% over the forecast period.

- By application, the municipal segment held a 64.2% market share in 2024.

- By application, the industrial segment is expected to grow at the fastest CAGR of 7.3% over the forecast period.

- By end-use industry, the food & beverage segment dominated the market by holding 38.4% share in 2024.

- By end-use industry, the pharmaceutical segment is expected to grow at the fastest CAGR of 7.5% during the forecast period.

- By capacity, the medium segment held a 56.4% market share in 2024.

- By capacity, the large segment is expected to grow at the fastest CAGR of 7.7% during the projected period.

What is Packaged Wastewater Treatment?

The market is driven by rising environmental concerns, water scarcity, and stringent discharge regulations. The packaged wastewater treatment market focuses on pre-engineered, compact treatment systems designed for decentralized wastewater management. These systems are ideal for remote areas, small communities, industrial sites, and institutions lacking centralized sewage infrastructure.

Advances in modular designs, membrane bioreactors (MBR), and energy-efficient technologies enhance system performance, while growing demand from developing regions and sustainable water reuse initiatives fuel global adoption.

Global Packaged Wastewater Treatment Market Outlook:

- Industry Growth Overview: Strict regulations on wastewater discharge are pushing municipalities and industries to adopt innovative and compliant treatment technologies. Also, a rise in water shortages is fuelling the demand for wastewater reuse for various applications.

- Sustainability Trends: This trend in the market includes an emphasis on energy efficiency through technologies such as energy recovery and membrane bioreactor systems. Ongoing focus on a circular economy model is continuously cycling, minimizing waste, and impacting positive market growth.

- Major Investors: Major companies in the market, such as Veolia, Xylem, and Suez, are heavily investing in corporate commitments and emerging markets to meet water recycling targets.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 34.34 Billion |

| Expected Size by 2035 | USD 73.66 Billion |

| Growth Rate from 2025 to 2034 | CAGR 8.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Leading Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segment Covered | By Type, By Application, By End-Use Industry, Capacity, By Region |

| Key Companies Profiled | SUEZ SA, Xylem Inc, Fluence Corporation Limited, WPL Limited (WCS Group), BioMicrobics Inc., Clearford Water Systems Inc., Ecolab Inc., Smith & Loveless Inc., Aquatech International LLC, WABAG Water Technology Ltd., Evoqua Water Technologies, Toshiba Water Solutions Pvt. Ltd., Organica Water Inc., RWL Water |

How Cutting Edge Technologies are Revolutionising the Packaged Wastewater Treatment Market?

Advanced technologies are transforming the market by enabling more efficient, smarter, and sustainable solutions. Major advancements like Artificial Intelligence, IoT, and membrane filtration technologies are revolutionizing conventional systems into more modular, compact, and highly effective plants that focus on water reuse and resource recovery.

Trade Analysis of Packaged Wastewater Treatment Market: Import & Export Statistics:

- In July 2025, the United States exported $2.91B and imported $1.98B of Chemical products n.e.s., resulting in a positive trade balance of $924M.

- In July 2025, the United States exported Chemical products mostly to Canada ($381M), Mexico ($352M), China ($222M), Japan ($191M), and Brazil ($179M).(Source: oec.world)

Packaged Wastewater Treatment Market Value Chain Analysis

- Feedstock Procurement : It refers to the sourcing and acquisition of the raw materials, which are to be treated, generally with a goal of converting them into valuable resources.

- Chemical Synthesis and Processing: It involves the end-user sector comprising facilities that produce basic chemicals, specialty chemicals, and other chemical products.

- Packaging and Labelling: It covers the specific regulations, materials, and needs for the transport and storage of hazardous and other wastes created by packaged wastewater treatment facilities.

- Regulatory Compliance and Safety Monitoring : It refers to the crucial practices and technologies used to ensure that these treatment systems fulfil all legal standards and operate without causing risks to human health or the environment.

Packaged Wastewater Treatment Market's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations/Investments |

| United States | The Environmental Protection Agency (EPA) sets the national baseline standards primarily through the Clean Water Act (CWA) and the Safe Drinking Water Act (SDWA). |

| European Union | New regulations will mandate stricter wastewater treatment, with secondary treatment required by 2035, nutrient removal (tertiary treatment) by 2039 for large plants, and micropollutant removal (quaternary treatment) by 2045. |

| India | The Central Pollution Control Board (CPCB) sets nationwide standards, while State Pollution Control Boards (SPCBs) enforce them locally. The National Green Tribunal (NGT) also issues directives and ensures compliance. |

Segment Insights

Type Insights

How Much Share Did the Membrane Bioreactor (MBR) Segment Held in 2024?

- The membrane bioreactor (MBR) segment dominated the market with a 40.4% share in 2024. The dominance of the segment can be attributed to the rising water scarcity, stringent environmental regulations, and technology's distinct benefits over traditional treatment methods. Also, MBR systems produce high-grade treated water.

- The moving bed biofilm reactor (MBBR) segment is expected to grow at the fastest CAGR of 7.2% over the forecast period. The growth of the segment can be credited to its high treatment efficiency, lower energy consumption, and smaller footprint as compared to traditional methods. This system can efficiently handle nitrogen and carbon removal through various processes.

- The extended aeration segment held a major market share in 2024. This is a biological treatment method that uses prolonged aeration and mixing to cut down organic matter in wastewater. It is widely used in small to medium-sized applications.

- The growth of the sequential batch reactor (SBR) segment is driven by its high-quality effluent production, technology's inherent flexibility, and compact design, which aligns with the rising need for cost-effective and decentralized treatment solutions.

Application Insights

Which Application Type Segment Dominated the Packaged Wastewater Treatment Market in 2024?

- The municipal segment held a 64.2% market share in 2024. The dominance of the segment can be linked to the rapid surge in global population and he large-scale shift from rural to urban areas. The compact and modular design of packaged systems results in much quicker installation times, which makes them convenient in operations.

- The industrial segment is expected to grow at the fastest CAGR of 7.3% over the forecast period. The growth of the segment can be driven by the ongoing demand to meet stricter discharge standards, coupled with the surge in population, which requires more efficient sanitation. Packaged systems are ideal for both industrial and residential applications.

End-Use Industry Insights

Which End-Use Industry Type Segment Dominated the Packaged Wastewater Treatment Market in 2024?

- The food & beverage segment dominated the market by holding 38.4% share in 2024. The dominance of the segment is owed to the growing demand for sustainable supply chains along with the integration of circular economy principles. Also, the food and beverage sector is a major user of water.

- The pharmaceutical segment is expected to grow at the fastest CAGR of 7.5% during the forecast period. The growth of the region is due to the rising manufacturing of pharmaceuticals and demand for specialized treatment to remove active pharmaceutical ingredient (API) compounds. Advancements in treatment technologies are also improving the overall operational efficiency.

- The chemical is one of the major segments in the market. This segment is growing because of the growing demand for water reuse and the increasing population and urbanization. Chemicals are used in both public health and municipal treatment to ensure compliance with stringent discharge limits.

- The oil & gas segment held a major market share in 2024. This industry generates a large amount of wastewater with high pollutant loads, which requires personalized treatment solutions. Rising concerns over water scarcity are encouraging various sectors to reuse and treat water.

Capacity Insights

How Much Share Did the Medium Segment Held in 2024?

- The medium segment held a 56.4% market share in 2024. The dominance of the segment can be attributed to the increasing need for scalable and decentralized solutions in developing industrial and urban areas. These systems are pre-engineered and compact units designed to control wastewater flows from various sources.

- The large segment is expected to grow at the fastest CAGR of 7.7% during the projected period. The growth of the segment can be credited to the growing demand for decentralized and cost-effective solutions. Packaged systems offer a flexible approach to wastewater treatment, which is ideal for large complexes.

- The growth of the small segment is driven by its rapid deployment and use in niche applications such as construction, emergencies, and off-grid locations. Their compact footprint and ease of transport give efficient and practical solutions for locations with limited space or infrastructure.

Regional Insight

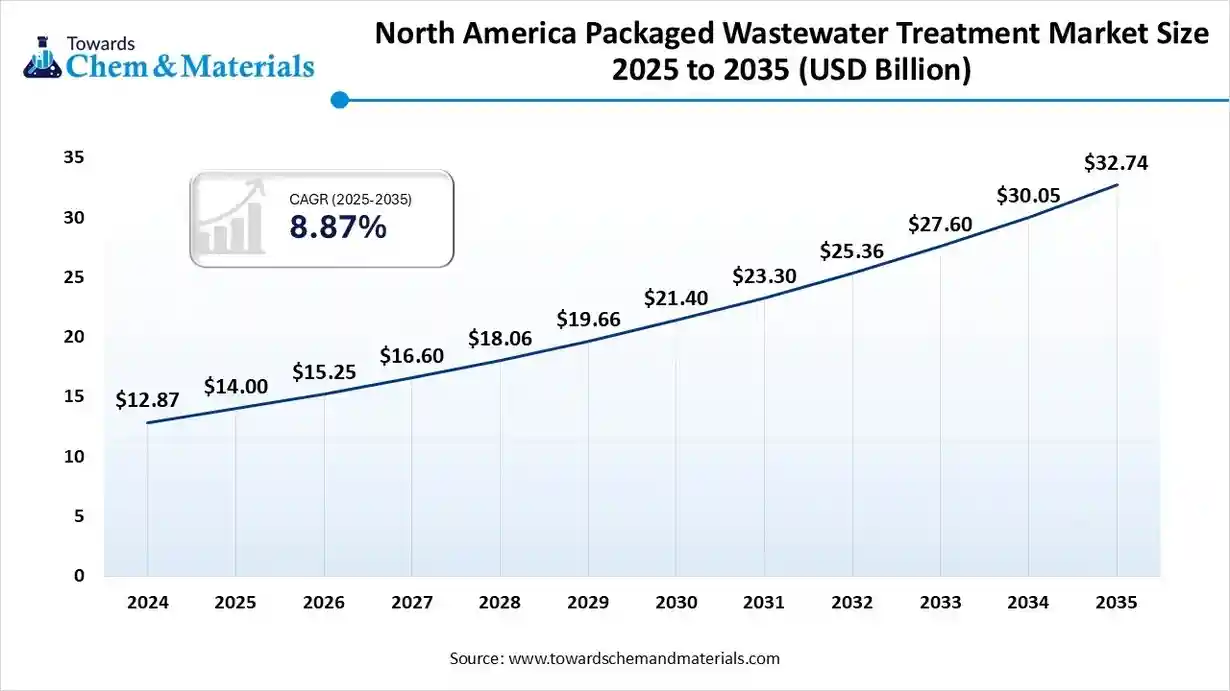

The North America packaged wastewater treatment market size was estimated at USD 14.00 billion in 2025 and is projected to reach USD 32.74 billion by 2035, growing at a CAGR of 8.87% from 2025 to 2035.North America dominated the market with a 44.40% share in 2024. The dominance of the region can be attributed to the growing demand for cost-effective, decentralized, and technologically advanced solutions. In addition, packaged modular system provides a more cost-effective and faster alternative to large-scale traditional plant construction, which makes them crucial for advancing the region's water management systems.

U.S. Packaged Wastewater Treatment Market Trends

In North America, the U.S. led the market due to the rising water scarcity, environmental regulations, and demand for decentralized solutions to replace aging infrastructure. Stringent regulations from the EPA are pushing municipalities and industries to adopt advanced treatment solutions.

Which Is The Fastest Growing Region In The Market?

Asia Pacific is expected to grow at the fastest CAGR of 8.4% over the forecast period. The growth of the region can be credited to the ongoing industrialization and urbanization, which lead to increased pollution and the need for clean water. Moreover, the development of compact and advanced packaged systems makes them more suitable and affordable in various areas.

China Packaged Wastewater Treatment Market Trends

In the Asia Pacific, China dominated the market due to ongoing government initiatives to enhance sanitation, especially in rural areas. The market in China is benefiting from advancements in automation, and IoT-based monitoring can improve overall treatment efficiency and minimize operational costs.

Europe is expected to grow at a notable CAGR over the forecast period.

The growth of the region can be driven by increasing concerns over water scarcity and growing adoption of smart technologies like IoT and AI. Furthermore, European countries have robust environmental policies, which necessitate innovative treatment to fulfil discharge standards.

Germany Packaged Wastewater Treatment Market Trends

Germany held a major market share in the European region. Germany's focus on sustainability creates demand for systems that can recover resources such as biogas, water, and nutrients from wastewater. Government incentives offer significant support for market development in the country.

South America held a significant market share in 2024.

The growth of the region is linked to growing demand for cost-effective, efficient, and sustainable packaged solutions, especially for remote and smaller industrial and residential applications where conventional infrastructure is not feasible.

Brazil Packaged Wastewater Treatment Market Trends

The market in Brazil is significant and anticipated to see robust growth, fuelled by the demand to address sanitation gaps, especially in urbanizing and rural areas. The rapid growth in major cities has created a growth in wastewater, which cannot be handled by existing infrastructure, leading to further market growth.

The packaged wastewater treatment market in the Middle East & Africa (MEA) is experiencing strong growth, driven by chronic water scarcity, rapid urbanisation, and expanding industrial activity. Key adoption drivers include modular and containerised treatment systems suited for remote or arid zones, and strong regulatory impetus for water reuse especially within Gulf countries such as Saudi Arabia and UAE.

Saudi Arabia Packaged Wastewater Treatment Market Trends

In Saudi Arabia, the packaged wastewater treatment market is experiencing rapid expansion, underpinned by the country’s push under Vision 2030 to enhance water reuse and infrastructure. he drive is motivated by water scarcity, industrial and municipal growth, and stricter effluent regulations. Modular and containerised systems are particularly in demand as scalable solutions for both urban and remote sites.

Recent Developments

- In January 2025, Ecologic Systems collaborated with Hubert Enviro Care Systems to transform wastewater management in Sri Lanka. This cutting-edge technology promises to revolutionize the environmental engineering landscape in Sri Lanka and the Maldives.(Source: sundaytimes.lk)

- In February 2024, ABB introduced an energy management solution called OPTIMAX for water and wastewater to boost the sustainability and efficiency of plants. This digital optimization tool can help to minimize overall energy use and costs.(Source: new.abb.com)

Top Packaged Wastewater Treatment Market Companies

Veolia Environnement S.A.

Corporate Information

- Veolia Environnement S.A. (ticker: VIE on Euronext) is a French global company active in water management, waste management and energy services.

- In 2023 the group had consolidated sales of €45.3 billion.

- The company serves hundreds of millions of people globally: e.g., in 2023 the group served ~113 million people with drinking water and ~103 million with wastewater services.

History and Background

- The origins trace back to Compagnie Générale des Eaux (founded 1853) which over time evolved via mergers and reorganizations into Veolia.

- In 2003 the company took the name “Veolia Environnement”.

- Over decades it expanded globally, diversifying from water services into waste, energy and integrated resource-management.

Key Developments and Strategic Initiatives

- In March 2024 the company launched its strategic programme “GreenUp 2024-2027”, aimed at accelerating ecological transformation.

- Key targets: ~€4 billion of growth investments, of which ~€2 billion prioritized on three “growth boosters”.

- Growth boosters: decarbonization, water technologies & new solutions, hazardous-waste treatment.

- Other targets: save 1.5 billion m³ fresh water by 2027, treat 10 million tons of hazardous waste/pollutants by 2027, emission reduction trajectory aligned to 1.5°C etc.

Mergers & Acquisitions

- The company frequently acquires targeted businesses to bolster capacity and geographic presence. For example, in June 2025 Veolia announced adding 530,000 tons of hazardous-waste treatment capacity via tuck-in acquisitions in US, Japan and Brazil (enterprise value ~€300 million).

- (Recent news): Veolia announced it will acquire the remaining ~30% stake of its water technologies & solutions unit (WT&S) from CDPQ for ~$1.75 billion, gaining full ownership and cost synergies by 2027.

Partnerships & Collaborations

- In February 2025 Veolia signed a memorandum of understanding with Abu Dhabi National Oil Company (ADNOC) to optimize water consumption and carbon footprint in the Middle East, in line with its growth strategy.

- In June 2025 Veolia and TotalEnergies SE signed an MoU for cooperation in energy transition and circular economy combining water and resource-recovery expertise with low-carbon and methane-emission technologies.

Product Launches / Innovations

- Veolia is investing heavily in new water-technologies: e.g., reuse of treated wastewater, treatment of emerging pollutants (PFAS, microplastics), adoption of AI and digital monitoring.

- Example: In the Middle East, Veolia is deploying sustainable desalination plants (e.g., units using AI-integrated reverse osmosis, more compact design) to double capacity by 2030.

Key Technology Focus Areas

- Water technologies: advanced treatment, reuse, modular packaged systems, AI/IoT monitoring, desalination, micro-pollutant removal.

- Waste/hazardous-waste treatment: high-temperature incineration, solvent recovery, recycling of batteries/plastics, large-scale treatment capacity.

- Decarbonization & energy efficiency: Bioenergies, energy-efficiency services, heating/cooling networks, industrial energy-services.

- Digital & smart services: predictive maintenance, digital monitoring, AI optimization of water/energy/waste flows.

- Circular economy: resource recovery, reuse of materials (plastics, metals), closed-loop processes.

R&D Organisation & Investment

- Veolia operates around 14 research centres globally, focusing on environmental technologies.

- As part of GreenUp, they plan an additional €200 million investment targeted at industrial pilots or acquisition of new technologies.

- The company has “almost 5,000 patents” in its portfolio (per its strategic programme descriptions).

SWOT Analysis

Strengths:

- Global scale and diversified business across water, waste and energy services ensure robust revenue base and geographical spread.

- Strong strategic programme (GreenUp) aligning with global trends (ecological transformation, decarbonization, water stress) positioning for future growth.

- Broad technology portfolio and innovation capacity, supported by many patents, global R&D centres and strategic partnerships.

- Established brand and extensive track record in large projects (municipal, industrial) and infrastructure services.

Weaknesses:

- Large scale operations may reduce agility and margin flexibility; services are often capital-intensive with long payback periods.

- Complexity of operations across many geographies brings regulatory, operational and cultural risk.

- Profit margins may be under pressure from large infrastructure investment, competitive tendering and rising input costs.

- Some commentary indicates thin margins in water/waste utilities business.

Opportunities:

- Rising global demand for water treatment, wastewater reuse, modular packaged solutions (especially in emerging markets) presents growth potential.

- Stricter environmental regulations and corporate sustainability mandates drive demand for hazardous-waste treatment, resource recovery and circular economy services.

- Digitalization and IoT enable value-added services (beyond pure treatment) boosting margins.

Expansion in high-growth geographies (Middle East, India, Africa) where water stress and waste volumes are increasing. - Example: expansion of hazardous-waste capacity in India.

Threats:

- Economic downturns, inflation and rising commodity/energy costs may compress margins.

- Regulatory/political risk: many contracts are with municipal/government clients subject to budget constraints and political shifts.

- Competition from other global players, modular start-ups, and technology disruptors may erode pricing power.

- Execution risk: large projects often face delays, cost overruns or regulatory issues (especially in emerging markets).

Recent News & Strategic Updates

- In May 2025 Veolia announced the acquisition of the remaining stake of its Water Technologies & Solutions unit from CDPQ for ~$1.75 billion, thereby taking full control and targeting cost synergies of €90 million by 2027.

- The group is expanding hazardous-waste treatment capacity globally: plans to add ~530,000 tons of annual capacity by 2030, including focus on India.

Other Top Companies:

- SUEZ SA: SUEZ SA is a global leader in environmental services, providing comprehensive solutions in the water cycle management and waste recovery sectors. In the packaged wastewater treatment market, SUEZ offers a wide range of modular, compact, and high-performance solutions.

- Xylem Inc.: Xylem Inc. provides advanced, modular wastewater treatment systems using smart, energy-efficient technologies for municipal, industrial, and decentralized applications.

- Fluence Corporation Limited

- WPL Limited (WCS Group)

- BioMicrobics Inc.

- Clearford Water Systems Inc.

- Ecolab Inc.

- Smith & Loveless Inc.

- Aquatech International LLC

- WABAG Water Technology Ltd.

- Evoqua Water Technologies

- Toshiba Water Solutions Pvt. Ltd.

- Organica Water Inc.

- RWL Water

Segments Covered in the Report

By Type

- Extended Aeration

- Moving Bed Biofilm Reactor (MBBR)

- Membrane Bioreactor (MBR)

- Sequential Batch Reactor (SBR)

- Others

By Application

- Municipal

- Industrial

By End-Use Industry

- Food & Beverage

- Chemical

- Pharmaceutical

- Oil & Gas

- Power Generation

- Others

By Capacity

- Small

- Medium

- Large

By Region

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa